Are you starting to think about the day you can finally retire and hang up your work hat? Transitioning from a working career to retirement is a major life change that requires careful planning and preparation. It can be an exciting time, but it also can be a bit overwhelming. You may be wondering, “What will I do with my time? How will I manage financially? What are the steps to take to make a smooth transition?” This article will help guide you through the process, giving you actionable tips and strategies to make your transition from work to retirement a positive and fulfilling one.

Retiring doesn’t have to be a scary process. In fact, it can be a wonderfully liberating experience. You have the opportunity to pursue your passions, travel the world, and enjoy more time with loved ones. But, it’s important to acknowledge that transitioning from a working career to retirement comes with challenges. You may experience a sense of identity loss, uncertainty about your financial security, and the need to adjust to a completely different lifestyle.

Defining Your Retirement Vision

Retirement is a significant milestone in life, often envisioned as a time of relaxation, travel, and pursuing passions. However, the path to achieving this ideal retirement vision requires careful planning and a clear understanding of your goals and priorities. Defining your retirement vision is the first crucial step towards securing a fulfilling and enjoyable post-work life.

1. Envision Your Ideal Lifestyle

Imagine waking up each day in retirement. What does your ideal lifestyle look like? Are you spending your days traveling the world, volunteering in your community, or pursuing creative hobbies? Consider the activities, hobbies, and experiences that bring you joy and fulfillment. Visualizing your ideal lifestyle will provide a foundation for setting specific goals and creating a plan that aligns with your aspirations.

2. Determine Your Financial Needs

Financial security is paramount in retirement. Determine your monthly expenses, including housing, healthcare, food, and leisure activities. Consider any potential future expenses, such as long-term care or unexpected medical costs. By understanding your financial needs, you can estimate the amount of savings required to support your desired lifestyle and create a realistic budget for retirement.

3. Set Realistic Goals

Based on your vision and financial needs, set specific, measurable, achievable, relevant, and time-bound (SMART) goals. These goals can include saving a certain amount of money, paying off debt, or achieving a specific retirement age. Setting realistic goals will provide direction and motivation throughout your retirement planning journey.

4. Consider Your Health and Well-being

Retirement is not just about financial security; it’s about maintaining good health and well-being. Consider how you will stay active, engage in healthy eating habits, and maintain social connections. Include these aspects in your retirement vision to ensure a fulfilling and enjoyable post-work life.

5. Embrace Flexibility and Adaptability

Retirement is a journey, and life can throw unexpected curveballs. It’s essential to embrace flexibility and adaptability. Be open to adjusting your plans and priorities as your circumstances change. Regularly reassess your vision and make adjustments as needed to ensure your retirement goals remain aligned with your evolving needs and desires.

6. Seek Professional Guidance

Consulting with a financial advisor or retirement planning expert can provide valuable insights and guidance. They can help you develop a personalized retirement plan, assess your financial situation, and make informed decisions about investments, savings, and retirement income strategies. Seeking professional guidance can increase your chances of achieving your retirement vision and securing a comfortable and fulfilling post-work life.

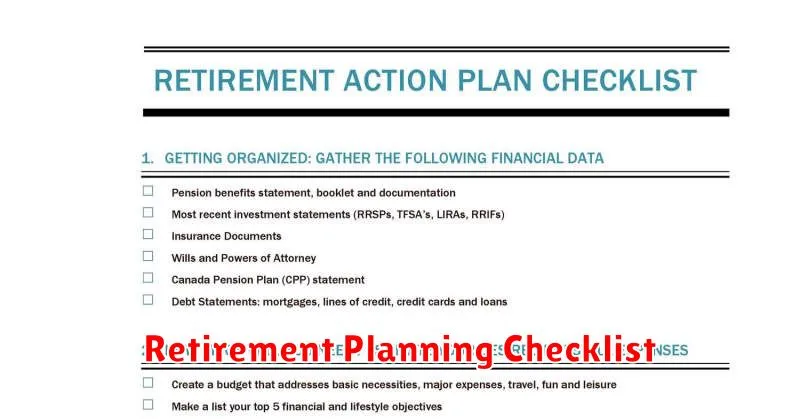

Financial Planning for Retirement: Assessing Your Needs

Retirement is a significant milestone in life, and it’s essential to plan financially to ensure a comfortable and fulfilling transition. A well-crafted retirement plan involves carefully assessing your needs, financial resources, and desired lifestyle.

1. Determine Your Retirement Goals

Start by defining your retirement goals. What do you envision your life being like after you stop working? Consider your aspirations, hobbies, travel plans, and desired living arrangements. These factors will help you establish a clear picture of your financial needs.

2. Estimate Your Expenses

Create a detailed budget that outlines your anticipated expenses in retirement. Factor in essential costs such as housing, healthcare, food, transportation, and utilities. Don’t forget to include discretionary spending on leisure activities, entertainment, and travel.

3. Assess Your Income Sources

Identify your potential sources of income in retirement, including Social Security benefits, pension plans, savings, investments, and any part-time work you might consider. Estimate the annual income you can expect from each source.

4. Calculate Your Savings Needs

Once you have estimated your expenses and income, you can calculate your savings needs. Subtract your projected income from your projected expenses to determine the annual shortfall. Multiply this amount by the number of years you expect to live in retirement to get your total savings goal. Online retirement calculators can assist with this calculation.

5. Review and Adjust Your Plan Regularly

Financial planning is an ongoing process. Review your retirement plan at least annually to account for changes in your financial situation, market conditions, and personal goals. Adjust your savings contributions, investment strategy, or spending habits as needed.

6. Seek Professional Advice

Consider consulting with a financial advisor to get personalized guidance. A qualified advisor can provide valuable insights into investment strategies, tax planning, and other financial aspects of retirement planning.

By carefully assessing your needs, you can create a comprehensive and effective retirement plan that sets you on the path to financial security and peace of mind.

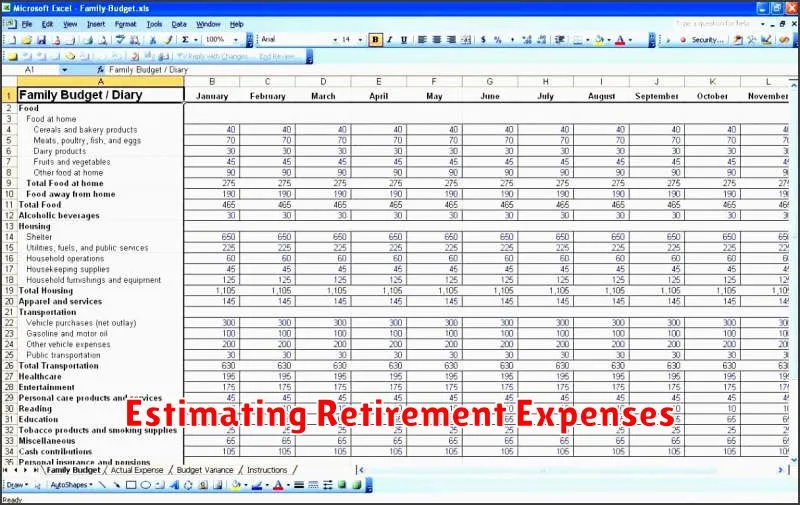

Estimating Retirement Expenses

Retirement is a time to enjoy the fruits of your labor and live life on your own terms. To ensure you can afford the lifestyle you desire, it’s crucial to accurately estimate your retirement expenses.

Here’s a breakdown of how to estimate your retirement expenses:

1. Analyze Your Current Spending

Start by examining your current expenses. Keep track of your spending for a few months to gain a clear picture of where your money goes. Categorize your expenses into essential categories such as housing, food, transportation, healthcare, and discretionary spending.

2. Account for Inflation

Inflation erodes the purchasing power of your money over time. Assume an average inflation rate of 3% per year, which means your expenses will likely increase by 3% each year in retirement. Use an online inflation calculator to determine how much your expenses might be in the future.

3. Consider Lifestyle Changes

Think about how your lifestyle might change in retirement. Will you travel more? Do you plan on moving to a different location? Will you take up new hobbies or activities that require additional expenses? Adjust your estimates based on these anticipated changes.

4. Factor in Healthcare Costs

Healthcare expenses can be significant in retirement. Factor in the cost of insurance premiums, out-of-pocket medical expenses, and potential long-term care. Consider researching Medicare costs and other healthcare options available to you.

5. Account for Unexpected Expenses

Life is unpredictable. It’s wise to set aside an emergency fund for unforeseen expenses. Include a buffer in your budget to cover unexpected repairs, medical emergencies, or other unforeseen costs.

6. Review and Adjust Regularly

It’s essential to review your retirement expense estimates regularly. As market conditions change, your investment portfolio may grow or decline. Adjust your estimates as needed to ensure you’re on track to meet your financial goals.

7. Seek Professional Advice

If you’re unsure about estimating your retirement expenses, seek advice from a qualified financial advisor. They can provide personalized guidance based on your specific circumstances and help you develop a comprehensive retirement plan.

By accurately estimating your retirement expenses, you can make informed decisions about your savings and investment strategies. This will help you ensure a comfortable and fulfilling retirement that allows you to enjoy the fruits of your labor.

Maximizing Retirement Income Sources

Retirement is a significant life transition, and it’s essential to plan for it financially. A robust retirement income strategy involves diversifying your income sources to ensure you have a steady stream of funds to cover your expenses. This article delves into various income streams you can tap into during retirement, offering strategies for maximizing each source.

1. Social Security

Social Security is a cornerstone of retirement income for many Americans. It’s a government-funded program designed to provide financial support during retirement. While Social Security benefits alone may not be sufficient to cover all your living expenses, they can form a crucial foundation for your retirement income plan. To maximize your Social Security benefits, consider delaying your claiming age beyond the full retirement age. This strategy will result in higher monthly payments for the rest of your life.

2. Retirement Savings

Retirement savings, such as 401(k)s and IRAs, are essential for building a comfortable retirement nest egg. Regular contributions and smart investment choices can significantly impact the size of your retirement savings. Consider consulting with a financial advisor to create a personalized investment strategy tailored to your risk tolerance and financial goals.

3. Pensions

Pensions are a traditional form of retirement income, often provided by employers. While pensions are becoming less common, they still provide a steady stream of income for those fortunate enough to have them. Understanding your pension plan details, including payment options and potential benefits, is crucial for maximizing its value.

4. Real Estate

Real estate can be a valuable income source during retirement. If you own a home, consider downsizing or renting out a portion of it to generate rental income. Alternatively, investing in rental properties or real estate investment trusts (REITs) can provide passive income streams. Remember, real estate investments come with inherent risks, so conduct thorough research before making any decisions.

5. Part-time Work

Part-time work can provide flexibility and supplement your retirement income. Many retirees find part-time jobs in areas that align with their skills and interests. This not only generates income but also offers social interaction and a sense of purpose. Consider options such as consulting, freelance work, or teaching.

6. Annuities

Annuities are financial products that provide a guaranteed stream of income for life. They can be a valuable tool for retirement planning, offering protection against longevity risk and market volatility. However, annuities have complex terms and conditions, so carefully consider the risks and benefits before purchasing one.

7. Reverse Mortgages

Reverse mortgages allow homeowners aged 62 and older to convert a portion of their home equity into cash. While they can provide financial relief, reverse mortgages have significant drawbacks, including high interest rates and the potential for losing ownership of your home. Explore all options and consult with a financial advisor before pursuing a reverse mortgage.

8. Investments

Investments in stocks, bonds, and other assets can provide growth potential and income streams during retirement. However, investing involves risks, and it’s crucial to diversify your portfolio and manage your investments strategically. Consider consulting with a financial advisor for guidance on building a diversified investment portfolio.

Maximizing Your Income Sources

To maximize your retirement income, consider the following strategies:

- Live within your means: Carefully track your expenses and adjust your lifestyle to avoid overspending.

- Delay Social Security benefits: If possible, delay claiming your Social Security benefits beyond your full retirement age to increase your monthly payments.

- Invest wisely: Choose investments aligned with your risk tolerance and financial goals.

- Consider part-time work: Explore part-time employment options to supplement your income.

- Seek professional advice: Consult with a financial advisor to create a personalized retirement income plan.

Retirement income planning requires careful consideration and proactive action. By diversifying your income sources, maximizing your investments, and living within your means, you can create a secure and comfortable retirement. Remember, seeking professional financial advice can provide valuable insights and guidance to help you achieve your retirement goals.

Social Security Benefits: Understanding Your Options

Social Security is a vital source of income for millions of Americans, providing financial security during retirement, disability, and survivor benefits. Understanding your options and maximizing your benefits is crucial for a comfortable and financially stable future. Here’s a comprehensive guide to navigating the intricacies of Social Security.

Types of Social Security Benefits

The Social Security program offers various benefits depending on your situation. The most common types include:

- Retirement Benefits: These are available to individuals who have worked and paid Social Security taxes for a certain period. The amount of your retirement benefit depends on your earnings history and the age you choose to start receiving payments.

- Disability Benefits: These are available to individuals who are unable to work due to a severe medical condition. Eligibility criteria include meeting specific work requirements and having a qualifying medical condition.

- Survivor Benefits: These are available to the surviving spouse, children, and dependent parents of deceased workers who were eligible for Social Security benefits.

Claiming Your Benefits

The age at which you choose to claim your Social Security benefits can significantly impact the amount you receive. The full retirement age is currently 67, but you can claim benefits as early as age 62 or delay claiming until age 70. Early claiming reduces your monthly benefit, while delaying increases it. It’s important to carefully consider your financial needs and life expectancy before making a decision.

Maximizing Your Benefits

To maximize your Social Security benefits, consider the following tips:

- Work Longer: The longer you work and pay Social Security taxes, the higher your benefits will be.

- Delay Claiming: Waiting until your full retirement age or later to claim benefits will result in a higher monthly payment.

- Coordinate Benefits: If you’re married, you can coordinate your claiming strategies to maximize your combined benefits.

- Stay Informed: Keep up-to-date on Social Security changes and regulations to ensure you’re making the best choices for your situation.

Resources and Information

The Social Security Administration (SSA) provides comprehensive information and resources online and through its local offices. You can visit their website at www.ssa.gov to access calculators, publications, and contact information. It’s also recommended to consult with a financial advisor or Social Security expert to get personalized advice and guidance.

Understanding your Social Security options and maximizing your benefits is crucial for securing your financial future. By taking the time to learn about the program and making informed decisions, you can ensure a comfortable and financially stable retirement.

Pensions and 401(k) Plans: Managing Rollovers and Distributions

Navigating the complexities of retirement savings can feel overwhelming, especially when it comes to understanding rollovers and distributions from pensions and 401(k) plans. These options present unique opportunities and challenges, and making informed decisions is crucial for maximizing your retirement savings. Let’s explore the key aspects of managing these accounts.

Understanding Rollovers

A rollover involves transferring funds from one retirement account to another, typically from a former employer’s plan to an individual retirement account (IRA). IRAs offer greater flexibility in investment choices and potential tax advantages. There are two main types of rollovers:

- Direct rollovers: Funds are transferred directly from the old plan to the new account, avoiding any tax withholding. This is generally the most beneficial option, as it minimizes potential tax liabilities.

- Indirect rollovers: You receive a distribution from the old plan and then personally deposit the funds into a new account within 60 days. This method carries the risk of incurring taxes and penalties if not done correctly.

When to Consider a Rollover

Several factors may prompt you to consider rolling over funds from your pension or 401(k) plan:

- Changing jobs: When you leave an employer, you have the option to leave your retirement funds in the old plan, roll them over to a new employer’s plan (if applicable), or transfer them to an IRA.

- Dissatisfaction with investment options: If your former employer’s plan offers limited investment choices, rolling over to an IRA with broader options may be advantageous.

- Seeking better performance: You may seek higher investment returns by diversifying your portfolio or choosing different investment strategies.

Distributions: Taking Out Your Savings

Distributions, also known as withdrawals, allow you to access funds from your retirement account. However, distributions are subject to specific rules and potential taxes and penalties:

- Age 59 1/2: You can generally access your retirement funds without penalties after reaching this age.

- Early withdrawals: Taking distributions before age 59 1/2 usually incurs a 10% penalty, plus your usual income tax rate. Exceptions exist for specific circumstances, such as medical expenses or first-time home purchases.

- Required minimum distributions (RMDs): Starting at age 72, you’re obligated to take annual distributions based on IRS guidelines. Failure to do so can result in penalties.

Planning for Your Retirement

Properly managing rollovers and distributions is essential for achieving your retirement goals. Consider consulting with a qualified financial advisor to develop a personalized plan that addresses your unique circumstances and financial objectives. By understanding the rules and options available, you can make informed decisions that maximize your retirement savings and help ensure a secure future.

Investment Strategies for Retirement Income

Retirement is a significant milestone in life, and it’s crucial to have a solid financial plan in place to ensure a comfortable and secure future. This involves developing effective investment strategies that will provide a steady stream of income during your golden years.

1. Diversify Your Portfolio

Diversification is key to mitigating risk in any investment portfolio, and retirement is no exception. By spreading your investments across different asset classes, such as stocks, bonds, real estate, and commodities, you can reduce the impact of any single asset’s performance on your overall returns. This approach helps protect your portfolio from market volatility and ensures a more consistent income stream.

2. Consider a Mix of Growth and Income-Generating Investments

A balanced portfolio should include a mix of investments designed for both growth and income. Growth investments, such as stocks, have the potential to generate higher returns over the long term, while income-generating investments, such as bonds and dividend-paying stocks, provide a steady stream of cash flow. By striking a balance between these two types of investments, you can achieve both capital appreciation and income generation to meet your retirement needs.

3. Explore Retirement Income Products

There are various financial products specifically designed to provide retirement income, such as annuities and reverse mortgages. Annuities offer guaranteed income streams, while reverse mortgages allow you to tap into the equity in your home. Consulting with a financial advisor can help you determine the most appropriate product for your specific circumstances.

4. Utilize Tax-Advantaged Retirement Accounts

Taking advantage of tax-advantaged retirement accounts, such as 401(k)s and IRAs, can significantly enhance your retirement savings. These accounts allow for pre-tax contributions, reducing your current tax burden, and often offer tax-deferred growth on your investments. However, it’s essential to understand the withdrawal rules and tax implications associated with these accounts.

5. Plan for Healthcare Expenses

Healthcare costs are a significant factor to consider in retirement planning. As you age, your healthcare expenses are likely to increase. You should factor in these expenses when determining your required retirement income and consider options like health savings accounts (HSAs) or long-term care insurance.

6. Regularly Review and Adjust Your Portfolio

It’s crucial to regularly review and adjust your investment portfolio to ensure it remains aligned with your retirement goals and risk tolerance. As you age, your investment horizon may shorten, and your risk tolerance might decrease. You may need to shift your portfolio towards more conservative investments to protect your principal while still generating income.

7. Seek Professional Advice

Investing for retirement can be complex, and it’s wise to seek professional advice from a qualified financial advisor. A financial advisor can help you develop a personalized retirement plan that takes into account your specific circumstances, goals, and risk tolerance. They can provide guidance on asset allocation, investment selection, and tax planning strategies to maximize your retirement income.

Healthcare in Retirement: Medicare and Other Options

Retirement brings a new set of considerations, and healthcare is one of the most important. As you transition into this new phase of life, understanding your healthcare options is crucial. Medicare, the federal health insurance program for people 65 and older, is a cornerstone of many retirees’ healthcare plans. However, it’s not the only option, and it’s essential to navigate the complexities of Medicare and other available choices.

Medicare: The Basics

Medicare is divided into four parts, each with distinct benefits and costs:

- Part A (Hospital Insurance): Covers inpatient hospital stays, skilled nursing facilities, hospice care, and some home health services.

- Part B (Medical Insurance): Covers doctor visits, outpatient care, preventive services, and medical equipment.

- Part C (Medicare Advantage): Offered by private insurance companies, it combines Part A, Part B, and often prescription drug coverage (Part D). These plans may have additional benefits and limitations.

- Part D (Prescription Drug Coverage): Offers coverage for prescription drugs, and you can enroll in a standalone Part D plan or through Medicare Advantage.

While Medicare is a significant benefit, it’s not a comprehensive solution. It often has copayments, deductibles, and limitations on coverage. Therefore, exploring other options for supplemental coverage is essential.

Beyond Medicare: Supplemental Options

Several options can help fill the gaps in Medicare coverage, including:

- Medigap Plans (Medicare Supplement Insurance): These private insurance policies help cover out-of-pocket expenses not covered by Medicare, like deductibles, coinsurance, and copayments.

- Medicare Advantage Plans: As mentioned earlier, these plans offered by private insurance companies can provide broader coverage than original Medicare, sometimes including dental, vision, and hearing benefits.

- Employer-Sponsored Health Plans: If you’re still working or have a retiree health plan through a former employer, consider whether this option best suits your needs.

- Individual Health Insurance: If you’re not eligible for Medicare or need additional coverage, you can explore individual health insurance plans through the Health Insurance Marketplace.

Making the Right Choice

Navigating the healthcare landscape in retirement can feel overwhelming. Consulting with a qualified insurance broker or healthcare advisor can be immensely beneficial. They can assess your needs, review your options, and help you make informed decisions. Remember, healthcare is a crucial aspect of your retirement planning, and understanding your options is essential for maintaining your well-being and financial stability.

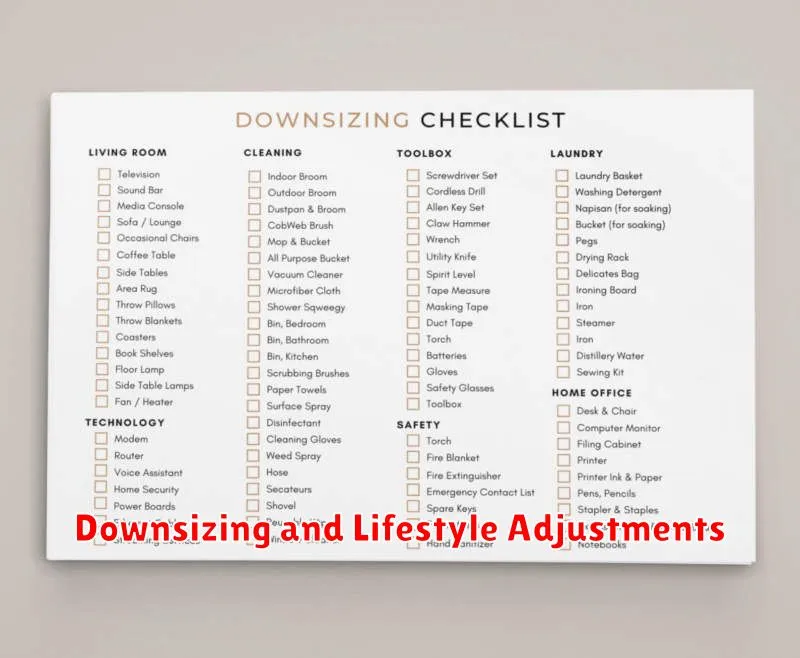

Downsizing and Lifestyle Adjustments

Downsizing is a significant life decision that involves simplifying your lifestyle and reducing your material possessions. It can be a challenging yet rewarding experience, often driven by factors such as retirement, financial constraints, or a desire for a simpler life.

As you embark on the journey of downsizing, it’s crucial to make necessary lifestyle adjustments to adapt to your new circumstances. This includes embracing a minimalist mindset, re-evaluating your priorities, and finding joy in experiences rather than material possessions.

Benefits of Downsizing:

Downsizing offers several benefits, including:

- Financial freedom: Reducing living expenses and debt.

- Reduced stress: Less clutter and a simpler lifestyle can promote mental well-being.

- More time for what matters: Freeing up time for hobbies, travel, and spending time with loved ones.

- Environmental impact: Downsizing can contribute to a more sustainable lifestyle.

Lifestyle Adjustments:

Here are some lifestyle adjustments to consider during the downsizing process:

- Minimalist mindset: Focus on essential items that bring value and joy to your life.

- Decluttering: Get rid of items you don’t use, need, or love.

- Experiences over possessions: Seek fulfillment through travel, hobbies, and meaningful connections.

- Digital organization: Streamline your digital files and accounts.

- Sustainability: Reduce your carbon footprint by adopting eco-friendly practices.

Downsizing is a personal journey, and the adjustments you make will depend on your unique circumstances and goals. By embracing a minimalist mindset and prioritizing experiences, you can create a fulfilling and meaningful life, even with fewer material possessions.

Staying Active and Engaged in Retirement

Retirement is a significant life transition that can bring both excitement and uncertainty. While it’s a time to enjoy newfound freedom, it’s also crucial to stay active and engaged to maintain a fulfilling and healthy lifestyle. Here are some strategies to help you make the most of your retirement years:

Embrace New Hobbies and Interests

Retirement provides an opportunity to explore passions you may have put on hold during your working years. Consider pursuing new hobbies like painting, photography, writing, or learning a new language. Joining clubs or groups related to your interests can connect you with like-minded individuals and foster a sense of community.

Stay Physically Active

Regular exercise is essential for maintaining physical and mental well-being. Engage in activities you enjoy, such as walking, swimming, dancing, or cycling. Physical activity not only improves your health but also helps reduce stress, boost energy levels, and improve your sleep quality.

Volunteer and Give Back

Volunteering is a rewarding way to stay connected to your community and make a difference. Find a cause you’re passionate about and dedicate your time and skills to it. Volunteering provides a sense of purpose, social interaction, and the satisfaction of helping others.

Travel and Explore

Retirement offers the chance to travel and experience new cultures. Whether it’s a dream vacation or exploring your own backyard, make time for adventures that broaden your horizons. Traveling keeps you mentally stimulated, provides new experiences, and creates lasting memories.

Stay Connected with Loved Ones

Maintaining strong relationships with family and friends is crucial for overall well-being. Make an effort to stay connected through regular visits, phone calls, or video chats. Social interaction provides emotional support, reduces loneliness, and helps you stay engaged with the world around you.

Embrace Lifelong Learning

Retirement is an excellent time to pursue lifelong learning. Take online courses, attend workshops, or join a book club. Expanding your knowledge base keeps your mind sharp, stimulates curiosity, and provides intellectual stimulation.

Conclusion

Staying active and engaged in retirement is essential for a fulfilling and healthy life. By embracing new hobbies, staying physically active, volunteering, traveling, staying connected, and pursuing lifelong learning, you can make the most of this exciting chapter in your life.