Building wealth requires smart financial strategies, and one of the most powerful tools at your disposal is tax-free investment accounts. These accounts allow your investments to grow without being subject to annual capital gains taxes, significantly accelerating your wealth accumulation. Imagine watching your money compound faster, free from the bite of taxes. By understanding how to leverage these accounts effectively, you can unlock substantial long-term benefits and position yourself for financial success.

Whether you’re a seasoned investor or just starting your wealth-building journey, this guide will equip you with the knowledge you need to master tax-free investment accounts. We’ll delve into the different types available, explore their unique features, and provide practical strategies to maximize your returns. Get ready to discover how these powerful financial vehicles can empower you to achieve your financial goals and build a brighter future.

Understanding Tax-Advantaged Accounts: The Basics

Tax-advantaged accounts, also known as retirement accounts, are designed to help individuals save for retirement by offering tax benefits. These accounts provide various advantages that can significantly impact your overall financial planning. In this article, we’ll delve into the fundamentals of tax-advantaged accounts, exploring their different types and how they can benefit you.

Types of Tax-Advantaged Accounts:

There are several types of tax-advantaged accounts, each with its own unique features and benefits:

1. Traditional IRA:

A Traditional IRA (Individual Retirement Account) allows you to contribute pre-tax dollars, meaning you deduct your contributions from your taxable income, reducing your immediate tax liability. However, you’ll pay taxes on the distributions when you withdraw the money in retirement.

2. Roth IRA:

A Roth IRA offers the opposite tax structure. You contribute after-tax dollars, so you don’t receive any immediate tax deduction. However, qualified withdrawals in retirement are tax-free. This makes Roth IRAs particularly attractive for individuals who anticipate being in a higher tax bracket in retirement.

3. 401(k):

A 401(k) is a retirement plan offered by employers. Similar to a Traditional IRA, contributions are pre-tax, reducing your taxable income. Employers may also offer matching contributions, which can significantly boost your savings.

4. 403(b):

A 403(b) is a retirement plan specifically for employees of public schools, non-profit organizations, and certain other tax-exempt organizations. It functions similarly to a 401(k) with pre-tax contributions and potential employer matching.

5. 529 Plan:

A 529 Plan is a savings plan designed for education expenses. Contributions grow tax-deferred, and withdrawals for qualified educational expenses are tax-free. This makes 529 Plans an excellent option for saving for college or other educational pursuits.

Benefits of Tax-Advantaged Accounts:

Tax-advantaged accounts offer numerous advantages for your financial planning:

1. Tax Savings:

The primary benefit is the potential for tax savings. Whether you deduct contributions from your taxable income or enjoy tax-free withdrawals in retirement, these accounts can significantly reduce your tax burden.

2. Compounding Growth:

By allowing your investments to grow tax-deferred, you benefit from the power of compounding. The earnings on your investments are reinvested, growing exponentially over time.

3. Retirement Security:

Tax-advantaged accounts are specifically designed to help you save for retirement. The tax benefits encourage you to save more and build a substantial nest egg for your future.

Choosing the Right Tax-Advantaged Account:

The best tax-advantaged account for you depends on your individual circumstances, such as your income level, tax bracket, and retirement goals. It’s crucial to consult with a financial advisor to determine the most suitable option for your needs.

Conclusion:

Understanding the fundamentals of tax-advantaged accounts is essential for successful financial planning. Whether you’re just starting your savings journey or looking to optimize your existing investments, these accounts can offer significant advantages in terms of tax savings, compounding growth, and retirement security. By carefully considering your options and seeking professional guidance, you can leverage the power of tax-advantaged accounts to achieve your financial goals.

Types of Tax-Free Investment Accounts: Pros and Cons

Investing your money can be a great way to grow your wealth over time. However, taxes can eat away at your returns. That’s why tax-free investment accounts are so popular. These accounts allow you to grow your money without paying taxes on your earnings. In this article, we’ll explore the different types of tax-free investment accounts available in the United States, their pros and cons, and how to choose the right one for you.

Here are the most common types of tax-free investment accounts:

Roth IRA

A Roth IRA is a retirement savings account that allows you to withdraw your earnings tax-free in retirement. Contributions to a Roth IRA are made after taxes, meaning that you won’t have to pay taxes on your withdrawals in retirement. The main benefit of a Roth IRA is that it provides tax-free income in retirement, which can be a big advantage if you expect to be in a higher tax bracket in retirement. However, one of the drawbacks is that you will have to pay taxes on the contributions now, which can be a challenge for people with lower incomes.

Traditional IRA

A Traditional IRA is another retirement savings account, but contributions are made with pre-tax dollars. You won’t pay taxes on your earnings until you withdraw them in retirement, and these withdrawals are taxed as ordinary income. One of the benefits of the Traditional IRA is that it can lower your current tax bill. On the other hand, you will have to pay taxes on your withdrawals in retirement.

401(k)

A 401(k) is a retirement savings plan offered by employers. Contributions are made with pre-tax dollars, and your earnings grow tax-deferred. Many employers also offer a matching contribution program, where they contribute a certain percentage of your salary to your 401(k) account. One of the benefits of a 401(k) is that it provides you with tax-deferred growth and can help you save for retirement. However, there are restrictions on how much you can contribute, and you may have to pay taxes on your withdrawals in retirement.

403(b)

A 403(b) is a retirement savings plan that is similar to a 401(k), but it is offered to employees of public schools, hospitals, and some non-profit organizations. These plans also offer tax-deferred growth and employer matching contributions.

529 Plan

A 529 plan is a tax-advantaged savings plan designed to help pay for qualified education expenses, such as tuition, fees, books, and room and board. Contributions to a 529 plan grow tax-deferred, and withdrawals are tax-free if used for qualified educational expenses. One of the benefits of a 529 plan is that it can help you save for your child’s education. However, there are restrictions on how the money can be used, and it is important to be aware of the potential tax implications if the funds are withdrawn for non-educational expenses.

Health Savings Account (HSA)

A Health Savings Account (HSA) is a tax-advantaged medical savings account available to individuals with high-deductible health insurance plans. Contributions are made with pre-tax dollars, and earnings grow tax-deferred. The biggest benefit of an HSA is that it allows you to save money for healthcare expenses while also getting tax benefits. However, it can be a challenge to pay for healthcare expenses out of pocket before reaching your deductible.

Choosing the Right Tax-Free Investment Account

The best tax-free investment account for you will depend on your individual circumstances and financial goals. Consider these factors:

- Your tax bracket

- Your financial goals

- Your risk tolerance

- Your time horizon

It is important to consult with a financial advisor to discuss your options and determine the best course of action for you. They can help you navigate the complex world of tax-free investment accounts and develop a comprehensive financial plan that meets your needs.

Maximizing Contributions to Tax-Free Accounts

Tax-free accounts, such as 401(k)s and IRAs, offer significant tax advantages for retirement savings. By contributing to these accounts, you can reduce your current tax liability and grow your investments tax-deferred, allowing your money to compound more rapidly. However, many individuals don’t maximize their contributions, leaving potential savings on the table.

Here are some strategies to maximize contributions to tax-free accounts:

- Contribute the Maximum Allowed: Take advantage of the full contribution limits set by the IRS. For 2023, the contribution limit for 401(k)s is $22,500, and for traditional and Roth IRAs, it’s $6,500. If you’re 50 or older, you can make additional “catch-up” contributions.

- Automate Contributions: Set up automatic contributions from your paycheck to your tax-free accounts. This ensures you’re consistently saving without having to think about it.

- Increase Contributions Gradually: If you can’t afford to contribute the maximum amount immediately, gradually increase your contributions over time. Even small increases can make a big difference in the long run.

- Consider a Roth IRA: If you expect to be in a higher tax bracket in retirement, a Roth IRA may be beneficial. Contributions are made with after-tax dollars, but withdrawals in retirement are tax-free.

- Take Advantage of Employer Matching: Many employers offer matching contributions to their employees’ 401(k)s. This essentially free money should be taken advantage of to maximize your retirement savings.

Maximizing contributions to tax-free accounts can significantly impact your financial future. By taking advantage of these tax advantages and following these strategies, you can set yourself up for a more comfortable retirement.

Investment Strategies for Tax-Free Growth

In the realm of personal finance, tax optimization is a crucial element for maximizing wealth accumulation. Investing in tax-free accounts can significantly enhance your investment returns by shielding your gains from taxation. Here are some effective strategies for achieving tax-free growth:

1. Roth IRA

A Roth IRA is a retirement account that allows for tax-free withdrawals in retirement. Contributions are made after-tax, but qualified distributions in retirement are tax-free. This makes it an ideal choice for individuals who anticipate being in a higher tax bracket during retirement.

2. 401(k)

Many employers offer 401(k) plans, which allow employees to contribute pre-tax income to a retirement account. While withdrawals in retirement are taxable, the pre-tax contributions help reduce your current tax liability. Some employers also offer Roth 401(k) options, where contributions are made after-tax but withdrawals are tax-free.

3. Municipal Bonds

Municipal bonds are issued by state and local governments. The interest earned on these bonds is typically exempt from federal income tax, and sometimes state and local taxes as well. This makes them an attractive option for investors seeking tax-free income.

4. Tax-Free Savings Accounts (TFSA)

Available in some countries, TFSAs allow individuals to contribute a certain amount each year, with all earnings and withdrawals being tax-free. They are a great tool for building tax-efficient savings for a variety of goals, such as a down payment on a home or retirement.

5. Tax-Loss Harvesting

This strategy involves selling losing investments to offset capital gains from other investments. By realizing losses, you can reduce your overall tax liability, effectively increasing your after-tax returns.

6. Dividend-Paying Stocks

Some companies pay dividends to their shareholders. Qualified dividends are often taxed at a lower rate than ordinary income. Consider investing in companies with a history of dividend payments to generate tax-advantaged income.

7. Real Estate

Real estate can offer tax advantages through depreciation deductions and potential tax-free capital gains on the sale of a primary residence. However, it’s essential to consult with a tax professional to understand the specific tax implications of real estate investments.

Remember, tax laws can be complex and vary depending on your location and circumstances. It’s highly recommended to seek professional financial advice to determine the most suitable investment strategies for your individual needs and tax situation.

The Power of Compounding in Tax-Free Accounts

Investing in tax-free accounts, like Roth IRAs or 401(k)s, offers a significant advantage: the ability to let your investments compound tax-free. Compounding is the snowball effect of earning interest on your initial investment and then earning interest on that interest. This phenomenon, known as the eighth wonder of the world, can dramatically accelerate your wealth growth over time.

How Compounding Works in Tax-Free Accounts

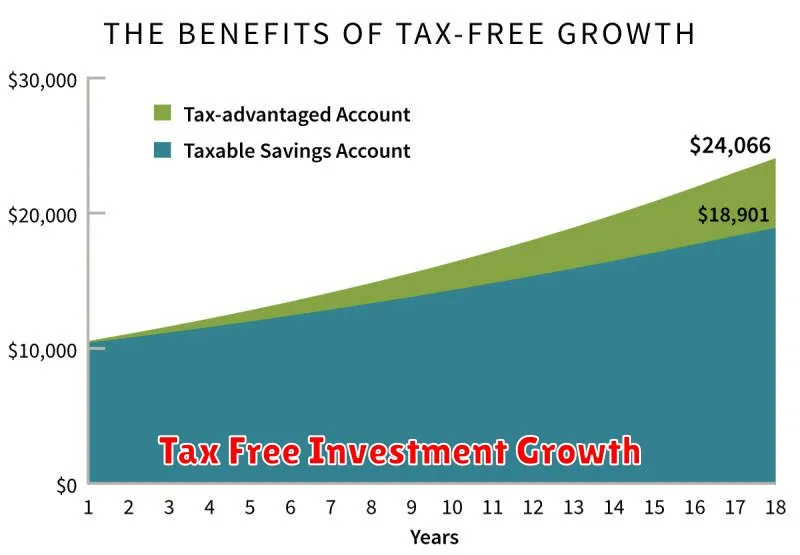

Imagine you invest $10,000 in a Roth IRA that earns an average annual return of 7%. In a taxable account, you would pay taxes on that 7% return each year, reducing your overall growth. However, in a tax-free account, that 7% return compounds completely tax-free. This means your $10,000 investment grows to $17,000 after 10 years, compared to $14,000 in a taxable account (assuming a 20% tax rate). The difference might seem small initially, but over decades, the gap widens dramatically.

The Power of Time

The magic of compounding truly shines over long periods. As time goes on, the initial investment becomes less important compared to the cumulative effect of compounding. For instance, if you invest $10,000 at age 25 and it grows at 7% annually, it will become roughly $76,000 by age 65. However, if you delay investing until age 35, you’ll need to invest $22,000 to reach the same $76,000 by age 65. This highlights the importance of starting early and letting compounding work its magic for you.

Key Takeaways

- Tax-free accounts allow for tax-free compounding, significantly boosting your investment growth over time.

- The earlier you start investing, the greater the benefit of compounding, as time works in your favor.

- While market fluctuations are inevitable, consistent long-term investing allows compounding to smooth out those fluctuations and lead to significant wealth accumulation.

By taking advantage of the power of compounding in tax-free accounts, you can set yourself on a path to achieve your financial goals and enjoy the benefits of long-term wealth building.

Withdrawal Strategies for Tax-Free Retirement Income

Retirement is a time to enjoy the fruits of your labor and live life to the fullest. But before you can do that, you need to figure out how you’re going to fund your retirement. There are a number of different withdrawal strategies you can use to ensure that you have enough money to live comfortably in retirement.

One popular strategy is to withdraw from your tax-advantaged retirement accounts, such as a 401(k) or IRA. These accounts allow you to grow your money tax-deferred and then withdraw it in retirement, but you will have to pay taxes on the distributions. However, if you choose to make withdrawals from your Roth IRA, your withdrawals are tax-free.

If you’re looking for tax-free retirement income, you may want to consider investing in tax-free municipal bonds. These bonds are issued by state and local governments and the interest income is generally exempt from federal income tax. You may also be able to find tax-free investments through your employer-sponsored retirement plan.

No matter what withdrawal strategy you choose, it’s important to work with a financial advisor to develop a plan that meets your individual needs. A financial advisor can help you understand the tax implications of different withdrawal strategies and ensure that you’re on track to achieve your retirement goals.

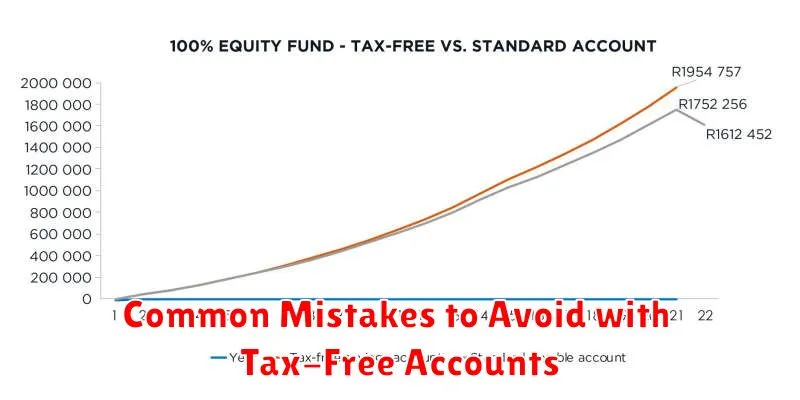

Common Mistakes to Avoid with Tax-Free Accounts

Tax-free accounts, such as Roth IRAs and 529 plans, can be a powerful tool for saving for retirement and education expenses. However, there are a few common mistakes that people make with these accounts that can reduce their benefits. Here are some tips to avoid these pitfalls.

1. Not contributing enough. One of the biggest mistakes people make is not contributing enough to their tax-free accounts. Remember that these accounts are designed to help you save for the long term, so it’s important to contribute as much as you can, as early as possible. The sooner you start, the more time your money has to grow tax-free. There are contribution limits, but make sure you max them out.

2. Not understanding the rules. Each type of tax-free account has its own set of rules. For example, Roth IRAs have income limits, while 529 plans have restrictions on how the money can be used. It’s important to understand the rules of your account before you start contributing. You can avoid penalties by understanding these rules.

3. Withdrawing money early. One of the biggest drawbacks of tax-free accounts is that you can’t access your money without paying penalties before a certain age or for a certain reason. This can be a problem if you need to access your money for an emergency expense. If you withdraw money from a Roth IRA before age 59 1/2, you’ll have to pay taxes and a 10% penalty. However, there are some exceptions to these rules.

4. Not using the money for its intended purpose. Tax-free accounts are designed for specific purposes, such as retirement or education. If you use the money for other purposes, you may have to pay taxes and penalties.

5. Not keeping track of your account. It’s important to keep track of your tax-free accounts so you can make sure you’re maximizing your benefits. You should review your account statements regularly and make sure you’re on track to reach your financial goals. Track your investments and make sure they are aligned with your risk tolerance.

By avoiding these common mistakes, you can make sure you’re getting the most out of your tax-free accounts. They are a valuable tool for saving for retirement and education expenses.