Feeling overwhelmed by your tax burden? Do you wish there was a way to reduce your tax liability while making a positive impact on the community? Look no further than charitable contributions! Donating to eligible charities can offer significant tax benefits, allowing you to lighten your tax load and support worthy causes at the same time.

This comprehensive guide will explore the ins and outs of charitable contributions and their tax implications. We’ll delve into the various deduction options, eligibility criteria, and strategies for maximizing your tax savings. Get ready to unlock the power of giving back and discover how charitable contributions can be a win-win for both your wallet and the community you care about.

Understanding the Tax Benefits of Charitable Giving

Charitable giving is a generous act that benefits both the recipient organization and the donor. But did you know that it also offers significant tax benefits? Understanding these benefits can encourage you to give more and maximize your impact. This article will delve into the key tax advantages of charitable giving.

Tax Deductions

The most common tax benefit associated with charitable giving is the ability to deduct your donations from your taxable income. This deduction can reduce your overall tax liability and save you money. The amount you can deduct depends on the type of donation and your filing status.

- Cash donations: You can deduct up to 60% of your Adjusted Gross Income (AGI) for cash donations.

- Donating appreciated assets: If you donate appreciated assets like stocks or real estate, you can deduct the fair market value of the asset at the time of donation, while also avoiding capital gains tax.

Itemized Deductions

To claim the charitable deduction, you need to itemize your deductions on your tax return. If you take the standard deduction, you can’t claim the charitable deduction.

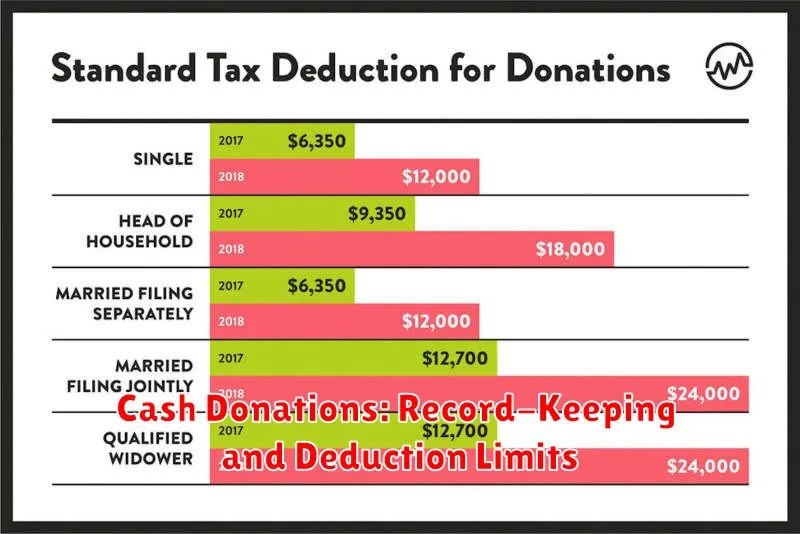

Standard Deduction vs. Itemized Deductions

The standard deduction is a set amount that you can deduct from your taxable income, while itemized deductions allow you to deduct specific expenses, including charitable donations.

The Importance of Documentation

For claiming charitable tax benefits, it’s essential to keep accurate records of your donations. This includes:

- Written acknowledgment from the charity: The acknowledgment should include the amount of your donation, the date of the donation, and a statement that the donation was made for a charitable purpose.

- Receipts for cash donations: Make sure to get receipts for all cash donations, even small ones.

Consult a Tax Professional

For complex situations or specific advice, it’s always recommended to consult a tax professional. They can help you understand the various tax benefits available to you and guide you through the process of claiming them.

In conclusion, charitable giving offers significant tax benefits that can help you save money and enhance your charitable contributions. Understanding these benefits and how to maximize them can make a big difference in the impact you can make through your generosity.

Eligible Organizations and Donations: What You Can Deduct

When it comes to making charitable donations, understanding the rules and regulations is crucial for maximizing your tax benefits. One of the most important aspects is determining which organizations qualify for tax deductions. Not all charities are created equal, and only certain types of organizations are eligible for you to claim a deduction on your taxes.

The Internal Revenue Service (IRS) classifies eligible organizations into several categories, each with specific requirements. Some of the most common types include:

- Public charities: These organizations typically receive funding from the general public and are often involved in a wide range of activities, such as providing social services, education, and healthcare.

- Private foundations: These organizations are typically funded by a single individual or family and often focus on specific charitable causes.

- Supporting organizations: These organizations are formed to support the activities of one or more public charities.

- Nonprofit organizations: While not all nonprofit organizations qualify for tax deductions, many do. It’s important to confirm the organization’s IRS classification.

In addition to the organization’s type, the nature of your donation can also affect its deductibility. For instance, you can generally deduct cash donations, donations of property, and volunteer services. However, there are specific rules and limitations for each type of donation. For example, you can usually deduct the full value of a cash donation, but the deductibility of property donations is often limited to the fair market value of the property at the time of the donation.

To ensure that your donation qualifies for a tax deduction, it’s essential to obtain proper documentation from the organization. This documentation typically includes a receipt acknowledging the donation and information about the organization’s tax-exempt status. You’ll also need to keep accurate records of your donations for tax purposes.

Understanding the rules surrounding eligible organizations and donations can help you maximize your tax benefits and support worthy causes. If you have any questions about the deductibility of your donations, it’s always best to consult with a qualified tax professional.

Cash Donations: Record-Keeping and Deduction Limits

Cash donations are a common way for individuals and businesses to support charities and other non-profit organizations. While making cash donations is generally straightforward, it’s essential to understand the record-keeping requirements and deduction limits to ensure you can claim the maximum tax benefit.

Record-Keeping

For cash donations of $250 or more, you must obtain a written acknowledgment from the charity. This acknowledgment should include:

- The name of the charity

- The date of the donation

- The amount of the donation

- A statement that the charity is a qualified organization

You should also keep a record of your donation, such as a canceled check or a receipt from the charity. This documentation is crucial for substantiating your donation for tax purposes.

Deduction Limits

The amount of cash donations you can deduct on your taxes is limited to 60% of your adjusted gross income (AGI). This means you can deduct up to 60% of your AGI in cash donations each year. Any amount exceeding this limit can be carried forward to future years.

For example, if your AGI is $100,000, you can deduct up to $60,000 in cash donations. If you donate $70,000, you can deduct $60,000 in the current year and carry forward the remaining $10,000 to the next year.

Additional Considerations

It’s important to note that some charities may have specific requirements for accepting cash donations. For example, some charities may require a minimum donation amount or may not accept cash donations at all. It’s always a good idea to contact the charity directly to inquire about their policies.

Furthermore, if you’re making a donation of $5,000 or more, you must use a specific form for reporting your donation. This form, known as Form 8283, provides additional information about the donation and helps the IRS verify its authenticity.

Conclusion

Cash donations are a valuable way to support non-profit organizations. By understanding the record-keeping requirements and deduction limits, you can maximize your tax benefits while contributing to the causes you care about. It’s always recommended to consult with a tax professional for personalized advice regarding your specific circumstances.

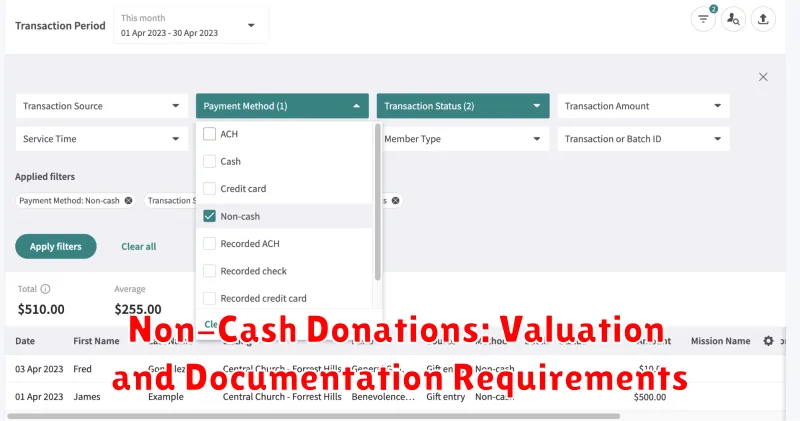

Non-Cash Donations: Valuation and Documentation Requirements

Non-cash donations, also known as in-kind donations, are contributions of goods or services that are not monetary. These donations can be valuable assets for non-profit organizations, but they also come with unique valuation and documentation requirements. This article will guide you through the process of properly valuing and documenting non-cash donations to ensure compliance with IRS regulations and maximize your organization’s tax benefits.

Valuation

The IRS requires that non-cash donations be valued at their fair market value (FMV). FMV is defined as the price that a willing buyer would pay to a willing seller in an open and competitive market. This means that you need to determine what the donated item would be worth if it were sold on the open market. Here are some helpful resources for determining the FMV of various types of donations:

- IRS Publication 561, Determining the Value of Donated Property

- Appraisers: Qualified appraisers can provide professional valuations for certain types of property, such as real estate, artwork, and antiques.

- Online Marketplaces: Websites like eBay and Craigslist can provide insights into the prices of similar items being sold.

- Retail Stores: You can compare the prices of donated items to similar items sold at retail stores.

Documentation

In addition to valuing the donation, you also need to maintain proper documentation to support the valuation. Here are the key elements of documentation:

- Donor Information: Collect the donor’s name, address, and contact information.

- Description of the Donation: Provide a detailed description of the donated item, including its make, model, condition, and any unique features.

- Date of Donation: Record the date the donation was received.

- Valuation Method: Document the method used to determine the FMV and the sources of information used (e.g., appraisal report, online marketplace data, retail price comparison).

- Appraisal Report: If you used an appraiser, obtain a written appraisal report that meets IRS requirements.

Tax Benefits

By properly valuing and documenting non-cash donations, your organization can claim a charitable contribution deduction on its tax return. The amount of the deduction is typically limited to the FMV of the donation. However, certain limitations and requirements apply, so it’s important to consult with a tax professional for guidance.

Conclusion

Non-cash donations can be a valuable resource for non-profit organizations. However, it’s crucial to understand and comply with IRS regulations regarding valuation and documentation. By following the guidelines outlined in this article, you can ensure that your organization receives the maximum tax benefits and maintains compliance with IRS requirements.

Donating Appreciated Assets: Maximizing Tax Benefits

When it comes to charitable giving, most people think about donating cash. However, there’s a powerful strategy that can amplify your impact and significantly reduce your tax burden: donating appreciated assets.

Appreciated assets are investments or property that have increased in value since you acquired them. This could include stocks, bonds, real estate, artwork, or even cryptocurrency. When you donate these assets, you can avoid paying capital gains tax, which can be substantial, especially if the assets have appreciated significantly.

Why Donate Appreciated Assets?

Here’s why donating appreciated assets is a smart move:

- Tax Deduction: You can deduct the fair market value of the asset at the time of the donation from your taxable income. This can result in significant tax savings.

- Avoid Capital Gains Tax: You won’t have to pay capital gains tax on the appreciation of the asset, which can be a substantial amount.

- Maximize Your Gift: By donating appreciated assets, you can give more to charity than you could with cash alone.

How It Works

The process of donating appreciated assets is straightforward. You simply transfer the asset to your chosen charity. They will then sell the asset and use the proceeds for their mission. However, it’s crucial to consult with a financial advisor and tax professional to ensure you’re maximizing the benefits and following all the necessary rules.

Things to Consider

While donating appreciated assets offers significant advantages, it’s essential to consider these points:

- Holding Period: Make sure you’ve held the asset for a long enough period to qualify for the long-term capital gains tax rate.

- Charity’s Needs: Ensure the charity you’re donating to can use the asset effectively.

- Alternative Strategies: Explore other charitable giving strategies, such as donor-advised funds, which can offer flexibility and tax benefits.

Conclusion

Donating appreciated assets can be a powerful way to support the causes you care about while reducing your tax burden. By carefully considering the benefits and potential drawbacks, you can make informed decisions that align with your philanthropic goals and financial objectives. Consulting with a qualified professional can provide valuable guidance and help you optimize your giving strategy.

Donor-Advised Funds: A Flexible Way to Give and Manage Donations

Donor-advised funds (DAFs) are charitable giving vehicles that allow individuals, families, and foundations to make tax-deductible contributions to a fund and then recommend grants from the fund to charities over time. DAFs offer a flexible and strategic way to manage your charitable giving, providing several benefits that can make them a valuable tool for both seasoned and novice philanthropists.

Benefits of Donor-Advised Funds

Here are some of the key advantages of utilizing a DAF:

- Tax Benefits: Contributions to a DAF are tax-deductible in the year they are made, even if you don’t distribute the funds to charities until later. This allows you to maximize your tax savings and potentially receive a larger charitable deduction.

- Flexibility and Control: You retain control over your donations, choosing when and where to distribute them from your DAF. This allows you to strategically support causes that resonate with your values and prioritize your giving according to your timeline and preferences.

- Investment Growth: Funds within a DAF can be invested, allowing your contributions to grow over time. This can potentially increase your impact and enable you to make larger donations to your chosen charities.

- Simplicity and Streamlining: A DAF simplifies the donation process, allowing you to make one large contribution and then distribute funds to multiple charities as needed. This eliminates the need for multiple individual donations and reduces administrative burdens.

- Charitable Planning: DAFs can be used as a powerful tool for charitable planning. They can be established as part of an estate plan, allowing you to make lasting contributions to your favorite causes after you are gone.

How Donor-Advised Funds Work

To set up a DAF, you make a contribution to a public charity that sponsors DAFs. This charity becomes the legal owner of the assets, but you maintain control over how they are distributed. You then recommend grants from your DAF to charities of your choice. The sponsoring charity typically handles the grantmaking process, ensuring efficient and effective distribution of your funds.

Choosing the Right Donor-Advised Fund

There are many sponsoring organizations that offer DAFs. It’s essential to choose one that aligns with your values and investment preferences. Consider factors like:

- Fees: Compare the fees charged by different DAF sponsors.

- Investment Options: Evaluate the investment options available within the DAF.

- Grantmaking Process: Understand the procedures for recommending and making grants.

- Reputation and Transparency: Research the sponsoring organization’s reputation and commitment to transparency.

Conclusion

Donor-advised funds offer a powerful and flexible way to support charitable causes and maximize your giving impact. If you’re looking for a strategic and tax-efficient approach to philanthropy, consider exploring the benefits of setting up a DAF.

Planned Giving: Leaving a Legacy Through Charitable Bequests

Planned giving, also known as charitable bequest, is a powerful way to make a lasting impact on the causes you care about while also benefiting from tax advantages. It involves incorporating charitable contributions into your estate plan, ensuring that your legacy extends beyond your lifetime.

Here’s a breakdown of the different types of planned giving options and their benefits:

Types of Planned Giving

- Bequests in Your Will: This is the most common method, where you designate a specific amount of money or assets to a charity in your will.

- Charitable Remainder Trusts: These trusts allow you to receive income from your assets for a set period, after which the remaining assets go to the charity.

- Charitable Lead Trusts: In this arrangement, the charity receives income from your assets for a specified period, and then the remaining assets are distributed to your beneficiaries.

- Gifts of Appreciated Property: You can donate appreciated assets, such as stocks or real estate, directly to a charity, avoiding capital gains tax.

- Life Insurance Policies: Designating a charity as the beneficiary of your life insurance policy can provide a substantial gift upon your passing.

Benefits of Planned Giving

Beyond the satisfaction of supporting worthy causes, planned giving offers several advantages:

- Tax Advantages: Charitable gifts often qualify for tax deductions, reducing your tax liability.

- Estate Planning: Planned giving can help streamline your estate and minimize estate taxes.

- Financial Security: Certain planned giving options, like charitable remainder trusts, can provide you with income for life.

- Legacy Creation: By leaving a bequest, you can leave a lasting impact on the world and ensure that your values continue to resonate.

Getting Started with Planned Giving

If you’re interested in exploring planned giving, it’s crucial to consult with a financial advisor and an estate planning attorney. They can help you navigate the intricacies of these options and choose the best approach for your circumstances.

Planned giving is a powerful tool for individuals who want to make a meaningful difference. By integrating charitable contributions into your estate plan, you can leave a lasting legacy and support the causes you hold dear.

Volunteer Work and Charitable Deductions: What You Need to Know

Volunteering is a rewarding experience that benefits both the community and the individual. It can be a great way to give back, learn new skills, and connect with others. But did you know that your volunteer work may also be eligible for tax deductions? This article will guide you through the ins and outs of claiming charitable deductions for your volunteer work.

While the value of your time spent volunteering isn’t directly deductible, there are certain expenses associated with volunteer work that can be claimed as charitable contributions. These expenses include:

- Out-of-pocket expenses: This includes costs such as travel, meals, and supplies that you directly incurred while volunteering.

- Donated goods: If you donate items to a qualified charity, you can often deduct the fair market value of those items. This could include clothes, furniture, or other household goods.

To claim a charitable deduction, you need to meet certain requirements. Firstly, the organization you volunteer for must be a qualified 501(c)(3) charity. You’ll need to obtain a written statement from the charity acknowledging your contributions. Secondly, you need to keep detailed records of your expenses. This includes receipts for travel, meal costs, and any other expenses related to your volunteer work.

The amount you can deduct is generally limited to a percentage of your adjusted gross income. The IRS offers several helpful forms and publications for determining your deductible amount, such as Form 8283 and Publication 526. Consulting with a tax professional can help you navigate the complexities of charitable deductions and ensure you’re taking advantage of all eligible benefits.

While the tax benefits may be a bonus, remember that volunteering is primarily about contributing to a cause you believe in. The real rewards of volunteering are the personal satisfaction and the positive impact you make on your community.

Maximizing Your Charitable Deductions: Strategies and Tips

Charitable giving is a rewarding act, but it can also be a smart financial move. By strategically planning your donations, you can maximize your tax deductions and make a greater impact with your contributions. Here’s a breakdown of key strategies and tips to help you get the most out of your charitable giving.

Understanding Charitable Deductions

The standard deduction is a fixed amount that you can subtract from your taxable income. You can choose to itemize your deductions, including charitable contributions, if they exceed the standard deduction. The amount you can deduct is typically limited to a percentage of your Adjusted Gross Income (AGI), with different limitations for cash and non-cash donations.

Maximize Your Deductions

Here are some strategies to increase your charitable deductions:

- Bundle Your Donations: Rather than making small donations throughout the year, consider making a larger contribution at the end of the year. This can help you reach the deduction threshold and maximize your savings.

- Donate Appreciated Assets: Instead of cash, consider donating appreciated assets like stocks or securities. This can result in a larger deduction than you’d receive from selling the asset and donating the proceeds. You’ll avoid paying capital gains tax on the appreciation, and you can potentially deduct the fair market value of the asset.

- Support Donor-Advised Funds: Donor-advised funds (DAFs) allow you to make a charitable contribution and receive an immediate tax deduction. You can then recommend grants from the fund over time to the charities you support.

- Plan for Large Gifts: If you are planning to make a significant donation, consider setting up a charitable remainder trust. This allows you to receive income from the trust for life, with the remainder going to your chosen charity. This can create a substantial tax savings for you and a large donation for the charity.

- Consider Giving Through Your Business: If you are a business owner, you can donate through your company, potentially receiving tax deductions as business expenses. This strategy can be especially beneficial for companies that have accumulated profits.

Important Tips for Charitable Giving

Beyond maximizing your deductions, keep these tips in mind:

- Get Receipts: Always obtain receipts from charities for all donations. These are crucial for documentation purposes and can help prevent any issues during tax season.

- Research Charities: Ensure the charities you support are reputable and use their donations effectively. You can check their ratings and financial information on websites like Charity Navigator and GuideStar.

- Consult a Tax Advisor: For complex charitable giving strategies, it is recommended to consult with a tax advisor. They can help you make informed decisions and ensure you are maximizing your deductions while remaining compliant with tax laws.

Conclusion

Charitable giving is a powerful way to make a difference while potentially saving on your taxes. By taking advantage of strategies and tips like those outlined above, you can maximize your deductions and create a significant impact on your chosen causes. Remember to research charities thoroughly and seek professional advice when needed to ensure you are giving effectively and responsibly.