Are you tired of feeling like you’re throwing money away to the IRS every year? It’s a common frustration, but it doesn’t have to be this way. With a little proactive planning and understanding of the tax code, you can significantly reduce your tax liability and keep more of your hard-earned money. This year, take control of your finances and implement tax strategies that will help you save money on your tax bill.

This article will explore a variety of effective tax strategies you can implement to minimize your tax burden in 2023. Whether you’re a self-employed individual, a business owner, or a high-income earner, there are specific techniques tailored to your unique situation. We’ll cover everything from maximizing deductions to taking advantage of tax credits, so you can confidently navigate the tax landscape and keep more of your money in your pocket. Let’s dive into the world of tax optimization and discover how to make this year your most tax-efficient yet!

Understanding Your Tax Liability

Understanding your tax liability is crucial for individuals and businesses alike. It involves comprehending the taxes you owe to the government based on your income, deductions, and credits. By accurately calculating and fulfilling your tax obligations, you can avoid penalties and maintain financial stability.

Key Factors Influencing Tax Liability

Several factors determine your tax liability, including:

- Income: This encompasses various forms of earnings, such as wages, salaries, investments, and business profits.

- Deductions: These are expenses that can be subtracted from your income to reduce your taxable amount. Common examples include mortgage interest, charitable contributions, and medical expenses.

- Credits: Tax credits directly reduce the amount of taxes you owe. They often target specific situations, such as child tax credits or energy efficiency improvements.

- Tax Rate: The tax rate you pay depends on your income level. Progressive tax systems, like the US federal income tax, have higher rates for higher earners.

Calculating Tax Liability

Determining your tax liability typically involves the following steps:

- Gather Financial Documents: Collect all relevant income statements, receipts, and other documents that support your deductions and credits.

- Calculate Gross Income: Add up all your income sources to determine your total earnings before deductions.

- Subtract Deductions: Apply eligible deductions to reduce your taxable income.

- Apply Credits: Utilize available tax credits to further reduce your tax liability.

- Determine Tax Rate: Identify the appropriate tax rate based on your taxable income.

- Calculate Tax Liability: Multiply your taxable income by the applicable tax rate to determine your tax obligation.

Seeking Professional Guidance

Navigating the complexities of tax law can be challenging. If you find yourself unsure about your tax liability, it’s recommended to consult a qualified tax professional. They can provide personalized advice, ensure accurate calculations, and help you maximize your tax benefits.

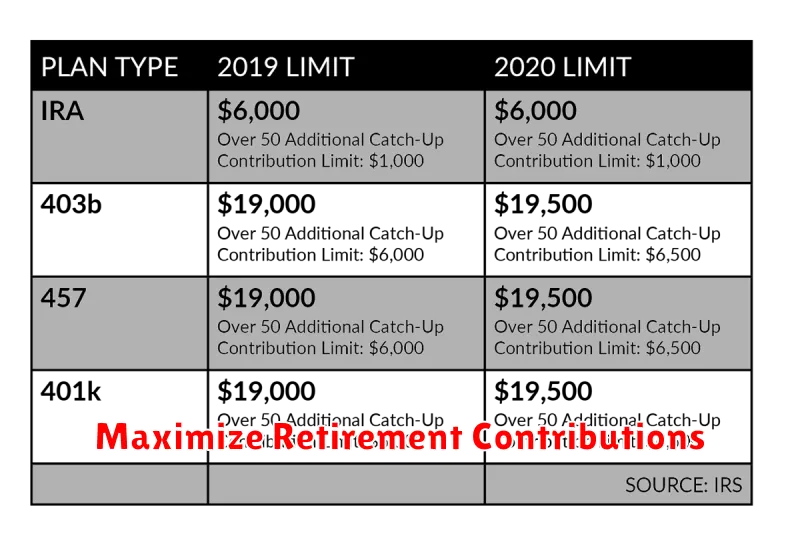

Maximize Retirement Contributions

Retirement planning is an essential aspect of financial well-being, and maximizing your contributions to retirement accounts is a crucial step towards securing your future. By taking advantage of the full potential of these accounts, you can significantly increase your savings and enjoy a comfortable retirement.

Benefits of Maximizing Retirement Contributions

Here are some compelling reasons to prioritize maximizing your retirement contributions:

- Tax Advantages: Many retirement accounts offer tax benefits, such as tax-deferred growth or tax-free withdrawals in retirement. By contributing the maximum amount, you can maximize these benefits and reduce your tax liability.

- Compounding Growth: The longer your investments have time to grow, the more significant the impact of compounding. Maximizing contributions allows your money to work harder for you over the years.

- Financial Security: By building a substantial retirement nest egg, you can reduce your reliance on social security and ensure a comfortable standard of living in your later years.

- Peace of Mind: Knowing you have saved enough for retirement can provide immense peace of mind and reduce financial stress.

Strategies for Maximizing Contributions

Here are some strategies to help you maximize your retirement contributions:

- Set a Budget: Create a detailed budget and identify areas where you can cut expenses to free up funds for retirement savings.

- Increase Contributions Gradually: Instead of making a drastic change, gradually increase your contributions over time. This allows you to adjust to the new spending pattern and avoid financial strain.

- Consider Employer Matching: If your employer offers a matching contribution, make sure you contribute enough to receive the full match. This is essentially free money you shouldn’t miss out on.

- Automate Contributions: Set up automatic contributions from your paycheck to your retirement accounts. This ensures that you are saving consistently without having to manually remember to make payments.

- Review Your Investments: Regularly review your investment portfolio and make necessary adjustments to ensure it aligns with your risk tolerance and retirement goals.

Conclusion

Maximizing retirement contributions is a smart financial decision that can significantly impact your future. By taking advantage of tax benefits, maximizing compounding growth, and building a substantial nest egg, you can secure a comfortable and fulfilling retirement.

Take Advantage of Tax Deductions

Tax season is right around the corner, and it’s a good time to start thinking about ways you can reduce your tax liability. One of the best ways to do this is to take advantage of tax deductions. Tax deductions are expenses that you can subtract from your taxable income, which can lower your overall tax bill.

There are many different types of tax deductions available, and the ones you qualify for will depend on your individual circumstances. Some common tax deductions include:

- Homeownership deductions: If you own a home, you may be able to deduct mortgage interest and property taxes.

- Medical expenses: You can deduct medical expenses that exceed a certain percentage of your adjusted gross income.

- Charitable contributions: You can deduct donations to qualified charities.

- State and local taxes: In some cases, you may be able to deduct state and local taxes, depending on your location and the specific deduction rules.

- Student loan interest: You can deduct up to $2,500 in interest paid on student loans.

To maximize your tax deductions, it’s important to keep good records of all your expenses throughout the year. You should also consult with a tax professional to ensure you’re taking advantage of all the deductions you’re eligible for. Here are some tips to help you maximize your deductions:

- Gather all your receipts and documentation: Keep all your receipts, invoices, and other documentation related to deductible expenses. This will help you ensure you’re claiming the correct deductions.

- Make sure you understand the rules: Familiarize yourself with the rules for each deduction you’re claiming. There are often specific requirements that must be met.

- Consult with a tax professional: If you’re unsure about which deductions you qualify for, it’s best to consult with a tax professional. They can help you identify all the potential deductions you may be eligible for and ensure you’re claiming them correctly.

Taking advantage of tax deductions can save you a significant amount of money on your taxes. By understanding the different types of deductions available and following these tips, you can maximize your deductions and minimize your tax liability.

Claim Tax Credits

Tax credits are a powerful tool to reduce your tax liability, and potentially even receive a refund from the government. There are many different types of tax credits available, so it’s important to understand which ones you may qualify for.

Here are some of the most common tax credits:

- Earned Income Tax Credit (EITC): This credit is available to low- and moderate-income working individuals and families. The amount of the credit depends on your income and family size.

- Child Tax Credit: This credit is available for each qualifying child under the age of 17. The amount of the credit is $2,000 per child.

- American Opportunity Tax Credit: This credit is available for the first four years of post-secondary education. The amount of the credit is up to $2,500 per student.

- Premium Tax Credit: This credit is available to individuals who purchase health insurance through the Affordable Care Act Marketplace. The amount of the credit depends on your income and family size.

How to claim tax credits:

You can claim tax credits by filing your federal income tax return. You will need to provide documentation to support your claim, such as your W-2 form or a Form 1098-T for education expenses. The best way to ensure you are claiming all eligible tax credits is to consult with a tax professional.

Benefits of claiming tax credits:

Claiming tax credits can help you save money on your taxes and potentially receive a refund from the government. This extra money can be used for many purposes, such as paying off debt, saving for the future, or simply having more disposable income. In addition, some tax credits, such as the EITC, can be used to increase your refund or reduce your tax liability even if you don’t owe any taxes.

Claiming tax credits is a valuable opportunity to reduce your tax burden and potentially receive a refund from the government. If you think you may qualify for any of the tax credits listed above, be sure to consult with a tax professional to ensure you’re taking advantage of all the benefits available to you.

Tax Loss Harvesting

Tax loss harvesting is a strategy used by investors to offset capital gains and reduce their overall tax liability. It involves selling losing investments and using the realized losses to offset capital gains. This can be done in several ways, including:

- Selling losing investments and immediately buying back similar investments. This is known as a “wash sale” and is generally not recommended.

- Selling losing investments and investing in different investments with similar risk profiles.

- Selling losing investments and holding the cash until a later date, when the market recovers.

Benefits of Tax Loss Harvesting

There are several benefits to tax loss harvesting, including:

- Reduced tax liability.

- Increased investment returns.

- Improved portfolio diversification.

Risks of Tax Loss Harvesting

There are also some risks associated with tax loss harvesting, including:

- Missing out on potential gains if the market rebounds quickly.

- Creating a tax liability in the future if the sold investment is repurchased.

- Incurring transaction costs.

Tips for Tax Loss Harvesting

Here are some tips for tax loss harvesting:

- Consult with a tax advisor.

- Don’t sell investments solely for tax purposes.

- Be mindful of wash sale rules.

- Consider your investment goals and time horizon.

Conclusion

Tax loss harvesting can be a valuable tool for investors looking to reduce their tax liability and improve their investment returns. However, it’s important to understand the risks and benefits before implementing this strategy.

Consider Tax-Advantaged Investments

Tax-advantaged investments offer the potential to grow your wealth while minimizing your tax burden. These investments allow you to shelter income and capital gains from taxation, potentially boosting your overall returns. Here are some popular tax-advantaged investment options:

Retirement Accounts

Retirement accounts, such as 401(k)s, IRAs, and 403(b)s, offer tax deferral on contributions and earnings. This means you won’t pay taxes on your contributions until you withdraw them in retirement. Some retirement accounts even offer tax-free withdrawals, depending on the type of account and your circumstances.

529 Plans

Designed for education savings, 529 plans allow you to save money for college tuition and expenses tax-free. Earnings grow tax-deferred, and withdrawals are tax-free if used for qualified educational expenses. These plans can be a powerful tool for saving for future education costs.

Health Savings Accounts (HSAs)

For those with a high-deductible health insurance plan, HSAs offer triple-tax advantages. Contributions are tax-deductible, earnings grow tax-deferred, and withdrawals for qualified medical expenses are tax-free. HSAs provide a valuable way to save for healthcare costs and potentially lower your overall tax burden.

Municipal Bonds

Interest earned from municipal bonds is typically exempt from federal income tax. These bonds are issued by state and local governments to fund infrastructure projects and other public initiatives. Municipal bonds can be attractive to investors seeking tax-free income.

Tax-Loss Harvesting

Although not a specific investment, tax-loss harvesting is a strategy that can help minimize your tax liability on investment losses. By selling losing investments and using the proceeds to buy similar investments, you can offset capital gains and potentially reduce your tax bill.

It’s crucial to consult with a financial advisor or tax professional before making any investment decisions. They can help you understand the specific tax implications of each investment and tailor your portfolio to your individual financial goals and tax situation. By taking advantage of tax-advantaged investments, you can potentially enhance your investment returns and achieve your financial objectives more effectively.

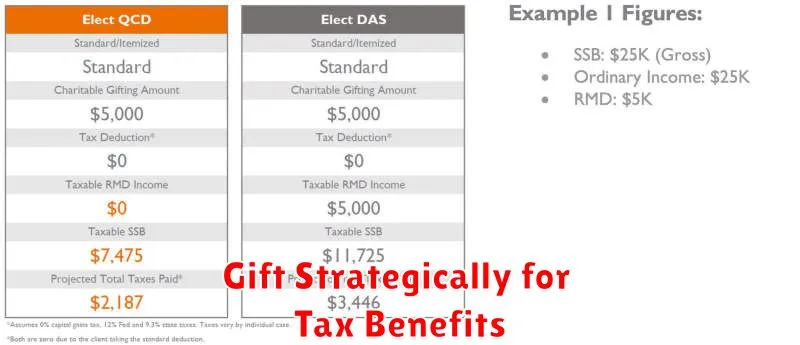

Gift Strategically for Tax Benefits

Gifting can be a rewarding experience, but it’s also important to consider the tax implications. By understanding the rules and strategies, you can maximize the benefits and minimize any potential tax burdens. This guide will help you navigate the complexities of gifting and make informed decisions.

Gift Tax Exclusion

The annual gift tax exclusion allows you to give away a certain amount of money each year without incurring any gift tax liability. For 2023, the exclusion is $17,000 per recipient. This means you can gift up to $17,000 to as many people as you want, without having to report the gift to the IRS.

Gift Tax Lifetime Exemption

In addition to the annual exclusion, there’s a lifetime exemption that protects you from paying gift tax on larger gifts. As of 2023, the lifetime exemption is $12.92 million per individual. This exemption is a cumulative amount, so you can use it over your lifetime for all gifts and transfers, including those exceeding the annual exclusion.

Gifting to Charities

Gifts to qualified charities are generally deductible for tax purposes. This means you can reduce your taxable income by the amount of your donation. The deductibility depends on the type of charity and the nature of the gift. Consult with a tax professional for specific advice on charitable deductions.

Gifting Strategies

Here are some strategies to consider when planning your gifts:

- Gift to a Trust: Establishing a trust can be a beneficial strategy for managing large gifts, particularly if you have complex family dynamics or want to protect assets from future legal issues.

- Gift Splitting: If you’re married, you can split a gift with your spouse to double the annual exclusion. This allows you to gift up to $34,000 per recipient, per year, without incurring gift tax liability.

- Gift Tax Returns: Even if you don’t owe gift tax, you may need to file a gift tax return. This is typically required if the total value of your gifts exceeds the annual exclusion limit.

Conclusion

Gifting can be a powerful tool for estate planning, wealth transfer, and supporting loved ones. By understanding the tax implications and implementing strategic planning, you can maximize the benefits of gifting while minimizing any potential tax burdens.

Hire a Tax Professional

Tax season can be a stressful time for many people. There are so many rules and regulations to keep track of, and it’s easy to make mistakes. If you’re not sure you can handle your taxes on your own, it’s best to hire a tax professional.

A tax professional can help you with a variety of tasks, including:

- Preparing your tax return

- Filing your tax return electronically

- Identifying deductions and credits you may be eligible for

- Answering questions about your taxes

- Representing you before the IRS

There are a few things to keep in mind when hiring a tax professional.

First, make sure they are licensed and qualified. You can check their credentials with the IRS or the state board of accountancy.

Second, get referrals from friends, family, or colleagues. You can also search online for tax professionals in your area.

Third, ask about their fees upfront. Some tax professionals charge a flat fee, while others charge an hourly rate.

Hiring a tax professional can save you time, money, and stress. If you’re not sure you can handle your taxes on your own, it’s worth considering hiring a professional.

Stay Informed About Tax Law Changes

Tax laws are constantly changing, and it’s important to stay up-to-date on the latest developments. This is especially true for businesses, as tax changes can have a significant impact on their bottom line.

One of the best ways to stay informed is to subscribe to a tax newsletter or blog. There are many reputable sources of tax information available online, and subscribing to a few of these can help you stay on top of the latest changes.

Another important step is to talk to a tax professional. A tax professional can help you understand the latest tax laws and how they might affect your business. They can also provide advice on how to minimize your tax liability.

Here are a few tips for staying informed about tax law changes:

- Subscribe to a tax newsletter or blog.

- Follow tax professionals on social media.

- Attend tax seminars or workshops.

- Talk to a tax professional.

By staying informed about tax law changes, you can help ensure that your business is compliant with the latest regulations and minimize your tax liability.