Retirement might seem far off, but it’s never too early to start planning. A 401(k) is a powerful tool that can help you build a secure financial future. This employer-sponsored retirement savings plan offers tax advantages that can significantly boost your nest egg. By understanding how to maximize your contributions and make smart investment choices, you can take control of your retirement savings and achieve your financial goals.

This guide will equip you with the knowledge and strategies to get the most out of your 401(k) plan. We’ll cover essential topics like contribution limits, investment options, and tax implications. Whether you’re just starting your career or nearing retirement, this comprehensive guide will help you maximize your savings and enjoy a comfortable retirement.

Understanding Your 401(k) Plan: Features and Benefits

A 401(k) plan is a retirement savings plan sponsored by your employer. It allows you to save pre-tax money toward retirement, potentially reducing your tax burden now and building a comfortable nest egg for later. Understanding your 401(k) plan’s features and benefits is crucial for maximizing your savings potential.

Key Features of a 401(k) Plan

- Pre-tax Contributions: You contribute pre-tax dollars to your 401(k) account, which lowers your taxable income for the year. This can significantly reduce your tax bill.

- Employer Match: Some employers offer matching contributions to your 401(k) plan. This means they’ll contribute a certain percentage of your contributions, up to a specific limit. This is essentially free money towards your retirement.

- Investment Options: 401(k) plans typically offer a range of investment options, including mutual funds, stocks, bonds, and target-date funds. You can choose the investments that align with your risk tolerance and retirement goals.

- Tax-Deferred Growth: Your investment earnings in a 401(k) grow tax-deferred, meaning you won’t pay taxes on them until you withdraw the money in retirement. This allows your money to grow at a faster rate than in a taxable account.

Benefits of a 401(k) Plan

- Retirement Security: A 401(k) plan helps you build a secure financial future by providing a dedicated savings vehicle for your retirement.

- Tax Advantages: The pre-tax contributions and tax-deferred growth of a 401(k) can save you a significant amount of money on taxes throughout your working life.

- Employer Match: This is essentially free money that can significantly boost your retirement savings.

- Investment Choices: You have the flexibility to choose from various investment options that align with your risk profile and financial goals.

Important Considerations

- Contribution Limits: There are annual contribution limits for 401(k) plans. For 2023, the limit is $22,500.

- Vesting Schedule: Some employers have vesting schedules, which determine how much of your employer’s contributions you own over time.

- Withdrawals: There are penalties for withdrawing money from a 401(k) before age 59 1/2, except for certain hardship situations.

- Rollover Options: When you leave your employer, you can usually roll over your 401(k) balance into an IRA or another qualified retirement plan.

Conclusion

Your 401(k) plan is a valuable tool for building a secure and comfortable retirement. By understanding its features and benefits, you can maximize your savings potential and secure your financial future.

Maximizing Employer Matching Contributions

Many employers offer a 401(k) matching program, which means they’ll contribute money to your 401(k) account based on the amount you contribute. This is free money, so it’s definitely worth taking advantage of. But how do you maximize your employer’s matching contributions?

First, make sure you understand your employer’s matching program. Some employers will match dollar-for-dollar up to a certain percentage of your salary, while others may offer a partial match. For example, your employer might match 50% of your contributions up to 6% of your salary. That means if you contribute 6% of your salary, your employer will contribute 3% of your salary. It’s important to know how much your employer will match and what the maximum contribution is.

Once you understand your employer’s matching program, you can start to maximize your contributions. The simplest way to maximize your employer’s matching contributions is to simply contribute enough to get the full match. If your employer matches 50% of your contributions up to 6% of your salary, you should contribute 6% of your salary to get the full match. This will give you the most free money possible.

If you’re not able to contribute the full amount needed to get the full match, try to contribute as much as you can. Every dollar you contribute will get you closer to the maximum match. Even if you can only contribute 3% of your salary, it’s better than contributing nothing. You’ll still be getting some free money from your employer.

Here are some tips to help you maximize your employer’s matching contributions:

- Set up automatic contributions. This will make it easier to consistently contribute to your 401(k) and get the full match from your employer.

- Increase your contributions gradually. If you can’t contribute the full amount right away, start by contributing a small percentage and gradually increase your contributions over time.

- Consider a Roth 401(k). With a Roth 401(k), you pay taxes on your contributions upfront, but your withdrawals in retirement are tax-free. This can be a good option if you expect to be in a higher tax bracket in retirement.

Maximizing your employer’s matching contributions is one of the easiest ways to boost your retirement savings. By understanding your employer’s matching program and making consistent contributions, you can take advantage of this valuable benefit and secure a brighter financial future.

Determining Your Ideal Contribution Rate

As you begin your journey into the world of retirement savings, one of the most crucial decisions you’ll face is determining your ideal contribution rate. This rate represents the percentage of your income you’ll allocate towards your retirement account. Striking the right balance is vital, ensuring you accumulate enough funds for a comfortable retirement while also meeting your present financial obligations.

To find your ideal contribution rate, consider the following factors:

1. Your Financial Goals

Start by defining your retirement goals. How much do you envision needing to live comfortably in retirement? What kind of lifestyle do you aspire to? Once you have a clear picture of your financial goals, you can begin to estimate how much you’ll need to save to achieve them.

2. Your Time Horizon

The length of time you have until retirement plays a significant role. The more time you have, the more you can benefit from compound interest. For instance, if you are younger with a longer time horizon, you can afford to contribute a smaller percentage of your income and still potentially reach your retirement goals. However, if you are closer to retirement, you may need to contribute a larger percentage to make up for lost time.

3. Your Income and Expenses

Your current income and expenses are crucial factors in determining your contribution rate. If you have a high income and low expenses, you have more financial flexibility to contribute a larger percentage. Conversely, if your income is lower or your expenses are high, you may need to contribute a smaller percentage, ensuring you maintain a healthy balance between saving and spending.

4. Your Employer Match

If your employer offers a matching contribution, it’s almost always a good idea to take advantage of this free money. Match your employer’s contribution to maximize your savings and get the most out of your retirement plan.

5. Your Risk Tolerance

Your risk tolerance influences your investment strategy. If you’re comfortable with risk, you can consider investing in more volatile assets with the potential for higher returns. However, if you’re risk-averse, you may prefer to invest in more conservative options. Your risk tolerance plays a role in your contribution rate, as it can impact your investment allocation and expected returns.

Ultimately, the ideal contribution rate is personal and depends on your unique circumstances. Start by using the factors outlined above to create a preliminary estimate. Then, you can adjust your rate as your financial situation evolves and you gain a better understanding of your retirement goals.

Investment Options Within Your 401(k)

A 401(k) is a retirement savings plan offered by many employers. It allows employees to contribute a portion of their paycheck pre-tax, which reduces their taxable income. The money is then invested in various options, such as stocks, bonds, and mutual funds, and grows tax-deferred until retirement. When you withdraw money in retirement, it is taxed at your ordinary income tax rate. Choosing the right investments for your 401(k) is crucial, as it can significantly impact your retirement savings.

Most 401(k) plans offer a variety of investment options, categorized as follows:

Common Investment Options

- Target-date funds: These funds automatically adjust their asset allocation as you get closer to retirement, becoming more conservative over time.

- Mutual funds: These funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets.

- Index funds: These funds track a specific market index, such as the S&P 500, providing a low-cost way to invest in the overall market.

- Exchange-traded funds (ETFs): Similar to index funds, ETFs are traded on stock exchanges and offer a diversified portfolio of stocks, bonds, or other assets.

- Individual stocks: You can invest in individual stocks of publicly traded companies, but this option carries higher risk.

- Bonds: These fixed-income investments represent loans to companies or the government, offering a predictable stream of income.

Factors to Consider When Choosing Investments

When deciding which investment options to choose for your 401(k), consider these factors:

- Risk tolerance: How much risk are you comfortable taking with your investments? Younger investors with a longer time horizon can typically afford to take on more risk.

- Investment timeframe: How long do you plan to invest your money? The longer your investment timeframe, the more time your investments have to grow.

- Investment goals: What do you want to achieve with your retirement savings? Do you want to retire early? Travel the world? Pay for your grandchildren’s college education?

- Fees and expenses: Compare the fees associated with different investment options. Lower fees can lead to higher returns over time.

- Diversification: It is important to diversify your investments across different asset classes to reduce risk. This can be achieved by investing in a mix of stocks, bonds, and other assets.

Professional Advice

If you’re unsure about which investments to choose, consider seeking professional advice from a financial advisor. They can help you create a personalized investment plan that aligns with your goals and risk tolerance.

Remember, your 401(k) is an important part of your retirement savings plan. By carefully choosing your investments, you can set yourself up for a comfortable and secure retirement.

The Importance of Diversifying Your Portfolio

Diversification is a crucial concept in investing that involves spreading your investments across different asset classes, industries, and geographies. This strategy aims to reduce risk and enhance potential returns. By diversifying your portfolio, you can mitigate the impact of any single investment performing poorly, thereby protecting your overall investment.

Benefits of Diversification

Diversification offers several benefits, including:

- Risk Reduction: Diversification helps minimize the impact of negative events affecting a specific asset class or industry. If one investment suffers losses, others may perform well, cushioning the overall impact on your portfolio.

- Potential for Higher Returns: Diversification allows you to invest in a wider range of assets with different growth potentials. This can lead to a higher overall return on your investment.

- Improved Sleep at Night: Diversification can provide peace of mind by reducing the stress associated with market volatility. Knowing that your investments are spread across various assets can make you feel more secure about your financial future.

How to Diversify Your Portfolio

There are many ways to diversify your portfolio. Here are some common strategies:

- Asset Allocation: Divide your investments across different asset classes, such as stocks, bonds, real estate, and commodities. The specific allocation will depend on your risk tolerance, investment goals, and time horizon.

- Industry Diversification: Invest in companies from various industries to reduce exposure to specific sector risks. For instance, investing in both technology and healthcare stocks can help mitigate the impact of any downturns in a particular sector.

- Geographic Diversification: Spreading investments across different countries and regions can help reduce the impact of economic or political events in a single location.

- Mutual Funds and ETFs: Consider investing in mutual funds or exchange-traded funds (ETFs) that provide instant diversification by investing in a basket of securities.

Conclusion

Diversification is a fundamental principle of investing that plays a vital role in managing risk and maximizing potential returns. By spreading your investments across different assets, industries, and geographies, you can create a portfolio that is more resilient to market fluctuations and provides a greater chance of achieving your financial goals.

Managing Your 401(k) During Job Transitions (Rollover Options)

Navigating a job transition can be a stressful process, especially when it comes to managing your retirement savings. Your 401(k), a valuable tool for building your financial future, needs careful consideration during these changes. One crucial decision you’ll face is what to do with your existing 401(k) funds: should you rollover your account, cash out, or leave it with your former employer?

Rollover Options

A rollover is generally the most advantageous option for maintaining the tax-advantaged status of your retirement savings. Here’s what you need to know:

Traditional IRA Rollover

A traditional IRA rollover allows you to transfer your 401(k) funds directly into a traditional individual retirement account (IRA). This option preserves the tax-deferred growth of your investments and allows for more investment flexibility. You can choose from a wide range of investment options within a traditional IRA, giving you greater control over your portfolio.

Roth IRA Rollover

If you’ve contributed to your 401(k) with after-tax dollars, you may be eligible for a Roth IRA rollover. This allows you to transfer your funds into a Roth IRA, where withdrawals in retirement will be tax-free. This option can be particularly beneficial for those who anticipate being in a higher tax bracket in retirement.

Direct Rollover to a New Employer’s 401(k)

If your new employer offers a 401(k) plan, you might consider a direct rollover to that plan. This eliminates the need for a separate IRA and simplifies your retirement savings management. However, you’ll be subject to the investment options available in your new employer’s plan.

Considerations for a 401(k) Rollover

Before you roll over your 401(k), consider these factors:

- Fees: Compare the fees associated with your former employer’s 401(k) plan to the fees of your new employer’s plan or a traditional IRA.

- Investment Options: Evaluate the investment choices available in each plan and their alignment with your investment goals.

- Loan Options: If you have a loan outstanding on your 401(k), you might need to repay it before rolling over the funds.

- Taxes: While a rollover generally preserves the tax-deferred nature of your savings, understand the potential tax implications and consult with a financial advisor if needed.

Avoiding Cashing Out

Cashing out your 401(k) should be a last resort. It typically comes with significant tax penalties and can severely impact your long-term retirement savings. Only consider this option if you’re facing an absolute financial emergency and have exhausted other options.

Conclusion

Making the right decision about your 401(k) during a job transition is crucial for maximizing your retirement savings. Consider your options carefully, consult with a financial advisor if necessary, and prioritize preserving the tax-advantaged benefits of your retirement plan.

Understanding Vesting Schedules and Their Impact

A vesting schedule is a common clause in employment contracts, especially for employees who receive equity compensation such as stock options or restricted stock units (RSUs). It determines how and when an employee earns the right to exercise their options or receive their shares. Understanding vesting schedules is crucial for both employees and employers as they have significant implications for both parties.

Types of Vesting Schedules

Vesting schedules typically follow one of these patterns:

- Cliff vesting: This schedule grants the employee all their equity at once after a specific period, typically four years. For example, after four years, the employee gains full ownership of their options or RSUs.

- Gradual vesting: This schedule grants the employee a portion of their equity over a period, usually four years. The most common model is a monthly vesting schedule, where the employee earns 1/48th of their total equity each month. This means that after one year, the employee owns 25% of their total equity, 50% after two years, and so on.

- Time-based vesting: This type of schedule is triggered by the passage of time, regardless of the employee’s performance.

- Performance-based vesting: This schedule is based on achieving specific performance goals or milestones. The employee receives their equity only after meeting the predetermined criteria.

Impact of Vesting Schedules

Vesting schedules have a significant impact on both employees and employers:

For Employees

- Incentivizes long-term commitment: Vesting schedules encourage employees to stay with the company for an extended period to fully realize the value of their equity.

- Provides financial security: The gradual vesting of equity allows employees to build wealth over time.

- Potential for significant financial gain: If the company performs well, the value of the employee’s vested equity can grow significantly.

- Risk of losing equity: If the employee leaves the company before the vesting period is complete, they may lose their unvested equity.

For Employers

- Attracts and retains talent: Vesting schedules are a valuable tool for attracting and retaining top talent by providing them with equity incentives.

- Aligns employee interests with company goals: By tying equity to company performance, vesting schedules encourage employees to contribute to the company’s success.

- Reduces risk of early departures: Vesting schedules can discourage employees from leaving the company prematurely, as they would forfeit their unvested equity.

- Financial burden of equity grants: The cost of equity compensation can be substantial, especially if the company’s stock price rises significantly.

Key Considerations

When reviewing a vesting schedule, employees should consider these factors:

- Vesting period: The length of the vesting period can significantly impact the employee’s potential earnings. A shorter vesting period means the employee can start realizing the value of their equity sooner.

- Vesting schedule type: Understanding the type of vesting schedule is crucial, as it will determine how and when the employee can earn their equity.

- Performance-based vesting: If the vesting schedule is performance-based, the employee should understand the criteria they need to meet to earn their equity.

- Company performance: The value of the employee’s equity will ultimately depend on the company’s performance.

Vesting schedules are an essential aspect of equity compensation. Understanding the different types, their impact on both employees and employers, and the key considerations is crucial for making informed decisions about equity-based employment opportunities.

Avoiding Early Withdrawal Penalties and Fees

Early withdrawal penalties are fees charged by financial institutions when you withdraw money from a deposit account before the maturity date. These penalties can be significant, especially if you have a large sum of money in your account. In this article, we’ll look at some common early withdrawal penalties and fees, and how to avoid them.

Types of Early Withdrawal Penalties

There are many different types of early withdrawal penalties. Some of the most common include:

- Certificate of Deposit (CD) Penalties: CDs are a type of time deposit that earns a fixed interest rate for a specific term. If you withdraw your money before the maturity date, you’ll likely face a penalty, which can range from a few months’ worth of interest to the entire interest earned on the CD.

- Savings Account Penalties: Some savings accounts may have early withdrawal penalties, particularly if they offer higher interest rates. These penalties are usually lower than CD penalties, but they are still something to consider.

- IRA Penalties: If you withdraw money from your IRA before age 59 1/2, you will likely have to pay both a 10% penalty and income taxes on the amount withdrawn. There are some exceptions, such as if you’re withdrawing money for a first-time home purchase or medical expenses.

- Mortgage Penalties: If you have a fixed-rate mortgage and you refinance or pay off the loan early, you may have to pay a prepayment penalty. This is less common today, but it’s important to check your loan documents to see if your mortgage has a prepayment penalty.

How to Avoid Early Withdrawal Penalties

There are several steps you can take to avoid early withdrawal penalties:

- Read the Fine Print: Before opening any type of deposit account, carefully read the terms and conditions to understand the penalties for early withdrawal.

- Choose a Longer Term for CDs: If you can afford to leave your money in a CD for a longer period, you may earn a higher interest rate and reduce the penalty.

- Consider a Short-Term CD: If you need access to your money in the near future, consider a short-term CD with a maturity date that aligns with your needs.

- Shop Around: Compare rates and fees for different financial institutions before opening an account. Some banks and credit unions offer CDs and savings accounts with no early withdrawal penalties.

- Consider Alternative Investments: If you need to access your money quickly, explore other investment options that don’t have early withdrawal penalties, such as high-yield savings accounts, money market accounts, or short-term bonds.

By understanding the different types of early withdrawal penalties and taking steps to avoid them, you can save yourself significant money and frustration.

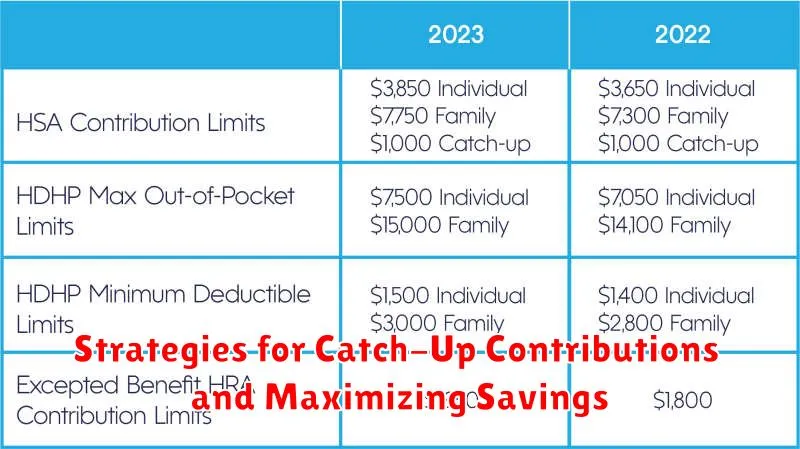

Strategies for Catch-Up Contributions and Maximizing Savings

Are you playing catch-up on your retirement savings? Don’t fret, it’s never too late to maximize your contributions and set yourself up for a comfortable retirement.

The good news is that the IRS offers a catch-up contribution provision for those aged 50 and older. This allows you to contribute more to your retirement accounts, helping you bridge the gap faster.

Understanding Catch-Up Contributions

Catch-up contributions let you contribute additional funds beyond the standard contribution limit. For 2023, individuals aged 50 and over can contribute an extra $7,500 to a 401(k) or 403(b) plan, and $1,000 to a Roth IRA. These extra contributions can significantly boost your retirement savings in a short period.

Strategies for Maximizing Savings

Here are some strategies to effectively leverage catch-up contributions and maximize your retirement savings:

- Prioritize Catch-Up Contributions: Treat catch-up contributions as a priority. Automatically increase your contributions to take advantage of the full catch-up allowance.

- Review and Adjust: Regularly assess your financial situation and adjust your contribution levels as needed. If your income increases or your expenses decrease, consider increasing your contributions to maximize your savings potential.

- Consider a Roth Conversion: If you’re nearing retirement and have a traditional IRA or 401(k), explore converting to a Roth IRA. This allows you to withdraw funds tax-free in retirement, which can be beneficial for tax planning.

- Explore Other Retirement Options: In addition to traditional and Roth IRAs and 401(k) plans, investigate other retirement savings options, such as solo 401(k)s or defined benefit plans, which might offer greater contribution limits or tax advantages.

Conclusion

Don’t underestimate the power of catch-up contributions. Utilize these strategies to accelerate your retirement savings and secure a comfortable future. Remember, it’s never too late to start or increase your contributions, and every dollar saved today will add up to a more secure financial future.