Are you ready for retirement? While it may seem like a distant thought, the truth is that the earlier you start planning, the better. Retirement planning isn’t just about saving money; it’s about ensuring a comfortable and fulfilling life after you stop working. It’s about having the freedom to pursue your passions, travel, and spend time with loved ones without financial worries. Starting early allows you to take advantage of the power of compounding, which can significantly boost your savings over time.

The benefits of starting your retirement plan early are undeniable. You’ll have more time to save, allowing you to reach your financial goals with less pressure. You can also take advantage of tax benefits offered by retirement accounts, such as 401(k)s and IRAs. Early planning also gives you the flexibility to adjust your strategy as your life changes, ensuring your plan stays aligned with your evolving needs. In this article, we’ll delve into the crucial reasons why starting your retirement plan early is essential for your future financial well-being.

Time: Your Greatest Asset in Retirement Savings

Retirement might seem like a distant dream, but the truth is, it’s closer than you think. And the most valuable tool you have in securing a comfortable future is time. Time, combined with smart financial planning, can work wonders for your retirement savings.

The Power of Compounding

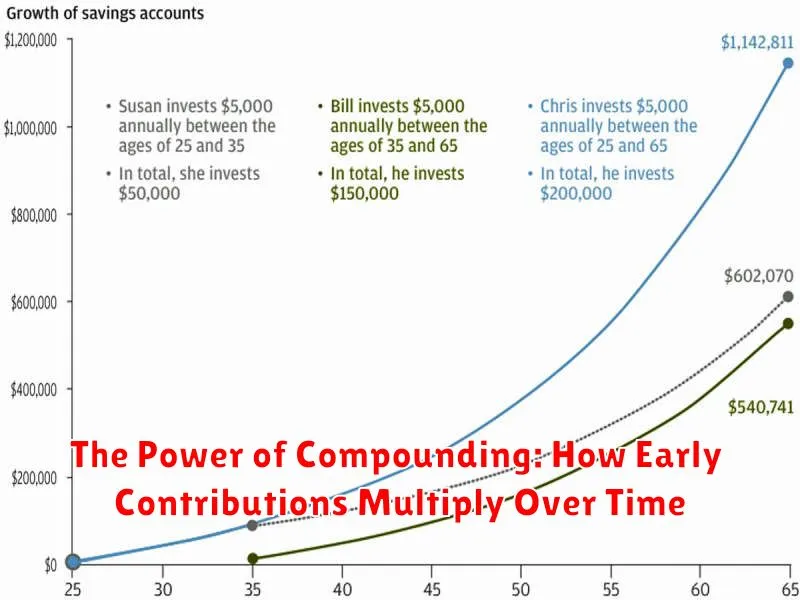

One of the key benefits of starting early is the magic of compounding. Compounding is the snowball effect of earning interest on your principal investment, and then earning interest on that interest. This creates exponential growth, turning small contributions into a substantial nest egg over time.

Imagine two individuals: Sarah starts saving at age 25, while John starts at age 35. Both contribute the same amount each year. By the time they reach 65, Sarah’s savings will be significantly larger due to the additional years of compounding.

Benefits of Early Retirement Planning

Beyond compounding, starting early offers several other advantages:

- Lower contributions: You need to save less each month to reach your goal.

- Less risk: You have more time to recover from market fluctuations.

- Flexibility: You have more options for investment strategies.

- Peace of mind: Knowing you’re on track for a secure future reduces financial stress.

Taking Action Today

Don’t let time slip away. The sooner you start, the better. Here are some practical steps to get started:

- Assess your current situation: Determine your income, expenses, and debt.

- Set realistic goals: Decide how much you need for retirement and when you plan to retire.

- Start saving: Even small amounts can make a big difference over time.

- Consider your investment options: Talk to a financial advisor to find suitable investment strategies.

- Review your plan regularly: Adjust your savings and investments as needed.

Remember, time is on your side when it comes to retirement savings. Don’t wait any longer. Take action today and harness the power of time to secure a comfortable future for yourself.

The Power of Compounding: How Early Contributions Multiply Over Time

Compounding is one of the most powerful forces in finance. It’s the snowball effect of earning interest on your initial investment, and then earning interest on that interest, and so on. It’s a simple concept, but it can have a profound impact on your wealth over time.

The earlier you start investing, the more time your money has to compound. This is because even small contributions can grow significantly over time. For example, if you invest $100 per month for 30 years at an average annual return of 8%, you’ll end up with over $1 million. But if you wait until you’re 40 to start investing, you’ll only have about $300,000 at the end of your 30-year investing journey, even if you contribute the same amount each month.

How Compounding Works

Think of compounding like a snowball rolling down a hill. The snowball starts small, but as it rolls down the hill, it picks up more snow and gets bigger and bigger. The same goes for your investments. The longer you let them compound, the more they grow.

Here’s a simple example:

- Let’s say you invest $1,000 at an annual return of 10%.

- After one year, you’ll have $1,100.

- In year two, you earn 10% on the $1,100, which is $110, so you’ll have $1,210.

- In year three, you earn 10% on $1,210, which is $121, so you’ll have $1,331.

As you can see, the amount of interest you earn each year gets bigger and bigger because it’s calculated on the previous year’s balance. This is the power of compounding.

The Importance of Early Investment

The earlier you start investing, the more time your money has to compound. This means that you can reach your financial goals faster and with less effort. The sooner you begin, the sooner your investments have time to mature and grow, giving you the potential to generate a larger sum of money. It’s never too late to start investing, but the sooner you begin, the more benefit you can expect from the power of compounding.

Tips for Maximizing Compounding

Here are a few tips for maximizing the power of compounding:

- Start early: The earlier you start investing, the more time your money has to grow.

- Invest regularly: Make regular contributions to your investments, even if they’re small.

- Invest in the right assets: Choose investments that have the potential to generate strong returns over the long term.

- Be patient: Compounding takes time. Don’t get discouraged if you don’t see results immediately. Just keep investing and let your money work for you.

Compounding is a powerful tool for building wealth. By understanding how it works and making smart investment decisions, you can take advantage of this force to reach your financial goals.

Setting Realistic Retirement Goals and Timelines

Retirement is a significant milestone in life, and it’s essential to plan for it effectively. One crucial aspect of retirement planning is setting realistic goals and timelines. This ensures that you have enough time to accumulate the necessary funds and enjoy a comfortable retirement. Here’s a comprehensive guide to help you establish sensible retirement goals and timelines:

1. Determine Your Retirement Lifestyle

Before setting any goals, it’s vital to visualize your ideal retirement lifestyle. Consider factors like:

- Living expenses: Estimate your monthly living costs, including housing, utilities, groceries, healthcare, and entertainment.

- Travel plans: Do you plan to travel extensively? Consider the potential costs associated with travel.

- Hobbies and activities: What activities do you enjoy? Factor in the costs associated with pursuing these activities.

- Healthcare expenses: Healthcare costs can rise significantly in retirement. Plan for potential healthcare expenses.

2. Estimate Your Retirement Income Needs

Once you’ve determined your desired lifestyle, calculate your estimated annual retirement income needs. This will help you understand how much money you’ll need to save and manage your finances effectively.

3. Consider Your Current Financial Situation

Assess your current financial situation, including your savings, investments, and debts. This will provide a realistic understanding of your starting point and help you set achievable goals.

4. Factor in Inflation

Inflation can erode the purchasing power of your savings over time. Account for inflation when setting your retirement goals. Aim to save enough to cover the rising costs of living in the future.

5. Set Realistic Savings Goals

Based on your retirement income needs and current financial situation, set realistic savings goals. Consider using a retirement calculator to estimate how much you need to save annually to reach your goals.

6. Establish Timelines

Establish realistic timelines for achieving your savings goals. Consider factors like your age, current savings rate, and expected investment returns. It’s crucial to be realistic about your timeline and adjust it if necessary.

7. Review and Adjust Regularly

Retirement planning is an ongoing process. Regularly review your goals and timelines to ensure they remain aligned with your financial situation and changing circumstances. Make adjustments as needed to stay on track.

8. Seek Professional Advice

Consider consulting with a financial advisor who can provide personalized guidance and help you create a comprehensive retirement plan.

Setting realistic retirement goals and timelines is essential for ensuring a comfortable and secure retirement. By following these steps, you can develop a solid plan and achieve your financial objectives for the future.

The Benefits of Starting Early, Even with Small Contributions

We all have goals, whether it’s saving for retirement, buying a house, or starting a business. Achieving these goals often requires time and consistent effort. While it can be tempting to put things off, the benefits of starting early, even with small contributions, cannot be overstated. Here’s why:

Power of Compounding: Compounding is the magic of earning interest on your interest. The earlier you start investing, the more time your money has to grow exponentially. Even small contributions made consistently over a long period can snowball into a significant sum.

Reduces Financial Stress: Starting early allows you to build a financial safety net, reducing stress and anxiety about your future. It gives you the freedom to make choices without being financially constrained.

Opportunity Cost: Procrastination has a hidden cost. By delaying, you miss out on potential earnings and growth. The earlier you start, the less opportunity cost you incur.

Building Good Habits: Saving and investing consistently become a habit. This habit can extend to other areas of your life, fostering a disciplined and goal-oriented mindset.

Achieving Financial Independence: Starting early gives you more control over your financial future. It empowers you to achieve financial independence and live life on your own terms.

Don’t let the fear of starting small or the feeling of being “too late” hold you back. Every little step counts. Embrace the power of starting early, and watch your dreams become reality.

Calculating Your Retirement Savings Needs

Retirement is a significant life milestone that requires careful planning and preparation. One crucial aspect of this planning involves determining how much you need to save to ensure a comfortable and financially secure retirement. The amount you need to save depends on various factors, including your lifestyle, health, and expected longevity. This article will guide you through calculating your retirement savings needs.

1. Determine Your Estimated Expenses

Start by estimating your monthly expenses in retirement. Consider factors such as housing, healthcare, food, transportation, entertainment, and travel. You can use a retirement calculator or a budgeting tool to help you with this estimation. It’s crucial to be realistic about your spending habits and account for potential increases in costs over time.

2. Consider Inflation

Inflation plays a significant role in retirement planning. The purchasing power of your savings will erode over time due to inflation. It’s essential to factor in inflation when calculating your retirement savings needs. You can use an inflation calculator to estimate how much your expenses will increase in the future.

3. Account for Healthcare Costs

Healthcare expenses can be substantial in retirement. As you age, your healthcare needs may increase, leading to higher medical bills. Consider factoring in costs associated with health insurance, prescription drugs, and long-term care. You can consult with a financial advisor or healthcare professional to get a more accurate estimate of your healthcare costs in retirement.

4. Factor in Your Investment Returns

Your retirement savings will grow over time through investment returns. However, it’s crucial to have realistic expectations about investment returns. Historical data can provide some insights into average returns, but remember that past performance is not indicative of future results. A conservative estimate of your investment returns will help you determine a more realistic savings goal.

5. Use a Retirement Calculator

Retirement calculators are valuable tools that can help you estimate your retirement savings needs. These online calculators take into account factors such as your age, current savings, desired retirement age, estimated expenses, and investment returns. By inputting your information, you can get a personalized estimate of how much you need to save for retirement.

6. Seek Professional Advice

If you’re unsure about your retirement savings needs or require more detailed guidance, consider seeking professional advice from a financial advisor. A financial advisor can assess your individual circumstances, create a personalized retirement plan, and recommend suitable investment strategies to help you reach your savings goals.

Conclusion

Calculating your retirement savings needs is a crucial step in securing your financial future. By following the steps outlined above, you can estimate how much you need to save and develop a comprehensive retirement plan. Remember to be realistic about your expenses, factor in inflation and healthcare costs, consider your investment returns, utilize retirement calculators, and seek professional advice when necessary. With proper planning and preparation, you can enjoy a comfortable and financially secure retirement.

Making Catch-Up Contributions Later vs. Consistent Savings from the Start

Saving for retirement is crucial, but life throws curveballs. Sometimes, you might find yourself starting later than you’d planned or needing to catch up on missed savings. This raises the question: Is it better to make catch-up contributions later in life or prioritize consistent saving from the very beginning?

Let’s explore the pros and cons of each approach:

Making Catch-Up Contributions Later

Pros:

- Potential to accelerate savings: Catch-up contributions allow you to significantly increase your retirement savings, especially if you’ve been saving consistently in the past.

- Tax advantages: Like traditional contributions, catch-up contributions are often tax-deductible, potentially saving you money on taxes.

- Flexibility: This option provides flexibility for those who may have had other financial priorities earlier in their lives.

Cons:

- Limited time for compounding: Catch-up contributions don’t make up for lost time. The power of compound interest works best when savings begin early.

- Possible strain on current finances: Catching up on savings can be challenging financially, especially if you have other obligations like mortgages or loans.

- Higher required contributions: Catch-up contributions can necessitate large contributions, which can be difficult to maintain consistently.

Consistent Savings from the Start

Pros:

- Power of compounding: The earlier you start saving, the longer your money has to grow through compound interest, leading to a larger retirement nest egg.

- Easier on your finances: Smaller, consistent contributions are often easier to manage than large catch-up contributions.

- Mental peace of mind: Knowing you’re consistently saving for retirement can provide peace of mind and reduce financial anxiety later in life.

Cons:

- Lower initial savings: Consistent savings may not seem like much at first, but the long-term impact of compounding is significant.

- Potential for missed opportunities: Life can get busy, and it’s easy to put off saving until later. This can limit your potential for growth.

The Bottom Line

The best approach depends on your individual circumstances. If you can start saving early and consistently, it’s ideal. However, if you’re behind on your retirement savings, catch-up contributions can be a valuable tool to get you back on track. It’s crucial to consult with a financial advisor to create a personalized plan that aligns with your goals and resources.

The Impact of Inflation on Future Purchasing Power

Inflation is a gradual increase in the price of goods and services over time. It can have a significant impact on your future purchasing power, which is the value of your money in the future. When inflation is high, your money buys less than it did in the past. This means that you need to earn more money to maintain the same standard of living.

There are several factors that can contribute to inflation, including:

- Increased demand for goods and services

- Increased costs of production

- Government policies

- Supply chain disruptions

The impact of inflation on your future purchasing power can be significant. For example, if the inflation rate is 3% per year, then your money will lose 3% of its value each year. This means that if you have $100 today, it will be worth $97 in one year.

There are several things you can do to protect yourself from the impact of inflation, including:

- Invest your money in assets that are likely to appreciate in value, such as stocks or real estate

- Increase your income to keep pace with inflation

- Reduce your spending

- Consider purchasing assets that can act as inflation hedges, such as gold or commodities

Inflation is a complex issue with far-reaching consequences. By understanding the factors that contribute to inflation and the ways it can impact your future purchasing power, you can take steps to protect your financial security.

Avoiding Retirement Shortfalls: The Value of Early Planning

Retirement is a significant milestone in life, a time to finally reap the rewards of years of hard work and dedication. However, many individuals approach retirement with trepidation, fearing financial shortfalls and a diminished quality of life. The key to avoiding these anxieties lies in early planning, a strategy that can pave the way for a secure and fulfilling retirement.

The Power of Compounding

One of the most powerful tools in retirement planning is the concept of compounding. It’s the snowball effect of earning interest on both your principal investment and previously accrued interest. The earlier you start saving, the longer your money has to grow, allowing compounding to work its magic. A small investment made early on can turn into a substantial sum over time.

Defining Your Retirement Goals

Before you start saving, it’s crucial to define your retirement goals. What kind of lifestyle do you envision? Do you want to travel extensively, pursue hobbies, or simply enjoy a relaxing life at home? Answering these questions helps you determine how much money you’ll need to save and how you can allocate your funds effectively.

Developing a Savings Strategy

With your goals in mind, you can develop a savings strategy. Consider contributing to a 401(k) or IRA, maximizing employer matching, and exploring other investment options. A financial advisor can assist you in creating a personalized plan that aligns with your risk tolerance and financial situation.

The Benefits of Early Planning

Early planning provides numerous benefits:

- Reduces Stress: You’ll have more time to adjust your savings strategy if you need to.

- Increases Flexibility: You’ll have greater flexibility to achieve your goals, whether it’s retiring earlier or pursuing a dream.

- Maximizes Compounding: You’ll leverage the power of compounding for a longer period, allowing your investments to grow exponentially.

Conclusion

Retirement may seem far off, but the benefits of early planning are undeniable. By starting early, you empower yourself to secure a comfortable and fulfilling retirement. Don’t let the fear of financial shortfalls overshadow the joy of this significant milestone. Embrace the power of early planning and pave the way for a worry-free future.

Case Studies: Comparing Early vs. Late Starters

The question of whether to start a business early in life or wait until later is a constant debate among entrepreneurs. There’s no one-size-fits-all answer, and the decision ultimately depends on individual circumstances, risk tolerance, and personal goals. To shed light on this dilemma, let’s delve into two contrasting case studies: one of an early starter and another of a late starter.

Case Study 1: The Early Starter

Meet Sarah, a 22-year-old college graduate who launched her own online bakery, “Sweet Delights,” right after completing her degree. Sarah had always been passionate about baking and saw a gap in the market for handcrafted desserts delivered to customers’ doorsteps. Her youthfulness brought a unique perspective, allowing her to connect with younger demographics through social media and online platforms. She leveraged her limited capital by operating from home, minimizing overhead costs. While facing challenges with time management and learning the ropes of running a business, Sarah’s determination and adaptability helped her navigate the early stages. Within a few years, Sweet Delights expanded its operations, hired employees, and gained a loyal customer base.

Case Study 2: The Late Starter

David, a seasoned professional in his 40s, had always dreamt of starting his own tech company. After years of working for corporations and gaining valuable experience in software development, he finally decided to take the plunge. David possessed a deep understanding of the industry, a strong network of contacts, and significant savings. His maturity and business acumen allowed him to navigate the complexities of securing funding, building a team, and managing risks. Although he faced challenges in adapting to the fast-paced world of startups, David’s experience and discipline helped him overcome obstacles and achieve his goals.

Insights from the Case Studies

These case studies highlight the contrasting advantages and disadvantages of starting a business early vs. late in life. Early starters often benefit from:

- Higher energy and adaptability

- Lower financial commitments

- Stronger connection with younger demographics

However, they may lack experience, networks, and financial resources.

Late starters, on the other hand, benefit from:

- Experience and business acumen

- Stronger financial foundation

- Established networks

They may face challenges with adapting to new technologies and staying relevant in a rapidly changing market.

Conclusion

Ultimately, the decision to start a business early or late is highly personal. Both approaches have their own merits and demerits. Success depends on a combination of factors, including passion, dedication, and a well-defined business plan. By carefully evaluating individual strengths, weaknesses, and the business landscape, entrepreneurs can determine the best path for their entrepreneurial journey.