Are you dreaming of a comfortable and fulfilling retirement? Retirement planning is one of the most important financial goals in your life. It is essential to start saving early and often, and to have a clear understanding of how much you need to save to reach your retirement goals. But with so many different factors to consider, how do you determine how much you need to save for retirement? This article will guide you through the process of calculating your retirement savings goal effectively, providing you with valuable insights and practical strategies to ensure a financially secure future.

Calculating your retirement savings goal requires a clear understanding of your desired lifestyle, expected expenses, and time horizon for retirement. By factoring in these key elements, you can estimate your future needs and design a personalized savings plan that aligns with your aspirations. It’s never too early or too late to start saving for retirement. This comprehensive guide will equip you with the knowledge and tools you need to make informed decisions about your financial future.

Estimate Your Retirement Expenses

Retirement is a significant milestone in life, and it’s crucial to be financially prepared. One essential aspect of planning for retirement is estimating your expenses. Understanding your financial needs during retirement will help you determine how much you need to save and invest. Here’s a comprehensive guide to estimating your retirement expenses:

1. Analyze Your Current Spending

Start by tracking your current spending habits. Use a budget tracking app, spreadsheet, or simply review your bank statements. Categorize your expenses to identify areas where you can potentially cut back or adjust. Consider these categories:

- Housing

- Food

- Transportation

- Healthcare

- Entertainment

- Savings

- Debt Repayment

- Other Expenses

2. Factor in Changes in Lifestyle

Your spending habits may change in retirement. Consider these factors:

- Housing: You might downsize, relocate, or consider alternative living arrangements.

- Healthcare: Healthcare costs typically rise as we age. Factor in potential expenses like health insurance premiums, prescription medications, and long-term care.

- Travel: You may have more time for travel, but factor in potential costs for vacations, flights, and accommodations.

- Entertainment: Your entertainment preferences may shift, so consider costs related to hobbies, activities, and social outings.

3. Account for Inflation

Inflation erodes the purchasing power of money over time. Estimate how inflation might affect your expenses. Use an inflation calculator to project the future value of your expenses.

4. Utilize Retirement Planning Tools

Many online tools and calculators can help you estimate your retirement expenses. These tools can project your future needs based on factors like your current income, savings, and desired retirement lifestyle.

5. Seek Professional Advice

Consider consulting a financial advisor for personalized guidance. A qualified professional can help you develop a comprehensive retirement plan that aligns with your individual circumstances and financial goals.

6. Review and Adjust Your Estimates

Your retirement expenses may fluctuate over time. Review your estimates regularly and adjust them as needed. Consider factors like changes in health, family needs, or economic conditions.

Estimating your retirement expenses is an important step towards financial security. By carefully considering your current spending, potential lifestyle changes, and inflation, you can create a more accurate picture of your financial needs in retirement. This information will help you make informed decisions about savings, investments, and overall financial planning.

Determine Your Retirement Income Sources

Retirement planning is a crucial aspect of financial well-being. It involves strategically saving and investing for your future, ensuring a comfortable lifestyle once you cease working. A key element of this planning is understanding your potential retirement income sources. These sources will contribute to your overall financial security and allow you to enjoy your golden years without financial worries.

One of the most significant retirement income sources is Social Security. This government-provided benefit is intended to provide a safety net for retirees, offering a monthly income stream. It’s essential to understand your eligibility for Social Security, as well as the amount of benefits you can expect to receive. The earlier you start planning, the better.

Another crucial source is your personal savings and investments. This includes retirement accounts such as 401(k)s, IRAs, and Roth IRAs. These accounts provide tax-advantaged ways to save for retirement. The more you contribute and the longer you invest, the greater your nest egg will grow. Additionally, investing in stocks, bonds, and real estate can also provide significant income streams in retirement.

For many, pensions can be a vital source of income. However, pensions are becoming less common, with many employers moving towards defined-contribution plans instead. If you’re fortunate enough to have a pension, understand its terms and how it will contribute to your retirement income.

Annuities are financial products that can provide a stream of income in retirement. They allow you to invest a lump sum and receive regular payments for a set period or for life. Annuities can be a helpful tool for retirement planning, but it’s important to carefully consider their features and associated fees before making a decision.

Finally, part-time work or consulting can supplement your retirement income. Many retirees choose to continue working part-time or take on consulting projects. This can provide additional financial resources and maintain a sense of purpose and engagement.

Determining your retirement income sources is essential for developing a comprehensive financial plan. By carefully assessing your potential income streams, you can make informed decisions about your savings, investments, and overall retirement strategy. Remember, planning early and diligently will help ensure a comfortable and fulfilling retirement.

Factor in Inflation and Life Expectancy

When it comes to planning for the future, it’s crucial to consider factors that can significantly impact your financial well-being. Two such factors are inflation and life expectancy.

Inflation refers to the general increase in prices of goods and services over time. As inflation rises, the purchasing power of your money decreases. This means that the same amount of money will buy you less in the future than it does today. For example, if the inflation rate is 3%, a product that costs $100 today will cost $103 in a year.

Life expectancy, on the other hand, refers to the average number of years a person is expected to live. Life expectancy has been steadily increasing in many parts of the world due to advancements in healthcare and living conditions. However, it’s important to remember that this is just an average. Individual life expectancy can vary significantly based on factors like lifestyle, genetics, and access to healthcare.

When planning for retirement, it’s important to consider both inflation and life expectancy. You need to ensure that your savings will be sufficient to cover your expenses throughout your retirement years, taking into account the eroding power of inflation. You should also factor in the possibility of living longer than expected, as you may need to plan for a longer retirement period.

Here are some ways to factor in inflation and life expectancy when planning for the future:

- Use an inflation calculator: These calculators can help you estimate how much your money will be worth in the future, taking into account inflation.

- Adjust your savings goals: Aim to save more than you think you need, as inflation will reduce the purchasing power of your savings over time.

- Invest in assets that can outpace inflation: Consider investments like stocks and real estate, which have historically outperformed inflation.

- Plan for a longer retirement: Be prepared to retire later or save more to account for the possibility of a longer lifespan.

By considering both inflation and life expectancy, you can make more informed financial decisions and ensure that you have enough resources to meet your needs throughout your lifetime.

Calculate Your Total Savings Goal

Saving money is an essential part of personal finance, and having a clear savings goal is crucial for staying motivated and achieving your financial objectives. This article will guide you through the process of calculating your total savings goal, considering different life stages and financial priorities.

1. Define Your Financial Goals

The first step is to identify your short-term, medium-term, and long-term financial goals. These could include:

- Emergency Fund: A safety net for unexpected expenses.

- Down Payment on a Home: Saving for your dream house.

- Retirement: Securing your financial future in your later years.

- Education: Funding your education or your children’s education.

- Travel: Saving for that dream vacation.

- Debt Payoff: Eliminating high-interest debt.

2. Determine the Time Horizon

For each goal, determine the time frame you have to achieve it. This could be a few months for an emergency fund, several years for a down payment on a house, or decades for retirement.

3. Estimate the Cost of Each Goal

Research and estimate the amount of money you’ll need to achieve each goal. For example, if you’re saving for a down payment on a house, consider factors like the average home price in your area and the required down payment percentage.

4. Account for Inflation

Inflation can significantly erode the value of your savings over time. To adjust for inflation, you can use an inflation calculator or consult with a financial advisor.

5. Consider Your Investment Strategy

The way you invest your savings will influence how quickly your money grows. Different investment options have varying levels of risk and potential returns. Consult with a financial professional to discuss your risk tolerance and choose an appropriate investment strategy.

6. Calculate Your Total Savings Goal

Once you have determined the estimated cost of each goal, adjusted for inflation, and considered your investment strategy, you can calculate your total savings goal. Simply add up the amounts you need to save for each individual goal.

7. Create a Budget and Track Your Progress

Developing a realistic budget and tracking your savings progress regularly will help you stay on track towards your total savings goal. Regularly review your budget and make adjustments as needed.

Remember, reaching your total savings goal takes time, discipline, and consistent effort. By following these steps, you can develop a comprehensive savings plan that aligns with your financial aspirations and helps you achieve your financial goals.

Determine Your Savings Rate and Timeline

Saving for retirement is an important goal for everyone. But it can be difficult to know how much to save and how long you need to save for. The first step in developing a retirement savings plan is to determine your savings rate and your timeline. You can use a retirement calculator to help you with this process.

Savings Rate

Your savings rate is the percentage of your income that you set aside for retirement each year. The higher your savings rate, the more money you will have saved by the time you retire. You may want to consider increasing your savings rate as you get closer to retirement, to make up for lost time. A good goal is to save 15% of your gross income, though you may choose a different savings rate based on your individual financial situation.

Timeline

Your timeline is the number of years you have until you plan to retire. The longer your timeline, the more time you have to grow your savings. This can be helpful if you aren’t able to save as much in the early years of your career. You can use a retirement calculator to help you determine how much money you will need to save each year to reach your retirement goals.

Factors to Consider

When determining your savings rate and timeline, it is important to consider your personal circumstances. For example, your age, income, and expenses, and your health and your family history are all factors that can influence your retirement planning.

Conclusion

Determining your savings rate and timeline is an important step in developing a successful retirement savings plan. Once you have determined these two factors, you can start to make specific plans for how you will save for your future.

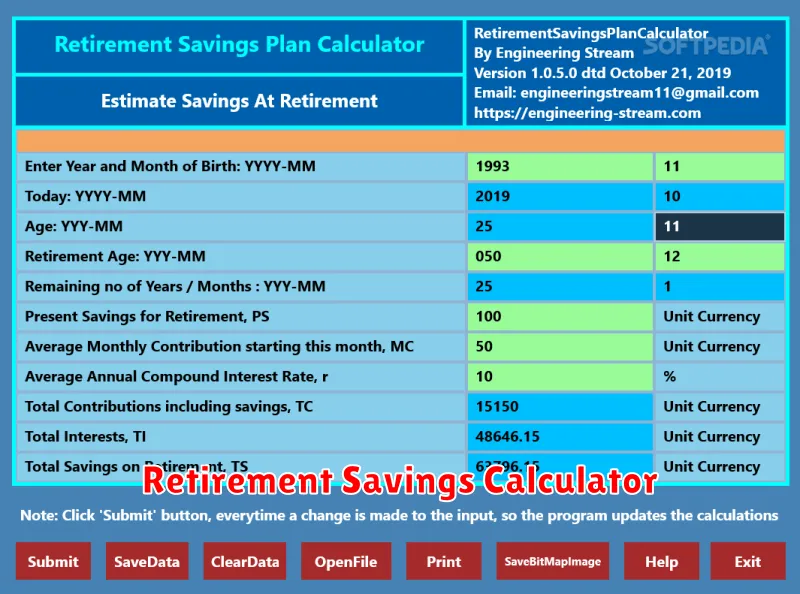

Consider Using a Retirement Savings Calculator

Retirement may seem like a long way off, but it’s never too early to start planning for it. A retirement savings calculator can be a valuable tool to help you understand how much you need to save and how your investments may grow over time.

There are many different types of retirement savings calculators available online, and they can be customized to reflect your individual circumstances. Some factors that may be considered include your age, income, expenses, and investment goals. You can also customize your retirement calculator to include assumptions about your expected rate of return on your investments and the amount of inflation you anticipate.

Using a retirement savings calculator can help you:

- Determine how much you need to save each month to reach your retirement goals.

- See how your savings may grow over time, based on different investment scenarios.

- Understand the impact of different retirement ages on your savings needs.

- Identify potential gaps in your retirement plan and make adjustments as needed.

Retirement planning can be complex, but a retirement savings calculator can provide valuable insights and help you make informed decisions about your financial future. It is important to remember that these calculators are only tools, and your individual situation may vary. It’s always best to speak with a financial advisor to get personalized advice.

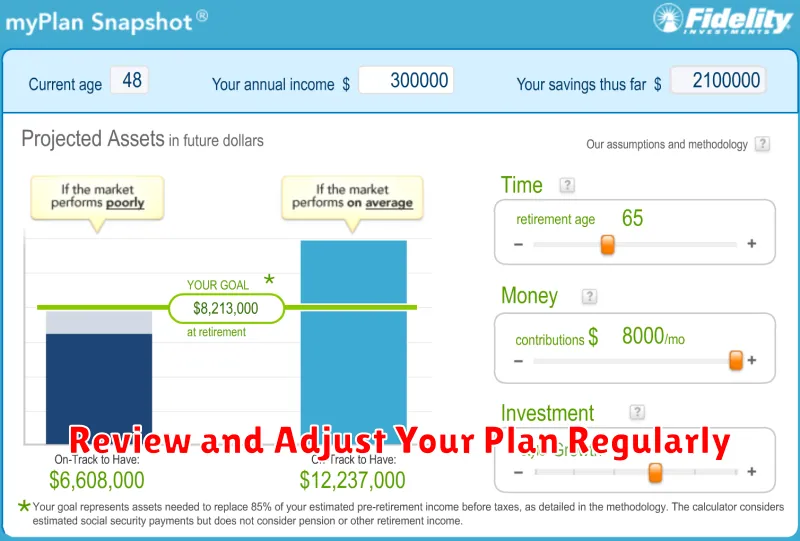

Review and Adjust Your Plan Regularly

Creating a plan is a great first step, but it’s important to remember that plans are not set in stone. As you work towards your goals, you’ll likely encounter unexpected challenges and opportunities. Regularly reviewing and adjusting your plan is essential to stay on track and ensure you’re making progress.

Here are some tips for reviewing and adjusting your plan:

- Schedule regular review sessions. Set aside time each week or month to evaluate your progress and make adjustments as needed.

- Reflect on your accomplishments. Celebrate your successes and acknowledge the progress you’ve made. This will help you stay motivated and focused.

- Identify areas for improvement. Are there any areas where you’re struggling or falling behind? Identify these areas and brainstorm solutions.

- Adjust your goals and deadlines. If your goals are no longer realistic or achievable, adjust them accordingly. You may also need to adjust your deadlines if you encounter unforeseen delays.

- Stay flexible and adaptable. Be open to change and willing to make adjustments as needed. The ability to adapt is crucial for achieving success.

By regularly reviewing and adjusting your plan, you can ensure that it remains relevant and effective in helping you achieve your goals.

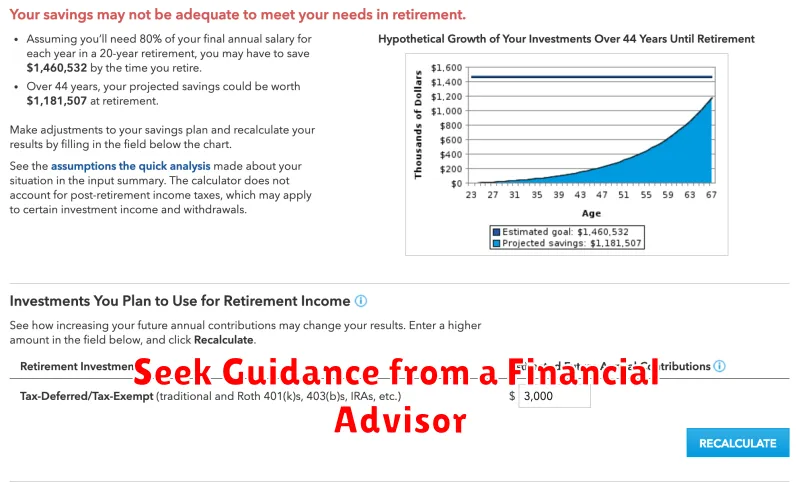

Seek Guidance from a Financial Advisor

Navigating the complex world of finances can be daunting, especially when it comes to making crucial decisions about your financial future. This is where seeking guidance from a qualified financial advisor can prove invaluable.

A financial advisor acts as your trusted guide, providing personalized advice and strategies to help you achieve your financial goals. They possess the expertise and knowledge to analyze your financial situation, assess your risk tolerance, and recommend tailored solutions that align with your aspirations.

Benefits of Consulting a Financial Advisor

Engaging a financial advisor offers a multitude of benefits, including:

- Objective Perspective: Financial advisors provide an unbiased perspective, helping you make informed decisions without emotional bias.

- Personalized Strategies: They create customized financial plans that cater to your specific circumstances and goals.

- Investment Management: Financial advisors can manage your investment portfolio, ensuring it aligns with your risk tolerance and investment objectives.

- Retirement Planning: They guide you in planning for a comfortable retirement, considering factors like savings, investments, and social security.

- Estate Planning: Financial advisors can assist in creating a comprehensive estate plan, protecting your assets and ensuring your wishes are fulfilled.

- Tax Optimization: They help you leverage tax strategies to minimize your tax liability and maximize your financial gains.

Choosing the Right Financial Advisor

When selecting a financial advisor, consider the following factors:

- Credentials and Experience: Look for advisors with relevant certifications, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA).

- Fee Structure: Understand the advisor’s fees and whether they charge a flat fee, hourly rate, or percentage of assets under management.

- Communication Style: Choose an advisor who communicates clearly and effectively, explaining complex financial concepts in a way you understand.

- Client References: Ask for references from previous clients to gauge the advisor’s track record and reputation.

Conclusion

Seeking guidance from a financial advisor can empower you to make informed financial decisions, achieve your goals, and build a secure financial future. By carefully considering the benefits and factors discussed above, you can find a qualified advisor who can partner with you on your financial journey.

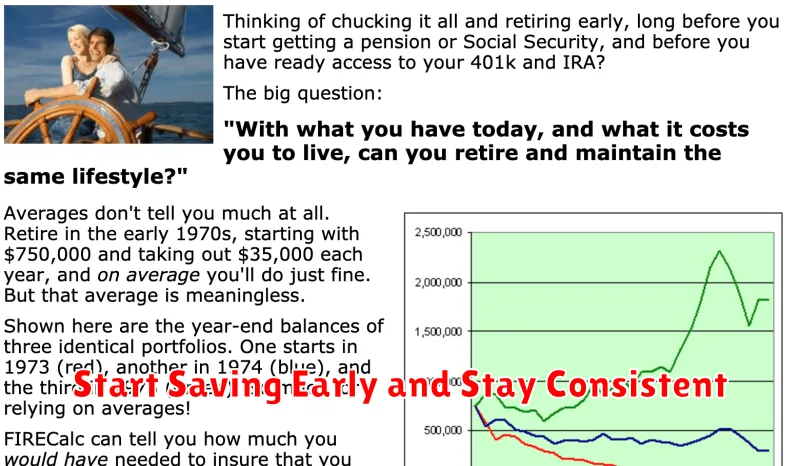

Start Saving Early and Stay Consistent

Saving money is essential for achieving financial goals. Whether you’re aiming for a down payment on a house, a comfortable retirement, or simply a rainy day fund, starting early and staying consistent is crucial.

The earlier you begin saving, the more time your money has to grow through compounding. This powerful concept allows your earnings to generate interest, which then earns more interest over time. Even small, regular contributions can add up significantly over the long term.

Consistency is equally important. Make saving a habit by setting aside a fixed amount of money each month, even if it’s just a small amount. You can automate your savings by setting up automatic transfers from your checking account to your savings account. This ensures you’re consistently putting money away without having to think about it.

Here are some practical tips for starting and maintaining a consistent savings plan:

- Set realistic savings goals: Determine how much you need to save and by when. This will give you a clear target to work towards.

- Create a budget: Track your income and expenses to identify areas where you can cut back and allocate more money to savings.

- Automate your savings: Set up automatic transfers from your checking account to your savings account on a regular basis.

- Consider a high-yield savings account: Look for accounts that offer higher interest rates to maximize your returns.

- Reward yourself: Celebrate your progress by rewarding yourself for reaching your savings milestones.

Saving money doesn’t have to be a chore. By starting early, staying consistent, and implementing smart strategies, you can build a solid financial foundation and achieve your financial goals.