Are you a parent struggling to make ends meet? Do you find yourself constantly worried about money and wondering how to provide for your family? You’re not alone. Many parents face financial challenges, but with a little planning and effort, you can learn how to budget effectively and manage your family’s finances responsibly. Budgeting is the key to financial stability, allowing you to prioritize your needs, save for the future, and avoid unnecessary debt.

This article will provide you with practical and actionable budgeting tips that can help you take control of your family finances. We’ll cover essential aspects of budgeting, such as tracking your spending, creating a realistic budget, and finding ways to save money. We’ll also discuss strategies for managing debt, saving for your children’s education, and building a secure financial future for your family. So, if you’re ready to conquer your financial worries and achieve financial peace of mind, read on!

Setting Family Financial Goals

Setting family financial goals is an essential step towards securing your family’s future. It provides a clear direction and motivation for your financial journey, ensuring that you’re working towards something meaningful.

Why are Family Financial Goals Important?

Financial goals offer numerous benefits for your family:

- Shared Vision: They create a shared vision for the future, aligning your family’s financial aspirations.

- Motivation and Accountability: Goals provide motivation to stay disciplined and accountable in your financial decisions.

- Financial Security: By setting goals, you prioritize financial security and stability for your family.

- Stress Reduction: Having a clear plan reduces financial anxiety and stress.

- Decision Making: Goals help you make informed financial decisions, ensuring they align with your family’s priorities.

Steps to Setting Family Financial Goals:

Follow these steps to establish effective family financial goals:

- Discuss your values and aspirations: Start by having an open and honest conversation with your family members. Discuss your shared values and what you want to achieve financially.

- Identify short-term and long-term goals: Categorize your goals into short-term (achievable within a year) and long-term (spanning several years). Examples include paying off debt, saving for a down payment on a house, or funding your children’s education.

- Make your goals SMART: Ensure your goals are Specific, Measurable, Attainable, Relevant, and Time-bound. This helps you track progress and stay motivated.

- Create a budget: Develop a budget that aligns with your goals. Track your income and expenses to identify areas where you can save or allocate funds towards achieving your goals.

- Regularly review and adjust: Life circumstances change, so it’s essential to review your goals and budget periodically. Adjust them as needed to reflect new priorities or financial situations.

Examples of Family Financial Goals:

Here are some common examples of family financial goals:

- Emergency Fund: Establishing a 3-6 month emergency fund to cover unexpected expenses.

- Debt Reduction: Paying off high-interest debt, such as credit card debt or student loans.

- Home Ownership: Saving for a down payment on a house or making mortgage payments.

- Retirement Planning: Saving for retirement to ensure financial security during your golden years.

- Education Fund: Saving for your children’s education, including college or vocational training.

- Travel and Leisure: Saving for family vacations or leisure activities.

Tips for Success:

Here are some tips for achieving your family financial goals:

- Involve everyone: Encourage participation from all family members, making them feel invested in the process.

- Be realistic: Set achievable goals that are not overly ambitious.

- Celebrate milestones: Acknowledge and celebrate your successes along the way to maintain motivation.

- Seek professional advice: Consider consulting with a financial advisor to receive personalized guidance and strategies.

Setting family financial goals is a collaborative effort that requires open communication, commitment, and a shared vision. By taking these steps and working together, you can build a secure and prosperous future for your family.

Tracking Income and Expenses

Tracking income and expenses is an essential part of managing your finances effectively. By keeping a close eye on your money flow, you can gain valuable insights into your spending habits, identify areas where you can save, and make informed financial decisions.

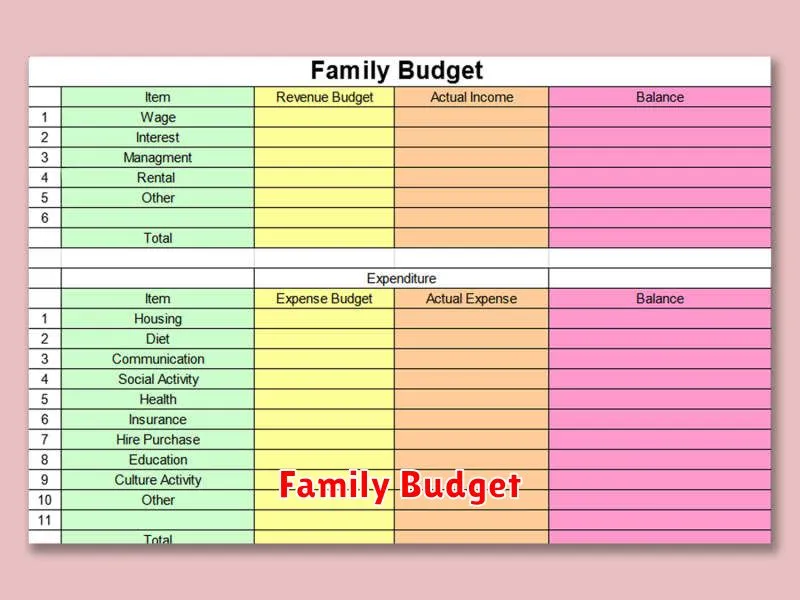

There are various methods for tracking income and expenses. Traditional methods include using a spreadsheet or a notebook, while modern approaches leverage financial apps and online tools. Whichever method you choose, consistency is key. Aim to record all your income and expenses regularly, ideally on a daily or weekly basis.

When tracking your income, be sure to include all sources, such as your salary, freelance work, investments, and any other forms of revenue. For expenses, categorize your spending into different categories such as housing, food, transportation, entertainment, and personal care. This will help you understand where your money is going and identify potential areas for cost-cutting.

Tracking income and expenses can initially seem like a tedious task, but the benefits are well worth the effort. It empowers you to take control of your finances, make informed spending decisions, and reach your financial goals. By understanding your financial situation, you can create a budget, save for the future, and avoid unnecessary debt.

Creating a Family Budget

A family budget is a financial plan that outlines how you will spend your income each month. It can help you track your spending, save money, and reach your financial goals. If you’re struggling to make ends meet, creating a budget can be a lifesaver. A budget can also help you plan for the future, like saving for a down payment on a house or your children’s college education.

Here are some tips for creating a family budget:

1. Track Your Spending

The first step to creating a budget is to track your spending for a month or two. You can use a spreadsheet, budgeting app, or even a notebook to keep track of where your money is going. Be sure to include all of your expenses, both big and small. Some examples of expenses include:

- Housing (rent or mortgage)

- Utilities (electricity, gas, water)

- Food

- Transportation (car payment, gas, public transportation)

- Healthcare (insurance premiums, doctor’s visits)

- Entertainment (movies, dining out, concerts)

- Debt payments (credit cards, student loans)

2. Create a Budget

Once you know how much you’re spending, you can start creating a budget. A budget is a plan for how you will spend your money each month. It should include your income and expenses. There are many different ways to create a budget, but a simple method is to use the 50/30/20 rule. This rule suggests that you allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. For example, if you make $5,000 a month, you would allocate $2,500 to needs, $1,500 to wants, and $1,000 to savings and debt repayment.

3. Stick to Your Budget

The most important part of budgeting is sticking to your plan. This can be difficult, especially when you’re tempted to spend money on things you don’t need. But if you want to reach your financial goals, you need to be disciplined and stick to your budget. Here are some tips for sticking to your budget:

- Set realistic goals.

- Make your budget a priority.

- Use cash or a debit card instead of a credit card.

- Track your spending regularly.

- Don’t be afraid to adjust your budget as needed.

Creating a family budget can seem daunting, but it doesn’t have to be. By following these tips, you can create a budget that works for your family and helps you achieve your financial goals. Remember to be patient and consistent, and you’ll be on your way to a more secure financial future.

Teaching Kids About Money

Teaching kids about money is an essential part of raising financially responsible adults. It’s never too early to start, and the earlier you begin, the better. The goal is to help children understand the value of money, how to manage it wisely, and how to make sound financial decisions. Here are some tips on how to teach kids about money:

Start Young

Introduce basic money concepts like saving, spending, and giving to your kids as soon as they can understand. Use simple language and examples they can relate to. For example, you can use a piggy bank to show them how to save their allowance or a chart to track their spending.

Allowances and Chores

Giving your kids an allowance for completing chores teaches them about responsibility and earning money. It also provides an opportunity for them to learn how to manage their own money. Encourage them to save a portion of their allowance, spend some on things they want, and consider giving a small amount to charity.

Talk About Money

Make money a topic of conversation at home. Discuss your family’s budget, explain your financial decisions, and talk about the importance of saving for the future. By involving your children in these conversations, you’re helping them understand the importance of financial literacy.

Teach Them About Needs vs. Wants

Help your kids understand the difference between needs and wants. A need is something essential for survival, like food, shelter, and clothing. A want is something that’s nice to have but not essential. Encourage them to prioritize needs over wants and to save for the things they want.

Set Good Examples

Kids learn by observing, so it’s important to set a good example when it comes to money. Be mindful of your own spending habits, save regularly, and avoid unnecessary debt. Your actions will speak louder than words.

Involve Them in Shopping

Take your kids shopping with you and involve them in making decisions. Ask them to compare prices, look for deals, and consider the value of different items. This will help them develop critical thinking skills and learn about the importance of making informed purchases.

Use Technology to Your Advantage

There are many helpful apps and websites designed to teach kids about money. These resources can provide interactive games, lessons, and tools to help children learn about saving, spending, and investing in a fun and engaging way.

Don’t Be Afraid to Make Mistakes

It’s okay to make mistakes when it comes to money. The important thing is to learn from them and use them as opportunities to teach your kids about financial responsibility. Be patient and supportive, and remember that learning about money is a lifelong process.

Be Consistent

Consistency is key when teaching kids about money. Don’t just talk about it once and then forget. Make it a regular part of your conversations and interactions. The more you reinforce these concepts, the better your children will understand them.

Teaching kids about money is a gift that will benefit them throughout their lives. By starting early, providing consistent guidance, and creating a positive learning environment, you can help your children develop strong financial habits that will serve them well in the future.

Saving for College

Saving for college is one of the biggest financial challenges many families face. The cost of higher education continues to rise, making it increasingly difficult to afford. However, there are a number of things you can do to make saving for college easier and more attainable.

One of the most important things you can do is to start saving early. The sooner you start, the more time your money has to grow. Even small, consistent contributions can make a big difference over time. You can use a 529 plan to save for college. These plans offer tax advantages and are designed specifically for college savings.

Another important step is to create a budget and stick to it. Make sure you are living within your means and that you are setting aside money each month for college savings. There are a lot of resources available online and in your community that can help you create a budget.

It is also important to involve your children in the process. Talk to them about the importance of education and the role that saving plays in achieving their goals. This will help them to understand the value of money and the importance of planning for the future. This will also help your child to stay motivated and engaged in the process.

Saving for college is a long-term commitment. It requires discipline and planning, but the rewards are worth it. By starting early, creating a budget, and involving your children in the process, you can make saving for college a reality.

Planning for Retirement

Retirement is a significant life event that requires careful planning and preparation. It’s a time when you can finally enjoy the fruits of your labor, pursue your passions, and spend more time with loved ones. However, it’s essential to ensure you have a solid financial foundation to support your desired lifestyle during this new chapter.

Here are some crucial aspects of retirement planning to consider:

1. Determine Your Retirement Goals

Before you start saving, it’s crucial to define what you envision for your retirement. What activities do you want to engage in? Where do you want to live? What are your travel aspirations? Knowing your goals will help you establish realistic financial targets and guide your savings strategy.

2. Estimate Your Retirement Expenses

Create a budget that outlines your estimated monthly expenses during retirement. Consider housing, healthcare, food, transportation, entertainment, and travel. Remember to factor in potential inflation and account for unexpected costs.

3. Determine Your Retirement Savings Needs

Based on your retirement goals and expense estimates, determine how much you’ll need to save to achieve financial security. Use online retirement calculators or consult with a financial advisor to get a personalized estimate.

4. Maximize Your Retirement Savings

Consider contributing to a 401(k) or IRA. These retirement accounts offer tax advantages that can significantly boost your savings. Many employers also offer matching contributions, essentially free money for your retirement.

5. Consider Investment Strategies

Once you’ve saved a substantial amount, consider diversifying your retirement portfolio by investing in a mix of stocks, bonds, and other asset classes. Consult with a financial advisor to create a personalized investment strategy aligned with your risk tolerance and goals.

6. Plan for Healthcare Costs

Healthcare expenses can be substantial during retirement. Explore options like Medicare and consider supplemental health insurance to cover potential gaps in coverage.

7. Review Your Retirement Plan Regularly

Life circumstances can change, so it’s vital to review your retirement plan regularly. Adjust your savings contributions, investment strategy, or expense estimates as needed to stay on track.

Retirement planning requires a long-term perspective and proactive efforts. By starting early, setting clear goals, and consistently saving, you can create a secure and fulfilling retirement.

Protecting Your Family with Insurance

Insurance is an essential part of protecting your family’s financial well-being. It provides a safety net in case of unexpected events, such as accidents, illnesses, or natural disasters. By purchasing the right insurance policies, you can safeguard your family’s future and ensure their financial stability.

Types of Insurance

There are various types of insurance policies available to meet different needs. Some common types include:

- Health Insurance: Covers medical expenses, including doctor visits, hospital stays, and prescription drugs.

- Life Insurance: Provides a death benefit to your beneficiaries, helping them financially cope with your loss.

- Homeowners Insurance: Protects your home and belongings from damage caused by fire, theft, or natural disasters.

- Auto Insurance: Covers damages to your vehicle and liability for accidents involving other drivers.

- Disability Insurance: Provides income replacement if you become unable to work due to an illness or injury.

Benefits of Insurance

Having adequate insurance offers numerous benefits, including:

- Financial Protection: Insurance helps mitigate financial losses from unexpected events, ensuring your family’s financial security.

- Peace of Mind: Knowing you have insurance in place can provide peace of mind and reduce stress in times of crisis.

- Legal Protection: Some insurance policies provide legal coverage in case of accidents or lawsuits.

- Access to Healthcare: Health insurance grants access to essential medical services and treatments.

Choosing the Right Insurance

Choosing the right insurance policies for your family requires careful consideration. Factors to consider include:

- Your Family’s Needs: Evaluate your family’s specific circumstances, including income, dependents, and assets.

- Your Budget: Determine how much you can afford to spend on insurance premiums.

- Coverage Levels: Choose appropriate coverage amounts to ensure adequate protection.

- Insurance Provider: Research different insurance companies and compare their policies, premiums, and customer service.

Conclusion

Insurance is an essential investment in your family’s well-being. By understanding the different types of insurance, evaluating your needs, and choosing the right policies, you can protect your family from financial hardship and create a secure future for them.