Are you tired of constantly overspending and struggling to make ends meet? You’re not alone. Many people find it challenging to stick to a budget, but it doesn’t have to be a constant battle. With the right tools and strategies, you can gain control of your finances and achieve your financial goals. In this article, we’ll explore some of the best tools available to help you stick to your budget, from budgeting apps to expense trackers and financial advisors.

Whether you’re trying to save for a down payment on a house, pay off debt, or simply want to have more financial freedom, these tools can provide you with the support and guidance you need. We’ll delve into the features, benefits, and drawbacks of each tool so you can choose the ones that best suit your individual needs and preferences. So, if you’re ready to take charge of your finances and start living a more financially secure life, let’s dive in!

Why Sticking to a Budget Can Be Challenging

Budgeting is an essential aspect of managing your finances. It helps you track your income and expenses, allowing you to make informed decisions about your spending. However, sticking to a budget can be challenging, especially when faced with unexpected expenses, temptations, and the allure of instant gratification.

One of the primary challenges is dealing with unexpected expenses. Life is unpredictable, and unforeseen situations can arise, requiring you to dip into your savings or adjust your budget. A car repair, a medical emergency, or a sudden home maintenance issue can throw your carefully crafted plan off track.

Another challenge is temptations. We live in a world of abundant consumerism, constantly bombarded with advertisements and promotions that entice us to spend money. It’s easy to succumb to impulse purchases or fall prey to marketing strategies that promise instant happiness. These temptations can easily derail your budgeting efforts.

Furthermore, instant gratification poses a significant hurdle. It’s human nature to seek immediate satisfaction, and the allure of having something now can override our long-term financial goals. This can lead to impulsive purchases and the erosion of our savings.

Despite these challenges, it’s important to remember that budgeting is crucial for achieving your financial goals. It’s about prioritizing your needs and making informed choices about your spending. By developing a realistic budget, monitoring your expenses, and being mindful of your spending habits, you can overcome these obstacles and gain control of your finances.

The Benefits of Using Budgeting Tools and Apps

In today’s world, managing finances is crucial for everyone, regardless of their income level. Budgeting is a vital step in ensuring financial stability and reaching financial goals. While traditional pen-and-paper methods for budgeting still work, using budgeting tools and apps offers several advantages that can simplify the process and make it more effective.

Increased Awareness and Control

One of the primary benefits of budgeting tools is that they provide a clear picture of your financial situation. By tracking your income and expenses, you gain a better understanding of where your money is going and identify areas where you can potentially cut back. This increased awareness allows you to make informed decisions about your spending habits and take control of your finances.

Easy Tracking and Organization

Budgeting tools automate the process of tracking your income and expenses. You can easily categorize transactions, set spending limits, and monitor your progress toward your financial goals. They also help you stay organized and keep all your financial information in one place, eliminating the need for multiple spreadsheets or notebooks.

Goal Setting and Monitoring

Many budgeting tools and apps allow you to set specific financial goals, such as saving for a down payment on a house, paying off debt, or investing for retirement. They can track your progress towards these goals and provide insights into how you can adjust your spending habits to reach them faster.

Financial Insights and Reports

Budgeting tools can generate insightful reports on your spending patterns, highlighting areas where you might be overspending or underutilizing your resources. They can also provide personalized recommendations for improving your financial management, such as suggesting ways to save money or reduce debt.

Accessibility and Convenience

Budgeting tools and apps are readily accessible on smartphones, tablets, and computers. This makes it convenient to manage your finances anytime, anywhere. Many apps also offer features like automatic syncing with bank accounts, eliminating the need for manual data entry.

Conclusion

Utilizing budgeting tools and apps offers a plethora of benefits that can significantly improve your financial well-being. From increased awareness and control to goal setting and insightful reports, these tools empower you to make informed decisions about your finances and work towards achieving your financial goals.

Top Budgeting Apps for Tracking Income and Expenses

Budgeting can be a daunting task, especially when it comes to keeping track of your income and expenses. But thankfully, there are numerous budgeting apps available that can help simplify the process and make managing your finances a breeze. In this blog post, we’ll explore some of the top budgeting apps for tracking income and expenses, highlighting their key features and benefits.

Mint

Mint is a popular budgeting app that offers a comprehensive suite of features, including:

- Automatic account aggregation: Mint connects to your bank accounts, credit cards, and other financial institutions to automatically pull your transactions.

- Budgeting and goal setting: Create custom budgets and set financial goals, such as saving for a down payment or paying off debt.

- Spending analysis: Gain insights into your spending habits through detailed reports and charts.

- Credit monitoring: Monitor your credit score and receive alerts about potential fraud.

YNAB (You Need a Budget)

YNAB takes a different approach to budgeting by emphasizing a “zero-based” methodology. This means that you allocate every dollar of your income to a specific category, leaving no room for overspending. Key features include:

- Zero-based budgeting: Allocate all your income to categories, ensuring you’re spending within your means.

- Goal-oriented budgeting: Set and track your financial goals, such as saving for retirement or a vacation.

- Spending tracking: Monitor your expenses and identify areas where you can save money.

- Debt management tools: Plan and track your debt repayment strategy.

Personal Capital

Personal Capital stands out as a powerful budgeting app that goes beyond basic expense tracking. It provides a comprehensive view of your financial picture, including:

- Investment management: Monitor your investment portfolio and receive personalized advice.

- Retirement planning: Estimate your retirement savings needs and track your progress.

- Net worth tracking: Gain insights into your overall financial health by monitoring your assets and liabilities.

- Cash flow analysis: Understand your income and expenses to make informed financial decisions.

EveryDollar

EveryDollar, created by the renowned financial expert Dave Ramsey, focuses on a simple and effective budgeting approach. It encourages a “cash envelope” system, where you allocate specific amounts of money to different spending categories.

- Cash envelope system: Allocate specific amounts to spending categories to stay on budget.

- Budgeting tools: Create a detailed budget and track your expenses against it.

- Debt payoff planning: Develop a debt snowball strategy to eliminate debt faster.

- Financial education resources: Access articles, videos, and other resources to improve your financial literacy.

PocketGuard

PocketGuard simplifies budgeting by providing a clear and visual overview of your finances. It uses artificial intelligence to analyze your spending habits and offer personalized insights.

- Spending analysis: Understand your spending patterns and identify areas for improvement.

- Budgeting tools: Create a budget and track your progress towards your financial goals.

- Savings goals: Set savings goals and track your progress toward achieving them.

- Debt management tools: Pay off debt faster by identifying areas where you can save money.

Conclusion

Whether you’re looking for a comprehensive suite of features, a simple and effective budgeting method, or personalized insights, there’s a budgeting app out there for you. By using one of these apps, you can take control of your finances, track your income and expenses, and achieve your financial goals.

Tools for Automating Savings and Bill Payments

In today’s fast-paced world, managing finances can feel like a constant juggle. Between work, family, and personal commitments, it’s easy to let bills slip your mind or forget to save for the future. Thankfully, there are numerous tools and services available that can automate the process of saving and bill payments, making it easier than ever to stay on top of your finances.

Automated Savings

Automated savings tools can help you build a nest egg without having to think about it. Here are a few options:

- Round-up apps: These apps automatically round up your purchases to the nearest dollar and invest the difference. This seemingly small amount can add up over time. Examples include Acorns and Qapital.

- Recurring transfers: Set up regular transfers from your checking account to your savings account, even if it’s just a small amount. This helps you build savings consistently.

- Goal-based savings: Many banks and apps offer goal-based savings accounts, where you can set a specific savings target (e.g., a down payment on a house or a vacation) and the app will help you track your progress and make sure you’re on track to reach your goal.

Automated Bill Payments

Automating bill payments can help you avoid late fees and ensure that your bills are paid on time. Here are some ways to automate bill payments:

- Online bill pay: Most banks offer online bill pay services that allow you to schedule payments to be sent out on specific dates. You can also set up recurring payments for bills that come due monthly, like your rent or mortgage.

- Direct debit: With direct debit, you authorize your bank to automatically deduct the amount of your bill from your checking account on the due date. This eliminates the need to manually pay your bills each month.

- Bill pay apps: Several apps, such as Mint and Personal Capital, allow you to manage and pay your bills from a single platform. These apps can also help you track your spending and identify areas where you can save money.

Benefits of Automating Savings and Bill Payments

Automating your finances offers several benefits:

- Reduces stress: By taking the burden of manual bill payments and savings off your shoulders, you can free up your time and reduce stress levels.

- Improves financial discipline: Automating your finances can help you stick to your budget and avoid overspending.

- Saves time: You’ll no longer need to spend hours each month manually paying bills or tracking your savings progress.

- Increases savings potential: By setting up automatic savings, you’ll be able to build your savings more consistently.

Choosing the Right Tools

With so many options available, it’s important to choose the right tools for your needs. Consider the following factors:

- Ease of use: The tools should be user-friendly and easy to set up and manage.

- Features: Make sure the tools offer the features you need, such as automatic savings, bill pay, budgeting, and financial tracking.

- Security: Choose tools from reputable providers that prioritize security and data privacy.

- Fees: Some tools may charge fees for certain services, so make sure to compare prices before choosing.

Automating savings and bill payments can be a game-changer for your financial wellbeing. By taking advantage of these tools, you can simplify your financial management, improve your financial discipline, and achieve your financial goals faster.

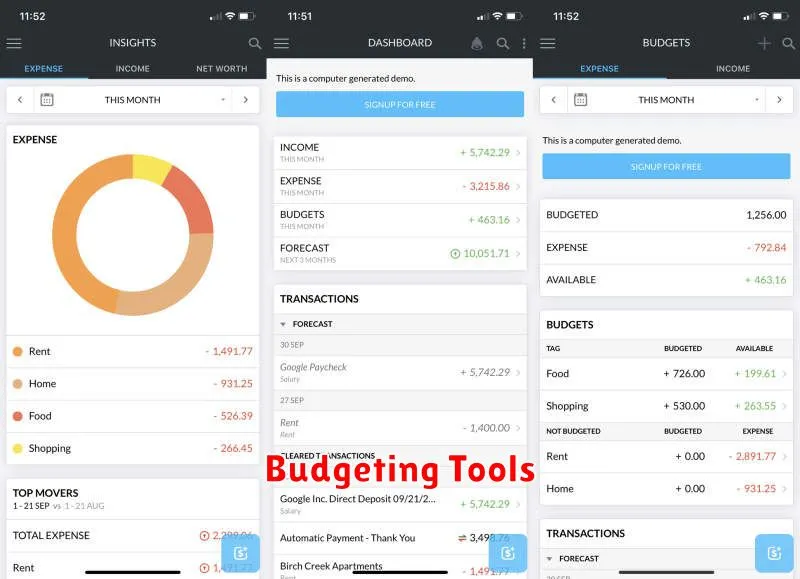

Budgeting Software for Visualizing Spending Habits

Visualizing your spending habits can be a powerful tool for achieving your financial goals. Budgeting software provides a variety of features that allow you to track your income and expenses, categorize transactions, and create budgets. But one of the most valuable features is the ability to visualize your spending data in charts and graphs. This visual representation can help you identify areas where you’re overspending, see trends over time, and make informed decisions about your finances.

Benefits of Visualizing Spending Habits

Here are some of the key benefits of using budgeting software to visualize your spending habits:

- Identify Spending Patterns: Visualizing your spending data can reveal patterns you might not have noticed otherwise. For example, you might see that you tend to spend more on dining out during the weekends or that your grocery bills increase during certain times of the year.

- Spot Overspending: By seeing your spending visually, you can quickly identify areas where you’re overspending relative to your budget. This allows you to make adjustments and stay on track with your financial goals.

- Track Progress: Visualizing your spending trends over time can help you track your progress towards your financial goals. You can see how your spending habits have changed and whether your efforts to save money are paying off.

- Gain Insights: Visualization can provide valuable insights into your spending habits. You might discover that you’re spending more on certain categories than you thought or that your spending is influenced by factors you hadn’t considered.

Tips for Visualizing Spending Habits

Here are some tips for effectively visualizing your spending habits using budgeting software:

- Choose the Right Charts and Graphs: Different types of charts and graphs are best suited for visualizing different types of data. For example, bar charts can be used to compare spending across categories, while line charts are effective for showing trends over time.

- Experiment with Different Views: Most budgeting software allows you to customize your visualizations. Experiment with different views to find the ones that are most helpful for understanding your spending habits.

- Set Up Alerts: Many budgeting software programs allow you to set up alerts to notify you when you’re nearing your budget limits or exceeding your spending targets.

- Regularly Review Your Visualizations: Make it a habit to review your spending visualizations regularly, at least once a month. This will help you stay on top of your spending habits and make adjustments as needed.

Conclusion

Visualizing your spending habits is a powerful way to gain control of your finances. Budgeting software can help you track your income and expenses, categorize transactions, and create budgets, all while providing you with insightful visualizations to help you make informed decisions about your money. By taking advantage of these features, you can gain valuable insights into your spending patterns, spot areas where you’re overspending, track your progress towards your financial goals, and ultimately achieve financial success.

Apps to Help You Manage Debt and Improve Credit Score

Managing your finances can be a daunting task, especially when it comes to debt and credit. However, there are several mobile apps available that can help you track your spending, stay on top of your debt payments, and improve your credit score. Here are some of the best apps to help you manage your debt and improve your credit score:

Debt Management Apps

These apps help you organize and track your debts, set up payment reminders, and create a budget to help you pay down your debt faster.

1. Mint

Mint is a popular budgeting and debt management app that aggregates all your financial accounts in one place. It provides insights into your spending habits, helps you create a budget, and offers debt payoff strategies. Mint also monitors your credit score for free.

2. NerdWallet

NerdWallet offers a comprehensive suite of financial tools, including a debt management feature. It helps you track your debt, calculate the time it will take to pay it off, and provides personalized recommendations for debt consolidation and refinancing.

3. Personal Capital

Personal Capital is a free financial management platform that offers a robust debt management tool. It helps you create a debt payoff plan, track your progress, and provides insights into your overall financial picture.

Credit Score Monitoring Apps

These apps track your credit score and provide alerts about changes or potential issues that could impact your score. They also offer tools to help you improve your credit score.

1. Credit Karma

Credit Karma offers free credit monitoring and reports from TransUnion and Equifax. It also provides personalized recommendations for improving your credit score and offers access to credit cards and loans based on your credit profile.

2. Experian

Experian offers a free credit monitoring app that provides access to your Experian credit report and score. It also offers tools to help you understand your credit score, track your credit utilization, and identify potential areas for improvement.

3. Credit.com

Credit.com offers a free credit monitoring service that includes access to your credit report and score from all three major credit bureaus. It also provides personalized tips for improving your credit score and offers a variety of credit monitoring and identity theft protection plans.

Tips for Using Debt and Credit Score Apps

Here are some tips for using debt and credit score apps effectively:

- Choose the right app for your needs. Different apps offer different features, so it’s important to choose one that aligns with your goals and financial situation.

- Set up automatic alerts. This will help you stay informed about any changes to your credit score or potential issues that may affect your finances.

- Use the insights provided by the app. These apps can provide valuable insights into your spending habits and areas where you can improve your financial health.

- Take action. Don’t just passively monitor your finances. Use the information provided by these apps to make positive changes and improve your financial well-being.

Investment Tracking Tools for Staying on Top of Your Finances

In today’s complex financial landscape, keeping track of your investments can feel overwhelming. From stocks and bonds to real estate and cryptocurrency, managing a diverse portfolio requires attention to detail and efficient organization. Fortunately, numerous investment tracking tools are available to empower you to stay on top of your finances and make informed decisions.

Investment Tracking Software:

Dedicated investment tracking software provides comprehensive features designed for serious investors. These platforms typically offer real-time portfolio monitoring, performance analysis, and personalized insights. Some popular options include:

- Personal Capital: Known for its user-friendly interface and robust financial planning tools, Personal Capital aggregates data from various accounts and provides insights into your overall financial picture.

- Mint: A well-established budgeting app, Mint also allows you to track investments and set financial goals.

- Quicken: A comprehensive financial management software, Quicken offers advanced investment tracking features, including tax optimization and portfolio rebalancing.

Online Brokerage Platforms:

Many online brokerage platforms, such as Fidelity, Charles Schwab, and TD Ameritrade, offer built-in investment tracking tools. These platforms provide detailed account statements, transaction histories, and performance charts, allowing you to monitor your holdings within a single interface.

Spreadsheet Programs:

For those who prefer a more hands-on approach, spreadsheet programs like Microsoft Excel or Google Sheets can be used to track investments manually. This method offers flexibility in customizing your data analysis and provides a deeper understanding of your portfolio’s composition.

Mobile Apps:

Numerous mobile apps are specifically designed for investment tracking, offering convenience and portability. These apps provide quick access to portfolio summaries, performance updates, and alerts on market trends.

Tips for Choosing the Right Tool:

- Consider your investment goals and complexity. Simple portfolios may be adequately tracked with basic tools, while complex portfolios may require more advanced software.

- Look for features that align with your needs, such as real-time data, performance analysis, and financial planning capabilities.

- Evaluate the platform’s user interface and ease of use. Choose a tool that you find intuitive and comfortable navigating.

By utilizing investment tracking tools, you can gain greater control over your finances and make informed decisions that align with your long-term financial goals. Embrace the power of technology to streamline your investment management and build a more secure financial future.

Choosing the Right Budgeting Tools for Your Needs

In today’s digital age, there are numerous budgeting tools available to help you manage your finances effectively. From simple spreadsheets to sophisticated software programs, finding the right tool for your needs can seem overwhelming. To make the best decision, it’s crucial to consider your individual requirements, financial goals, and technological proficiency.

Factors to Consider When Choosing a Budgeting Tool

- Budgeting Method: Some tools focus on traditional budgeting methods like the 50/30/20 rule, while others employ zero-based budgeting or envelope budgeting. Select a tool that aligns with your preferred approach.

- Features: Consider features like automatic transaction tracking, bill reminders, spending analysis, financial reporting, and goal-setting tools. Choose a tool that offers the functionality you need.

- User Interface: The tool’s user interface should be intuitive and easy to navigate. Look for a tool with a clean layout, clear instructions, and customizable features.

- Mobile Accessibility: If you prefer managing your budget on the go, ensure the tool has a robust mobile app.

- Security: Choose a reputable provider with strong security measures to protect your financial data.

- Cost: Budgeting tools range from free to paid subscriptions. Decide on a budget that fits your financial situation.

Types of Budgeting Tools

Here are some popular types of budgeting tools:

- Spreadsheet Software: Microsoft Excel or Google Sheets allow for customizable budgeting templates and basic financial tracking. However, they require manual data entry and lack advanced features.

- Budgeting Apps: Apps like Mint, Personal Capital, and YNAB offer automated transaction tracking, spending analysis, and goal-setting features. They are user-friendly and accessible on mobile devices.

- Financial Software: Programs like Quicken and Moneydance offer comprehensive financial management tools, including budgeting, bill pay, investment tracking, and tax preparation. These programs are often more expensive than apps but provide advanced functionality.

Tips for Successful Budgeting

Regardless of the tool you choose, here are some tips for successful budgeting:

- Set Realistic Goals: Establish achievable financial goals that align with your values and priorities.

- Track Your Spending: Monitor your income and expenses regularly to identify areas for improvement.

- Create a Budget: Allocate your funds strategically based on your needs and goals.

- Stick to Your Plan: Be disciplined and avoid impulsive purchases that derail your budget.

- Review Regularly: Periodically review your budget and make adjustments as needed.

Conclusion

Choosing the right budgeting tool can empower you to take control of your finances. Consider your needs, financial goals, and technological preferences to select a tool that aligns with your individual circumstances. By using a budgeting tool effectively, you can achieve your financial objectives and create a more secure future for yourself.

Tips for Maximizing the Effectiveness of Budgeting Tools

Budgeting tools can be incredibly helpful in managing your finances and achieving your financial goals. However, to truly maximize their effectiveness, it’s important to understand how to use them properly. Here are some tips for getting the most out of your budgeting tools:

1. Choose the Right Tool for Your Needs

There are many different budgeting tools available, each with its own features and benefits. Consider your individual needs and preferences when making your choice. Some factors to consider include:

- Ease of use: How user-friendly is the tool?

- Features: Does the tool offer the features you need, such as bill tracking, expense categorization, and financial reporting?

- Integration: Does the tool integrate with your bank accounts and credit cards?

- Cost: Is the tool free or paid?

2. Set Up Your Budget

Once you’ve chosen a budgeting tool, it’s time to set up your budget. This involves tracking your income and expenses and allocating your funds to different categories, such as housing, food, transportation, and entertainment. It’s important to be as accurate as possible when tracking your spending.

3. Monitor Your Spending Regularly

Regularly monitoring your spending is crucial for staying on track with your budget. Aim to review your spending at least once a week or even daily. This will help you identify areas where you can cut back and make adjustments as needed. Remember, being aware of your spending habits is vital for financial success.

4. Set Realistic Goals

Setting realistic financial goals is key to maximizing the effectiveness of your budgeting tools. Your goals should be specific, measurable, achievable, relevant, and time-bound (SMART). If your goals are too ambitious, you may get discouraged and give up.

5. Automate Your Savings

Most budgeting tools offer the option to automate your savings. This means setting up automatic transfers from your checking account to your savings account on a regular basis. Automating your savings ensures that you’re consistently building your financial reserves, even when life gets busy.

6. Be Consistent

The key to successful budgeting is consistency. Stick to your budget as much as possible and make it a habit to track your spending and review your progress regularly. Don’t give up if you slip up occasionally. Just get back on track and keep moving forward.

7. Don’t Be Afraid to Adjust

Your financial situation and goals may change over time. Be prepared to adjust your budget accordingly. It’s important to review your budget regularly and make any necessary changes. It’s not about being perfect; it’s about being flexible and adapting to your evolving needs.

By following these tips, you can effectively leverage budgeting tools to take control of your finances, achieve your financial goals, and build a brighter future.