Are you a freelancer or entrepreneur struggling to manage your finances? Being your own boss is an exciting and rewarding path, but it can also be financially challenging. Without a steady paycheck and benefits, you have to be more intentional with your money. Managing your finances effectively is crucial for your success and financial security. But don’t worry, it’s not as complicated as it seems. This article will provide you with valuable personal finance tips tailored specifically for freelancers and entrepreneurs.

We’ll cover everything from setting up a budget to saving for taxes, building a safety net, and investing for the future. By understanding and implementing these personal finance strategies, you can achieve financial stability and peace of mind, allowing you to focus on growing your business. So, whether you’re just starting out or have been freelancing or running your own business for a while, read on to discover the essential financial tips that will help you thrive in the world of self-employment.

Income Fluctuations and Budgeting

Income fluctuations are a common reality for many people, whether due to seasonal work, freelance gigs, or unexpected changes in employment. These fluctuations can make it challenging to stick to a budget and manage finances effectively. However, with a strategic approach, you can navigate income fluctuations and maintain financial stability.

Embrace a Flexible Budgeting Approach

Instead of a rigid budget, consider a flexible budgeting approach that adapts to your changing income. This involves creating a base budget that covers essential expenses, such as rent, utilities, and groceries, and allocating remaining funds to savings, debt repayment, and discretionary spending.

Track Income and Expenses

To understand your income patterns and spending habits, it’s crucial to track both your income and expenses. Use a budgeting app, spreadsheet, or notebook to record all transactions. This will help you identify areas where you can cut back or adjust your spending during periods of lower income.

Build an Emergency Fund

Having an emergency fund is essential for navigating income fluctuations. Aim to save 3-6 months’ worth of living expenses in a readily accessible account. This cushion will provide financial security during unexpected events, such as job loss or medical emergencies.

Consider a Side Hustle or Additional Income Source

If you anticipate income fluctuations, having a side hustle or additional income source can provide a safety net. This can help you supplement your primary income during periods of reduced earnings and build your financial resilience.

Review and Adjust Your Budget Regularly

Regularly review your budget and make adjustments based on your income and expenses. This could involve cutting back on non-essential spending during lean months or increasing your savings rate when your income is higher.

Seek Professional Advice

If you’re struggling to manage income fluctuations, don’t hesitate to seek professional advice from a financial advisor. They can provide personalized guidance on budgeting, saving, and investing based on your unique circumstances.

Conclusion

Income fluctuations can be challenging, but with a flexible budgeting approach, careful tracking, and a strategic plan, you can navigate these challenges and achieve your financial goals. By embracing a proactive approach to your finances, you can build financial stability and navigate the ups and downs of income with confidence.

Creating a Separate Business Budget

A business budget is a financial plan that outlines how much money you expect to earn and spend over a specific period. It is a vital tool for any business owner, regardless of the size or industry. A well-crafted budget can help you make informed decisions about your business, track your progress, and stay on top of your finances.

One of the most important aspects of creating a successful budget is to separate your personal and business finances. This means creating two separate accounts, one for your business and one for your personal expenses. This separation will make it much easier to track your business income and expenses and prevent confusion when it comes time to file your taxes.

Benefits of a Separate Business Budget

There are many benefits to creating a separate business budget. Some of the key advantages include:

- Improved financial management: Keeping your business finances separate allows you to track income and expenses accurately, making it easier to manage your cash flow and make informed financial decisions.

- Increased accountability: A separate budget can help you stay accountable for your business spending and ensure that you are using your resources wisely.

- Simplified tax filing: Keeping your business finances separate makes it much easier to prepare your taxes, as you will have a clear record of your income and expenses.

- Enhanced credibility: Having a separate business budget can enhance your business’s credibility and attract investors or lenders.

Steps to Creating a Separate Business Budget

Here are some steps to guide you in creating a separate business budget:

- Open a separate business bank account: This is the most crucial step to separate your personal and business finances.

- Categorize your income and expenses: Classify your business income and expenses into relevant categories to track spending patterns.

- Track your income and expenses: Regularly monitor your income and expenses to identify any discrepancies or areas where you can save.

- Project future income and expenses: Estimate your income and expenses for the next year or more to plan for growth and unexpected costs.

- Review and adjust your budget regularly: Ensure your budget is updated and reflects the current state of your business.

Conclusion

Creating a separate business budget is an essential step for any entrepreneur. It helps to improve financial management, increase accountability, and streamline tax filing. By separating your personal and business finances, you can gain a clear understanding of your business’s financial health and make informed decisions for its growth and success.

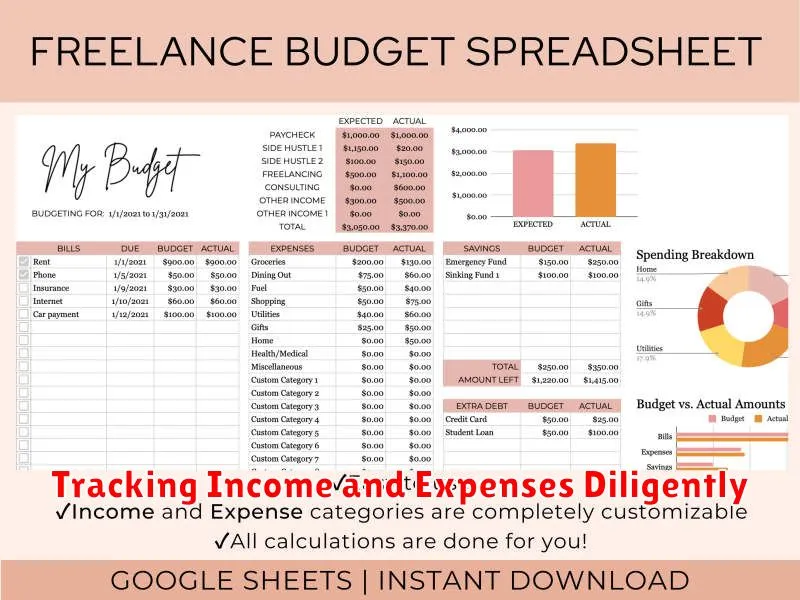

Tracking Income and Expenses Diligently

Tracking income and expenses diligently is crucial for maintaining financial stability and achieving your financial goals. Whether you’re a small business owner, a freelancer, or simply looking to manage your personal finances better, keeping an accurate record of your money flow can provide valuable insights and help you make informed financial decisions.

Here are some key benefits of tracking your income and expenses:

- Identify Spending Patterns: Tracking your expenses allows you to see where your money is going and identify areas where you might be overspending. This awareness can help you prioritize spending and make adjustments to your budget.

- Set Realistic Financial Goals: By understanding your income and expenses, you can set realistic financial goals based on your actual spending patterns. Whether it’s saving for a down payment, paying off debt, or investing, tracking helps you stay on track.

- Improve Budgeting Accuracy: Budgeting becomes more effective when you have accurate data about your income and expenses. You can make informed decisions about how to allocate your funds and avoid unexpected financial surprises.

- Track Progress and Make Adjustments: Tracking your income and expenses allows you to monitor your progress towards your financial goals. If you’re not on track, you can easily adjust your spending habits or income sources to get back on course.

- Prepare for Tax Season: Keeping detailed records of your income and expenses is essential for filing your taxes accurately. This can help you avoid penalties and ensure you receive all the deductions and credits you’re entitled to.

There are various methods for tracking income and expenses, from simple spreadsheets to sophisticated financial software. Choose the method that best suits your needs and preferences. Regardless of the method you choose, consistency is key.

Make it a habit to track your income and expenses regularly, whether it’s daily, weekly, or monthly. The more frequently you track, the better insights you will gain into your financial situation. By diligently tracking your income and expenses, you can gain control of your finances, achieve your financial goals, and build a strong financial foundation for your future.

Managing Taxes as a Freelancer or Entrepreneur

Being a freelancer or entrepreneur has its perks, but it also comes with the responsibility of managing your own taxes. While this may seem daunting, it’s crucial to understand the basics and stay organized to ensure smooth sailing throughout the year.

Understanding Your Tax Obligations

As a freelancer or entrepreneur, you’re classified as a self-employed individual. This means you’re responsible for paying both your own income taxes and self-employment taxes, which cover Social Security and Medicare. Unlike traditional employees, where taxes are withheld from paychecks, you’ll need to estimate your tax liability and make quarterly payments.

Choosing a Tax Filing Status

The tax filing status you choose will impact your tax liability. You have several options, including:

- Single: For those who are unmarried or legally separated.

- Married Filing Jointly: For married couples who choose to file their taxes together.

- Married Filing Separately: For married couples who choose to file their taxes individually.

- Head of Household: For unmarried individuals who pay more than half the costs of supporting a qualifying child or dependent.

- Qualifying Widow(er) with Dependent Child: For surviving spouses who meet specific criteria.

Tracking Your Income and Expenses

Keeping accurate records is essential for managing your taxes. You’ll need to track all your income and expenses, including:

- Income: This includes all payments you receive for your services, including invoices, direct deposits, and cash payments.

- Expenses: This includes any costs incurred in running your business, such as office supplies, software subscriptions, travel expenses, and professional services.

Estimating Your Tax Liability

Estimating your tax liability throughout the year is crucial to avoid penalties. You can use various methods, such as:

- Using tax software: Online tax software can help you estimate your tax liability based on your income and expenses.

- Consulting a tax professional: A tax advisor can provide personalized guidance and help you create a tax plan.

Making Quarterly Tax Payments

As a self-employed individual, you’re required to make quarterly estimated tax payments. These payments ensure you’re keeping up with your tax obligations throughout the year and avoid penalties for underpayment. You can make these payments through the IRS website or by mail.

Deductions and Credits

There are various deductions and credits available to self-employed individuals, which can help reduce your tax liability. Some common deductions include:

- Home office deduction: If you use a portion of your home for business purposes, you can deduct a portion of your home expenses.

- Business expenses: This includes expenses related to running your business, such as office supplies, marketing, and professional services.

- Health insurance premiums: You can deduct the cost of your health insurance premiums if you’re self-employed.

Tax Filing Season

You’ll need to file your tax return annually, typically by April 15th. When filing your return, you’ll need to provide detailed records of your income, expenses, and any deductions or credits you claim.

Seeking Professional Help

If you’re unsure about your tax obligations or find the process overwhelming, it’s highly recommended to consult a tax professional. They can provide personalized advice, help you navigate the complexities of tax laws, and ensure you’re maximizing your tax savings.

Managing taxes as a freelancer or entrepreneur can be a challenge, but by understanding the basics, staying organized, and seeking professional help when needed, you can ensure smooth sailing and maximize your financial well-being.

Building an Emergency Fund for Lean Times

In the unpredictable world we live in, financial emergencies can strike at any time. A sudden job loss, unexpected medical bills, or a car breakdown can quickly derail your financial stability. That’s why it’s crucial to have an emergency fund, a safety net that can cushion you during tough times.

Why is an Emergency Fund Important?

An emergency fund provides a sense of security and peace of mind. It allows you to navigate unexpected expenses without resorting to high-interest loans or dipping into your savings. Here are some key benefits:

- Reduces financial stress: Knowing you have a financial buffer can alleviate anxiety about unexpected events.

- Prevents debt accumulation: You can avoid borrowing money at high interest rates by using your emergency fund.

- Provides flexibility: An emergency fund allows you to make financial decisions without feeling pressured.

- Protects your long-term goals: You can avoid jeopardizing your savings for retirement or other goals by using your emergency fund for immediate needs.

How Much Should You Save?

The general recommendation is to have 3-6 months of living expenses in your emergency fund. This amount should cover your essential costs, including rent/mortgage, utilities, groceries, transportation, and debt payments. However, the ideal amount depends on your individual circumstances, such as your income, expenses, and risk tolerance.

Building Your Emergency Fund

Start small and be consistent. Set a realistic savings goal and contribute to your emergency fund regularly. Here are some strategies:

- Automate your savings: Set up automatic transfers from your checking account to your savings account.

- Challenge yourself with a “no-spend” day or week: Track your expenses and see where you can cut back.

- Find extra income: Consider a side hustle or selling unused items to boost your savings.

- Negotiate lower bills: Contact your service providers to see if you can lower your monthly expenses.

Protecting Your Emergency Fund

Once you’ve built a solid emergency fund, protect it from erosion. Keep your money in a high-yield savings account or money market account. Avoid using your emergency fund for non-essential expenses, and replenish it regularly.

Conclusion

Building an emergency fund may seem daunting, but it’s an essential step toward financial security. Start today by setting a goal, creating a budget, and committing to saving consistently. The peace of mind you’ll gain is priceless.

Setting Up a Retirement Savings Plan

Retirement may seem far off, but it’s never too early to start planning. A well-funded retirement savings plan can provide financial security and peace of mind in your later years. Here’s a comprehensive guide to help you set up a successful retirement savings plan:

1. Determine Your Retirement Goals

Before you start saving, it’s crucial to understand your retirement goals. Consider your desired lifestyle, estimated expenses, and how long you want your savings to last. For example, do you envision traveling the world, buying a vacation home, or simply maintaining your current standard of living? Having a clear vision will help you set realistic financial targets.

2. Choose the Right Retirement Savings Accounts

Several retirement savings account options are available, each with unique features and benefits. Here are some common choices:

- 401(k)s: Offered by employers, these accounts allow pre-tax contributions that grow tax-deferred. Some employers offer matching contributions, effectively boosting your savings.

- Traditional IRAs: Individual Retirement Accounts (IRAs) provide tax-deductible contributions, allowing you to potentially lower your current tax liability. You’ll pay taxes on withdrawals in retirement.

- Roth IRAs: Roth IRAs allow after-tax contributions, meaning you won’t owe taxes on withdrawals in retirement. This option can be particularly advantageous if you expect to be in a higher tax bracket in retirement.

3. Decide on Your Contribution Amount

The amount you contribute is a key factor in your retirement savings success. Start by aiming to contribute as much as possible, taking advantage of any employer matching programs offered. Consider increasing your contributions over time as your income grows. Many financial experts recommend saving at least 15% of your pre-tax income for retirement.

4. Invest Your Savings Wisely

Once you’ve contributed to your retirement accounts, it’s crucial to invest your savings wisely. Diversify your portfolio across different asset classes, such as stocks, bonds, and real estate, to minimize risk. You can choose between actively managed funds, passive index funds, or a combination of both. It’s essential to understand the associated risks and potential returns of each investment option.

5. Regularly Review and Adjust Your Plan

Life circumstances change over time, so it’s important to regularly review and adjust your retirement savings plan. Reassess your goals, investment strategies, and contribution amounts periodically to ensure they still align with your needs. As you get closer to retirement, you may want to shift your portfolio towards a more conservative approach.

6. Seek Professional Advice

For personalized guidance, consider seeking advice from a qualified financial advisor. They can help you develop a comprehensive retirement plan tailored to your specific goals and risk tolerance. Additionally, they can provide insights into tax strategies, investment options, and other factors that can significantly impact your retirement outcomes.

Remember, starting early and consistently saving for retirement is essential. By following these steps, you can set yourself up for a financially secure and fulfilling future.

Investing for Long-Term Financial Security

Investing is a crucial aspect of achieving long-term financial security. It allows your money to grow over time, helping you reach your financial goals. Whether you’re saving for retirement, a down payment on a house, or your children’s education, investing plays a vital role.

There are various investment options available, each with its own risk and reward profile. Some common types of investments include:

- Stocks: Represent ownership in a company. Stock prices fluctuate based on the company’s performance.

- Bonds: Loans you make to a company or government. They offer a fixed interest rate and are generally considered less risky than stocks.

- Real Estate: Investing in properties, such as houses, apartments, or commercial buildings.

- Mutual Funds and Exchange-Traded Funds (ETFs): Diversified portfolios of stocks, bonds, or other assets managed by professional fund managers.

When making investment decisions, it’s important to consider your financial goals, risk tolerance, and investment horizon. It’s also crucial to do your research and understand the potential risks and rewards associated with each investment.

Here are some key tips for long-term investing:

- Start early: The earlier you start investing, the more time your money has to grow.

- Diversify your portfolio: Don’t put all your eggs in one basket. Spread your investments across different asset classes to reduce risk.

- Invest regularly: Consistency is key. Make regular contributions to your investments, even if it’s a small amount.

- Be patient: Investing is a long-term game. Don’t expect to get rich quick. Stay focused on your goals and don’t panic sell during market fluctuations.

- Rebalance your portfolio: Periodically review your investment allocation and make adjustments as needed to maintain your desired risk profile.

Investing for long-term financial security requires discipline, patience, and a well-thought-out strategy. By following these tips and seeking professional advice if needed, you can set yourself up for a financially secure future.

Health Insurance and Other Essential Benefits for Freelancers

Being a freelancer offers many benefits, such as flexibility and independence. However, it also comes with certain responsibilities, such as securing your own health insurance and other essential benefits. Many freelancers worry about affording these benefits, but there are ways to ensure you have the coverage you need without breaking the bank.

Health Insurance

One of the biggest concerns for freelancers is health insurance. Without an employer-sponsored plan, you’ll need to find your own coverage. Fortunately, there are a few options available to freelancers.

- Individual Health Insurance Plans: These plans are purchased directly from insurance companies and can be tailored to your individual needs. You can find plans on the Health Insurance Marketplace or through a broker.

- Association Health Plans: These plans are offered through professional associations and can offer lower premiums than individual plans.

- Short-Term Health Insurance: This type of insurance provides temporary coverage for a limited period, often used as a stop-gap measure until you qualify for a longer-term plan.

It’s crucial to compare plans carefully to find the best coverage at an affordable price. Consider factors such as premiums, deductibles, copayments, and the network of providers. It’s also essential to understand your state’s health insurance regulations.

Other Essential Benefits

In addition to health insurance, freelancers should also consider the following benefits:

- Disability Insurance: This coverage protects you financially if you become unable to work due to an illness or injury. It can help replace lost income and provide peace of mind.

- Life Insurance: This insurance provides a death benefit to your beneficiaries if you pass away. It can help cover expenses such as funeral costs and outstanding debts.

- Retirement Savings: As a freelancer, you’re responsible for saving for your retirement. You can contribute to a traditional IRA or a Roth IRA, or open a solo 401(k) if you’re self-employed.

- Professional Liability Insurance: This coverage protects you from financial losses if you’re accused of negligence or malpractice in your work. It’s essential for many freelancers, especially those who work with clients’ confidential information or provide professional services.

Finding Affordable Benefits

There are several ways to make essential benefits more affordable:

- Explore State and Federal Resources: Many states and federal agencies offer resources to help freelancers access affordable insurance and other benefits. Check with your state’s Department of Insurance or the Small Business Administration (SBA).

- Consider a Health Savings Account (HSA): HSAs allow you to save pre-tax dollars for healthcare expenses, which can reduce your tax burden.

- Negotiate with Clients: Some clients are willing to pay for certain benefits, such as health insurance or professional liability insurance. It’s worth having this conversation with your clients.

- Join a Freelancer Association: Many freelancer associations offer discounts on health insurance and other benefits to their members.

Securing essential benefits is crucial for freelancers to protect their financial well-being. By understanding your options and taking advantage of available resources, you can find affordable and comprehensive coverage that meets your needs.