Are you looking for ways to teach your kids about personal finance? It’s never too early to start talking to your children about money. In fact, the earlier you start, the better. By teaching them about financial literacy, you can help them develop good habits that will set them up for success in the future. They will learn how to budget, save, and invest their money wisely. And they will be better prepared to handle their finances responsibly as adults.

But where do you start? Teaching personal finance to kids can seem daunting. You might not know where to begin or what topics to cover. Don’t worry! This article will provide you with a comprehensive guide to help you teach your kids about money management. From simple concepts like saving and spending to more advanced topics like investing and debt management, we’ll cover it all.

Start with the Basics: Earning, Spending, and Saving

Personal finance is a broad topic, but it can be broken down into a few key areas: earning, spending, and saving. Understanding these basics is essential for managing your money effectively.

Earning

Earning refers to the income you generate from your work or other sources. This could include a salary, wages, commissions, investments, or even rental income. The more you earn, the more financial flexibility you have. It’s important to track your income accurately to understand your overall financial situation.

Spending

Spending is the money you use to purchase goods and services. It’s important to be mindful of your spending habits and to make sure that you’re not spending more than you earn. Creating a budget can help you track your spending and make informed decisions about your money.

Saving

Saving is the act of setting aside money for future use. This could be for short-term goals like a vacation or long-term goals like retirement. Saving is crucial for financial security and peace of mind. It allows you to handle unexpected expenses and build a financial safety net.

By focusing on these basic concepts, you can start to build a strong foundation for your personal finances. Understanding your income, expenses, and savings habits is the first step to achieving your financial goals.

Introduce the Concept of Needs vs. Wants

In the realm of personal finance and consumer behavior, it’s crucial to understand the distinction between needs and wants. This fundamental concept serves as a guiding principle for making informed financial decisions, prioritizing spending, and ultimately achieving financial well-being.

Needs are those essential items or services that are absolutely necessary for survival, health, and basic well-being. These include:

- Food

- Water

- Shelter

- Clothing

- Healthcare

- Transportation (in some cases)

Wants, on the other hand, are those items or services that are not essential for survival but provide comfort, pleasure, or convenience. Examples include:

- Expensive gadgets

- Luxury vacations

- Designer clothes

- Dining out frequently

- Entertainment subscriptions

While wants can be enjoyable and contribute to a fulfilling life, it’s important to recognize that they are not essential for survival. Differentiating between needs and wants empowers individuals to make conscious spending decisions, prioritize essential expenses, and avoid unnecessary debt.

Set Up a Savings Goal and Help Them Track Their Progress

Saving money can be a daunting task, especially for children and young adults. They may not understand the importance of saving or have the discipline to stick to a budget. That’s where you can step in and help! By setting up a savings goal and providing tools to track progress, you can empower them to achieve their financial goals.

Choose a Savings Goal

Start by discussing their financial aspirations with them. What are they saving for? A new video game, a trip with friends, or perhaps a college fund? Once you have a clear goal in mind, you can work together to determine the amount they need to save and the time frame for achieving it.

Set Up a Savings Account

Opening a savings account specifically for their goal can make a huge difference. It visually separates their savings from their everyday spending money. Consider choosing a bank that offers features like interest-earning accounts or rewards programs to incentivize saving.

Create a Visual Tracker

A visual tracker can be a powerful tool to keep them motivated. Use a chart, a jar, or even a mobile app to display their progress towards their goal. They can visually see their savings grow, which can be incredibly rewarding and encouraging.

Make It Fun and Engaging

Saving money doesn’t have to be boring! Incorporate games, challenges, and rewards to make the process more enjoyable. For example, you could set up a “money challenge” where they earn extra money for completing chores or achieving certain milestones.

Celebrate Success

It’s crucial to acknowledge and celebrate their achievements along the way. When they reach a significant milestone, recognize their hard work and dedication. This positive reinforcement can help them stay motivated and committed to their savings goals.

Lead by Example

Children and young adults are often influenced by their parents’ behavior. If you demonstrate responsible saving habits, it will have a positive impact on their own financial decisions. Let them see you setting aside money regularly and discussing your financial goals.

Setting up a savings goal and providing tools to track progress is an important step in teaching children and young adults about financial responsibility. By fostering their understanding and encouraging them to save, you can equip them with valuable life skills that will benefit them for years to come.

Teach Them About Budgeting and Responsible Spending

It’s never too early to teach kids about budgeting and responsible spending. These skills are essential for financial success in life, and the sooner kids learn them, the better.

Here are a few tips on how to teach your kids about budgeting and responsible spending:

Start with the Basics

Begin by explaining the difference between needs and wants. A need is something that is essential for survival, like food, clothing, and shelter. A want is something that is nice to have, but not essential.

Once your kids understand the difference, you can start teaching them about saving. Explain that saving money allows them to purchase things they want in the future.

Give Them Allowance

Giving your kids an allowance is a great way to teach them about managing money. You can start with a small allowance and increase it as they get older. Make sure to discuss with them how they should use their allowance, and encourage them to save a portion of it.

Involve Them in Family Budgeting

Involving your kids in family budgeting can be a great way to teach them about money management. Show them how much you spend on different things, like groceries, rent, and utilities. You can even let them help you make decisions about how to spend the family’s money.

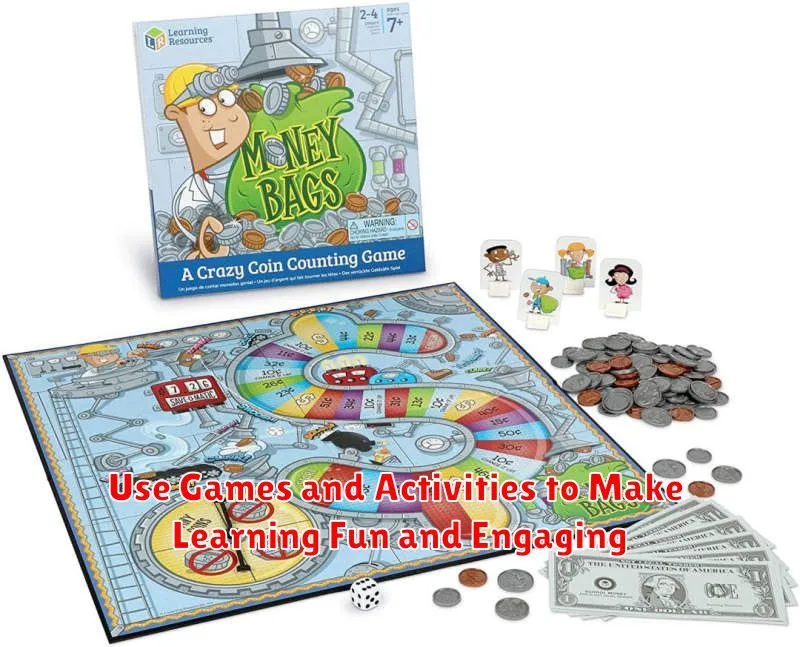

Use Games and Activities

There are a variety of games and activities that can help teach kids about budgeting and responsible spending. These can be fun and engaging ways for kids to learn about money.

Lead by Example

Kids learn by watching their parents, so it’s important to lead by example when it comes to money management. Make sure you are budgeting your own money and spending responsibly.

By teaching your kids about budgeting and responsible spending, you are giving them the skills they need to be financially successful in life. They will be able to make informed decisions about their money and avoid falling into debt.

Give Them Opportunities to Earn Money Through Chores or Allowance

Teaching kids about money is an important part of parenting. It can help them understand the value of money and learn how to manage it responsibly. One way to teach kids about money is to give them opportunities to earn money through chores or allowance.

When kids earn money for chores, they are learning the value of hard work. They are also learning that money doesn’t come easily. It takes effort to earn money, and they need to be willing to put in the work to get what they want.

Allowance can also be a great way to teach kids about money. It can help them learn how to budget, save, and spend money wisely. When kids receive an allowance, they can choose how to spend it. They can save it for something they want, or they can spend it on something they need.

When giving kids chores or an allowance, it’s important to be consistent. Make sure they know what they need to do to earn money and how much they will get paid. You should also have a system in place for paying them.

Here are some tips for giving kids opportunities to earn money through chores or allowance:

- Start early. The sooner you start teaching kids about money, the better.

- Keep it simple. Don’t make chores or allowance too complicated.

- Be consistent. Make sure you are consistent with the chores and allowance you give your kids.

- Talk about money. Talk to your kids about money and how it works.

- Be patient. It takes time to teach kids about money. Be patient and consistent, and eventually, they will learn.

Giving kids opportunities to earn money through chores or allowance is a great way to teach them about money and help them develop good financial habits. By doing so, you can help them become financially responsible adults.

Explain the Importance of Giving Back to the Community

Giving back to the community is an essential aspect of a fulfilling life. It is the act of contributing time, resources, or skills to make a positive impact on the well-being of others and the environment. By engaging in community service, we foster a sense of belonging, strengthen social bonds, and create a more equitable and sustainable society.

Enhancing Social Cohesion

Community involvement plays a vital role in fostering social cohesion. When individuals contribute to their community, they develop a sense of shared purpose and responsibility. Volunteering, donating to local charities, or participating in community events creates opportunities for people from diverse backgrounds to interact and build relationships. These interactions strengthen social bonds, reduce isolation, and promote a sense of belonging.

Addressing Societal Needs

Community service helps address critical societal needs. By volunteering at food banks, mentoring youth, or supporting environmental initiatives, individuals can contribute to addressing poverty, hunger, education gaps, and environmental degradation. By working together, communities can create solutions that benefit all members and improve the overall quality of life.

Personal Growth and Fulfillment

Giving back to the community is not only beneficial for society but also for individuals themselves. Engaging in service provides opportunities for personal growth, skill development, and a sense of fulfillment. Volunteering allows individuals to learn new skills, develop leadership qualities, and gain valuable experience. It can also boost self-esteem, reduce stress, and foster a sense of purpose.

Building a Sustainable Future

Community service plays a crucial role in building a sustainable future. By supporting environmental initiatives, participating in community gardens, or promoting sustainable practices, individuals can contribute to protecting the environment and creating a healthier planet for future generations. These actions demonstrate the importance of collective responsibility and the need to work together to address pressing environmental challenges.

Conclusion

Giving back to the community is a fundamental act of human connection and compassion. It strengthens social bonds, addresses societal needs, fosters personal growth, and contributes to a sustainable future. By engaging in community service, we not only make a difference in the lives of others but also enrich our own lives with a sense of purpose and fulfillment.

Use Games and Activities to Make Learning Fun and Engaging

Incorporating games and activities into your lessons can be a highly effective way to make learning more fun and engaging for students. It provides a change of pace from traditional lectures and textbook work, allowing students to actively participate in the learning process and better retain information.

Benefits of Using Games and Activities

Here are some key benefits of using games and activities in your classroom:

- Increased Engagement: Games and activities naturally pique students’ curiosity and interest, making them more likely to participate and stay focused.

- Improved Learning: Active learning through games and activities helps students process information more deeply, leading to better understanding and retention.

- Enhanced Collaboration: Many games and activities encourage teamwork, communication, and problem-solving skills, fostering a collaborative learning environment.

- Fun and Enjoyable Learning: By making learning fun, students are more likely to develop a positive attitude towards education and be motivated to learn.

Types of Games and Activities

There are numerous types of games and activities you can use in your classroom, depending on the subject and age group. Here are a few examples:

Interactive Games:

- Kahoot!: This online quiz platform allows you to create interactive quizzes and games for various subjects.

- Boggle: A classic word game that encourages vocabulary development and quick thinking.

- Jeopardy!: A popular game show format that can be adapted for various topics and subjects.

Role-Playing Activities:

- Historical Simulations: Students can take on roles of historical figures and act out events from a particular era.

- Debates: Encourage students to research and present arguments on different sides of a topic.

- Case Studies: Present real-life scenarios for students to analyze and solve problems.

Creative Activities:

- Storytelling: Encourage students to write, perform, or illustrate stories related to the subject matter.

- Art Projects: Use art to convey concepts, such as creating timelines or diagrams.

- Music and Drama: Integrate music or drama activities to enhance learning and memory retention.

Tips for Using Games and Activities Effectively

Here are some tips to ensure that games and activities are successful in your classroom:

- Set Clear Learning Objectives: Ensure that the activities align with your lesson goals and learning objectives.

- Choose Activities Appropriate for Age and Level: Select games and activities that are challenging yet accessible for your students.

- Provide Clear Instructions: Make sure students understand the rules and objectives before starting.

- Facilitate Learning: Guide and support students during the activity and encourage them to reflect on their learning.

- Debrief the Activity: After the activity, take time to discuss the learning outcomes and connect the experience to the overall curriculum.

By integrating games and activities into your teaching, you can create a more engaging and effective learning environment that fosters student motivation and deepens their understanding. Remember to tailor your approach to the specific subject, age group, and individual needs of your students.

Encourage Open Communication About Money Matters

Talking about money can be a sensitive topic, but it’s crucial for building a strong and healthy relationship. Open communication about financial matters fosters trust, transparency, and a shared understanding of your financial goals. It allows you to work together as a team to achieve financial stability and achieve your dreams.

Benefits of Open Communication About Money

Here are some key benefits of open communication about money:

- Increased Trust and Transparency: When you openly discuss your financial situation, you build trust and transparency in your relationship. It helps to avoid misunderstandings and resentment that can arise from secrets and hidden debts.

- Shared Financial Goals: Communicating about money allows you to align your financial goals and work towards them together. Whether it’s saving for a down payment on a house, paying off debt, or investing for retirement, a shared understanding helps you stay motivated and on track.

- Financial Planning and Decision-Making: Open communication facilitates informed financial planning and decision-making. You can discuss budgets, expenses, investments, and financial strategies together, making sure both partners are on board with the plans.

- Reduced Stress and Conflict: By talking openly about money, you can minimize stress and conflict. When you’re on the same page about finances, you’re less likely to experience disagreements or feel overwhelmed by money matters.

Tips for Communicating About Money

Here are some tips for fostering open communication about money in your relationship:

- Choose a Comfortable Time and Place: Find a quiet, distraction-free environment where you can have a conversation without interruptions.

- Start with a Positive Tone: Frame the conversation as an opportunity to work together and achieve your shared financial goals.

- Be Honest and Transparent: Don’t be afraid to share your financial situation, including income, expenses, debts, and assets. It’s important to be honest and transparent to build trust.

- Listen Actively: Pay attention to what your partner has to say, and show empathy for their perspective. Active listening helps to foster understanding and empathy.

- Focus on Solutions: If there are disagreements or concerns, work together to find solutions that benefit both partners. Don’t focus on blame or judgment.

- Set Regular Check-Ins: Schedule regular time to discuss your finances, even if it’s just a quick update on your progress towards your financial goals.

Conclusion

Open communication about money is essential for building a strong and financially secure relationship. By talking openly, honestly, and respectfully about your finances, you can foster trust, transparency, and a shared understanding of your financial goals. This will help you to work together as a team to achieve financial stability and reach your dreams.