Have you ever felt like you’re constantly struggling to keep up with your finances? You’re not alone. Lifestyle inflation is a common problem that can derail even the most well-intentioned budgeting plans. It happens when your spending habits gradually increase as your income rises, leading to a vicious cycle of needing more and more money to maintain your lifestyle. This can leave you feeling stressed, overwhelmed, and like you’re always playing catch-up.

But don’t despair! There are ways to avoid lifestyle inflation and stick to your budget. By understanding the common pitfalls and implementing strategies for mindful spending, you can regain control of your finances and achieve your financial goals. This article will provide you with practical tips and actionable advice to help you break free from the cycle of lifestyle inflation and build a more secure financial future.

Understanding Lifestyle Inflation

Lifestyle inflation is a term used to describe the tendency of people to increase their spending as their income rises. This can happen gradually over time, as people get used to a certain level of spending and then find it difficult to cut back when their income decreases. It can also happen more quickly, such as when people get a promotion or a raise and then start spending more on things like nicer clothes, a bigger car, or a more expensive home.

There are a few key factors that contribute to lifestyle inflation:

- Keeping up with the Joneses: Many people feel pressure to keep up with their friends and neighbors, which can lead them to spend more on things they don’t really need.

- The “treat yourself” mentality: It’s easy to fall into the habit of rewarding yourself with purchases whenever you achieve a goal or have a good day. But these purchases can quickly add up.

- The “I deserve it” attitude: As people earn more money, they may start to feel like they deserve to spend more on themselves. This can lead to them buying things they don’t really need.

- Lack of budgeting: If you don’t have a budget, it’s easy to overspend without realizing it.

Lifestyle inflation can have a negative impact on your financial health. If you’re spending more than you earn, you may find yourself in debt or struggling to save money for the future. It’s important to be aware of lifestyle inflation and take steps to avoid it.

Here are some tips for avoiding lifestyle inflation:

- Create a budget and stick to it: This will help you track your spending and make sure you’re not overspending.

- Be mindful of your spending habits: Pay attention to where your money is going and challenge yourself to find ways to save money.

- Don’t let your lifestyle creep up on you: As your income increases, resist the urge to spend more on non-essentials.

- Prioritize your financial goals: What is most important to you financially? Make sure your spending aligns with your goals.

By being aware of lifestyle inflation and taking steps to avoid it, you can protect your financial health and achieve your financial goals.

Track Your Spending and Identify Areas of Increase

Tracking your spending is essential for managing your finances effectively. It allows you to see where your money is going, identify areas where you can cut back, and make informed decisions about your spending habits.

One of the best ways to track your spending is to use a budgeting app or spreadsheet. These tools can help you categorize your expenses, set budgets for different categories, and track your progress over time. You can also manually track your spending using a notebook or a simple spreadsheet. The important thing is to choose a method that works for you and stick with it.

Once you have a clear picture of your spending, you can start to identify areas where you can reduce your expenses. Look for areas where you are spending more than you need to, or where you could potentially save money by making small changes. For example, you may be able to reduce your grocery bill by cooking more meals at home, or you may be able to save on your phone bill by switching to a cheaper plan.

It’s important to be realistic about your spending habits and set achievable goals. Don’t try to cut back on everything at once, as this is likely to lead to frustration and you are more likely to give up.

By tracking your spending and identifying areas of increase, you can take control of your finances and achieve your financial goals. Remember, it’s never too late to start tracking your spending and making positive changes to your financial habits.

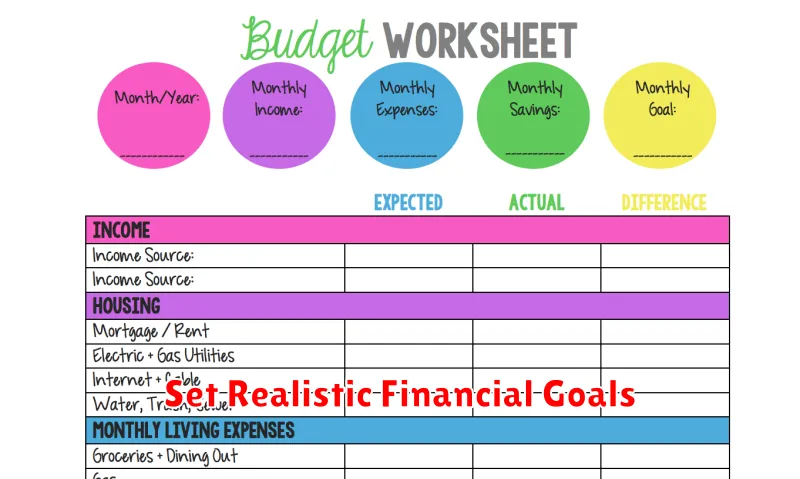

Set Realistic Financial Goals

Setting financial goals is crucial for achieving financial success. However, it’s important to set realistic goals that are achievable and motivating. If your goals are too ambitious or unrealistic, you’re likely to become discouraged and give up.

Start by assessing your current financial situation. Consider your income, expenses, debts, and assets. Once you have a clear understanding of where you stand financially, you can begin to set goals.

When setting financial goals, consider the following tips:

- Be specific. Instead of saying “I want to save more money,” specify the amount you want to save and the time frame.

- Make them measurable. Track your progress towards your goals to stay motivated and on track.

- Set achievable goals. Don’t set yourself up for failure by setting goals that are too difficult to reach.

- Make them relevant to your needs and values. Your goals should be meaningful to you and align with your overall financial objectives.

- Set a deadline. Having a deadline will help you stay focused and motivated.

By setting realistic financial goals, you can create a roadmap for achieving your financial dreams. Remember to break down your goals into smaller, more manageable steps, and celebrate your successes along the way. Your financial journey will be more enjoyable and rewarding when you have clear goals and a plan to reach them.

Prioritize Needs over Wants

In the fast-paced world we live in, it’s easy to get caught up in the constant pursuit of the latest and greatest. Advertisements bombard us with shiny objects and tempting offers, making it difficult to differentiate between our true needs and our fleeting wants. But understanding this distinction is crucial for achieving financial stability and overall well-being.

Needs are essential for survival and basic functionality. They include things like food, water, shelter, clothing, healthcare, and transportation. These are the things we absolutely need to live a healthy and productive life. On the other hand, wants are desires or preferences that aren’t essential for survival but add comfort, pleasure, or convenience to our lives. This category encompasses things like luxury items, entertainment, travel, and expensive gadgets.

While there’s nothing wrong with indulging in wants occasionally, prioritizing needs over wants is essential for long-term financial health. When we focus on meeting our fundamental needs first, we create a solid foundation for financial security. This allows us to save money, invest in our future, and avoid unnecessary debt.

Here are some practical tips for prioritizing needs over wants:

- Create a budget: Track your income and expenses to identify areas where you can cut back on non-essential spending. This will help you allocate your resources efficiently.

- Delay gratification: Resist the urge to buy things you don’t need right away. Give yourself time to think about whether you truly need something before making a purchase.

- Focus on experiences over material possessions: Instead of spending money on expensive items, consider investing in experiences that enrich your life, such as travel, hobbies, or spending time with loved ones.

- Find alternative ways to satisfy wants: Look for cheaper alternatives to expensive items, such as borrowing, renting, or buying used goods.

By prioritizing needs over wants, we cultivate a more mindful and responsible approach to spending. This not only strengthens our financial well-being but also allows us to focus on what truly matters in life.

Find contentment in what you have

In a world obsessed with constant acquisition and comparison, finding contentment can feel like an impossible feat. We’re bombarded with messages that tell us we need more, better, and newer things to be happy. But true contentment comes not from external factors, but from within. It’s about appreciating what we have, embracing the present moment, and finding joy in the simple things.

It’s easy to get caught up in the cycle of wanting more. We compare ourselves to others, feeling inadequate when we see them with bigger houses, fancier cars, or more expensive clothes. We chase after fleeting pleasures, hoping that the next purchase or experience will finally bring us lasting happiness. But the truth is, this pursuit is often a treadmill that leaves us feeling empty and dissatisfied.

The key to finding contentment lies in shifting our focus. Instead of yearning for what we lack, let’s cultivate gratitude for what we already have. Take a moment to appreciate your health, your relationships, your home, your talents, and the small joys that make up your daily life. Even the simplest things, like a warm cup of coffee in the morning or a sunny afternoon walk, can bring a sense of peace and fulfillment.

Contentment is not about settling for less or denying ourselves pleasure. It’s about recognizing the abundance that already exists in our lives. It’s about learning to find joy in the journey, not just the destination. When we can appreciate the present moment, embrace the beauty around us, and find gratitude for the good in our lives, we open ourselves up to a profound sense of contentment that is independent of external circumstances.

Finding contentment is a journey, not a destination. It takes practice, awareness, and a willingness to let go of the constant pursuit of more. But the rewards are well worth the effort. When we cultivate contentment, we create a foundation of peace and joy that can withstand the ups and downs of life.

Automate Your Savings

Saving money can be a challenging task, especially when you have other financial priorities. However, there are ways to make saving easier and more effective. One of the most effective strategies is to automate your savings. By setting up automatic transfers from your checking account to your savings account, you can ensure that you are consistently saving money without having to think about it.

Here are some benefits of automating your savings:

- Consistency: Automating your savings ensures that you are saving money regularly, regardless of how busy your life gets.

- Simplicity: Setting up automatic transfers is a one-time process, and you can forget about it after that.

- Goal-Oriented: You can set up automatic transfers to specific savings goals, such as a down payment on a house, a vacation, or retirement.

- Increased Savings: By automating your savings, you are less likely to spend the money before you can save it.

Here are some tips for automating your savings:

- Start Small: Begin by automating a small amount of money each month, and gradually increase the amount as you become more comfortable.

- Set a Schedule: Choose a specific day of the month or week to transfer money to your savings account.

- Use a Savings App: There are numerous apps available that can help you automate your savings. These apps often provide features such as round-up savings and goal-setting.

Automating your savings is a simple and effective way to build a strong financial future. By setting up automatic transfers, you can take the guesswork out of saving and ensure that you are consistently putting money aside for your financial goals.

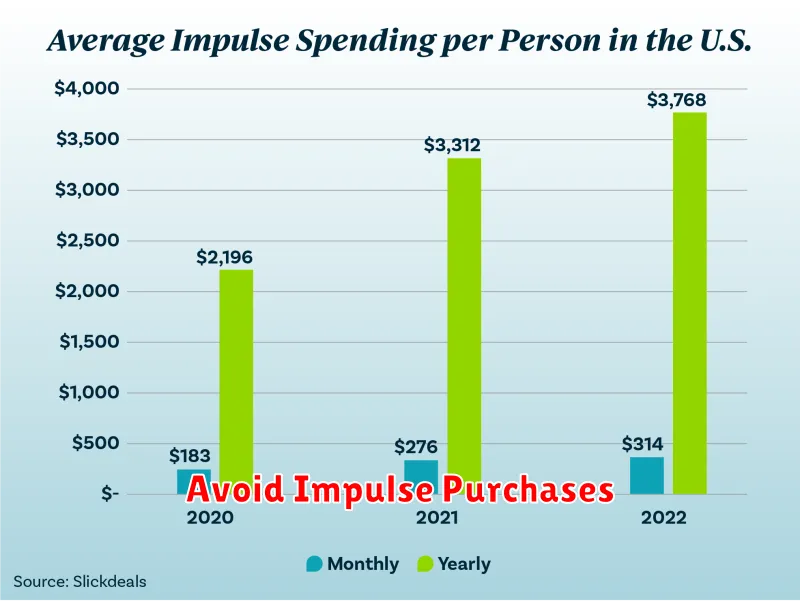

Avoid Impulse Purchases

Impulse purchases can be a major drain on your finances. They are unplanned and often unnecessary, and they can quickly add up over time. If you’re struggling to control your impulse buying, there are a few things you can do to help you avoid these unnecessary purchases.

Identify Your Triggers

The first step to avoiding impulse purchases is to identify your triggers. What situations or emotions cause you to spend money impulsively? It could be stress, boredom, or even just being in a particular store. Once you know what your triggers are, you can start to develop strategies for avoiding them.

Create a Budget and Stick to It

Creating a budget can help you stay on track with your spending. A budget will help you understand where your money is going and identify areas where you can cut back. It’s important to allocate a specific amount of money for each category of spending, such as groceries, gas, and entertainment, and stick to your budget as closely as possible.

Use the 24-Hour Rule

Before making a major purchase, use the 24-hour rule. If you see something you want, wait at least 24 hours before purchasing it. This will give you time to think about the purchase and decide if you really need it. This simple strategy can help you avoid many impulsive purchases.

Shop with a List

Shopping with a list can help you avoid buying things you don’t need. Make a list before you go to the store and stick to it. This way, you’ll be less likely to be tempted by impulse buys. It’s also important to leave your credit cards at home, as this will make it harder for you to make impulse purchases.

Unsubscribe From Marketing Emails

Marketing emails can often trigger impulse purchases. They are designed to make you want to buy things you don’t need. Unsubscribe from any marketing emails that you don’t need. This will help reduce the number of temptations you face.

Avoiding impulse purchases can be challenging, but it’s important to remember that you’re in control of your spending. By following these tips, you can avoid unnecessary purchases and save money in the long run.

Be Mindful of Your Social Circle

The people we surround ourselves with have a profound impact on our lives. They influence our thoughts, beliefs, and behaviors. This is why it’s essential to be mindful of our social circle and ensure that we’re surrounded by people who support, uplift, and inspire us.

A healthy social circle consists of individuals who are positive, supportive, and encouraging. They celebrate our successes, offer a listening ear during tough times, and challenge us to grow. They also respect our boundaries and values, creating a safe and nurturing environment.

On the other hand, toxic relationships can drain our energy and negatively impact our well-being. These relationships often involve individuals who are constantly critical, manipulative, or draining. They may make us feel insecure, anxious, or depressed.

It’s important to recognize the signs of a toxic relationship and take steps to protect ourselves. If you find yourself in a relationship that is causing you harm, it’s essential to set boundaries, limit contact, or even end the relationship altogether.

Building a healthy social circle requires effort and intention. It’s important to prioritize spending time with people who make us feel good and support our growth. We can also actively seek out new connections with like-minded individuals through shared interests, hobbies, or volunteer work.

Remember, the people we surround ourselves with have a significant influence on our lives. Be mindful of your social circle and cultivate relationships that nourish your soul and inspire you to be your best self.

Seek Support and Accountability

Building a successful business is a challenging journey that requires dedication, hard work, and a strong support system. It’s easy to get caught up in the day-to-day operations and lose sight of the bigger picture, which is why seeking support and accountability is crucial for your growth.

Having a network of people you can trust and rely on can provide invaluable insights, guidance, and encouragement. Here are some key ways to seek support and accountability in your entrepreneurial journey:

Mentors and Advisors

Mentors and advisors offer valuable experience and guidance based on their own successes and failures. They can provide objective feedback, help you navigate challenges, and keep you accountable to your goals.

Accountability Partners

An accountability partner is someone you regularly check in with to discuss your progress and hold each other accountable. This could be a fellow entrepreneur, a friend, or a business coach. Having a structured accountability system can keep you motivated and focused.

Networking Groups

Joining industry-specific networking groups provides access to a community of like-minded individuals who can offer support, share resources, and provide valuable connections. These groups can also serve as support networks during challenging times.

Business Coaches

Professional business coaches offer personalized guidance and support to help you achieve your business goals. They can help you identify your strengths and weaknesses, develop strategies, and overcome obstacles.

Seeking support and accountability is not a sign of weakness; it’s a sign of strength and a commitment to your success. By building a strong network of support and accountability partners, you can navigate the challenges of entrepreneurship with greater confidence and achieve your full potential.

Celebrate Milestones Responsibly

Life is full of milestones, from graduations and promotions to birthdays and anniversaries. These are moments worth celebrating, but it’s important to do so responsibly. While you want to have a good time and enjoy the occasion, it’s also crucial to prioritize safety and well-being for yourself and others.

Here are some tips for celebrating milestones responsibly:

Plan Ahead

One of the best ways to ensure a safe and enjoyable celebration is to plan ahead. This includes setting a budget, making reservations, and considering transportation arrangements. It also means thinking about the location and the activities you’ll be doing. If you’re planning an event that involves alcohol, it’s crucial to have a designated driver or use ride-sharing services.

Be Mindful of Your Limits

Whether it’s alcohol, food, or dancing, it’s essential to be mindful of your limits. Don’t feel pressured to keep up with others. Listen to your body and take breaks when you need them. If you’re drinking, pace yourself and stay hydrated.

Respect Others

Celebrating milestones is a time to connect with loved ones. Show respect for everyone attending, including those who may not be drinking or participating in certain activities. Be mindful of noise levels and the impact your celebration may have on the surrounding community.

Stay Safe

Safety should always be a top priority. This means avoiding risky behaviors, such as driving under the influence or engaging in illegal activities. It also means being aware of your surroundings and taking precautions to protect yourself and your belongings. If you’re celebrating outdoors, be aware of the weather and dress accordingly.

Enjoy the Moment

Ultimately, the goal of celebrating milestones is to create lasting memories. Take time to appreciate the occasion, connect with your loved ones, and make the most of the moment. By celebrating responsibly, you can ensure that your milestones are marked with joy, safety, and positive memories that will last a lifetime.