Are you looking for ways to boost your investment returns and reduce risk? Diversifying your investment portfolio is a crucial step in achieving your financial goals. A diversified portfolio spreads your investments across different asset classes, industries, and geographic locations, minimizing your exposure to any single investment’s fluctuations. By strategically diversifying, you can potentially unlock greater returns while safeguarding your capital from market downturns.

This article will guide you through the essential steps to diversify your investment portfolio effectively. We’ll explore different asset classes, including stocks, bonds, real estate, and commodities, providing insights into their characteristics and how they contribute to a well-rounded portfolio. We’ll also delve into practical strategies for allocating your assets wisely, based on your risk tolerance, investment horizon, and financial goals. Get ready to learn how to navigate the world of investing with confidence and build a portfolio that works for you.

Understanding Investment Risk and Return

Investing is an essential part of achieving financial goals, whether it’s building wealth, securing your future, or pursuing dreams. However, the journey to financial success often involves navigating the complex world of risk and return. Understanding these fundamental concepts is crucial for making informed investment decisions that align with your financial objectives and risk tolerance.

What is Investment Risk?

Investment risk refers to the possibility that an investment will not perform as expected, resulting in a loss of capital or a lower return than anticipated. It’s the inherent uncertainty associated with any investment, and it can arise from various factors, including:

- Market Risk: Fluctuations in the overall market, driven by economic conditions, political events, or investor sentiment.

- Company Risk: Factors specific to a particular company, such as financial performance, management decisions, or industry competition.

- Interest Rate Risk: Changes in interest rates can impact the value of fixed-income investments like bonds.

- Inflation Risk: The erosion of purchasing power due to rising inflation can reduce the real return on investments.

- Currency Risk: Fluctuations in exchange rates can affect the value of investments held in foreign currencies.

What is Investment Return?

Investment return represents the profit or gain generated from an investment. It can be expressed as a percentage of the initial investment or as a dollar amount. Return can be derived from various sources, including:

- Capital Appreciation: The increase in the market value of an investment over time.

- Income: Regular payments received from an investment, such as dividends from stocks or interest from bonds.

- Capital Gains: The profit realized when an investment is sold at a higher price than its purchase price.

The Relationship Between Risk and Return

There’s a fundamental relationship between risk and return: higher risk generally implies the potential for higher return, while lower risk often corresponds to lower potential returns. This relationship is based on the principle that investors demand compensation for taking on more risk. The higher the potential for loss, the higher the expected return investors require.

Managing Risk and Return

Balancing risk and return is crucial for any investor. The appropriate balance depends on individual circumstances, financial goals, and risk tolerance. Here are some key considerations:

- Risk Tolerance: Assess your ability and willingness to accept potential losses in pursuit of higher returns.

- Investment Horizon: Longer investment horizons generally allow for greater risk-taking, as there’s more time to recover from potential losses.

- Diversification: Spreading investments across different asset classes, industries, and geographic regions can help reduce overall risk.

- Professional Advice: Consulting with a financial advisor can provide valuable guidance on managing risk and return based on your specific situation.

Understanding the interplay of risk and return is essential for making informed investment decisions. By carefully considering your risk tolerance, investment goals, and the available investment options, you can build a portfolio that aligns with your financial aspirations and helps you achieve your long-term objectives.

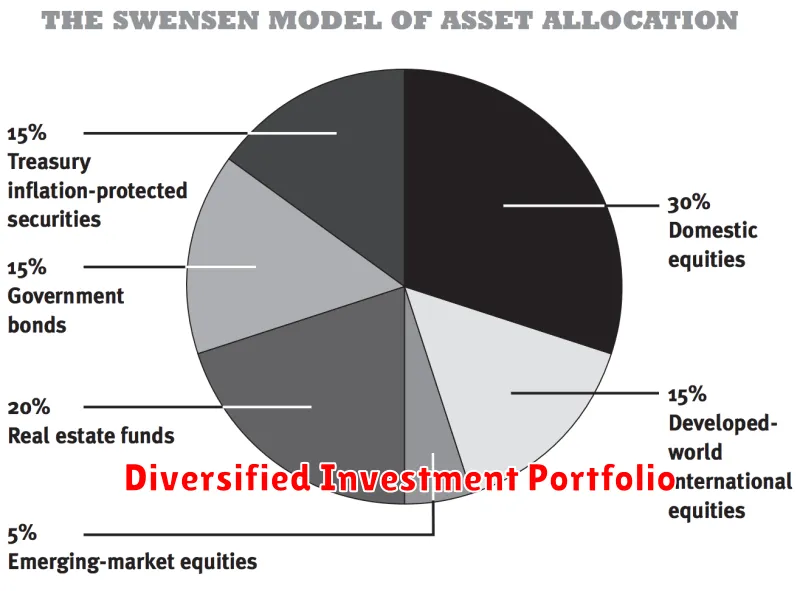

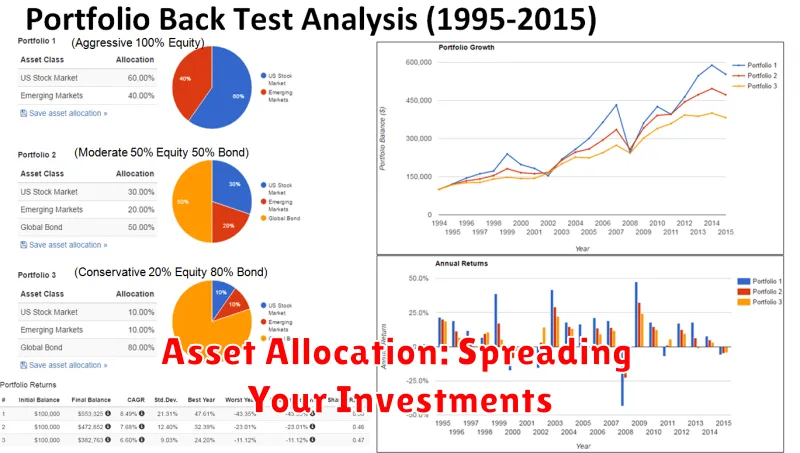

Asset Allocation: Spreading Your Investments

Asset allocation is the process of dividing your investment portfolio among different asset classes, such as stocks, bonds, real estate, and cash. The goal of asset allocation is to reduce risk and maximize returns by diversifying your investments. It’s like spreading your eggs across different baskets, so if one basket falls, you don’t lose all your eggs.

Why is asset allocation important?

Asset allocation is important because it helps you to:

- Reduce risk: By investing in a variety of asset classes, you can mitigate the impact of any one asset class performing poorly. For example, if stocks are down, bonds may be up, and vice versa.

- Maximize returns: Different asset classes have different risk and return profiles. By allocating your investments strategically, you can potentially achieve higher returns over the long term.

- Meet your financial goals: Your asset allocation strategy should be aligned with your financial goals, such as retirement, buying a home, or saving for your children’s education.

How to create an asset allocation strategy

Creating an asset allocation strategy involves several steps:

- Determine your risk tolerance: How much risk are you comfortable taking with your investments? This will determine your allocation to different asset classes.

- Define your investment goals: What are you saving for? What time horizon do you have? Your investment goals will guide your asset allocation.

- Select asset classes: Choose the asset classes that are appropriate for your risk tolerance and investment goals. Common asset classes include stocks, bonds, real estate, and cash.

- Allocate your investments: Determine the percentage of your portfolio that you will allocate to each asset class.

- Monitor and adjust your strategy: Your asset allocation strategy should be reviewed and adjusted periodically, as your risk tolerance, investment goals, and market conditions change.

Asset allocation is a key element of successful investing. By diversifying your investments and allocating them strategically, you can reduce risk and potentially achieve higher returns over the long term.

Diversification Across Different Asset Classes

Diversification is a fundamental principle of investing that aims to reduce risk by allocating investments across different asset classes. By spreading investments across various asset types, investors can mitigate the impact of any single asset class performing poorly. This strategy helps to smooth out returns over time and reduce overall portfolio volatility.

Key Asset Classes

Here are some of the major asset classes that investors typically consider for diversification:

- Equities (Stocks): Represent ownership in companies and offer potential for growth but also carry higher risk.

- Fixed Income (Bonds): Debt securities that provide regular interest payments and are generally considered less risky than stocks.

- Real Estate: Tangible assets that can provide rental income and appreciation potential, but also require significant capital and management.

- Commodities: Raw materials like gold, oil, and agricultural products that can hedge against inflation and provide portfolio diversification.

- Cash and Equivalents: Liquid assets like cash, money market accounts, and short-term bonds that offer low returns but provide safety and liquidity.

Benefits of Diversification

Diversification offers several key advantages:

- Reduced Risk: By spreading investments across different asset classes, investors can mitigate the impact of any single asset class performing poorly.

- Improved Returns: Diversification can help to smooth out returns over time and potentially enhance overall portfolio performance.

- Enhanced Stability: A diversified portfolio is generally more stable and less susceptible to market fluctuations.

- Protection Against Inflation: Some asset classes, like commodities and real estate, can provide protection against inflation.

Strategies for Diversification

There are various strategies investors can employ to diversify their portfolios:

- Asset Allocation: Determine the percentage of your portfolio to allocate to each asset class based on your risk tolerance, investment goals, and time horizon.

- Global Diversification: Invest in assets from different countries and regions to reduce exposure to specific economic or political events.

- Sector Diversification: Within equities, invest in companies from different industries to minimize the impact of sector-specific risks.

Conclusion

Diversification is an essential investment principle that helps to reduce risk, improve returns, and enhance portfolio stability. By allocating investments across different asset classes, investors can create a more resilient and diversified portfolio that can navigate market volatility and achieve long-term financial goals.

Geographical Diversification: Expanding Your Reach

Geographical diversification is a strategic approach that involves expanding a business’s operations to multiple locations across different geographical regions. It’s a powerful tool for businesses seeking to mitigate risks, tap into new markets, and enhance their overall growth potential. This article will delve into the compelling benefits of geographical diversification and explore how businesses can effectively implement this strategy.

Mitigating Risks

One of the most significant advantages of geographical diversification is risk mitigation. By operating in multiple locations, businesses can spread their assets and operations, reducing the impact of potential disruptions in any single region. This is especially crucial in today’s volatile global landscape, where economic downturns, political instability, and natural disasters can pose substantial threats to businesses. By diversifying geographically, companies can buffer themselves against these risks, ensuring their continued stability and profitability.

Accessing New Markets

Geographical diversification opens up new markets and customer bases, expanding a business’s reach and revenue potential. By establishing operations in different regions, companies can tap into unique consumer demographics, cultural preferences, and market trends. This access to new markets provides opportunities for growth, product innovation, and increased brand recognition. Moreover, by entering new markets, businesses can diversify their revenue streams, making them less reliant on any single region for their success.

Optimizing Costs and Resources

Geographical diversification can also lead to cost optimization and resource allocation efficiency. By setting up operations in regions with lower labor costs, businesses can reduce their overall expenses. Additionally, diversifying operations allows companies to take advantage of regional specialization and expertise. For example, a business might establish a research and development center in a region known for its technological prowess or a manufacturing facility in a region with abundant natural resources. This strategic allocation of resources can enhance efficiency and productivity.

Enhanced Global Competitiveness

Geographical diversification contributes to a business’s global competitiveness by building a strong international presence. By establishing operations in key markets around the world, companies can gain a deeper understanding of local customer needs and preferences. This knowledge allows them to tailor their products and services to meet specific market demands, enhancing their competitiveness and customer satisfaction. Moreover, a strong international presence can attract foreign investment, partnerships, and talent, further boosting a business’s global standing.

Considerations for Implementing Geographical Diversification

While geographical diversification offers numerous benefits, it’s essential to carefully consider several factors before implementing this strategy. These include:

- Market research: Thoroughly understand the target markets, their characteristics, and potential growth prospects.

- Political and economic stability: Assess the stability of the chosen locations and the potential impact of political and economic factors on business operations.

- Cultural differences: Understand the cultural nuances and customs of different regions to ensure effective communication and business practices.

- Infrastructure and logistics: Evaluate the availability of necessary infrastructure, transportation, and logistics capabilities to support business operations.

- Legal and regulatory framework: Ensure compliance with local laws and regulations, including tax laws, labor laws, and environmental regulations.

Conclusion

Geographical diversification is a strategic approach that can significantly enhance a business’s growth potential, risk mitigation, and global competitiveness. By carefully considering the factors mentioned above and implementing a well-defined strategy, businesses can successfully expand their reach, tap into new markets, and achieve sustained success in the global marketplace.

Rebalance Your Portfolio Regularly

Rebalancing your portfolio is an essential practice for any investor, regardless of experience level. It involves adjusting the proportions of your assets to maintain your desired asset allocation. While market fluctuations are inevitable, consistent rebalancing can help you stay on track toward your financial goals.

Why Rebalance?

Rebalancing addresses the natural tendency of investments to drift from their intended allocation. As some assets perform better than others, their weight within your portfolio increases. This can lead to an overconcentration in certain areas, creating unnecessary risk and potentially hindering your returns.

The Benefits of Rebalancing

Rebalancing offers several key benefits:

- Reduced Risk: By selling overperforming assets and buying underperforming ones, you reduce the risk associated with excessive concentration in any single asset class.

- Improved Returns: Rebalancing helps you capitalize on market downturns by buying low and selling high, potentially enhancing your long-term returns.

- Disciplined Investing: Rebalancing promotes a disciplined approach to investing, helping you avoid emotional decisions based on market fluctuations.

When to Rebalance

The frequency of rebalancing depends on your individual risk tolerance and investment goals. However, a common recommendation is to rebalance your portfolio at least once a year or when your asset allocation deviates by more than 5% from your target.

How to Rebalance

Rebalancing involves the following steps:

- Determine your target asset allocation: This reflects your desired mix of stocks, bonds, cash, and other assets based on your risk tolerance and investment goals.

- Monitor your current asset allocation: Track the performance of your investments regularly to identify any significant deviations from your target.

- Adjust your portfolio: Buy or sell assets to bring your current allocation closer to your target.

- Rebalance periodically: Maintain a consistent rebalancing schedule to ensure your portfolio remains aligned with your goals.

Conclusion

Rebalancing your portfolio is an essential step in achieving your financial goals. By regularly adjusting your asset allocation, you can mitigate risk, enhance returns, and maintain a disciplined approach to investing. Remember to consult with a financial advisor to determine the best rebalancing strategy for your specific needs and circumstances.

Consider Your Investment Time Horizon

Investing is all about time. The longer you have to invest, the more time your money has to grow. If you’re young and just starting out, you can afford to take on more risk. But if you’re closer to retirement, you’ll want to be more conservative. That’s why it’s important to consider your investment time horizon.

Seek Advice from a Qualified Financial Advisor

Navigating the complex world of finances can be daunting, especially when making significant decisions like investing, planning for retirement, or managing debt. While there are numerous resources available online and in books, seeking advice from a qualified financial advisor can provide invaluable support and guidance.

Here are some compelling reasons why you should consider consulting a financial advisor:

Personalized Financial Plan

A financial advisor will work with you to understand your financial goals, risk tolerance, and time horizon. Based on this information, they can create a personalized financial plan that outlines strategies for achieving your objectives.

Expert Investment Advice

Investing can be risky, and making the wrong decisions can have serious consequences. A financial advisor has the knowledge and experience to help you navigate the investment landscape and make informed decisions that align with your financial goals.

Retirement Planning

Retirement planning is crucial, as it ensures you have enough financial resources to live comfortably during your golden years. A financial advisor can help you develop a retirement plan that considers factors such as your current savings, expected expenses, and desired lifestyle.

Debt Management

High levels of debt can significantly impact your financial well-being. A financial advisor can help you create a debt management plan that includes strategies for reducing your debt burden and improving your credit score.

Tax Optimization

Tax laws can be complex, and it’s important to ensure you are taking advantage of all available tax deductions and credits. A financial advisor can help you optimize your tax strategy to minimize your tax liability.

Finding the Right Advisor

When searching for a financial advisor, it’s essential to do your research and choose someone who is qualified, experienced, and has a good reputation. Look for advisors who hold the Certified Financial Planner (CFP) designation or other relevant credentials.

Conclusion

Consulting a qualified financial advisor can provide significant benefits, including personalized financial planning, expert investment advice, retirement planning, debt management, and tax optimization. By seeking professional guidance, you can make informed financial decisions and work towards achieving your financial goals.

Monitor and Adjust Your Portfolio as Needed

Once you’ve built a portfolio, it’s important to monitor it regularly and make adjustments as needed. Your investment goals may change over time, and the market is constantly fluctuating. As a result, your portfolio may need to be rebalanced or adjusted to reflect those changes.

For example, if you’re nearing retirement, you may want to shift your portfolio to a more conservative allocation, with a greater emphasis on fixed-income investments. Or, if you’re experiencing a significant life event, such as the birth of a child, you may need to adjust your portfolio to reflect your new financial needs.

There are a few key things to keep in mind when monitoring your portfolio:

- Review your asset allocation. This refers to the mix of different types of investments in your portfolio, such as stocks, bonds, and cash. Your asset allocation should be in line with your investment goals and risk tolerance. As your goals and tolerance change, you may need to adjust your allocation accordingly.

- Track your performance. It’s important to keep track of how your portfolio is performing. This will help you to identify any areas where you may need to make adjustments. You can track your performance through a variety of online tools and services.

- Review your investments regularly. It’s a good idea to review your investments at least once a year, and more often if there are any significant changes in your life or the market. This will help you to ensure that your portfolio is still meeting your needs.

- Rebalance your portfolio. As your investments grow and the market fluctuates, your asset allocation can drift out of balance. This is why it’s important to rebalance your portfolio regularly. Rebalancing involves buying or selling assets to bring your portfolio back to its target allocation.

Monitoring your portfolio regularly and making adjustments as needed can help you to stay on track to achieve your financial goals. It’s important to remember that investing involves risk. There is no guarantee that you will make money or that your portfolio will grow. However, by carefully monitoring your portfolio and making adjustments as needed, you can improve your chances of success.