Tax season can be a stressful time for many people. The thought of filing taxes can be overwhelming, and the potential for making mistakes can be scary. However, with a little planning and preparation, you can make tax season much less stressful. This article will provide you with a step-by-step guide on how to prepare for tax season with minimal stress.

The first step is to gather all of your necessary documents. This includes your W-2 forms, 1099 forms, and any other tax-related documents. Once you have all of your documents, you can start organizing them. This will help you find the information you need quickly and easily. The next step is to learn about the different tax deductions and credits you are eligible for. There are many tax breaks available to both individuals and families, so it’s important to do your research and take advantage of all the deductions you can.

Understanding Your Tax Obligations

Navigating the world of taxes can be daunting, but it’s a crucial aspect of responsible citizenship. Understanding your tax obligations is essential for staying compliant with the law and managing your finances effectively. This guide will provide you with a comprehensive overview of key tax concepts, your responsibilities, and resources to help you along the way.

What are Taxes?

Taxes are mandatory financial contributions levied by the government on individuals and businesses. These contributions are used to fund public services such as education, healthcare, infrastructure, and national defense. Taxes can be levied on various forms of income, property, goods, and services.

Types of Taxes

There are numerous types of taxes, but some of the most common include:

- Income Tax: Tax levied on earnings from wages, salaries, investments, and other sources.

- Sales Tax: Tax added to the price of goods and services at the point of sale.

- Property Tax: Tax based on the value of real estate or personal property.

- Corporate Income Tax: Tax levied on the profits of corporations.

- Excise Tax: Tax imposed on specific goods or services, such as gasoline or tobacco.

Your Tax Responsibilities

As a taxpayer, you have certain responsibilities, including:

- Filing a Tax Return: You must file a tax return annually to report your income and calculate your tax liability.

- Paying Taxes on Time: Taxes are typically due on a specific date each year, and late payments can result in penalties and interest.

- Keeping Accurate Records: Maintain detailed records of your income, expenses, and other relevant financial information for tax purposes.

- Understanding Tax Laws: Stay informed about changes in tax laws and regulations that may affect your tax obligations.

Resources for Tax Information

There are various resources available to help you understand your tax obligations:

- Internal Revenue Service (IRS): The IRS website provides comprehensive information about tax laws, forms, and publications.

- Tax Professionals: Certified public accountants (CPAs) and enrolled agents (EAs) can provide expert advice and assistance with tax preparation.

- Tax Software: Tax preparation software can guide you through the filing process and help you calculate your tax liability.

Conclusion

Understanding your tax obligations is crucial for financial stability and compliance with the law. By staying informed, maintaining accurate records, and utilizing available resources, you can navigate the tax system effectively and fulfill your tax responsibilities with confidence.

Gathering Your Financial Documents

Having your financial documents organized and readily available can save you a significant amount of time and stress. Whether you’re applying for a loan, filing your taxes, or simply trying to keep track of your finances, having all of your documents in one place can make a world of difference.

Here are some of the essential financial documents you should gather and organize:

- Bank statements: This includes checking, savings, and money market accounts. Keep at least one year of statements on hand.

- Credit card statements: You should keep at least one year’s worth of statements.

- Loan documents: This includes mortgages, auto loans, student loans, and personal loans. Keep a copy of your loan agreement and any related paperwork.

- Investment statements: This includes brokerage accounts, retirement accounts, and other investments.

- Tax returns: Keep at least three years’ worth of tax returns and supporting documentation.

- Insurance policies: This includes home, auto, health, and life insurance. Keep a copy of your policy documents and any related paperwork.

- Pay stubs: Keep at least one year’s worth of pay stubs.

- W-2 forms: Keep these for as long as you need to file taxes (three years).

- Social Security card: Keep this in a safe place, along with a copy of your driver’s license or other form of identification.

- Passport: If you have one, keep it in a safe and secure location.

Once you have gathered all of your documents, you can start organizing them. One way to do this is to create a file folder system. You can create separate folders for each type of document, such as bank statements, credit card statements, and loan documents.

You can also use a digital filing system. Many online services offer free or paid storage options for your documents. This can be a convenient way to keep your documents organized and accessible from any device.

It’s also a good idea to keep copies of your important documents in a safe place, such as a fireproof safe or safety deposit box. This can help protect your documents in case of an emergency.

By taking the time to gather and organize your financial documents, you can make your life much easier. This can also help you stay on top of your finances and make informed financial decisions.

Choosing the Right Filing Status

When filing your taxes, one of the first decisions you’ll need to make is your filing status. Your filing status determines which tax brackets you’ll fall into, as well as which deductions and credits you’re eligible for. The IRS offers several filing statuses, each with its own set of rules and benefits.

Here are the five main filing statuses:

- Single: This is the most common filing status and is used by individuals who are not married, divorced, or legally separated.

- Married Filing Jointly: This status is available to couples who are legally married. It allows them to combine their income and deductions on one tax return.

- Married Filing Separately: This status is also available to married couples, but it allows them to file their taxes independently. This can be beneficial if one spouse has significantly higher income than the other, or if they wish to avoid joint liability for each other’s debts.

- Qualifying Widow(er) with Dependent Child: This status is available to a surviving spouse who has a qualifying child living with them. It allows them to file as if they were married filing jointly for two years after their spouse’s death.

- Head of Household: This status is available to unmarried individuals who pay more than half the costs of keeping up a home for a qualifying child or other dependent.

The best filing status for you will depend on your individual circumstances. It’s important to consider your income, deductions, and credits when making this decision. You can use tax software or consult with a tax professional to determine the most advantageous filing status for your situation.

Here are some tips for choosing the right filing status:

- Consider your income: Filing jointly is generally advantageous for couples with similar incomes. However, if one spouse has significantly higher income than the other, filing separately may be more beneficial.

- Review your deductions and credits: Some deductions and credits are only available to certain filing statuses. For example, the child tax credit is available to those who are filing as single, married filing jointly, or head of household.

- Consult with a tax professional: If you’re unsure which filing status is right for you, it’s always a good idea to consult with a tax professional.

By carefully considering your options and seeking professional advice, you can choose the filing status that will help you minimize your tax liability.

Exploring Tax Deductions and Credits

Navigating the world of taxes can be a daunting task, especially when you’re trying to maximize your refund or minimize your tax liability. Fortunately, there are tools available to help you do just that: tax deductions and tax credits. While they both reduce your tax burden, they work in distinct ways.

A tax deduction reduces your taxable income, lowering the amount of income you’re taxed on. Imagine it as a discount on your total income. For instance, if you’re eligible for a deduction of $1,000, your taxable income will be reduced by $1,000, leading to lower taxes owed.

A tax credit, on the other hand, directly reduces the amount of taxes you owe. It’s like a direct payment from the government. For example, if you qualify for a $500 tax credit, your tax liability will be reduced by $500, regardless of your income. Tax credits are often considered more valuable than deductions because they provide a dollar-for-dollar reduction in your tax bill.

Here are some examples of common tax deductions and credits:

Tax Deductions

- Mortgage interest deduction: This allows you to deduct the interest you pay on your home mortgage, reducing your taxable income.

- State and local tax (SALT) deduction: This deduction, capped at $10,000, allows you to deduct certain state and local taxes, such as property taxes and income taxes.

- Charitable contributions: If you make donations to eligible charities, you may be able to deduct a portion of those contributions on your taxes.

Tax Credits

- Earned Income Tax Credit (EITC): This tax credit is available to low- and moderate-income working individuals and families, providing a substantial tax break.

- Child Tax Credit: This credit provides a tax break for each qualifying child under the age of 17. It can be claimed as a refundable credit, meaning you may receive a portion of the credit even if you don’t owe any taxes.

- American Opportunity Tax Credit: This credit helps pay for the first four years of college education for eligible students.

It’s crucial to understand the specific requirements and eligibility criteria for each deduction and credit. The IRS website offers detailed information about various tax benefits. You may also consult with a tax professional for personalized guidance.

By leveraging tax deductions and credits, you can potentially lower your tax burden and keep more of your hard-earned money. However, it’s essential to plan and research the different options available to you, ensuring you comply with all tax laws and regulations.

Organizing Your Records

Organizing your records can seem like a daunting task, but it’s essential for maintaining a well-run business. Whether you’re a small startup or a large corporation, having a system in place to manage your records is crucial for efficiency, accuracy, and compliance.

Here are some key steps to help you organize your records effectively:

1. Determine What Records You Need to Keep

The first step is to identify the types of records you need to retain and for how long. Different industries and regulations have specific requirements, so it’s crucial to consult with your legal counsel or industry experts. Some common records to consider include:

- Financial records (e.g., invoices, receipts, bank statements)

- Customer records (e.g., contracts, orders, communication logs)

- Employee records (e.g., payroll, tax forms, employment contracts)

- Legal documents (e.g., licenses, permits, insurance policies)

- Marketing and sales records (e.g., customer lists, campaign reports)

- Project records (e.g., proposals, budgets, timelines)

2. Establish a Filing System

Once you know what records to keep, you need a systematic way to organize them. Consider these options:

- Physical Filing: This involves storing paper documents in folders, file cabinets, or binders. A well-defined file structure is essential for easy retrieval.

- Digital Filing: Electronic storage options like cloud-based platforms or folders on your computer allow for easy access and sharing. Ensure you have robust security measures in place to protect sensitive information.

- Hybrid System: Combine physical and digital filing for a more versatile approach. For example, you might store important documents physically while maintaining digital copies for backup and easy access.

3. Implement a Regular Filing Routine

Consistency is key to a well-organized record system. Develop a routine for filing documents promptly after they are received or created. This could be daily, weekly, or monthly, depending on your volume of records. Avoid letting paperwork pile up, as it can lead to chaos and missed deadlines.

4. Use a Record Retention Policy

Establish a policy that outlines the retention periods for different types of records. This policy should be based on industry regulations, legal requirements, and your company’s specific needs. You can use this policy to determine when records can be destroyed or archived.

5. Regularly Review and Purge Records

Over time, your record system can become cluttered. Regularly review your records and purge any that are no longer needed. This will help maintain a clean and organized system, freeing up valuable storage space and improving efficiency.

6. Utilize Technology

Consider using software solutions that can streamline your record-keeping processes. Document management systems, cloud storage platforms, and electronic signature tools can enhance efficiency and reduce errors.

7. Train Employees

Ensure all employees are aware of the record-keeping procedures and policies. Provide training on proper filing practices, security protocols, and retention guidelines. A well-trained workforce can contribute to a smooth and organized record-keeping system.

Organizing your records is a continuous process. By implementing these strategies, you can establish a system that promotes efficiency, accuracy, and compliance, ultimately contributing to the success of your business.

Utilizing Tax Software or Hiring a Professional

The process of filing taxes can be daunting, especially for those with complex financial situations. Many people grapple with the decision of whether to use tax software or hire a professional tax preparer. Both options have their merits, and the best choice ultimately depends on your individual circumstances and comfort level.

Tax Software

Tax software offers a convenient and cost-effective way to file your taxes. It’s available online and through downloadable programs, allowing you to complete your return at your own pace.

Pros:

- Cost-effective: Tax software is typically cheaper than hiring a professional.

- Convenience: You can file your taxes from the comfort of your home at any time.

- User-friendly: Most tax software programs are designed to be intuitive and easy to use.

- Personalized guidance: Many software programs offer step-by-step instructions and helpful tips.

Cons:

- Limited support: Tax software may not be able to handle complex tax situations.

- Potential for errors: Mistakes can occur if you’re not familiar with tax laws and regulations.

- No personal advice: Tax software cannot provide personalized tax advice.

Professional Tax Preparer

Hiring a professional tax preparer can offer peace of mind and expert guidance.

Pros:

- Expertise: Tax preparers have extensive knowledge of tax laws and regulations.

- Personalized advice: You can get tailored recommendations based on your specific financial situation.

- Accuracy: Professionals are trained to minimize errors and ensure accurate filings.

- Peace of mind: Knowing your taxes are being handled by an expert can alleviate stress.

Cons:

- Cost: Hiring a professional can be more expensive than using tax software.

- Time commitment: You may need to schedule appointments and gather all necessary documents.

- Potential for fraud: It’s important to choose a reputable tax preparer.

Conclusion

Ultimately, the decision of whether to use tax software or hire a professional depends on your individual needs and priorities. If you have a simple tax situation and are comfortable with tax software, it can be a cost-effective and convenient option. However, if you have a complex financial situation or want personalized advice, hiring a professional tax preparer may be the better choice.

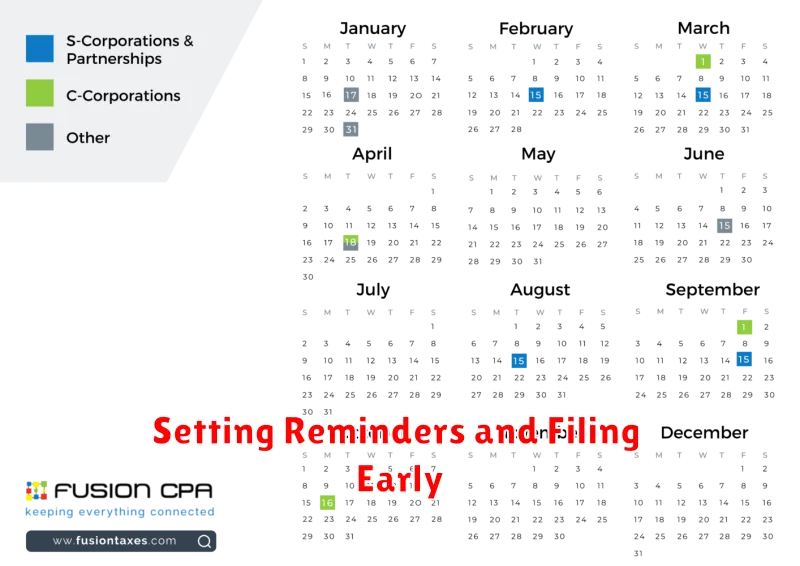

Setting Reminders and Filing Early

Taxes are a complex and often confusing subject. It can be easy to forget important deadlines or make mistakes that could lead to penalties. One way to avoid these problems is to set reminders and file early.

Setting reminders can be as simple as adding a note to your calendar or setting an alarm on your phone. You can also use online tools like Google Calendar or Apple Calendar to create recurring reminders.

Filing early will give you more time to gather all the necessary documents and information. It will also reduce the chances of making mistakes on your return. If you’re worried about not having all the information you need, you can still file an extension. But it’s best to file your return as soon as possible to avoid any late penalties.

Here are some other tips for setting reminders and filing early:

- Make a list of all the important tax deadlines for the year.

- Set reminders for each deadline at least a week in advance.

- Gather all your tax documents as soon as possible.

- Start working on your taxes early in the tax season.

- If you have any questions, contact a tax professional.

By following these tips, you can avoid the stress and headaches of dealing with taxes at the last minute. You can also help ensure that you’re taking advantage of all the deductions and credits that you’re entitled to. Remember, it’s always better to be prepared than to be sorry.

Avoiding Common Tax Mistakes

Tax season can be a stressful time for many people. It can be difficult to keep track of all your income and expenses, and it’s easy to make mistakes that could cost you money. But there are a few common tax mistakes that you can easily avoid.

One of the most common mistakes is failing to file on time. The deadline for filing your taxes is April 15th each year. If you miss the deadline, you could face penalties. You can also get an extension to file your taxes, but you will still owe any taxes that you owe by the original deadline.

Another common mistake is failing to keep good records. This includes all of your income, expenses, deductions, and credits. The IRS requires you to keep records for at least three years, so it’s important to keep them organized.

A third common mistake is claiming too many deductions or credits. The IRS has strict rules about which deductions and credits you can claim. If you claim deductions or credits that you’re not entitled to, you could face penalties. Make sure to understand the rules for each deduction and credit and be prepared to provide documentation to the IRS if you are audited. You may want to use tax software to ensure you aren’t making these errors.

Finally, many people make mistakes when they file their taxes electronically. You should always use reputable tax software or e-filing services, and make sure to review your return carefully before you submit it. It’s also important to keep your tax information secure. Never give your Social Security number or other personal information to anyone you don’t trust.

By avoiding these common tax mistakes, you can help ensure that you’re filing your taxes correctly and that you’re getting the maximum refund possible. It is also important to remember that the tax laws are complex, and it’s best to seek advice from a tax professional if you have any questions. They can help you understand your tax obligations and ensure that you’re taking advantage of all of the deductions and credits you’re eligible for.

Planning for Next Year’s Taxes

Tax season can be a stressful time, but it doesn’t have to be. By planning ahead, you can reduce your tax burden and ensure a smoother filing experience. Here are some tips for getting started:

1. Review Your Previous Year’s Taxes: Start by looking at your tax return from the previous year. This will help you identify any areas where you may have overpaid or underpaid, and it will give you a baseline for planning your taxes for the current year.

2. Track Your Income and Expenses: Keep meticulous records of all your income and expenses throughout the year. This includes receipts for business expenses, charitable donations, and medical expenses. Many banks and financial institutions offer free budgeting tools and apps, which can make this process easier.

3. Consider Tax-Advantaged Accounts: Take advantage of tax-advantaged retirement accounts such as 401(k)s and IRAs to reduce your taxable income. You may also want to look into flexible spending accounts (FSAs) for healthcare and dependent care expenses.

4. Stay Informed About Tax Law Changes: Tax laws can change from year to year. Stay informed about any updates or new deductions that may be available to you. The IRS website and reputable financial websites are good sources for tax information.

5. Seek Professional Advice: If you have a complex financial situation, consider consulting with a tax professional. They can help you develop a comprehensive tax plan that meets your individual needs.

By following these tips, you can better prepare for next year’s tax season and minimize your tax liability. Remember, early planning and proactive management can make a significant difference in your overall financial well-being.