Are you tired of feeling like you’re constantly struggling to make ends meet? Do you dream of achieving financial goals like buying a home, traveling the world, or retiring early? The key to achieving these dreams is learning how to prioritize your spending. When you know how to prioritize, you can free up the money you need to reach your goals. Prioritizing your spending doesn’t mean you have to live a life of deprivation. It simply means making conscious choices about where your money goes, so you can get the most out of it.

This guide will walk you through the process of creating a budget and identifying your financial priorities. We’ll discuss strategies for cutting unnecessary expenses, and how to automate your savings so you can reach your goals faster. Whether you’re just starting out or looking to revamp your financial habits, this article is packed with actionable tips to help you take control of your finances and achieve the financial freedom you deserve.

Identify Your Short-Term and Long-Term Financial Goals

Defining your financial goals is an essential step towards achieving financial success. Whether you’re looking to buy a new car, pay off debt, or save for retirement, having clear goals will help you stay motivated and make informed decisions.

It’s helpful to break down your goals into two categories: short-term and long-term.

Short-Term Financial Goals

Short-term goals are typically those you aim to achieve within a year or less. They might include:

- Paying off credit card debt

- Saving for a vacation

- Making a down payment on a car

- Saving for a major purchase (e.g., appliances, furniture)

Long-Term Financial Goals

Long-term goals are those that you’re working towards over a longer period, such as several years or even decades. Examples include:

- Buying a home

- Saving for retirement

- Funding your children’s education

- Investing in a business

Tips for Identifying Your Financial Goals

Here are some tips for identifying and defining your financial goals:

- Be specific. Instead of saying “I want to save money,” try “I want to save $10,000 for a down payment on a house in the next two years.”

- Set realistic goals. Don’t set yourself up for failure by aiming too high. Make sure your goals are achievable given your current income and expenses.

- Write them down. Putting your goals in writing can make them feel more real and help you stay accountable.

- Review them regularly. As your life changes, your financial goals may need to be adjusted. Make sure to review them periodically to ensure they’re still relevant and achievable.

Once you’ve identified your financial goals, you can start developing a plan to achieve them. This may involve budgeting, saving, investing, or reducing debt.

Remember, reaching your financial goals takes time and effort. But by setting clear goals and taking consistent action, you can achieve financial success and live the life you dream of.

Categorize Your Expenses: Needs vs. Wants

In the realm of personal finance, understanding the distinction between needs and wants is paramount. This simple yet powerful concept can empower you to make informed financial decisions, prioritize your spending, and ultimately achieve your financial goals.

Needs are essential items or services that are required for survival, health, and well-being. They encompass necessities like food, shelter, clothing, healthcare, and transportation. Without these essentials, you would face significant hardship or risk compromising your health and safety.

On the other hand, wants are non-essential items or services that provide enjoyment, comfort, or convenience. They are often considered discretionary expenses, meaning they can be reduced or eliminated without impacting your basic needs. Examples of wants include entertainment, dining out, travel, luxury goods, and subscriptions.

Categorizing your expenses as needs or wants is a fundamental step in creating a budget. By understanding where your money goes, you can identify areas where you may be overspending on wants while neglecting essential needs. This insight can help you prioritize your spending, allocate your resources effectively, and make informed decisions about where to cut back.

Here are some tips for categorizing your expenses:

- Keep track of your spending: Use a budgeting app, spreadsheet, or notebook to record every transaction for a month or two.

- Ask yourself: “Do I truly need this?” If the answer is no, then it’s likely a want.

- Consider the consequences: Would your life be significantly impacted if you eliminated this expense?

By consciously categorizing your expenses, you can gain greater control over your finances. This empowers you to make choices that align with your financial goals, reduce unnecessary spending, and ultimately achieve financial stability.

Allocate Your Income Based on Goal Priority

In today’s fast-paced world, it is crucial to have a clear financial plan. It allows you to allocate your income effectively, ensuring you prioritize your goals and achieve financial stability. One of the most effective strategies is to allocate your income based on goal priority. By understanding the importance of prioritizing your financial goals, you can create a budget that aligns with your aspirations.

First, identify your financial goals. These could include short-term goals like paying off debt or saving for a vacation, and long-term goals like buying a house or retiring comfortably. Once you have a list, assign a priority level to each goal based on its significance and urgency.

Next, analyze your income and expenses. Create a budget that reflects your spending habits and outlines where your money is going each month. You may use budgeting apps or spreadsheets to track your income and spending.

Once you have a clear picture of your income and expenses, you can start allocating your income based on goal priority. Assign a certain percentage of your income to each goal, ensuring that your most important goals receive the highest allocation. For example, if paying off debt is your top priority, you may allocate a larger portion of your income to debt repayment.

It’s important to be realistic and flexible with your budget. Circumstances can change, and you may need to adjust your spending habits or prioritize certain goals. Regularly review your budget and make necessary adjustments. It’s also beneficial to set up automatic transfers to ensure that funds are consistently allocated to your goals.

By allocating your income based on goal priority, you create a structured approach to managing your finances. This method not only helps you achieve your goals but also promotes financial discipline and satisfaction. The more you focus on achieving your goals, the more likely you are to stay motivated and track your progress.

Track Your Spending and Identify Areas for Reduction

Managing your finances effectively is crucial for achieving financial stability and reaching your financial goals. One of the essential steps in this process is to track your spending. By keeping a close eye on where your money goes, you can identify areas for potential reduction and make informed decisions about your financial choices.

1. Start Tracking Your Spending

The first step is to gather all your financial documents, such as bank statements, credit card bills, and receipts. You can use a spreadsheet, budgeting app, or even a simple notebook to record your expenses. Categorize your expenses to get a clear picture of where your money is going. Common categories include:

- Housing

- Food

- Transportation

- Entertainment

- Utilities

- Healthcare

- Personal care

- Debt payments

2. Analyze Your Spending Habits

Once you have a comprehensive record of your spending, it’s time to analyze your habits. Look for areas where you might be overspending or making unnecessary purchases. For example, you might discover you’re spending more on dining out than you planned or that you’re making impulse buys at the grocery store. Don’t be afraid to admit where you’re spending unnecessarily. This is an important part of improving your financial health.

3. Identify Potential Areas for Reduction

Based on your analysis, you can identify areas where you can cut back on your spending. Consider these strategies:

- Negotiate lower rates for your utilities, cable, or internet services.

- Reduce your grocery expenses by meal planning and buying in bulk.

- Cut back on entertainment spending by exploring free or low-cost activities.

- Reduce transportation costs by carpooling, using public transportation, or cycling.

- Minimize unnecessary subscriptions and memberships.

4. Create a Budget

A budget is a powerful tool for controlling your spending. It helps you allocate your income to specific categories and track your progress toward your financial goals. Start by setting realistic financial goals and then allocate your income to each category. Make adjustments as needed. Creating a budget can help you avoid overspending and ensure that you’re meeting your financial obligations.

5. Track Your Progress

After implementing changes to your spending, it’s important to monitor your progress. Review your spending records regularly to see if your efforts are yielding positive results. Adjust your budget and spending habits as needed to achieve your financial goals.

Conclusion

Tracking your spending and identifying areas for reduction can be a valuable step towards improving your financial health. By following these strategies, you can gain control over your finances, avoid unnecessary expenses, and work towards achieving your financial goals.

Automate Savings and Bill Payments

Managing your finances can be a daunting task, especially when you have to juggle multiple bills, savings goals, and daily expenses. Fortunately, technology has made it easier than ever to streamline your finances and take control of your money. One powerful tool at your disposal is automation.

Automating your savings and bill payments can save you time, reduce stress, and help you reach your financial goals faster. Here’s how it works:

Automatic Savings

Instead of manually transferring money from your checking account to your savings account each month, you can set up automatic transfers. This ensures that you consistently save money, even when you’re busy or forget. You can choose the amount you want to save, the frequency of transfers, and even set up recurring savings goals. With automation, you can:

- Build an emergency fund

- Save for retirement

- Fund your travel goals

- Save for a down payment on a house

Automatic Bill Payments

Paying bills on time is crucial to avoid late fees and damage your credit score. By setting up automatic bill payments, you can rest assured that your bills will be paid on time, every time. You can schedule recurring payments for bills like:

- Mortgage or rent

- Utilities (electricity, water, gas)

- Credit card bills

- Internet and phone bills

- Subscriptions

Benefits of Automating Savings and Bill Payments

Here are some key benefits of using automation to manage your finances:

- Saves Time: No more manually transferring money or writing checks.

- Reduces Stress: You can relax knowing that your bills are paid on time and your savings goals are on track.

- Improves Budgeting: Automating your savings and bill payments helps you stick to your budget and avoid overspending.

- Boosts Credit Score: Paying bills on time is essential for maintaining a good credit score.

- Increased Financial Control: Automation gives you more control over your finances, allowing you to focus on other important aspects of your life.

Setting up automatic savings and bill payments is easy and can be done through your bank’s online platform or mobile app. Most financial institutions offer this feature, so explore your options and choose a system that best suits your needs.

Review and Adjust Your Spending Plan Periodically

A spending plan is a crucial tool for managing your finances and achieving your financial goals. However, it’s not a one-and-done process. Your financial situation, goals, and priorities can change over time, so it’s essential to regularly review and adjust your spending plan to ensure it remains effective.

Benefits of Regular Reviews

There are several benefits to reviewing and adjusting your spending plan on a regular basis:

- Stay on track with your goals: As your goals evolve, your spending plan should reflect those changes. Regular reviews help you assess your progress and make necessary adjustments to stay on track.

- Identify areas for improvement: Reviewing your spending patterns can reveal areas where you might be overspending or under-saving. This allows you to make adjustments and improve your financial efficiency.

- Adapt to life changes: Major life events such as a job change, marriage, or the birth of a child can significantly impact your financial situation. Regular reviews ensure your spending plan aligns with these changes.

- Reduce debt and build wealth: By staying on top of your spending and making necessary adjustments, you can effectively manage debt and accelerate your wealth-building journey.

How Often Should You Review?

The frequency of your spending plan reviews depends on your individual circumstances. However, it’s generally recommended to review it at least:

- Quarterly (every 3 months): This frequency allows you to stay updated on your progress and make timely adjustments.

- Annually: This is a good time to review your overall financial situation, including your income, expenses, goals, and investment portfolio.

Tips for Reviewing and Adjusting Your Spending Plan

Here are some tips to make the review process more effective:

- Gather your financial data: Collect your bank statements, credit card statements, and other relevant documents to get a clear picture of your income and expenses.

- Analyze your spending: Categorize your expenses and identify areas where you might be overspending or under-saving.

- Assess your goals: Evaluate your short-term and long-term financial goals and see how your spending plan aligns with them.

- Make necessary adjustments: Based on your analysis, make changes to your spending plan to ensure it’s aligned with your goals and current financial situation.

- Stay consistent: Regularly tracking your spending and making necessary adjustments will help you stay on top of your finances and achieve your financial aspirations.

Reviewing and adjusting your spending plan is an essential part of financial management. It allows you to stay on track with your goals, adapt to life changes, and make informed decisions about your money. By making this a regular habit, you can take control of your finances and achieve your financial dreams.

Celebrate Milestones and Stay Motivated

Achieving goals is a journey that requires perseverance and a positive mindset. As you progress towards your aspirations, it’s essential to acknowledge and celebrate your accomplishments along the way. Recognizing milestones, no matter how small, can serve as a powerful motivator, boosting your confidence and keeping you driven.

When you celebrate milestones, you’re essentially acknowledging the progress you’ve made and reinforcing the belief that you’re capable of achieving your goals. This positive reinforcement can significantly enhance your motivation and help you stay on track. It’s a reminder that you’re moving in the right direction and that your efforts are paying off.

Here are some tips on how to effectively celebrate your milestones:

- Set clear goals and break them down into smaller milestones. This provides a roadmap for your journey and gives you tangible targets to celebrate.

- Acknowledge each milestone with a small celebration. This could be anything from a simple treat to a night out with friends. The important thing is to acknowledge your achievement and show yourself appreciation.

- Reflect on your progress and what you’ve learned along the way. This reflection can provide valuable insights and help you stay motivated for the next stage of your journey.

- Share your achievements with others. Sharing your successes can inspire others and create a supportive network that can help you stay motivated. It can also help you to gain a fresh perspective and see your progress from a different angle.

Remember, celebrating your milestones is not about bragging or being self-indulgent. It’s about acknowledging your hard work and giving yourself the recognition you deserve. It’s about staying positive and motivated on the path to achieving your goals.

By celebrating your milestones, you can not only boost your confidence and stay motivated but also create a positive cycle of achievement and growth. This can lead to greater success in both your personal and professional life.

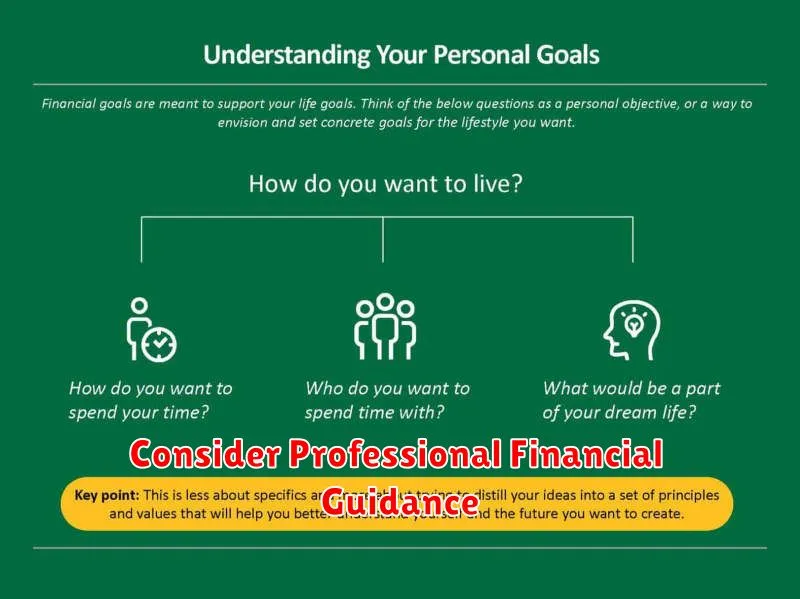

Consider Professional Financial Guidance

Navigating the complex world of finances can be overwhelming, even for the most financially savvy individuals. From managing debt to planning for retirement, there are numerous financial decisions that require careful consideration. In such situations, seeking guidance from a qualified financial advisor can prove invaluable.

Financial advisors possess the expertise and knowledge to help you make informed financial decisions aligned with your goals and risk tolerance. They offer a comprehensive range of services, including:

- Financial planning: Developing a personalized financial plan that encompasses budgeting, saving, investing, and retirement planning.

- Investment management: Managing your investment portfolio, selecting appropriate assets, and adjusting strategies based on market conditions.

- Debt management: Developing strategies to reduce debt, negotiate with creditors, and improve your credit score.

- Retirement planning: Guiding you through the complexities of retirement planning, including savings strategies, investment options, and Social Security benefits.

- Estate planning: Helping you create a comprehensive estate plan, including wills, trusts, and power of attorney documents.

By working with a financial advisor, you gain access to:

- Objective advice: Financial advisors provide unbiased guidance based on your individual circumstances, not influenced by sales quotas or product commissions.

- Specialized knowledge: They stay up-to-date on market trends, regulations, and investment strategies, providing you with the latest insights.

- Accountability and support: Having a financial advisor helps you stay on track with your financial goals, provides support during challenging times, and holds you accountable for your financial decisions.

While financial advisors charge fees for their services, the benefits they offer often outweigh the cost. By leveraging their expertise and guidance, you can achieve your financial goals more effectively and make informed decisions that secure your financial future.