Are you tired of constantly feeling like you’re living paycheck to paycheck? Do you struggle to save money and find yourself constantly overspending? You’re not alone. Many people find it challenging to manage their finances effectively, and it can feel overwhelming to know where to start. But don’t worry! Creating a monthly budget can be a life-changing tool that empowers you to take control of your finances, achieve your financial goals, and finally experience true financial freedom.

In this comprehensive guide, we will walk you through the steps on how to create a monthly budget that truly works for you. We will explore different budgeting methods, from traditional to modern approaches, and provide practical tips and strategies to help you track your expenses, prioritize spending, and save more money. We will also discuss common budgeting mistakes to avoid and offer insights on how to stay motivated and make budgeting a sustainable habit in your life.

Assessing Your Income and Expenses

Understanding your financial situation is crucial for making informed decisions about your money. A key step in this process is assessing your income and expenses. This allows you to see where your money is going and identify areas where you can potentially save or earn more.

Tracking Your Income

Start by listing all sources of income you receive, including your salary, wages, investments, and any other regular income streams. Be sure to include both gross income (before taxes and deductions) and net income (after taxes and deductions). This will give you a clear picture of how much money you have available each month.

Categorizing Your Expenses

Next, track your expenses for a period of time, such as a month or three months. This will provide valuable insights into your spending habits. Categorize your expenses into different groups such as:

- Housing (rent, mortgage, utilities, property taxes)

- Transportation (car payments, gas, public transportation)

- Food (groceries, dining out)

- Healthcare (insurance, medical expenses)

- Entertainment (movies, concerts, hobbies)

- Personal care (haircuts, toiletries)

- Debt payments (loans, credit cards)

- Savings and investments (retirement contributions, emergency fund)

Analyzing Your Financial Data

Once you have collected your income and expense data, analyze it to understand your overall financial picture. Calculate your net income by subtracting your total expenses from your total income. This will show you your monthly surplus or deficit.

You can then use this information to identify areas where you can cut back on spending, increase your income, or adjust your financial goals. For example, you might find that you are spending too much on dining out, or that you could increase your savings rate by reducing discretionary expenses.

Tools and Resources

There are a variety of tools and resources available to help you track your income and expenses, including:

- Budgeting apps (Mint, YNAB, Personal Capital)

- Spreadsheets (Excel, Google Sheets)

- Financial advisors

Conclusion

Assessing your income and expenses is an important first step towards achieving your financial goals. By understanding where your money is going, you can make informed decisions about how to manage your finances effectively.

Setting Financial Goals

Setting financial goals is crucial for achieving financial security and stability. It provides a roadmap to guide your financial decisions and helps you stay motivated on your journey to financial success.

To effectively set financial goals, consider the following steps:

1. Define Your Financial Objectives

Start by identifying your short-term and long-term financial goals. Short-term goals may include saving for a vacation, paying off debt, or building an emergency fund. Long-term goals could be purchasing a home, retiring comfortably, or funding your children’s education.

2. Set SMART Goals

Ensure that your goals are Specific, Measurable, Attainable, Relevant, and Time-bound (SMART). This framework helps you create actionable goals that are more likely to be achieved.

3. Create a Budget

Develop a realistic budget that reflects your income and expenses. Track your spending and identify areas where you can cut back or allocate funds towards your financial goals. A budget serves as a foundation for achieving your financial aspirations.

4. Prioritize Your Goals

Prioritize your financial goals based on their importance and urgency. Focus on the most crucial goals first, such as paying off high-interest debt or building an emergency fund.

5. Monitor Your Progress

Regularly review your progress towards your financial goals. Adjust your strategies if necessary and stay motivated to stay on track. Celebrating milestones along the way can boost your morale and keep you motivated.

Setting financial goals and adhering to a plan can empower you to take control of your financial future. By following these steps, you can establish a solid foundation for financial well-being and achieve your desired financial outcomes.

Identifying Spending Habits

Tracking your spending habits is crucial for achieving financial goals. It provides insights into where your money is going and helps you identify areas where you can cut back or make changes. To understand your spending patterns effectively, consider these steps:

1. Gather Your Financial Data

The first step is to collect all relevant financial information. This includes:

- Bank statements

- Credit card statements

- Receipts

- Online transaction records

Having all your financial documents in one place allows you to analyze your spending comprehensively.

2. Categorize Your Expenses

Once you’ve collected your data, it’s time to categorize your expenses. This process helps you understand where your money is being spent. Common categories include:

- Housing

- Food

- Transportation

- Entertainment

- Shopping

- Bills

You can create your own categories that reflect your specific needs and spending patterns.

3. Analyze Your Spending

After categorizing your expenses, it’s time to analyze your spending patterns. Look for trends and areas where you might be overspending. For instance, you may notice that you spend a significant portion of your income on eating out or online shopping. This analysis will help you identify areas for improvement.

4. Track Your Progress

Once you’ve identified areas where you want to make changes, start tracking your progress. This can be done through a budget tracker, spreadsheet, or even a simple notepad. By regularly monitoring your spending, you can stay accountable and ensure that you’re making progress towards your financial goals.

5. Evaluate and Adjust

Regularly evaluate your spending habits and make adjustments as needed. Your financial situation and priorities may change over time, so it’s essential to stay flexible and adaptable. Review your spending habits every month or quarter to ensure that they are still aligned with your goals.

Identifying your spending habits is an ongoing process. By taking the time to track and analyze your expenses, you gain valuable insights into your financial behavior, empowering you to make informed decisions and achieve your financial aspirations.

Choosing a Budgeting Method

Managing your money effectively is crucial for financial well-being. A budget serves as a roadmap, guiding you towards your financial goals and ensuring that you spend within your means. Choosing the right budgeting method is essential for success, as different approaches cater to varying needs and preferences.

Here are some popular budgeting methods to consider:

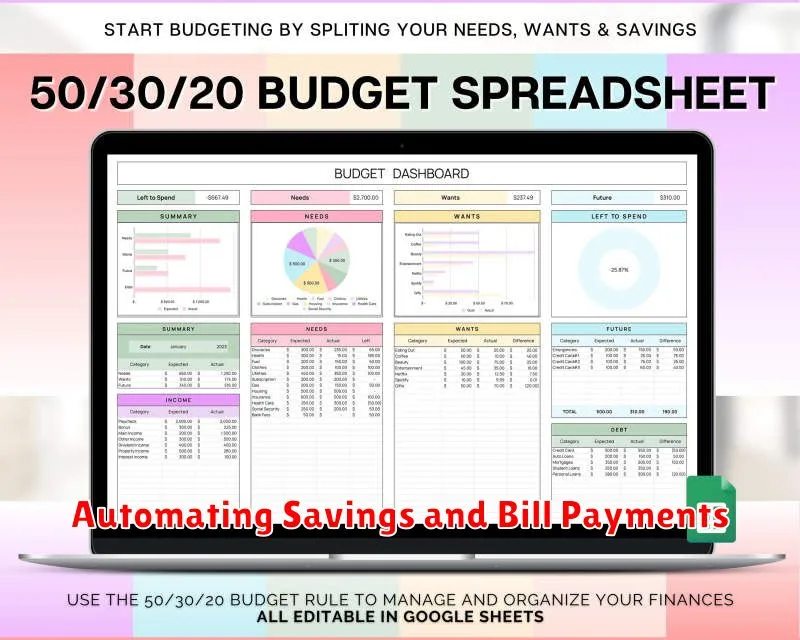

1. 50/30/20 Method

This simple and straightforward method divides your after-tax income into three categories: 50% for needs (essentials like housing, utilities, groceries), 30% for wants (entertainment, dining out, hobbies), and 20% for savings and debt repayment. It provides a good framework for balancing spending and saving.

2. Zero-Based Budgeting

This method involves allocating every dollar of your income to a specific category. It requires meticulous tracking of expenses and ensuring that every dollar is accounted for, leaving a zero balance at the end of each month. This approach encourages mindful spending and eliminates unnecessary expenditures.

3. Envelope System

The envelope system involves physically allocating cash to different categories, such as groceries, entertainment, and transportation. This method promotes visual awareness of your spending and limits overspending within each category. However, it may not be suitable for everyone, especially those who prefer digital tracking.

4. Pay Yourself First

This method prioritizes saving by automatically transferring a fixed amount of money from your paycheck to a savings account. It emphasizes building financial security and encourages a mindset of saving first and spending what’s left.

5. The 50/20/30 Method

Similar to the 50/30/20 method, but with a slightly different breakdown. This method allocates 50% for needs, 20% for saving, and 30% for wants. This method emphasizes the importance of savings and encourages financial planning.

The best budgeting method for you depends on your individual circumstances, financial goals, and personal preferences. Experiment with different methods to find one that suits your lifestyle and helps you achieve financial success. Remember, consistency and discipline are key to effective budgeting.

Allocating Funds to Different Categories

Effective money management is crucial for achieving financial stability and reaching your financial goals. One vital aspect of this is allocating your funds wisely across different categories. This involves carefully considering your needs, priorities, and financial situation to ensure you have enough money for essential expenses, savings, and investments.

A well-structured budget helps in allocating funds to various categories. Here’s a breakdown of common categories to consider:

Essential Expenses

These are the non-negotiable expenses that you need to survive. They include:

- Housing: Rent or mortgage payments, utilities (electricity, water, gas), and property taxes.

- Food: Groceries, dining out, and meal delivery services.

- Transportation: Car payments, gas, public transportation, and car maintenance.

- Healthcare: Health insurance premiums, doctor’s visits, and medications.

- Debt Repayment: Minimum payments on loans, credit cards, and other debts.

Savings

Savings are essential for unexpected expenses, emergencies, and achieving long-term financial goals. Here are different types of savings:

- Emergency Fund: A safety net to cover unexpected costs like job loss or medical bills.

- Retirement Savings: Contributions to retirement accounts like 401(k)s or IRAs.

- Goal-Based Savings: Dedicated funds for specific goals, like buying a house or traveling.

Investments

Investing allows your money to grow over time, providing potential for long-term financial security. Different investment options include:

- Stocks: Ownership in publicly traded companies.

- Bonds: Loans to companies or governments.

- Real Estate: Investing in property for rental income or appreciation.

- Mutual Funds: Diversified investments that pool money from multiple investors.

Discretionary Spending

This category includes non-essential expenses like entertainment, hobbies, dining out, and shopping. While it’s important to allocate funds for enjoyment, it’s crucial to track and manage this spending to avoid overspending.

Factors to Consider When Allocating Funds

The ideal allocation will vary depending on your individual circumstances. Here are some factors to consider:

- Age: Younger individuals might prioritize savings and investments, while older individuals might focus on retirement planning and healthcare expenses.

- Income: Your income level will influence how much you can allocate to different categories.

- Financial Goals: Prioritize funds based on your short-term and long-term goals.

- Debt Levels: Allocate sufficient funds for debt repayment to improve your credit score and reduce interest expenses.

Conclusion

Allocating funds strategically is a crucial aspect of effective money management. By considering your needs, priorities, and financial situation, you can create a budget that supports your financial well-being and helps you reach your financial goals.

Tracking Your Spending and Progress

Tracking your spending and progress is essential for achieving your financial goals. By understanding where your money goes, you can identify areas where you can cut back and allocate resources more effectively. It also allows you to monitor your progress toward your financial goals and adjust your strategy as needed.

Why Tracking Your Spending Matters

There are several compelling reasons why tracking your spending is crucial:

- Identify Spending Habits: Tracking your spending provides valuable insights into your spending habits. You may be surprised to learn where your money is going, revealing areas where you can make adjustments.

- Gain Control of Your Finances: By tracking your spending, you gain greater control over your finances. It helps you become more mindful of your spending decisions and prevents overspending.

- Achieve Financial Goals: Tracking your progress toward your financial goals is crucial for staying motivated and on track. It allows you to see how much you’ve saved or invested and adjust your strategy as needed.

- Make Informed Financial Decisions: Tracking your spending helps you make informed financial decisions. By analyzing your spending patterns, you can determine what’s essential and what can be reduced or eliminated.

Tips for Effective Spending Tracking

Here are some effective tips for tracking your spending:

- Choose a Method: There are various methods for tracking spending, including spreadsheets, budgeting apps, or manual logging. Choose a method that suits your preferences and lifestyle.

- Track Every Expense: Be diligent about recording every expense, no matter how small. This ensures you have an accurate representation of your spending.

- Categorize Expenses: Categorize your expenses to gain a better understanding of where your money is going. This helps you identify areas where you can make adjustments.

- Review Regularly: Review your spending regularly, ideally on a weekly or monthly basis. This allows you to monitor your progress and make adjustments as needed.

- Set Financial Goals: Define your financial goals to provide a clear roadmap for your spending. This could include saving for retirement, paying off debt, or buying a home.

Benefits of Tracking Progress

Tracking your progress towards your financial goals provides several benefits:

- Motivation: Seeing your progress can be motivating and keep you on track.

- Accountability: It holds you accountable for your financial decisions and encourages you to stay disciplined.

- Sense of Control: It provides a sense of control over your finances and gives you peace of mind.

- Adjustments: Tracking your progress allows you to adjust your strategy if needed. You may realize you need to save more or cut back in certain areas.

Tracking your spending and progress is an essential step towards achieving your financial goals. By being mindful of your spending and monitoring your progress, you can create a solid foundation for a secure financial future.

Making Adjustments as Needed

In the ever-evolving landscape of life, it is inevitable that we will encounter situations that require us to make adjustments. Whether it’s a change in our personal circumstances, a shift in our professional goals, or simply a desire to improve our well-being, the ability to adapt is crucial for success and happiness.

The process of making adjustments can be challenging, but it is essential to embrace the opportunity for growth and transformation. By adopting a flexible mindset and a willingness to embrace the unknown, we can navigate change with greater ease and emerge stronger on the other side.

It’s important to recognize that making adjustments is not about abandoning our values or compromising our integrity. Rather, it’s about finding creative solutions that align with our core beliefs and allow us to thrive in new and unexpected circumstances.

One key strategy for making adjustments effectively is to focus on our why. By understanding the underlying reasons for our desire to change, we can tap into a wellspring of motivation that will sustain us through the process. When our actions are driven by a clear purpose, we are more likely to persevere in the face of adversity and achieve our desired outcomes.

Another essential aspect of making adjustments is the ability to seek support from others. Whether it’s a trusted friend, family member, mentor, or therapist, surrounding ourselves with people who believe in us and provide encouragement can make a world of difference. Their insights and perspectives can offer valuable guidance as we navigate unfamiliar territory.

Finally, it’s crucial to acknowledge that the journey of making adjustments is often a process, not a destination. There will be setbacks, challenges, and moments of doubt along the way. But by remaining committed to our goals and celebrating our progress, we can gradually move towards a more fulfilling and balanced life.

Automating Savings and Bill Payments

In today’s fast-paced world, it’s easy to get caught up in the daily grind and forget about important financial tasks like saving and paying bills. But what if there was a way to automate these tasks, freeing up your time and energy for other things? Fortunately, with the rise of technology, automating savings and bill payments has never been easier.

Automating Savings

Setting up automatic savings transfers can be a game-changer for your financial health. By scheduling regular transfers from your checking account to your savings account, you can build a financial cushion without having to manually move money every month. This can be especially helpful for achieving long-term financial goals like retirement or a down payment on a house.

Automating Bill Payments

Similarly, automating bill payments can eliminate the stress of late fees and missed deadlines. By setting up recurring payments for your bills, you can ensure that they are paid on time, every time. Many banks and financial institutions offer online bill pay services that make it easy to schedule payments.

Benefits of Automation

There are numerous benefits to automating savings and bill payments, including:

- Increased Financial Security: By ensuring that your bills are paid on time, you reduce the risk of late fees and penalties.

- Improved Time Management: Automating these tasks frees up your time to focus on other priorities.

- Enhanced Budgeting: Regular savings transfers can help you stay on track with your budgeting goals.

- Reduced Stress: Eliminating the need to manually manage these tasks can reduce financial stress and anxiety.

Getting Started with Automation

Setting up automatic savings and bill payments is a simple process. Most banks and financial institutions offer online tools that make it easy to schedule transfers and payments. You can also use third-party apps and services that provide similar functionality.

Conclusion

Automating savings and bill payments is a smart move for anyone who wants to simplify their finances and take control of their financial future. By freeing yourself from the hassle of manual tasks, you can focus on achieving your financial goals and living a more stress-free life.

Staying Motivated and Consistent

Staying motivated and consistent can be a challenge, especially when it comes to achieving long-term goals. It’s easy to get caught up in the daily grind and lose sight of what’s important. But with the right strategies, you can cultivate a mindset that helps you stay on track and reach your full potential.

Set Clear Goals

The first step is to define your goals clearly. What do you want to achieve? Why is it important to you? Once you have a clear understanding of your goals, you can start breaking them down into smaller, more manageable steps. This will make the journey seem less daunting and give you a sense of accomplishment as you progress.

Find Your Why

Motivation is often fueled by a strong why. Why are you pursuing this goal? What impact will it have on your life? Connecting with your purpose will help you stay engaged and motivated, even when things get tough.

Create a Routine

Consistency is key to success. Creating a routine can help you establish regular habits that support your goals. Schedule time for working towards your goals, and stick to it as much as possible. Consistency helps build momentum and makes it easier to stay on track.

Celebrate Your Wins

Don’t underestimate the power of celebrating your wins. Acknowledge your progress, no matter how small. This will help you stay positive and motivated. It’s important to reward yourself for your efforts, even if it’s something simple.

Embrace Challenges

Setbacks are inevitable. Instead of getting discouraged, view them as opportunities for growth. Learn from your mistakes, adjust your approach, and keep moving forward.

Surround Yourself with Support

Find people who believe in you and can offer encouragement and support. Surround yourself with a network of positive influences who will help you stay accountable and motivated.