Retirement may seem like a distant dream, but it’s never too early to start planning. As you navigate the world of investing, choosing the right investment vehicles for your retirement accounts can feel overwhelming. With so many options available, it’s crucial to understand the diverse landscape of investment vehicles and how they can contribute to your long-term financial security. This guide will explore some of the most popular and effective investment vehicles designed to help you reach your retirement goals.

From traditional IRAs and 401(k)s to innovative ROTH IRAs and target-date funds, there’s a wide range of investment vehicles tailored to different risk tolerances and financial situations. This article will delve into the pros and cons of each, helping you make informed decisions about where to invest your hard-earned money. Whether you’re a seasoned investor or just starting, understanding these investment vehicles is essential for building a robust retirement portfolio.

Understanding Your Retirement Goals

Retirement planning is a crucial aspect of financial well-being, ensuring a comfortable and fulfilling life after you stop working. However, it’s often overlooked or postponed due to other pressing priorities. To effectively plan for retirement, understanding your goals is paramount. Here’s a comprehensive guide to help you define and clarify your retirement aspirations.

1. Determine Your Retirement Timeline

The first step is to determine your desired retirement age. This will depend on various factors, including your current age, health, financial situation, and personal preferences. A realistic timeline allows you to calculate the time you have to save and invest for retirement.

2. Define Your Lifestyle Expectations

What do you envision your retirement years looking like? Do you see yourself traveling extensively, pursuing hobbies, volunteering, or simply relaxing at home? Understanding your lifestyle expectations will help you estimate your expenses and plan accordingly.

3. Calculate Your Estimated Expenses

Based on your lifestyle goals, estimate your monthly and annual expenses during retirement. Consider housing costs, healthcare, travel, entertainment, and any other anticipated expenditures. Remember to account for potential inflation, which can erode the purchasing power of your savings over time.

4. Assess Your Current Financial Situation

Take stock of your current financial assets, including savings, investments, and retirement accounts. Analyze your income, expenses, and debts to understand your financial health and identify areas for improvement.

5. Consider Your Income Sources

Besides savings and investments, identify potential income sources during retirement, such as Social Security, pensions, or rental income. This will help you determine how much you need to rely on your savings and investments.

6. Set Realistic Goals

While it’s essential to have aspirations, it’s crucial to set realistic goals that are achievable within your financial constraints. Avoid overestimating returns or underestimating expenses. Consider seeking professional advice from a financial advisor to create a personalized retirement plan.

7. Regularly Review and Adjust

Retirement planning is an ongoing process. As your life circumstances change, so too should your retirement goals. Regularly review your financial situation, adjust your savings strategy, and make necessary adjustments to ensure you remain on track.

Understanding your retirement goals is the foundation of a secure and fulfilling future. By carefully considering your aspirations, financial situation, and potential income sources, you can create a comprehensive plan that sets you up for a comfortable and enjoyable retirement.

Factors to Consider When Choosing Investments

Investing is an essential part of financial planning, as it allows you to grow your wealth over time. However, with so many investment options available, it can be overwhelming to know where to start. To make informed decisions, it’s crucial to consider several factors that will influence your investment success.

1. Your Financial Goals

Before investing, define your financial goals. Are you saving for retirement, a down payment on a house, or your child’s education? Your goals will determine your investment timeline, risk tolerance, and the type of investments that are appropriate for you.

2. Your Risk Tolerance

Your risk tolerance refers to your ability and willingness to accept potential losses in exchange for the possibility of higher returns. If you’re risk-averse, you may prefer low-risk investments like bonds. If you’re comfortable with more volatility, you might consider stocks or other higher-risk assets.

3. Your Investment Time Horizon

The investment time horizon refers to the length of time you plan to keep your investments. Longer time horizons allow for more risk, as you have time to recover from market fluctuations. Short-term investments usually involve less risk.

4. Your Investment Knowledge and Experience

Your level of investment knowledge and experience plays a crucial role in selecting the right investments. If you’re a beginner, you may want to start with simple, low-risk investments or seek professional advice. Experienced investors may have the knowledge and skills to handle more complex strategies.

5. Investment Fees and Costs

Different investment options come with varying fees and costs. Consider factors like management fees, trading commissions, and account maintenance expenses. High fees can significantly erode your returns over time.

6. Diversification

Diversification is a key principle of investing, as it reduces risk by spreading your money across different asset classes. Consider investing in a mix of stocks, bonds, real estate, and other assets to minimize potential losses.

7. Market Conditions

Market conditions can significantly impact your investment returns. It’s important to stay informed about economic trends, interest rates, and other market factors that may influence investment performance.

By carefully considering these factors, you can make informed investment decisions that align with your financial goals and risk tolerance. Remember, investing is a long-term strategy, and patience and discipline are essential for success.

Traditional vs. Roth Accounts: Weighing the Tax Benefits

When it comes to retirement savings, you have a few options, but two of the most popular are traditional and Roth individual retirement accounts (IRAs). Both offer significant tax benefits, but the way those benefits work can make a big difference in your overall retirement income. So how do you know which one is right for you? Let’s break down the key differences to help you make the best decision for your financial future.

Traditional IRAs

With a traditional IRA, you contribute pre-tax dollars, meaning your contributions are deducted from your taxable income, reducing your tax bill in the present. The money grows tax-deferred, meaning you won’t pay taxes on it until you withdraw it in retirement. This can be a great option if you expect to be in a lower tax bracket in retirement than you are now.

Pros

- Tax deduction: Reduce your taxable income today.

- Tax-deferred growth: Avoid paying taxes on earnings until retirement.

- Potential for lower taxes in retirement: If you expect to be in a lower tax bracket in retirement, you’ll pay less in taxes on withdrawals.

Cons

- Taxes on withdrawals: You’ll pay taxes on withdrawals in retirement.

- Required minimum distributions: You must start taking withdrawals at age 72, even if you don’t need the money.

- Potential for higher taxes in retirement: If you end up in a higher tax bracket in retirement, your withdrawals will be taxed at a higher rate.

Roth IRAs

With a Roth IRA, you contribute after-tax dollars, meaning you won’t get a tax deduction for your contributions. However, the money grows tax-free, and you won’t pay any taxes on withdrawals in retirement. This can be a good choice if you expect to be in a higher tax bracket in retirement than you are now.

Pros

- Tax-free withdrawals: You won’t pay taxes on withdrawals in retirement.

- No required minimum distributions: You can leave the money in the account as long as you want.

- Potential for lower taxes in retirement: If you end up in a higher tax bracket in retirement, you’ll avoid paying taxes on your withdrawals.

Cons

- No tax deduction: Your contributions won’t reduce your taxable income today.

- Income limits: There are income limits for contributing to a Roth IRA. If you earn too much, you may not be able to contribute or you may only be able to contribute a reduced amount.

- Potential for lower growth: Because you’re not getting a tax deduction on your contributions, your money may grow slightly slower than in a traditional IRA.

Which Account is Right for You?

The best choice for you will depend on your individual circumstances, including your current tax bracket, your expected future tax bracket, and your risk tolerance. Consider these factors:

- Your current income: If you’re in a lower tax bracket now, a traditional IRA may be more beneficial, as you’ll get a tax deduction today.

- Your expected future income: If you expect to be in a higher tax bracket in retirement, a Roth IRA may be a better choice, as you’ll avoid paying taxes on withdrawals.

- Your risk tolerance: If you’re willing to take on more risk, a traditional IRA may be a good option, as the potential for tax-deferred growth can be significant. If you’re risk-averse, a Roth IRA may be a better choice, as you’ll know exactly how much you’ll be paying in taxes on your withdrawals.

It’s a good idea to talk to a financial advisor to get personalized advice based on your specific situation.

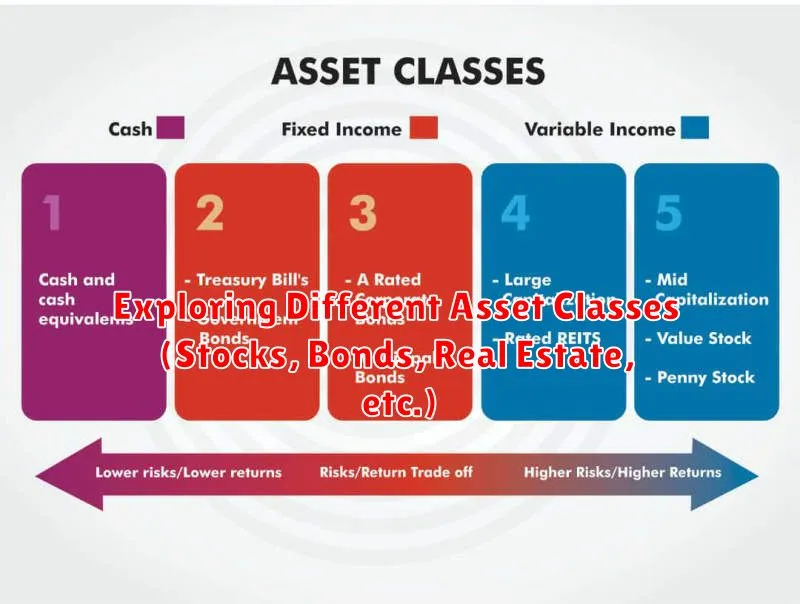

Exploring Different Asset Classes (Stocks, Bonds, Real Estate, etc.)

In the realm of investing, understanding different asset classes is crucial for building a diversified and well-rounded portfolio. Asset classes represent distinct categories of investments with unique characteristics, risk profiles, and potential returns. By allocating your capital strategically across various asset classes, you can mitigate risk and potentially enhance your overall investment performance.

Stocks

Stocks, also known as equities, represent ownership in publicly traded companies. When you buy a stock, you become a shareholder and have a claim on the company’s assets and earnings. Stocks are generally considered a higher-risk investment than bonds, but they also have the potential for higher returns. The value of stocks can fluctuate significantly based on factors such as company performance, market sentiment, and economic conditions.

Bonds

Bonds are debt securities that represent a loan from an investor to a borrower, typically a company or government. When you buy a bond, you are essentially lending money and receive interest payments in return. Bonds are generally considered less risky than stocks, as they offer a fixed rate of return and are less susceptible to market volatility. However, they also tend to have lower potential returns than stocks.

Real Estate

Real estate encompasses land and any permanent structures attached to it. It can be a tangible asset that provides rental income, appreciation potential, or a place to live. Real estate investments can offer diversification and potential for long-term growth, but they can also be illiquid and require significant capital outlays. It’s important to carefully consider factors such as location, property type, and market conditions before investing in real estate.

Commodities

Commodities are raw materials, such as gold, oil, and agricultural products, that are traded on exchanges. Commodity investments can provide exposure to inflation protection, as their prices tend to rise during periods of high inflation. However, they are generally considered a volatile asset class with high price fluctuations.

Alternatives

Alternative investments encompass a wide range of assets that fall outside traditional asset classes, such as hedge funds, private equity, and collectibles. These investments typically have a high barrier to entry and require specialized knowledge. They can offer potential for high returns and diversification, but they also come with significant risks.

Diversification

The key to successful investing lies in diversification across different asset classes. By spreading your investments across a range of assets with different risk profiles and return characteristics, you can reduce overall portfolio risk and potentially enhance returns. The optimal allocation to each asset class will depend on your individual investment goals, risk tolerance, and time horizon.

Professional Advice

It’s important to seek professional advice from a qualified financial advisor before making any investment decisions. They can help you assess your individual circumstances, set realistic financial goals, and develop a diversified investment strategy that aligns with your needs and risk tolerance.

Target-Date Funds vs. Lifecycle Funds: A Comparative Analysis

Target-date funds and lifecycle funds are both designed to help investors build wealth over time, but they approach this goal in slightly different ways. Both types of funds are designed to gradually shift their asset allocation towards a more conservative mix as the target date approaches, which is typically the investor’s retirement date. However, there are some key differences between them that are important to understand before choosing the right fund for your needs.

Target-Date Funds

Target-date funds are actively managed mutual funds or exchange-traded funds (ETFs) that automatically adjust their asset allocation over time based on the investor’s target date. The target date is typically the investor’s expected retirement date, but it can be adjusted based on individual needs.

The primary goal of target-date funds is to provide a diversified investment portfolio that is designed to meet the investor’s long-term financial goals. These funds typically invest in a mix of stocks, bonds, and other assets, with the specific allocation varying depending on the target date and the fund’s investment strategy.

Advantages of Target-Date Funds:

- Automatic rebalancing

- Diversification

- Professional management

Disadvantages of Target-Date Funds:

- Fees

- Risk of underperformance

Lifecycle Funds

Lifecycle funds are similar to target-date funds in that they also adjust their asset allocation over time based on the investor’s target date. However, lifecycle funds are typically passively managed, meaning they track a specific index or benchmark. This means they have lower fees than actively managed target-date funds.

Lifecycle funds are designed to provide a diversified investment portfolio that is suitable for investors of different ages and risk tolerances. The specific asset allocation of a lifecycle fund will vary depending on the investor’s target date and the underlying index or benchmark that the fund tracks.

Advantages of Lifecycle Funds:

- Lower fees

- Transparency

- Diversification

Disadvantages of Lifecycle Funds:

- Limited investment options

- Less flexibility

Choosing the Right Fund

The best type of fund for you will depend on your individual investment goals, risk tolerance, and financial situation. If you’re looking for a hands-off approach with professional management, target-date funds may be a good option. If you’re comfortable with passive investing and prefer lower fees, lifecycle funds may be a better choice.

It’s important to do your research and compare different funds before making a decision. Consider factors such as fees, investment strategy, performance history, and asset allocation.

You may also want to consult with a financial advisor to get personalized advice on choosing the right fund for your needs.

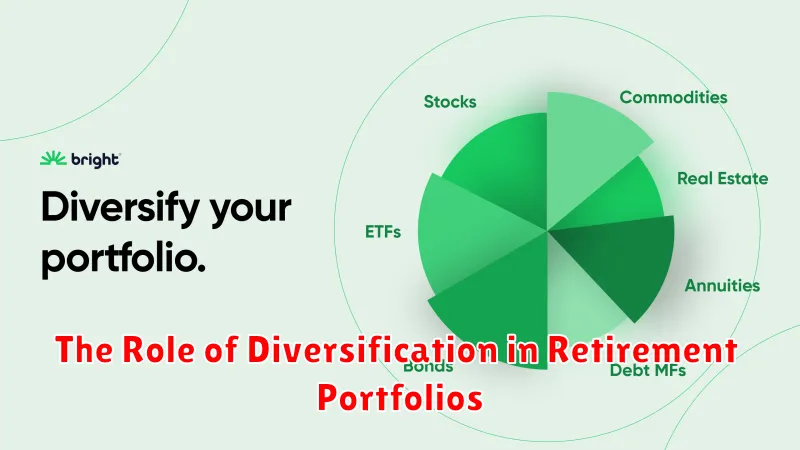

The Role of Diversification in Retirement Portfolios

Diversification is a crucial element in any investment portfolio, particularly when it comes to retirement planning. It involves spreading investments across various asset classes, such as stocks, bonds, real estate, and commodities, to mitigate risk and potentially enhance returns.

In the context of retirement portfolios, diversification plays a vital role for several reasons:

Reduced Risk

Diversification helps mitigate the impact of market volatility. When one asset class experiences a downturn, others may perform well, cushioning the overall portfolio from significant losses. This principle is based on the idea that different asset classes tend to move independently of each other.

Increased Potential Returns

While diversification doesn’t guarantee higher returns, it can potentially improve long-term performance. By investing in a variety of assets, investors can capitalize on opportunities across different market sectors and economic cycles. This can lead to greater overall growth over time.

Enhanced Flexibility

A diversified portfolio provides flexibility in managing investments. It allows investors to adjust their asset allocation based on changing market conditions, risk tolerance, and financial goals. This adaptability is particularly important during retirement, as individuals may need to adapt their investment strategies to accommodate factors such as healthcare costs and longevity.

Examples of Diversification

- Stocks: Investing in a mix of large-cap, small-cap, and international stocks provides broad exposure to different segments of the stock market.

- Bonds: Bonds offer diversification by providing a fixed income stream and potentially lower volatility than stocks.

- Real Estate: Real estate can offer inflation protection and potential for appreciation.

- Commodities: Commodities, such as gold and oil, can serve as a hedge against inflation and economic uncertainty.

Conclusion

Diversification is essential for retirement portfolios, as it reduces risk, potentially enhances returns, and provides flexibility. By spreading investments across various asset classes, investors can build a portfolio that is better positioned to weather market fluctuations and achieve long-term financial goals.

Evaluating Risk Tolerance and Time Horizon

Before embarking on any investment journey, it is crucial to assess your risk tolerance and time horizon. These two factors are intertwined and significantly influence your investment decisions.

Risk Tolerance

Risk tolerance refers to your ability and willingness to accept potential losses in pursuit of higher returns. It’s a subjective measure influenced by factors like your financial situation, age, investment goals, and personal beliefs.

Individuals with a high risk tolerance are comfortable with potentially volatile investments that offer the potential for substantial gains. On the other hand, those with a low risk tolerance prefer investments with lower potential returns but greater stability.

Time Horizon

Your time horizon represents the length of time you plan to hold your investments. A longer time horizon allows for greater flexibility and potential for higher returns, as you have more time to recover from market fluctuations.

Short-term investments, typically those held for less than a year, are generally more volatile and require a higher risk tolerance. Conversely, long-term investments, often held for several years or decades, provide greater potential for growth and can be managed with a lower risk tolerance.

Determining Your Risk Tolerance and Time Horizon

There are various methods to determine your risk tolerance and time horizon. Some common approaches include:

- Questionnaires: Online or paper-based questionnaires can help assess your risk tolerance based on your financial situation, investment goals, and comfort levels with different investment strategies.

- Financial advisors: Consulting with a financial advisor can provide personalized guidance on determining your risk tolerance and time horizon based on your individual circumstances.

- Self-assessment: You can also self-assess your risk tolerance and time horizon by considering your investment goals, financial situation, and comfort level with potential losses.

Importance of Aligning Risk Tolerance and Time Horizon

Aligning your risk tolerance and time horizon is essential for achieving your investment goals. If your investments are too risky for your tolerance level, you may experience emotional distress and be tempted to sell during market downturns, potentially leading to losses.

Conversely, if your investments are too conservative for your time horizon, you may not achieve your desired returns. Understanding and aligning these two factors allows you to create an investment strategy that balances potential returns with acceptable risk, ensuring a more sustainable and successful investment journey.

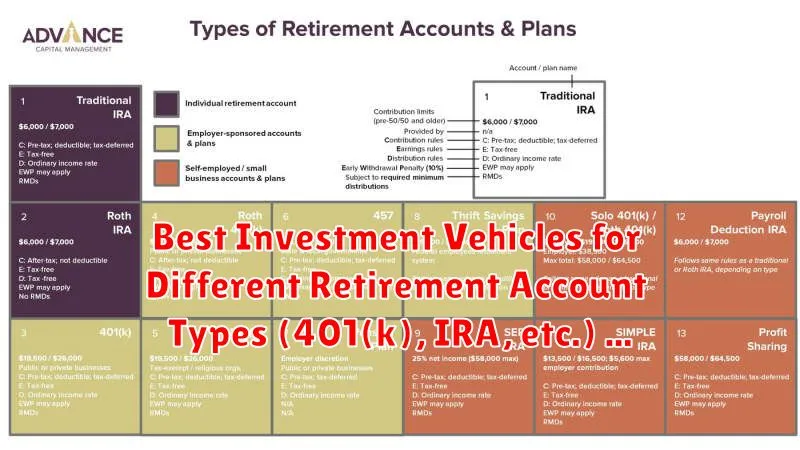

Best Investment Vehicles for Different Retirement Account Types (401(k), IRA, etc.)

Retirement planning is a crucial aspect of financial well-being, and choosing the right investment vehicles for your retirement accounts is essential. Different retirement account types, such as 401(k)s, IRAs, and Roth IRAs, offer unique features and investment options. Understanding these differences and selecting the appropriate investment vehicles for each account can significantly impact your long-term financial success.

401(k) Plans

A 401(k) is a retirement savings plan sponsored by your employer. It allows you to contribute pre-tax income, reducing your taxable income in the present. Employer matching contributions are a common benefit of 401(k) plans, enhancing your retirement savings.

When investing in a 401(k), consider options such as:

- Mutual funds: These offer diversified investments across various asset classes, providing a balanced approach to risk management.

- Target-date funds: These automatically adjust your asset allocation as you get closer to retirement, providing a convenient and hassle-free investment strategy.

- Index funds: These track specific market indexes, such as the S&P 500, offering low-cost and efficient exposure to a broad range of stocks.

Traditional Individual Retirement Accounts (IRAs)

A Traditional IRA is a retirement savings plan that allows you to contribute after-tax income and receive tax deductions on contributions. The earnings grow tax-deferred, meaning you won’t pay taxes until you withdraw the money in retirement.

Traditional IRAs offer flexibility in investment options, including:

- Stocks: Offer the potential for higher returns but also carry more risk.

- Bonds: Provide stability and lower risk compared to stocks.

- Real estate: Can provide income and appreciation, but requires significant capital and management.

- Mutual funds: Provide diversification across various asset classes, allowing for a balanced approach to risk management.

Roth Individual Retirement Accounts (Roth IRAs)

A Roth IRA allows you to contribute after-tax income, but unlike traditional IRAs, withdrawals in retirement are tax-free. Contributions are not tax-deductible, but your earnings grow tax-free, making Roth IRAs particularly attractive for individuals expecting to be in a higher tax bracket in retirement.

Investment options for Roth IRAs are similar to those available for traditional IRAs, including:

- Stocks

- Bonds

- Real estate

- Mutual funds

Factors to Consider When Choosing Investment Vehicles

When choosing investment vehicles for your retirement accounts, consider the following factors:

- Risk tolerance: Assess your ability and willingness to handle market fluctuations.

- Time horizon: Consider how long you have until retirement, as investments with longer time horizons can afford more risk.

- Financial goals: Determine your desired retirement income and lifestyle.

- Fees and expenses: Compare the costs associated with different investment options.

Conclusion

Selecting the best investment vehicles for your retirement accounts is a crucial decision that impacts your long-term financial well-being. By understanding the different account types, investment options, and factors to consider, you can make informed choices to build a solid foundation for a comfortable retirement.

Seeking Professional Financial Advice for Optimal Investment Strategies

In the ever-evolving financial landscape, navigating the complexities of investment strategies can be daunting. While many individuals believe they can manage their finances independently, seeking professional financial advice offers a plethora of benefits that can significantly enhance investment outcomes.

One of the primary advantages of consulting a financial advisor is their specialized expertise. They possess in-depth knowledge of financial markets, investment vehicles, and economic trends, enabling them to provide tailored recommendations based on individual circumstances, risk tolerance, and financial goals. This specialized knowledge allows advisors to identify potential opportunities and mitigate risks that may not be apparent to the average investor.

Moreover, financial advisors offer an objective perspective. When making investment decisions, emotions can often cloud judgment, leading to irrational choices. An experienced advisor provides a neutral viewpoint, helping investors avoid impulsive decisions driven by fear or greed. They guide clients towards a well-defined investment plan that aligns with their long-term objectives.

Another significant benefit is accountability. Having a financial advisor holds investors accountable for their financial goals. Regular meetings and progress reports foster transparency and ensure that investment strategies are on track. Advisors provide ongoing monitoring and adjustments as necessary, ensuring that clients remain aligned with their financial objectives.

Furthermore, financial advisors can assist with estate planning and tax optimization. These aspects are often overlooked by individuals, but they can have a profound impact on wealth preservation and future generations. By leveraging their expertise, advisors can help clients minimize tax liabilities and ensure the smooth transfer of assets.

While the cost of financial advice may seem like an added expense, it is an investment in long-term financial security. The benefits of professional guidance far outweigh the potential costs, particularly for individuals with significant assets or complex financial situations. By seeking the right financial advisor, investors can gain access to invaluable expertise, objectivity, accountability, and comprehensive financial planning, ultimately leading to better investment outcomes.