Planning for retirement can feel overwhelming, but it doesn’t have to be. Retirement calculators are powerful tools that can help you gain clarity and confidence in your financial future. These online calculators allow you to input your current savings, income, and expenses, and then project how much money you’ll need to retire comfortably. By using a retirement calculator, you can get a personalized estimate of your retirement readiness and identify areas where you can make adjustments to reach your goals.

Whether you’re just starting to think about retirement or are nearing the finish line, using a retirement calculator can provide valuable insights. By understanding your current financial situation and projecting your future needs, you can create a plan that sets you up for a successful and comfortable retirement. Ready to take control of your financial future? Let’s explore the benefits of retirement calculators and how to use them effectively.

Why Retirement Planning is Essential

Retirement planning is the process of preparing for life after you stop working. It involves making decisions about how you will save money, invest your savings, and spend your money in retirement. Retirement planning is essential because it helps you to secure your financial future and enjoy a comfortable lifestyle in your later years.

Here are some of the key benefits of retirement planning:

- Financial security: Retirement planning helps you to ensure that you have enough money to cover your expenses in retirement, such as housing, food, healthcare, and travel. Without proper planning, you may find yourself struggling financially in your later years.

- Peace of mind: Knowing that you have a plan in place for your retirement can provide you with peace of mind. You can relax and enjoy your golden years without worrying about money.

- Freedom and flexibility: Retirement planning can give you the freedom to choose how you want to spend your time and money. You can pursue your passions, travel the world, or simply relax and enjoy life.

- Control over your future: Retirement planning allows you to take control of your financial future. You can make decisions about your savings, investments, and spending that will help you achieve your retirement goals.

Retirement planning is not just about saving money. It is also about making smart decisions about your investments, managing your expenses, and planning for your future healthcare needs. By taking the time to plan for your retirement, you can set yourself up for a secure and enjoyable future.

Understanding Different Retirement Savings Plans

Retirement planning is crucial for securing your financial future. There are various retirement savings plans available, each with its unique features and benefits. Understanding these options is essential to choose the right plan that aligns with your financial goals and circumstances. This guide explores some of the most common retirement savings plans.

401(k) Plans

A 401(k) plan is a defined-contribution retirement savings plan offered by employers. Employees contribute a portion of their pre-tax salary to the plan, which grows tax-deferred. Some employers may also offer matching contributions, boosting your savings. 401(k) plans are typically offered by large companies and can be either traditional or Roth.

403(b) Plans

Similar to 401(k) plans, 403(b) plans are defined-contribution retirement savings plans, but they are offered by non-profit organizations, such as schools, hospitals, and religious institutions. The contribution and tax treatment are similar to 401(k) plans, offering pre-tax contributions and tax-deferred growth.

Individual Retirement Accounts (IRAs)

IRAs are individual retirement accounts that allow you to save for retirement on your own. They offer flexibility and tax advantages, with two primary types: traditional and Roth.

- Traditional IRAs allow you to contribute pre-tax dollars, reducing your taxable income in the present. You’ll pay taxes on the withdrawals in retirement.

- Roth IRAs accept after-tax contributions. Your withdrawals in retirement are tax-free, making it an attractive option for those expecting to be in a higher tax bracket during retirement.

Simplified Employee Pension (SEP)

SEPs are retirement plans designed for self-employed individuals and small business owners. You can contribute both as an employee and an employer, allowing for tax-deferred growth and potential tax deductions.

Solo 401(k)

Solo 401(k) plans are similar to SEPs, but they offer more flexibility in contribution limits and potential for higher contributions. These plans are also suitable for self-employed individuals and small business owners.

Choosing the Right Plan

The best retirement savings plan for you depends on your individual circumstances, such as your age, income, and employment status. Consulting with a financial advisor can help you navigate the complex world of retirement planning and choose the most suitable option for your financial future.

Factors Affecting Your Retirement Needs

Planning for retirement is an essential part of a secure financial future. However, retirement needs vary greatly depending on individual circumstances. Several factors influence how much money you’ll need and how long your savings will last. Here are some key factors to consider:

Lifestyle

Your desired lifestyle in retirement is a major determining factor. Do you envision traveling extensively, pursuing hobbies, or simply enjoying a quiet life at home? A more active lifestyle will naturally require more financial resources. Consider how much you expect to spend on travel, entertainment, dining, and other activities.

Healthcare

Healthcare costs can significantly impact your retirement budget. As you age, healthcare needs tend to increase, and medical expenses can escalate. Factor in potential long-term care costs, such as assisted living or nursing home expenses. It’s wise to consult with healthcare professionals and financial advisors to estimate your healthcare needs.

Inflation

Inflation erodes the purchasing power of your savings over time. It’s crucial to consider the impact of inflation on your retirement planning. As prices rise, your savings will need to grow accordingly to maintain your desired standard of living.

Life Expectancy

Your life expectancy plays a vital role in determining how long your retirement savings need to last. As life spans continue to increase, you may need to plan for a longer retirement period. Consider factors like family history and overall health when estimating your life expectancy.

Debt

Carrying significant debt into retirement can strain your financial resources. Before retirement, strive to reduce or eliminate high-interest debt, such as credit card balances or personal loans. This will free up more income for your retirement needs.

Investment Returns

Your investment returns will influence the growth of your retirement savings. It’s essential to develop a diversified investment strategy and seek professional advice to maximize your returns while managing risk.

Tax Implications

Tax implications can affect your retirement income. Consider how taxes will impact your Social Security benefits, pension income, and withdrawals from retirement accounts. Seek guidance from a tax advisor to optimize your tax strategy.

Conclusion

Retirement planning is a personalized journey. Understanding the factors that influence your retirement needs is essential for achieving a comfortable and financially secure retirement. By carefully considering these factors and making informed decisions, you can set yourself up for a successful and fulfilling retirement experience.

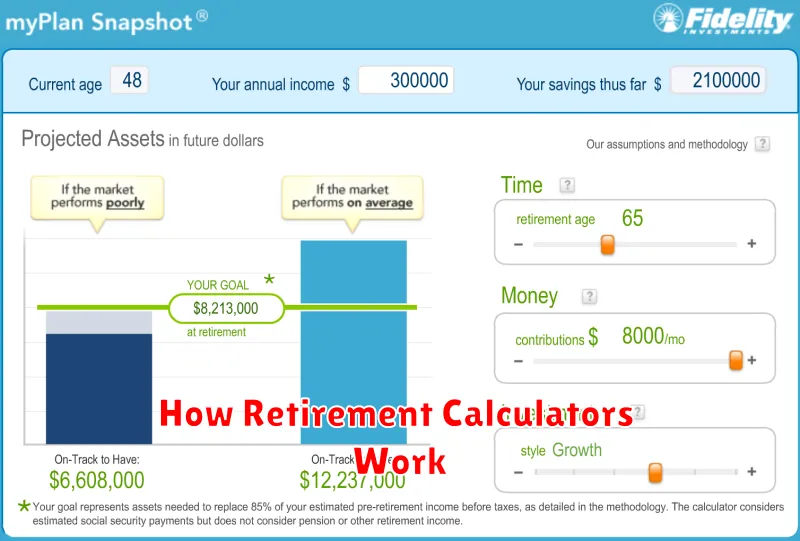

How Retirement Calculators Work

Retirement calculators are tools that help you estimate how much money you’ll need to save for retirement and how long your savings will last. They take into account factors like your current age, income, expenses, investment returns, and desired retirement age.

Retirement calculators use a variety of formulas and assumptions to make these estimates. The most common formula is the rule of 72, which estimates how long it will take for an investment to double in value. To calculate the doubling time, you divide 72 by the annual rate of return. For example, if your investment earns a 6% annual return, it will take approximately 12 years (72 / 6) for your investment to double.

Retirement calculators also consider your expenses. They use your current expenses and project how they will change in retirement. For example, your housing costs might decrease if you move to a smaller home or relocate to a less expensive area. On the other hand, your healthcare costs might increase as you age.

Retirement calculators can be a helpful tool for planning your retirement, but it’s important to remember that they are just estimates. Your actual retirement experience may differ depending on a variety of factors, such as market performance, inflation, and your own personal circumstances.

Inputting Your Financial Information

When providing your financial information, it is crucial to ensure its accuracy and security.

Here are some key tips to keep in mind:

- Double-check all details: Carefully review your account numbers, names, addresses, and other information to ensure there are no errors.

- Use a secure connection: Always input your financial information on websites that use HTTPS, indicated by a padlock icon in the address bar.

- Avoid public Wi-Fi: Public Wi-Fi networks are less secure and can expose your information to potential threats.

- Be wary of phishing scams: Never click on suspicious links or provide your information to unfamiliar websites.

By adhering to these guidelines, you can minimize the risk of financial fraud and safeguard your sensitive data.

Interpreting the Results and Adjusting Your Plan

After running your experiment, you’ll have a wealth of data to analyze. This is where you get to see what worked, what didn’t, and what areas you need to focus on going forward. Don’t be afraid to dive deep into the data, but keep your goals in mind.

First, look at your key metrics. Did you achieve the desired outcome? If not, why not? This is where the analysis gets interesting. Look for patterns in the data. Are there any particular groups that performed better or worse than others? Did changes in your marketing strategy lead to improvements?

Next, consider your hypothesis. Did the results support or refute your initial assumptions? This can help you understand the underlying reasons for your successes and failures.

With this information, you can start adjusting your plan. If something isn’t working, don’t be afraid to pivot. Experiment with new approaches and keep iterating. This is a continuous process, and the more you learn, the better your plan will become.

Remember, the goal is to learn and improve. Even if your experiment didn’t produce the desired results, it still provided valuable insights that you can use to move forward.

Exploring Different Retirement Scenarios

Retirement is a significant life transition, and it’s essential to plan for it carefully. There are many different retirement scenarios, and each one comes with its own set of challenges and opportunities. Understanding these scenarios can help you make informed decisions about your finances, lifestyle, and future plans.

One common retirement scenario is the “traditional retirement,” where individuals retire from their careers at a specific age, typically 65, and begin receiving retirement benefits. This scenario often involves a significant lifestyle change, as people transition from working to leisure and spending more time with family and friends.

Another scenario is the “phased retirement,” where individuals gradually reduce their work hours or transition to part-time employment. This can be a good option for those who want to maintain some income and stay active but also enjoy more time for leisure activities.

A third scenario is the “delayed retirement,” where individuals choose to work longer than the traditional retirement age. This can be motivated by a desire to save more money, maintain a sense of purpose, or simply enjoy their work.

Finally, there is the “early retirement” scenario, where individuals retire before the traditional age. This can be a challenging scenario, as it may require significant financial planning and a willingness to adjust to a different lifestyle.

It’s important to remember that no two retirement scenarios are exactly alike. The best scenario for you will depend on your individual circumstances, including your financial situation, health, lifestyle preferences, and career goals.

By exploring different retirement scenarios and developing a plan that addresses your unique needs and goals, you can increase your chances of enjoying a comfortable and fulfilling retirement.

Seeking Professional Financial Advice

In today’s complex financial world, it can be challenging to navigate the intricacies of investments, savings, and financial planning. This is where seeking professional financial advice from a qualified advisor can prove invaluable. A financial advisor can provide personalized guidance and support to help you achieve your financial goals.

Benefits of Professional Financial Advice

Here are some key benefits of working with a financial advisor:

- Objective Perspective: Financial advisors offer an unbiased viewpoint, helping you make rational decisions free from emotional influences. They can objectively analyze your situation, identify potential risks and opportunities, and provide recommendations tailored to your needs.

- Expertise and Knowledge: Financial advisors possess extensive knowledge of the financial markets, investment strategies, and tax laws. They stay up-to-date on industry trends and can leverage their expertise to create a robust financial plan.

- Personalized Financial Plan: A financial advisor will work closely with you to understand your goals, risk tolerance, and financial circumstances. They will then develop a customized financial plan that outlines your investment strategy, savings goals, and retirement planning.

- Accountability and Monitoring: With a financial advisor, you have a dedicated professional who regularly monitors your investments, adjusts your portfolio based on market conditions, and ensures that you stay on track to meet your goals.

Finding the Right Financial Advisor

When choosing a financial advisor, it’s crucial to find someone who is:

- Qualified and Licensed: Ensure they hold the necessary certifications and licenses to provide financial advice in your jurisdiction.

- Experienced and Reputable: Look for advisors with a proven track record and positive client testimonials.

- Transparent and Communicative: Choose an advisor who explains their fees clearly and keeps you informed about your investments and portfolio performance.

- A Good Fit for You: Build a relationship with an advisor who you trust and feel comfortable discussing your financial matters with.

Conclusion

Seeking professional financial advice can empower you to make informed decisions and achieve your financial aspirations. By working with a qualified advisor, you gain access to expert guidance, personalized strategies, and ongoing support to help you build a secure and prosperous financial future.

Making Informed Decisions for a Secure Future

In today’s dynamic and rapidly evolving world, making informed decisions is paramount to securing a brighter future. Whether it’s navigating personal finances, choosing career paths, or engaging in civic discourse, the ability to gather reliable information, analyze options, and make sound judgments is crucial. This article explores the significance of informed decision-making and provides insights into how individuals can cultivate this essential skill.

The Importance of Informed Decisions

Informed decisions are not merely about choosing the “right” option; they are about making choices that are grounded in understanding, reason, and a consideration of potential consequences. This approach fosters:

- Enhanced Confidence: When individuals feel equipped with the necessary knowledge and insights, they approach decision-making with greater confidence and a sense of control.

- Reduced Risk: By carefully evaluating options and potential outcomes, individuals can minimize the likelihood of making choices that lead to regret or negative repercussions.

- Increased Success: Informed decisions often align with long-term goals and aspirations, leading to a greater likelihood of achieving desired outcomes.

- Improved Personal Well-being: Making choices that are aligned with values and aspirations contributes to a sense of fulfillment and satisfaction.

Cultivating Informed Decision-Making

The ability to make informed decisions is not an inherent trait; it’s a skill that can be developed and refined over time. Here are some key strategies:

- Seek Reliable Information: Engage with reputable sources, such as academic journals, established news organizations, and government agencies. Be wary of biased or sensationalized content.

- Consider Multiple Perspectives: Explore diverse viewpoints and perspectives on the issue at hand. This allows for a more holistic understanding and reduces the likelihood of being swayed by a single bias.

- Analyze Options Carefully: Weigh the potential benefits and drawbacks of each option. Consider both short-term and long-term consequences.

- Embrace Uncertainty: Accept that some decisions involve inherent uncertainty. Focus on making the most informed choice possible, given the available information.

- Reflect and Learn: After making a decision, take time to reflect on the process. Identify what worked well and what could be improved for future decision-making.

Conclusion

Making informed decisions is a fundamental skill that empowers individuals to shape their own destinies and contribute meaningfully to society. By cultivating this ability, individuals can navigate the complexities of life with greater clarity, confidence, and purpose, ultimately securing a brighter future for themselves and future generations.