Buying a big-ticket item like a car or a house can be a daunting task, especially when it comes to budgeting. Many people find themselves overwhelmed by the sheer size of the investment, making it difficult to create a realistic plan. However, with a little bit of planning and discipline, you can effectively budget for these major purchases and achieve your financial goals. This guide will equip you with the essential tools and strategies to make your dream of owning a car or a home a reality.

Planning for a large purchase requires a strategic approach that goes beyond simply saving money. You need to establish a clear vision of your financial goals, understand the financial implications of the purchase, and develop a comprehensive budget that outlines all aspects of your financial life. By following this guide, you can navigate the process of budgeting for a car or a home with confidence, ensuring you make informed decisions that align with your financial well-being.

Determine Your Financial Capacity

Before embarking on any investment journey, it’s crucial to determine your financial capacity. This involves understanding your current financial situation and assessing your ability to invest. Start by creating a budget to track your income and expenses. This will reveal your monthly cash flow and highlight areas where you can potentially save money.

Next, analyze your existing assets and liabilities. Consider your savings, investments, and any outstanding debt. This will provide a clear picture of your financial standing.

Once you have a grasp of your financial position, you can determine your risk tolerance. This involves assessing your comfort level with potential losses and your investment goals.

- Are you seeking short-term gains or long-term growth?

- How comfortable are you with market fluctuations?

Understanding your financial capacity will empower you to make informed investment decisions that align with your financial goals and risk appetite.

Define Your Purchase Goals and Timeline

Before you start shopping for a new car, it’s important to define your goals and timeline. This will help you stay focused and make informed decisions. Consider these questions:

- What is your budget?

- What type of car do you need (e.g., sedan, SUV, truck)?

- What features are important to you (e.g., safety, fuel efficiency, technology)?

- How long do you plan to keep the car?

- Do you want to buy new or used?

Once you have a good understanding of your needs, you can start to research different car models and dealerships. It’s also a good idea to get pre-approved for a loan so you know how much you can afford to borrow.

Having a clear timeline for your purchase can help you stay motivated and avoid making impulsive decisions. For example, you may want to set a deadline for when you want to have the car by.

Explore Financing Options and Interest Rates

When it comes to making a significant purchase, such as a car, home, or education, financing often becomes a crucial aspect. It’s important to understand the various financing options available and the associated interest rates to make informed decisions.

Financing options typically involve taking out a loan from a lender, such as a bank, credit union, or online lender. The lender provides you with a sum of money, and you agree to repay the loan over a specified period with interest. The interest rate reflects the cost of borrowing money, and it’s crucial to compare rates from different lenders to find the best deal.

Interest rates can vary significantly based on factors like your credit score, loan amount, loan term, and the lender’s policies. A higher credit score typically results in lower interest rates, while a larger loan amount or longer loan term may lead to higher rates.

It’s essential to consider the total cost of borrowing, which includes the principal loan amount, interest, and any fees. Understanding the impact of different interest rates on the total cost can help you make a well-informed decision.

Here are some common financing options to explore:

- Personal loans: These loans are unsecured, meaning they don’t require collateral, and can be used for various purposes, such as debt consolidation, home improvements, or medical expenses.

- Auto loans: Specifically designed for purchasing vehicles, these loans typically have lower interest rates than personal loans due to the collateral involved (the car itself).

- Mortgages: Used to finance the purchase of a home, these loans have the longest repayment terms and often have fixed or adjustable interest rates.

- Student loans: These loans are available to help cover the costs of education, and they offer various repayment options, including income-driven repayment plans.

Before committing to any financing option, carefully compare interest rates, loan terms, and fees from different lenders. Utilize online tools and resources to get pre-approved for loans and obtain personalized interest rate estimates.

Factor in Additional Costs Beyond the Purchase Price

When buying a new home, it’s easy to get caught up in the excitement of finding the perfect place and focusing solely on the purchase price. However, it’s crucial to remember that the purchase price is just the tip of the iceberg. There are several additional costs you need to factor in to get a realistic picture of the total expenses involved.

Here are some key factors to consider beyond the purchase price:

1. Closing Costs

Closing costs are fees associated with finalizing the home purchase. These costs can vary depending on the location and lender, but typically include items such as:

- Loan origination fee: A fee charged by the lender for processing your mortgage.

- Appraisal fee: The cost of having a professional assess the property’s value.

- Title search and insurance: To ensure the property’s ownership is clear and protect against potential claims.

- Recording fees: Fees charged by the local government for recording the transfer of ownership.

- Property taxes: You may need to pay prorated property taxes for the portion of the year you’ll own the home.

2. Moving Expenses

Moving can be a costly affair, with expenses ranging from:

- Hiring movers: The cost of professional movers to transport your belongings.

- Packing supplies: Boxes, tape, packing peanuts, and other materials to protect your valuables.

- Transportation: Fuel, tolls, and parking fees if you’re driving yourself.

3. Home Improvements

Once you’ve settled in, you may find the need for some home improvements to make the space truly yours. This could include:

- Painting: Refreshing the walls with a new color.

- Landscaping: Adding plants, flowers, and hardscaping to enhance the outdoor space.

- Appliance upgrades: Replacing outdated appliances with newer, energy-efficient models.

- Remodeling: Making significant changes to the layout or functionality of the home.

4. Ongoing Expenses

In addition to the initial costs, you’ll also have ongoing expenses related to owning a home, including:

- Mortgage payments: Monthly payments covering principal and interest.

- Property taxes: Annual taxes based on the assessed value of your home.

- Homeowners insurance: Protection against damage to your property and liability.

- Utilities: Electricity, gas, water, and sewage costs.

- Maintenance and repairs: Addressing unexpected issues that may arise over time.

By considering these additional costs, you’ll be better prepared for the true financial commitment involved in homeownership. Make sure to budget for these expenses to avoid any surprises and ensure a smooth and enjoyable transition to your new home.

Establish a Realistic Savings Plan

Saving money can seem like a daunting task, especially when you’re trying to balance your budget with everyday expenses. However, establishing a realistic savings plan is crucial for your financial well-being. It allows you to achieve your financial goals, whether it’s purchasing a home, investing in your future, or simply having a financial safety net.

The first step is to assess your current financial situation. Determine your income, expenses, and existing debt. This will help you understand where your money is going and identify areas where you can potentially save. Track your spending for a month to gain a clearer picture of your financial habits.

Once you have a grasp of your financial landscape, you can set realistic savings goals. Start small and gradually increase your savings amount as you become more comfortable. Instead of aiming for a large sum, break down your goals into smaller, achievable milestones. For example, instead of saving $10,000 in one year, aim for $833 per month.

Automate your savings by setting up automatic transfers from your checking account to your savings account. This ensures that you consistently save money without having to manually transfer funds each month. Choose a fixed amount that works for you and schedule the transfer on a regular basis, such as weekly or bi-weekly.

Consider opening a high-yield savings account or a money market account to maximize your returns. These accounts typically offer higher interest rates than traditional savings accounts, allowing your money to grow faster. Research different financial institutions and compare their interest rates and fees before making a decision.

Saving money can be challenging, but it’s essential for financial security. By establishing a realistic savings plan, you can make significant progress towards your financial goals and achieve financial stability. Remember to be patient, consistent, and stay motivated throughout your savings journey.

Track Your Expenses and Identify Areas for Adjustment

In today’s economy, it’s more important than ever to be mindful of your spending habits. Tracking your expenses can help you understand where your money is going and identify areas where you can make adjustments to save more. This is especially important if you are trying to reach a financial goal, such as saving for a down payment on a house or paying off debt.

There are many different ways to track your expenses. You can use a spreadsheet, a budgeting app, or even just a notebook and pen. The important thing is to choose a method that works for you and that you will actually use.

Once you start tracking your expenses, you will begin to see patterns emerge. You may notice that you spend more money on certain categories than others, or that you tend to overspend when you are out with friends. This information can be valuable in helping you make changes to your spending habits.

Here are a few tips for tracking your expenses:

- Set up a budget. This will help you stay on track with your spending and ensure that you are not overspending.

- Track every expense. Even small purchases, such as coffee or a snack, can add up over time.

- Categorize your expenses. This will help you see where your money is going and identify areas where you can cut back.

- Review your expenses regularly. This will help you stay on top of your spending and make adjustments as needed.

By tracking your expenses and making adjustments to your spending habits, you can take control of your finances and achieve your financial goals.

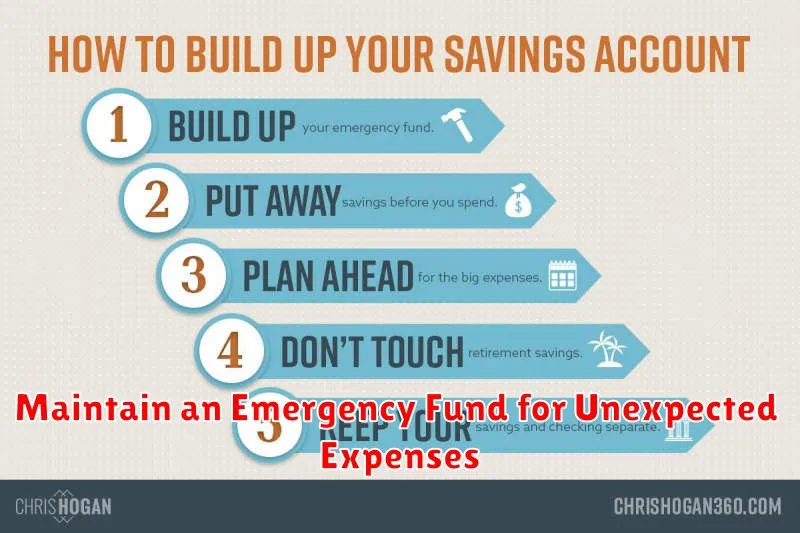

Maintain an Emergency Fund for Unexpected Expenses

Life is unpredictable, and unexpected expenses can arise at any time. Car repairs, medical emergencies, job loss, or even a natural disaster can leave you financially unprepared. That’s why it’s crucial to establish and maintain an emergency fund. An emergency fund is a safety net that provides financial security and peace of mind in times of need.

Benefits of an Emergency Fund

Having an emergency fund offers numerous benefits, including:

- Financial Security: It protects you from financial hardship when unexpected expenses arise, preventing you from going into debt or dipping into your savings.

- Peace of Mind: Knowing you have a financial cushion can alleviate stress and anxiety, allowing you to focus on resolving the issue at hand.

- Avoid Debt: An emergency fund can prevent you from resorting to high-interest credit cards or loans, saving you from accumulating debt and its associated financial burdens.

- Opportunity to Take Advantage of Unexpected Opportunities: An emergency fund can provide the financial flexibility to seize opportunities that arise unexpectedly, such as a new business venture or a down payment on a home.

How to Establish an Emergency Fund

Building an emergency fund is a simple yet effective strategy. Here’s how to get started:

- Set a Goal: Determine the amount you need in your emergency fund. A common recommendation is three to six months’ worth of living expenses.

- Start Small: Even a small amount saved regularly can make a difference. Begin by setting aside a portion of your income each month.

- Automate Savings: Set up automatic transfers from your checking account to your savings account to make saving effortless.

- Track Progress: Regularly monitor your progress and adjust your savings amount as needed.

- Be Patient: Building an emergency fund takes time and discipline. Don’t get discouraged; stick with it and you’ll reap the rewards.

Tips for Maintaining an Emergency Fund

Once you’ve established an emergency fund, it’s important to maintain it:

- Resist the Temptation to Spend It: Your emergency fund is for unexpected expenses, not for frivolous purchases.

- Replenish After Use: When you use your emergency fund, make it a priority to replenish it as soon as possible.

- Review Regularly: Periodically assess your emergency fund’s adequacy and adjust it based on your current financial situation and expenses.

An emergency fund is a vital part of financial security. By establishing and maintaining one, you can prepare for life’s uncertainties and enjoy peace of mind knowing you have a financial safety net in place.

Review and Adjust Your Budget Regularly

Creating a budget is a crucial step in managing your finances, but it’s not a one-time event. A budget is a living document that needs to be regularly reviewed and adjusted to reflect your changing circumstances. Life is full of unexpected twists and turns, and your financial needs and priorities can change over time.

Here are some compelling reasons why you should review and adjust your budget regularly:

- Track Your Progress: A regular budget review allows you to assess how well you are sticking to your financial goals. You can see if you’re saving enough, spending within your limits, and making progress toward your financial objectives.

- Identify Spending Leaks: When you take a closer look at your spending habits, you might uncover areas where you are overspending without realizing it. Identifying these “spending leaks” can help you find ways to cut back and save more.

- Account for Changes: Life is full of changes, from salary increases and job changes to unexpected expenses and emergencies. Reviewing your budget regularly ensures that it remains aligned with your current income and spending patterns.

- Adjust for Inflation: Inflation can erode the purchasing power of your money over time. Regularly reviewing your budget and adjusting your spending allocations can help you stay ahead of inflation and maintain your financial stability.

- Set New Financial Goals: As your life evolves, your financial goals may change too. A budget review allows you to re-evaluate your goals and adjust your budget accordingly to support your aspirations.

Regular budget reviews are essential for maintaining financial control and achieving your financial goals. Make it a habit to review your budget at least once a quarter or even monthly, especially when you experience significant life changes. By proactively managing your budget, you can ensure your finances stay aligned with your priorities and help you reach your financial dreams.

Seek Professional Financial Advice If Needed

It’s important to remember that everyone’s financial situation is unique, and what works for one person may not work for another. If you’re feeling overwhelmed or unsure about your financial decisions, it’s always a good idea to seek professional financial advice. A qualified financial advisor can help you develop a personalized plan that meets your specific needs and goals. They can also help you understand complex financial concepts, such as investments, retirement planning, and estate planning.

Here are some of the benefits of seeking professional financial advice:

- Objective perspective: Financial advisors can provide an objective perspective on your financial situation, helping you make informed decisions without emotional bias.

- Personalized plan: A financial advisor can develop a customized plan that takes into account your individual circumstances, goals, and risk tolerance.

- Expert knowledge: Financial advisors have extensive knowledge of the financial markets and can help you navigate complex financial concepts.

- Accountability: Working with a financial advisor can help you stay accountable to your financial goals.

If you’re considering seeking professional financial advice, be sure to do your research and choose a reputable advisor who is qualified to meet your needs. You can ask for referrals from friends or family, or search online for certified financial planners.