Running a small business can be incredibly rewarding, but it also comes with its fair share of challenges. One of the biggest hurdles is navigating the complex world of taxes. As a small business owner, you’re responsible for understanding and complying with a wide range of tax laws and regulations, which can feel overwhelming. But don’t despair! There are several effective tax strategies you can employ to significantly reduce your tax burden and maximize your profits.

This guide will explore proven strategies that can help you save money on taxes, offering valuable insights for small business owners at every stage of their journey. From taking advantage of deductions and credits to optimizing your business structure, we’ll equip you with the knowledge to make informed financial decisions and navigate the tax landscape with confidence. So, buckle up and get ready to unlock the secrets to tax savings for your small business!

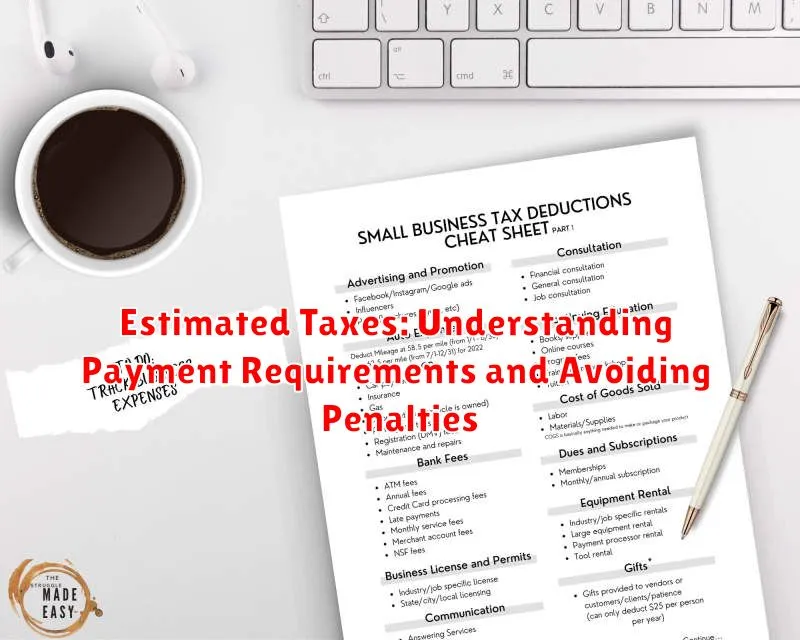

Common Tax Deductions for Small Businesses

Running a small business can be a rewarding experience, but it also comes with its fair share of complexities, especially when it comes to taxes. Fortunately, there are several tax deductions available to small business owners that can help reduce their tax liability and increase their bottom line. This article will explore some of the most common tax deductions that small businesses can take advantage of.

1. Home Office Deduction

If you use a portion of your home for business purposes, you may be eligible for the home office deduction. This deduction allows you to deduct a portion of your home’s expenses, such as mortgage interest, rent, utilities, and insurance, based on the percentage of your home used for business. It’s crucial to maintain accurate records of your business use of the space to support your claim. The home office deduction can be claimed using either the Simplified Method or the Regular Method, with the Simplified Method offering a simpler calculation but a smaller potential deduction.

2. Business Expenses

The majority of expenses incurred in running your business are generally deductible. This includes expenses for things like:

- Advertising and Marketing

- Office Supplies

- Salaries and Wages

- Insurance Premiums

- Rent or Lease Payments

- Travel Expenses

- Professional Fees

- Utilities

- Repairs and Maintenance

- Depreciation

3. Depreciation

Depreciation allows you to deduct the cost of business assets, such as computers, equipment, and vehicles, over their useful lives. This deduction helps account for the gradual wear and tear on these assets and reduces your taxable income. The depreciation method used will depend on the type of asset and the IRS guidelines.

4. Section 179 Deduction

Section 179 of the Internal Revenue Code allows businesses to deduct the full purchase price of qualifying equipment in the year it’s placed in service, up to a certain limit. This can significantly reduce your tax liability and provide a substantial upfront tax savings.

5. Health Insurance Premiums

Small business owners who offer health insurance to themselves or their employees can deduct the premiums paid as a business expense. This can be a significant tax benefit, especially for businesses with higher healthcare costs.

6. Retirement Plan Contributions

Contributing to a retirement plan, such as a SEP-IRA or a Solo 401(k), can offer significant tax benefits. These contributions are typically tax-deductible, and the funds grow tax-deferred until retirement. This can be a smart strategy for both saving for retirement and reducing your current tax liability.

7. Education and Training Expenses

Investing in education and training for yourself or your employees can lead to higher productivity and better business outcomes. You can deduct expenses related to these activities, including tuition, fees, books, and travel expenses. This deduction can help offset the costs of enhancing your skills and knowledge.

8. Charitable Contributions

If your business makes charitable donations, you can deduct these contributions up to a certain percentage of your taxable income. This is a great way to support worthy causes while also benefiting your tax situation.

9. Bad Debts

If your business has uncollectible debts, you can deduct these bad debts as a business expense. This can help offset the losses from customers who fail to pay their invoices.

10. State and Local Taxes (SALT) Deduction

The Tax Cuts and Jobs Act of 2017 limited the deductibility of state and local taxes to $10,000 per household. However, small businesses may be able to deduct additional SALT expenses through other provisions of the tax code, such as the deduction for business interest expense. It’s essential to consult with a tax professional to understand the specifics of this deduction.

Conclusion

Taking advantage of all eligible tax deductions is essential for minimizing your tax liability and maximizing your business’s profitability. While this list highlights common deductions, it’s not exhaustive, and specific circumstances may warrant additional deductions. It’s highly recommended to consult with a qualified tax professional to ensure you’re taking full advantage of all applicable deductions and complying with current tax laws.

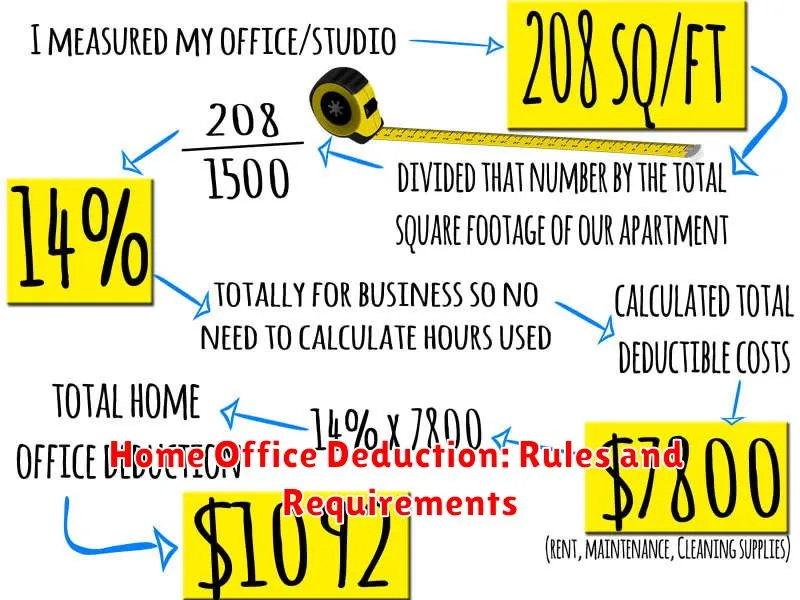

Home Office Deduction: Rules and Requirements

The home office deduction allows taxpayers to deduct a portion of their home expenses if they use a portion of their home exclusively and regularly for business purposes. This deduction can help reduce your tax liability, but it comes with certain rules and requirements that you need to meet.

Eligibility Requirements

To qualify for the home office deduction, you must meet the following requirements:

- You must use the space in your home exclusively and regularly for your business.

- The space must be your principal place of business or a place where you meet clients, patients, or customers.

- You must use the space for your business for a significant portion of the year.

- You must be an independent contractor, sole proprietor, or a small business owner.

Types of Home Office Deductions

There are two methods to calculate your home office deduction:

- Actual Expenses Method: This method allows you to deduct the actual expenses you incurred for your home office, such as rent, mortgage interest, property taxes, utilities, insurance, and repairs. You can only deduct the portion of these expenses that applies to the business use of your home.

- Simplified Method: This method is easier to calculate, but it also results in a smaller deduction. You can deduct $5 per square foot of your home office space, up to a maximum of 300 square feet.

Documentation Requirements

To claim the home office deduction, you must have proper documentation to support your expenses. This documentation includes:

- A record of the square footage of your home office.

- Receipts and invoices for all home office expenses.

- A written description of how you use your home office for business purposes.

Conclusion

The home office deduction can be a valuable tax benefit for eligible taxpayers. However, it’s important to understand the rules and requirements to ensure you qualify for the deduction and claim it accurately. If you have any questions, consult with a tax professional.

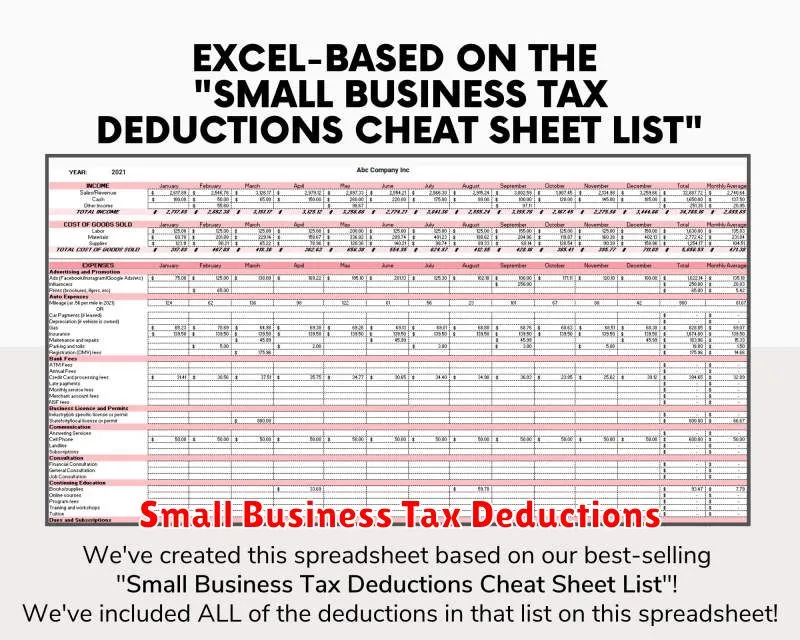

Deductible Business Expenses: Identifying and Tracking Expenses

As a business owner, you’re likely well aware of the importance of keeping track of your expenses. But did you know that many of these expenses can actually be deducted from your taxable income, potentially saving you a significant amount of money? Understanding which expenses are deductible and how to track them effectively is crucial for minimizing your tax burden and maximizing your profits.

Identifying Deductible Expenses

The IRS offers a wide range of deductible expenses for businesses, categorized broadly as:

- Ordinary and necessary expenses: These are expenses that are common in your industry and essential for running your business. Examples include rent, utilities, salaries, and supplies.

- Reasonable expenses: Expenses must be reasonable in amount and not excessive for the services rendered. This means you should avoid inflated or unnecessary expenditures.

- Expenses directly related to your business: Only expenses directly associated with your business activities are deductible. Personal expenses, such as a vacation or home improvements, are not deductible.

To further understand which expenses are deductible, consider these categories:

Commonly Deductible Expenses

- Advertising and Marketing

- Bank Fees and Interest

- Depreciation

- Employee Salaries and Benefits

- Insurance Premiums

- Legal and Accounting Fees

- Office Supplies and Equipment

- Rent and Utilities

- Repairs and Maintenance

- Travel Expenses

Tracking Expenses

Accurate and organized recordkeeping is essential for claiming all eligible deductions. Here are some tips for tracking expenses:

- Use a dedicated system: Employ a spreadsheet, accounting software, or a dedicated business expense tracking app to record all transactions.

- Keep detailed receipts: Gather all receipts for purchases, including date, vendor, and itemized expenses. Store these receipts in a safe and organized manner.

- Categorize expenses: Organize your expenses by category, such as rent, utilities, or marketing, for easy analysis and reporting.

- Maintain a log of mileage: If you use your personal vehicle for business purposes, keep a log of mileage to claim mileage deductions.

- Regularly review and reconcile: Periodically review your expense records against bank statements and other financial documents to ensure accuracy.

Consult with a Professional

For complex situations or specialized business expenses, it’s always advisable to seek guidance from a qualified tax professional. They can provide tailored advice on deductible expenses and help you maximize your deductions.

Benefits of Effective Expense Tracking

- Reduced tax liability: Claiming all eligible deductions lowers your taxable income, resulting in lower tax payments.

- Improved financial management: Tracking expenses provides valuable insights into your business’s financial health and spending patterns.

- Enhanced business decision-making: Analyzing your expenses helps you make informed decisions about resource allocation and cost optimization.

By diligently identifying and tracking your business expenses, you can ensure you’re claiming all eligible deductions, minimizing your tax burden, and maximizing your financial well-being.

Depreciation of Assets: Methods and Benefits

Depreciation is a crucial accounting concept that reflects the gradual decline in value of a tangible asset over time due to wear and tear, obsolescence, or usage. It is a systematic and rational allocation of the cost of an asset over its useful life. Understanding depreciation is essential for businesses as it impacts financial reporting, tax planning, and investment decisions.

Methods of Depreciation

Several methods are used to calculate depreciation, each with its own assumptions and implications. The most common methods include:

- Straight-Line Depreciation: This method evenly distributes the cost of an asset over its useful life. It is simple to calculate and widely used. For example, if an asset costs $10,000 and has a useful life of 5 years, the annual depreciation expense would be $2,000.

- Declining Balance Depreciation: This method depreciates an asset at a higher rate in the early years of its life and at a lower rate in later years. It is based on the assumption that an asset loses more value in the initial years. The double-declining balance method is a popular variant that depreciates the asset at twice the straight-line rate.

- Sum-of-the-Years’ Digits Depreciation: This method uses a fraction based on the sum of the remaining years of useful life to calculate depreciation. It results in higher depreciation in the early years and lower depreciation in later years.

- Units of Production Depreciation: This method depreciates an asset based on its actual usage or production. It is suitable for assets that are used extensively or have a variable usage pattern. For example, a machine that produces 10,000 units per year will be depreciated at a rate of 1/10,000 per unit produced.

Benefits of Depreciation

Depreciation provides several benefits to businesses, including:

- Accurate Financial Reporting: Depreciation allows businesses to reflect the decline in value of their assets in their financial statements. This provides a more realistic picture of the company’s financial health and performance.

- Tax Savings: Depreciation expenses are deductible for tax purposes, reducing taxable income and tax liabilities. This can be a significant advantage for businesses, particularly those with large capital investments.

- Investment Planning: Depreciation helps businesses plan for future asset replacements by recognizing the declining value of existing assets. It allows for the accumulation of funds to replace assets when they reach the end of their useful lives.

- Asset Management: By tracking depreciation, businesses can monitor the performance of their assets and make informed decisions about their maintenance, repair, or disposal.

Conclusion

Depreciation is a vital accounting concept that plays a significant role in business operations. By understanding depreciation methods and their benefits, businesses can make more informed financial decisions, optimize tax planning, and ensure the long-term sustainability of their operations.

Tax Credits for Small Businesses: Incentives for Growth and Innovation

Small businesses are the backbone of the American economy, driving innovation, creating jobs, and contributing significantly to the nation’s economic growth. Recognizing their importance, the US government offers a range of tax credits designed to provide financial incentives and support the growth and success of small businesses.

These tax credits can be a valuable resource for small business owners, offering potential financial benefits that can be used to invest in new equipment, expand operations, hire new employees, or simply increase their bottom line. Understanding the available tax credits and their eligibility requirements is crucial for maximizing these opportunities.

Key Tax Credits for Small Businesses:

Here are some of the most prominent tax credits designed specifically for small businesses:

- Work Opportunity Tax Credit (WOTC): This credit is offered to businesses that hire individuals from certain target groups, such as veterans, long-term unemployed individuals, and ex-felons. It provides a tax credit based on the wages paid to these employees.

- Small Business Health Care Tax Credit: This credit is available to small businesses that provide health insurance to their employees. The amount of the credit is based on the size of the business and the average premium paid by employees.

- Research and Development (R&D) Tax Credit: This credit encourages businesses to invest in innovation and research. It provides a tax credit for expenses incurred in developing new products, processes, or technologies.

- Energy Efficient Commercial Buildings Tax Deduction: This deduction provides a tax credit for businesses that make energy-efficient improvements to their commercial buildings. It incentivizes investments in sustainable practices and reduces energy consumption.

Benefits of Tax Credits:

Beyond the obvious financial benefits, tax credits offer several advantages for small businesses:

- Increased Profitability: Tax credits directly reduce a business’s tax liability, increasing their net income and cash flow.

- Investment Opportunities: The financial relief from tax credits allows businesses to invest in growth initiatives, such as purchasing new equipment, hiring additional staff, or expanding their operations.

- Competitive Advantage: By taking advantage of tax credits, small businesses can gain a competitive edge by reducing their costs and enhancing their ability to offer competitive pricing or invest in innovation.

- Government Support: Tax credits demonstrate government support for small businesses and their role in the economy, encouraging entrepreneurship and job creation.

How to Claim Tax Credits:

To claim tax credits, businesses must carefully review the specific eligibility criteria for each credit. This involves understanding the applicable industry, employee demographics, expenses incurred, and other relevant factors. It is highly recommended to consult with a qualified tax professional who can guide businesses through the process and ensure they are claiming all eligible credits.

By actively exploring and claiming available tax credits, small businesses can unlock significant financial benefits that can contribute to their growth, innovation, and overall success. These incentives offer a valuable opportunity to enhance competitiveness, expand operations, and thrive in today’s dynamic economic landscape.

Estimated Taxes: Understanding Payment Requirements and Avoiding Penalties

Estimated taxes are payments made throughout the year to cover your tax liability. They are required for individuals who don’t have taxes withheld from their income, such as freelancers, self-employed individuals, and those with income from investments. Understanding your estimated tax obligations and making timely payments is crucial to avoid penalties.

Who Needs to Pay Estimated Taxes?

You may need to pay estimated taxes if you:

- Are self-employed or a freelancer.

- Have income from investments, such as dividends or capital gains.

- Have income from sources other than employment, like rental properties or royalties.

- Expect to owe more in taxes than the amount withheld from your wages.

Calculating Your Estimated Tax Payment

To calculate your estimated tax payments, you can use the IRS’s Form 1040-ES. You can base your estimate on your previous year’s tax return or your expected income for the current year. The IRS offers several payment methods, including online, by mail, or through a tax professional.

Estimated Tax Payment Deadlines

Estimated taxes are due on the following dates:

- April 15th for the first quarter.

- June 15th for the second quarter.

- September 15th for the third quarter.

- January 15th of the following year for the fourth quarter.

If any of these dates fall on a weekend or holiday, the deadline is shifted to the next business day.

Avoiding Penalties

Failure to pay estimated taxes on time can result in penalties. To avoid penalties, you should:

- Pay your estimated taxes on time.

- Make accurate estimates. Underestimating your tax liability can lead to penalties.

- File your tax return on time. Even if you’ve paid estimated taxes, you still need to file your tax return by the deadline.

- Keep records of your income and expenses. This will help you accurately calculate your estimated tax liability.

Conclusion

Understanding and fulfilling your estimated tax obligations is crucial for avoiding penalties. By planning ahead, accurately calculating your payments, and staying organized, you can ensure that you’re meeting your tax responsibilities and minimizing your tax burden.

Choosing the Right Business Structure for Tax Optimization

Starting a business is an exciting endeavor, but it’s crucial to consider the legal structure from the beginning. The choice of business structure significantly impacts your tax obligations and overall financial well-being. Here’s a comprehensive guide to help you select the right business structure for tax optimization.

Understanding Business Structures

Several common business structures exist, each with its own set of rules and regulations. The most popular include:

- Sole Proprietorship: A single owner operates the business, and there’s no legal distinction between the owner and the business. Profits and losses flow directly to the owner’s personal tax return.

- Partnership: Two or more individuals share ownership and profits. Like sole proprietorships, partners report business income and expenses on their personal tax returns.

- Limited Liability Company (LLC): Offers liability protection to its owners (members) while allowing flexibility in taxation. Owners can choose to be taxed as a sole proprietorship, partnership, or corporation.

- Corporation: A separate legal entity from its owners (shareholders). Corporations have their own tax obligations and are subject to double taxation (at the corporate level and again when profits are distributed to shareholders).

Factors to Consider for Tax Optimization

When selecting a business structure, consider these tax-related factors:

- Tax Rates: Different structures have varying tax rates. For example, corporations face corporate income tax rates, while sole proprietorships and partnerships pay taxes at individual rates.

- Deductions and Credits: Certain business structures offer specific deductions and credits, which can significantly reduce your tax liability.

- Liability Protection: Choosing a structure like an LLC or corporation provides liability protection, shielding your personal assets from business debts and lawsuits.

- Administrative Requirements: Corporations and LLCs typically require more administrative tasks and paperwork compared to sole proprietorships and partnerships.

- Future Growth Plans: If you anticipate expanding your business, consider a structure that allows for easy scaling and access to capital.

Seeking Professional Advice

The optimal business structure is highly dependent on your individual circumstances and goals. It’s strongly recommended to consult with a tax advisor or attorney who can assess your specific situation and provide personalized guidance.

Remember, choosing the right business structure is a crucial step in maximizing your tax efficiency and setting your business up for long-term success. Don’t hesitate to seek professional advice to make an informed decision.

Leveraging Tax-Advantaged Retirement Plans

Retirement planning is a crucial aspect of financial security. It involves saving and investing for your future, ensuring you have enough resources to live comfortably during your golden years. One of the most effective strategies for retirement planning is leveraging tax-advantaged retirement plans. These plans offer significant benefits that can help you accumulate wealth and minimize your tax burden.

Types of Tax-Advantaged Retirement Plans

Several types of tax-advantaged retirement plans are available, each with its own set of rules and benefits. Some common plans include:

- 401(k) plans: Offered by employers, allowing employees to contribute pre-tax dollars to their retirement accounts.

- 403(b) plans: Similar to 401(k) plans but typically offered by non-profit organizations, schools, and universities.

- Traditional IRAs: Individual Retirement Accounts that allow pre-tax contributions and tax-deferred growth.

- Roth IRAs: IRAs where contributions are made after taxes, but withdrawals in retirement are tax-free.

- SEP IRAs: Simple IRAs designed for self-employed individuals and small business owners.

Benefits of Tax-Advantaged Retirement Plans

Utilizing tax-advantaged retirement plans offers several benefits:

- Tax Deductions: Pre-tax contributions to most retirement plans reduce your taxable income, leading to lower tax bills in the present.

- Tax-Deferred Growth: Your investments grow tax-free until retirement, allowing your savings to compound faster.

- Tax-Free Withdrawals: With Roth IRAs, withdrawals in retirement are entirely tax-free.

- Employer Matching: Some employers offer matching contributions to 401(k) plans, effectively increasing your savings.

Strategies for Maximizing Benefits

To maximize the benefits of tax-advantaged retirement plans, consider the following strategies:

- Contribute the Maximum: Contribute the maximum amount allowed by your plan to take full advantage of tax benefits.

- Choose the Right Plan: Select the plan that best suits your individual needs and circumstances.

- Diversify Your Investments: Spread your retirement savings across different asset classes to manage risk and potential returns.

- Review and Adjust Regularly: Regularly review your retirement plan and make adjustments as needed based on your financial goals and life changes.

Conclusion

Tax-advantaged retirement plans are invaluable tools for building a secure financial future. By understanding the different types of plans, their benefits, and effective strategies, you can maximize your savings and minimize your tax burden. Take advantage of these plans today to set yourself up for a comfortable and financially secure retirement.

Staying Informed About Tax Law Changes

Tax laws are constantly changing, and it’s important to stay up-to-date on the latest developments. Changes in tax law can have a significant impact on your finances, so it’s essential to be aware of any new rules or regulations that may affect you. This article will discuss some ways to stay informed about tax law changes.

Follow the IRS

The Internal Revenue Service (IRS) is the primary source of information on tax law changes. The IRS website provides a wealth of resources, including news releases, publications, and regulations. You can also sign up for email alerts from the IRS to receive notifications about new tax laws and regulations.

Subscribe to Tax Newsletters

Many organizations and publications offer tax newsletters that provide updates on tax law changes. These newsletters can be a valuable resource for staying informed about changes that may affect you. Some popular tax newsletters include:

- Tax Foundation

- Tax Policy Center

- Tax Analysts

Consult with a Tax Professional

If you are unsure about how tax law changes may affect you, it is best to consult with a tax professional. A tax professional can help you understand the new laws and how they may impact your tax liability. They can also provide advice on how to comply with the new regulations.

Stay Informed Throughout the Year

Don’t wait until tax season to stay informed about tax law changes. It’s important to stay up-to-date throughout the year to avoid any surprises. By following these tips, you can stay informed about tax law changes and ensure that you are in compliance with the latest regulations.