Owning rental property can be a lucrative investment, but it also comes with its fair share of financial complexities. One of the most important aspects of managing rental property is understanding the tax implications. As a landlord, you have the opportunity to claim a wide range of deductions, which can significantly reduce your tax liability and increase your overall profits. This article will provide you with valuable tax tips for rental property owners to maximize deductions and ensure you’re taking advantage of all the benefits available to you.

From mortgage interest and property taxes to depreciation and repairs, there are numerous deductions you can claim. By strategically understanding and utilizing these deductions, you can optimize your tax situation and boost your investment returns. Whether you’re a seasoned landlord or a first-time property owner, this guide will equip you with the knowledge you need to minimize your tax burden and maximize your financial success in the rental property market. Let’s dive into the world of tax deductions and explore how you can claim your rightful share of savings.

Understanding Rental Property Tax Deductions

Owning a rental property can be a lucrative investment, but it also comes with its share of expenses. One of the most significant expenses is taxes, but the good news is that you can deduct many of these expenses on your taxes, potentially saving you a significant amount of money. Understanding which rental property tax deductions you are eligible for and how to claim them is crucial for maximizing your returns.

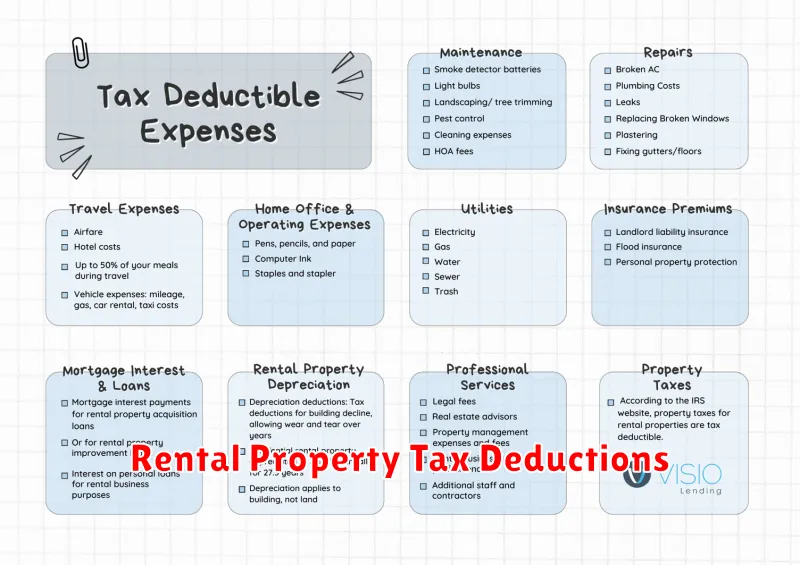

Common Rental Property Tax Deductions

There are a wide range of expenses associated with owning and operating a rental property that you can deduct. Here are some of the most common:

- Mortgage interest: You can deduct the interest paid on your rental property mortgage.

- Property taxes: The property taxes you pay on your rental property are deductible.

- Insurance premiums: You can deduct premiums for homeowner’s or renter’s insurance policies that cover your rental property.

- Depreciation: You can depreciate the value of your rental property over time, deducting a portion of the cost each year.

- Repairs and maintenance: You can deduct expenses for repairs and maintenance that are necessary to keep your rental property in good condition.

- Utilities: If you pay for utilities on behalf of your tenants, such as water, sewer, electricity, and gas, you can deduct these expenses.

- Advertising and marketing: Expenses associated with advertising and marketing your rental property are deductible.

- Travel expenses: If you travel to inspect or manage your rental property, you can deduct these expenses.

- Professional fees: You can deduct fees paid to professionals such as real estate agents, property managers, and accountants.

Important Considerations

Keep in mind that there are some important considerations when claiming rental property tax deductions:

- Documentation: You must keep accurate and detailed records of all your expenses to support your deductions.

- Rental use: You can only deduct expenses related to the portion of your property that is used for rental purposes.

- Passive activity rules: If you are considered a passive investor in your rental property, there are limitations on the amount of deductions you can claim.

Seek Professional Guidance

Tax laws are complex, and it’s essential to seek guidance from a qualified tax professional to ensure you are taking advantage of all available deductions and avoiding potential pitfalls. A tax professional can help you understand the rules, determine which deductions you are eligible for, and advise on the best strategies for claiming your deductions.

By understanding the various rental property tax deductions available to you and following the proper guidelines, you can significantly reduce your tax liability and increase your overall rental property investment returns.

Common Deductible Expenses for Landlords

Being a landlord can be a lucrative business venture, but it also comes with its own set of expenses. Luckily, the IRS allows landlords to deduct certain expenses related to their rental properties on their taxes, helping to reduce their tax burden and boost their bottom line. Understanding these deductible expenses can help you maximize your savings and optimize your rental property investments.

Common Deductible Expenses for Landlords

Here are some of the most common deductible expenses for landlords:

1. Mortgage Interest

The interest paid on a mortgage for a rental property is generally deductible. This includes both principal and interest payments, as well as any points paid at closing.

2. Property Taxes

Property taxes paid on a rental property are also deductible. This includes both real estate taxes and personal property taxes.

3. Insurance

Insurance premiums for a rental property, such as homeowner’s insurance or liability insurance, are deductible expenses. This also includes flood insurance and earthquake insurance.

4. Repairs and Maintenance

Expenses incurred for repairs and maintenance of a rental property are deductible. This includes expenses for plumbing, electrical, HVAC, roofing, and other necessary repairs.

5. Depreciation

Landlords can deduct a portion of the cost of their rental property over time through depreciation. This allows for the gradual recovery of the cost of the property over its useful life.

6. Advertising and Marketing

Expenses incurred for advertising and marketing the rental property, such as online listings, flyers, and open house costs, are deductible.

7. Utilities

If you pay for utilities for your rental property, such as water, sewer, gas, and electricity, you can deduct these expenses. However, utilities paid by the tenant are not deductible by the landlord.

8. Management Fees

If you hire a property manager to manage your rental property, you can deduct the management fees paid.

9. Travel Expenses

Travel expenses incurred for managing your rental property, such as driving to and from the property for repairs or inspections, are deductible.

10. Legal and Accounting Fees

Legal and accounting fees related to your rental property, such as those incurred for tax preparation or eviction proceedings, are deductible.

Important Considerations

It’s important to note that these are just some of the common deductible expenses for landlords. The specific deductions you can claim may vary depending on your individual circumstances and the tax laws in your state. It’s always best to consult with a tax professional to ensure you are claiming all of the deductions you are entitled to.

Depreciation: Maximizing Your Tax Benefits

Depreciation is a crucial concept for businesses and individuals alike, especially when it comes to maximizing tax benefits. It allows you to deduct the cost of assets over time, reducing your taxable income and ultimately saving you money. Understanding depreciation and its various methods can be a valuable tool for financial planning and optimization.

What is Depreciation?

Depreciation is the systematic allocation of the cost of a tangible asset over its useful life. In simpler terms, it’s the gradual decrease in the value of an asset due to wear and tear, obsolescence, or other factors. This decrease in value is recognized as an expense in your financial statements and can be used to reduce your taxable income.

Types of Depreciation Methods:

Several depreciation methods are available, each with its own set of rules and calculations. Here are some of the most common methods:

- Straight-line depreciation: This method spreads the cost of an asset evenly over its useful life. It’s a simple and widely used method.

- Double-declining balance method: This method depreciates an asset at twice the rate of the straight-line method, resulting in higher depreciation in the early years and lower depreciation in later years.

- Sum-of-the-years’ digits method: This method uses a declining balance approach based on the sum of the years of the asset’s useful life.

- Units of production method: This method depreciates an asset based on its actual usage or production output.

Tax Benefits of Depreciation:

Depreciation offers significant tax benefits by:

- Reducing taxable income: By deducting depreciation expense, you lower your taxable income, resulting in lower tax liability.

- Increasing cash flow: The tax savings from depreciation can be used to reinvest in your business or for other purposes.

- Encouraging investment: The depreciation deduction provides an incentive for businesses to invest in new assets, which can lead to economic growth.

Conclusion:

Depreciation is a valuable tool for tax planning and financial optimization. By understanding the different methods and their implications, businesses and individuals can maximize their tax benefits and make informed financial decisions. It’s essential to consult with a tax professional to determine the most appropriate depreciation method for your specific situation.

Home Office Deduction for Rental Property Owners

If you own a rental property and use part of it for your business, you may be eligible for the home office deduction. This deduction allows you to deduct a portion of your expenses related to the rental property, such as mortgage interest, property taxes, insurance, and utilities, as business expenses.

To claim the home office deduction, you must meet certain requirements. First, you must use the space exclusively for your business. This means that you cannot use the space for personal purposes, such as watching television or sleeping. Second, you must use the space regularly for your business. Third, the space must be your principal place of business. If you have multiple places of business, the space must be where you conduct the majority of your business activities.

There are two methods for calculating the home office deduction: the regular method and the simplified method. The regular method uses the actual expenses associated with the home office space, while the simplified method uses a flat rate per square foot of space used.

Regular Method

The regular method requires you to calculate the percentage of your home used for business purposes. You can do this by dividing the area of your home office by the total area of your home. You can then deduct a percentage of your home-related expenses equal to that percentage.

Simplified Method

The simplified method allows you to deduct a set amount per square foot of your home office space. The IRS sets the annual rate, which is adjusted periodically. The simplified method is generally easier to calculate, but it may result in a lower deduction than the regular method.

Example

Suppose you own a rental property and use a 100 square foot room for your business. The property is a total of 1,000 square feet. Using the regular method, you would be able to deduct 10% of your home-related expenses (100 square feet/1,000 square feet). If the property taxes were $1,000, you could deduct $100 ($1,000 x .10).

Using the simplified method, you could deduct $5 per square foot of your home office, so you could deduct a total of $500 ($5 x 100 square feet).

Important Considerations

- You must keep accurate records of your home office expenses.

- You must be prepared to prove that you meet the requirements for the home office deduction.

The home office deduction can be a valuable tax benefit for rental property owners who use part of their property for their business. However, it’s important to make sure you meet the requirements and keep accurate records. Consult with a tax professional for more detailed guidance on claiming the home office deduction.

Deducting Repairs vs. Improvements

When you own a home, you’ll likely have to make repairs and improvements from time to time. These expenses can sometimes be deductible on your taxes, but it’s important to understand the difference between repairs and improvements.

Repairs

Repairs are expenses that are made to maintain your home in its current condition. They fix or restore something that has been damaged or worn out. Here are some examples of repairs:

- Fixing a leaky faucet

- Replacing a broken window pane

- Painting a room

- Repairing a roof leak

Generally, you can’t deduct the cost of repairs on your taxes. However, if you are a landlord, you may be able to deduct the cost of repairs on your rental property.

Improvements

Improvements are expenses that add value to your home. They can be anything that makes your home more desirable or functional. Here are some examples of improvements:

- Adding a new bathroom

- Building a deck

- Installing central air conditioning

- Adding a new room

You can usually deduct the cost of improvements if you sell your home. The cost of improvements is added to your basis in the home, which is the amount you paid for the home plus the cost of any improvements. When you sell your home, you will pay capital gains tax on the difference between your basis and the sale price. However, if you have lived in your home for at least two out of the five years before selling, you can exclude up to $250,000 of capital gains if you are single or $500,000 if you are married filing jointly.

Capital Expenses

Improvements can be considered a capital expense, meaning they are an investment in your property that will last for more than a year. The IRS defines capital expenses as “expenses that are incurred for the acquisition, construction, or improvement of property.”

How to Determine If an Expense is a Repair or Improvement

The best way to determine if an expense is a repair or an improvement is to ask yourself: Does the expense add value to my home? If the answer is yes, then it is likely an improvement. If the answer is no, then it is likely a repair.

If you are unsure about whether an expense is a repair or an improvement, it’s always best to consult with a tax professional. They can help you determine the correct treatment of the expense and ensure that you are taking advantage of all available deductions.

Record Keeping Tips for Rental Property Expenses

Maintaining accurate records of your rental property expenses is crucial for managing your finances effectively and minimizing tax liabilities. By following these tips, you can streamline your record-keeping process and ensure compliance with IRS regulations:

1. Establish a Dedicated System: Create a dedicated system for tracking your expenses, such as a spreadsheet, accounting software, or a physical filing system. This helps you keep track of all receipts and documents in an organized manner.

2. Record All Expenses: Document every expense related to your rental property, including mortgage payments, property taxes, insurance, repairs, maintenance, utilities, and marketing costs. This thorough record-keeping will be essential for tax deductions.

3. Gather Supporting Documentation: For each expense, collect supporting documentation, such as receipts, invoices, canceled checks, and bank statements. These documents serve as proof of your expenditures and should be retained for at least three years.

4. Categorize Expenses: Categorize your expenses into relevant categories, such as repairs and maintenance, utilities, or advertising. This allows for easy analysis and reporting when preparing your tax returns.

5. Use Separate Bank Accounts: Maintain separate bank accounts for your personal finances and rental property income and expenses. This separation simplifies tracking and minimizes the risk of mixing funds.

6. Track Depreciation: Rental properties depreciate over time, and this depreciation can be claimed as a tax deduction. Keep records of the property’s purchase price, improvements, and useful life to calculate depreciation accurately.

7. Document Rental Income: Maintain records of all rental income received, including dates, amounts, and tenant names. This information is essential for tax reporting purposes.

8. Regularly Review and Update: Review your records regularly to ensure accuracy and completeness. Update your records as needed, especially after major repairs or improvements.

9. Consider Professional Help: If you’re struggling to manage your record-keeping or have complex rental property expenses, consider seeking professional help from a tax advisor or accountant. They can provide guidance and ensure your records are compliant with all applicable tax laws.

By diligently following these record-keeping tips, you can streamline your rental property expenses, optimize tax benefits, and make informed financial decisions for your investment property.

Tax Benefits of Hiring a Property Manager

Owning a rental property can be a lucrative investment, but it also comes with its fair share of responsibilities. From finding tenants and collecting rent to handling repairs and maintenance, managing a rental property can be a time-consuming and stressful endeavor. That’s where a property manager comes in. Not only can they take the burden off your shoulders, but hiring a property manager can also offer significant tax benefits.

Deductible Expenses

Property managers charge fees for their services, which are typically deductible expenses. These fees can include:

- Management fees

- Advertising and marketing costs

- Tenant screening fees

- Legal and accounting expenses

By deducting these expenses, you can reduce your taxable income and ultimately save on your tax bill.

Depreciation

Another significant tax benefit of owning rental property is the ability to deduct depreciation. Depreciation is the gradual decline in value of an asset over time, and it can be deducted each year for the life of the property.

While hiring a property manager doesn’t directly impact your depreciation deduction, it can help you maximize the benefit. By ensuring your property is properly maintained and managed, a property manager can help preserve its value and extend its useful life, allowing you to claim a larger depreciation deduction over time.

Mortgage Interest

If you have a mortgage on your rental property, you can deduct the interest paid on the mortgage. This is a significant tax benefit that can significantly reduce your tax liability.

Property Taxes

Property taxes are another deductible expense for rental property owners. These taxes can vary depending on the location and value of the property.

Conclusion

Hiring a property manager can be a smart investment for rental property owners, not only for the convenience and peace of mind it provides but also for the significant tax benefits. By taking advantage of these tax deductions, you can minimize your tax burden and maximize your profits from your rental property.

Staying Updated on Rental Property Tax Laws

As a landlord, staying informed about rental property tax laws is crucial for ensuring compliance and maximizing your profits. Tax laws are constantly evolving, and failing to keep up can lead to costly penalties and legal issues. Here’s a comprehensive guide to staying updated on rental property tax laws:

1. Understand Your Local and State Laws

Rental property tax laws vary significantly depending on your location. It’s essential to familiarize yourself with the specific regulations in your city, county, and state. The Internal Revenue Service (IRS) provides valuable resources on federal tax laws related to rental properties, but you’ll need to research local ordinances as well.

2. Utilize Online Resources

The internet offers a wealth of information on rental property tax laws. Websites like the IRS website, state tax agencies, and professional organizations like the National Association of Realtors (NAR) provide comprehensive guidance and updates. You can also search for articles, blogs, and forums dedicated to landlord-related topics.

3. Consult with a Tax Professional

Enlisting the help of a qualified tax professional is highly recommended. They can provide personalized advice based on your specific situation and ensure you’re taking advantage of all applicable deductions and credits. A tax professional can also keep you informed of any recent changes to tax laws that might impact your rental property.

4. Attend Industry Events and Workshops

Staying connected with the real estate industry is vital for staying up-to-date. Attend conferences, workshops, and webinars related to property management and taxation. These events often feature presentations and discussions on current tax regulations and provide opportunities to network with other landlords and professionals.

5. Subscribe to Newsletters and Alerts

Many organizations and websites offer newsletters and email alerts that provide updates on tax law changes. Subscribe to these resources to receive timely notifications and stay informed about any potential impacts on your rental property.

6. Regularly Review Your Tax Records

Make it a habit to review your tax records periodically. This includes your rental income and expenses, depreciation calculations, and any deductions you’ve claimed. By doing so, you can identify any potential errors or areas where you might need to adjust your tax strategy.

Conclusion

Staying informed about rental property tax laws is an ongoing process that requires diligence and attention. By following these tips, you can ensure compliance, maximize your profits, and avoid potential legal issues. Remember, seeking professional advice when needed is crucial for navigating the complexities of tax regulations.