Tax season can be a stressful time for many people. With all the forms, deadlines, and regulations, it’s easy to make mistakes. In fact, according to the IRS, millions of taxpayers make errors on their returns every year. These mistakes can result in penalties, interest charges, and even audits. But don’t worry, there are steps you can take to avoid making common tax mistakes.

In this article, we’ll discuss some of the most common tax mistakes that people make and provide helpful tips on how to avoid them. We’ll cover topics such as claiming the wrong deductions, failing to keep accurate records, and missing important deadlines. By reading this article, you can gain valuable insights and strategies to ensure a smooth and accurate tax filing experience.

Understanding Common Tax Filing Errors

Filing your taxes can be a daunting task, and even the most meticulous taxpayers can make mistakes. It’s important to understand common tax filing errors to avoid them and ensure you’re getting the correct refund or paying the right amount of taxes. Here are some of the most frequent mistakes people make when filing their taxes:

1. Incorrect Filing Status

Choosing the wrong filing status can lead to significant tax consequences. It’s crucial to select the appropriate status based on your marital status, dependents, and other factors. Make sure you understand the differences between single, married filing jointly, married filing separately, head of household, and qualifying widow(er).

2. Missing or Incorrect Personal Information

Double-check that you’ve entered all your personal information accurately, including your Social Security number, name, address, and dependents’ information. Any discrepancies could lead to delays in processing your return or even an audit.

3. Errors in Deductions and Credits

There are numerous deductions and credits available to taxpayers, but it’s essential to ensure you qualify for them and claim them correctly. Some common errors include claiming dependents who don’t meet the requirements, overstating charitable contributions, or taking incorrect deductions for medical expenses or mortgage interest.

4. Failing to File on Time

The IRS has strict deadlines for filing your taxes, and failing to meet these deadlines can result in penalties. Make sure you know the filing deadline and file your taxes on time, even if you need to file an extension.

5. Not Keeping Adequate Records

Proper recordkeeping is essential for accurate tax filing. Keep receipts, pay stubs, and other documentation that supports your tax deductions and credits. This will help you avoid errors and ensure you can substantiate your claims if audited.

6. Ignoring Your W-2 and 1099 Forms

Your W-2 and 1099 forms contain crucial information about your income and taxes withheld. Make sure you review these forms carefully and enter the information accurately on your tax return. Any discrepancies could result in errors in your tax liability.

7. Not Utilizing Tax Software or Professional Help

While filing your taxes online or using tax software can be convenient, it’s important to ensure you understand how to use these tools correctly. Seek professional help from a tax preparer if you’re not confident in your ability to file accurately. A tax professional can provide valuable guidance and help you avoid costly mistakes.

8. Not Understanding the Tax Implications of Life Events

Major life events, such as getting married, having a child, or purchasing a home, can significantly impact your tax obligations. It’s essential to understand these changes and adjust your tax filing accordingly. Seek professional advice if you have questions about the tax implications of life events.

By understanding these common tax filing errors, you can take steps to avoid them and ensure your tax return is accurate and timely. Don’t hesitate to seek professional help if you have any questions or concerns about filing your taxes. Proper tax planning and preparation can save you time, money, and headaches in the long run.

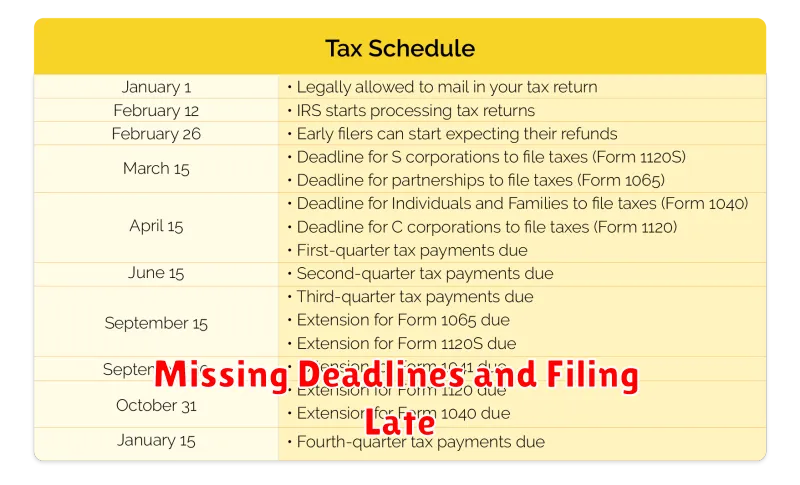

Missing Deadlines and Filing Late

Missing deadlines and filing late can have serious consequences, both for individuals and businesses. In the personal realm, it can lead to late fees, missed opportunities, and damage to personal relationships. Professionally, it can result in lost clients, decreased productivity, and even job loss. It’s crucial to understand the reasons behind these issues and develop strategies to prevent them from occurring.

Common Causes of Missing Deadlines

There are several common reasons why people miss deadlines. These include:

- Poor Time Management: Underestimating the time required to complete a task, failing to prioritize effectively, and not setting realistic deadlines can all contribute to missed deadlines.

- Procrastination: This is a common problem where people delay tasks until the last minute, leaving themselves with insufficient time to complete them properly.

- Lack of Organization: Not having a clear system for managing tasks, such as a calendar or to-do list, can lead to confusion and missed deadlines.

- Distractions: Constant interruptions and distractions, such as social media or email, can significantly impede progress and cause deadlines to be missed.

- Fear of Failure: Sometimes, people avoid starting a task because they fear they won’t be able to complete it successfully. This can lead to procrastination and missed deadlines.

Consequences of Missing Deadlines

The consequences of missing deadlines can be far-reaching. They include:

- Financial Penalties: Many institutions and organizations impose late fees or penalties for missed deadlines, such as late rent payments, missed credit card payments, or late tax filings.

- Lost Opportunities: Missing a deadline can mean missing out on valuable opportunities, such as applying for a job, submitting a project proposal, or registering for an event.

- Damage to Reputation: Consistently missing deadlines can damage your reputation and make it difficult to gain trust from others.

- Stress and Anxiety: The pressure of impending deadlines can lead to significant stress and anxiety, which can have a negative impact on overall well-being.

- Legal Issues: In certain situations, missing deadlines can have legal consequences, such as failing to file a legal document on time or missing a court date.

Tips for Avoiding Missed Deadlines

There are several things you can do to avoid missing deadlines:

- Plan Ahead: Break down large tasks into smaller, more manageable steps, and allocate specific timeframes for each step. Set realistic deadlines for each step to ensure the overall project stays on track.

- Use a Calendar or To-Do List: Utilize a calendar or to-do list to keep track of all your deadlines, appointments, and tasks. Make sure to set reminders for upcoming deadlines.

- Prioritize Tasks: Focus on the most important tasks first and address them with the appropriate level of urgency. Avoid distractions and stay focused on the task at hand.

- Seek Help: If you’re struggling to meet a deadline, don’t be afraid to ask for help. Delegate tasks to others or seek assistance from a mentor or colleague.

- Learn from Mistakes: If you do miss a deadline, take some time to reflect on why it happened. Identify areas for improvement and implement changes to prevent similar situations in the future.

Missing deadlines can be frustrating and detrimental, but with proper planning, organization, and self-discipline, it can be avoided. By developing effective strategies to manage your time, prioritize tasks, and stay focused, you can increase your chances of meeting deadlines and achieving your goals.

Incorrect Filing Status and Dependent Information

It is important to file your taxes with the correct filing status and dependent information. This will help ensure that you are paying the correct amount of taxes and that you are receiving all of the credits and deductions that you are entitled to. Choosing the wrong filing status can result in an incorrect tax liability, and failing to claim all eligible dependents may mean you miss out on valuable tax breaks.

What is Filing Status?

Your filing status determines your tax bracket and the amount of taxes you owe. There are five filing statuses:

- Single: For unmarried individuals.

- Married Filing Jointly: For married couples who want to file their taxes together.

- Married Filing Separately: For married couples who want to file their taxes separately.

- Head of Household: For unmarried individuals who pay more than half the cost of keeping up a home for a qualifying child.

- Qualifying Widow(er) with Dependent Child: For surviving spouses who meet certain requirements.

Who is a Dependent?

A dependent is a person who relies on you for financial support. You can claim a dependent on your tax return if they meet certain requirements. Some common examples of dependents include:

- Children: Your biological, adopted, or stepchildren who meet certain age and residency requirements.

- Other Relatives: Other family members, such as parents, siblings, or grandparents, who meet certain requirements.

- Non-relatives: Individuals who are not related to you but who meet certain requirements, such as foster children.

Consequences of Incorrect Filing Status and Dependent Information

Filing with the wrong status or omitting eligible dependents can lead to several consequences:

- Higher Tax Liability: You may owe more taxes than necessary.

- Missed Tax Credits and Deductions: You may miss out on valuable tax breaks.

- Audit Risk: Filing with incorrect information could increase the likelihood of an audit.

- Penalties: The IRS may impose penalties for filing with inaccurate information.

How to Correct Filing Errors

If you discover that you filed with the wrong filing status or missed claiming dependents, you can correct the error by filing an amended tax return. To file an amended return, you will need to use Form 1040-X, Amended U.S. Individual Income Tax Return.

Overlooking Eligible Deductions and Credits

It’s tax season again, and many people are busy filing their returns. While you may be focused on getting your taxes done as quickly as possible, it’s important to take the time to make sure you’re claiming all the deductions and credits you’re eligible for. Failing to do so could result in you paying more taxes than you need to.

One of the most common mistakes people make is overlooking eligible deductions. There are many different types of deductions, and the ones you’re eligible for will depend on your individual circumstances. Some common deductions include:

- Standard deduction: This is a fixed amount that you can deduct from your taxable income. The amount of the standard deduction varies depending on your filing status.

- Itemized deductions: These are deductions for specific expenses, such as medical expenses, charitable contributions, and home mortgage interest. You can choose to take the standard deduction or itemize your deductions, but you can’t take both.

- Above-the-line deductions: These deductions are subtracted from your gross income before you calculate your adjusted gross income (AGI). Some common above-the-line deductions include contributions to a traditional IRA, student loan interest, and educator expenses.

In addition to deductions, there are also a number of tax credits that you may be eligible for. Tax credits reduce your tax liability dollar for dollar, while deductions only reduce your taxable income. Some common tax credits include:

- Earned Income Tax Credit (EITC): This credit is available to low- and moderate-income working individuals and families. The amount of the credit depends on your income and the number of qualifying children you have.

- Child Tax Credit: This credit is available for each qualifying child under the age of 17. The amount of the credit is $2,000 per child, but it may be reduced or phased out depending on your income.

- American Opportunity Tax Credit: This credit is available for qualified educational expenses for the first four years of post-secondary education. The amount of the credit is up to $2,500 per student, but it may be reduced or phased out depending on your income.

The best way to make sure you’re claiming all the deductions and credits you’re eligible for is to talk to a tax professional. They can help you review your tax situation and identify any potential deductions or credits that you may have overlooked. You can also use tax preparation software or websites to help you identify deductions and credits.

Don’t wait until the last minute to file your taxes. Give yourself plenty of time to gather all the necessary documents and to review your tax return carefully. And make sure you’re claiming all the deductions and credits you’re eligible for. It could save you a lot of money.

Miscalculations and Mathematical Errors

Miscalculations and mathematical errors can occur in various aspects of our lives, ranging from simple everyday tasks to complex scientific research. These errors can have significant consequences, leading to incorrect outcomes, wasted time and resources, and even financial losses. Understanding the causes and consequences of miscalculations is crucial for minimizing their occurrence and ensuring accuracy in our calculations.

Common Causes of Miscalculations

Miscalculations can arise from a variety of factors, including:

- Human error: Carelessness, distractions, or lack of attention to detail can lead to mistakes in calculations.

- Misunderstanding of concepts: A lack of understanding of the underlying mathematical principles or formulas can result in incorrect application.

- Incorrect data entry: Entering incorrect numbers or values into calculations can lead to inaccurate results.

- Rounding errors: Rounding numbers during calculations can introduce small errors that accumulate over time.

- Software bugs: Errors in software programs or calculators can also cause miscalculations.

Consequences of Mathematical Errors

The consequences of miscalculations can vary depending on the context and the magnitude of the error. Some potential consequences include:

- Incorrect outcomes: Miscalculations can lead to incorrect results in scientific experiments, engineering projects, or financial analyses.

- Wasted time and resources: Retesting, recalculating, and correcting errors can consume valuable time and resources.

- Financial losses: Incorrect financial calculations can result in financial losses, such as underestimating costs or overestimating revenue.

- Safety risks: Miscalculations in engineering or medical settings can pose safety risks, leading to accidents or injuries.

- Loss of credibility: Repeated miscalculations can damage an individual’s or organization’s credibility.

Minimizing Miscalculations

To minimize the risk of miscalculations, it is important to:

- Double-check calculations: Always double-check your work to ensure accuracy.

- Use appropriate tools: Employ calculators, spreadsheets, or specialized software to assist with calculations.

- Understand the concepts: Ensure a thorough understanding of the mathematical principles and formulas involved.

- Maintain focus and concentration: Avoid distractions and pay close attention to details during calculations.

- Regularly review and update calculations: Periodically review and update calculations to account for any changes or errors.

By being aware of the common causes and consequences of miscalculations and taking steps to minimize their occurrence, we can improve the accuracy of our calculations and avoid costly errors.

Failure to Report All Income

Failing to report all income is a serious offense that can have severe consequences. It is important to understand the implications of this action and take steps to ensure that all income is properly reported.

What is considered income? Income is any money you receive from any source, including wages, salaries, tips, interest, dividends, capital gains, and rental income. It also includes income from self-employment, such as freelance work or operating a business.

Why is it important to report all income? When you fail to report all income, you are not only evading taxes but also potentially committing fraud. The IRS has a number of ways to detect unreported income, such as through third-party reporting, audits, and investigations. If you are caught, you could face significant penalties, including fines, jail time, and even the seizure of your assets.

What are the consequences of failing to report all income? The consequences of failing to report all income can be severe. You may face:

- Civil penalties: These penalties are assessed by the IRS and can range from a percentage of the unpaid tax to a flat fee.

- Criminal penalties: If the IRS determines that you intentionally failed to report income, you could face criminal charges, which can include fines and imprisonment.

- Loss of tax benefits: You may be ineligible for certain tax credits and deductions if you fail to report all income.

- Damaged credit score: If the IRS files a lien against you, it can have a negative impact on your credit score.

- Difficulty obtaining loans or financing: Lenders may be hesitant to provide loans or financing if you have a history of tax issues.

How to avoid failing to report all income? It is essential to keep accurate records of all income received. This includes keeping receipts, invoices, and other documentation. You should also consult with a qualified tax professional to ensure that you are properly reporting all income.

Conclusion: Failure to report all income is a serious offense that can have significant consequences. By understanding the importance of reporting all income and taking steps to ensure that all income is properly reported, you can avoid these negative consequences and maintain your financial well-being.

Improper Record Keeping

Keeping accurate and complete records is essential for any business, regardless of size or industry. Proper record keeping ensures compliance with regulations, provides valuable insights into business operations, and helps to protect the company from legal and financial risks. However, many businesses struggle with improper record keeping, which can lead to a variety of problems.

One of the most common issues is inconsistent data entry. This can occur when different employees use different methods or formats for recording information, leading to discrepancies and inaccuracies. Another problem is lack of organization. When records are not properly organized and stored, it becomes difficult to retrieve information quickly and efficiently. This can lead to wasted time and lost opportunities.

Missing or incomplete records are another major issue. This can happen if records are not created in the first place, or if they are lost or destroyed due to poor storage practices. Missing records can lead to serious legal consequences, especially in industries subject to stringent regulations.

The consequences of improper record keeping can be significant. Legal penalties are one possibility, especially if a company fails to comply with regulations. Improper record keeping can also lead to financial losses, such as missed tax deductions or lost revenue due to inaccurate information. In addition, reputational damage can result from improper record keeping, particularly if a company is found to be engaging in fraudulent or unethical practices.

To avoid the negative consequences of improper record keeping, businesses must take steps to improve their record-keeping practices. This includes implementing a consistent system for data entry, establishing clear procedures for record storage and retrieval, and regularly reviewing and updating records. It’s also important to train employees on proper record-keeping techniques, and to use technology to automate and streamline record-keeping processes.

Consequences of Tax Mistakes

Tax mistakes can have serious consequences, from small penalties to significant financial burdens. Understanding the potential repercussions can help individuals and businesses avoid costly errors.

Financial Penalties

The most common consequence of tax mistakes is financial penalties. The Internal Revenue Service (IRS) imposes penalties for various offenses, including:

- Late filing: Failure to file tax returns by the deadline.

- Late payment: Failing to pay taxes owed by the due date.

- Accuracy-related penalty: Errors on tax returns that result in underpayment of taxes.

- Underpayment penalty: Failing to pay enough tax throughout the year.

The severity of penalties varies depending on the nature of the mistake and the taxpayer’s circumstances.

Interest Charges

In addition to penalties, the IRS charges interest on unpaid taxes. Interest rates are typically higher than standard loan rates, making it crucial to pay taxes on time.

Audits

Tax mistakes can trigger an audit by the IRS. An audit involves a thorough examination of tax records to verify accuracy and compliance. Audits can be time-consuming and stressful, and they may result in additional taxes, penalties, and interest.

Legal Action

In some cases, tax mistakes can lead to legal action. The IRS can file a lien on assets or pursue criminal charges for tax evasion.

Reputational Damage

Tax mistakes can harm an individual’s or business’s reputation. Public records of tax penalties or legal actions can damage credibility and make it difficult to obtain loans or secure business deals.

Avoiding Tax Mistakes

To minimize the risk of tax mistakes, consider the following tips:

- Keep accurate records: Maintain detailed records of income, expenses, and other relevant financial information.

- Seek professional advice: Consult with a qualified tax professional for guidance on tax laws and compliance.

- File on time: Submit tax returns by the deadline to avoid late filing penalties.

- Pay on time: Make timely payments to avoid interest charges.

By taking proactive measures and seeking professional help, individuals and businesses can significantly reduce the likelihood of tax mistakes and their associated consequences.

Tips for Accurate Tax Filing

Tax season can be a stressful time, but it doesn’t have to be. By following a few simple tips, you can ensure that you file your taxes accurately and avoid any potential problems with the IRS.

Gather all necessary documents.

Before you start filling out your tax forms, make sure you have all the necessary documents, such as your W-2, 1099, and other income statements. You should also gather any receipts for deductions or credits you plan to claim.

Choose the right filing status.

Your filing status affects your tax liability, so it’s important to choose the right one. The most common filing statuses are single, married filing jointly, married filing separately, head of household, and qualifying widow(er).

Use the correct tax forms.

There are a variety of tax forms, and it’s important to use the correct ones for your situation. The IRS website has a helpful guide that can help you determine which forms you need.

Claim all eligible deductions and credits.

Make sure you’re taking advantage of all the deductions and credits you’re entitled to. Some common deductions include the standard deduction, itemized deductions, and charitable contributions. Some common credits include the earned income tax credit, child tax credit, and American opportunity tax credit.

Double-check your work.

Before you file your taxes, double-check your work for any errors. Make sure all your information is correct and that you’ve claimed all the deductions and credits you’re eligible for. You can also use tax software or a tax professional to help you file your taxes accurately.

File your taxes on time.

The deadline for filing your federal income taxes is April 15th each year. If you can’t file on time, you can request an extension, but you’ll still need to pay any taxes owed by the original deadline.

By following these tips, you can ensure that you file your taxes accurately and avoid any potential problems with the IRS. If you have any questions about your taxes, don’t hesitate to consult with a tax professional.

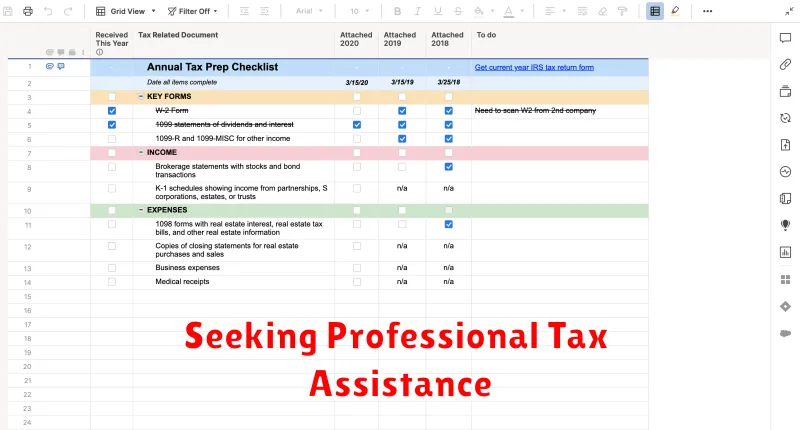

Seeking Professional Tax Assistance

Navigating the complexities of the tax system can be a daunting task, even for the most financially savvy individuals. From understanding tax laws to accurately filing returns, the process can be overwhelming and time-consuming. That’s where seeking professional tax assistance comes in. Enlisting the help of a qualified tax professional can provide numerous benefits, ensuring compliance with tax regulations and maximizing your tax savings.

The Importance of Professional Tax Assistance

Here are some compelling reasons why seeking professional tax assistance is highly recommended:

- Expertise and Knowledge: Tax laws are constantly evolving, and staying abreast of the latest changes can be challenging. Tax professionals possess specialized knowledge and expertise, ensuring you receive accurate and up-to-date advice.

- Accurate Filing: Filing your taxes incorrectly can lead to penalties and audits. Professionals meticulously review your financial information, identify deductions and credits, and ensure your return is filed accurately.

- Maximizing Tax Savings: Tax professionals know the ins and outs of tax codes and can help you identify legitimate deductions and credits to minimize your tax liability. This can lead to significant savings, freeing up more of your hard-earned money.

- Peace of Mind: Knowing that your taxes are handled by a skilled professional provides peace of mind, allowing you to focus on other important aspects of your life.

- Representation in Audits: If you’re ever audited by the IRS, having a tax professional on your side can be invaluable. They can handle all communication with the IRS, ensuring your rights are protected.

Choosing the Right Tax Professional

When selecting a tax professional, it’s crucial to choose someone you trust and who has the necessary qualifications and experience. Here are some factors to consider:

- Credentials and Experience: Look for professionals with relevant certifications, such as Certified Public Accountant (CPA), Enrolled Agent (EA), or Certified Financial Planner (CFP).

- Specialization: Some professionals specialize in specific areas, such as small business taxes, real estate, or international taxation. Choose a professional who specializes in your specific needs.

- Reputation and Reviews: Check online reviews and testimonials to get an idea of a professional’s reputation.

- Communication and Availability: Ensure that you feel comfortable communicating with the professional and that they are readily available to answer your questions.

Conclusion

Seeking professional tax assistance is a wise investment that can save you time, money, and stress. By enlisting the help of a qualified tax professional, you can ensure your taxes are filed accurately, your tax savings are maximized, and you have the peace of mind knowing your financial interests are well-protected.