Navigating the tax implications of selling investments can be a daunting task. You might be celebrating a hefty profit, but the realization that Uncle Sam wants a piece of the action can quickly dampen the mood. Fear not, fellow investor! Understanding how to manage your taxes when selling investments is crucial to maximizing your gains and minimizing your tax burden. This comprehensive guide will equip you with the knowledge and strategies to navigate the complex world of investment taxes, ensuring you keep more of your hard-earned money.

Whether you’re a seasoned investor or just starting out, this guide covers everything from understanding different types of capital gains to maximizing deductions and exploring tax-efficient investment strategies. We’ll break down complex tax concepts into easy-to-understand terms and provide practical tips to help you strategize your investment sales for optimal tax efficiency. Let’s dive in and take control of your tax destiny!

Understanding Capital Gains and Losses

Capital gains and losses are the profits or losses that result from the sale or exchange of a capital asset. Capital assets are generally considered to be any asset that is held for investment or for the production of income, such as stocks, bonds, real estate, and artwork.

When you sell a capital asset for more than you paid for it, you have a capital gain. When you sell a capital asset for less than you paid for it, you have a capital loss.

Types of Capital Gains and Losses

There are two main types of capital gains and losses:

- Short-term capital gains and losses: These occur when you sell an asset that you’ve held for less than a year. Short-term capital gains are taxed at your ordinary income tax rate, while short-term capital losses can be used to offset your other income.

- Long-term capital gains and losses: These occur when you sell an asset that you’ve held for more than a year. Long-term capital gains are taxed at lower rates than short-term capital gains. The current long-term capital gains tax rates are 0%, 15%, or 20%, depending on your income level.

Example

Let’s say you bought 100 shares of XYZ stock for $50 per share in January 2023. You sold those shares in December 2023 for $60 per share. You would have a long-term capital gain of $1,000, calculated as follows:

- Sale price: $60 per share x 100 shares = $6,000

- Purchase price: $50 per share x 100 shares = $5,000

- Capital gain: $6,000 – $5,000 = $1,000

Reporting Capital Gains and Losses

You’ll need to report your capital gains and losses on your federal income tax return. You can use Form 8949, Sales and Other Dispositions of Capital Assets, to report your capital gains and losses. You can also use Form 1040, U.S. Individual Income Tax Return, to report your capital gains and losses.

Conclusion

Understanding capital gains and losses is important for both investors and taxpayers. By understanding how these gains and losses are calculated and taxed, you can make informed decisions about your investments and properly report your income.

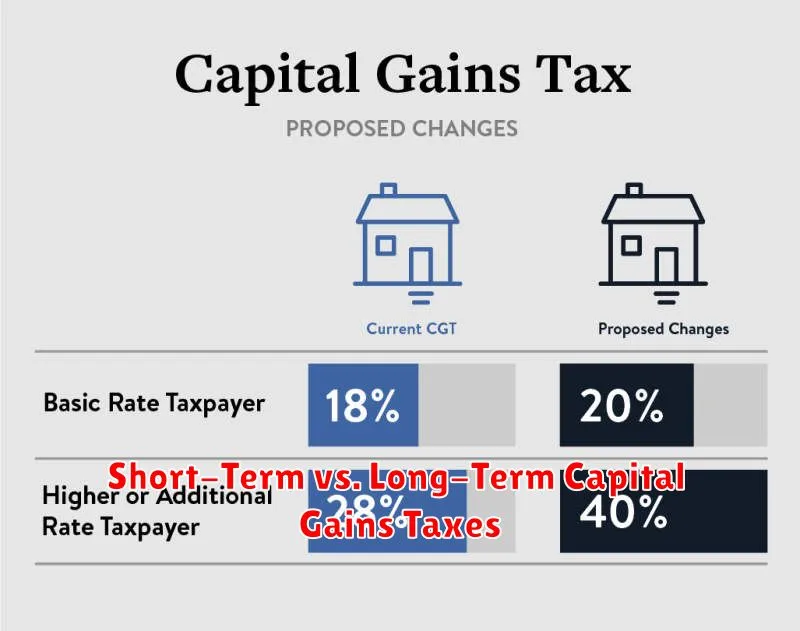

Short-Term vs. Long-Term Capital Gains Taxes

When you sell an asset for more than you paid for it, you have a capital gain. The tax rate you pay on that gain depends on how long you held the asset. If you held the asset for less than a year, it’s considered a short-term capital gain. If you held it for a year or more, it’s considered a long-term capital gain.

Short-term capital gains are taxed at your ordinary income tax rate. This means that you’ll pay the same tax rate on your capital gains as you would on your salary or wages. Long-term capital gains are taxed at lower rates, depending on your income level. For 2023, the long-term capital gains tax rates are:

- 0% for those in the 10% or 12% tax brackets.

- 15% for those in the 22%, 24%, 32%, and 35% tax brackets.

- 20% for those in the highest tax bracket (37%).

There are some exceptions to these rules. For example, if you sell your primary residence, you may be able to exclude up to $250,000 of capital gains (or $500,000 for married couples filing jointly). There are also special rules for collectibles and certain other types of assets.

If you’re considering selling an asset, it’s important to understand how capital gains taxes will affect you. Talk to a tax advisor to learn more about the rules and how to minimize your tax liability.

Tax-Loss Harvesting Strategies

Tax-loss harvesting is a strategy that involves selling losing investments to offset capital gains and reduce your tax liability. It’s a powerful tool that can save you money, but it’s important to understand how it works and the potential drawbacks.

How Tax-Loss Harvesting Works

When you sell an investment for a loss, you can use that loss to offset any capital gains you may have realized in the same year. If your losses exceed your gains, you can deduct up to $3,000 of those losses from your taxable income each year. Any remaining losses can be carried forward to future years.

Example of Tax-Loss Harvesting

Let’s say you bought 100 shares of XYZ stock for $50 per share and it’s now trading at $40 per share. You have a capital loss of $1,000 (100 shares x $10 loss per share). If you sell those shares, you can use that $1,000 loss to offset any capital gains you may have realized from other investments.

Benefits of Tax-Loss Harvesting

Tax-loss harvesting can offer several benefits, including:

- Reduced Tax Liability: By offsetting capital gains, you can reduce your overall tax bill.

- Increased After-Tax Returns: The tax savings you realize can lead to higher after-tax returns on your investments.

- Improved Portfolio Management: Tax-loss harvesting can help you rebalance your portfolio by selling underperforming investments and investing in more promising ones.

Considerations for Tax-Loss Harvesting

While tax-loss harvesting can be a valuable strategy, there are some things to keep in mind:

- Wash Sale Rule: The IRS has a wash sale rule that prohibits you from repurchasing a security that you have sold at a loss within 30 days before or after the sale. If you do, the loss will be disallowed and your cost basis in the new shares will be adjusted.

- Timing: It’s important to consider the timing of your tax-loss harvesting, as it may impact your tax liability for the current year or future years.

- Investment Goals: Tax-loss harvesting should not be used to avoid selling investments that are aligned with your long-term financial goals.

Conclusion

Tax-loss harvesting can be a powerful strategy for reducing your tax liability and boosting your investment returns. It’s important to understand the rules and considerations involved, and consult with a financial advisor to determine if it’s right for you.

Offsetting Gains with Losses

In the realm of finance, understanding the concept of offsetting gains with losses is crucial for optimizing investment strategies. This practice involves using losses to reduce taxable gains, thereby minimizing overall tax liabilities. It is a fundamental aspect of tax planning, allowing investors to strategically manage their financial outcomes.

The basic principle behind offsetting gains with losses is that capital gains and losses are treated differently for tax purposes. Capital gains refer to profits realized from the sale of assets, such as stocks or real estate, while capital losses represent the losses incurred from the sale of such assets. When capital gains exceed capital losses in a given period, the difference is considered taxable income. Conversely, when capital losses exceed capital gains, the difference can be used to offset taxable income.

One common strategy for offsetting gains with losses is through tax-loss harvesting. This involves selling losing investments to realize the losses and offsetting them against realized gains. This can be done through various methods, such as selling specific stocks or mutual funds, or engaging in wash sales, where a security is repurchased within 30 days of its sale to avoid triggering the wash sale rule.

The benefits of offsetting gains with losses are significant. By reducing taxable income, investors can lower their tax liabilities, effectively increasing their overall returns. Moreover, it allows for the preservation of capital, as losses can be used to offset gains, mitigating the impact of taxable income.

However, it’s essential to remember that offsetting gains with losses is a complex tax strategy. It’s crucial to consult with a qualified financial advisor or tax professional to understand the specific rules and regulations associated with your investment portfolio and tax jurisdiction. They can provide personalized guidance on optimal strategies for maximizing tax benefits and minimizing tax liabilities.

Impact of Investment Holding Period

The holding period of an investment refers to the length of time an investor owns an asset. It is a crucial factor that significantly influences the overall returns and risk profile of an investment. The impact of the holding period can be analyzed from various perspectives, including:

Returns and Growth Potential

Generally, longer holding periods tend to correlate with higher returns. This is because investments have the opportunity to compound over time. Compounding is the snowball effect where earnings are reinvested to generate further earnings, leading to exponential growth. For example, stocks have historically outperformed other asset classes over long-term periods, due to their potential for capital appreciation and dividend growth.

Risk and Volatility

The holding period also impacts risk and volatility. Short-term investments are typically more volatile as market fluctuations can significantly impact their value in a shorter time frame. Conversely, long-term investments tend to be less volatile as market fluctuations are averaged out over a longer period. This is why it is often recommended to invest for the long term to reduce risk and allow for market cycles to play out.

Taxes and Fees

The holding period can also affect tax liabilities and investment fees. Short-term investments may be subject to higher capital gains taxes, while long-term investments often have lower tax rates. Similarly, some investment accounts, such as retirement accounts, have tax advantages for longer holding periods. Investment fees can also vary depending on the holding period, with longer-term investments generally having lower annual fees.

Investment Strategy and Goals

The holding period should be aligned with the investor’s overall investment strategy and goals. For instance, an investor seeking short-term gains may focus on high-growth stocks or speculative investments with a shorter holding period. Conversely, an investor aiming for long-term wealth accumulation might prefer a buy-and-hold strategy with a longer holding period, investing in diversified portfolios of stocks, bonds, and real estate.

Conclusion

The holding period is a critical factor in investment decision-making. Understanding its impact on returns, risk, taxes, and investment goals is essential for investors to make informed choices that align with their financial objectives. By carefully considering the holding period, investors can optimize their investment strategies and maximize their chances of achieving long-term financial success.

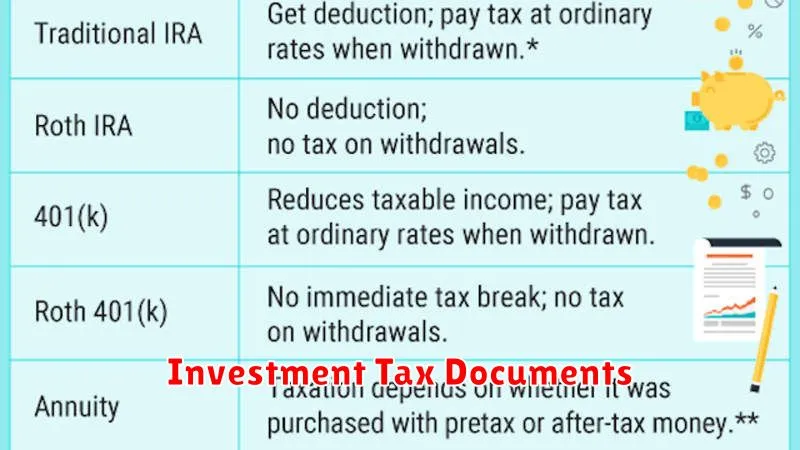

Tax Implications for Different Investment Types

Investing can be a great way to grow your wealth over time, but it’s important to understand the tax implications of different investment types. The way your investments are taxed can vary significantly depending on the type of investment, your tax bracket, and other factors.

Here’s a breakdown of some common investment types and their tax implications:

Stocks

When you sell stocks, you’ll have to pay capital gains tax on any profits. The rate you pay will depend on how long you held the stock and your income level. Short-term capital gains, from investments held for less than a year, are taxed at your ordinary income tax rate. Long-term capital gains, from investments held for a year or more, are taxed at preferential rates.

Bonds

Interest income from bonds is typically taxed as ordinary income. However, some bonds, like municipal bonds, are exempt from federal income tax. You may also be able to deduct some of the interest expense on bonds if you use them to finance a business or investment property.

Mutual Funds and ETFs

Mutual funds and ETFs are similar to stocks in that they represent ownership in a basket of assets. They are taxed in a similar way to stocks: dividends and capital gains distributions are taxed at ordinary income and capital gains rates, respectively.

Real Estate

Real estate investments can generate both income and capital gains. Rental income is taxed as ordinary income, while capital gains from the sale of a property are taxed at capital gains rates. There are also a number of deductions available for real estate investors, such as depreciation, interest, and property taxes.

Retirement Accounts

Retirement accounts like 401(k)s and IRAs offer tax advantages, deferring taxes on contributions and earnings until retirement. However, distributions from these accounts are taxed as ordinary income in retirement.

Cryptocurrency

Cryptocurrency is considered a capital asset, similar to stocks. Gains from trading cryptocurrency are taxed as capital gains, with short-term gains taxed as ordinary income and long-term gains taxed at preferential rates.

It’s essential to consult with a tax advisor to understand the specific tax implications of your investments, as the rules can be complex and subject to change. A qualified advisor can help you develop an investment strategy that minimizes your tax burden and maximizes your returns.

Tax-Advantaged Accounts for Investments

Investing in the stock market can be a great way to grow your wealth over time. However, it’s important to consider the tax implications of your investments. Fortunately, there are a number of tax-advantaged accounts available that can help you reduce your tax burden and grow your wealth more efficiently.

Types of Tax-Advantaged Accounts

Here are some of the most common tax-advantaged accounts:

1. Traditional IRA

A traditional IRA is a retirement account that allows you to contribute pre-tax dollars. This means that you won’t have to pay taxes on your contributions until you withdraw them in retirement. Traditional IRA contributions may also be tax deductible, depending on your income level.

2. Roth IRA

A Roth IRA is another type of retirement account, but it differs from a traditional IRA in that contributions are made with after-tax dollars. This means that you’ll pay taxes on your contributions upfront, but your withdrawals in retirement will be tax-free. This can be a great option for those who expect to be in a higher tax bracket in retirement.

3. 401(k)

A 401(k) is a retirement savings plan offered by employers. It allows you to contribute pre-tax dollars to the account, and your contributions may be matched by your employer. 401(k) plans offer tax deferral, meaning you won’t have to pay taxes on your contributions until you withdraw them in retirement.

4. 529 Plan

A 529 plan is a tax-advantaged savings plan designed specifically for education expenses. Contributions to a 529 plan grow tax-deferred, and withdrawals for qualified education expenses are tax-free. This can be a valuable tool for families saving for their children’s college education.

5. Health Savings Account (HSA)

An HSA is a tax-advantaged account available to those enrolled in a high-deductible health insurance plan. Contributions to an HSA are tax-deductible, and withdrawals for qualified medical expenses are tax-free. HSAs can be a great way to save money on healthcare costs and grow your savings.

Benefits of Tax-Advantaged Accounts

Tax-advantaged accounts offer a number of benefits, including:

- Tax savings: Tax-advantaged accounts can help you reduce your tax liability, both now and in the future.

- Growth potential: Your investments can grow tax-deferred, allowing your money to compound more quickly.

- Flexibility: There are a variety of tax-advantaged accounts to choose from, so you can find one that best meets your needs.

Considerations When Choosing a Tax-Advantaged Account

When choosing a tax-advantaged account, it’s important to consider factors such as:

- Your income level

- Your time horizon

- Your investment goals

It’s also important to consult with a financial advisor to discuss your specific situation and determine which tax-advantaged accounts are right for you.

Conclusion

Tax-advantaged accounts can be valuable tools for growing your wealth and reducing your tax burden. By understanding the different types of accounts available and considering your personal circumstances, you can make informed decisions about how to best invest your money.

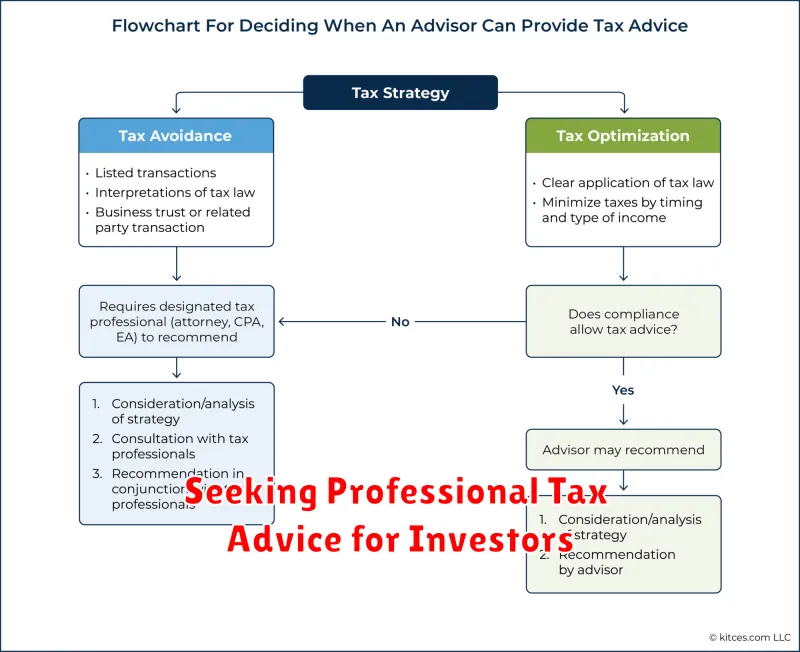

Seeking Professional Tax Advice for Investors

Investing can be a complex and rewarding endeavor, but it also comes with its fair share of challenges. One of the most important aspects of successful investing is understanding the tax implications of your investment decisions. Navigating the intricacies of tax laws can be daunting, especially for investors who are new to the market. This is where seeking professional tax advice becomes crucial.

A qualified tax advisor can provide valuable insights and guidance to help you make informed decisions that minimize your tax liability and maximize your returns. Here are some key reasons why seeking professional tax advice is essential for investors:

Tax Planning and Strategies

Tax advisors are experts in tax laws and regulations, and they can help you develop effective tax planning strategies. They can identify potential tax savings opportunities, such as tax-advantaged accounts like IRAs and 401(k)s, as well as deductions and credits that you may be eligible for. This proactive approach can significantly reduce your tax burden and enhance your investment returns.

Investment Portfolio Optimization

A tax advisor can help you optimize your investment portfolio by considering the tax implications of different investment choices. For example, they can guide you on the best types of investments to hold in taxable accounts versus tax-advantaged accounts. They can also advise you on strategies like tax-loss harvesting, which involves selling losing investments to offset capital gains and reduce your overall tax liability.

Compliance and Reporting

Tax laws can be constantly changing, and staying compliant with these regulations can be a challenge. A tax advisor can ensure that you are filing your taxes accurately and on time. They can also help you prepare for audits and address any potential tax issues that may arise.

Peace of Mind

Knowing that you have a qualified tax advisor on your side can provide peace of mind. You can be confident that your investments are being managed in a tax-efficient manner, and you can focus on your long-term investment goals without worrying about the complexities of tax laws.

When seeking professional tax advice, it is important to choose a qualified and experienced advisor who specializes in investment taxation. Look for someone who is a Certified Public Accountant (CPA) or a Certified Financial Planner (CFP) with a strong understanding of investment strategies and tax laws. You should also consider the advisor’s communication style and their ability to explain complex tax concepts in a clear and understandable way.

Investing requires careful consideration of both financial and tax implications. By seeking professional tax advice, you can gain valuable insights, make informed decisions, and maximize your investment returns. Remember that a little tax planning can go a long way in helping you achieve your financial goals.