Are you tired of feeling lost when it comes to your personal finances? Do you struggle to keep track of your spending and savings? It’s time to take control and embark on a journey to financial freedom. Tracking your financial progress is essential for achieving your financial goals and reaching your full potential. Whether you’re saving for a down payment on a house, paying off debt, or simply wanting to have a better understanding of your money, this article will provide you with the best ways to track your personal finance progress.

By implementing these strategies, you’ll gain valuable insights into your spending habits, identify areas for improvement, and make informed decisions about your money. Get ready to unlock the power of financial tracking and pave the way for a brighter financial future.

The Importance of Tracking Your Finances

In today’s fast-paced world, it’s easy to lose track of your finances. But it’s crucial to stay organized and informed about your income, expenses, and overall financial health. Tracking your finances is not just about knowing where your money goes; it’s about taking control of your future and setting yourself up for success.

Here are some key benefits of tracking your finances:

1. Identify Spending Habits:

By tracking your spending, you gain a clear picture of where your money is going. This can be eye-opening, revealing areas where you may be overspending or spending unnecessarily. Armed with this knowledge, you can make informed decisions about how to adjust your spending habits and prioritize your financial goals.

2. Set and Achieve Financial Goals:

Whether you’re saving for a down payment on a house, paying off debt, or planning for retirement, tracking your finances is essential for achieving your financial goals. By monitoring your progress, you can stay motivated and make necessary adjustments along the way to ensure you’re on track.

3. Avoid Overspending and Debt:

When you track your finances, you are more likely to stay within your budget and avoid overspending. By keeping an eye on your expenses, you can catch potential red flags early and take steps to prevent debt accumulation. This proactive approach can save you from unnecessary stress and financial strain.

4. Make Informed Financial Decisions:

Tracking your finances provides a solid foundation for making informed decisions about your money. With a clear understanding of your income, expenses, and overall financial situation, you can confidently make choices that align with your financial goals and priorities.

5. Prepare for Unexpected Expenses:

Life throws curveballs, and unexpected expenses can arise at any time. Tracking your finances can help you prepare for these situations by building an emergency fund. Knowing your spending habits and having a financial cushion can provide peace of mind and financial stability.

Tracking your finances doesn’t have to be complicated. There are numerous budgeting apps and tools available that can make the process easy and efficient. By taking the time to monitor your money, you are taking control of your financial future and setting yourself up for success.

Setting Clear Financial Goals to Track Progress

Setting clear financial goals is crucial for achieving financial success. It provides direction, motivation, and a roadmap to track your progress. Without specific goals, it’s easy to lose sight of your financial aspirations and become complacent.

1. Define Your Financial Goals

Start by identifying what you want to achieve financially. Your goals could include:

- Paying off debt: This could be credit card debt, student loans, or a personal loan.

- Saving for retirement: You might want to set a specific savings target or aim for a comfortable retirement lifestyle.

- Saving for a down payment: This could be for a house, a car, or a major purchase.

- Investing for growth: You might want to invest in the stock market, real estate, or other assets.

- Building an emergency fund: This will provide a safety net for unexpected expenses.

2. Set SMART Goals

Once you’ve identified your financial goals, ensure they are SMART:

- Specific: Define your goals clearly and avoid vague statements. For example, instead of “save money,” set a goal like “save $10,000 for a down payment on a house.”

- Measurable: Your goals should have quantifiable targets. How much money do you want to save, invest, or pay off?

- Achievable: Set realistic goals that you can actually achieve within a reasonable timeframe. Don’t overwhelm yourself with overly ambitious targets.

- Relevant: Your goals should align with your overall financial objectives and priorities. Are they important to you?

- Time-Bound: Establish a specific deadline for achieving each goal. This will create a sense of urgency and keep you accountable.

3. Create a Financial Plan

Develop a detailed financial plan outlining how you will achieve your goals. This might involve:

- Budgeting: Track your income and expenses to identify areas where you can cut back or save more.

- Saving strategies: Decide how much to save each month and where to allocate your savings.

- Investment plan: Determine your investment strategy and choose appropriate investment options.

- Debt management: Develop a plan for paying off debt, prioritizing high-interest debts first.

4. Monitor Your Progress Regularly

Track your progress towards your goals on a regular basis. You can use spreadsheets, budgeting apps, or financial tracking tools to monitor your savings, investments, and debt payments. This will help you stay motivated and make adjustments to your plan as needed.

5. Celebrate Your Achievements

As you reach milestones towards your financial goals, take time to celebrate your achievements. This will reinforce your progress and keep you motivated on your journey to financial success.

Remember, setting clear financial goals is only the first step. The key to achieving those goals lies in consistent action and ongoing commitment.

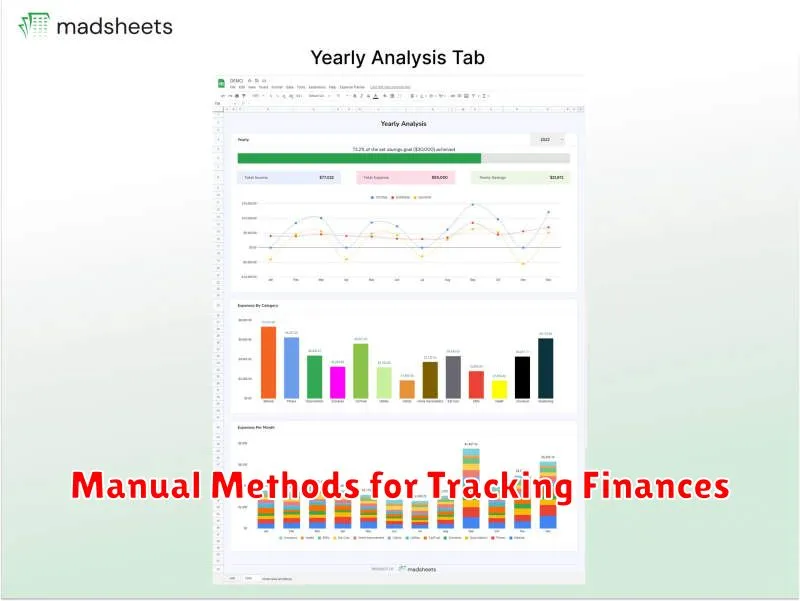

Manual Methods for Tracking Finances

In today’s digital age, it’s easy to rely on apps and software to manage your finances. But there’s something to be said for the simplicity and control of manual tracking. Whether you’re new to budgeting, prefer a hands-on approach, or simply want a backup system, learning how to track your finances manually can be a valuable skill.

The Benefits of Manual Tracking

While technology offers convenience, manual tracking comes with its own set of advantages:

- Increased awareness: The act of physically writing down your transactions can help you become more aware of your spending habits. You’re more likely to notice patterns and make changes when you see your expenses laid out in front of you.

- Enhanced control: When you’re in control of your finances, you feel empowered. Manual tracking gives you a sense of ownership and allows you to make decisions based on your own observations.

- Reduced reliance on technology: This is particularly important in times of internet outages or when you’re traveling without access to your devices.

Methods for Manual Tracking

There are numerous ways to track your finances manually, each with its own pros and cons:

1. Spreadsheet

Using a spreadsheet program like Microsoft Excel or Google Sheets allows you to create a detailed and customizable budget. You can easily categorize expenses, calculate balances, and create charts to visualize your spending patterns.

2. Budget Planner

Physical budget planners offer a tangible and organized approach. They often come with pre-designed sections for income, expenses, savings goals, and other financial information. They can also be a motivating factor, as you can physically see your progress.

3. Notebook

For a simpler approach, a notebook can be used to jot down your transactions. You can use a simple format, such as date, description, and amount, or create your own system to track your finances.

Tips for Success

Here are some tips for effective manual tracking:

- Consistency is key: Aim to track your transactions regularly, whether daily, weekly, or monthly. The more consistent you are, the better picture you’ll have of your finances.

- Be thorough: Don’t forget to track every transaction, big or small. Small expenses can add up quickly, so it’s important to be comprehensive.

- Review regularly: Set aside time to review your financial records and analyze your spending patterns. This can help you identify areas where you can save money or adjust your budget.

While manual tracking may seem old-fashioned, it can be a powerful tool for understanding and controlling your finances. If you’re looking for a way to connect with your money more directly, consider giving manual tracking a try. You might be surprised by the insights you gain and the sense of accomplishment it provides.

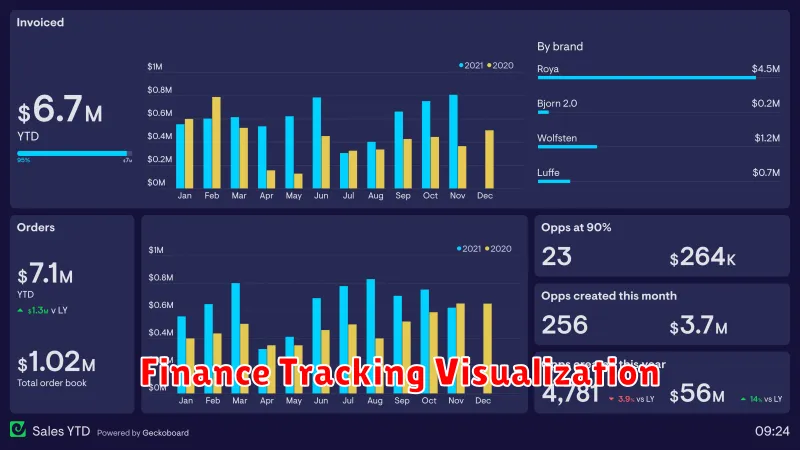

Utilizing Budgeting Apps and Software

In today’s digital age, managing your finances has become more accessible than ever, thanks to the proliferation of budgeting apps and software. These powerful tools can help you gain control over your spending, track your income, and achieve your financial goals. Whether you’re a seasoned financial expert or just starting your financial journey, a budgeting app can be a valuable asset.

Here are some compelling reasons to consider utilizing budgeting apps and software:

Streamlined Budgeting

One of the most significant benefits of these apps is their ability to simplify the budgeting process. Most apps allow you to categorize your transactions automatically, making it effortless to see where your money is going. You can set budgets for different categories, such as groceries, entertainment, or dining out, and the app will alert you when you’re approaching your limits. This level of detail and control gives you a clear picture of your financial health and empowers you to make informed decisions about your spending.

Enhanced Financial Awareness

By tracking your spending habits, budgeting apps provide valuable insights into your financial behavior. You’ll be able to identify areas where you’re overspending and adjust your habits accordingly. Many apps offer personalized recommendations and financial advice based on your spending patterns. This data-driven approach can help you make more conscious financial choices and develop healthy spending habits.

Improved Savings and Debt Management

Budgeting apps are excellent tools for both saving and managing debt. They allow you to set savings goals and track your progress toward achieving them. Some apps even offer automatic savings features, where you can schedule regular transfers from your checking account to your savings account. Moreover, these apps can help you prioritize your debt repayment by organizing your loans and displaying their interest rates, helping you focus on the most expensive debts first.

Accessibility and Convenience

The convenience of using budgeting apps is undeniable. Most apps are accessible on your smartphone, tablet, or computer, allowing you to manage your finances anytime, anywhere. You can easily update your transactions, check your budget, and review your financial progress with a few taps on your screen.

Conclusion

Budgeting apps and software have become essential tools for modern financial management. They offer a comprehensive suite of features that simplify budgeting, enhance financial awareness, promote savings, and facilitate debt management. By embracing these technological advancements, you can take control of your finances, achieve your financial goals, and build a more secure future.

Monitoring Your Net Worth Regularly

Monitoring your net worth regularly is an important part of financial planning. It helps you track your progress toward your financial goals, identify areas where you can improve, and make informed decisions about your money.

To monitor your net worth, you need to calculate the value of your assets and subtract your liabilities. Your assets are anything that you own that has value, such as cash, investments, real estate, and personal property. Your liabilities are anything that you owe, such as loans, credit card debt, and mortgages.

There are a number of tools and resources available to help you monitor your net worth. Some popular options include:

- Spreadsheets: A simple spreadsheet can be used to track your assets and liabilities.

- Personal finance software: Software like Mint and Personal Capital can automatically track your accounts and calculate your net worth.

- Online net worth calculators: Many websites offer free net worth calculators that allow you to input your assets and liabilities to calculate your net worth.

Once you’ve chosen a method for monitoring your net worth, it’s important to be consistent. Aim to track your net worth at least once a month, or even more frequently if you make significant financial changes.

Here are some tips for monitoring your net worth:

- Be accurate: Make sure your asset and liability information is accurate and up-to-date.

- Track your progress: Keep a record of your net worth over time to see how it’s changing.

- Don’t be afraid to adjust your goals: If your net worth is not growing as quickly as you would like, you may need to adjust your financial goals or make changes to your spending habits.

Monitoring your net worth is a simple but effective way to stay on top of your finances. By tracking your progress and making necessary adjustments, you can work towards achieving your financial goals and building a secure future.

Tracking Spending Habits and Categories

Tracking your spending habits and categorizing your expenses can be a powerful tool for managing your finances. By understanding where your money is going, you can identify areas where you can save and make more informed decisions about your spending.

There are several methods for tracking spending, including:

- Budgeting apps: These apps allow you to connect your bank accounts and track your spending automatically. Many also offer features like budgeting tools, expense categorization, and financial reports.

- Spreadsheets: You can create your own spreadsheet to track your income and expenses manually. This gives you complete control over the data and allows you to customize the categories and reports.

- Manual tracking: You can use a notebook or a piece of paper to record your expenses as you make them. This is a simple method, but it requires more effort to maintain and analyze.

When categorizing your expenses, it’s important to choose a system that works for you. Some common categories include:

- Housing: Rent, mortgage, property taxes, utilities

- Transportation: Car payments, gas, public transportation, parking

- Food: Groceries, dining out, takeout

- Entertainment: Movies, concerts, travel, hobbies

- Personal care: Haircuts, clothing, toiletries

- Debt payments: Credit card payments, student loans, personal loans

- Savings: Emergency fund, retirement savings, investments

Once you have tracked your spending and categorized your expenses, you can analyze your data to identify areas where you can improve. For example, you may discover that you’re spending too much on eating out or that you could be saving more for retirement. Armed with this information, you can make adjustments to your spending habits and work towards your financial goals.

Reviewing Investment Performance

Regularly reviewing your investment performance is crucial for ensuring your portfolio is on track to meet your financial goals. By analyzing your returns, you can identify areas where your strategy needs adjustments and make informed decisions to optimize your investment portfolio.

Key Performance Indicators

To evaluate your investment performance, consider the following key performance indicators:

- Return on Investment (ROI): This metric calculates the percentage gain or loss on your investments over a specific period. A higher ROI indicates better performance.

- Annualized Rate of Return (ARR): ARR represents the average annual return over a specific period, taking into account compounding. It provides a clearer picture of your long-term performance.

- Risk-Adjusted Return: This indicator measures the return relative to the risk taken. Popular metrics include Sharpe ratio and Sortino ratio.

- Alpha: Alpha reflects the excess return generated by your portfolio compared to a benchmark index. A positive alpha suggests outperformance.

Analyzing Performance

When analyzing your investment performance, consider the following factors:

- Time Horizon: Evaluate your performance over different time frames, such as short-term (1-3 years) and long-term (5-10 years) to understand the overall trend.

- Market Conditions: Factor in prevailing market conditions and economic trends that may have influenced your returns. Compare your performance to relevant market benchmarks.

- Investment Strategy: Assess whether your investment strategy aligns with your risk tolerance and financial goals. Identify areas where your strategy needs refinement.

- Fees and Expenses: Account for investment fees, trading costs, and other expenses that can impact your overall returns.

Taking Action

Based on your performance review, consider the following actions:

- Rebalance Your Portfolio: Ensure your asset allocation aligns with your risk tolerance and adjust holdings to maintain the desired balance.

- Adjust Investment Strategy: If your performance falls short of expectations, consider revising your investment strategy to address areas of underperformance.

- Seek Professional Advice: Consult with a financial advisor or investment professional for personalized guidance and insights.

Regularly reviewing your investment performance allows you to stay informed, make informed decisions, and enhance your chances of achieving your financial goals.

Assessing Progress Towards Debt Reduction

Debt reduction is a crucial aspect of financial stability, both for individuals and nations. It involves taking deliberate steps to decrease outstanding financial obligations, ultimately leading to improved financial health. The process requires careful planning, disciplined execution, and consistent effort to achieve meaningful results.

To effectively assess progress towards debt reduction, it’s essential to establish clear goals and metrics. These benchmarks provide a tangible framework for tracking progress and evaluating the effectiveness of debt reduction strategies. Key metrics include:

- Total Debt Outstanding: Tracking the overall amount of debt owed provides a comprehensive view of progress. A consistent decline in this figure indicates positive movement towards debt reduction.

- Debt-to-Income Ratio: This metric, calculated by dividing total debt by annual income, reveals the proportion of income dedicated to debt repayment. A decreasing debt-to-income ratio signifies improved financial health.

- Minimum Payments Made: Ensuring consistent and timely minimum payments on all debts is crucial. This prevents late fees and penalties, while also contributing towards debt reduction.

- Extra Payments Made: Allocating additional funds beyond minimum payments accelerates debt reduction. This proactive approach significantly shortens the repayment timeline.

- Debt Reduction Strategies Employed: Evaluating the effectiveness of implemented strategies, such as debt consolidation, debt snowball, or balance transfers, helps identify areas for optimization.

While these metrics provide valuable insights, it’s important to consider individual circumstances and goals when assessing progress. Some may prioritize reducing high-interest debt, while others focus on paying off smaller debts to gain momentum. Regularly reviewing progress and making necessary adjustments is crucial for achieving debt reduction objectives.

Furthermore, it’s essential to acknowledge the role of external factors that can influence debt reduction efforts. Economic conditions, job security, and unexpected expenses can impact the pace of debt reduction. Adapting strategies to these external factors ensures a more sustainable and achievable path towards financial freedom.

Assessing progress towards debt reduction is a continuous process that requires diligence and commitment. By tracking key metrics, evaluating strategies, and adapting to changing circumstances, individuals and nations can effectively monitor their progress and move closer to their financial goals.

Tips for Staying Consistent with Tracking

Tracking your progress is essential for achieving your goals. However, staying consistent with tracking can be challenging. Here are some tips to help you stay on track:

1. Set Realistic Goals: Don’t try to track everything at once. Start with a few key metrics that are important to you and gradually add more as you get comfortable.

2. Make It Easy: Choose a tracking method that is easy and convenient for you. Use a digital tool, a notebook, or a combination of both.

3. Find Your Motivation: Why are you tracking your progress? Knowing your motivation can help you stay focused and committed.

4. Make It a Habit: Schedule time for tracking and make it a regular part of your routine. You can use a reminder app or set aside a specific time each day.

5. Celebrate Your Wins: Recognize your progress and celebrate your successes. This will help you stay motivated and encouraged.

6. Don’t Give Up: There will be days when you don’t feel like tracking. It’s okay to miss a day or two, but don’t give up entirely. Get back on track as soon as possible.

Staying consistent with tracking requires effort and commitment. But, with the right strategies, it can become a habit that helps you achieve your goals.