Are you looking for ways to grow your wealth and achieve financial freedom? Investing is one of the most effective ways to do so, but it can seem daunting and complicated. Luckily, there are now a plethora of investment apps that make investing accessible and easy for everyone. These apps offer a user-friendly interface, low fees, and a range of investment options, making it easier than ever to start building your portfolio.

Whether you’re a seasoned investor or just starting out, finding the right investment app is crucial. But with so many options available, how do you choose the one that best suits your needs? In this article, we’ll explore the best investment apps for building wealth, highlighting their features, pros and cons, and what makes them stand out from the crowd. Let’s dive in and find the perfect app to help you achieve your financial goals.

Understanding Your Investment Goals and Risk Tolerance

Investing can be a daunting task, especially for those new to the financial world. With so many options available, it can be overwhelming to know where to start. However, the first step to successful investing is understanding your own investment goals and risk tolerance. These two key factors will guide your investment decisions and help you create a portfolio that aligns with your financial aspirations.

Investment Goals

Your investment goals are the specific financial objectives you hope to achieve through investing. These goals can be short-term, such as saving for a down payment on a house, or long-term, like funding your retirement. It’s crucial to define your goals clearly, as they will influence your investment strategy and time horizon.

- Time Horizon: How long do you have to reach your investment goals? Short-term goals typically require less risk, while long-term goals allow for more aggressive investing.

- Investment Amount: How much money are you willing and able to invest? This will determine the types of investments you can consider.

- Desired Return: What rate of return are you hoping to achieve? Realistic expectations are key to avoiding disappointment and unnecessary risk-taking.

Risk Tolerance

Your risk tolerance measures your ability and willingness to accept fluctuations in the value of your investments. Some investors are comfortable with significant volatility, while others prefer a more conservative approach. Understanding your risk tolerance is essential to choosing investments that match your comfort level.

Several factors influence your risk tolerance, including:

- Age: Younger investors typically have a longer time horizon and can afford to take on more risk, while older investors may prioritize preserving capital.

- Financial Situation: Your income, expenses, and debt level can influence your risk tolerance. If you have a stable income and low debt, you may be able to handle more risk.

- Investment Experience: More experienced investors may be more comfortable with higher-risk investments.

- Personal Circumstances: Factors like family responsibilities or health concerns can impact your willingness to take risks.

Matching Goals and Tolerance

Once you’ve identified your investment goals and risk tolerance, you can start to develop a portfolio that aligns with both. For example, a young investor with a long time horizon and a high risk tolerance might invest in a diversified portfolio of stocks and other growth-oriented assets. On the other hand, an older investor nearing retirement with a low risk tolerance might focus on bonds and other conservative investments.

It’s important to remember that your goals and tolerance can change over time. As your financial situation and life circumstances evolve, you may need to adjust your investment strategy accordingly. Regular reviews and adjustments are crucial to ensuring your portfolio remains aligned with your long-term objectives.

Seeking Professional Advice

If you’re unsure about how to determine your investment goals or risk tolerance, or how to build a portfolio that meets your needs, it’s always a good idea to seek professional advice from a financial advisor. A qualified advisor can help you develop a personalized plan that takes into account your unique circumstances and helps you achieve your financial aspirations.

Types of Investment Apps Available

The rise of investment apps has made it easier than ever for people to invest in the stock market and other financial instruments. With so many different apps available, it can be overwhelming to choose the right one for your needs. Here are some of the most common types of investment apps available:

Brokerage Apps

Brokerage apps, such as Robinhood, Webull, and Fidelity Go, allow you to buy and sell stocks, ETFs, and other securities. They typically offer a wide range of features, including real-time quotes, charting tools, and research reports. Some brokerage apps also offer fractional shares, which allow you to buy a portion of a share of stock.

Robo-Advisors

Robo-advisors, such as Betterment, Wealthfront, and Acorns, are automated investment platforms that use algorithms to build and manage your portfolio. Robo-advisors typically charge lower fees than traditional investment advisors and offer a variety of investment strategies, such as target-date funds and diversified portfolios.

Micro-Investing Apps

Micro-investing apps, such as Acorns and Stash, allow you to invest small amounts of money on a regular basis. These apps often use spare change from purchases or round up your transactions to the nearest dollar and invest the difference. Micro-investing apps can be a good option for beginners or those who want to start investing with a small amount of money.

Cryptocurrency Apps

Cryptocurrency apps, such as Coinbase, Kraken, and Gemini, allow you to buy, sell, and trade cryptocurrencies. These apps typically offer a wide range of cryptocurrencies, including Bitcoin, Ethereum, and Litecoin. Cryptocurrency apps can be a volatile investment, but they can also offer the potential for high returns.

Investing in Real Estate

Apps like Fundrise, Roofstock, and Arrived Homes allow you to invest in real estate, either through REITs or by buying shares in individual properties. This can be a way to diversify your portfolio and potentially earn passive income.

It’s important to research different investment apps and compare their features, fees, and investment options before choosing one. Consider your investment goals, risk tolerance, and level of experience when making your decision.

Key Features to Look for in an Investment App

Investing can seem daunting, but with the right tools, it can be a rewarding and accessible experience. Investment apps have revolutionized the way people manage their finances, offering a convenient and user-friendly platform to build wealth. But with so many apps available, it can be overwhelming to choose the right one. This guide will highlight key features to look for when selecting an investment app.

Ease of Use and Navigation

The best investment apps are designed to be user-friendly, even for novice investors. Look for an app with a clear and intuitive interface, easy-to-understand terminology, and helpful tutorials or resources. You should be able to navigate the app effortlessly and access the information you need quickly.

Investment Options

A good investment app offers a variety of options to suit different investment goals and risk tolerances. Some popular choices include:

- Stocks: Individual company shares offer the potential for high returns, but also carry higher risk.

- ETFs (Exchange Traded Funds): ETFs track a specific index, offering diversification and lower costs compared to mutual funds.

- Mutual Funds: Professionally managed portfolios that pool money from multiple investors.

- Bonds: Fixed-income investments that offer lower risk than stocks.

- Real Estate: Some apps allow you to invest in real estate through REITs (Real Estate Investment Trusts).

Research and Educational Resources

A reputable investment app should provide access to research tools and educational resources to help you make informed investment decisions. Look for features like:

- Market Data: Real-time stock quotes, charts, and historical data.

- Financial News: Updates on market trends, company news, and economic indicators.

- Analyst Ratings: Expert opinions on stocks and other investments.

- Educational Content: Articles, videos, and tutorials to enhance your financial literacy.

Security and Privacy

Your financial data is sensitive, so it’s crucial to choose an investment app with robust security measures. Look for features like:

- Two-Factor Authentication: An extra layer of security to protect your account.

- Data Encryption: Protecting your personal and financial information from unauthorized access.

- Strong Password Requirements: Encourage the use of complex passwords.

Customer Support

You should be able to reach customer support easily if you have questions or encounter problems. Look for an app that offers multiple channels of support, such as email, phone, and live chat.

Fees and Commissions

Before investing, consider the fees associated with the app. Some apps may charge commissions on trades, account maintenance fees, or other charges. Compare fees across different apps to find the most affordable option.

Conclusion

Choosing the right investment app can empower you to take control of your financial future. By considering the key features discussed above, you can find an app that meets your individual needs and helps you achieve your financial goals. Remember to do your research, read reviews, and compare different options before making a decision. Happy investing!

Comparing Popular Investment Apps

In today’s digital age, investing has become more accessible than ever before, thanks to the emergence of numerous investment apps. These platforms offer a convenient and user-friendly way to manage your finances, allowing you to buy and sell stocks, bonds, ETFs, and other assets with just a few taps on your smartphone. However, with so many options available, it can be overwhelming to choose the right investment app for your needs.

To help you make an informed decision, we’ve compiled a comprehensive comparison of some of the most popular investment apps, considering factors such as user interface, fees, investment options, research tools, and customer support. Let’s dive in!

Robinhood

Robinhood is a popular investment app known for its commission-free trading, simple interface, and gamified features. It offers a wide range of investment options, including stocks, ETFs, options, and cryptocurrency. Robinhood also provides fractional shares, allowing you to invest in expensive stocks with smaller amounts of money.

Pros:

- Commission-free trading

- User-friendly interface

- Fractional shares

- Wide range of investment options

Cons:

- Limited research tools

- No access to mutual funds

- Gamification features can encourage risky behavior

Acorns

Acorns is a micro-investing app that automatically invests your spare change from everyday purchases. It utilizes “round-up” functionality, rounding up your purchases to the nearest dollar and investing the difference. Acorns offers a variety of portfolios based on your risk tolerance and investment goals.

Pros:

- Automatic investing

- Micro-investing

- Diversified portfolios

Cons:

- Limited investment options

- Higher fees compared to other apps

- Lack of advanced features

Stash

Stash is another micro-investing app that emphasizes fractional shares and thematic investing. It offers a variety of investment options, including ETFs, stocks, and fractional shares. Stash also provides educational content and personalized investing advice.

Pros:

- Fractional shares

- Thematic investing

- Educational content

Cons:

- Higher fees than commission-free brokers

- Limited research tools

- Not ideal for experienced investors

M1 Finance

M1 Finance is an investment app that focuses on automated investing and portfolio management. It allows you to create custom portfolios based on your investment goals and risk tolerance. M1 Finance also offers fractional shares and automatic rebalancing.

Pros:

- Automated investing

- Customizable portfolios

- Fractional shares

- Automatic rebalancing

Cons:

- Limited research tools

- No access to individual stocks

- Not ideal for active traders

Fidelity Go

Fidelity Go is a robo-advisor offered by Fidelity Investments. It provides automated portfolio management based on your investment goals and risk tolerance. Fidelity Go is a good option for investors who prefer a hands-off approach.

Pros:

- Automated portfolio management

- Low fees

- Access to Fidelity’s extensive resources

Cons:

- Limited customization options

- No access to individual stocks

Conclusion

Choosing the right investment app depends on your individual needs and preferences. Consider factors such as your investment goals, risk tolerance, experience level, and budget. By carefully comparing the features and fees of different apps, you can find the one that best suits your investment journey.

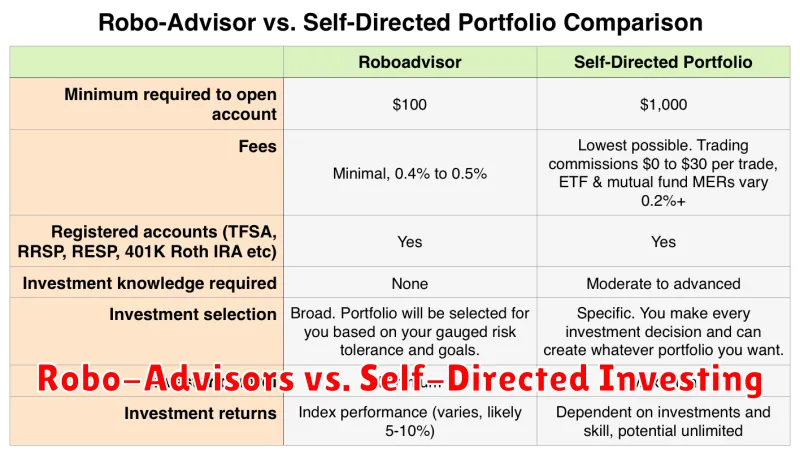

Robo-Advisors vs. Self-Directed Investing

The world of investing can be overwhelming, especially for those just starting out. There are countless investment options, complex financial jargon, and a constant stream of market news. But don’t worry, you’re not alone! There are two main approaches to investing: using a robo-advisor or taking a self-directed approach.

Let’s break down each option to help you decide which path is right for you.

Robo-Advisors: The Hands-Off Approach

Robo-advisors are automated investment platforms that use algorithms and technology to create and manage your investment portfolio. They typically offer a low-cost, hands-off approach to investing, making them attractive to beginners and busy individuals.

Here are some key benefits of using a robo-advisor:

- Convenience: Setting up an account and managing your portfolio is usually simple and can be done entirely online.

- Accessibility: Robo-advisors often have low minimum investment requirements, making them accessible to investors with smaller portfolios.

- Low Fees: Robo-advisors typically charge lower fees than traditional investment advisors.

- Diversification: Robo-advisors often use algorithms to create diversified portfolios across different asset classes, reducing risk.

However, robo-advisors also have some limitations:

- Limited Customization: While some robo-advisors allow for a degree of customization, they don’t offer the same level of flexibility as a self-directed approach.

- Lack of Personal Touch: Robo-advisors lack the personalized advice and financial guidance that traditional advisors provide.

- Limited Investment Options: Some robo-advisors may not offer a wide range of investment options.

Self-Directed Investing: The Hands-On Approach

Self-directed investing gives you complete control over your investment decisions. You choose your investments, manage your portfolio, and handle all transactions yourself.

Here are some advantages of self-directed investing:

- Flexibility: You have the freedom to choose any investment you want, from stocks and bonds to real estate and cryptocurrencies.

- Control: You’re in charge of every aspect of your investment strategy.

- Potential for Higher Returns: While riskier, you have the potential to earn higher returns if your investment choices are successful.

But self-directed investing also comes with its own challenges:

- Time Commitment: Researching investments, managing your portfolio, and staying informed about market trends can take a significant amount of time and effort.

- Risk: Without professional guidance, you’re responsible for making all investment decisions, which can lead to losses if you don’t have the necessary experience or knowledge.

- Emotional Investing: It can be difficult to remain objective when investing your own money, and emotional decisions can lead to poor investment choices.

Which Approach is Right for You?

The best approach depends on your individual circumstances, investment goals, and risk tolerance.

Robo-advisors are a good option for:

- Beginners who are new to investing.

- Busy individuals who want a hands-off approach.

- Investors with limited time and resources.

Self-directed investing is a good option for:

- Experienced investors who want complete control over their portfolios.

- Individuals who enjoy researching and making their own investment decisions.

- Investors who are willing to take on a higher level of risk.

Ultimately, the best way to decide is to carefully consider your individual needs and preferences. You can also consult with a financial advisor to get personalized advice and guidance.

Fees and Charges to Consider

When choosing a financial product or service, it’s crucial to consider the associated fees and charges. These costs can significantly impact your overall financial health, so it’s essential to be aware of them before making any decisions.

Here are some common fees and charges you should be aware of:

Account Fees

These fees are associated with maintaining and using your accounts. They may include:

- Monthly maintenance fees: Charged for simply having an account open.

- Inactivity fees: Applied if you don’t use your account for a certain period.

- Overdraft fees: Charged when you spend more money than you have in your account.

- Minimum balance fees: Applied if your account falls below a specific minimum balance.

Transaction Fees

These fees are related to the transactions you make using your account. Common transaction fees include:

- ATM withdrawal fees: Charged for using an ATM outside your bank’s network.

- Foreign transaction fees: Applied for using your card or account in a foreign country.

- Wire transfer fees: Charged for transferring money electronically.

- Check processing fees: Applied for depositing or cashing checks.

Investment Fees

If you’re investing, you may encounter various fees, such as:

- Management fees: Charged by investment managers for handling your investments.

- Trading commissions: Fees charged for buying and selling securities.

- Expense ratios: Annual fees associated with mutual funds and exchange-traded funds (ETFs).

Loan Fees

When taking out a loan, you may be required to pay:

- Origination fees: Charged for processing your loan application.

- Closing costs: Fees associated with finalizing the loan.

- Prepayment penalties: Charges for paying off your loan early.

- Late payment fees: Applied if you miss a loan payment.

It’s essential to compare fees and charges across different financial institutions and products before making a decision. Remember, understanding these costs can help you make informed choices and avoid unexpected expenses.

Security Measures and Data Protection

In today’s digital age, where information is constantly being shared and stored online, ensuring data security and privacy is paramount. Organizations and individuals alike must prioritize robust security measures to protect sensitive information from unauthorized access, theft, or misuse.

Data encryption plays a crucial role in safeguarding data. This process involves converting data into an unreadable format, making it incomprehensible to unauthorized individuals. Encryption algorithms use complex mathematical formulas to scramble data, ensuring its confidentiality and integrity.

Access controls are essential for limiting access to sensitive data to authorized personnel only. By implementing strong password policies, multi-factor authentication, and role-based access control, organizations can prevent unauthorized access and mitigate the risk of data breaches.

Regular security audits and vulnerability assessments are vital for identifying and mitigating potential security risks. These assessments help organizations to proactively address security vulnerabilities, implement necessary security controls, and ensure compliance with industry standards.

Employee training and awareness are critical components of a comprehensive data protection strategy. Educating employees on best practices for data security, phishing prevention, and password management can significantly reduce the risk of human error and malicious attacks.

Data backup and recovery are essential for safeguarding data against loss or corruption. Regular backups of critical data allow organizations to restore data in case of disaster, hardware failure, or malicious attacks. Implementing a robust data recovery plan is essential for business continuity and data resilience.

Compliance with data protection regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), is crucial for organizations that handle personal data. These regulations set standards for data collection, storage, and processing, ensuring data privacy and individual rights.

By implementing these security measures and data protection practices, organizations can effectively mitigate security risks, protect sensitive information, and foster trust with their stakeholders. Ensuring data security and privacy is an ongoing process that requires continuous vigilance, adaptation, and improvement.

Tips for Choosing the Right Investment App for You

In today’s digital age, investing has become more accessible than ever before, thanks to the rise of investment apps. These platforms offer a user-friendly interface and allow you to manage your investments conveniently from your smartphone or computer. However, with so many options available, choosing the right investment app can be overwhelming. Here are some tips to help you navigate the world of investment apps and find the one that best suits your needs.

1. Define Your Investment Goals

Before you start exploring different apps, it’s essential to define your investment goals. What are you hoping to achieve with your investments? Are you saving for retirement, buying a house, or simply building a portfolio for long-term growth? Your goals will determine the type of investments you need and the features you should look for in an app.

2. Consider Your Investment Experience

Your investment experience is another crucial factor to consider. Are you a seasoned investor or a beginner? If you’re new to investing, you might prefer an app that offers educational resources, tutorials, and a guided approach. On the other hand, experienced investors might look for apps with advanced features and more flexibility.

3. Research and Compare Apps

Once you’ve determined your goals and experience level, it’s time to research and compare different investment apps. Look for apps that offer the following features:

- A wide range of investment options: This could include stocks, bonds, mutual funds, ETFs, and more.

- User-friendly interface: The app should be easy to navigate and understand, regardless of your experience level.

- Low fees and commissions: Fees can eat into your returns, so it’s essential to choose an app with competitive pricing.

- Strong security measures: Your financial information should be protected with robust security protocols.

- Excellent customer support: You should be able to reach customer support easily and get assistance when you need it.

4. Read Reviews and Testimonials

Before you commit to an app, read reviews and testimonials from other users. This can give you valuable insights into the app’s performance, reliability, and customer service.

5. Try a Demo or Free Trial

Many investment apps offer demo accounts or free trials. This allows you to test the app’s features and interface before committing to a paid account.

6. Choose an App That Aligns with Your Values

Some investment apps may align with specific values, such as sustainability or social responsibility. If you’re passionate about these causes, you might want to choose an app that reflects your values.

By following these tips, you can find the right investment app to help you achieve your financial goals. Remember, investing is a marathon, not a sprint, so take your time, do your research, and choose an app that empowers you to make informed decisions.