Are you looking for a way to streamline your personal finances and maximize rewards? A credit card can be a valuable tool, but choosing the right one for your needs is crucial. With so many options available, it can be overwhelming to find the perfect fit. From cash back rewards to travel miles, credit cards offer a range of benefits, but each comes with its own terms and conditions. This guide will equip you with the knowledge to navigate the world of credit cards and choose the best option for your financial goals.

By understanding your spending habits, evaluating your credit score, and comparing various features, you can discover the credit card that will help you reach your financial goals. Whether you prioritize earning rewards, managing your budget, or building your credit, this comprehensive guide will provide you with the insights you need to make an informed decision.

Understanding Your Spending Habits

Understanding your spending habits is crucial for managing your finances effectively. By tracking your expenses and analyzing your spending patterns, you can gain valuable insights into where your money is going and identify areas where you can save. Here’s a guide to help you understand your spending habits:

Track Your Expenses

The first step to understanding your spending habits is to track your expenses. There are several methods you can use to do this:

- Manual tracking: Use a notebook, spreadsheet, or budgeting app to record every transaction.

- Automatic tracking: Use a financial app or bank statement that automatically categorizes your expenses.

Choose the method that best suits your preferences and lifestyle. Consistency is key, so try to track your expenses for at least a month to get a comprehensive picture.

Analyze Your Spending Patterns

Once you have a record of your expenses, it’s time to analyze them. Look for recurring patterns and trends in your spending. Ask yourself questions like:

- What are your biggest expense categories?

- Where do you tend to overspend?

- Are there any unnecessary expenses you can cut back on?

Identify areas where you can make adjustments to reduce your spending.

Identify Your Spending Triggers

Spending triggers are external factors that influence your spending decisions. Understanding your triggers can help you avoid impulse purchases and make more conscious choices.

- Emotional triggers: Stress, boredom, or sadness can lead to spending.

- Social triggers: Peer pressure, social media influence, or marketing tactics can encourage spending.

- Environmental triggers: Being in a certain location, like a shopping mall, can trigger spending.

Once you identify your triggers, you can develop strategies to avoid them or manage your spending when they arise.

Create a Budget

A budget is a plan for how you will spend your money. Based on your spending habits and financial goals, create a budget that allocates your income to different categories. A budget can help you stay on track with your spending goals and prevent overspending.

Review and Adjust

Regularly review your spending habits and make adjustments as needed. Your needs and priorities may change over time, so it’s important to adapt your budget and spending habits accordingly. By understanding your spending habits, you can take control of your finances and achieve your financial goals.

Types of Credit Cards Available

Credit cards are a popular form of payment for many people, and for good reason. They offer convenience, rewards, and can help build credit. However, there are many different types of credit cards available, each with its own set of benefits and drawbacks. Understanding the different types of credit cards can help you choose the one that best fits your needs.

Cash Back Credit Cards

Cash back credit cards offer a percentage of cash back on every purchase you make. This cash back can be redeemed for cash, statement credits, gift cards, or other rewards. These cards are great for people who want to earn rewards on their everyday spending. They are easy to use and can help you save money over time.

Travel Rewards Credit Cards

Travel rewards credit cards offer points or miles that can be redeemed for travel expenses, such as flights, hotels, and car rentals. These cards are great for people who travel frequently, especially those who prefer to redeem rewards for travel-related purchases. They can also help you save money on your travel expenses.

Balance Transfer Credit Cards

Balance transfer credit cards offer a 0% introductory APR (annual percentage rate) for a set period of time, making them a good option for people who want to consolidate debt and save money on interest charges. These cards are especially useful for people with high-interest debt, such as credit card balances or personal loans. Just be aware that the introductory APR will expire, and you will likely be charged a higher interest rate after that. It’s important to pay down the balance before the introductory period ends to avoid incurring interest charges.

Secured Credit Cards

Secured credit cards require a security deposit, which is typically equal to your credit limit. These cards are a good option for people with limited credit history or who are looking to build their credit. Since the security deposit acts as collateral, these cards are generally easier to get approved for. Secured credit cards can help you build credit by demonstrating responsible spending habits. Once you’ve established a good credit history, you can usually switch to an unsecured credit card.

Store Credit Cards

Store credit cards are offered by specific retailers and can be used to make purchases at that particular store. These cards often come with rewards programs, such as discounts or special offers. They can be convenient for shoppers who frequently visit that store, but be careful of the high interest rates these cards often carry. Only use store credit cards if you’re sure you can pay off the balance before interest accumulates.

Conclusion

The type of credit card that’s best for you depends on your individual needs and spending habits. Before you apply for a credit card, consider your credit score, spending patterns, and financial goals. It’s important to shop around and compare offers from different lenders to find the best deal.

Interest Rates and Fees: What to Look Out For

When you’re looking for a loan, interest rates and fees are two of the most important factors to consider. They can have a big impact on the total cost of your loan, so it’s important to shop around and compare rates and fees from different lenders.

Interest Rates

An interest rate is the percentage that a lender charges you for borrowing money. The higher the interest rate, the more you’ll pay in interest over the life of your loan. Interest rates can vary depending on a number of factors, including:

- Your credit score

- The type of loan you’re getting

- The amount of money you’re borrowing

- The length of the loan

- The current economic conditions

It’s important to get pre-approved for a loan from several different lenders so that you can compare interest rates. This will help you find the best deal possible.

Fees

Fees are charges that lenders may add to the cost of your loan. These fees can vary depending on the lender and the type of loan you’re getting. Some common fees include:

- Origination fee: This is a fee charged by the lender for processing your loan application.

- Application fee: This is a fee charged by the lender for processing your loan application.

- Closing costs: These are fees that are charged at the closing of your loan. They can include things like appraisal fees, title insurance, and recording fees.

- Prepayment penalty: This is a fee charged by the lender if you pay off your loan early.

- Late payment fee: This is a fee charged by the lender if you make a late payment on your loan.

Make sure to ask about all of the fees that will be charged to you before you take out a loan. This will help you avoid any surprises later on.

How to Find the Best Rates and Fees

Here are a few tips for finding the best interest rates and fees on a loan:

- Shop around: Get quotes from multiple lenders to compare interest rates and fees.

- Improve your credit score: A higher credit score will usually qualify you for lower interest rates. You can improve your credit score by paying your bills on time, keeping your credit card balances low, and avoiding new credit applications.

- Consider a shorter loan term: A shorter loan term will generally result in a lower interest rate. However, you will have higher monthly payments.

- Ask about discounts: Some lenders offer discounts for things like automatic payments or loyalty programs.

- Read the fine print: Carefully review the loan agreement before you sign it. Make sure you understand all of the terms and conditions, including the interest rate, fees, and repayment schedule.

By taking the time to shop around and compare rates and fees, you can save money on the cost of your loan. And by understanding the factors that affect interest rates and fees, you can make informed decisions about your borrowing.

Rewards Programs and Perks

Rewards programs are a great way to incentivize customers to continue doing business with you. They can help you build customer loyalty, increase sales, and improve customer satisfaction. But with so many different types of rewards programs out there, it can be tough to know where to start. In this article, we’ll take a look at some of the most popular types of rewards programs and discuss the benefits of each.

One of the most common types of rewards programs is a points-based program. Customers earn points for making purchases, and they can redeem those points for discounts, free products, or other rewards. Points-based programs are easy to understand and can be very effective at driving repeat business. For example, Starbucks has a points-based program called “My Starbucks Rewards”. Customers earn stars for every dollar they spend, and they can redeem their stars for free drinks, food, or merchandise.

Another popular type of rewards program is a tiered program. In a tiered program, customers are placed into different tiers based on their spending levels. The higher the tier, the more rewards they receive. This type of program can be a great way to motivate customers to spend more and to reward your most loyal customers. For example, Amazon has a tiered program called “Amazon Prime”. Prime members receive free two-day shipping, exclusive deals, and other benefits.

Referral programs are another great way to reward customers and grow your business. With a referral program, customers are rewarded for referring their friends and family to your business. Referral programs can be very effective at acquiring new customers and generating word-of-mouth marketing. For example, Dropbox offers a referral program where both the referrer and the referee receive free storage space.

In addition to the rewards programs mentioned above, you can also offer other types of perks to your customers. These perks can include things like free shipping, early access to sales, or exclusive content. Perks can be a great way to add value to your customer experience and to make your business stand out from the competition.

No matter what type of rewards program you choose, it’s important to make sure that it’s easy to understand and use. The program should also be valuable to your customers and provide them with tangible benefits. If you can create a rewards program that meets these criteria, you’ll be well on your way to building a loyal customer base.

Credit Limit and Its Implications

A credit limit is the maximum amount of money that a lender allows you to borrow on a credit card or line of credit. It’s an important aspect of your credit profile and can significantly impact your financial well-being. Understanding the implications of your credit limit is crucial for managing your finances effectively.

Benefits of a High Credit Limit

A high credit limit can offer several benefits, including:

- Lower credit utilization ratio: Your credit utilization ratio is the amount of credit you’re using compared to your available credit. A lower ratio is generally better for your credit score.

- More financial flexibility: A higher limit gives you more room to make purchases without exceeding your credit limit and incurring fees.

- Potential for better interest rates: Some lenders may offer lower interest rates to borrowers with higher credit limits.

Risks of a High Credit Limit

While a high credit limit can be beneficial, it also comes with certain risks:

- Temptation to overspend: A high credit limit can make it easier to overspend, leading to debt accumulation.

- Negative impact on credit score: If you consistently use a large portion of your credit limit, it can negatively impact your credit score.

- Higher minimum payments: A high credit limit may result in higher minimum payments, making it more difficult to manage your debt.

Managing Your Credit Limit

To effectively manage your credit limit, consider the following:

- Use a credit monitoring service: This can help you track your credit limit and utilization ratio.

- Set spending limits: Create a budget and stick to it to avoid overspending.

- Pay your balance in full each month: This helps prevent interest charges and keeps your credit utilization ratio low.

- Request a credit limit increase only when necessary: Don’t increase your credit limit just for the sake of having a higher number.

By understanding the implications of your credit limit and managing it responsibly, you can improve your financial well-being and build a strong credit history.

Building and Maintaining Good Credit

Good credit is essential for a lot of things in life, including buying a house, getting a car loan, or even renting an apartment. It can also affect your interest rates on other loans, like credit cards and personal loans. So, it’s important to build and maintain a good credit score.

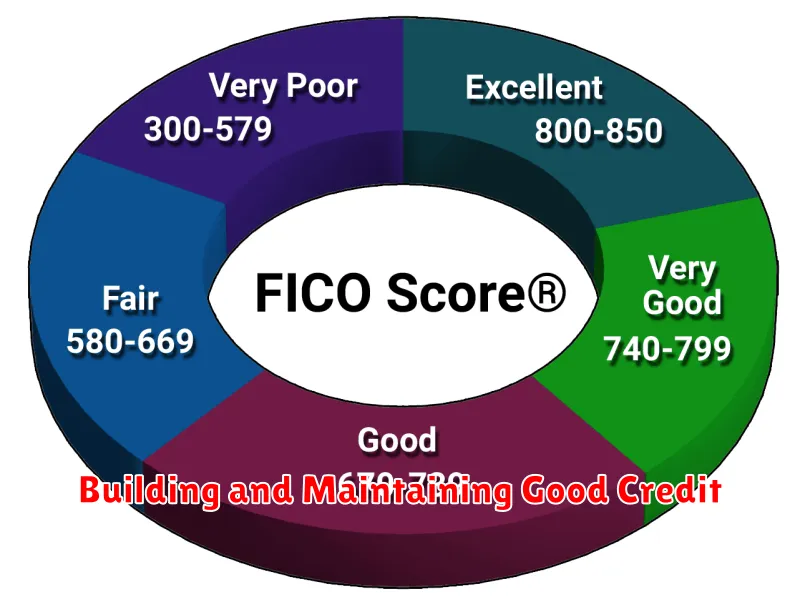

How Credit Scores Work

Your credit score is a number that represents your creditworthiness. It’s based on information in your credit report, which is a detailed history of your borrowing and repayment activity. Lenders use your credit score to determine your risk as a borrower. The higher your score, the lower your risk and the more likely you are to qualify for loans with lower interest rates.

Building Good Credit

Here are some tips for building good credit:

- Pay your bills on time. This is the most important factor in your credit score. Late payments can significantly damage your score.

- Keep your credit utilization low. Credit utilization is the amount of credit you’re using compared to your total available credit. Aim to keep your utilization rate below 30%.

- Don’t open too many new accounts. Every time you apply for a new credit card or loan, a hard inquiry is made on your credit report. Too many hard inquiries can lower your score.

- Become an authorized user on a credit card with a good history. This can help build your credit, especially if you’re new to credit.

- Consider a secured credit card. These cards require you to make a security deposit, which helps protect the lender. Secured credit cards are a good option for people who are just starting to build credit.

Maintaining Good Credit

Once you’ve built a good credit score, it’s important to maintain it. Here are some tips:

- Continue paying your bills on time. This is essential for keeping your score high.

- Monitor your credit report regularly. You can get a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year at AnnualCreditReport.com.

- Dispute any errors on your credit report. If you find any inaccuracies, you can dispute them with the credit bureau.

- Avoid closing old credit accounts. Closing accounts can lower your credit score, especially if you have a low credit limit.

The Importance of Good Credit

Good credit is important for many reasons. It can help you get approved for loans with lower interest rates, which can save you thousands of dollars over time. It can also help you qualify for better rental terms and even land a job. By following the tips above, you can build and maintain a good credit score and enjoy all the benefits that come with it.

Reading the Fine Print

In the bustling world of consumerism, we’re bombarded with alluring offers and enticing deals. From smartphones to subscriptions, it’s easy to get caught up in the excitement and overlook the fine print. But, failing to read the fine print can lead to unexpected consequences, hidden fees, and even legal disputes.

The fine print, often buried in dense paragraphs of legalese, contains crucial information about the product or service you’re considering. It outlines terms and conditions, limitations, and potential risks. It’s your guide to understanding the true nature of the offer and ensuring you’re not signing up for something you didn’t intend to.

Here’s why reading the fine print is crucial:

- Avoid Hidden Fees and Charges: The fine print often reveals additional fees, charges, or penalties that might not be immediately obvious. These can include activation fees, monthly service charges, cancellation fees, or late payment penalties.

- Understand Service Limitations: The fine print details any limitations or restrictions on the product or service. It may specify data usage limits, warranty exclusions, or geographical restrictions.

- Protect Your Rights and Interests: The fine print can outline your rights and responsibilities, including warranty provisions, dispute resolution mechanisms, and data privacy policies. Understanding these terms helps you safeguard your interests.

- Make Informed Decisions: By reading the fine print, you gain a comprehensive understanding of the product or service, enabling you to make informed and conscious decisions.

Don’t be intimidated by the dense text. Take your time, read carefully, and highlight any terms that seem unclear or raise concerns. If you need clarification, don’t hesitate to reach out to the company or consult with a legal professional.

Reading the fine print is an investment in your own protection. It empowers you to make informed choices, avoid unexpected surprises, and ensure that you’re getting what you paid for.

Comparing Credit Card Offers

In today’s world, credit cards are ubiquitous. They offer convenience, rewards, and even access to financing. But with so many options available, choosing the right credit card can feel overwhelming. Comparing credit card offers is essential for finding the card that best suits your needs and financial goals.

Key Factors to Consider

When comparing credit card offers, there are several key factors to consider:

- Annual Percentage Rate (APR): This is the interest rate you’ll pay on your balance. A lower APR is always better.

- Annual Fee: Some credit cards charge an annual fee, while others do not. Consider the value of the benefits offered against the cost of the fee.

- Rewards Program: Many credit cards offer rewards programs, such as cash back, points, or miles. Choose a program that aligns with your spending habits.

- Introductory Offers: Some cards offer introductory promotional periods with lower APRs or bonus rewards. Make sure to understand the terms and conditions of these offers.

- Perks and Benefits: Look for additional perks like travel insurance, purchase protection, or access to airport lounges.

- Credit Limit: The credit limit is the maximum amount you can borrow on your card. Choose a limit that suits your spending needs but avoids unnecessary debt.

Tools for Comparing Credit Card Offers

Several resources can help you compare credit card offers:

- Credit Card Comparison Websites: Websites like Credit Karma, NerdWallet, and Bankrate allow you to compare offers from various issuers based on your criteria.

- Credit Card Issuer Websites: Explore the websites of major credit card issuers to see their current offers and terms.

- Credit Card Reviews: Read reviews from other cardholders to get insights into the pros and cons of different cards.

Tips for Choosing the Right Credit Card

Here are some tips for making the best decision:

- Consider your spending habits: Identify where you spend most of your money and choose a card that rewards you for those purchases.

- Check your credit score: A higher credit score typically qualifies you for better interest rates and offers.

- Read the fine print: Pay attention to the terms and conditions, including fees, APRs, and rewards program rules.

- Don’t rush the decision: Take your time to compare offers and choose the card that best meets your needs.

Conclusion

Comparing credit card offers is crucial for making an informed decision. By carefully considering the key factors and utilizing available resources, you can find the credit card that provides the best value and supports your financial goals.

Making the Final Decision Based on Your Needs

Once you’ve considered all of the options and weighed the pros and cons, it’s time to make a decision. This can be a difficult process, especially if you’re dealing with a complex issue. But it’s important to remember that there is no right or wrong answer, and the best choice for you is the one that will meet your needs and goals.

To help you make the final decision, it’s helpful to ask yourself the following questions:

- What are my most important priorities?

- What are the potential consequences of each option?

- What are my values and how do they align with each option?

- What resources do I have available to me?

- What support do I have from others?

Once you’ve answered these questions, you can begin to narrow down your choices. It’s also important to consider the long-term implications of your decision. What will the impact be on your life in the future?

Ultimately, the best decision is the one that feels right for you. Trust your instincts and don’t be afraid to seek out advice from others you trust.