Traveling is an incredible experience that can broaden your horizons and create lifelong memories. But the cost of travel can be daunting, especially if you’re on a tight budget. You might think that you have to sacrifice your savings to see the world. But don’t worry, you can still travel without breaking the bank! By learning to budget effectively, you can plan an amazing trip while staying within your financial means.

This article will guide you through the steps of creating a travel budget that works for you. We’ll cover everything from setting realistic goals to finding affordable flights and accommodations. You’ll discover practical tips and tricks to make your dream vacation a reality, without sacrificing your hard-earned savings. Get ready to explore the world without breaking the bank!

Identify Your Travel Priorities

Traveling can be an amazing experience, but it can also be overwhelming. With so many destinations to choose from and so many things to do, it’s easy to get lost in the planning process. That’s why it’s important to identify your travel priorities before you even start to think about specific destinations.

What are your travel priorities? What’s most important to you when you travel? Are you looking for a relaxing beach vacation, an adventurous backpacking trip, a cultural immersion experience, or a combination of all of the above? Once you know what’s most important to you, you can start to narrow down your options and find the perfect trip for you.

Here are a few questions to help you identify your travel priorities:

- What kind of budget are you working with?

- How much time do you have to travel?

- What kind of activities do you enjoy?

- What kind of weather do you prefer?

- What kind of food do you like to eat?

- Are you comfortable traveling alone or do you prefer to travel with a group?

Once you’ve answered these questions, you’ll have a better idea of what your travel priorities are and you can start to plan your next adventure.

Set Realistic Savings Goals

Saving money can seem daunting, but it’s essential for achieving financial stability and reaching your long-term goals. The key is to set realistic savings goals that are achievable and motivating. Here’s a guide to help you set smart goals:

1. Determine Your Financial Situation

Before setting any goals, it’s crucial to understand your current financial standing. Track your income and expenses for a month to get a clear picture of where your money is going. This will help you identify areas where you can potentially cut back and increase your savings.

2. Define Your Savings Goals

What do you want to save for? Are you planning for a down payment on a house, a vacation, or retirement? Be specific about your goals and set a timeframe for achieving them. This will give you a target to aim for and keep you motivated.

3. Start Small and Gradually Increase

Don’t try to save too much too soon. Start with a small, manageable amount that you can comfortably set aside each month. As your income grows and your spending habits adjust, you can gradually increase your savings rate.

4. Break Down Large Goals into Smaller Milestones

Large savings goals can feel overwhelming. Divide them into smaller, achievable milestones to make them less daunting. For example, instead of focusing on the entire cost of a house, set a goal for saving a specific amount every six months. This approach will provide a sense of accomplishment along the way and keep you on track.

5. Automate Your Savings

Make saving effortless by automating your savings. Set up automatic transfers from your checking account to your savings account on a regular basis. This way, you’ll save consistently without having to think about it.

6. Review and Adjust Regularly

Life is full of unexpected events, so it’s important to review your savings goals and make adjustments as needed. If your financial situation changes, you may need to reassess your savings plan. Stay flexible and adapt to your circumstances.

7. Celebrate Your Success

Don’t forget to celebrate your progress! Reaching your savings milestones is a significant accomplishment. Reward yourself in a way that aligns with your goals and reinforces your positive financial habits.

By setting realistic savings goals and following these strategies, you’ll be well on your way to achieving financial security and accomplishing your dreams.

Track Your Spending Habits

Tracking your spending habits is a crucial step towards achieving your financial goals. By understanding where your money goes, you can identify areas for improvement and make informed decisions about your finances. There are several methods to track your spending, from traditional pen-and-paper methods to sophisticated budgeting apps.

Benefits of Tracking Your Spending

Tracking your spending offers numerous benefits, including:

- Increased awareness: It brings to light areas of spending you may not have been aware of.

- Improved budgeting: It allows you to create a realistic budget and stick to it.

- Reduced impulsive spending: By seeing your spending patterns, you can become more mindful of your purchases.

- Faster debt repayment: By identifying unnecessary expenses, you can allocate more money towards debt repayment.

- Financial peace of mind: Understanding your spending habits can reduce financial stress and anxiety.

Methods for Tracking Spending

There are several effective methods to track your spending:

- Spreadsheet or notebook: A simple and traditional method that allows for customization.

- Budgeting apps: These apps offer automated tracking, categorization, and insightful reports.

- Bank statements: Regularly reviewing your bank statements can reveal spending patterns.

Tips for Effective Spending Tracking

To maximize the benefits of tracking your spending, consider these tips:

- Be consistent: Track your spending regularly, ideally daily or weekly.

- Categorize your expenses: This provides insights into your spending habits and allows you to identify areas for improvement.

- Review your spending periodically: Analyze your spending patterns and adjust your budget accordingly.

- Set spending goals: Having clear goals helps you stay motivated and on track.

Tracking your spending is an essential step towards financial success. By understanding your spending patterns, you can make informed decisions, reduce impulsive spending, and achieve your financial goals.

Explore Affordable Travel Options

Traveling can be an incredibly enriching experience, but it often comes with a hefty price tag. However, you don’t have to sacrifice your wanderlust to stay within budget. There are plenty of affordable travel options available, allowing you to explore the world without breaking the bank.

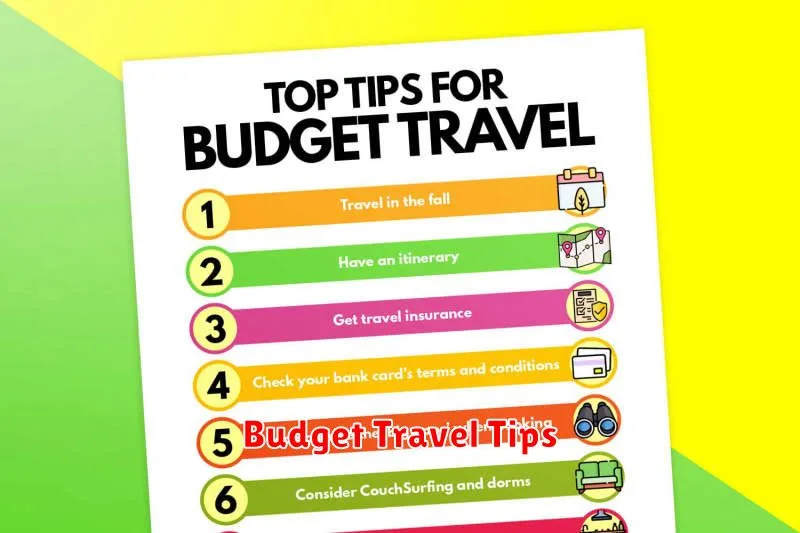

One of the most effective ways to save money is by traveling during the off-season. Airlines and hotels often offer discounted rates during shoulder seasons, when the weather is still pleasant but tourist crowds are smaller. Consider visiting destinations like Europe in the spring or fall, or exploring tropical islands during the dry season.

Another way to keep costs down is by choosing budget-friendly accommodations. Hostels offer a social and cost-effective option, while Airbnb rentals provide a more private and local experience. Consider staying in hostels or apartments rather than luxurious hotels to save significantly on accommodation costs.

Embrace local transportation to reduce your travel expenses. Public transportation is often a much cheaper alternative to taxis or rental cars, especially for exploring cities. Consider walking or cycling to get around, not only saving money but also experiencing the local culture and discovering hidden gems.

Pack light to avoid baggage fees. Bring only essential items and choose versatile clothing that can be mixed and matched. Many budget airlines charge for checked baggage, so minimizing luggage can save you significant money.

Don’t forget to take advantage of free activities. Most destinations offer numerous free or low-cost attractions, such as museums, parks, and historical landmarks. Research local events, festivals, and markets to enjoy authentic experiences without spending a fortune.

Food can be another significant expense, but it doesn’t have to be. Explore local markets and street food stalls for delicious and affordable meals. Pack snacks and drinks for your travels to minimize reliance on expensive restaurants.

Plan ahead to find the best deals. Book flights and accommodations in advance, especially for peak season travel. Look for package deals and special offers that can save you a considerable amount of money.

Travel with a purpose. Instead of aiming for a luxurious getaway, consider volunteering, studying abroad, or working remotely. This can not only make travel more affordable but also offer enriching and meaningful experiences.

With a little planning and creativity, you can travel the world without breaking the bank. Embrace affordable options, explore local culture, and enjoy every moment of your adventure. Remember, traveling is about making memories, not just spending money.

Cut Down on Unnecessary Expenses

In today’s economy, it’s more important than ever to be mindful of your spending. Every little bit counts, and even small changes can make a big difference in your overall financial health. This article will focus on simple ways to cut down on unnecessary expenses.

1. Track Your Spending

The first step to cutting down on unnecessary expenses is to understand where your money is going. Keep a budget journal, utilize a budgeting app, or use a simple spreadsheet to track all your spending for a month. This will help you identify areas where you can easily cut back. You may be surprised at how much you spend on things you don’t really need.

2. Cut Back on Eating Out

Eating out is a big expense for many people. If you’re looking to save money, try cooking more meals at home. Start small, maybe one or two nights a week. You can also look for ways to make your meals more affordable, such as buying in bulk or using coupons.

3. Shop Around for Better Deals

Don’t be afraid to shop around for the best deals. This applies to everything from groceries and gas to clothing and electronics. Many websites and apps offer comparison shopping tools that can help you find the best prices. You can also take advantage of sales and discounts.

4. Avoid Impulse Purchases

Impulse purchases are one of the biggest culprits of unnecessary spending. If you see something you want, don’t buy it right away. Wait a day or two and see if you still want it. If you’re still interested, then go ahead and buy it. But if you’ve changed your mind, you’ve saved yourself some money.

5. Consider Alternatives to New Purchases

Before you buy something new, consider if you can use something you already own, rent it, or borrow it. For example, if you need a tool for a one-time project, you might be able to borrow it from a friend or neighbor. If you’re looking to buy a new piece of furniture, consider buying it used or refurbished instead of brand new.

6. Don’t Be Afraid to Say “No”

It’s perfectly fine to say “no” to things you can’t afford or don’t really want. This can be difficult, especially when it comes to social situations. But if you’re serious about cutting down on unnecessary expenses, you need to be willing to say “no” to things that don’t align with your financial goals.

By following these tips, you can easily cut down on unnecessary expenses and save money. Every little bit counts, and these small changes can make a big difference in your overall financial health.

Find Creative Ways to Earn Extra Income

Are you looking for ways to earn extra income? With the cost of living rising, many people are looking for ways to supplement their income. There are many creative ways to earn extra money, and you don’t have to have a lot of time or skills to get started. Here are a few ideas to get you started.

1. Sell Your Stuff

Do you have any old clothes, books, or electronics that you no longer need? You can sell these items online or at a consignment shop to earn some extra cash. There are many online marketplaces where you can sell your used items, such as eBay, Craigslist, and Facebook Marketplace. If you have a lot of items to sell, consider hosting a yard sale or using a service like Letgo or OfferUp.

2. Become a Virtual Assistant

Are you organized and efficient? If so, you could become a virtual assistant. Virtual assistants provide administrative, technical, or creative assistance to clients from a remote location. They can work for businesses of all sizes, and there are many tasks that virtual assistants can handle, such as scheduling appointments, managing email, and creating presentations. You can find virtual assistant jobs on websites like Upwork, Fiverr, and Indeed.

3. Start a Blog

If you have a passion for writing, consider starting a blog. You can share your thoughts and ideas with the world and earn money through advertising, affiliate marketing, or selling products or services. To start a blog, you will need to choose a platform, such as WordPress or Blogger, and then create content that is relevant to your audience.

4. Teach English Online

Do you speak English fluently? If so, you can teach English online to students around the world. There are many online platforms that connect English teachers with students. You can set your own hours and work from the comfort of your own home.

5. Become a Delivery Driver

If you have a car and enjoy driving, you can sign up to be a delivery driver for companies like Uber Eats, Grubhub, or DoorDash. You can set your own hours and work as much or as little as you like.

6. Start a Side Hustle

There are many other side hustles that you can start to earn extra income. For example, you can become a pet sitter, dog walker, or house cleaner. You can also offer your services as a freelance writer, graphic designer, or web developer.

7. Take Surveys

If you have a few spare minutes, you can take surveys online to earn a little extra cash. Many websites offer paid surveys, and you can choose to participate in surveys that are relevant to your interests. However, it’s important to note that some survey sites may not be legitimate, so it’s important to do your research before signing up.

There are many creative ways to earn extra income. The key is to find something that you enjoy and that fits into your lifestyle. With a little effort, you can earn some extra money and reach your financial goals.

Leverage Travel Rewards and Discounts

Traveling can be an expensive endeavor, but there are ways to save money and maximize your travel experiences. One of the most effective strategies is to leverage travel rewards and discounts. These programs can help you earn points, miles, and cashback, which can be redeemed for flights, hotels, rental cars, and other travel-related expenses.

Credit Card Rewards

Many credit cards offer travel rewards programs, allowing you to earn points or miles for every dollar you spend. Some cards even offer bonus points for travel-related purchases. Look for cards with generous rewards, low annual fees, and travel perks like airport lounge access or travel insurance.

Airline Loyalty Programs

Joining airline loyalty programs is another great way to earn rewards. You can accumulate miles by flying with that airline, booking flights through their website, or using their co-branded credit cards. Miles can be redeemed for free flights, upgrades, and other benefits.

Hotel Loyalty Programs

Similar to airline programs, hotel loyalty programs reward you for staying at their properties. You can earn points for stays, dining, and other hotel services. These points can be used for free nights, room upgrades, and other perks.

Travel Subscription Services

Subscription services like Scott’s Cheap Flights and The Flight Deal can help you find discounted flights and hotel deals. They curate and send you alerts for exclusive offers, ensuring you never miss out on a great deal.

Travel Agencies and Tour Operators

Travel agencies and tour operators often have access to exclusive discounts and packages that are not available to the public. They can also provide valuable insights and recommendations to help you plan your trip efficiently and save money.

Conclusion

By leveraging travel rewards and discounts, you can significantly reduce your travel costs and enjoy more of your trips. From credit card rewards to loyalty programs and subscription services, there are numerous ways to maximize your travel savings. Remember to research and compare different options to find the best fit for your travel needs and budget.

Plan and Book in Advance for Better Deals

When it comes to travel, planning and booking in advance can make a big difference in the price you pay. Whether you’re planning a vacation, a business trip, or even just a weekend getaway, booking early can save you a significant amount of money.

Here are a few reasons why:

Early Bird Discounts

Many airlines and hotels offer early bird discounts for bookings made well in advance. These discounts can be substantial, especially during peak travel seasons. So, if you know when you want to travel, don’t wait until the last minute to book.

More Availability

Booking in advance gives you more flexibility when it comes to choosing flights, hotels, and other travel options. You’ll have a wider selection of dates, times, and destinations to choose from, and you’ll be less likely to be stuck with limited options or higher prices.

Avoid Peak Season Prices

Travel during peak season, like school holidays or summer, can be extremely expensive. By booking in advance, you can often avoid these inflated prices and secure a more affordable trip.

Take Advantage of Promotions

Airlines, hotels, and travel agencies often run special promotions and deals, especially for early bookings. These promotions can include free upgrades, baggage allowance, or even discounts on car rentals. Keeping an eye out for these promotions can lead to significant savings.

Plan Your Budget

Booking in advance allows you to plan your travel budget more effectively. You can set aside funds for your trip and track your spending to avoid overspending.

Reduce Stress

Booking in advance can also help reduce stress. Knowing that your travel arrangements are taken care of, you can focus on other aspects of your trip, such as packing and planning activities.

Of course, booking in advance isn’t always possible, especially if you’re planning a last-minute trip. However, if you have the flexibility, consider making your travel arrangements well in advance to save money and enjoy a more relaxed travel experience.

Travel Off-Season for Lower Prices

Are you looking for a way to save money on your next trip? Consider traveling during the off-season. This can be a great way to get lower prices on flights, hotels, and other travel expenses. You’ll also experience fewer crowds and less competition for popular attractions. While it’s true that some destinations may have limited activities during the off-season, there’s still plenty to see and do. And, with fewer tourists around, you may even get a more authentic travel experience.

To help you plan your off-season travel, here are some tips:

- Do your research. Find out when the off-season is for your desired destination. This can vary depending on the location and the type of activities you want to do.

- Book your flights and accommodations in advance. This will help you secure the best deals, especially if you’re traveling during a popular holiday period. You can use online travel agents or airlines directly. Make sure to check the fine print so that you can understand all the terms and conditions.

- Be flexible. If you’re open to traveling on weekdays instead of weekends or during shoulder season, you may be able to find even better deals.

- Consider alternative destinations. If your dream destination is too expensive during the off-season, consider a nearby or similar destination. This can be a great way to save money while still experiencing a new place.

Traveling off-season can be a great way to save money and enjoy a more relaxing travel experience. So, start planning your next adventure today!