Are you and your partner ready to take control of your finances? Building a strong financial foundation as a couple is essential for long-term happiness and stability. Whether you’re just starting out or have been together for years, effective budgeting is key to achieving your financial goals together. Managing joint finances can sometimes be a challenge, but with the right strategies and communication, you can navigate the ups and downs of money with ease.

This article will provide you with practical budgeting tips designed specifically for couples, empowering you to create a financial plan that works for both of you. We’ll cover essential topics like setting financial goals, creating a budget, tracking expenses, and communicating effectively about money. Ready to make your money work for you as a team? Let’s dive in!

Open Communication About Finances

Financial matters can be a sensitive subject in any relationship, whether it’s romantic, familial, or platonic. But open and honest communication about finances is essential for building trust, avoiding conflict, and achieving shared financial goals. This article will explore the importance of open communication about finances and provide practical tips to foster healthy financial dialogues.

Why Open Communication Matters

Open communication about finances offers numerous benefits, including:

- Increased Transparency and Trust: Sharing financial information builds trust and transparency, fostering a sense of security and shared responsibility.

- Effective Decision-Making: Open communication enables couples or families to make informed financial decisions together, aligning their goals and priorities.

- Reduced Conflict: By discussing finances openly, you can avoid misunderstandings and potential conflicts arising from financial secrecy.

- Improved Financial Well-being: Open communication can lead to more effective budgeting, debt management, and long-term financial planning.

Tips for Open Communication About Finances

Here are some practical tips for fostering open and honest financial conversations:

- Choose the Right Time and Place: Find a comfortable and private setting where you can talk openly and without distractions.

- Start with a Positive Attitude: Approach the conversation with a willingness to listen and understand each other’s perspectives.

- Be Specific and Honest: Don’t shy away from discussing specific financial details, including income, expenses, debts, and savings.

- Listen Actively and Empathize: Pay attention to each other’s concerns, fears, and aspirations regarding money.

- Set Shared Financial Goals: Discuss your long-term financial goals and work together to create a plan to achieve them.

- Regularly Review Finances: Make it a habit to review your finances together at least once a month or quarterly.

- Seek Professional Help if Needed: If you struggle to communicate openly about finances, consider seeking guidance from a financial advisor or therapist.

Conclusion

Open communication about finances is crucial for building strong and healthy relationships. By fostering transparency, trust, and shared decision-making, you can create a more secure and prosperous financial future together. Remember, communication is a two-way street, so be willing to listen, understand, and work collaboratively to achieve your financial goals.

Setting Shared Financial Goals

When it comes to finances, having a shared vision with your partner is crucial for a strong and stable relationship. Setting shared financial goals not only ensures you’re both on the same page but also strengthens your bond as you work together towards a common objective. But how do you go about establishing these goals and making them stick?

1. Open and Honest Communication

The foundation of any successful financial partnership is open and honest communication. This means having regular conversations about your financial situation, including income, expenses, debts, and savings goals. Don’t shy away from discussing difficult topics, such as past financial mistakes or spending habits. Be empathetic and understanding, and remember that communication is a two-way street.

2. Define Your Values and Priorities

Before setting any specific goals, take time to define your shared values and priorities as a couple. What is most important to you financially? Do you prioritize saving for retirement, buying a house, or traveling the world? Understanding your core values will help you align your financial goals with your overall life aspirations.

3. Set SMART Goals

Once you’ve established your shared values, it’s time to set specific, measurable, achievable, relevant, and time-bound (SMART) goals. Instead of simply saying “we want to save more,” be more specific: “We want to save $10,000 for a down payment on a house within the next two years.” Breaking down larger goals into smaller, manageable steps will keep you motivated and on track.

4. Create a Budget Together

A budget is an essential tool for achieving your financial goals. Sit down together and track your income and expenses for a few months to get a clear picture of your spending patterns. Then, create a realistic budget that allocates funds towards your goals and prioritizes essential expenses. Regular reviews of your budget will ensure it remains relevant and adaptable to your evolving needs.

5. Celebrate Milestones and Stay Motivated

Reaching milestones is a great way to stay motivated and celebrate your progress. Don’t forget to acknowledge and appreciate each other’s efforts along the way. Whether it’s saving a certain amount of money or making a significant payment towards debt, take the time to celebrate these achievements and reinforce your commitment to your shared goals.

Remember, setting shared financial goals is not just about money. It’s about building a stronger relationship, fostering trust, and working together towards a brighter financial future. Open communication, shared values, and a collaborative approach will make your journey more rewarding and fulfilling.

Creating a Joint Budget That Works for Both Partners

Creating a joint budget that works for both partners can be a challenge, but it is essential for a healthy financial relationship. It requires open communication, compromise, and a willingness to work together. Here are some tips for creating a joint budget that works for both partners:

1. Start with Open Communication

The first step is to have an open and honest conversation about your financial goals, values, and spending habits. This conversation should be about understanding each other’s perspectives and finding common ground. Be willing to listen to your partner’s concerns and try to understand where they are coming from.

2. Track Your Spending

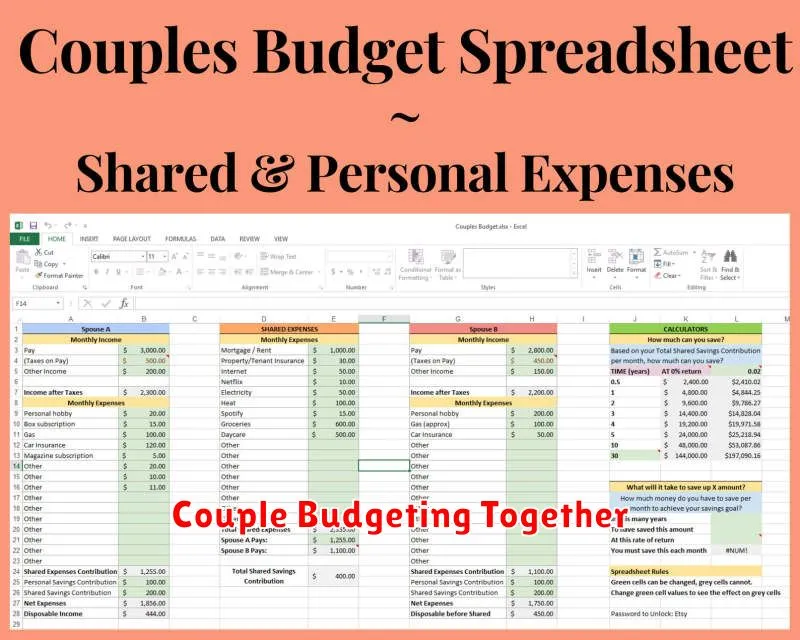

Once you have a clear understanding of each other’s financial situation, it’s time to start tracking your spending. This can be done using a budgeting app, a spreadsheet, or even a simple notebook. Tracking your spending will help you identify areas where you can cut back and make adjustments to your budget.

3. Set Financial Goals

Having shared financial goals is crucial for building a successful joint budget. This could include saving for a down payment on a house, paying off debt, investing for retirement, or planning for a family vacation. Having shared goals will give you both a sense of purpose and motivation to work together.

4. Create a Budget Together

Once you have tracked your spending and set your financial goals, it’s time to create a budget together. This is where you will allocate your income to different categories, such as housing, food, transportation, and entertainment. Be sure to allocate enough money to cover your essential expenses, as well as some funds for savings and fun.

5. Review and Adjust Regularly

It’s important to review your budget regularly, at least once a month. This will help you stay on track with your financial goals and make adjustments as needed. You may need to adjust your budget if your income changes, if your expenses increase, or if your financial goals change.

6. Be Flexible and Willing to Compromise

Remember that creating a joint budget is a team effort. It requires flexibility and a willingness to compromise. You may not always agree on everything, but it’s important to find a solution that works for both of you. If you’re struggling to agree on something, try to come up with a compromise that is fair to both partners.

Creating a joint budget that works for both partners takes time and effort, but it is an investment in your financial future. By following these tips, you can create a budget that will help you achieve your shared financial goals and build a strong and healthy financial relationship.

Deciding on a System for Tracking Expenses

Tracking your expenses is a crucial step in managing your finances effectively. Whether you’re looking to save money, invest wisely, or simply understand where your money is going, a solid expense tracking system is essential. But with so many options available, choosing the right system can feel overwhelming.

Here’s a breakdown of key factors to consider when deciding on a system for tracking expenses:

1. Your Personal Preferences:

The best system is one that you’ll actually use consistently. Consider your comfort level with technology, your preferred method of inputting data (manual entry, mobile app, etc.), and your overall time commitment. If you prefer a hands-on approach, a simple spreadsheet might suffice. But if you value automation and convenience, a dedicated expense-tracking app might be a better fit.

2. Scope of Tracking:

What are your goals for tracking expenses? Are you focusing on a specific area like groceries, entertainment, or travel? Or do you want a comprehensive overview of all your spending?

The level of detail you need will influence your choice of system. For granular tracking, a detailed budget tracker with categories and subcategories might be necessary. If you’re only concerned with a few key expense categories, a simpler system might do the trick.

3. Features and Functionality:

Explore the features offered by different systems. Some key functionalities to look for include:

- Automatic transaction syncing: This can save you time and effort by automatically importing transactions from your bank accounts and credit cards.

- Categorization and tagging: This helps you organize your expenses and analyze your spending patterns.

- Budgeting tools: These allow you to set spending limits for different categories and track your progress toward your financial goals.

- Reporting and visualization: This provides insightful data on your spending habits, allowing you to make informed decisions about your finances.

4. Cost and Accessibility:

Expense tracking systems come in various price ranges, from free to premium options. Consider your budget and whether you’re willing to pay for features and functionalities that are important to you. Make sure the system is accessible on your preferred devices (phone, tablet, computer).

5. Security and Privacy:

If you’re using a digital system, it’s crucial to ensure the security and privacy of your financial data. Look for platforms that use encryption and secure protocols to protect your information.

Ultimately, the best system for tracking expenses is the one that fits your individual needs and preferences. Don’t be afraid to experiment with different options until you find a system that you’re comfortable with and that effectively helps you manage your money.

Addressing Financial Differences and Challenges

Financial differences and challenges can arise in various aspects of life, from personal relationships to business ventures. It’s crucial to acknowledge and address these issues effectively to maintain healthy dynamics and achieve desired outcomes. Here are some key strategies for navigating financial differences and overcoming challenges:

Open Communication and Transparency

The foundation of addressing financial differences lies in open and honest communication. Encourage a culture of transparency where both parties feel comfortable discussing their financial situations, goals, and concerns. This includes sharing income, expenses, and any outstanding debts. Regular communication fosters trust and understanding, paving the way for collaborative solutions.

Define Shared Financial Goals

Once you understand each other’s financial positions, work together to define shared financial goals. This might involve saving for a down payment on a house, paying off student loans, or planning for retirement. Having a common vision creates a sense of purpose and motivates both parties to work towards achieving their objectives.

Establish a Budget and Financial Plan

Creating a comprehensive budget is essential for managing finances effectively. Collaboratively track income, allocate funds for essential expenses, and identify areas where spending can be adjusted. A financial plan outlines long-term strategies for reaching your shared goals, providing a roadmap for responsible financial management.

Compromise and Negotiation

Financial differences often require compromise and negotiation. Be willing to listen to each other’s perspectives and find solutions that address both parties’ concerns. This might involve adjusting spending habits, making sacrifices, or finding alternative approaches to achieve your goals. Compromise is key to maintaining a balanced and equitable financial relationship.

Seek Professional Advice

Don’t hesitate to seek professional financial advice from a qualified advisor. A financial planner can offer expert guidance on budgeting, debt management, investment strategies, and other financial matters. Their objective perspective can help you make informed decisions and navigate complex financial situations.

Maintain Regular Reviews

Regularly review your budget, financial plan, and overall progress towards your shared goals. This helps you stay on track, make adjustments as needed, and ensure that your financial strategies are still aligned with your evolving circumstances.

Managing Debt as a Couple

Managing debt as a couple can be a challenging but rewarding experience. Open and honest communication is key to success. Here are some tips for couples to effectively manage their debt together:

1. Set Financial Goals Together

Discuss your short-term and long-term financial goals. Do you want to buy a house, go on a dream vacation, or retire early? Having shared goals will help you stay motivated and work towards a common objective.

2. Create a Budget

Develop a detailed budget that outlines your income and expenses. Track your spending carefully and identify areas where you can cut back. Consider using a budgeting app or spreadsheet to simplify the process.

3. Talk About Your Debt

Be transparent with each other about your individual debts, including the amount, interest rates, and minimum payments. Understanding the full picture of your debt is essential for making informed decisions.

4. Prioritize Debt Repayment

There are different strategies for debt repayment, such as the snowball method (paying off the smallest debts first) or the avalanche method (paying off the debts with the highest interest rates first). Choose a strategy that works best for your situation.

5. Consider Debt Consolidation

Debt consolidation can help simplify your payments and potentially lower your interest rates. However, make sure to research the terms and conditions carefully before making any decisions.

6. Seek Professional Help

If you are struggling to manage your debt, don’t hesitate to seek professional help from a credit counselor or financial advisor. They can provide guidance and support tailored to your specific needs.

7. Avoid Taking On New Debt

Once you’ve started paying down your debt, avoid taking on new debt unless absolutely necessary. This will help you stay on track and prevent your progress from being reversed.

8. Build an Emergency Fund

Having an emergency fund can help you avoid accumulating debt in the event of unexpected expenses. Aim to save at least three to six months’ worth of living expenses.

9. Celebrate Your Progress

As you make progress towards your debt-free goals, take time to celebrate your achievements. This will help you stay motivated and recognize the hard work you are putting in.

Managing debt as a couple requires teamwork, communication, and commitment. By following these tips, you can create a solid financial foundation for your relationship and achieve your shared financial goals.

Building a Strong Financial Future Together

In today’s world, it’s more crucial than ever to have a solid financial foundation. Whether you’re a young adult just starting out, a family growing together, or a seasoned individual looking to secure your future, building financial strength is an essential life skill.

But navigating the complexities of finances can be daunting. That’s where a collaborative approach comes in. By working together, couples, families, and even roommates can create a shared vision for their financial future and achieve their goals with greater ease and confidence.

Key Steps to Build a Strong Financial Future Together:

1. Open Communication: The foundation of any successful partnership, financial or otherwise, is honest and open communication. Regularly discuss your financial goals, values, and concerns with your partner(s) or roommates.

2. Set Shared Financial Goals: Whether it’s buying a home, saving for retirement, or paying off debt, define your collective aspirations. Having clear, shared goals will keep you motivated and on track.

3. Create a Budget: Tracking your income and expenses is crucial for managing your finances effectively. Collaboratively create a budget that reflects your shared spending habits and goals. Consider using budgeting apps or tools for a streamlined process.

4. Save and Invest Wisely: Build a safety net by establishing an emergency fund. Explore investment options, such as retirement accounts or mutual funds, to grow your wealth over time. Seek guidance from a financial advisor if needed.

5. Manage Debt Strategically: High-interest debt can hinder your financial progress. Create a plan to pay down debt, whether it’s consolidating loans, prioritizing payments, or pursuing debt consolidation programs.

Benefits of Building Financial Strength Together:

1. Enhanced Financial Security: By pooling resources and working together, you create a stronger financial foundation that provides greater security and peace of mind.

2. Increased Accountability: Having a shared financial plan and goals promotes accountability and responsibility. You’re more likely to stick to your budget and make informed decisions when you know you’re working towards a common objective.

3. Stronger Relationships: Financial transparency and collaboration can strengthen your relationships by fostering trust, understanding, and shared responsibility.

Building a strong financial future together requires ongoing effort and communication. But the rewards are significant. By embracing a collaborative approach, you can achieve your financial goals and build a more secure and fulfilling life for yourself and your loved ones.

Seeking Professional Financial Advice

In today’s complex financial landscape, it can be overwhelming to manage your money effectively. From investments and retirement planning to taxes and estate planning, the decisions you make can have a significant impact on your financial future. This is where seeking professional financial advice can be invaluable.

A financial advisor can provide you with expert guidance and support, helping you navigate the complexities of financial management and achieve your financial goals. Here are some compelling reasons why seeking professional financial advice is a wise investment:

Objectivity and Perspective

Financial advisors bring an objective perspective to your financial situation. They can help you identify biases, blind spots, and emotional influences that might cloud your judgment. By stepping back and looking at the bigger picture, they can provide you with unbiased insights and recommendations.

Expertise and Knowledge

Financial advisors are trained professionals with extensive knowledge of the financial markets, investment strategies, and tax laws. They stay abreast of industry trends and regulations, ensuring that your financial plans are aligned with the latest developments.

Personalized Strategies

Every individual’s financial situation is unique. Financial advisors take the time to understand your specific circumstances, goals, and risk tolerance. They then develop customized financial strategies tailored to your needs, ensuring that your investments and financial decisions are aligned with your overall objectives.

Financial Planning and Goal Setting

Financial advisors can help you create a comprehensive financial plan that encompasses various aspects of your financial life, including retirement planning, college savings, debt management, and estate planning. They can guide you in setting realistic financial goals and tracking your progress over time.

Investment Management

Financial advisors can manage your investments, balancing risk and return based on your goals and tolerance for risk. They can diversify your portfolio, adjust your investment allocation, and monitor market performance to optimize your returns.

Peace of Mind

Knowing that you have a trusted professional guiding your financial decisions can provide immense peace of mind. You can rest assured that your money is being managed effectively and strategically, giving you confidence in your financial future.

If you’re looking to enhance your financial well-being, seeking professional financial advice is a smart move. By working with a qualified financial advisor, you can gain valuable insights, develop sound financial strategies, and achieve your financial goals with greater confidence.