Retirement should be a time to relax and enjoy the fruits of your labor, not stress about finances. However, the reality is that taxes can significantly impact your retirement income, potentially leaving you with less to spend on the things you love. Proper tax planning is crucial to ensure you maximize your income and enjoy a comfortable retirement. This article will guide you through essential strategies to plan for taxes in retirement and optimize your financial well-being.

We will delve into key tax considerations for retirees, such as understanding different income sources, utilizing tax-advantaged accounts, and exploring strategies to minimize your tax burden. Whether you’re approaching retirement or already enjoying your golden years, this comprehensive guide will equip you with valuable insights to navigate the complexities of retirement taxes and maximize your after-tax income.

Understanding Your Retirement Income Sources: Tax Implications

Retirement is a significant life transition, and understanding your income sources and their tax implications is crucial for financial planning. This guide provides insights into common retirement income sources and their tax treatment in the US.

Social Security Benefits

Social Security is a federal program that provides retirement, disability, and survivor benefits. The amount of Social Security benefits you receive is based on your earnings history. A portion of your benefits may be subject to federal income tax, depending on your total income.

Taxability of Social Security Benefits: The amount of Social Security benefits subject to federal income tax depends on your “combined income,” which includes your adjusted gross income (AGI), non-taxable interest income, and half of your Social Security benefits. If your combined income exceeds certain thresholds, a portion of your Social Security benefits may be taxed. You can find the income thresholds on the IRS website.

Pensions

Pensions are traditional retirement plans offered by some employers. They provide a fixed monthly income stream after retirement. The taxability of pension income depends on the type of pension plan.

Defined Benefit Pensions: These pensions are typically funded by your employer and provide a guaranteed income stream based on factors like your salary and years of service. Pension payments are generally taxed as ordinary income.

Defined Contribution Pensions: These plans are funded by both the employer and the employee. They typically offer a lump-sum payment at retirement, which you can then withdraw or roll over into an IRA. The tax implications of withdrawals from defined contribution plans depend on how the funds were contributed and the withdrawal method.

Retirement Accounts

Retirement accounts, such as IRAs and 401(k)s, allow you to save for retirement and potentially defer taxes on your earnings and growth. The tax treatment of withdrawals from retirement accounts depends on the type of account and the withdrawal method.

Traditional IRAs and 401(k)s: Contributions to traditional IRAs and 401(k)s are typically tax-deductible, which means you pay taxes on the withdrawals in retirement. However, you can choose to pay taxes on the contributions during the early years and avoid taxes during retirement with a Roth IRA or Roth 401(k).

Roth IRAs and 401(k)s: Contributions to Roth IRAs and 401(k)s are made with after-tax dollars, and withdrawals during retirement are tax-free.

Other Income Sources

In addition to the above, you may receive retirement income from sources such as:

- Annuities: These are financial products that provide a guaranteed stream of income in retirement. The tax treatment of annuity payments depends on the type of annuity purchased.

- Rental Income: If you own rental properties, you’ll receive rental income, which is generally taxed as ordinary income.

- Interest and Dividends: Interest and dividends from investments are generally taxable as ordinary income.

- Capital Gains: Gains from selling assets, such as stocks or bonds, are taxed as capital gains. The tax rate for capital gains depends on the holding period and your income level.

Tax Planning for Retirement Income

Tax planning is essential for maximizing your retirement income and minimizing your tax liability. Consider these strategies:

- Diversify Income Sources: Spread your income across different sources to reduce the impact of tax on any single income stream.

- Maximize Retirement Account Contributions: Consider making the maximum contributions to your retirement accounts, especially if you qualify for tax deductions.

- Take Advantage of Tax-Advantaged Accounts: Explore tax-advantaged savings accounts, such as health savings accounts (HSAs) or flexible spending accounts (FSAs), to reduce your taxable income.

- Consult a Tax Professional: Seek advice from a qualified tax professional to develop a tax planning strategy tailored to your specific circumstances.

Understanding the tax implications of your retirement income sources is critical for making informed financial decisions. By planning for retirement income and taxes, you can enjoy a comfortable and financially secure retirement.

Traditional IRA vs. Roth IRA: Tax Considerations in Retirement

Retirement planning is a crucial aspect of financial security, and choosing the right type of retirement account is essential. Two popular options are the Traditional IRA and the Roth IRA. While both offer tax benefits, they differ significantly in their tax treatment during retirement, making it important to understand the tax considerations involved.

Traditional IRA

With a Traditional IRA, contributions are tax-deductible in the year they are made. This means you reduce your taxable income and potentially lower your tax liability for the current year. However, withdrawals in retirement are taxed as ordinary income. This means you’ll pay taxes on the entire amount you withdraw, even if the principal was contributed with pre-tax dollars.

Roth IRA

In contrast, a Roth IRA offers tax-free withdrawals in retirement. Contributions to a Roth IRA are made with after-tax dollars, so you don’t receive a tax deduction in the current year. However, when you withdraw your contributions and earnings during retirement, they are completely tax-free. This can be a significant advantage if you expect to be in a higher tax bracket in retirement.

Tax Considerations When Choosing

The decision of whether to choose a Traditional IRA or a Roth IRA depends on your individual circumstances and financial outlook. Here are some factors to consider:

- Current Tax Bracket: If you are in a lower tax bracket now, a Traditional IRA may be more advantageous, as you’ll get a tax deduction now. However, if you anticipate being in a higher tax bracket in retirement, a Roth IRA might be a better choice.

- Expected Future Income: If you expect your income to decrease in retirement, a Traditional IRA may be more beneficial, as you’ll pay taxes at a lower rate then.

- Investment Growth: Roth IRAs are particularly attractive for long-term investments, as the tax-free growth can lead to significant tax savings over time.

Conclusion

Understanding the tax implications of Traditional and Roth IRAs is crucial for making informed retirement planning decisions. Whether you choose one over the other depends on your individual circumstances and financial goals. It is recommended to consult with a financial advisor to determine the best option for your unique situation.

Tax-Efficient Withdrawal Strategies for Retirement Accounts

Retirement is a time to enjoy the fruits of your labor, but it’s also a time to be mindful of taxes. How you withdraw from your retirement accounts can significantly impact your tax burden. Here are some tax-efficient withdrawal strategies to consider:

1. Maximize Your Required Minimum Distributions (RMDs)

If you’re over 72, you’re required to take minimum distributions from your traditional IRAs and 401(k)s. While you can’t avoid these distributions, you can strategically choose how to take them. You can opt to take your RMDs in a lump sum or spread them out over the year. Consider spreading out your RMDs to avoid pushing yourself into a higher tax bracket. You can also consider Roth conversions to potentially reduce your future tax liability.

2. Prioritize Roth Distributions

If you have both traditional and Roth retirement accounts, it’s generally more tax-efficient to withdraw from your Roth accounts first. Since Roth contributions and earnings are tax-free at retirement, you can avoid paying taxes on these withdrawals. This strategy can be particularly beneficial if you’re in a higher tax bracket in retirement than you were when you made your Roth contributions.

3. Consider a Roth Conversion

If you have a traditional IRA or 401(k) and expect to be in a higher tax bracket in retirement, a Roth conversion might be beneficial. By converting your traditional IRA or 401(k) to a Roth IRA, you’ll pay taxes on the conversion, but future withdrawals will be tax-free. This strategy can be particularly valuable if you anticipate a significant increase in your income in retirement, such as from a second job or from receiving Social Security benefits.

4. Utilize Tax-Loss Harvesting

Tax-loss harvesting can be a powerful tool for managing your retirement portfolio. This strategy involves selling losing investments to offset capital gains and reduce your overall tax liability. While this strategy can be applied to both pre- and post-retirement accounts, it can be especially beneficial for managing your retirement portfolio. This strategy can be particularly beneficial for reducing taxes on capital gains from your retirement accounts.

5. Seek Professional Guidance

Retirement planning and tax strategies can be complex. A qualified financial advisor can help you develop a personalized plan that takes into account your individual circumstances and goals. A financial advisor can help you identify the most tax-efficient withdrawal strategies for your specific situation. This will allow you to maximize your retirement income and minimize your tax burden.

By carefully considering these tax-efficient withdrawal strategies, you can significantly reduce your tax burden and enjoy a more financially secure retirement. Remember to consult with a financial advisor to develop a strategy that meets your unique needs and goals.

Minimizing Taxes on Social Security Benefits

For many retirees, Social Security benefits are a crucial source of income. However, it’s important to be aware that a portion of your benefits may be subject to federal income tax. This article will explore how Social Security benefits are taxed and provide tips on minimizing your tax liability.

How Are Social Security Benefits Taxed?

The amount of your Social Security benefits that is taxable depends on your combined income, which includes:

- Your adjusted gross income (AGI)

- Your non-taxable interest income

- Half of your Social Security benefits

If your combined income falls within certain thresholds, a portion or all of your Social Security benefits may be taxed. The thresholds vary based on your filing status, as shown in the table below:

| Filing Status | Base Amount | Taxable Percentage |

|---|---|---|

| Single | $25,000 | 50% |

| Married Filing Jointly | $32,000 | 50% |

| Head of Household | $25,000 | 50% |

| Qualifying Widow(er) | $32,000 | 50% |

| Married Filing Separately | $16,000 | 50% |

For example, if you are single and your combined income is $30,000, you will be taxed on 50% of your Social Security benefits. If your combined income exceeds the higher thresholds, up to 85% of your benefits may be taxable.

Tips to Minimize Social Security Taxes

While you can’t avoid Social Security taxes altogether, there are strategies to minimize your tax liability:

- Delay taking your Social Security benefits: You can delay your benefits beyond your full retirement age to receive a higher monthly payment. This could help reduce the percentage of your benefits that are taxable.

- Adjust your income: If your income is close to the thresholds, consider adjusting your retirement income sources, such as working part-time or reducing your withdrawals from tax-advantaged accounts, to lower your combined income.

- Make tax-advantaged contributions: Contributions to 401(k)s, IRAs, and other tax-advantaged accounts can reduce your taxable income, potentially lowering the amount of your Social Security benefits subject to tax.

- Consider Roth conversions: If you have traditional retirement accounts, converting some of your funds to a Roth IRA can reduce your taxable income in retirement, potentially impacting your Social Security benefits.

- Seek professional advice: Consult with a financial advisor or tax professional to understand the specific implications of your situation and develop strategies to minimize your taxes on Social Security benefits.

Understanding how Social Security benefits are taxed and employing smart strategies can help you keep more of your hard-earned retirement income. By implementing some of these tips, you can effectively manage your tax burden and enjoy a more comfortable retirement.

Estate Planning and Legacy Considerations for Retirees

Retirement is a time to relax, enjoy life, and spend time with loved ones. It’s also a time to think about your legacy and ensure that your assets are distributed according to your wishes. Estate planning is an essential part of retirement planning, and it can help you protect your assets, minimize taxes, and ensure that your loved ones are taken care of after you’re gone.

Here are some key estate planning considerations for retirees:

1. Will and Trust

A will is a legal document that outlines how your assets will be distributed after your death. It’s crucial to have a will in place to avoid intestacy, which means your assets will be distributed according to the laws of your state, not necessarily your wishes. A trust can be used to manage assets for beneficiaries, potentially providing tax benefits and protecting assets from creditors.

2. Power of Attorney

A power of attorney grants someone the authority to make financial and legal decisions on your behalf if you become incapacitated. It’s essential to appoint someone you trust and who is familiar with your financial affairs.

3. Healthcare Directives

Advance healthcare directives, including a living will and a durable power of attorney for healthcare, ensure your wishes are followed if you are unable to make decisions about your healthcare. These documents specify your preferences regarding life-sustaining treatment and appoint someone to make healthcare decisions for you.

4. Beneficiary Designations

Review and update beneficiary designations for your retirement accounts, life insurance policies, and other assets regularly. This ensures that your assets go to the intended recipients.

5. Long-Term Care Planning

As you age, the risk of needing long-term care increases. Consider planning for potential long-term care expenses through long-term care insurance, reverse mortgages, or other financial strategies.

6. Tax Implications

Estate taxes can significantly impact the inheritance your beneficiaries receive. Consult with a tax advisor to understand potential tax implications and explore strategies for minimizing estate taxes.

7. Charitable Giving

If you’re passionate about certain causes, consider incorporating charitable giving into your estate plan. You can donate assets to charities during your lifetime or through your will or trust.

8. Review and Update Regularly

Your estate plan should be reviewed and updated regularly to reflect changes in your financial situation, family dynamics, and legal requirements. It’s recommended to review your plan every three to five years or after significant life events like marriage, divorce, or the birth of a child.

Estate planning can seem daunting, but it’s an essential part of retirement planning. By taking the time to create a comprehensive estate plan, you can protect your assets, minimize taxes, and ensure your loved ones are taken care of after you’re gone. Consulting with an experienced estate planning attorney can help you navigate the complexities of estate planning and create a plan that meets your specific needs and goals.

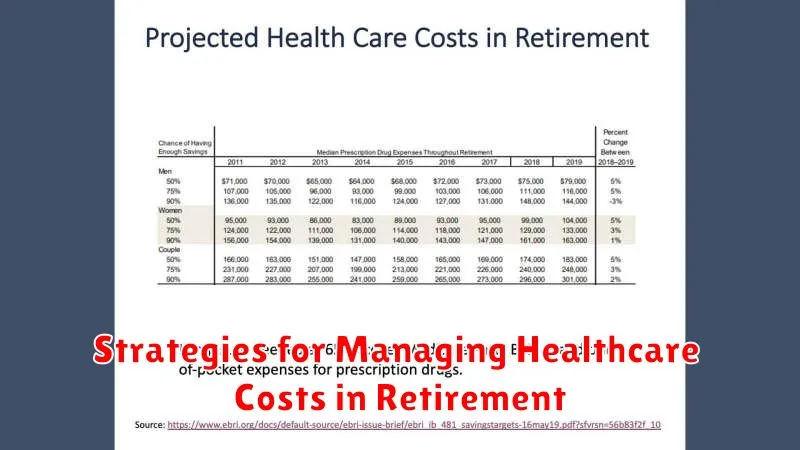

Strategies for Managing Healthcare Costs in Retirement

Retirement is a time to enjoy the fruits of your labor, but it can also be a time when healthcare costs become a major concern. As you age, you’re more likely to experience health problems that require expensive treatments. Plus, you may lose employer-sponsored health insurance when you retire. So, it’s crucial to develop a plan to manage healthcare costs in retirement.

1. Plan Ahead and Estimate Costs

One of the most important steps you can take is to plan ahead and estimate how much you’ll need to cover healthcare expenses in retirement. This can help you create a budget and make informed decisions about your finances. You can use online calculators or consult with a financial advisor to get an estimate of your future healthcare costs.

2. Explore Medicare Options

Medicare is a federal health insurance program available to people over 65 and those with certain disabilities. It can help you pay for a wide range of medical expenses. Familiarize yourself with the different parts of Medicare – Medicare Part A (Hospital Insurance), Medicare Part B (Medical Insurance), Medicare Part C (Medicare Advantage), and Medicare Part D (Prescription Drug Coverage) – and choose the plan that best suits your needs and budget.

3. Consider a Health Savings Account (HSA)

If you have a high-deductible health plan (HDHP), you may be eligible to open a Health Savings Account (HSA). An HSA is a tax-advantaged savings account that can be used to pay for qualified medical expenses. The money you contribute to an HSA grows tax-free, and you can withdraw it tax-free to pay for medical expenses. HSAs are an excellent way to save for healthcare costs in retirement.

4. Maintain a Healthy Lifestyle

A healthy lifestyle can help you prevent chronic health conditions that can lead to expensive medical bills. Eat a balanced diet, exercise regularly, and get enough sleep. If you smoke, quit. By taking care of your health, you can reduce your healthcare costs in retirement.

5. Shop Around for Affordable Healthcare

Don’t settle for the first healthcare plan you find. Shop around for the best coverage and rates. You can compare plans online or through a healthcare broker. Consider factors such as deductibles, copays, and network coverage when choosing a plan.

6. Consider Long-Term Care Insurance

Long-term care (LTC) insurance can help cover the costs of assisted living, nursing home care, or in-home care. If you have a family history of health issues, or you’re concerned about the possibility of needing LTC, you may want to consider buying a policy.

7. Get Financial Advice

It’s always a good idea to talk to a financial advisor to discuss your healthcare costs in retirement. A financial advisor can help you create a plan to manage your expenses and make informed decisions about your savings and investments.

Managing healthcare costs in retirement can be a challenge, but it’s not insurmountable. By following these strategies, you can take control of your finances and enjoy a healthy and fulfilling retirement.

Seeking Professional Guidance for Retirement Tax Planning

Retirement is a significant milestone in life, and proper tax planning is crucial to ensure a comfortable and financially secure future. As you approach retirement, it’s essential to consider the potential tax implications of your savings, investments, and income. While navigating the complexities of retirement taxes can seem daunting, seeking professional guidance can provide invaluable support and peace of mind.

Understanding Your Retirement Tax Landscape

Retirement tax planning involves understanding various factors that can impact your tax liability. These include:

- Tax brackets: Your retirement income will be taxed at your applicable federal and state income tax rates.

- Required Minimum Distributions (RMDs): You’ll be required to withdraw a minimum amount from your retirement accounts starting at age 72. These withdrawals will be taxed as ordinary income.

- Tax-advantaged retirement accounts: Traditional IRA and 401(k) accounts provide tax deferral on contributions, but withdrawals are taxed in retirement. Roth IRAs and Roth 401(k)s offer tax-free withdrawals in retirement, but contributions are not tax-deductible.

- Social Security benefits: A portion of your Social Security benefits may be taxable, depending on your income.

- State and local taxes: Some states have income taxes on retirement income, while others offer exemptions or deductions.

Benefits of Seeking Professional Guidance

A qualified financial advisor or tax professional can provide personalized guidance tailored to your specific circumstances. They can help you:

- Develop a comprehensive retirement tax strategy: This includes minimizing your tax liability throughout retirement and ensuring you’re taking advantage of all available tax benefits.

- Optimize your investment portfolio: This involves allocating assets strategically to reduce tax exposure and maximize after-tax returns.

- Plan for RMDs: They can help you determine the optimal withdrawal strategy to minimize taxes on your distributions.

- Navigate complex tax rules and regulations: Retirement tax laws can be intricate, and professionals can keep you informed of any changes or potential tax traps.

- Provide ongoing support and adjustments: Your financial needs and tax situation may evolve over time, and your advisor can help you adjust your plan as needed.

Conclusion

Retirement tax planning is crucial for maximizing your financial well-being. By seeking professional guidance, you can gain a better understanding of your tax landscape, develop a customized strategy, and enjoy a more financially secure retirement.

Conclusion: Maximizing Your Retirement Income and Enjoying Financial Security

Retirement is a significant life milestone, and it’s essential to plan effectively to ensure financial security and enjoy your golden years. By following the strategies outlined in this article, you can maximize your retirement income and achieve your financial goals. Remember, it’s never too early or too late to start planning.

Taking proactive steps, such as saving diligently, investing wisely, and seeking professional advice, can help you build a strong foundation for a comfortable and fulfilling retirement. Don’t hesitate to reach out to a financial advisor for personalized guidance and support in tailoring your retirement plan to your unique needs and circumstances. With careful planning and a commitment to financial responsibility, you can confidently embrace retirement with the financial peace of mind you deserve.

Retirement is a time for relaxation, pursuing passions, and enjoying the fruits of your labor. By taking control of your finances and making informed decisions, you can ensure that retirement is a truly rewarding and fulfilling chapter in your life. Remember, a secure financial future is not just about money; it’s about freedom, flexibility, and the ability to live life on your own terms.