Are you constantly struggling to stick to your budget? Do you find yourself setting ambitious financial goals that leave you feeling frustrated and overwhelmed? If so, you’re not alone. Many people fall into the trap of setting unrealistic financial goals, which can ultimately lead to disappointment and financial stress. The key to achieving financial success is to set realistic goals that are achievable and sustainable in the long run.

Setting realistic goals in your budget is essential for several reasons. First, it helps you stay motivated and focused on your financial objectives. When you set achievable goals, you’re more likely to see progress, which can boost your confidence and encourage you to keep striving for your financial aspirations. Additionally, realistic goals prevent you from setting yourself up for disappointment and frustration, ultimately leading to a more positive and sustainable approach to managing your finances.

Understanding Your Financial Situation

Taking control of your finances is a crucial step towards a secure and fulfilling future. It all starts with understanding your current financial situation. This involves assessing your income, expenses, assets, and liabilities.

Income

Your income is the money you receive from various sources, such as your job, investments, or rental properties. Create a list of all your income sources and track how much you earn from each. This will provide you with a clear picture of your financial resources.

Expenses

Expenses are the costs you incur on a regular basis. These can be categorized into fixed expenses, such as rent or mortgage payments, and variable expenses, such as groceries or entertainment. Tracking your expenses is crucial for identifying areas where you can potentially cut back and save money.

Assets

Assets are anything of value that you own. This includes your house, car, savings accounts, investments, and any other valuable possessions. Understanding the value of your assets is essential for assessing your overall financial health.

Liabilities

Liabilities are your debts, such as student loans, credit card debt, or car loans. Keeping track of your liabilities and their associated interest rates is crucial for managing your debt and making informed financial decisions.

Net Worth

Your net worth represents the difference between your assets and liabilities. A positive net worth indicates that you have more assets than liabilities, which is generally a good sign of financial stability.

Creating a Budget

Once you understand your income, expenses, assets, and liabilities, you can start creating a budget. A budget helps you plan your spending and track your progress towards your financial goals. It allows you to allocate your income to different categories, ensuring that you are spending within your means and saving enough for the future.

Conclusion

Understanding your financial situation is the foundation for making sound financial decisions. By diligently tracking your income, expenses, assets, and liabilities, you can create a budget that aligns with your financial goals and helps you achieve long-term financial well-being.

Identifying Your Financial Goals

Having financial goals is essential for achieving your desired financial future. They provide direction, motivation, and a roadmap to guide your financial decisions.

Types of Financial Goals

Financial goals can be categorized into different types based on their time horizon and purpose:

- Short-term goals (within 1 year):

- Saving for an emergency fund

- Paying off high-interest debt

- Taking a vacation

- Medium-term goals (1 to 5 years):

- Saving for a down payment on a house

- Funding a child’s education

- Starting a business

- Long-term goals (5+ years):

- Retirement planning

- Investing for wealth building

- Leaving an inheritance

Tips for Identifying Your Financial Goals

Here are some tips to help you identify your financial goals:

- Reflect on your values and aspirations: What is important to you? What do you want to achieve in life?

- Consider your current financial situation: What are your income, expenses, and debts? What are your financial strengths and weaknesses?

- Dream big: Don’t be afraid to set ambitious goals. You can always adjust them as needed.

- Be specific and measurable: Define your goals with clear targets and timelines. For example, “Save $10,000 for a down payment on a house within 2 years.”

- Write them down: Putting your goals in writing makes them more tangible and helps you stay focused.

Conclusion

Identifying your financial goals is a crucial step towards achieving financial success. By setting clear and achievable goals, you can create a plan, stay motivated, and make informed decisions that will lead you to a more secure and fulfilling financial future.

Setting SMART Financial Goals

Setting financial goals is crucial for achieving financial stability and reaching your aspirations. However, simply saying “I want to be financially secure” isn’t enough. To effectively track your progress and make tangible strides, your goals need to be SMART: Specific, Measurable, Achievable, Relevant, and Time-Bound.

Specific

Avoid vague goals like “save more money”. Instead, be specific about what you aim to achieve. For example, “I want to save $5,000 for a down payment on a house within the next two years.”

Measurable

Quantify your goals to track your progress. How much money do you want to save? How much debt do you want to pay off? By setting specific numbers, you can see how far you’ve come and stay motivated.

Achievable

While it’s good to have ambitious goals, make sure they’re realistic. Don’t set yourself up for failure by aiming too high. Consider your current income, expenses, and financial situation when setting your goals.

Relevant

Ensure your goals align with your overall financial objectives and values. If your goal is to save money for retirement, it should be relevant to your long-term financial plan.

Time-Bound

Set a deadline for your goals. This provides a sense of urgency and helps you stay on track. For example, you could set a goal to save $1,000 by the end of the year.

Benefits of SMART Goals

Setting SMART financial goals offers several benefits:

- Increased Motivation: Having clear and specific goals keeps you motivated and focused on your financial aspirations.

- Improved Planning: SMART goals encourage thoughtful planning and help you develop strategies to achieve your objectives.

- Enhanced Accountability: Measurable goals allow you to track your progress, making you accountable for your financial decisions.

- Greater Confidence: Achieving your goals builds confidence and reinforces your commitment to financial responsibility.

Examples of SMART Financial Goals

- Save $10,000 in emergency savings within 12 months.

- Pay off $5,000 in credit card debt within 18 months.

- Invest $500 per month in a retirement account for the next 20 years.

- Increase my net worth by $20,000 within the next three years.

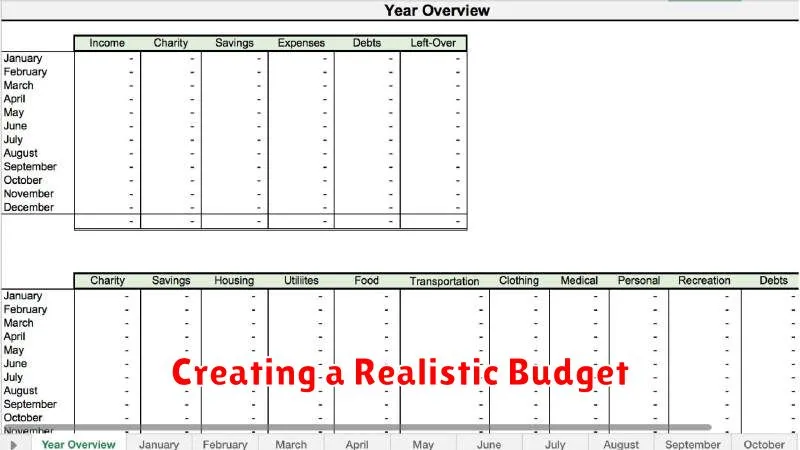

Creating a Realistic Budget

A budget is a plan for how you will spend your money. It’s a tool that can help you reach your financial goals, such as saving for retirement or buying a house. A realistic budget should take into account your income, expenses, and financial goals. Here are some tips for creating a realistic budget:

1. Track Your Spending

The first step to creating a realistic budget is to track your spending. This means keeping track of every dollar you spend for a month or two. You can use a budgeting app, a spreadsheet, or even just a notebook. Once you know where your money is going, you can start to make changes.

2. Create a List of Your Income and Expenses

Once you know how much money you’re spending, you can create a list of your income and expenses. Your income includes any money you earn from your job, investments, or other sources. Your expenses include everything you spend money on, such as rent, groceries, transportation, and entertainment.

3. Set Financial Goals

What are you saving for? Do you want to buy a house, pay off debt, or save for retirement? Setting financial goals will help you stay motivated and on track.

4. Allocate Your Money

Once you know your income, expenses, and financial goals, you can start to allocate your money. This means deciding how much money you will spend on each category of expenses. A common budgeting method is the 50/30/20 rule. This rule suggests allocating 50% of your after-tax income to needs, 30% to wants, and 20% to savings and debt repayment.

5. Review and Adjust Your Budget Regularly

Your budget should be a living document. You should review it regularly, at least once a month, and adjust it as needed. Your income and expenses may change over time, so it’s important to keep your budget up to date.

Creating a realistic budget takes time and effort, but it is worth it. A budget can help you take control of your finances, reach your financial goals, and achieve financial security.

Tracking Your Progress and Making Adjustments

Progress is rarely linear. There will be times when you’re making great strides, and times when you hit a wall. It’s important to be able to track your progress so you can see where you’re succeeding and where you need to make adjustments.

There are a few different ways to track your progress. You can use a journal, a spreadsheet, or a dedicated progress tracking app. The most important thing is to find a system that works for you and that you’ll actually use.

Once you’ve started tracking your progress, take some time to review it regularly. Look for patterns and trends. Are you consistently making progress on certain goals but struggling with others? What are the factors that seem to be contributing to your success or lack of success?

Based on your review, you can then make adjustments to your plan. If you’re not making progress on a particular goal, you may need to adjust your strategy or set more realistic goals. If you’re consistently exceeding your goals, you may be able to challenge yourself further.

It’s important to be flexible and adaptable when it comes to your goals. Be willing to make adjustments as needed, and don’t be afraid to experiment with different approaches. The more you track your progress and make adjustments, the more likely you are to achieve your goals.

Staying Motivated and Committed to Your Goals

Staying motivated and committed to your goals can be a challenging but rewarding journey. It’s easy to get sidetracked by life’s demands, but with the right strategies, you can stay on track and achieve your aspirations. Here’s a guide to help you maintain your motivation and commitment:

1. Define Clear and Specific Goals

Start by setting clear and specific goals that you are passionate about. Avoid vague or overly ambitious goals that are difficult to achieve. Break down your goals into smaller, manageable steps, which will make the journey less daunting.

2. Visualize Success

Visualize yourself achieving your goals, experiencing the joy and fulfillment they bring. This positive visualization helps you stay motivated and builds your belief in your ability to succeed. Create a vision board or use affirmations to reinforce your commitment.

3. Find Your Why

Understanding the underlying reason behind your goals is crucial. What motivates you to pursue them? What impact will achieving them have on your life and the lives of others? Connecting with your “why” will help you overcome obstacles and stay committed even when faced with challenges.

4. Build a Support System

Surround yourself with supportive friends, family, or mentors who believe in you and your goals. Share your aspirations with them and seek their encouragement and advice. A strong support system can provide you with motivation, accountability, and a sense of community.

5. Celebrate Milestones

As you progress toward your goals, acknowledge and celebrate your achievements, no matter how small they may seem. Celebrating milestones helps you stay motivated and reinforces your progress. Reward yourself for your efforts and maintain a positive mindset.

6. Embrace Failure as a Learning Opportunity

Setbacks and failures are inevitable on your journey. Instead of getting discouraged, view them as valuable learning opportunities. Analyze your mistakes, adapt your approach, and use the experience to grow stronger and more resilient.

7. Stay Flexible and Adaptable

Be prepared to adjust your plans and strategies as you encounter new challenges or opportunities. Life is unpredictable, and staying flexible and adaptable allows you to stay motivated and navigate unexpected changes.

8. Practice Self-Care

Remember to prioritize your well-being. Engage in activities that bring you joy and help you recharge. Adequate sleep, exercise, healthy eating, and relaxation are essential for maintaining motivation and focus.

Staying motivated and committed to your goals is an ongoing process. By implementing these strategies, you can cultivate a mindset that supports your aspirations and helps you achieve your dreams.

Celebrating Milestones and Rewarding Yourself

Life is a journey filled with ups and downs, and it’s important to acknowledge and celebrate the milestones we achieve along the way. These milestones, big or small, represent progress, growth, and our dedication to reaching our goals. By taking the time to reward ourselves for these achievements, we can boost our motivation, reinforce positive habits, and foster a sense of accomplishment.

Celebrating milestones doesn’t have to be extravagant. It can be as simple as taking a break, enjoying a favorite meal, or treating yourself to a small indulgence. The key is to acknowledge and appreciate the effort and dedication that went into reaching that milestone. By doing so, we create positive associations with our goals and make it more likely that we’ll continue striving for future success.

Here are some ideas for rewarding yourself:

- Take a break: Give yourself permission to step away from work or responsibilities and recharge. This could be a few hours of reading, a relaxing bath, or a walk in nature.

- Enjoy a favorite meal: Treat yourself to a delicious meal that you’ve been craving. Whether it’s a fancy restaurant or a homemade dish, make it a special occasion.

- Buy something you’ve been wanting: It doesn’t have to be expensive, but a small purchase can be a great way to celebrate a milestone.

- Spend time with loved ones: Connect with people who matter to you and enjoy their company.

- Do something you love: Engage in an activity that brings you joy and fulfillment, like painting, playing music, or reading a good book.

Remember that rewarding yourself is not about being selfish or indulgent. It’s about acknowledging your accomplishments and reinforcing the behavior that led to them. By celebrating milestones and rewarding ourselves, we create a positive feedback loop that motivates us to keep moving forward and achieving our dreams.