Are you a college student struggling to make ends meet? You’re not alone. College life can be expensive, with tuition, books, and living expenses adding up quickly. But don’t worry, there are ways to save money and make your budget work for you. With a little planning and effort, you can manage your finances and avoid going into debt. This article will provide you with effective budgeting tips for college students to help you save money without sacrificing your college experience.

From learning how to prioritize spending to finding creative ways to earn extra cash, we’ll cover it all. We’ll also discuss the importance of creating a budgeting plan and how to track your expenses. So, if you’re ready to take control of your finances and start saving money, keep reading!

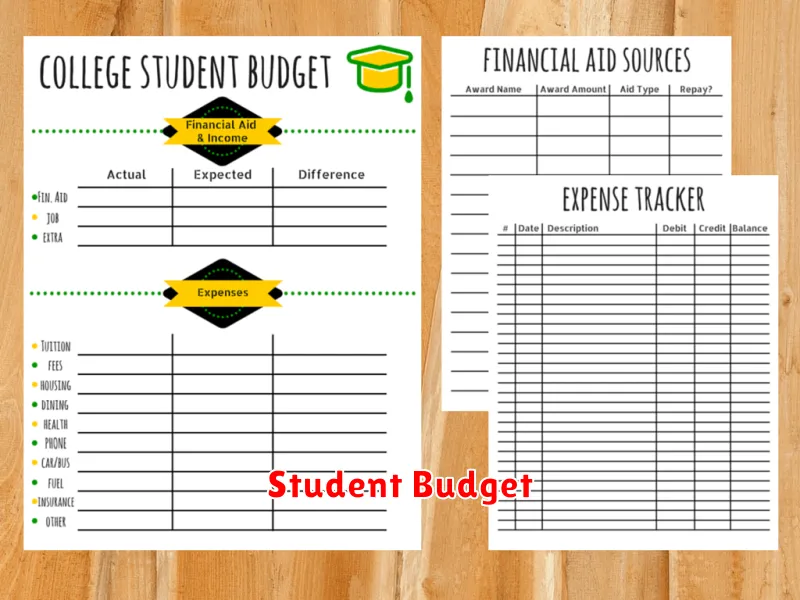

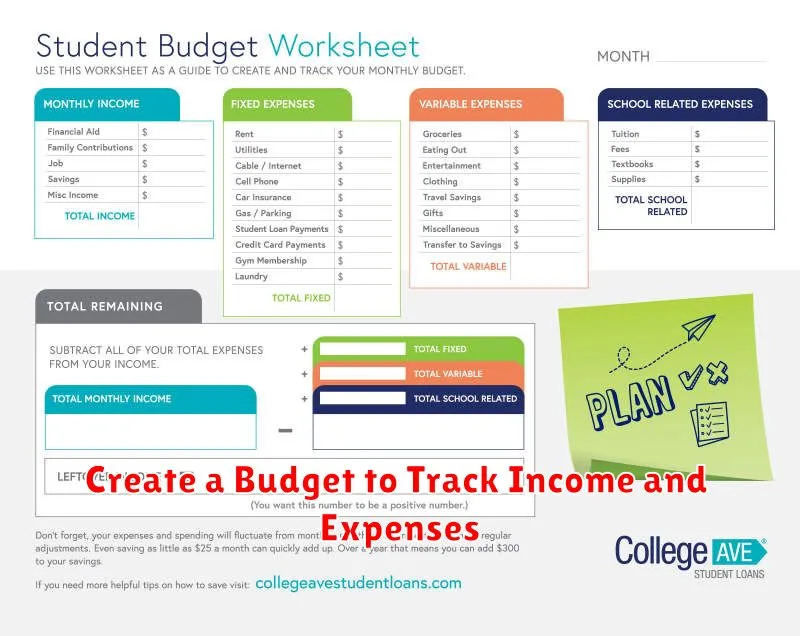

Create a Budget to Track Income and Expenses

Creating a budget is an essential step in managing your finances effectively. A budget is a plan that outlines how you will spend your money each month. It helps you track your income and expenses, identify areas where you can save money, and achieve your financial goals.

Step 1: Track Your Income and Expenses

Before you can create a budget, you need to know how much money you earn and spend each month. You can track your income and expenses manually using a spreadsheet or notebook, or you can use a budgeting app. There are many budgeting apps available, such as Mint, YNAB, and Personal Capital.

Step 2: Categorize Your Expenses

Once you have a list of your income and expenses, categorize them. This will help you see where your money is going. Common expense categories include:

- Housing

- Transportation

- Food

- Utilities

- Healthcare

- Entertainment

- Personal care

- Debt payments

Step 3: Create a Budget

Now that you know how much money you earn and spend, you can create a budget. A budget is a plan that outlines how you will spend your money each month. It should include your income, expenses, and savings goals. You can create a budget using a spreadsheet, a budgeting app, or a simple notebook.

Step 4: Stick to Your Budget

The most important step in creating a budget is sticking to it. This may require some discipline, but it is essential if you want to achieve your financial goals. Regularly review your budget and make adjustments as needed.

Tips for Creating a Budget

Here are some tips for creating a budget:

- Be realistic about your income and expenses.

- Set clear financial goals.

- Prioritize your expenses.

- Look for ways to save money.

- Review your budget regularly and make adjustments as needed.

Creating a budget is an important step towards financial stability and achieving your financial goals. By tracking your income and expenses, categorizing them, and creating a plan for your spending, you can take control of your finances and work towards a brighter future.

Explore Student Discounts and Deals

Being a student can be expensive. Between tuition, books, and living expenses, it can be hard to find the money for everything you need. Luckily, there are tons of student discounts and deals available to help you save money. From food and clothing to travel and entertainment, you can find discounts on just about anything. All you need to do is know where to look.

One of the best places to start is with your school’s student center. Many schools have a student center that offers discounts on everything from local restaurants to movie tickets. You can also check with your school’s student government or student union to see what deals they have negotiated with local businesses. Another great resource is the Student Advantage website. They offer a wide variety of discounts on everything from textbooks to travel. You can even get discounts on products and services from major brands like Apple, Nike, and Microsoft.

In addition to websites and student centers, there are also a number of apps that offer student discounts. These apps can help you find discounts on everything from food to clothing. Some popular student discount apps include:

- UNiDAYS

- Student Beans

- Chick-fil-A One

These apps make it easy to find and redeem student discounts, right from your phone.

So don’t forget to take advantage of all the student discounts and deals that are available. You can save a lot of money and still enjoy your time as a student. Good luck!

Save on Textbooks by Buying Used or Renting

Textbooks are a major expense for students, but there are ways to save money. You can buy used textbooks, rent them, or even get them for free.

Buying used textbooks is a great way to save money. You can find used textbooks online or at campus bookstores. You can also find used textbooks at local thrift stores or libraries.

Renting textbooks is another option. You can rent textbooks from online companies or from campus bookstores. Renting textbooks is a good option if you don’t want to buy them and you only need them for a semester.

If you’re lucky, you might be able to get free textbooks. Some colleges and universities offer free textbooks to students. You can also find free textbooks online or at local libraries.

Here are some tips for saving money on textbooks:

- Compare prices from different sources before you buy.

- Look for discounts on textbooks. Some bookstores offer discounts to students.

- Buy used textbooks whenever possible.

- Rent textbooks if you only need them for a semester.

- See if your school offers free textbooks.

By following these tips, you can save money on textbooks and avoid breaking the bank.

Cook at Home More Often to Avoid Expensive Restaurant Meals

It’s no secret that eating out can be expensive. With the rising cost of ingredients and labor, restaurants are forced to charge more for their meals. This can be a real strain on your budget, especially if you eat out frequently.

One way to save money is to cook at home more often. While cooking at home might seem like a hassle, it’s actually a lot easier and more affordable than you might think. There are countless recipes available online and in cookbooks, so you can find something to suit your taste and budget. Plus, cooking at home gives you the opportunity to control the ingredients and portion sizes, so you can be sure you’re eating healthy and delicious food.

Here are a few tips for making cooking at home more enjoyable and affordable:

- Plan your meals: Before you head to the grocery store, take some time to plan out your meals for the week. This will help you avoid impulse purchases and ensure you have all the ingredients you need on hand.

- Cook in bulk: When you do cook, try to make extra portions so you can have leftovers for lunch or dinner the next day. This will save you time and money in the long run.

- Use leftovers creatively: Don’t be afraid to get creative with your leftovers. You can turn a roast chicken into a delicious salad or soup, or use leftover pasta to make a quick and easy pasta salad.

Cooking at home doesn’t have to be a chore. With a little planning and effort, you can create delicious and affordable meals that you and your family will love. And who knows, you might even discover a new favorite recipe or two along the way!

Find Affordable Housing Options On or Off Campus

Finding affordable housing as a student can be a challenge, but it’s not impossible. Whether you prefer to live on campus or off campus, there are many options available to help you save money.

On-Campus Housing

On-campus housing offers convenience and access to campus resources, but it can sometimes be more expensive than off-campus options. However, there are ways to make on-campus housing more affordable:

- Choose a smaller room or shared apartment. This can significantly reduce your monthly rent.

- Look for housing with a meal plan included. This can save you money on groceries.

- Take advantage of any discounts or financial aid programs offered by your school. Many schools have programs to help students find affordable housing options.

Off-Campus Housing

Off-campus housing offers more independence and privacy, but it requires more responsibility and planning. Here are some tips for finding affordable off-campus housing:

- Start your search early. This will give you more time to find the best deals.

- Consider renting with roommates. This can significantly reduce your monthly rent.

- Look for housing in areas that are further away from campus. Rent tends to be lower in areas that are not as close to campus.

- Explore websites like Craigslist, Facebook Marketplace, and Zillow. These websites offer a wide range of rental options.

Financial Aid and Resources

Don’t forget to explore financial aid options and resources that can help you pay for housing. Many schools offer scholarships, grants, and work-study programs that can help cover the cost of housing.

Finding affordable housing as a student takes research and planning. By considering the options above, you can find a comfortable and affordable place to live during your studies.

Use Public Transportation or Bike to Save on Transportation Costs

In today’s economy, it is more important than ever to find ways to save money. One of the biggest expenses for most people is transportation. If you are looking to cut back on your transportation costs, there are a few things you can do.

One option is to use public transportation. This can be a great way to save money, especially if you live in a city with a robust public transportation system. You can also consider biking or walking to your destination. This is a great way to get some exercise and save money on gas and parking.

If you need to drive, there are still some things you can do to save money. One is to carpool with friends or coworkers. This can help you split the cost of gas and parking. Another option is to buy a fuel-efficient car. This will save you money on gas in the long run.

No matter what your transportation needs are, there are ways to save money. By following these tips, you can reduce your transportation costs and free up some extra cash.

Get a Part-Time Job to Supplement Your Income

Are you looking for ways to supplement your income? A part-time job can be a great way to bring in extra money and reach your financial goals. Whether you need to pay off debt, save for a down payment on a house, or just want to have a little extra cash to spend, there are plenty of part-time jobs available that can fit your schedule and skillset.

One of the biggest benefits of a part-time job is the flexibility it offers. Many part-time jobs allow you to choose your own hours, which can be especially helpful if you have other commitments such as school or family. You can also choose a job that aligns with your interests and skills, making it more enjoyable and rewarding.

Another advantage of part-time work is the opportunity to gain new skills and experience. Even if you’re working in a field that’s unrelated to your career goals, you can still develop valuable transferable skills such as customer service, communication, and teamwork. These skills can be valuable in any profession and can help you advance in your career.

Of course, there are also some potential drawbacks to working part-time. It can be difficult to balance a part-time job with other responsibilities, and you may have to sacrifice some leisure time. Additionally, part-time jobs often offer fewer benefits than full-time positions, such as health insurance and paid time off.

Despite these challenges, a part-time job can be a great way to boost your income and achieve your financial goals. If you’re looking for extra money and the flexibility to work around your other commitments, a part-time job may be the right solution for you.

Avoid Impulse Purchases and Unnecessary Expenses

Impulse buying can be a major drain on your finances. It’s easy to get caught up in the moment and make purchases you don’t really need, especially when you’re shopping online or in a store with a lot of tempting items. However, there are several things you can do to avoid impulse purchases and save money.

One of the most important things you can do is to create a budget and stick to it. This will help you to track your spending and make sure you’re not overspending. When you’re shopping, consider whether the purchase fits into your budget before you make it.

Another helpful tip is to shop with a list. This will help you to focus on the items you need and avoid buying things you don’t. If you’re shopping online, try to add items to your cart and then wait a day or two before making the purchase. This will give you time to think about whether you really need the item.

You can also unsubscribe from marketing emails and avoid browsing websites that tempt you to buy things you don’t need. If you’re on a shopping spree, it’s best to leave your credit cards at home. This will help you to avoid overspending and making unnecessary purchases.

It’s also important to understand the psychology of impulse buying. Many factors can trigger an impulse purchase, such as emotional stress, boredom, or simply seeing something you like. Once you understand the triggers, you can be more aware of them and avoid making impulsive decisions.

Avoiding impulse purchases can be challenging, but it’s essential for managing your finances. By following these tips, you can make more informed decisions and save money in the long run.

Set Financial Goals to Stay Motivated

It can be hard to stay motivated when it comes to your finances. You may feel overwhelmed by the amount of debt you have or feel like you’re not making enough progress towards your financial goals. But setting realistic financial goals can help you stay motivated and on track.

When setting financial goals, it’s important to make them SMART: Specific, Measurable, Achievable, Relevant, and Time-Bound. For example, instead of saying “I want to save more money,” you could say, “I want to save $1,000 by the end of the year.” This goal is specific, measurable, achievable, relevant, and time-bound.

Here are some tips for setting financial goals:

- Start small. Don’t try to do too much at once. Start with one or two small goals that you can easily achieve. This will help you build momentum and confidence.

- Break down your goals into smaller steps. This will make them seem less daunting and more achievable. For example, if you want to save $1,000, you could break that down into monthly goals of saving $83.

- Write down your goals. This will help you stay focused and accountable.

- Track your progress. This will help you see how far you’ve come and stay motivated. You can track your progress using a spreadsheet, a budgeting app, or a simple notebook.

- Celebrate your successes. When you reach a goal, take some time to celebrate your accomplishment. This will help you stay motivated and on track.

Setting financial goals can help you stay motivated and on track to achieve your financial dreams. By following these tips, you can set SMART goals that are achievable and will help you reach your financial goals.