Retirement may seem far off, but it’s never too early to start planning and saving. One of the best ways to build a secure financial future is by taking advantage of tax-advantaged retirement accounts. These accounts offer valuable benefits that can help you save more money and reduce your tax burden in the long run. Choosing the right retirement account can be crucial for maximizing your savings and maximizing your returns.

Whether you’re just starting your career or nearing retirement, understanding the different retirement account options available is essential. This article will explore some of the best retirement accounts for tax advantages, outlining their features, eligibility requirements, and how they can benefit your financial planning. We’ll guide you through the world of IRAs, 401(k)s, Roth IRAs, and more, helping you make informed decisions about your financial future.

Understanding Tax-Advantaged Retirement Accounts

Retirement planning is an essential part of your financial journey, and tax-advantaged retirement accounts play a significant role in securing your future. These accounts offer specific tax benefits designed to encourage saving for retirement. Understanding these benefits can make a substantial difference in your overall retirement savings. Let’s delve into the world of tax-advantaged retirement accounts.

Types of Tax-Advantaged Retirement Accounts

There are two main types of tax-advantaged retirement accounts:

1. Traditional Retirement Accounts

Traditional retirement accounts, such as 401(k)s, 403(b)s, and IRAs, allow pre-tax contributions. This means you deduct your contributions from your taxable income, reducing your immediate tax liability. However, you’ll pay taxes on the withdrawals during retirement. Traditional accounts can be a great option for those who expect to be in a lower tax bracket during retirement.

2. Roth Retirement Accounts

Roth retirement accounts, including Roth 401(k)s and Roth IRAs, are funded with after-tax dollars. This means you won’t receive a tax deduction for your contributions. The benefit comes later when you withdraw your funds in retirement – they are tax-free. Roth accounts are ideal for those who anticipate being in a higher tax bracket during retirement.

Key Tax Advantages

Both traditional and Roth accounts offer unique tax benefits, but some common advantages include:

- Tax-Deferred Growth: Earnings from your investments grow tax-free within the account.

- Potential Tax Savings: Depending on the type of account, you may enjoy tax deductions on contributions or tax-free withdrawals in retirement.

- Reduced Tax Liability: By contributing to these accounts, you can lower your taxable income, leading to potential tax savings in the present.

Choosing the Right Account

The best tax-advantaged retirement account for you depends on your individual circumstances, such as your income, tax bracket, and retirement goals. It’s wise to consult with a financial advisor to make an informed decision.

Conclusion

Tax-advantaged retirement accounts offer valuable benefits that can significantly enhance your retirement savings. By understanding the various types of accounts and their tax implications, you can make informed choices to build a secure financial future. Remember to explore your options and seek professional advice to ensure you select the most appropriate accounts for your unique needs.

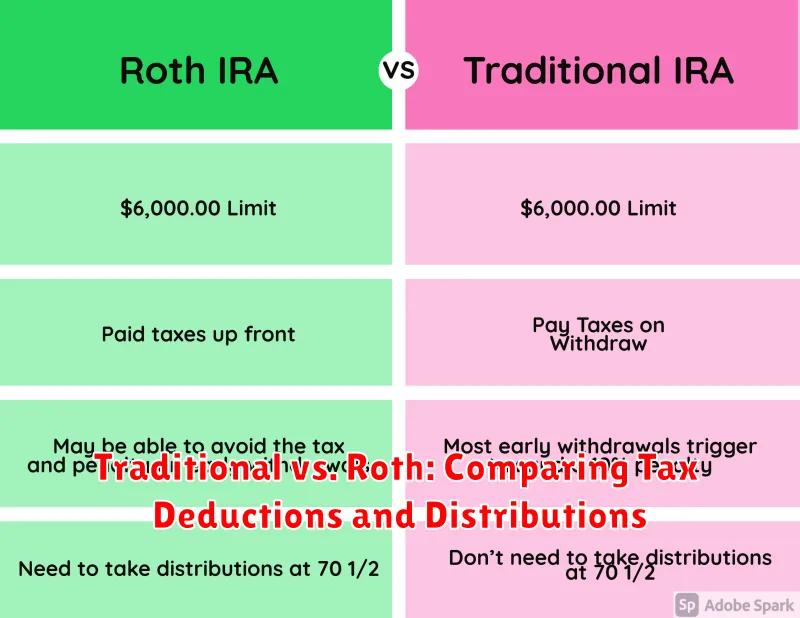

Traditional vs. Roth: Comparing Tax Deductions and Distributions

When it comes to retirement planning, choosing the right type of Individual Retirement Account (IRA) is crucial. Two popular options are the Traditional IRA and the Roth IRA. While both offer tax advantages, they operate differently, affecting your tax burden at different stages of your life. Understanding the key differences between these accounts can help you make an informed decision that aligns with your financial goals.

Traditional IRA: Tax Deductions Now, Taxes Later

With a Traditional IRA, contributions are tax-deductible in the year you make them. This means you reduce your taxable income, potentially lowering your current tax bill. However, withdrawals in retirement are taxed as ordinary income. In essence, you’re deferring taxes to a later date.

Roth IRA: Taxes Now, Tax-Free Distributions Later

In contrast, the Roth IRA requires you to contribute after-tax dollars. This means you don’t receive a tax deduction upfront. However, the real benefit lies in the future. All qualified withdrawals in retirement are completely tax-free, meaning you won’t owe any taxes on the money you take out.

Key Differences in a Nutshell

| Feature | Traditional IRA | Roth IRA |

|---|---|---|

| Contributions | Tax-deductible | After-tax |

| Withdrawals in Retirement | Taxable | Tax-free |

| Tax Benefits | Tax deduction now | Tax-free distributions later |

| Best for | Individuals expecting lower tax brackets in retirement | Individuals expecting higher tax brackets in retirement |

Which IRA Is Right for You?

The choice between a Traditional IRA and a Roth IRA ultimately depends on your individual circumstances and financial outlook. Consider these factors:

- Current Tax Bracket: If you are in a high tax bracket now, a Traditional IRA might be more advantageous, allowing you to lower your immediate tax burden.

- Expected Future Tax Bracket: If you anticipate being in a higher tax bracket in retirement, a Roth IRA could be more beneficial, ensuring your withdrawals are tax-free.

- Risk Tolerance: Roth IRAs offer more certainty about your future tax liability, but Traditional IRAs might provide more flexibility in terms of tax planning.

- Income Limits: Both Traditional and Roth IRAs have income limitations that may affect your eligibility.

It’s always wise to consult with a financial advisor to discuss your specific situation and determine which IRA best aligns with your long-term financial goals.

401(k) Plans: Employer-Sponsored Savings and Tax Benefits

A 401(k) plan is a retirement savings plan sponsored by an employer. It allows employees to save pre-tax income, which reduces their current tax liability. The money grows tax-deferred, meaning you won’t have to pay taxes on it until you withdraw it in retirement.

There are two main types of 401(k) plans:

- Traditional 401(k): Contributions are made with pre-tax dollars, reducing your taxable income. You’ll pay taxes on the withdrawals in retirement.

- Roth 401(k): Contributions are made with after-tax dollars, meaning you won’t pay taxes on the withdrawals in retirement.

Benefits of a 401(k) Plan

Here are some of the benefits of participating in a 401(k) plan:

- Tax Advantages: You can save money on taxes by contributing to a 401(k) plan. With a traditional 401(k), you pay taxes on your withdrawals in retirement, but not on your contributions. With a Roth 401(k), you don’t have to pay taxes on your withdrawals in retirement, but you do pay taxes on your contributions.

- Employer Matching: Many employers offer a matching contribution to their employees’ 401(k) plans. This means that your employer will contribute a certain percentage of your salary to your 401(k) account, up to a certain limit. This is free money that can help you save for retirement.

- Investment Options: 401(k) plans typically offer a wide range of investment options, such as mutual funds, ETFs, and bonds. This allows you to diversify your portfolio and choose investments that align with your risk tolerance and retirement goals.

- Automatic Payroll Deductions: When you sign up for a 401(k) plan, you can choose to have a certain amount of money automatically deducted from your paycheck each pay period. This can make it easier to save consistently and reach your retirement goals.

Things to Consider

Before you decide to participate in a 401(k) plan, there are a few things you should consider:

- Investment Options: Make sure your plan offers investment options that meet your needs and risk tolerance.

- Fees: Be sure to check the fees associated with your 401(k) plan. High fees can eat into your returns over time.

- Vesting: Some employers have vesting requirements for employer matching contributions. This means you may not be able to keep the full amount of your employer’s contributions if you leave the company before you are fully vested.

Conclusion

A 401(k) plan is a valuable tool for saving for retirement. It offers tax advantages, employer matching, and investment options. By taking advantage of a 401(k) plan, you can set yourself up for a comfortable retirement.

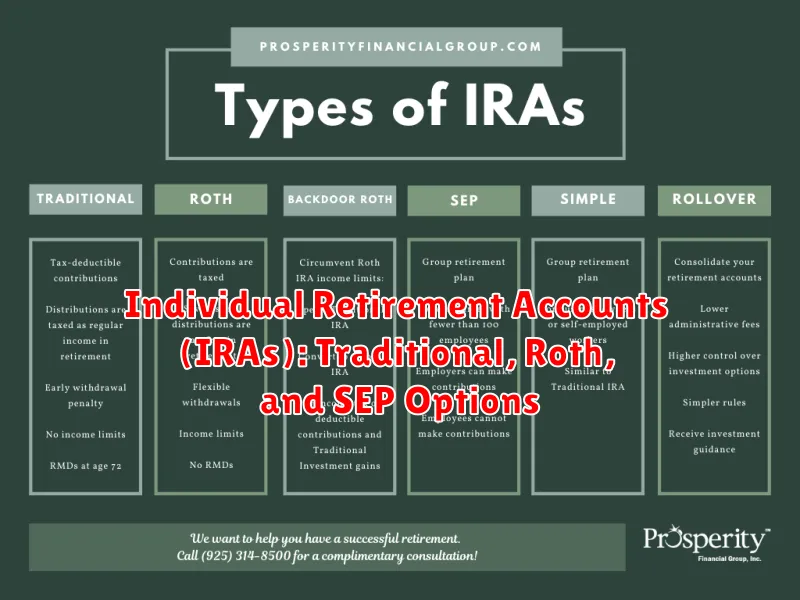

Individual Retirement Accounts (IRAs): Traditional, Roth, and SEP Options

An Individual Retirement Account (IRA) is a retirement savings plan that allows individuals to save money for retirement on a tax-advantaged basis. There are several different types of IRAs, each with its own unique rules and benefits. Here’s a breakdown of the most common IRA options:

Traditional IRA

A Traditional IRA allows you to contribute pre-tax dollars, which means you don’t have to pay taxes on the money until you withdraw it in retirement. Your contributions may also be tax-deductible, lowering your current tax bill. However, you will have to pay taxes on your distributions in retirement.

Benefits:

- Tax-deductible contributions

- Taxes deferred until retirement

- May be suitable for those expecting to be in a lower tax bracket in retirement

Drawbacks:

- You will have to pay taxes on distributions in retirement

- May not be beneficial for those expecting to be in a higher tax bracket in retirement

Roth IRA

A Roth IRA allows you to contribute after-tax dollars, meaning you won’t have to pay taxes on your distributions in retirement. While contributions aren’t tax-deductible, your withdrawals in retirement are tax-free. This can be advantageous if you expect to be in a higher tax bracket in retirement.

Benefits:

- Tax-free withdrawals in retirement

- May be suitable for those expecting to be in a higher tax bracket in retirement

Drawbacks:

- Contributions aren’t tax-deductible

- May not be beneficial for those expecting to be in a lower tax bracket in retirement

SEP IRA

A Simplified Employee Pension (SEP) IRA is a retirement savings plan designed for self-employed individuals and small business owners. It allows you to contribute both as an employee and an employer.

Benefits:

- Flexible contribution limits

- Tax-deductible contributions

- Taxes deferred until retirement

Drawbacks:

- You will have to pay taxes on distributions in retirement

- May be more complex to manage than other IRA options

Choosing the Right IRA for You

The best type of IRA for you depends on your individual financial situation and goals. Consider your current and projected tax bracket, your expected retirement income, and your risk tolerance. It’s always a good idea to consult with a financial advisor to determine the best option for your specific needs.

Self-Employed Retirement Plans: Solo 401(k), SEP IRA, and SIMPLE IRA

If you’re self-employed, you have unique retirement planning needs. Unlike traditional employees who contribute to 401(k) plans through their employers, self-employed individuals are responsible for setting up and contributing to their own retirement accounts. Fortunately, several options are available to help you save for your future, including Solo 401(k), SEP IRA, and SIMPLE IRA plans.

These plans offer tax advantages that can help you save for retirement while reducing your tax burden. Let’s delve deeper into each plan and explore their key features and benefits.

Solo 401(k)

A Solo 401(k) is a retirement savings plan designed specifically for self-employed individuals and small business owners with no employees (or just a spouse working in the business). This plan combines the features of a traditional 401(k) and an IRA.

With a Solo 401(k), you can contribute as both an “employee” and an “employer.” As the “employee,” you can contribute up to $22,500 in 2023, or $30,000 if you are 50 or older. As the “employer,” you can contribute up to 25% of your net adjusted self-employment income.

The combined total of your employee and employer contributions cannot exceed $66,000 in 2023. Like traditional 401(k) plans, Solo 401(k) contributions are tax-deferred, meaning you won’t pay taxes on them until you withdraw the money in retirement.

SEP IRA

A Simplified Employee Pension (SEP) IRA is another popular retirement savings plan for self-employed individuals and small business owners. It’s a simple and flexible plan that allows you to contribute a percentage of your net adjusted self-employment income, up to 25% of your income or $66,000, whichever is less in 2023.

SEP IRA contributions are also tax-deductible, reducing your taxable income and your tax bill for the year. You can withdraw your contributions tax-free in retirement.

SIMPLE IRA

A Savings Incentive Match Plan for Employees (SIMPLE) IRA is a retirement savings plan that is available to small businesses with 100 or fewer employees. The SIMPLE IRA allows both employers and employees to contribute to the plan.

As an employee, you can contribute up to $15,500 in 2023, or $22,500 if you are 50 or older. Your employer must match your contributions, either by matching 2% of your compensation or contributing a fixed percentage of your compensation (up to 3%) regardless of your contributions.

The contributions are tax-deferred, and withdrawals are tax-free in retirement.

Choosing the Right Plan

The best retirement plan for you depends on your individual circumstances, including your income, financial goals, and tax situation. Consider factors such as contribution limits, tax advantages, and withdrawal rules when deciding which plan is right for you.

Consulting with a financial advisor can provide valuable guidance and help you select the most appropriate retirement plan for your needs.

Maximizing Tax Benefits Through Deductions and Credits

Navigating the complexities of taxes can be daunting, especially when it comes to maximizing your tax benefits. Fortunately, the U.S. tax code offers numerous deductions and credits designed to reduce your tax liability. Understanding and effectively utilizing these provisions can significantly impact your financial well-being.

Deductions: Lowering Your Taxable Income

Deductions work by lowering your taxable income, the amount of income upon which taxes are calculated. They directly reduce the amount of income that is subject to tax rates, potentially resulting in significant savings.

Some common deductions include:

- Standard Deduction: A fixed amount that you can deduct, regardless of your itemized deductions.

- Itemized Deductions: Specific expenses that can be deducted, such as medical expenses, charitable contributions, and mortgage interest.

- Homeowner’s Deductions: Deductions for mortgage interest, property taxes, and other expenses related to owning a home.

- Business Expenses: Deductions for expenses incurred in running a business, such as rent, utilities, and salaries.

Credits: Directly Reducing Your Tax Liability

Unlike deductions, credits directly reduce the amount of taxes you owe. This can be more beneficial than deductions, as credits can sometimes result in a tax refund even if you have no tax liability.

Some notable credits include:

- Earned Income Tax Credit (EITC): A credit for low- and moderate-income working individuals and families.

- Child Tax Credit: A credit for each qualifying child.

- American Opportunity Tax Credit: A credit for qualified education expenses.

- Residential Renewable Energy Credit: A credit for installing solar panels or other renewable energy sources in your home.

Strategies for Maximizing Your Tax Benefits

To fully leverage the benefits of deductions and credits, consider the following strategies:

- Keep Accurate Records: Maintain detailed records of all relevant expenses and income. This will help you identify potential deductions and credits.

- Consult a Tax Professional: A qualified tax advisor can provide personalized advice and help you navigate the complexities of the tax code.

- Stay Updated on Tax Law Changes: Tax laws are constantly evolving. Stay informed about any new deductions or credits that may benefit you.

By understanding and utilizing deductions and credits effectively, you can minimize your tax liability and maximize your financial resources.

Contribution Limits and Income Restrictions for Different Accounts

Retirement savings plans like 401(k)s, Roth IRAs, and Traditional IRAs offer valuable tax benefits to help you save for retirement. However, these accounts often have contribution limits and income restrictions that can impact your ability to maximize your savings. Understanding these limits and restrictions is crucial for maximizing your retirement savings potential.

401(k)s

Contribution Limits: In 2023, the maximum contribution limit for 401(k)s is $22,500. If you are 50 years or older, you can contribute an additional $7,500 as a “catch-up” contribution, bringing the total limit to $30,000.

Income Restrictions: There are no income restrictions for contributing to a 401(k). Anyone who is employed by a company that offers a 401(k) plan can contribute.

Roth IRAs

Contribution Limits: The maximum contribution limit for a Roth IRA in 2023 is $6,500 for those under 50, and $7,500 for those 50 and older.

Income Restrictions: Roth IRAs have income restrictions. For 2023, if your modified adjusted gross income (MAGI) is above $153,000 as a single filer, married filing separately, or head of household, or above $228,000 for those who are married filing jointly or qualifying widow(er), you cannot contribute to a Roth IRA.

Traditional IRAs

Contribution Limits: The maximum contribution limit for a Traditional IRA in 2023 is $6,500 for those under 50, and $7,500 for those 50 and older.

Income Restrictions: Traditional IRAs have income restrictions for those who are covered by an employer-sponsored retirement plan. For 2023, if your MAGI is above $73,000 as a single filer, married filing separately, or head of household, or above $146,000 for those who are married filing jointly or qualifying widow(er), you cannot deduct traditional IRA contributions. However, you can still contribute, but the contributions will not be tax-deductible.

Important Considerations

The contribution limits and income restrictions for these retirement accounts can change from year to year. It’s essential to stay up-to-date on the latest rules and regulations. You can find this information on the IRS website or by consulting a financial advisor.

Remember, these limits and restrictions are in place to ensure fair and equitable access to retirement savings programs. While they may seem like hurdles, they ultimately serve to promote a strong and stable retirement savings system.

Tax Implications of Withdrawals in Retirement

Retirement planning is a complex and multifaceted endeavor, encompassing various aspects such as savings, investments, and, crucially, the tax implications of withdrawals. Understanding the tax treatment of your retirement income is essential to maximizing your after-tax returns and ensuring a comfortable financial future.

Types of Retirement Accounts

Before delving into the tax implications, let’s briefly review the different types of retirement accounts:

- Traditional IRA: Contributions are tax-deductible, but withdrawals in retirement are taxed as ordinary income.

- Roth IRA: Contributions are made with after-tax dollars, allowing for tax-free withdrawals in retirement.

- 401(k): Similar to a traditional IRA, contributions are pre-tax, and withdrawals are taxed as ordinary income.

- 403(b): Often found in non-profit organizations, similar tax treatment to 401(k) plans.

Tax Implications of Withdrawals

The tax implications of withdrawals vary depending on the type of retirement account and the individual’s circumstances. Here’s a breakdown:

Traditional IRAs and 401(k)s:

Withdrawals from traditional IRAs and 401(k)s are generally taxed as ordinary income in the year they are taken. This means they are subject to your usual federal and state income tax rates. For example, if you withdraw $10,000 from a traditional IRA and your marginal tax rate is 25%, you would owe $2,500 in federal income tax on that withdrawal.

Roth IRAs:

The beauty of Roth IRAs is that qualified withdrawals in retirement are tax-free. This means you can enjoy your retirement income without worrying about a tax bite. However, to be considered qualified, withdrawals must meet certain conditions, including being taken after age 59 1/2 and being held for at least five years.

Required Minimum Distributions (RMDs)

Once you reach age 72 (or 70 1/2 for those born before July 1, 1949), you are generally required to start taking minimum distributions from your traditional IRAs, 401(k)s, and other qualified retirement plans. Failing to do so can result in significant penalties. RMDs are taxed as ordinary income.

Tax-Efficient Withdrawal Strategies

To minimize your tax burden, consider the following tax-efficient withdrawal strategies:

- Withdraw from Roth IRA first: If you have both Roth and traditional retirement accounts, prioritize withdrawals from the Roth IRA to avoid taxes.

- Use the “bucket” strategy: Divide your retirement savings into different “buckets” with varying tax implications. Use lower-taxed accounts first and save higher-taxed accounts for later.

- Consider Roth conversions: Convert a portion of your traditional IRA to a Roth IRA, allowing for tax-free withdrawals in the future.

Consult with a Financial Professional

The tax implications of retirement withdrawals can be complex. It’s highly recommended to consult with a qualified financial professional to develop a personalized strategy that takes into account your specific situation and goals. They can provide guidance on tax-efficient withdrawal strategies, RMDs, and other relevant considerations.

Seeking Professional Tax Advice for Retirement Planning

Retirement planning is a crucial aspect of financial well-being, and it’s essential to consider the tax implications of your retirement savings and withdrawals. While you can research and learn about tax strategies on your own, seeking professional tax advice can provide valuable insights and guidance tailored to your specific circumstances.

Here are some reasons why seeking professional tax advice for retirement planning can be beneficial:

1. Expertise and Knowledge

Tax laws and regulations are complex and constantly changing. A qualified tax advisor possesses the expertise and up-to-date knowledge to navigate these complexities and ensure you’re taking advantage of all available tax deductions, credits, and strategies.

2. Personalized Strategies

Every individual’s retirement situation is unique. Your tax advisor can analyze your income, assets, and retirement goals to develop a personalized tax plan that aligns with your specific needs and objectives. They can help you identify the most advantageous retirement accounts, investment options, and withdrawal strategies to minimize your tax liability.

3. Tax Optimization

A tax advisor can help you optimize your tax situation throughout your retirement years. They can advise on strategies for minimizing your tax burden on Social Security benefits, Roth conversions, and other retirement income sources. They can also help you avoid common tax pitfalls that could lead to penalties or lost savings.

4. Retirement Planning Integration

Tax considerations should be integrated with your overall retirement planning. A tax advisor can work closely with your financial advisor or retirement planner to ensure your tax strategies are aligned with your broader financial goals. They can help you understand how tax implications affect your investment choices and retirement income streams.

5. Peace of Mind

By seeking professional tax advice, you gain peace of mind knowing that your retirement planning is on solid ground. You can be confident that you’re making informed decisions and taking advantage of all available tax benefits. This can reduce stress and anxiety associated with retirement planning.

Conclusion

Seeking professional tax advice for retirement planning is a smart investment in your financial future. A qualified tax advisor can provide valuable expertise, personalized strategies, and peace of mind, helping you navigate the complexities of taxes and secure a comfortable and financially sound retirement.