Are you tired of constantly feeling stressed about money? Do you find yourself living paycheck to paycheck, unable to save for your goals? You’re not alone. Many people struggle with managing their finances, but it doesn’t have to be this way. Creating a budget is the first step towards a stress-free financial future. A budget can help you gain control over your money, achieve your financial goals, and finally feel confident about your financial situation.

A budget isn’t just about tracking your expenses; it’s about making conscious decisions about how you spend your money. By understanding where your money goes, you can identify areas where you can cut back and allocate funds towards your priorities, such as saving for retirement, paying off debt, or taking a dream vacation. With a solid budget in place, you can build a stable financial foundation that will provide peace of mind and allow you to focus on the things that truly matter to you.

The Link Between Budgeting and Financial Stress

Financial stress is a common problem that can have a significant impact on our mental and physical health. It can lead to anxiety, depression, sleep problems, and even physical health issues. One of the biggest contributors to financial stress is a lack of budgeting. Budgeting is the process of creating a plan for how you will spend your money. When you have a budget, you are more likely to be aware of your spending habits, stick to your financial goals, and avoid overspending.

Here are some of the ways that budgeting can help reduce financial stress:

- Reduces anxiety and worry: When you have a budget, you know where your money is going and you can track your progress toward your financial goals. This can help to reduce anxiety and worry about money.

- Helps you avoid debt: Budgeting helps you stay within your means, which can help you avoid taking on unnecessary debt. Debt can be a major source of financial stress.

- Gives you control over your finances: When you budget, you are taking control of your finances and making conscious decisions about how to spend your money. This can give you a sense of empowerment and reduce financial stress.

- Helps you achieve your financial goals: Budgeting can help you reach your financial goals, whether it’s saving for retirement, paying off debt, or buying a house. Achieving your goals can be a great source of satisfaction and reduce financial stress.

If you are struggling with financial stress, creating a budget can be a powerful tool to help you gain control of your finances and reduce your stress levels. Here are some tips for creating a budget:

- Track your spending: The first step to creating a budget is to track your spending for a month or two. This will give you a clear picture of where your money is going.

- Create a spending plan: Once you know how much money you are spending, create a spending plan that allocates your money to different categories, such as housing, food, transportation, and entertainment.

- Stick to your plan: Once you have created your budget, it is important to stick to it as much as possible. Review your budget regularly and make adjustments as needed.

Creating a budget can be a simple yet effective way to reduce financial stress. It can help you take control of your finances, avoid debt, achieve your financial goals, and live a more financially secure and stress-free life.

Assessing Your Current Financial Situation

Taking stock of your current financial situation is a crucial step in achieving your financial goals. It provides a clear picture of where you stand and allows you to make informed decisions about your money. By understanding your income, expenses, assets, and debts, you can identify areas for improvement and develop strategies to reach your financial objectives.

1. Track Your Income and Expenses

The first step in assessing your financial situation is to track your income and expenses. This involves keeping a detailed record of all your earnings and spending for a specific period, such as a month. You can use a budgeting app, spreadsheet, or even a simple notebook. This will give you a clear understanding of where your money is coming from and where it is going.

2. Analyze Your Assets

Assets are anything of value that you own. This includes:

- Checking and savings accounts

- Investments (stocks, bonds, mutual funds)

- Real estate (home, rental property)

- Vehicles

- Valuables (jewelry, art, collectibles)

By evaluating your assets, you can see how much wealth you have accumulated and identify potential sources of future income.

3. Examine Your Debts

Debts are any financial obligations you owe to others. These include:

- Credit card debt

- Student loans

- Mortgages

- Personal loans

It is essential to understand the amount of debt you have, the interest rates on those debts, and the minimum payments required. High debt levels can significantly impact your financial well-being.

4. Calculate Your Net Worth

Your net worth is the difference between your assets and liabilities (debts). It represents your overall financial health. A positive net worth indicates that you have more assets than debts, while a negative net worth suggests you owe more than you own.

5. Develop a Budget

Once you have a clear understanding of your income, expenses, assets, and debts, you can develop a budget. A budget is a plan for how you will spend your money. It helps you track your spending, prioritize your financial goals, and stay on track with your financial plan.

6. Review and Adjust Regularly

Your financial situation is constantly changing, so it is essential to review and adjust your assessment regularly. Make sure you are staying on track with your budget and adjusting your financial plans as needed. This will help you stay in control of your finances and achieve your financial goals.

Identifying Your Income and Expenses

Managing your finances effectively requires a clear understanding of your income and expenses. By accurately tracking these two crucial aspects, you gain valuable insights into your financial situation and can make informed decisions to achieve your financial goals.

Income

Your income represents the money you receive from various sources. It can include:

- Salary or wages from your employment

- Self-employment income from your business ventures

- Investment income from stocks, bonds, or real estate

- Government benefits such as Social Security or unemployment benefits

- Other income such as alimony, child support, or gifts

Expenses

Your expenses represent the money you spend on various goods and services. It’s essential to categorize your expenses to understand where your money is going. Some common expense categories include:

- Housing: Rent or mortgage payments, property taxes, homeowner’s insurance, utilities

- Transportation: Car payments, gas, insurance, public transportation

- Food: Groceries, dining out

- Healthcare: Health insurance premiums, medical expenses, prescriptions

- Personal care: Clothing, toiletries, haircuts

- Entertainment: Movies, concerts, travel

- Debt payments: Credit card bills, loans

- Savings: Contributions to retirement accounts, emergency funds

Tools for Tracking Income and Expenses

There are various tools available to help you track your income and expenses effectively. Some popular options include:

- Spreadsheets: Use a spreadsheet program like Microsoft Excel or Google Sheets to create a simple budget tracker.

- Budgeting apps: Many mobile apps offer features like expense tracking, budgeting, and financial analysis.

- Online banking platforms: Many banks offer online tools for managing your finances, including transaction history and expense categorization.

By meticulously tracking your income and expenses, you can gain a clear picture of your financial health and identify areas for improvement. This valuable information allows you to make informed decisions about your spending, saving, and investing, ultimately leading you toward your financial goals.

Setting Financial Goals: Short-Term and Long-Term

Financial goals are essential for achieving your financial aspirations and securing your future. Setting well-defined goals provides a clear roadmap, motivates you to save and invest wisely, and helps you make informed financial decisions.

Financial goals can be categorized into two main types: short-term and long-term.

Short-Term Financial Goals

Short-term financial goals are typically achievable within a year or less. These goals are often smaller and more manageable, providing a sense of accomplishment and momentum towards larger financial objectives. Examples of short-term financial goals include:

- Paying off credit card debt

- Saving for a vacation

- Making a down payment on a car

- Building an emergency fund

- Saving for a new appliance

Long-Term Financial Goals

Long-term financial goals are those that require several years to achieve. These goals are often more ambitious and require a significant amount of planning, discipline, and commitment. Examples of long-term financial goals include:

- Purchasing a home

- Saving for retirement

- Funding your child’s education

- Investing in real estate

- Starting a business

Setting SMART Financial Goals

To ensure your financial goals are effective, it’s essential to set SMART goals. This acronym stands for:

- Specific: Your goals should be clear and well-defined, avoiding vague or ambiguous statements.

- Measurable: You should be able to track your progress towards your goals. Define specific metrics and milestones.

- Attainable: Ensure your goals are realistic and achievable within your current financial situation.

- Relevant: Your goals should align with your overall financial aspirations and values.

- Time-Bound: Set a specific deadline or timeframe for achieving your goals.

Creating a Financial Plan

Once you’ve defined your short-term and long-term financial goals, it’s crucial to create a detailed financial plan. This plan will outline the steps you need to take to achieve your goals, including:

- Budgeting and tracking your expenses

- Saving and investing strategies

- Debt management plan

- Regular reviews and adjustments to your plan

Conclusion

Setting and achieving financial goals is a fundamental aspect of financial well-being. By defining your goals, creating a plan, and consistently working towards them, you can achieve your financial aspirations and secure your future.

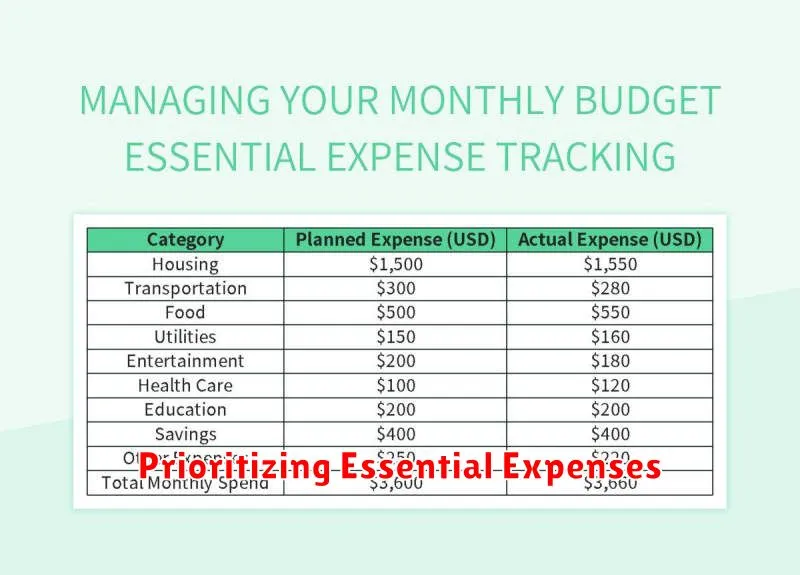

Prioritizing Essential Expenses

In today’s economic climate, it’s more important than ever to be mindful of your spending habits. While it’s tempting to indulge in non-essential items, prioritizing essential expenses is crucial for financial stability and peace of mind. Essential expenses are those that are necessary for survival and well-being, while non-essential expenses are those that are nice to have but not absolutely necessary.

To effectively prioritize your expenses, it’s essential to create a budget. This involves tracking your income and expenses, identifying areas where you can cut back, and allocating funds to essential categories. By doing so, you can ensure that you are meeting your basic needs while avoiding unnecessary debt.

Essential Expenses to Prioritize

- Housing: Rent or mortgage payments are typically the largest expense for most individuals.

- Utilities: This includes electricity, gas, water, and internet, which are essential for daily life.

- Food: A healthy diet is crucial for good health, so budgeting for groceries is important.

- Transportation: Whether you rely on public transport, a car, or walking, allocating funds for transportation is essential.

- Healthcare: Health insurance premiums, doctor’s visits, and medications are crucial for maintaining your well-being.

- Debt Repayment: If you have outstanding debts, prioritizing their repayment is important to avoid accumulating interest charges.

Tips for Prioritizing Essential Expenses

Here are some practical tips to help you prioritize essential expenses:

- Track Your Spending: Monitor your income and expenses diligently to identify areas where you can cut back.

- Create a Budget: Set realistic spending limits for each category and stick to them.

- Negotiate Bills: Explore options for lowering your bills, such as negotiating with service providers or switching to a cheaper plan.

- Shop Smart: Look for deals and discounts when shopping for groceries, clothing, and other necessities.

- Reduce Non-Essential Spending: Identify unnecessary expenses, such as entertainment, dining out, and subscriptions, and cut back where possible.

Prioritizing essential expenses is a crucial step towards financial stability and a sense of security. By creating a budget, tracking your spending, and making informed choices, you can effectively manage your finances and ensure that you are meeting your basic needs.

Finding Areas to Reduce Spending

In today’s economic climate, it’s more important than ever to be mindful of your spending habits. With inflation on the rise and interest rates increasing, finding ways to reduce your expenses can make a significant difference in your financial well-being. Whether you’re looking to save for a big purchase, pay off debt, or simply increase your financial flexibility, there are many areas where you can trim the fat from your budget.

Start with a Budget

The first step to finding areas to reduce spending is to create a detailed budget. This involves tracking all your income and expenses for a period of time, typically one month. There are many budgeting apps and tools available to help you with this task. Once you have a clear picture of where your money is going, you can start identifying areas where you can cut back.

Scrutinize Your Subscriptions

Many people subscribe to streaming services, gym memberships, or other services that they don’t use as much as they thought they would. Take a look at your subscriptions and cancel any that you don’t use regularly or that you can find alternatives for. You might be surprised how much you can save by eliminating unnecessary subscriptions.

Shop Around for Better Rates

From your mobile phone plan to your insurance premiums, you can often find better rates by shopping around. Don’t be afraid to negotiate with your providers or switch to a competitor if you can find a better deal. You can also use online comparison tools to quickly see which providers offer the best rates.

Cut Back on Food Expenses

Food is one of the biggest budget items for many people. There are many ways to cut back on food expenses. Consider eating out less often, cooking more meals at home, and taking advantage of grocery store sales and coupons. Meal prepping in advance can also save you time and money.

Reduce Entertainment Spending

Entertainment expenses can quickly add up. If you’re looking to save money, consider reducing your entertainment spending. This could mean going to fewer movies, staying in more often, or finding free or inexpensive ways to entertain yourself. Look for free events in your community, join a book club, or learn a new hobby.

Conclusion

Finding areas to reduce spending doesn’t have to be a painful process. By following these tips and being mindful of your spending habits, you can save money and achieve your financial goals. Remember, every little bit counts. The key is to be proactive and make a conscious effort to reduce your expenses. You’ll be surprised how much you can save in the long run.

Allocating Funds for Savings and Debt Repayment

Managing your finances effectively involves striking a balance between saving for the future and tackling existing debt. It’s crucial to establish a clear strategy for allocating your funds to ensure you’re making progress on both fronts.

Here’s a breakdown of how to approach the allocation of funds for savings and debt repayment:

1. Determine Your Financial Goals

Before you start allocating funds, it’s essential to define your financial goals. What are you saving for? What types of debt are you aiming to repay?

For example, are you saving for retirement, a down payment on a house, or your child’s education? Are you tackling high-interest credit card debt, student loans, or a personal loan?

2. Assess Your Income and Expenses

Create a detailed budget that outlines your monthly income and expenses. Track your spending for a few months to get a realistic picture of your financial situation.

Identify areas where you can cut back on unnecessary expenses and free up more cash for savings and debt repayment.

3. Prioritize Debt Repayment

If you have high-interest debt, prioritize paying it off first. High-interest debt can quickly spiral out of control and eat into your savings.

Consider using strategies like the debt snowball or the debt avalanche method to effectively manage your debt repayment.

4. Establish a Savings Plan

Once you’ve tackled high-interest debt, it’s time to focus on building a solid savings foundation. Start by setting aside a small portion of your income each month.

Consider automating your savings by setting up automatic transfers from your checking account to your savings account. This will help you stay consistent with your savings goals.

5. Review and Adjust

Regularly review your budget and make adjustments as needed. Your financial situation can change over time, so it’s essential to stay adaptable.

If your income increases, you can allocate more funds to savings or debt repayment. If you experience a decrease in income, you may need to adjust your spending habits or consider reducing your savings contributions temporarily.

6. Seek Professional Guidance

If you’re struggling to manage your finances, don’t hesitate to seek professional guidance from a financial advisor. They can provide personalized advice and support to help you develop a sound financial plan.

By following these steps, you can effectively allocate your funds for both saving and debt repayment, setting yourself up for a brighter financial future.

Creating a Realistic Budget You Can Stick To

A budget is a plan for how you will spend your money. It can help you reach your financial goals, such as saving for retirement or buying a house. But creating a budget can be challenging, especially if you’re not used to tracking your spending. Here are some tips for creating a realistic budget that you can stick to:

1. Track Your Spending

The first step is to track your spending for a few months. This will give you a clear picture of where your money is going. You can use a spreadsheet, a budgeting app, or even just a notebook. Be sure to track every expense, no matter how small.

2. Categorize Your Spending

Once you’ve tracked your spending, categorize it into different categories, such as housing, food, transportation, entertainment, and debt payments. This will help you see where you are spending the most money.

3. Set Financial Goals

What do you want to achieve with your money? Do you want to save for a down payment on a house, pay off debt, or invest for retirement? Setting financial goals will help you stay motivated and on track with your budget.

4. Create a Spending Plan

Now it’s time to create a spending plan. This is where you allocate your income to different categories. Be realistic about your spending habits and be sure to set aside money for your financial goals.

5. Be Flexible

Life is full of surprises, so it’s important to be flexible with your budget. If something unexpected happens, such as a job loss or medical emergency, you may need to adjust your spending. Don’t be afraid to make changes to your budget as needed.

6. Review Your Budget Regularly

It’s important to review your budget regularly to make sure you’re still on track. You may need to make adjustments as your income or expenses change. It’s a good idea to review your budget at least once a month.

Tracking Your Progress and Making Adjustments

It’s important to track your progress as you work towards your goals. This will help you stay motivated and make necessary adjustments along the way. There are many different ways to track your progress, but some common methods include:

- Keeping a journal or log

- Using a spreadsheet or tracking app

- Taking progress photos or videos

- Reviewing your work regularly

Once you have a system for tracking your progress, you can start to identify areas where you’re making good progress and areas where you need to make adjustments. If you’re not seeing the results you want, don’t be afraid to change your approach. This could involve:

- Setting more realistic goals

- Breaking down your goals into smaller steps

- Finding new resources or support

- Adjusting your timeline

It’s important to be patient and persistent as you work towards your goals. Progress may not always be linear, and there will be times when you feel like you’re not making any progress at all. But if you keep track of your progress and make adjustments as needed, you’ll eventually reach your goals.

Tips for Staying Motivated and Achieving Financial Freedom

Financial freedom is a dream for many people, but it can be difficult to stay motivated on the path to achieving it. The journey can be long and challenging, but it’s worth it in the end. Here are some tips for staying motivated and achieving financial freedom:

Set SMART Goals: Start by setting clear and specific financial goals. Make sure your goals are Specific, Measurable, Attainable, Relevant, and Time-bound. Having well-defined goals gives you a clear direction and helps you track your progress.

Create a Budget: A budget is essential for managing your money effectively. Track your income and expenses to understand where your money is going. This will help you identify areas where you can cut back and save more.

Automate Your Savings: Make saving a habit by setting up automatic transfers from your checking account to your savings account. This way, you’ll be saving consistently without having to think about it.

Invest Your Money: Investing your savings is crucial for building wealth. Research different investment options like stocks, bonds, and real estate, and choose the ones that align with your risk tolerance and financial goals.

Seek Support and Accountability: Surround yourself with people who support your financial goals. Join financial communities, attend workshops, or find a mentor who can provide guidance and encouragement.

Celebrate Your Progress: As you achieve milestones on your financial journey, take time to celebrate your successes. This will help you stay motivated and recognize your progress.

Don’t Give Up: The path to financial freedom is rarely linear. There will be setbacks and challenges along the way. Stay persistent, learn from your mistakes, and never give up on your dream.