Are you looking for a way to build long-term wealth and secure your financial future? If so, you’ve come to the right place! Real estate investing is a proven strategy that has helped countless individuals achieve financial independence. It offers the potential for passive income, appreciation, and tax advantages, making it an attractive option for those seeking to grow their wealth. But where do you even begin?

This comprehensive guide will walk you through the fundamentals of real estate investing for wealth management. We’ll cover everything from identifying your investment goals and understanding different investment strategies to choosing the right properties and managing your portfolio. Whether you’re a seasoned investor or just starting out, this article will provide you with the knowledge and insights you need to confidently navigate the world of real estate investing.

Understanding the Basics of Real Estate Investing for Wealth Building

Real estate investing is a proven path to building wealth. It’s a tangible asset class that can provide consistent cash flow and long-term appreciation. However, understanding the basics of real estate investing is essential for success.

Types of Real Estate Investments

There are several types of real estate investments, each with its own risks and rewards. Some common types include:

- Residential Properties: These include single-family homes, townhouses, condos, and multi-family units. They are often popular for rental income and potential appreciation.

- Commercial Properties: These encompass office buildings, retail stores, and industrial spaces. They typically offer higher rental income but may require more expertise and capital.

- Land: Investing in undeveloped land can be a long-term play, potentially yielding significant returns as development occurs.

- Real Estate Investment Trusts (REITs): REITs are publicly traded companies that own and operate income-producing real estate. They offer investors a way to diversify their portfolio with real estate exposure.

Key Considerations

Before diving into real estate investing, consider these factors:

- Financial Situation: Assess your financial position, including your credit score, debt-to-income ratio, and available capital.

- Investment Goals: Determine your investment objectives, such as cash flow generation, appreciation, or tax benefits.

- Market Research: Thoroughly research the real estate market in your desired location, including trends, supply and demand, and potential risks.

- Investment Strategy: Develop a well-defined investment strategy, outlining your acquisition, management, and exit plan.

Benefits of Real Estate Investing

Real estate investing can offer numerous benefits, including:

- Passive Income: Rental properties can provide a steady stream of passive income.

- Appreciation: Real estate values tend to appreciate over time, potentially leading to capital gains.

- Tax Advantages: Certain real estate investments offer tax benefits such as depreciation deductions.

- Tangible Asset: Real estate is a tangible asset that can provide a sense of security and stability.

Risks to Consider

Real estate investing also comes with its share of risks:

- Market Volatility: Real estate values can fluctuate due to economic conditions and other factors.

- Property Management: Managing rental properties can be time-consuming and challenging.

- Vacancy Risk: There’s always the risk of having vacant units, leading to lost rental income.

- Liquidity Risk: Real estate can be less liquid than other investments, making it difficult to sell quickly.

Getting Started

If you’re ready to explore real estate investing, consider these steps:

- Educate Yourself: Learn about the different types of real estate investments, market analysis, and property management.

- Seek Professional Advice: Consult with a real estate agent, financial advisor, or attorney for guidance and support.

- Start Small: Begin with a smaller investment, such as a rental property, to gain experience before scaling up.

- Network and Build Relationships: Connect with other real estate investors, lenders, and property managers to learn from their experiences.

Real estate investing can be a rewarding and lucrative endeavor. By understanding the basics, managing risks, and developing a sound investment strategy, you can embark on a path towards building wealth and achieving your financial goals.

Different Ways to Invest in Real Estate: From Rental Properties to REITs

Real estate is a popular investment option for many people. It can offer a variety of benefits, such as passive income, tax advantages, and appreciation potential. But there are many different ways to invest in real estate.

One of the most common ways to invest in real estate is to purchase a rental property. This can be a single-family home, a multi-family building, or even a commercial property. Rental properties can provide a steady stream of passive income, and they can also appreciate in value over time. However, rental properties require significant time and effort to manage.

Another popular way to invest in real estate is through REITs (Real Estate Investment Trusts). REITs are companies that own and operate income-producing real estate. Investors can purchase shares of REITs on the stock market, just like they would purchase shares of any other publicly traded company. REITs offer a way to diversify your real estate investments and potentially earn passive income.

There are also a number of other ways to invest in real estate, such as:

- Fix and flip: This involves purchasing distressed properties, renovating them, and then selling them for a profit.

- Wholesale investing: This involves finding buyers and sellers of properties and then connecting them for a fee.

- Real estate crowdfunding: This involves investing in real estate projects through online platforms.

- Real estate notes: This involves lending money to borrowers who are purchasing real estate.

The best way to invest in real estate depends on your individual financial goals, risk tolerance, and time commitment. Be sure to do your research and consult with a financial advisor before making any investment decisions.

Assessing Your Financial Readiness for Real Estate Investment

Investing in real estate can be a lucrative venture, but it’s crucial to ensure you’re financially prepared before taking the plunge. A thorough assessment of your financial situation is essential to determine if you’re ready to handle the responsibilities and potential risks associated with real estate investment. This article will guide you through key factors to consider and steps to take before embarking on your real estate investment journey.

1. Evaluate Your Credit Score

Your credit score is a significant factor in securing financing for a real estate investment. Lenders use this score to assess your creditworthiness and determine the interest rate you qualify for. A higher credit score typically translates to lower interest rates, which can save you substantial money over the life of your loan. Before making any investment decisions, ensure you understand your credit score and take steps to improve it if necessary.

2. Analyze Your Savings and Income

Real estate investment involves various upfront and ongoing expenses, including the down payment, closing costs, property taxes, insurance, and potential repairs. Carefully evaluate your savings and income to determine if you can comfortably manage these expenses without jeopardizing your financial stability. It’s recommended to have a substantial emergency fund to cover unexpected costs and prevent financial strain.

3. Calculate Your Debt-to-Income Ratio (DTI)

Your debt-to-income ratio (DTI) represents the percentage of your monthly income allocated to debt payments. Lenders typically have DTI limits for loan approval, and a lower DTI generally indicates a stronger financial position. Calculate your DTI by dividing your total monthly debt payments by your gross monthly income. A lower DTI will improve your chances of getting approved for a mortgage and securing favorable terms.

4. Assess Your Investment Goals and Time Horizon

Define your investment goals clearly. Are you seeking long-term passive income, capital appreciation, or a combination of both? Establish a realistic time horizon for your investment. Real estate investments can take time to generate returns, and short-term fluctuations in the market are inevitable. Understanding your investment goals and timeframe will guide your investment strategy and help you stay focused on your objectives.

5. Consider Potential Risks and Challenges

Real estate investment is not without risks. Property values can fluctuate, unexpected repairs can arise, and tenants may pose challenges. It’s essential to be aware of these potential risks and have strategies in place to mitigate them. Conduct thorough due diligence on properties before making an investment, consider purchasing property insurance, and familiarize yourself with local landlord-tenant laws.

By meticulously assessing your financial readiness, you can increase your chances of success in real estate investment. Remember, a solid financial foundation is the cornerstone of any investment strategy.

Setting Realistic Investment Goals and Strategies

Investing can be a daunting task, especially for beginners. With so many options available, it’s easy to feel overwhelmed and unsure where to start. However, the key to successful investing lies in setting realistic goals and developing a well-defined strategy.

Define Your Investment Goals

Before you begin investing, it’s crucial to determine your financial objectives. What do you hope to achieve through investing? Are you saving for retirement, a down payment on a house, or a child’s education? Clearly defining your goals will help you choose the right investments and stay focused on your path.

Consider Your Time Horizon

Your time horizon is the period over which you plan to invest. A longer time horizon allows for greater risk tolerance, as you have more time to recover from potential market fluctuations. For short-term goals, such as saving for a down payment, a more conservative investment approach is generally recommended.

Assess Your Risk Tolerance

Everyone has a different level of comfort with risk. Risk tolerance refers to your willingness to accept potential losses in exchange for the possibility of higher returns. It’s important to honestly assess your own risk tolerance and select investments that align with your comfort level.

Develop a Diversified Portfolio

Diversification is a key principle of investing. It involves spreading your investments across different asset classes, such as stocks, bonds, real estate, and commodities. This helps reduce risk by mitigating the impact of any single investment’s performance on your overall portfolio.

Stay Informed and Monitor Your Investments

The investment landscape is constantly changing, so it’s essential to stay informed about market trends and economic conditions. Regularly monitor your portfolio and make adjustments as needed to ensure your investments are still aligned with your goals and risk tolerance.

Seek Professional Advice

If you’re unsure about how to approach investing, don’t hesitate to seek advice from a qualified financial advisor. A financial advisor can help you create a personalized investment plan that meets your specific needs and objectives.

Conclusion

Setting realistic investment goals and developing a sound strategy are essential for achieving financial success. By defining your goals, considering your time horizon, assessing your risk tolerance, and diversifying your portfolio, you can navigate the world of investing with confidence.

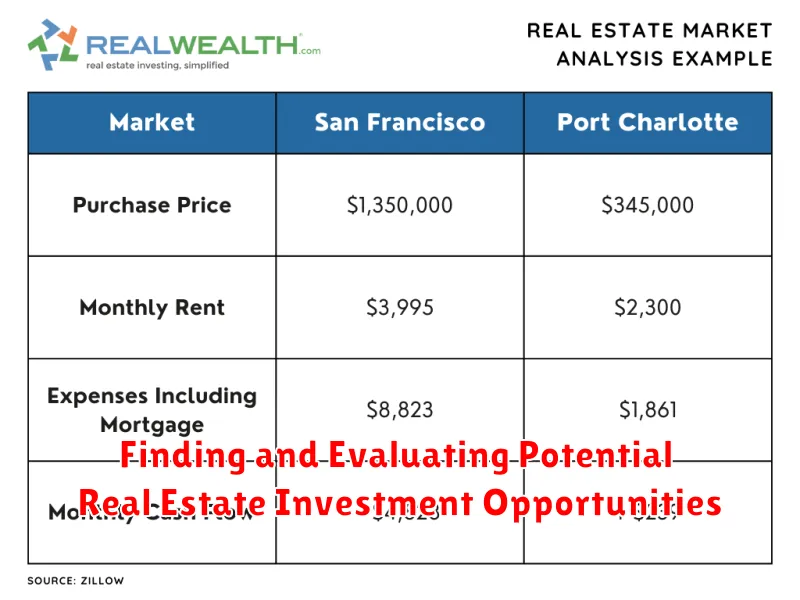

Finding and Evaluating Potential Real Estate Investment Opportunities

Real estate investing can be a lucrative way to build wealth, but it requires careful planning and execution. Finding and evaluating potential opportunities is crucial for maximizing returns and mitigating risks. This article will guide you through the process of identifying promising real estate investments.

1. Defining Your Investment Goals and Criteria

Before embarking on your search, it’s essential to establish clear investment objectives. Consider factors such as:

- Investment horizon: How long do you plan to hold the property?

- Risk tolerance: How comfortable are you with market fluctuations and potential losses?

- Return expectations: What annual return are you aiming for?

- Property type: Are you interested in residential, commercial, or industrial properties?

- Location preferences: Where do you want to invest?

- Budget: How much capital do you have available?

2. Exploring Potential Investment Opportunities

Once you have a clear understanding of your investment goals, you can start exploring potential opportunities. Some common sources include:

- Real estate agents: Connect with reputable agents who specialize in investment properties.

- Online real estate platforms: Websites like Zillow, Realtor.com, and Redfin offer extensive listings and market data.

- Foreclosure auctions: These can provide opportunities to acquire properties at discounted prices.

- Networking: Attend real estate events and connect with investors to learn about potential deals.

- Direct marketing: Look for properties advertised in local newspapers, flyers, and online classifieds.

3. Conducting Thorough Due Diligence

Once you’ve identified a few potential investment properties, it’s crucial to conduct thorough due diligence to assess their viability. This involves:

- Property inspection: Hire a qualified inspector to evaluate the property’s condition and identify any potential issues.

- Market analysis: Research the local real estate market to determine demand, vacancy rates, and rental income potential.

- Financial analysis: Calculate the property’s estimated cash flow, return on investment (ROI), and potential appreciation.

- Legal review: Consult with a real estate attorney to review the property’s title, deed, and any relevant contracts.

- Environmental assessment: Determine if any environmental hazards or regulations could impact the property’s value.

4. Evaluating the Investment

After conducting due diligence, you can assess the investment’s overall attractiveness. Consider factors such as:

- Risk-reward profile: Is the potential return commensurate with the level of risk?

- Financial viability: Can the property generate positive cash flow and achieve your investment goals?

- Market potential: Is the property located in a growing area with strong demand?

- Exit strategy: How do you plan to sell or refinance the property in the future?

5. Making an Informed Decision

Based on your evaluation, you can decide whether to proceed with the investment. If you decide to move forward, negotiate the purchase price and terms carefully. Ensure that you have a clear understanding of all the risks and rewards involved.

Real estate investing can be a rewarding endeavor, but it requires careful planning and execution. By following these steps, you can increase your chances of finding and evaluating profitable investment opportunities.

Financing Your Real Estate Investments: Mortgages and Other Options

Investing in real estate can be a lucrative venture, but it often requires significant capital. Securing financing is a crucial step in your real estate journey, enabling you to acquire properties and leverage the power of debt to build wealth. While mortgages are the most common financing option, there are other avenues to explore, each with its own advantages and disadvantages. This article delves into the world of real estate financing, exploring mortgages and alternative options to help you make informed decisions.

Mortgages: The Traditional Route

Mortgages are the most familiar and readily available form of real estate financing. They allow borrowers to purchase a property with a down payment and pay off the remaining amount over a fixed period, typically 15 to 30 years. Mortgages come in various types, including:

- Conventional Mortgages: Offered by private lenders and typically require a down payment of 20% or more. These loans are often favored for their competitive interest rates and flexibility.

- FHA Mortgages: Backed by the Federal Housing Administration, FHA loans offer lower down payment requirements and more lenient credit standards, making them appealing to first-time homebuyers or borrowers with less-than-perfect credit.

- VA Mortgages: Exclusively available to eligible veterans, active-duty military personnel, and surviving spouses, VA loans offer no down payment requirement and competitive interest rates.

- USDA Mortgages: Designed to promote homeownership in rural areas, USDA loans offer financing for properties located in eligible rural areas.

Alternative Financing Options

Beyond traditional mortgages, a range of alternative financing options can cater to specific needs and investment strategies:

- Private Loans: These loans are provided by individuals or institutions not affiliated with traditional banks. Private loans can offer faster approvals and more flexibility, but they often come with higher interest rates and require strong creditworthiness.

- Hard Money Loans: These loans are secured by the property being purchased and are typically offered by private lenders specializing in short-term financing. Hard money loans are often used for fix-and-flip projects or when traditional financing is unavailable.

- Seller Financing: In this scenario, the seller of the property provides financing to the buyer. Seller financing can be advantageous for both parties, allowing the buyer to secure a loan with potentially lower interest rates and the seller to receive a consistent income stream.

- Crowdfunding: Leveraging online platforms, crowdfunding allows investors to pool funds to finance real estate projects. This approach can provide access to capital for large-scale projects and diversify investment portfolios.

Factors to Consider

Choosing the right financing option depends on your individual circumstances, investment goals, and risk tolerance. Here are some key factors to consider:

- Credit Score: A higher credit score typically qualifies you for better interest rates and loan terms.

- Down Payment: The amount of money you can put down will influence the type of financing options available and the overall loan amount.

- Interest Rate: The interest rate determines the cost of borrowing money, so it’s crucial to compare rates and find the most favorable terms.

- Loan Term: Longer loan terms generally result in lower monthly payments but accrue more interest over time.

- Closing Costs: Additional expenses associated with securing a loan, such as appraisal fees, title insurance, and origination fees, need to be factored into your budget.

Conclusion

Financing is a critical component of real estate investing. Understanding the different options available, including mortgages and alternative financing methods, empowers you to make informed decisions and navigate the financial complexities of acquiring properties. Carefully evaluate your financial situation, investment goals, and risk tolerance to select the financing solution that aligns with your unique needs and propels you toward success in your real estate journey.

The Importance of Due Diligence: Inspections and Property Assessments

When purchasing a property, it’s crucial to conduct thorough due diligence to ensure you’re making an informed and sound investment. This process involves several steps, including inspections and property assessments, which play a vital role in uncovering potential issues and evaluating the property’s true value.

Why are Inspections and Assessments Important?

Imagine buying a property only to discover major structural defects or hidden environmental concerns after closing the deal. This could result in costly repairs, legal disputes, or even the need to sell the property at a loss. Inspections and assessments help you avoid such scenarios by providing a comprehensive understanding of the property’s condition and any potential risks.

Types of Inspections

Several types of inspections are commonly performed during the due diligence process:

- Home Inspection: A comprehensive evaluation of the property’s structure, systems (heating, electrical, plumbing), and appliances, identifying potential issues and recommending necessary repairs.

- Pest Inspection: Detects the presence of termites, rodents, or other pests that could damage the property.

- Well and Septic Inspections: For properties with private water and sewage systems, these inspections assess their functionality and compliance with local regulations.

- Environmental Inspection: Identifies any potential environmental hazards like asbestos, lead paint, or radon, which can significantly impact the property’s value and safety.

Property Assessments

Property assessments provide insights into the property’s financial value:

- Appraisal: An impartial evaluation of the property’s market value based on factors like location, size, condition, and recent sales in the area.

- Property Tax Assessment: Determines the property’s value for taxation purposes, which influences the amount of property taxes you’ll pay.

Benefits of Due Diligence

Conducting thorough due diligence offers numerous benefits:

- Informed Decision-Making: The information gathered from inspections and assessments empowers you to make a well-informed decision about the property purchase.

- Negotiating Power: Armed with inspection reports and assessments, you can leverage this information to negotiate a lower purchase price or request the seller to address identified issues.

- Peace of Mind: Knowing the property’s condition and potential risks allows you to purchase with peace of mind, knowing you’ve taken all necessary steps to protect your investment.

Conclusion

Due diligence, including inspections and property assessments, is an essential step in the property purchase process. By investing time and effort into this process, you can ensure that you’re making a sound financial decision and avoiding potential pitfalls. Remember, a thorough due diligence process is your best defense against unexpected surprises and costly repairs down the road.

Managing Your Real Estate Investments: Tenants, Maintenance, and More

Owning real estate can be a rewarding investment, but it also comes with responsibilities. Managing your properties effectively is crucial for maximizing your returns and minimizing headaches. This article will provide you with essential insights into managing tenants, handling maintenance, and other vital aspects of real estate investment.

Tenant Management

Finding reliable tenants is the cornerstone of successful real estate investing. Here are some key strategies:

- Thorough Screening: Conduct comprehensive background checks, including credit history, criminal records, and rental history.

- Clear Lease Agreements: Establish detailed lease agreements outlining responsibilities, rent payments, and termination clauses.

- Effective Communication: Maintain open and respectful communication with tenants to address concerns promptly and build positive relationships.

- Regular Inspections: Perform routine inspections to ensure property maintenance and identify potential issues.

- Legal Compliance: Stay informed about local landlord-tenant laws and regulations to avoid legal complications.

Maintenance and Repairs

Maintaining your properties is essential for tenant satisfaction and preserving your investment. Consider these practices:

- Preventative Maintenance: Regularly inspect and address minor issues before they escalate into major problems.

- Emergency Response: Establish a system for handling emergency repairs promptly and efficiently.

- Budgeting: Set aside funds for routine maintenance and unexpected repairs.

- Reliable Contractors: Build a network of trusted contractors for various maintenance needs.

- Tenant Responsibilities: Clearly define tenant responsibilities for minor maintenance tasks in the lease agreement.

Financial Management

Managing the finances of your real estate investments is crucial for profitability.

- Accurate Budgeting: Create a detailed budget encompassing expenses such as mortgage payments, taxes, insurance, maintenance, and vacancies.

- Income Tracking: Maintain records of rental income and other revenue streams.

- Tax Optimization: Seek professional advice to maximize tax benefits and deductions associated with real estate ownership.

- Investment Goals: Define your investment goals and track your progress towards achieving them.

Technology and Tools

Technology can significantly enhance real estate management efficiency.

- Property Management Software: Utilize software platforms for tenant communication, rent collection, maintenance tracking, and financial reporting.

- Online Payment Options: Offer convenient online payment options to streamline rent collection.

- Digital Marketing: Utilize digital marketing channels to reach potential tenants and promote your properties.

Managing real estate investments effectively requires a combination of organization, communication, and financial discipline. By implementing these strategies and embracing technology, you can enhance your returns, minimize risks, and build a successful real estate portfolio.

Building a Profitable Real Estate Portfolio Over Time

Building a profitable real estate portfolio can be a rewarding and lucrative endeavor, but it requires careful planning, strategic investments, and a long-term perspective. This guide will outline the key steps and considerations involved in creating a thriving real estate portfolio over time.

1. Define Your Investment Goals and Strategy

Before embarking on your real estate journey, it’s crucial to define your investment goals and develop a clear strategy. Consider factors such as:

- Investment horizon: How long do you plan to hold your properties?

- Risk tolerance: What level of risk are you comfortable with?

- Financial resources: How much capital do you have available for investment?

- Desired return on investment: What kind of financial returns are you aiming for?

- Property types: What types of properties are you interested in, such as single-family homes, multi-family units, or commercial properties?

Once you have a solid understanding of your goals and strategy, you can start identifying investment opportunities that align with your vision.

2. Conduct Thorough Market Research

Thorough market research is essential for making informed investment decisions. Analyze factors such as:

- Local real estate trends: Are property values increasing, decreasing, or stabilizing?

- Rental market demand: Is there a strong demand for rental properties in the area?

- Economic conditions: How is the local economy performing, and how might that impact the real estate market?

- Infrastructure and amenities: Are there any upcoming developments or improvements that could enhance property values?

Understanding the local market will help you identify areas with potential for growth and minimize investment risks.

3. Secure Financing and Funding

To acquire properties, you’ll need access to financing. Explore various financing options, such as:

- Mortgages: Traditional mortgages are a common financing source for residential properties.

- Private loans: You can also obtain loans from private lenders, often with higher interest rates.

- Hard money loans: These are short-term loans secured by real estate, typically used for quick renovations or flips.

Choose a financing option that aligns with your financial situation and investment strategy.

4. Property Selection and Due Diligence

When selecting properties, prioritize those with strong fundamentals, such as:

- Location: Choose properties in desirable neighborhoods with high rental demand.

- Condition: Assess the condition of the property and factor in potential renovation costs.

- Potential for appreciation: Consider factors that could drive future property value appreciation.

Conduct thorough due diligence, including inspections, appraisals, and reviewing legal documents, to ensure the property meets your standards and is free of any hidden issues.

5. Property Management and Maintenance

Efficient property management is crucial for maximizing returns. Consider options such as:

- Self-management: If you have the time and expertise, you can manage your properties yourself.

- Professional property managers: Hiring a property manager can save you time and effort, but it comes with added costs.

Regular maintenance and repairs are essential for preserving property value and preventing costly issues.

6. Tax Optimization and Legal Compliance

Stay informed about real estate tax laws and regulations to optimize your tax benefits and ensure legal compliance. Consider strategies such as:

- Depreciation: Depreciating your properties can reduce your tax liability.

- Tax-advantaged investments: Explore tax-advantaged investment options, such as 1031 exchanges.

7. Diversification and Risk Management

Diversify your real estate portfolio by investing in different property types and locations. This helps mitigate risk and create a more balanced investment strategy. Implement risk management strategies, such as:

- Insurance: Obtain comprehensive insurance coverage for your properties.

- Contingency funds: Set aside funds to cover unexpected expenses and potential losses.

8. Continuous Learning and Refinement

The real estate market is constantly evolving, so continuous learning and refinement are crucial. Stay updated on market trends, emerging technologies, and best practices to maintain a competitive edge.

Building a profitable real estate portfolio takes time, effort, and a commitment to learning and adaptation. By following these key steps and principles, you can lay the foundation for long-term success in the real estate investment arena.