Are you a freelance worker who wants to ensure you’re prepared for tax season? If so, you’re not alone. Many freelancers struggle with understanding their tax obligations and how to plan for them effectively. But don’t worry, you don’t have to navigate the complexities of freelance taxes alone. This comprehensive guide will walk you through everything you need to know about planning for taxes as a freelance worker, from understanding your tax liabilities to maximizing deductions and minimizing your tax burden.

Proper tax planning is essential for any freelancer looking to stay financially stable. By taking the time to understand your tax obligations and leverage available deductions, you can ensure you’re not caught off guard by a hefty tax bill at the end of the year. This article provides practical tips and strategies to help you navigate the world of freelance taxes with confidence. Whether you’re just starting your freelancing journey or a seasoned veteran, this guide will equip you with the knowledge to make informed financial decisions and stay compliant with tax regulations.

Understanding Self-Employment Taxes

If you’re self-employed, you’re responsible for paying your own taxes. This includes both income tax and self-employment taxes, which cover Social Security and Medicare. Understanding self-employment taxes is essential for managing your finances and ensuring you’re paying the correct amount.

What are Self-Employment Taxes?

Self-employment taxes are a combination of Social Security and Medicare taxes that are paid by self-employed individuals. These taxes are calculated as a percentage of your net earnings from self-employment. The current rate for Social Security is 12.4% and for Medicare is 2.9%, for a total of 15.3%. This means that you are essentially paying both the employer and employee portion of these taxes.

Who Pays Self-Employment Taxes?

Anyone who is considered self-employed is required to pay self-employment taxes. This includes:

- Sole proprietors

- Partnerships

- Independent contractors

- Freelancers

- Gig workers

How are Self-Employment Taxes Calculated?

To calculate your self-employment taxes, you’ll need to determine your net earnings from self-employment. This is your total income from self-employment minus your business expenses. You then multiply your net earnings by the self-employment tax rate (15.3%).

When are Self-Employment Taxes Paid?

Self-employment taxes are paid quarterly through IRS form 1040-ES. You can also pay them when you file your annual tax return. The IRS will send you a notice if you are required to pay quarterly.

Deductions for Self-Employment Taxes

You may be able to deduct half of your self-employment taxes on your federal income tax return. This is known as the self-employment tax deduction. This can help reduce your overall tax burden.

Tips for Managing Self-Employment Taxes

- Keep accurate records of your income and expenses. This will help you calculate your taxes accurately and make sure you’re not overpaying.

- Set aside money each month to cover your self-employment taxes. This can help prevent a large tax bill at the end of the year.

- Consult with a tax professional if you have any questions or need help understanding your tax obligations.

Self-employment taxes can be a significant expense, but understanding how they work can help you manage them effectively. By staying informed and planning ahead, you can ensure you’re meeting your tax obligations and staying on top of your finances.

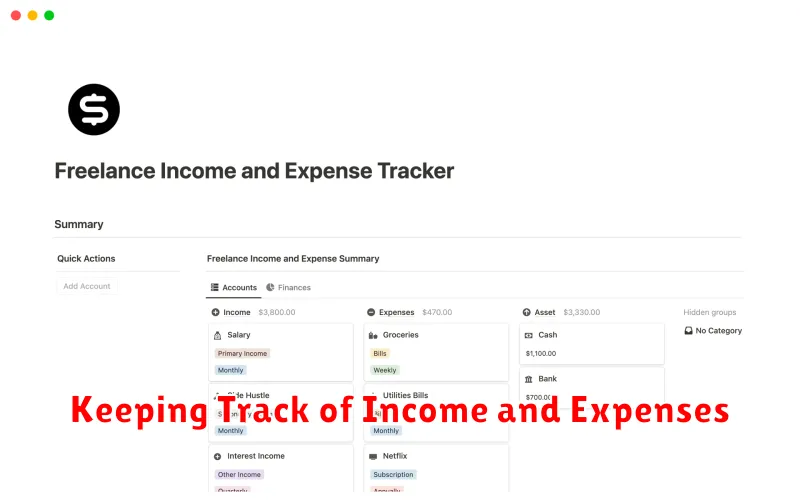

Keeping Track of Income and Expenses

In today’s fast-paced world, it can be difficult to keep track of your finances. You’re constantly on the go, juggling work, family, and social commitments. It’s easy to let your finances fall by the wayside, especially when you’re feeling overwhelmed. But it’s essential to stay on top of your income and expenses, so you can make informed decisions about your money.

Fortunately, there are plenty of ways to keep track of your finances, whether you prefer the traditional pen and paper approach or the more modern digital methods. No matter what method you choose, the key is to be consistent and disciplined in your tracking. Here are some tips to help you get started:

Choose a Method that Works for You

There are many different ways to track your income and expenses. You can use a spreadsheet, a budgeting app, or even just a simple notebook. The important thing is to find a method that you’re comfortable with and that you’ll actually use.

Track Everything

It’s important to track every penny that comes in and goes out of your account. This includes your salary, interest earnings, dividends, and any other income you receive. It also includes all of your expenses, both big and small, such as your rent or mortgage, utilities, groceries, transportation, entertainment, and even your daily coffee.

Categorize Your Expenses

Categorizing your expenses can help you understand where your money is going. Once you know where your money is going, you can start to make adjustments to your spending habits. You can categorize your expenses by necessity (housing, food, utilities) and discretionary (entertainment, travel, dining out).

Review Your Finances Regularly

It’s a good idea to review your finances on a regular basis, such as monthly or quarterly. This will help you stay on top of your spending and make any necessary adjustments. During your review, you can identify areas where you can cut back on expenses or increase your income.

Set Financial Goals

Having clear financial goals can help you stay motivated and on track. Your financial goals may include saving for a down payment on a house, paying off debt, or investing for retirement. Once you have your goals in mind, you can create a budget that will help you achieve them.

By following these tips, you can start to get a handle on your finances and make informed decisions about your money. Keep in mind, that managing your finances is an ongoing process. It requires time and effort, but the rewards are worth it.

Estimated Taxes: What You Need to Know

Estimated taxes are payments you make throughout the year to cover your tax liability. They’re often required for individuals who don’t have enough taxes withheld from their paychecks or other income sources. This can include self-employed individuals, independent contractors, and anyone with income from investments or other sources that aren’t subject to withholding.

The Internal Revenue Service (IRS) offers a variety of methods for paying estimated taxes, including:

- Online: Through the IRS website or authorized payment providers.

- By mail: Using a tax payment voucher.

- By phone: Through the IRS payment system.

Who Needs to Pay Estimated Taxes?

You generally need to pay estimated taxes if you expect to owe at least $1,000 in federal income tax after subtracting your withholdings. This applies to individuals who:

- Are self-employed or independent contractors: These individuals receive income that isn’t subject to withholding.

- Have significant investment income: Capital gains and dividends can lead to substantial tax liabilities.

- Receive income from other sources not subject to withholding: This could include royalties, rental income, or alimony payments.

- Experience a change in their tax situation: If you’ve received a large bonus, had a significant income increase, or started a new job with lower withholdings, you may need to pay estimated taxes.

How to Calculate Estimated Taxes

The most common method for calculating estimated taxes is using the IRS Form 1040-ES. This form guides you through calculating your income, deductions, and credits, helping you determine your estimated tax liability. You can also use online tax calculators or consult with a tax professional to assist you with these calculations.

Payment Deadlines

Estimated taxes are typically paid in four installments:

- April 15th: For the first quarter.

- June 15th: For the second quarter.

- September 15th: For the third quarter.

- January 15th (of the following year): For the fourth quarter.

Note that if any of these dates fall on a weekend or holiday, the deadline is shifted to the next business day.

Penalties

Failing to pay estimated taxes can result in penalties from the IRS. These penalties can be substantial, so it’s essential to pay your estimated taxes on time. However, you might be able to avoid penalties if you meet certain conditions, such as having sufficient withholding or making estimated payments throughout the year.

Conclusion

Understanding your tax obligations and staying on top of estimated tax payments is crucial for responsible financial management. By familiarizing yourself with the rules and guidelines, you can minimize the risk of penalties and ensure you’re fulfilling your tax responsibilities effectively.

Deductible Expenses for Freelancers

As a freelancer, you’re responsible for managing your own finances, including paying taxes. One of the ways to reduce your tax burden is by claiming deductible expenses. These are expenses related to your business that you can deduct from your income, ultimately lowering your taxable income and tax liability.

Understanding which expenses are deductible and how to document them is crucial. Here’s a breakdown of common deductible expenses for freelancers:

Office Expenses

- Home Office: If you use a portion of your home for business, you can deduct a percentage of your rent, utilities, and other home-related expenses.

- Office Supplies: This includes items like paper, pens, printer ink, and computer accessories.

- Software: Software specifically used for your business, such as accounting software, design tools, or productivity apps.

- Computer Equipment: Laptops, desktops, monitors, and other equipment used for work.

Business Travel

- Transportation: Mileage driven for business purposes or public transportation costs.

- Lodging: Hotel or Airbnb expenses when traveling for work.

- Meals: Reasonable costs for meals while on business trips.

Marketing & Advertising

- Website Hosting: Costs associated with maintaining your website.

- Social Media Advertising: Paid advertising on platforms like Facebook, Instagram, or LinkedIn.

- Print Marketing: Brochures, flyers, or business cards.

Professional Development

- Education & Training: Courses or workshops related to your field of work.

- Professional Memberships: Dues for industry associations or professional organizations.

- Conferences & Trade Shows: Costs for attending industry events.

Other Deductible Expenses

- Insurance: Business liability insurance, health insurance (if self-employed), and other relevant insurance policies.

- Legal & Accounting Fees: Costs associated with professional services for your business.

- Subscriptions: Subscriptions to industry publications, databases, or online services.

Remember, it’s crucial to keep detailed records of all your business expenses. This includes receipts, invoices, and any other relevant documentation. This documentation will be necessary when you file your taxes and claim your deductions. Consulting with a tax professional can also help you understand the specific deductions available to you and ensure you maximize your tax savings.

Tax Credits for the Self-Employed

Being self-employed offers many benefits, but it also comes with the responsibility of managing your own taxes. One of the advantages of being self-employed is that you can take advantage of several tax credits that are not available to employees. These credits can help reduce your tax liability and put more money back in your pocket.

What are Tax Credits?

Tax credits are deductions from your tax liability, which means they directly reduce the amount of taxes you owe. Unlike tax deductions, which reduce your taxable income, tax credits directly reduce your tax bill. This makes them even more valuable for saving money on your taxes.

Tax Credits for Self-Employed Individuals

Here are some of the most common tax credits available to self-employed individuals:

- Child Tax Credit: The Child Tax Credit is a significant credit for individuals with qualifying children. This credit can reduce your tax liability by up to $2,000 per qualifying child.

- Earned Income Tax Credit (EITC): The EITC is a refundable tax credit for low- and moderate-income working individuals and families. The amount of the credit depends on your income and family size.

- Premium Tax Credit (PTC): If you purchased health insurance through the Marketplace, you may be eligible for the PTC. This credit helps you afford your health insurance premiums.

- Retirement Savings Contributions Credit (Saver’s Credit): This credit is available to individuals who make contributions to a retirement plan, such as a 401(k) or IRA. The amount of the credit depends on your income and the amount you contribute.

- Credit for Increasing Research Activities (R&D Credit): If you are a self-employed individual who invests in research and development activities, you may be eligible for the R&D credit.

How to Claim Tax Credits

To claim tax credits, you will need to file Form 1040, the U.S. Individual Income Tax Return. You will also need to complete any necessary schedules and forms to support your claim. It is important to keep accurate records of your income and expenses throughout the year, as this information will be needed when you file your taxes.

Seek Professional Guidance

The tax code can be complex, and it is always a good idea to consult with a tax professional to ensure you are taking advantage of all the credits and deductions you are eligible for. They can help you understand your options and maximize your tax savings.

Choosing the Right Retirement Plan

Retirement planning is a crucial part of financial planning, and choosing the right retirement plan is essential for securing your financial future. With various options available, it can be overwhelming to determine which plan suits your needs and goals. This article will guide you through the process of choosing the right retirement plan, highlighting key considerations and factors to weigh.

Types of Retirement Plans

Several types of retirement plans are available, each with its own features, benefits, and eligibility criteria. Here are some of the most common:

- 401(k) Plans: Offered by employers, these plans allow employees to contribute pre-tax dollars to an investment account. Employers may also offer matching contributions.

- 403(b) Plans: Similar to 401(k) plans but offered to employees of non-profit organizations, educational institutions, and religious organizations.

- Traditional Individual Retirement Account (IRA): A personal retirement savings plan that allows individuals to make tax-deductible contributions.

- Roth IRA: A personal retirement savings plan that allows individuals to make after-tax contributions, with tax-free withdrawals in retirement.

- Simplified Employee Pension (SEP) IRA: A retirement plan for self-employed individuals and small business owners.

- Solo 401(k): A retirement plan designed for self-employed individuals or small business owners with no employees.

Factors to Consider

When choosing a retirement plan, several factors should be considered:

- Your Age and Time Horizon: The closer you are to retirement, the more conservative your investment strategy should be.

- Your Risk Tolerance: Your ability to withstand market fluctuations should influence your investment choices.

- Your Income Level: Your income level will determine your contribution limits and potential tax benefits.

- Your Employer’s Matching Contributions: If your employer offers matching contributions, take advantage of this free money.

- Investment Options: Choose a plan with a wide range of investment options that align with your financial goals.

- Fees and Expenses: Compare the fees and expenses associated with different plans to ensure you’re getting a good value.

Seeking Professional Advice

It’s always advisable to seek professional advice from a financial advisor who can help you assess your individual circumstances and recommend the most suitable retirement plan. They can provide personalized guidance on investment strategies, asset allocation, and tax planning.

Conclusion

Choosing the right retirement plan is a crucial decision that can significantly impact your financial well-being. By carefully considering the factors discussed above and seeking professional advice, you can make an informed choice that sets you on the path to a comfortable and secure retirement.

Filing Your Taxes as a Freelancer

Being a freelancer is a great way to be your own boss and set your own hours. But it also comes with a lot of responsibility, including filing your own taxes. It can seem daunting at first, but it’s actually not that complicated once you understand the basics.

1. Determine Your Filing Status

The first step is to determine your filing status. This will affect your tax bracket and the deductions you’re eligible for. Common filing statuses include single, married filing jointly, married filing separately, and head of household.

2. Understand Your Income and Expenses

As a freelancer, you’re responsible for tracking your income and expenses. This includes everything from the money you earn from clients to the costs of running your business, such as software subscriptions, office supplies, and travel expenses.

3. Choose a Filing Method

You can file your taxes electronically or by mail. Filing electronically is often faster and more convenient, and it can help reduce the risk of errors. You can use tax software like TurboTax or H&R Block, or you can hire a tax professional.

4. Take Advantage of Deductions

There are several deductions that freelancers can take advantage of, such as the home office deduction, business expenses, and health insurance premiums. Make sure to research all the deductions you’re eligible for and claim them on your return.

5. Pay Estimated Taxes Throughout the Year

As a freelancer, you’re required to pay estimated taxes throughout the year. This is because you don’t have taxes withheld from your paychecks like traditional employees. You can make estimated tax payments quarterly using Form 1040-ES.

6. Keep Good Records

It’s essential to keep good records of your income and expenses. This will make filing your taxes much easier and can help you avoid any potential audits. Make sure to keep receipts for all business expenses and track your income carefully.

7. Get Help if Needed

If you’re unsure about any aspect of filing your taxes, don’t hesitate to get help from a tax professional. They can help you understand your obligations, maximize your deductions, and ensure you’re filing your taxes correctly.

Filing your taxes as a freelancer can be a bit more complex than for traditional employees, but by following these steps, you can make the process much smoother. Remember to keep good records, take advantage of deductions, and get help if needed.

Seeking Professional Tax Advice

Navigating the complexities of the tax system can be a daunting task, especially for individuals and businesses facing unique financial situations. This is where seeking professional tax advice becomes invaluable. A qualified tax advisor can provide expert guidance, ensuring you comply with tax regulations and maximize your tax benefits.

Here are some key reasons why seeking professional tax advice is crucial:

- Expertise and Knowledge: Tax laws are constantly evolving, and staying abreast of all changes can be overwhelming. Tax advisors possess in-depth knowledge of current tax regulations and strategies, enabling them to identify deductions, credits, and exemptions you may be eligible for.

- Personalized Strategies: Each individual’s financial situation is unique, requiring tailored tax planning. A tax advisor will analyze your income, expenses, and goals to develop a customized strategy that optimizes your tax liability.

- Audit Protection: An experienced tax advisor can help you minimize your audit risk by ensuring your tax returns are accurate and complete. They can also represent you before the IRS if an audit occurs.

- Peace of Mind: Entrusting your tax matters to a professional provides peace of mind, knowing that your financial interests are protected. You can focus on your business or personal goals while your tax advisor handles the complexities of tax compliance.

When seeking professional tax advice, it’s essential to choose a qualified and reputable advisor. Look for professionals with the necessary credentials, such as a Certified Public Accountant (CPA) or an Enrolled Agent (EA). Research their experience, expertise, and client testimonials to ensure they align with your needs.

Investing in professional tax advice can save you money, reduce stress, and ensure your financial well-being. Don’t hesitate to reach out to a qualified tax advisor for guidance and support in navigating the complexities of the tax system.