Are you tired of constantly wondering where your money goes each month? Do you find yourself struggling to make ends meet, even though you feel like you’re not spending that much? If so, you’re not alone. Many people find it difficult to track their expenses effectively. Thankfully, there are a number of excellent budgeting tools available that can help you take control of your finances. These tools can help you track your spending, set budgets, and even automate your savings, all while giving you valuable insights into your financial habits.

Whether you prefer a simple spreadsheet or a sophisticated app, there’s a budgeting tool out there for you. In this article, we’ll explore some of the best options available, highlighting their features and benefits so you can choose the one that best suits your needs. From free budgeting apps to comprehensive financial management platforms, we’ll cover it all. So, get ready to ditch the guesswork and embrace a more informed approach to managing your money. Let’s dive in!

The Benefits of Using Budgeting Tools and Apps

In today’s digital age, there are countless tools and apps available to help us manage our finances. Among these, budgeting tools and apps stand out as essential resources for achieving financial stability and reaching our financial goals.

Here are some of the key benefits of using budgeting tools and apps:

1. Increased Financial Awareness

Budgeting tools provide a clear picture of your income and expenses. By tracking every dollar that comes in and goes out, you gain a better understanding of your spending habits and identify areas where you can cut back.

2. Goal Setting and Tracking

Most budgeting apps allow you to set financial goals, such as saving for a down payment on a house, paying off debt, or investing for retirement. They also provide progress tracking, keeping you motivated and on track to achieve your goals.

3. Automated Savings

Many budgeting apps offer automated savings features. You can set up recurring transfers from your checking account to your savings account, ensuring that you’re consistently saving money towards your goals.

4. Reduced Debt

By visualizing your spending patterns, budgeting tools can help you identify and prioritize high-interest debt. This can lead to more strategic debt repayment, reducing the overall amount of interest you pay.

5. Improved Financial Discipline

Using a budgeting tool encourages financial discipline by holding you accountable for your spending. It provides a clear picture of your financial situation, making it easier to make responsible financial decisions.

6. Easy Access and Convenience

Budgeting apps are readily accessible on your smartphone or computer, allowing you to track your finances on the go. They provide real-time updates and notifications, keeping you informed about your financial status.

Overall, budgeting tools and apps are valuable resources for anyone looking to take control of their finances. They provide the necessary insights, tools, and motivation to make informed financial decisions, achieve your goals, and build a secure financial future.

Key Features to Look for in a Budgeting Tool

Budgeting can be a daunting task, but it doesn’t have to be. With the right budgeting tool, you can take control of your finances and achieve your financial goals. But with so many budgeting tools available, how do you choose the right one for you? Here are some key features to look for:

Easy to Use Interface

A good budgeting tool should be easy to use and navigate. You should be able to easily track your income and expenses, create budgets, and set financial goals. Look for a tool with a user-friendly interface and clear instructions.

Automatic Categorization

Automatic categorization is a great feature that saves you time and effort. The tool should be able to automatically categorize your transactions based on your spending habits. This feature helps you get a clear picture of where your money is going.

Budgeting Templates

Budgeting templates can help you get started with your budgeting. Look for a tool that offers various budgeting templates, such as the 50/30/20 budget or the zero-based budget. Templates provide a structure to start and adjust to fit your needs.

Financial Reporting

A good budgeting tool should provide you with detailed financial reports. These reports can help you track your progress, identify areas where you can save money, and make informed financial decisions. Reports can include spending summaries, trend analysis, and projections.

Goal Setting

Setting financial goals is essential for staying motivated and on track. Look for a tool that allows you to set goals, track your progress, and receive reminders. Goals can be for saving, debt reduction, or investing.

Security

Security is paramount when choosing a budgeting tool. Ensure the tool uses industry-standard security measures to protect your sensitive financial information. Look for features like encryption, two-factor authentication, and regular security audits.

Mobile App

A mobile app can be a great way to manage your budget on the go. Look for a budgeting tool with a mobile app that offers the same functionality as the desktop version. This allows you to track your spending, adjust your budget, and set goals from your phone.

Integration

Integration with other financial tools can be a significant advantage. Look for a budgeting tool that integrates with your bank accounts, credit cards, and other financial services. This feature streamlines your financial management and eliminates manual data entry.

Customer Support

Good customer support is essential, especially when using a budgeting tool. Look for a tool that offers reliable customer support through various channels, such as email, phone, or live chat.

Choosing the right budgeting tool can significantly impact your financial well-being. By considering these key features, you can find a tool that meets your needs and helps you achieve your financial goals.

Top Budgeting Apps for Different Needs and Preferences

Budgeting apps have become increasingly popular in recent years, offering a convenient and effective way to manage your finances. With so many options available, choosing the right app can be a challenge. This article will provide a comprehensive guide to the top budgeting apps for different needs and preferences.

Best for Beginners: Mint

Mint is a popular budgeting app that is known for its simplicity and ease of use. It automatically categorizes your transactions and provides insights into your spending habits. Mint also offers features such as bill payment reminders and credit score monitoring.

Best for Advanced Users: Personal Capital

Personal Capital is a more comprehensive budgeting app that caters to advanced users. It offers advanced features such as investment tracking, retirement planning, and net worth analysis. Personal Capital also provides personalized financial advice from certified financial advisors.

Best for Couples: Honeydue

Honeydue is a budgeting app designed specifically for couples. It allows you to sync your bank accounts and track your shared expenses. Honeydue also offers features such as shared goals and money requests.

Best for Visual Learners: YNAB (You Need a Budget)

YNAB (You Need a Budget) is a popular budgeting app that uses a “zero-based” budgeting method. This means that every dollar you earn is assigned a purpose. YNAB is visually appealing and offers detailed insights into your spending habits.

Best for Debt Management: EveryDollar

EveryDollar is a budgeting app that focuses on debt management. It uses a “cash-flow” budgeting method, which involves allocating money to specific categories. EveryDollar also offers features such as debt snowball calculators and spending trackers.

Best for Gamification: Mvelopes

Mvelopes is a budgeting app that uses a gamification approach to make budgeting more engaging. It allows you to assign money to “envelopes” for different categories. Mvelopes also offers features such as spending challenges and rewards.

Conclusion

The best budgeting app for you will depend on your individual needs and preferences. Consider your level of financial experience, desired features, and budget when making your decision. With the right app, you can take control of your finances and reach your financial goals.

Free vs. Paid Budgeting Tools: Which is Right for You?

Budgeting is essential for achieving financial stability and reaching your financial goals. In today’s digital age, there are numerous budgeting tools available, both free and paid. While free tools offer a basic level of functionality, paid tools typically provide more advanced features and personalized support. Choosing the right budgeting tool depends on your individual needs and preferences.

Free Budgeting Tools

Free budgeting tools are a great starting point for those new to budgeting or looking for a simple solution. They typically offer basic features such as:

- Tracking income and expenses

- Creating budgets

- Generating reports

Some popular free budgeting tools include Mint, Personal Capital, and PocketGuard. These tools are user-friendly and can be accessed online or through mobile apps. However, free tools may have limitations such as:

- Limited features

- Advertisements

- Data privacy concerns

Paid Budgeting Tools

Paid budgeting tools offer a more comprehensive and customizable budgeting experience. They typically provide advanced features such as:

- Automated budgeting

- Goal setting and tracking

- Financial planning tools

- Personalized support

Some popular paid budgeting tools include YNAB (You Need a Budget), EveryDollar, and Personal Capital Premium. These tools can help you take control of your finances, achieve your financial goals, and avoid debt.

Choosing the Right Tool

The best budgeting tool for you depends on your individual needs and financial situation. Consider the following factors:

- Budgeting experience

- Financial goals

- Budgeting needs

- Budget

If you are new to budgeting, a free tool can be a good starting point. However, if you are serious about achieving your financial goals, a paid tool may be a better investment. Ultimately, the best budgeting tool is one that you will actually use and that helps you achieve your financial objectives.

How to Choose the Best Budgeting Tool for Your Lifestyle

Managing your finances can be a daunting task, especially if you’re not sure where to start. Thankfully, there are numerous budgeting tools available that can help you track your spending, set financial goals, and ultimately take control of your money. However, with so many options to choose from, picking the best budgeting tool for your specific lifestyle can feel overwhelming.

To help you navigate this process, here’s a comprehensive guide outlining key factors to consider when selecting a budgeting tool:

1. Determine Your Budgeting Needs

Before diving into the world of budgeting tools, take a moment to assess your individual needs. Consider factors like:

- Your financial goals: Are you aiming to save for a down payment on a house, pay off debt, or invest for retirement? The tool you choose should align with your goals.

- Your comfort level with technology: Some tools are highly automated and user-friendly, while others require more manual input. Choose a tool that fits your comfort level.

- Your budget size: If you have a complex budget with multiple income sources or expenses, a tool with robust features might be necessary.

2. Explore Different Budgeting Tool Types

Budgeting tools come in various forms, each with its own advantages and disadvantages. The most common types include:

- Spreadsheet software: Excel or Google Sheets offer flexibility but require manual data entry and formula creation.

- Budgeting apps: These mobile apps are user-friendly, often offering features like automatic expense tracking and goal setting. Popular examples include Mint, Personal Capital, and YNAB (You Need A Budget).

- Online budgeting tools: Web-based tools provide comprehensive features and often integrate with your bank accounts for automatic transaction syncing.

3. Consider Key Features

Once you’ve narrowed down your options, evaluate the specific features each tool offers. Look for features like:

- Expense tracking: The ability to track your spending and categorize transactions.

- Budgeting capabilities: Setting budget limits for different spending categories.

- Goal setting: Defining financial goals and creating a plan to achieve them.

- Reporting and analysis: Generating reports to visualize your spending patterns and identify areas for improvement.

- Bank account integration: Automatically syncing your transactions with your bank accounts.

- Security and privacy: Ensuring your financial data is protected.

4. Try Before You Buy

Many budgeting tools offer free trials or limited free versions. Take advantage of these opportunities to test the tool and see if it meets your needs. Consider factors like:

- User interface: Is it easy to navigate and understand?

- Customization options: Can you tailor the tool to your preferences?

- Customer support: Is there reliable support available if you encounter issues?

5. Don’t Be Afraid to Switch

Finding the perfect budgeting tool might require some trial and error. If a tool doesn’t meet your needs, don’t hesitate to switch to another one. The key is to find a tool that helps you reach your financial goals and makes managing your money more manageable.

Setting Up Your Budgeting Tool for Success

Budgeting is an essential aspect of personal finance, and choosing the right budgeting tool can significantly impact your success. Whether you prefer a simple spreadsheet or a sophisticated app, setting up your tool properly is key to achieving your financial goals. Here’s a comprehensive guide to help you get started:

1. Determine Your Budgeting Method

There are several popular budgeting methods, each with its own advantages and disadvantages. Consider the following:

- Zero-Based Budgeting: Allocating every dollar of your income to specific categories, ensuring no money is left unallocated.

- 50/30/20 Method: Dividing your income into 50% for needs, 30% for wants, and 20% for savings and debt repayment.

- Envelope Method: Using physical envelopes to track spending in different categories.

Choose the method that best aligns with your preferences and financial situation.

2. Gather Your Financial Data

Before you can start budgeting, you need to gather accurate financial data. This includes:

- Income: List all your income sources and the amount you receive from each.

- Expenses: Track your spending for a month or two to identify your regular expenses and any areas where you can cut back.

- Debts: List all your outstanding debts, including the interest rate and minimum payment.

- Savings Goals: Identify your short-term and long-term savings goals.

3. Choose a Tool That Fits Your Needs

The best budgeting tool for you depends on your individual preferences and financial goals. Consider factors like:

- Ease of use: Look for a tool with a user-friendly interface and intuitive features.

- Features: Choose a tool that offers features like expense tracking, budget categories, goal setting, and reporting.

- Integration: Look for tools that integrate with your bank accounts for automatic transaction updates.

- Cost: Budgeting tools range in price from free to premium options. Choose a tool that fits your budget.

4. Set Up Your Budget Categories

Once you have your chosen tool, create budget categories that reflect your spending habits. Some common categories include:

- Housing: Rent or mortgage payments, utilities, and insurance.

- Transportation: Car payments, gas, public transportation, and parking.

- Food: Groceries, dining out, and takeout.

- Entertainment: Movies, concerts, travel, and hobbies.

- Debt Payments: Credit cards, loans, and student loans.

- Savings: Emergency fund, retirement savings, and specific goals.

5. Input Your Income and Expenses

Enter your income sources and your monthly expenses into your chosen tool. Make sure to allocate each expense to the correct category.

6. Adjust and Track Your Budget

Review your budget regularly and make adjustments as needed. Track your spending and compare it to your budgeted amounts. This will help you identify areas where you can save money or make changes to your spending habits.

Setting up a budgeting tool is an investment in your financial well-being. By following these steps, you can create a system that empowers you to take control of your finances and reach your financial goals.

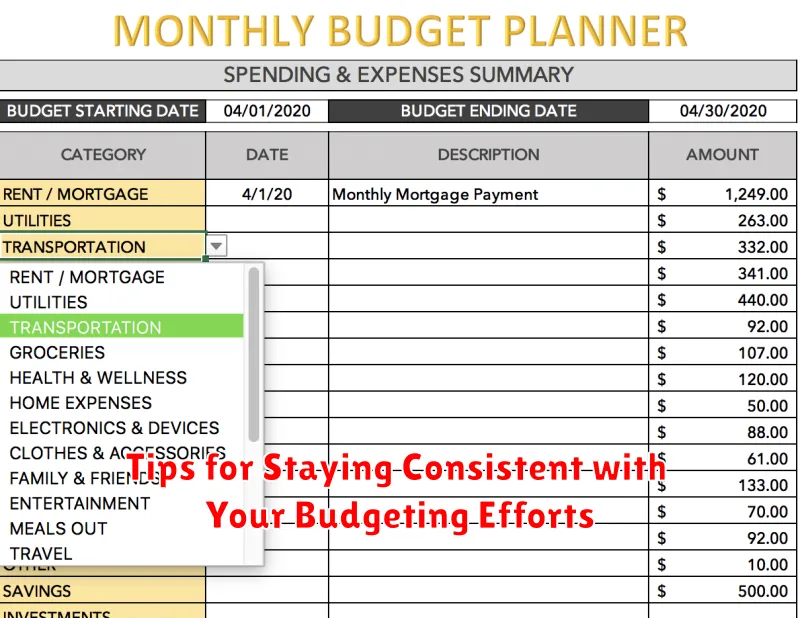

Tips for Staying Consistent with Your Budgeting Efforts

Creating a budget is a great first step towards financial freedom. However, simply creating a budget isn’t enough. It’s also important to stay consistent with your budgeting efforts. This can be a challenge, especially when life throws curveballs your way. But, with a little effort, you can make budgeting a habit that will help you achieve your financial goals.

Set Realistic Goals

The first step to staying consistent with your budgeting is to set realistic goals. Don’t try to change everything at once. Start with small, achievable goals, and gradually increase your efforts as you become more comfortable with the process. For example, if you’re trying to reduce your spending on eating out, start by limiting yourself to one restaurant meal per week. Once you’ve mastered that, you can reduce it to once every two weeks, and so on.

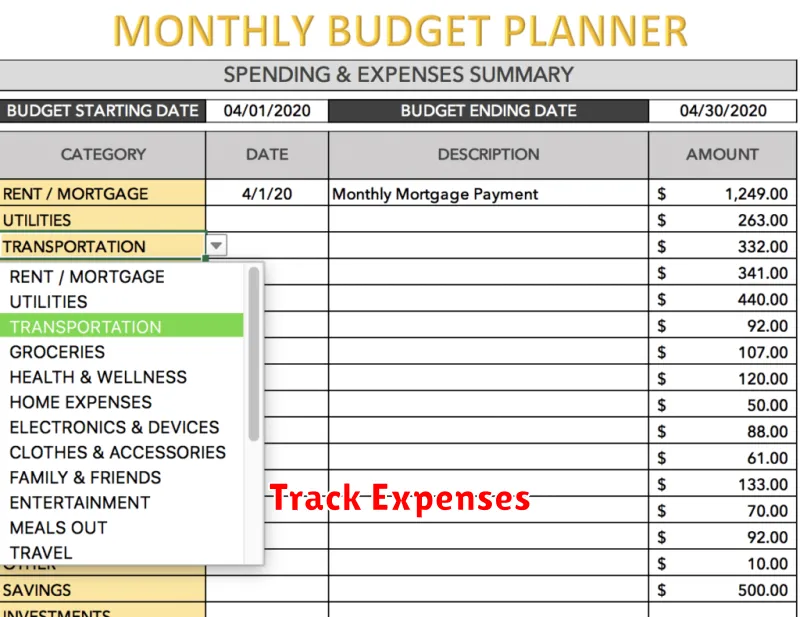

Track Your Spending

The best way to stay on track with your budget is to track your spending. This can be done manually using a spreadsheet or notebook, or you can use a budgeting app. The important thing is to be consistent with your tracking. Make sure to record every expense, no matter how small.

Make Budgeting a Habit

The key to staying consistent with your budget is to make it a habit. This means incorporating budgeting into your daily routine. For example, you could set aside 15 minutes each day to review your spending and make sure you’re staying on track. You can also schedule regular budget meetings with yourself or a partner to discuss your progress and make adjustments as needed.

Don’t Be Afraid to Adjust

Your budget isn’t set in stone. As your circumstances change, you’ll need to adjust your budget accordingly. Don’t be afraid to make changes to your budget as needed. If you find that you’re consistently overspending in a certain category, you can reduce your spending in that category or find ways to make up for it in other areas.

Reward Yourself

It’s important to reward yourself for your efforts. When you reach a budgeting milestone, treat yourself to something special. This will help you stay motivated and on track with your goals. Just be sure to stay within your budget when rewarding yourself!

Staying consistent with your budgeting efforts can be challenging, but it’s essential for achieving your financial goals. By setting realistic goals, tracking your spending, making budgeting a habit, adjusting your budget as needed, and rewarding yourself for your efforts, you can make budgeting a part of your life and achieve your financial dreams.

Analyzing Your Spending Habits and Identifying Areas for Improvement

Understanding your spending habits is crucial for achieving your financial goals. By analyzing your spending patterns, you can identify areas where you can save money and allocate resources more effectively. This article will guide you through the process of analyzing your spending, identifying areas for improvement, and developing strategies for achieving your financial objectives.

1. Track Your Spending

The first step is to track your spending diligently. This involves keeping a record of every dollar you spend, whether it’s for groceries, dining out, entertainment, or anything else. You can use a spreadsheet, a budgeting app, or even a notebook to track your expenses.

2. Categorize Your Spending

Once you have collected data on your spending, categorize your expenses into different groups, such as:

- Housing: Rent or mortgage, utilities, insurance, property taxes

- Transportation: Car payment, fuel, insurance, public transportation

- Food: Groceries, dining out, takeout

- Entertainment: Movies, concerts, travel

- Personal Care: Haircuts, toiletries, clothing

- Healthcare: Insurance premiums, medical expenses

- Debt Payments: Credit card payments, student loan payments

- Savings: Emergency fund, retirement contributions, investments

- Other: Any expenses that don’t fit into the above categories

3. Analyze Your Spending Patterns

After categorizing your spending, take a close look at your spending patterns. Are there any categories where you’re spending more than you’d like? Are there any categories where you could potentially reduce your spending without compromising your quality of life? For instance, if you find yourself spending a significant amount on dining out, you might consider reducing your dining out frequency and cooking at home more often.

4. Identify Areas for Improvement

Based on your analysis, identify areas where you can make changes to improve your spending habits. Consider the following:

- Reduce unnecessary expenses: Cut down on expenses that are not essential, such as subscriptions, entertainment, or impulse purchases.

- Negotiate lower rates: Contact your service providers, such as your phone, internet, or insurance companies, and negotiate lower rates or explore cheaper alternatives.

- Shop around for better deals: Before making a significant purchase, compare prices and shop around for the best deals.

- Automate savings: Set up automatic transfers from your checking account to your savings account to build your emergency fund and invest for the future.

5. Set Realistic Goals

Don’t try to change everything at once. Set realistic goals for yourself and focus on making gradual changes. For example, you could start by reducing your dining out expenses by 20% or setting a goal of saving 10% of your income each month.

6. Track Your Progress

Monitor your progress regularly and adjust your spending habits as needed. Celebrate your successes and use setbacks as learning opportunities. By tracking your progress, you can stay motivated and achieve your financial objectives.

7. Seek Professional Advice

If you find it challenging to manage your spending or develop a budget on your own, consider seeking professional advice from a financial advisor. A financial advisor can help you create a personalized plan and guide you towards financial success.

Conclusion

Analyzing your spending habits and identifying areas for improvement is a crucial step towards achieving your financial goals. By tracking your expenses, categorizing them, identifying areas for improvement, and setting realistic goals, you can take control of your finances and build a brighter financial future. Remember, every small change you make can have a significant impact over time.