Are you tired of watching your savings dwindle while retirement seems further away than ever? It’s time to turn your hard-earned savings into a reliable income stream that can sustain you throughout your golden years. This article will provide you with a comprehensive guide on how to convert your savings into a steady retirement income. We’ll explore various strategies, from traditional investments like stocks and bonds to alternative options like real estate and annuities. Whether you’re just starting to plan for retirement or looking to optimize your existing portfolio, this guide will equip you with the knowledge and tools to secure a financially stable future.

Many people approach retirement planning with a sense of fear and uncertainty. The thought of relying on a finite pool of savings to cover potentially decades of expenses can be overwhelming. But with the right approach and a solid understanding of your options, you can transform your savings into a dependable retirement income that provides peace of mind and financial security. We’ll delve into the essential concepts of retirement planning, discuss the importance of diversification, and uncover the best strategies for maximizing your returns while minimizing risk.

Assessing Your Retirement Savings

Retirement planning is a crucial aspect of financial well-being, and it’s never too early to start thinking about your future. As you approach retirement age, it’s essential to assess your savings to determine if you’re on track to achieve your financial goals. This assessment involves evaluating your current savings, projected expenses, and potential sources of income during retirement.

1. Determine Your Retirement Goals

Before assessing your savings, it’s important to define your retirement goals. What kind of lifestyle do you envision for yourself? Do you plan to travel extensively, pursue hobbies, or simply relax and enjoy your time? Clearly defining your retirement goals will help you estimate your required savings.

2. Calculate Your Estimated Expenses

Once you have a clear understanding of your retirement goals, you can estimate your expenses. Consider factors such as housing, healthcare, transportation, food, entertainment, and taxes. It’s wise to factor in inflation and unexpected expenses.

3. Review Your Current Savings

Take stock of your current retirement savings, including contributions to 401(k)s, IRAs, and other retirement accounts. Consider any other assets you may have, such as real estate or investments.

4. Estimate Your Potential Income Sources

Besides your retirement savings, consider potential income sources during retirement, such as Social Security benefits, pensions, or part-time work. These sources can supplement your savings and help you reach your financial goals.

5. Project Your Savings Growth

Use a retirement calculator or consult with a financial advisor to project your savings growth based on your current contributions, estimated returns, and time horizon. This projection will help you understand if your savings are on track to meet your needs.

6. Make Adjustments as Needed

If your assessment reveals that your savings are not on track to meet your goals, it’s important to make adjustments. Consider increasing your contributions, exploring investment options with higher returns, or delaying retirement. You may also want to reduce expenses or explore additional income sources.

Assessing your retirement savings is an essential step in ensuring a comfortable and secure future. By taking the time to evaluate your financial situation and make necessary adjustments, you can increase your chances of achieving your retirement goals.

Estimating Your Retirement Expenses

Retirement is a significant life milestone that requires careful planning and preparation. One crucial aspect of retirement planning is accurately estimating your future expenses. Knowing how much you will need to live comfortably in retirement is essential to ensure financial security and peace of mind.

Factors Affecting Retirement Expenses

Retirement expenses can vary greatly depending on several factors, including:

- Lifestyle: Your current and desired lifestyle will significantly impact your expenses. If you plan to travel extensively, maintain an active social life, or pursue hobbies, your costs will likely be higher.

- Location: The cost of living in different locations can vary drastically. Moving to a less expensive area can reduce your retirement expenses.

- Health: Healthcare costs are a major consideration in retirement. If you anticipate significant medical expenses, you’ll need to factor those into your budget.

- Housing: Housing is often the largest expense in retirement. Downsizing or moving to a less expensive home can help reduce your housing costs.

- Inflation: The rate of inflation can erode the purchasing power of your savings over time. It’s essential to consider inflation when estimating your future expenses.

Estimating Your Retirement Income

To determine how much you’ll need to cover your expenses in retirement, you’ll need to estimate your income sources. These may include:

- Social Security: The amount you receive from Social Security will depend on your earnings history.

- Pensions: If you have a pension plan, you can use the estimated monthly payout to calculate your income.

- Investments: You can estimate the income from your investments based on your expected returns.

- Part-time work: You may choose to continue working part-time in retirement, which can supplement your income.

Using Retirement Calculators

Retirement calculators are valuable tools that can help you estimate your expenses and income. These calculators take into account various factors, such as your current age, savings, income, and expected return on investments. You can find online retirement calculators or consult with a financial advisor.

Reviewing and Adjusting Your Estimates

It’s important to periodically review and adjust your retirement expense estimates. Life circumstances can change, and your financial goals may evolve. Regularly evaluating your budget and making necessary adjustments will help ensure you stay on track for a comfortable retirement.

Conclusion

Estimating your retirement expenses is a crucial step in planning for a financially secure future. By considering the factors discussed above, utilizing retirement calculators, and periodically reviewing your estimates, you can gain a better understanding of your retirement needs and make informed decisions that will set you up for success.

Exploring Income-Generating Investments

In the realm of personal finance, the pursuit of financial security often involves seeking investments that generate income. Income-generating investments offer a consistent stream of passive income, which can be particularly valuable for individuals looking to supplement their earnings, build wealth, or achieve specific financial goals. This article will delve into the various types of income-generating investments available, exploring their potential benefits and risks.

1. Dividends Stocks

Dividend stocks are shares of companies that distribute a portion of their profits to shareholders in the form of regular cash payments. These dividends provide a steady stream of income, and their value can appreciate over time. When you invest in dividend stocks, you are essentially becoming a part-owner of the company and sharing in its success. The amount of dividend paid varies from company to company, and it can be influenced by factors such as the company’s profitability, financial health, and dividend policy.

2. Real Estate

Real estate investments can generate income through rental properties, commercial spaces, or even land. By owning rental properties, investors can collect monthly rental payments from tenants. Commercial real estate, such as office buildings or retail centers, can generate income through lease agreements. Land can appreciate in value over time, providing potential capital gains. Real estate investments can be more illiquid than other types of investments, meaning they can be challenging to sell quickly if needed.

3. Bonds

Bonds are debt securities that represent a loan made by an investor to a borrower, typically a government or corporation. When you invest in bonds, you are lending money to the borrower in exchange for regular interest payments. Bonds are generally considered less risky than stocks, but they also offer lower potential returns. There are different types of bonds available, each with its own unique features and risks.

4. High-Yield Savings Accounts

High-yield savings accounts offer higher interest rates than traditional savings accounts, allowing you to earn more on your deposits. These accounts are insured by the Federal Deposit Insurance Corporation (FDIC), providing a level of security for your funds. While the interest rates may not be as high as other income-generating investments, they offer a safe and convenient way to earn interest on your savings.

5. Annuities

Annuities are financial products that provide a stream of income for a specified period. When you purchase an annuity, you make a lump-sum payment or a series of payments to an insurance company, which then agrees to make regular payments to you in the future. Annuities can provide a guaranteed stream of income, but they often come with fees and surrender charges, which should be carefully considered before purchasing.

Conclusion

Income-generating investments offer a variety of options to suit different financial goals and risk tolerances. Before investing in any income-generating asset, it’s essential to carefully research and understand the potential benefits and risks involved. Consider your financial situation, investment goals, and time horizon to make informed investment decisions. It’s also wise to consult with a financial advisor to receive personalized advice and guidance.

Creating a Retirement Budget

Retirement is a significant life milestone, and it’s essential to have a comprehensive plan to ensure financial security and a comfortable lifestyle. A crucial aspect of retirement planning is creating a realistic and sustainable budget. A well-structured budget helps you understand your expenses, project future income, and make informed financial decisions.

1. Determine Your Retirement Income

Start by assessing your potential sources of income in retirement. This may include:

- Social Security benefits: Visit the Social Security Administration website to estimate your benefits.

- Pension: If you have a pension plan, contact your employer for details about your benefits.

- Savings and investments: Calculate the projected value of your retirement savings based on your current investment portfolio and expected returns.

- Part-time income: Consider any potential part-time work or entrepreneurial ventures that could supplement your income.

2. Estimate Your Expenses

Create a detailed list of your anticipated expenses in retirement. Categorize them into:

- Housing: Mortgage or rent, property taxes, utilities, and home maintenance.

- Healthcare: Health insurance premiums, medical expenses, prescriptions.

- Food: Groceries, dining out, and entertainment.

- Transportation: Vehicle payments, insurance, gas, and public transportation.

- Travel: Vacation expenses, airfare, hotels, and activities.

- Other expenses: Entertainment, hobbies, personal care, clothing, and miscellaneous items.

3. Adjust for Inflation

Inflation can significantly erode the purchasing power of your retirement income over time. Use an inflation calculator to adjust your estimated expenses for future years.

4. Consider Your Lifestyle

Your retirement lifestyle will play a significant role in determining your expenses. If you plan to travel extensively, maintain an active social life, or pursue hobbies, your budget will need to reflect these activities.

5. Create a Budget Plan

Once you’ve estimated your income and expenses, create a detailed budget plan. Track your spending habits and make adjustments as needed. Consider using budgeting tools or spreadsheets to streamline the process.

6. Review and Adjust Regularly

Life is unpredictable, and your retirement budget may require adjustments over time. Review your budget periodically to account for changes in your income, expenses, or lifestyle.

7. Seek Professional Advice

Consult with a financial advisor for personalized guidance on creating a retirement budget that meets your specific needs and financial goals. A financial advisor can help you optimize your savings, investments, and retirement planning strategies.

Conclusion

Creating a retirement budget is a crucial step in ensuring financial security and peace of mind. By carefully considering your income, expenses, and future needs, you can build a plan that provides you with the financial freedom to enjoy your retirement years.

Understanding Social Security Benefits

Social Security is a federal program that provides retirement, disability, and survivor benefits to eligible Americans. It is funded through payroll taxes, and benefits are paid out to retirees, disabled workers, and families of deceased workers. Understanding how Social Security benefits work is essential for planning your financial future.

Retirement Benefits

Social Security retirement benefits are paid to individuals who have worked and paid into the system for a certain amount of time. The amount of benefits you receive is based on your earnings history, with higher earners receiving more benefits. You can begin receiving retirement benefits at age 62, but you’ll receive the full amount at your full retirement age (FRA), which is between 66 and 67, depending on your birth year.

Disability Benefits

Social Security disability benefits are available to workers who are unable to work due to a medical condition that is expected to last for at least 12 months or result in death. To qualify for disability benefits, you must have a documented medical condition and meet the Social Security Administration’s (SSA) definition of disability. The amount of disability benefits you receive is also based on your earnings history.

Survivor Benefits

Social Security survivor benefits are paid to the surviving spouse, children, and other dependents of a deceased worker. These benefits can provide financial support to families who have lost a loved one and are struggling to make ends meet. The amount of survivor benefits you receive is based on the deceased worker’s earnings history.

Applying for Social Security Benefits

You can apply for Social Security benefits online, by phone, or in person at a local SSA office. The application process can be complex, so it’s important to gather all the necessary documentation before you apply. The SSA website has a wealth of information on applying for benefits, including eligibility requirements and application forms.

Understanding Your Social Security Statement

The SSA provides a personalized Social Security statement that outlines your earnings history, estimated benefits, and your FRA. It’s important to review your Social Security statement regularly to ensure your information is accurate and to get an idea of how much you can expect to receive in benefits. You can access your statement online through your my Social Security account.

Considering Annuities and Pension Options

As you approach retirement, it’s crucial to carefully consider your financial options, particularly when it comes to annuities and pensions. These financial instruments can provide a steady stream of income during your golden years, but it’s essential to understand their nuances and how they might fit into your overall retirement plan.

Annuities

Annuities are insurance contracts that provide a guaranteed stream of income for a specified period, often for life. They can be a valuable tool for generating retirement income, particularly if you’re concerned about outliving your savings.

There are two main types of annuities:

- Fixed annuities: These offer a fixed interest rate, providing predictable income payments. They are generally considered less risky than variable annuities.

- Variable annuities: These tie your returns to the performance of underlying investments, offering the potential for higher returns but also carrying higher risk.

Pensions

Pensions are retirement plans offered by employers that provide a regular income stream to retirees. They typically come in two forms:

- Defined-benefit pensions: These promise a specific monthly benefit based on your years of service and salary. They offer predictable income but are becoming less common.

- Defined-contribution pensions: These allow you to contribute a portion of your salary to a retirement account, often with an employer match. Your retirement income is based on the accumulated value of your contributions and investments.

Factors to Consider

When deciding whether annuities or pensions are right for you, consider the following:

- Your risk tolerance: If you’re risk-averse, fixed annuities or defined-benefit pensions may be more suitable. Variable annuities and defined-contribution pensions offer higher potential returns but also carry greater risk.

- Your financial goals: What level of income do you need in retirement? Do you have other sources of income? These factors will influence your decision.

- Your health and life expectancy: If you expect to live a long life, annuities that provide lifetime income payments may be attractive.

- Fees and expenses: Be sure to compare the fees associated with different annuity and pension options.

Professional Advice

It’s highly recommended to consult with a qualified financial advisor to discuss your specific situation and explore the best options for your retirement planning. A professional can help you assess your needs, understand the nuances of annuities and pensions, and develop a personalized strategy that aligns with your financial goals.

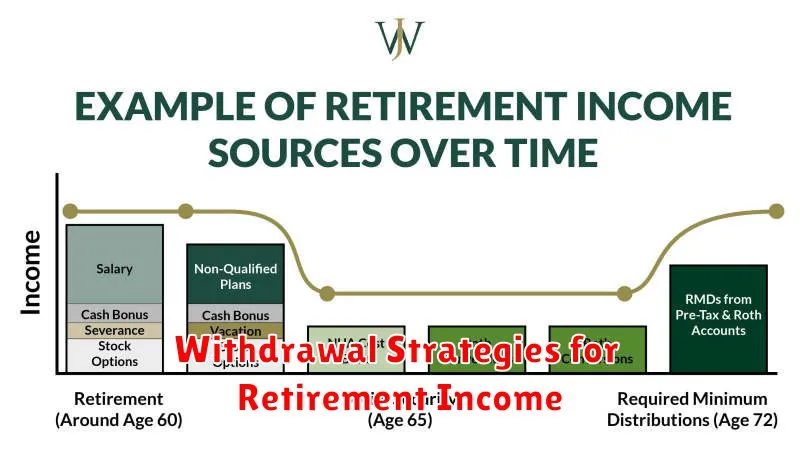

Withdrawal Strategies for Retirement Income

Retirement is a significant milestone in life, marking a transition from working years to a period of leisure and enjoyment. However, it also brings about the crucial task of managing your finances to ensure a comfortable and sustainable lifestyle. One of the most critical aspects of retirement planning is developing a sound withdrawal strategy, which outlines how you will access and utilize your accumulated savings to meet your ongoing needs.

A well-thought-out withdrawal strategy is essential for maximizing your retirement income and preserving your assets for the long term. It helps you avoid running out of money prematurely, navigate market fluctuations, and achieve your financial goals. There are several popular withdrawal strategies that retirees can consider, each with its own advantages and disadvantages.

The 4% Rule

The 4% rule is a widely recognized guideline that suggests withdrawing 4% of your retirement savings in the first year and adjusting subsequent withdrawals for inflation. This rule is based on historical market performance and aims to provide a sustainable income stream for 30 years. While it has been successful for many retirees, it’s important to note that it’s not a guarantee and should be considered within the context of your individual circumstances.

The Required Minimum Distribution (RMD)

For traditional IRAs and 401(k)s, the Required Minimum Distribution (RMD) dictates the minimum amount you must withdraw each year starting at age 72. These distributions are subject to income tax, so it’s essential to factor them into your withdrawal planning. You may choose to withdraw more than the RMD if you need additional income, but withdrawing less can result in penalties.

The Bucket Strategy

The bucket strategy involves dividing your retirement savings into different “buckets” based on their intended use and risk tolerance. For example, you might have a short-term bucket for covering immediate expenses, a medium-term bucket for covering expenses over the next 5-10 years, and a long-term bucket for investments that can grow over time. This approach allows for greater flexibility and helps you manage your risk by allocating assets appropriately.

The Safe Withdrawal Rate

The safe withdrawal rate is a more personalized approach that considers factors such as your age, life expectancy, investment portfolio, and spending habits. By factoring in these variables, you can determine a withdrawal rate that is both sustainable and meets your individual needs. This approach requires more detailed analysis and may benefit from professional financial advice.

Ultimately, the best withdrawal strategy for you will depend on your unique circumstances and financial goals. It’s crucial to consult with a qualified financial advisor to develop a personalized plan that aligns with your retirement aspirations and risk tolerance. By carefully considering your options and seeking professional guidance, you can ensure that your retirement savings last for the long haul and provide you with the financial security you deserve.

Managing Investment Risk During Retirement

Retirement is a time for enjoying the fruits of your labor, but it also presents a unique set of financial challenges, particularly when it comes to managing investment risk. While you may be used to a long-term investing horizon, the dynamics change once you start drawing down your savings.

During your working years, you had the luxury of time to recover from market downturns. However, in retirement, you need your savings to last for potentially decades, with the added pressure of needing to withdraw funds for living expenses. This makes managing investment risk crucial for ensuring financial security in your golden years.

Understanding Your Risk Tolerance

The first step in managing investment risk is understanding your risk tolerance. This refers to your ability and willingness to withstand potential losses in your portfolio. Factors such as your age, health, financial goals, and overall financial situation all play a role in determining your risk tolerance.

A younger retiree with a longer time horizon may be more comfortable with a higher-risk portfolio, as they have time to recover from market downturns. Conversely, an older retiree with a shorter time horizon may prefer a lower-risk portfolio to minimize the potential for significant losses.

Diversification: A Cornerstone of Risk Management

One of the most effective ways to manage investment risk is through diversification. This means spreading your investments across different asset classes, such as stocks, bonds, real estate, and commodities. By diversifying, you reduce your exposure to any single asset class, thereby mitigating the impact of market fluctuations.

For example, if you invest solely in stocks, your portfolio will be highly vulnerable to stock market downturns. However, by including bonds, which tend to perform well during periods of market volatility, you can reduce the overall risk of your portfolio.

Rebalancing Your Portfolio

As time passes, the relative proportions of your investments may change due to market performance. Rebalancing involves periodically adjusting your portfolio to restore your desired asset allocation. This ensures that your portfolio remains aligned with your risk tolerance and financial goals.

Rebalancing can be a powerful tool for managing risk because it helps to prevent you from getting overly concentrated in any one asset class. It also allows you to take advantage of market inefficiencies by buying low-performing assets and selling high-performing assets, thereby increasing your potential for long-term returns.

Withdrawal Strategies

Your withdrawal strategy is another key aspect of managing investment risk in retirement. This refers to how you plan to withdraw money from your savings each year. There are various withdrawal strategies, each with its own advantages and disadvantages.

One popular approach is the 4% rule, which suggests withdrawing 4% of your portfolio value each year. This rule assumes a long-term average return of 7% and aims to preserve your capital over a 30-year retirement. However, it’s important to note that this rule is just a guideline and may not be suitable for everyone.

Consulting a Financial Advisor

Navigating the complexities of investment risk management can be daunting. Consider consulting with a qualified financial advisor. They can help you assess your risk tolerance, develop a personalized investment plan, and provide ongoing guidance as your needs and circumstances change.

A financial advisor can also help you understand your investment options, such as individual stocks, mutual funds, exchange-traded funds (ETFs), and annuities. They can also advise you on tax implications, Social Security benefits, and other financial planning considerations.