Retirement is a time to enjoy the fruits of your labor, but it’s also a time to carefully manage your finances. You’ve worked hard to save for your golden years, and now you need to make sure those savings last. A sustainable withdrawal strategy is essential for ensuring that you have enough money to cover your living expenses and maintain your lifestyle throughout retirement. In this article, we’ll discuss how to create a sustainable withdrawal strategy that will help you make your retirement savings last a lifetime.

Creating a sustainable withdrawal strategy is not a one-size-fits-all process. It involves careful consideration of your individual circumstances, including your age, health, expenses, and risk tolerance. You’ll also need to factor in potential market volatility and inflation. By understanding these key elements, you can create a withdrawal strategy that will help you achieve your retirement goals.

The Importance of a Well-Defined Retirement Withdrawal Strategy

Retirement is a significant milestone in life, marking the end of a long career and the beginning of a new chapter. It’s a time to enjoy the fruits of your labor, pursue passions, and travel the world. However, achieving a fulfilling retirement requires careful planning and a well-defined withdrawal strategy.

A retirement withdrawal strategy outlines how you plan to access and utilize your savings throughout retirement. It’s crucial for several reasons:

1. Ensuring Longevity of Your Funds:

Retirement is a long journey, and it’s impossible to predict how long you’ll live. A well-defined withdrawal strategy ensures that your savings will last throughout your retirement years, preventing you from running out of money before you’ve had a chance to enjoy it.

2. Avoiding Unnecessary Risk:

Many retirees, eager to stretch their savings, take on excessive risk in their investments. A well-designed withdrawal strategy helps you understand your risk tolerance and ensures that your investments align with your financial goals and time horizon. This reduces the chances of experiencing significant losses that could jeopardize your retirement security.

3. Maintaining a Consistent Lifestyle:

Retirement should be a time to enjoy life without financial stress. A withdrawal strategy helps you determine how much you can spend each year while maintaining a comfortable standard of living. It can also guide your spending habits, ensuring you don’t overspend and compromise your future financial security.

4. Addressing Potential Financial Needs:

Life is unpredictable, and unforeseen expenses may arise during retirement. A well-defined withdrawal strategy can account for potential financial needs, such as healthcare costs, long-term care, or unexpected repairs. By incorporating these factors into your plan, you can ensure that you have the financial resources to address these challenges without jeopardizing your retirement savings.

5. Achieving Financial Peace of Mind:

Having a clear plan for your retirement withdrawal gives you peace of mind. Knowing how much you can spend, how to manage your investments, and how to address potential financial needs eliminates anxiety and allows you to focus on enjoying your retirement years.

A well-defined retirement withdrawal strategy is essential for a successful and fulfilling retirement. By carefully considering your financial goals, risk tolerance, and potential needs, you can create a plan that ensures your savings will last throughout your retirement years and provide you with the financial security and peace of mind you deserve.

Calculating Your Retirement Income Needs and Expenses

Retirement is a significant life milestone that requires careful planning and preparation. One of the most crucial aspects of retirement planning is determining your income needs and expenses. By accurately calculating these figures, you can ensure that you have enough financial resources to maintain your desired lifestyle during your golden years.

1. Estimate Your Retirement Expenses

Start by considering your current expenses and how they may change in retirement. Some expenses, such as housing and healthcare, may increase, while others, such as commuting and child-related expenses, may decrease. It’s essential to account for both fixed and variable expenses.

- Housing: Consider mortgage payments, rent, property taxes, insurance, utilities, and maintenance.

- Healthcare: Factor in health insurance premiums, deductibles, co-pays, and potential long-term care expenses.

- Food: Estimate your grocery and dining expenses, considering potential changes in eating habits.

- Transportation: Account for car payments, gas, insurance, public transportation, and potential travel expenses.

- Entertainment: Budget for hobbies, leisure activities, and social engagements.

- Other: Include miscellaneous expenses like personal care, clothing, gifts, and charitable donations.

2. Account for Inflation

Inflation can significantly erode the purchasing power of your savings over time. Use an inflation calculator to project how your expenses will increase in the future. A typical inflation rate of 3% can have a substantial impact on your retirement income needs.

3. Factor in Your Lifestyle Preferences

Your retirement lifestyle will significantly influence your income requirements. If you plan to travel extensively or engage in expensive hobbies, you’ll need a higher income than someone who prefers a more modest lifestyle.

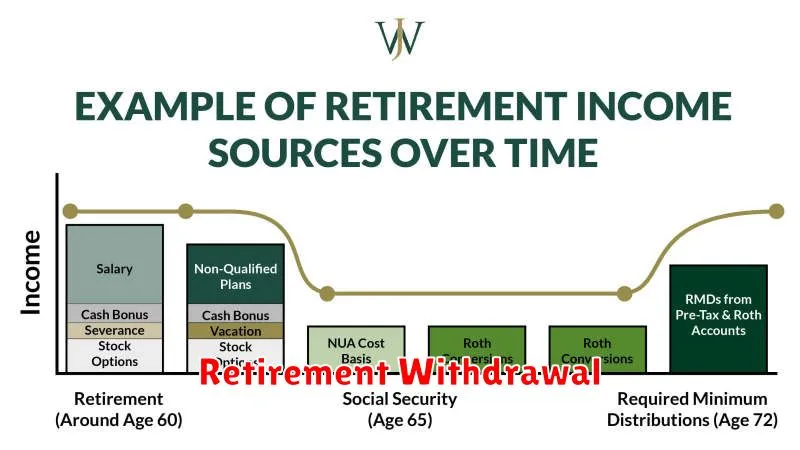

4. Consider Your Income Sources

Estimate your retirement income from various sources, including:

- Social Security: Check your estimated Social Security benefits using the Social Security Administration’s website.

- Pensions: If you have a pension plan, determine your estimated monthly payments.

- Retirement Savings: Project your withdrawals from 401(k)s, IRAs, and other retirement accounts based on your investment growth and withdrawal strategy.

- Part-time Work: Consider any potential income from part-time employment or entrepreneurial ventures.

5. Assess Your Financial Needs

Compare your projected retirement expenses to your estimated income sources. If your expenses exceed your income, you may need to adjust your spending habits, increase your savings, or delay retirement.

6. Seek Professional Advice

Consulting with a financial advisor can provide valuable insights and guidance on retirement planning. They can help you develop a personalized strategy based on your individual circumstances and goals.

Conclusion

Calculating your retirement income needs and expenses is crucial for achieving financial security during your golden years. By carefully considering your expenses, accounting for inflation, and factoring in your lifestyle preferences, you can create a comprehensive retirement plan that meets your financial needs and allows you to enjoy a fulfilling retirement.

Factors Affecting Withdrawal Rate Sustainability: Inflation, Market Volatility, and Longevity

The sustainability of a retirement withdrawal rate is influenced by various factors, particularly inflation, market volatility, and longevity. These factors can significantly impact the longevity of retirement savings, requiring careful consideration and planning to ensure financial security throughout retirement.

Inflation

Inflation erodes the purchasing power of money over time. As prices rise, retirees need more money to maintain their desired standard of living. A high inflation rate can quickly deplete retirement savings, making it challenging to sustain the desired withdrawal rate.

Market Volatility

Market volatility refers to the fluctuations in investment returns. During periods of market downturns, retirement portfolios can experience significant losses, potentially jeopardizing the sustainability of withdrawal rates. It’s crucial to plan for potential market volatility and consider strategies to mitigate its impact.

Longevity

Longevity, or the increasing life expectancy, plays a significant role in retirement planning. As individuals live longer, their retirement savings need to last longer as well. This necessitates a more conservative withdrawal rate to ensure sufficient funds for the extended retirement period.

Managing Withdrawal Rate Sustainability

To manage withdrawal rate sustainability, retirees can consider various strategies, such as:

- Adjusting the withdrawal rate: This involves decreasing the withdrawal amount during periods of high inflation or market volatility.

- Investing in a diversified portfolio: A diversified portfolio can help mitigate the impact of market fluctuations, potentially reducing the risk of depleting savings.

- Generating income streams: Retirees can explore generating additional income streams, such as part-time work or rental income, to supplement their retirement income.

- Periodically reassessing the plan: It’s essential to regularly review retirement plans, considering factors such as inflation, market performance, and life expectancy.

By understanding the factors influencing withdrawal rate sustainability and implementing appropriate strategies, retirees can enhance their chances of achieving a financially secure retirement.

Common Retirement Withdrawal Strategies: 4% Rule, Bucket Strategy, and More

Retirement is a significant milestone in life, and having a well-defined withdrawal strategy is crucial for ensuring financial security and peace of mind. There are various strategies available, each with its pros and cons. Here’s a look at some of the most common retirement withdrawal strategies.

The 4% Rule

The 4% rule is a widely recognized strategy that suggests withdrawing 4% of your retirement savings in the first year and adjusting it annually for inflation. This rule assumes a 7% average annual return on your investments, which is based on historical market performance. The 4% rule aims to ensure your savings last for at least 30 years, giving you a high probability of not running out of money.

The Bucket Strategy

The bucket strategy divides your retirement savings into different buckets, each with a specific time horizon and risk tolerance. For instance, you might allocate a “short-term bucket” for immediate needs and a “long-term bucket” for investments with higher growth potential. This approach allows you to manage your retirement funds strategically based on your spending needs and risk preferences.

The Guaranteed Income Strategy

The guaranteed income strategy focuses on securing a steady stream of income during retirement. This can involve using annuities, which provide regular payments for a specified period, or purchasing an immediate annuity, which guarantees lifetime income. This strategy is particularly attractive to those who want to minimize the risk of outliving their savings.

The Reverse Mortgage Strategy

A reverse mortgage can be a valuable option for homeowners who need additional income in retirement. This type of loan allows you to borrow against the equity in your home, receiving regular payments without having to make monthly mortgage payments. However, it’s crucial to understand the potential risks and costs associated with reverse mortgages.

Factors to Consider When Choosing a Withdrawal Strategy

When selecting a retirement withdrawal strategy, it’s essential to consider factors such as:

- Your age and life expectancy

- Your retirement savings balance and income

- Your investment portfolio and risk tolerance

- Your spending habits and future goals

- Your health and potential health care costs

Consulting a Financial Advisor

It’s highly recommended to consult with a qualified financial advisor to develop a personalized retirement withdrawal strategy. They can help you evaluate your financial situation, assess your retirement goals, and choose the most appropriate approach for your unique circumstances.

Remember, retirement is a journey, not a destination. A well-defined withdrawal strategy can provide you with the confidence and flexibility to navigate your golden years with peace of mind.

Determining a Safe Withdrawal Rate Based on Your Circumstances

A safe withdrawal rate (SWR) is the percentage of your retirement portfolio you can withdraw annually without risking running out of money before you die. There is no one-size-fits-all SWR, as it depends on several factors, including your age, life expectancy, investment portfolio, and spending habits.

Factors to Consider

- Age and Life Expectancy: Younger retirees have more time to recover from market downturns, so they can typically withdraw more than older retirees. Life expectancy also plays a role; the longer you expect to live, the lower your SWR should be.

- Investment Portfolio: Your portfolio’s asset allocation, including stocks, bonds, and real estate, affects its potential growth and volatility. A portfolio with a higher proportion of stocks may generate higher returns but also carries more risk.

- Spending Habits: Your desired lifestyle and spending habits will determine how much you need to withdraw annually. A more conservative lifestyle allows for a lower SWR.

- Inflation: Inflation erodes the purchasing power of your money over time. You need to consider inflation when calculating your SWR to ensure your withdrawals maintain their value.

- Unexpected Expenses: Unexpected medical expenses, home repairs, or family emergencies can significantly impact your retirement savings. Building a buffer into your SWR can help you manage these unexpected costs.

Calculating Your Safe Withdrawal Rate

There are various methods for calculating your SWR. Some popular methods include:

- The 4% Rule: This rule suggests that you can safely withdraw 4% of your retirement portfolio annually, adjusted for inflation. It’s a popular starting point but may not be suitable for everyone, particularly those with shorter time horizons or higher spending needs.

- The Trinity Study: This study analyzed historical market data to determine safe withdrawal rates for different time horizons. It found that a SWR of 4% over 30 years has a high probability of success, but this can vary depending on the specific time period studied.

- Personalized SWR Calculators: Several online calculators allow you to input your personal circumstances, such as age, life expectancy, portfolio allocation, and spending habits, to estimate a personalized SWR.

Important Considerations

When determining your SWR, it’s essential to consider the following:

- Be Conservative: Starting with a conservative SWR provides a safety margin and allows for adjustments as needed.

- Review Regularly: Your circumstances and market conditions can change over time, so it’s crucial to review your SWR periodically and make adjustments if necessary.

- Consider Other Sources of Income: Social Security, pensions, and part-time work can supplement your retirement income, allowing for a higher SWR.

- Don’t Forget Taxes: Taxes can significantly impact your retirement income. Factor in taxes when calculating your SWR.

- Seek Professional Advice: A financial advisor can help you create a personalized financial plan that includes a realistic and sustainable SWR.

Determining your SWR is a critical step in planning for a secure and comfortable retirement. By carefully considering your individual circumstances and using reliable methods for calculating your SWR, you can increase your chances of achieving your retirement goals and enjoying a fulfilling retirement.

Managing Investment Risk During Retirement: Asset Allocation and Diversification

Retirement is a significant life stage, and managing investments during this period requires a strategic approach to minimize risk and ensure financial security. One of the key aspects of managing investment risk is asset allocation, which involves distributing your investment portfolio among different asset classes, such as stocks, bonds, real estate, and cash. Diversification is another important strategy to mitigate risk, spreading your investments across a range of assets to reduce the impact of any single investment’s performance.

Why is Asset Allocation Crucial in Retirement?

Asset allocation plays a critical role in retirement planning because it helps to balance risk and return. As you enter retirement, your investment goals shift. You need to generate income to support your lifestyle while preserving your capital to ensure long-term financial stability. Asset allocation allows you to tailor your portfolio to these specific needs.

How to Approach Asset Allocation in Retirement

There is no one-size-fits-all approach to asset allocation. Your specific needs and risk tolerance will determine the best allocation strategy for you. However, some general principles to consider include:

- Time Horizon: Retirement is a long-term investment, so you have more time to recover from market fluctuations. You can generally afford to take on more risk compared to younger investors with a shorter investment horizon.

- Income Needs: Your income needs will determine the proportion of your portfolio allocated to income-generating assets like bonds or dividend-paying stocks.

- Risk Tolerance: Your willingness to accept fluctuations in your portfolio’s value will influence your asset allocation. If you are risk-averse, you may prefer a more conservative allocation with a higher proportion of bonds and less exposure to stocks.

- Investment Goals: Your investment goals, such as preserving capital, generating income, or leaving a legacy, will also shape your asset allocation strategy.

The Role of Diversification

Diversification is an essential complement to asset allocation. It helps to mitigate the impact of market volatility by spreading your investments across a range of asset classes and industries. A diversified portfolio reduces the risk of significant losses from any single investment performing poorly. Consider diversifying your portfolio across:

- Different Asset Classes: Include stocks, bonds, real estate, commodities, and cash.

- Industries: Invest in companies from various industries to reduce your exposure to any specific sector’s performance.

- Geographic Regions: Invest in companies and assets from different regions to reduce your vulnerability to economic or political events in a particular area.

Adjusting Your Asset Allocation Over Time

As you move through retirement, your investment needs and risk tolerance may change. Regular reviews of your asset allocation are crucial to ensure it remains aligned with your goals. As you age and your time horizon shortens, you may consider shifting towards a more conservative allocation with a higher proportion of fixed-income investments. Regularly rebalancing your portfolio can help you maintain your desired asset allocation and manage risk effectively.

Conclusion

Managing investment risk during retirement is crucial to ensure financial security and peace of mind. By carefully considering your individual circumstances, implementing a well-defined asset allocation strategy, and diversifying your portfolio, you can mitigate risk and achieve your retirement goals. Remember to regularly review and adjust your investment plan as your needs and circumstances change throughout retirement.

Adjusting Your Withdrawal Strategy Over Time: Market Fluctuations and Changing Needs

Retirement planning is a dynamic process that requires constant adjustments to account for evolving market conditions and your changing needs. A well-crafted withdrawal strategy should not be set in stone, but rather viewed as a flexible framework that adapts to the ebb and flow of your financial landscape. In this article, we delve into the factors that warrant a reassessment of your withdrawal strategy, exploring how to navigate market fluctuations and accommodate life’s inevitable shifts.

Market Volatility and Its Impact

The stock market is inherently volatile, experiencing both periods of growth and decline. During market downturns, a fixed withdrawal rate can deplete your retirement nest egg faster than anticipated. To mitigate this risk, consider adopting a flexible withdrawal approach. Instead of drawing a predetermined amount each year, adjust your withdrawals based on market performance and your investment portfolio’s health. This allows for a more conservative approach during volatile periods, potentially preserving your capital for the long term.

Shifting Life Circumstances

Retirement is not a static state; your financial needs and priorities can evolve significantly over time. Unexpected expenses, medical bills, or a desire to travel more frequently can necessitate changes in your withdrawal strategy. For instance, if you require additional funds for a major home renovation, you may need to temporarily increase your withdrawals or delay certain spending goals. Regularly reviewing your financial plan and adjusting your withdrawal strategy to accommodate these life events is crucial.

Inflation’s Impact on Purchasing Power

Inflation erodes the purchasing power of your savings over time. To maintain your desired standard of living in retirement, your withdrawal strategy must account for inflation. A fixed withdrawal rate without adjusting for inflation can leave you with dwindling funds as the cost of goods and services rises. Consider increasing your annual withdrawals by a percentage that aligns with the inflation rate, ensuring your retirement income keeps pace with the rising cost of living.

Tax Considerations

Your tax bracket can fluctuate during retirement as your income stream changes. As you withdraw funds from your retirement accounts, you may be subject to taxes on those distributions. Understanding the tax implications of your withdrawal strategy is essential. It’s advisable to consult with a tax professional to optimize your withdrawals for tax efficiency and minimize your tax burden in retirement.

Seeking Professional Guidance

Navigating the complexities of retirement planning, particularly when it comes to adjusting your withdrawal strategy, can be challenging. Seeking guidance from a qualified financial advisor can provide valuable insights and personalized recommendations tailored to your specific circumstances. They can help you develop a robust withdrawal strategy that aligns with your financial goals and risk tolerance, ensuring a comfortable and secure retirement.

In conclusion, a dynamic withdrawal strategy is key to weathering market fluctuations and adapting to changing needs in retirement. Regularly reviewing your plan, adjusting your withdrawals based on market performance, and seeking professional advice are essential steps toward ensuring a sustainable and fulfilling retirement.

Avoiding Common Retirement Withdrawal Mistakes

Retirement is a significant milestone in life, and it’s crucial to approach it with a well-defined strategy. One of the most critical aspects of retirement planning is managing your withdrawals. Making unwise decisions can deplete your savings quickly, leaving you financially vulnerable. To help you avoid common retirement withdrawal mistakes, we’ve compiled a comprehensive guide.

1. Failing to Create a Comprehensive Withdrawal Plan

Before you start withdrawing from your retirement accounts, it’s essential to have a clear plan in place. This plan should consider your financial goals, lifestyle expectations, expected longevity, and potential sources of income. A well-structured withdrawal plan will ensure that you don’t withdraw more than you need and that you can sustain your desired lifestyle throughout retirement.

2. Withdrawing Too Much Too Soon

Many retirees make the mistake of withdrawing too much money from their savings early on. While it’s tempting to enjoy your newfound freedom, it’s crucial to remember that your retirement savings need to last for potentially decades. By withdrawing too much, you increase the risk of running out of money before you reach the end of your retirement.

3. Not Adjusting for Inflation

Inflation can significantly erode the purchasing power of your savings over time. If you fail to adjust your withdrawals for inflation, you may find that your spending power decreases, making it difficult to maintain your desired standard of living. It’s essential to consider the potential impact of inflation when planning your withdrawals.

4. Ignoring Taxes

Retirement withdrawals are often subject to taxes, and failing to account for these taxes can significantly reduce the amount of money you have available to spend. Ensure that you understand the tax implications of your withdrawals and plan accordingly. Consider strategies like Roth conversions or tax-efficient withdrawal methods to minimize your tax burden.

5. Overlooking the Importance of Diversification

Diversifying your retirement portfolio can help mitigate risk and protect your savings from market fluctuations. When withdrawing from your accounts, ensure that you’re not solely relying on one asset class. Consider withdrawing from a mix of stocks, bonds, and other investments to balance your portfolio and reduce the impact of market volatility.

6. Neglecting Regular Reviews

Retirement is a dynamic phase, and your financial needs and circumstances may change over time. It’s crucial to regularly review your withdrawal plan and make adjustments as necessary. Consider factors like changes in your health, living expenses, and market conditions. By staying proactive, you can ensure that your withdrawal plan remains aligned with your evolving needs.

7. Failing to Seek Professional Advice

Retirement planning can be complex, and it’s wise to seek professional advice from a qualified financial advisor. An advisor can help you create a comprehensive withdrawal plan, assess your risk tolerance, and develop strategies to maximize your retirement income. Consider consulting with an advisor before making any significant decisions regarding your retirement savings.

Avoiding common retirement withdrawal mistakes is essential for ensuring a comfortable and financially secure retirement. By implementing these strategies, you can protect your hard-earned savings and enjoy your golden years without financial stress.

Seeking Professional Guidance for a Personalized Withdrawal Plan

Planning for retirement is a crucial aspect of financial well-being. As you approach retirement, it’s essential to develop a withdrawal plan that ensures your financial security and helps you achieve your retirement goals. While there are many resources available, seeking professional guidance from a financial advisor can provide invaluable insights and tailored strategies for your unique situation.

Why is a Personalized Withdrawal Plan Important?

A personalized withdrawal plan considers various factors specific to your circumstances, including:

- Your age and health

- Your retirement income sources

- Your investment portfolio

- Your expenses and lifestyle

- Your risk tolerance and financial goals

By taking these factors into account, a financial advisor can create a withdrawal plan that helps you:

- Maximize your retirement income

- Minimize taxes

- Protect your savings from market fluctuations

- Ensure you have enough funds to cover your expenses throughout retirement

- Achieve your financial goals, such as travel, education, or leaving an inheritance

Benefits of Professional Guidance

Working with a financial advisor offers several benefits, including:

- Expert knowledge and experience: Financial advisors have the expertise and experience to navigate complex financial concepts and market trends.

- Objectivity and unbiased advice: They can provide an objective perspective on your financial situation, helping you avoid emotional decision-making.

- Tailored strategies: They develop personalized withdrawal plans based on your unique needs and goals.

- Ongoing support and guidance: They provide ongoing support throughout your retirement, adjusting your plan as necessary to adapt to changing circumstances.

Finding the Right Advisor

When choosing a financial advisor, consider factors such as:

- Experience and qualifications: Look for advisors with a strong track record and relevant certifications.

- Fees and compensation: Understand how the advisor charges for their services.

- Communication style and rapport: Ensure you feel comfortable discussing your financial situation with the advisor.

- References and testimonials: Ask for references from previous clients and read online reviews.

Conclusion

A personalized withdrawal plan is crucial for a successful and financially secure retirement. Seeking professional guidance from a qualified financial advisor can provide invaluable insights and strategies to help you achieve your financial goals and enjoy your retirement years to the fullest.