Retirement should be a time to relax and enjoy the fruits of your labor, not stress about finances. However, the […]

Category: Tax Advice and Strategies

The Impact of Capital Gains Taxes on Your Wealth Strategy

Are you considering making investments but feeling unsure about how capital gains taxes will impact your overall wealth strategy? Understanding […]

The Role of Tax Planning in Building Long-Term Wealth

Building wealth is a long-term journey that requires careful planning and strategic decision-making. One crucial aspect of this journey is […]

How to Organize Your Financial Records for Tax Filing

Tax season can be a stressful time, but it doesn’t have to be. One of the best ways to reduce […]

Tax Deductions and Credits You Might Be Missing

Are you leaving money on the table when you file your taxes? It’s possible that you’re missing out on valuable […]

Common Tax Mistakes and How to Avoid Them

Tax season can be a stressful time for many people. With all the forms, deadlines, and regulations, it’s easy to […]

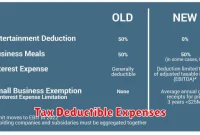

Tax Strategies for Small Business Owners to Save Money

Running a small business can be incredibly rewarding, but it also comes with its fair share of challenges. One of […]

How to Reduce Your Tax Burden with Charitable Contributions

Feeling overwhelmed by your tax burden? Do you wish there was a way to reduce your tax liability while making […]

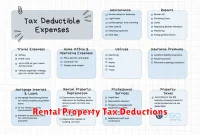

Tax Tips for Rental Property Owners to Maximize Deductions

Owning rental property can be a lucrative investment, but it also comes with its fair share of financial complexities. One […]

Key Tax Changes You Need to Know for This Year

It’s a new year, and with that comes a fresh set of tax laws and regulations. Whether you’re a seasoned […]