Retirement is a time to enjoy the fruits of your labor, but it can be difficult to do so if your savings are being eroded by inflation. Inflation is the rate at which prices for goods and services increase over time, and it can have a significant impact on your purchasing power. If you are not careful, inflation can eat away at your retirement savings, leaving you with less money than you need to live comfortably.

Fortunately, there are a number of things you can do to protect your retirement savings from inflation. By following some basic strategies, you can ensure that your nest egg stays healthy and provides for you in retirement. This article will discuss some of the most effective strategies for protecting your retirement savings from inflation.

Understanding Inflation and its Impact on Retirement Savings

Inflation is a crucial economic factor that significantly affects retirement savings. It represents a general increase in the prices of goods and services over time, resulting in a decline in the purchasing power of money. Understanding inflation and its impact on retirement savings is vital for individuals planning for their golden years.

How Inflation Erodes Savings

As inflation rises, the value of your savings diminishes. The money you saved today won’t buy as much in the future due to the increased cost of goods and services. This phenomenon is known as the time value of money, where the purchasing power of money decreases over time.

Impact on Retirement Savings

Inflation can significantly impact your retirement savings in several ways:

- Reduced purchasing power: Inflation erodes the real value of your savings, making it harder to maintain your desired standard of living in retirement.

- Increased expenses: As prices rise, you’ll need more money to cover basic necessities like food, housing, and healthcare in retirement.

- Longer retirement horizon: Individuals are living longer, which means they need to save more to cover their expenses for an extended period.

Strategies to Combat Inflation

Several strategies can help mitigate the impact of inflation on your retirement savings:

- Invest in inflation-resistant assets: Consider investments like real estate, commodities, and inflation-protected securities (TIPS) to help preserve the value of your savings.

- Increase your savings rate: Saving more can help offset the effects of inflation and ensure you have enough to meet your retirement goals.

- Adjust your spending habits: Find ways to reduce your expenses and make your savings go further.

- Review your retirement plan regularly: Regularly review your retirement plan to ensure it aligns with your goals and adjusts for inflation.

Conclusion

Inflation is an unavoidable aspect of the economy that can significantly impact your retirement savings. Understanding its impact and taking steps to mitigate its effects is crucial for securing a comfortable retirement. By implementing the strategies outlined above, you can protect your savings and ensure a secure financial future.

Reviewing Your Retirement Plan: Assessing Inflation Protection

Retirement planning is a long-term endeavor, and it’s crucial to account for the ever-present factor of inflation. Inflation, the steady increase in the cost of goods and services, can significantly erode the purchasing power of your retirement savings over time. As such, it’s vital to review your retirement plan regularly, with a particular focus on your inflation protection strategies.

Inflation’s Impact on Retirement

Imagine retiring with a nest egg of $1 million today. In 20 years, with an average inflation rate of 3%, that $1 million would have the same purchasing power as approximately $550,000 today. This means that your retirement savings would need to grow substantially just to maintain your current lifestyle.

Assessing Your Inflation Protection

To determine how well your retirement plan is equipped to combat inflation, ask yourself these questions:

- What is your assumed inflation rate?

- Do your investment strategies account for inflation?

- Are your retirement goals realistic, considering inflation?

- Do you have a strategy for adjusting your retirement spending in response to inflation?

Inflation Protection Strategies

There are various strategies you can implement to enhance your inflation protection:

- Invest in inflation-resistant assets: Consider investments such as real estate, commodities, and inflation-indexed bonds, which tend to hold their value better during periods of rising prices.

- Embrace a diversified portfolio: A diversified portfolio, including a mix of stocks, bonds, and alternative investments, can help cushion the impact of inflation.

- Adjust your spending: Monitor your spending habits and be prepared to make adjustments to your lifestyle if necessary. Look for opportunities to cut costs and explore alternative ways to meet your needs.

- Increase your savings contributions: If possible, increase your contributions to your retirement accounts to counter the effects of inflation.

- Consider Social Security: While Social Security benefits are not always indexed to inflation, they can provide a valuable source of income in retirement.

Regular Reviews Are Key

It’s essential to review your retirement plan regularly, at least annually, and adjust your strategies as needed. Market conditions change, and your investment goals may evolve over time. By proactively assessing your inflation protection, you can make informed decisions that help ensure a comfortable and financially secure retirement.

Adjusting Your Savings Rate: Outpacing Inflation

Inflation is a persistent concern for individuals looking to secure their financial future. As the cost of living rises, it becomes increasingly challenging to maintain the purchasing power of savings. However, by adopting a proactive approach and adjusting your savings rate, you can effectively outpace inflation and achieve your financial goals.

Understanding Inflation

Inflation refers to a sustained increase in the general price level of goods and services over time. This means that the same amount of money can buy fewer goods and services in the future than it could in the past. Inflation erodes the value of savings, making it crucial to adjust your savings rate accordingly.

The Importance of Adjusting Your Savings Rate

Adjusting your savings rate is essential for several reasons. First, it helps to maintain the purchasing power of your savings. By saving more, you can compensate for the erosion of value caused by inflation. Second, it allows you to achieve your financial goals, such as retirement, homeownership, or education. When inflation is high, you need to save more to reach your goals.

Strategies for Adjusting Your Savings Rate

There are several strategies you can implement to adjust your savings rate and outpace inflation:

- Increase Your Savings Contributions: Review your budget and identify areas where you can reduce expenses. Consider increasing your contributions to retirement accounts, such as 401(k)s or IRAs.

- Invest in Assets That Outperform Inflation: Explore investment options that have historically outpaced inflation, such as stocks, real estate, or commodities. However, remember that investments carry risks, and it’s essential to diversify your portfolio.

- Consider Alternative Investments: Explore alternative investments like index-linked bonds or inflation-protected securities (TIPS), which are designed to provide returns that outpace inflation.

- Automate Your Savings: Set up automatic transfers from your checking account to your savings account. This helps to ensure that you are saving consistently without having to manually transfer funds.

Conclusion

Inflation is a reality that we must acknowledge and address. By adjusting your savings rate, you can protect the purchasing power of your savings and achieve your financial goals. Remember that consistent saving and investing are key to building a secure financial future.

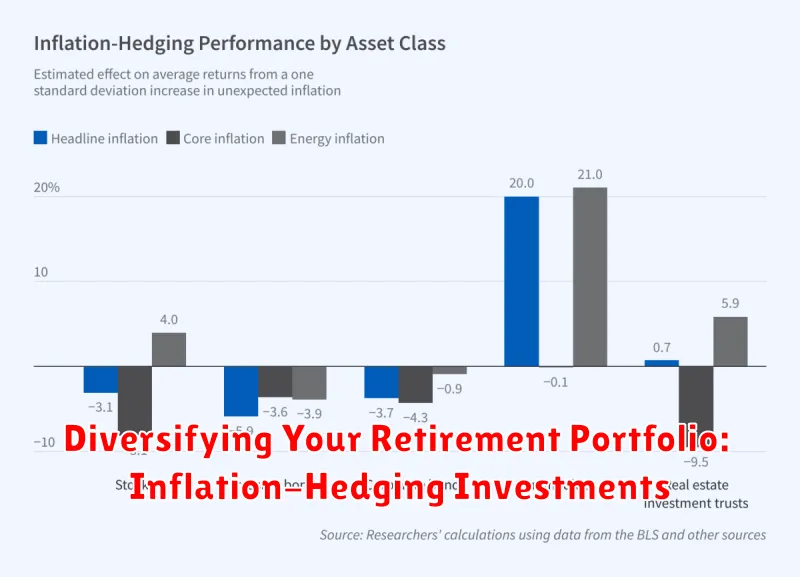

Diversifying Your Retirement Portfolio: Inflation-Hedging Investments

As retirement approaches, it’s crucial to consider how inflation may impact your savings. Inflation erodes the purchasing power of money over time, making it essential to incorporate inflation-hedging investments into your retirement portfolio.

Understanding Inflation

Inflation is the rate at which the prices of goods and services rise over time. It can significantly impact your retirement savings, as your purchasing power decreases if your investments don’t keep pace with inflation. For example, if inflation averages 3% annually, a retirement nest egg worth $1 million today would have the same purchasing power as $740,000 in 20 years.

Inflation-Hedging Investments

Several investment options can help offset the impact of inflation on your retirement portfolio. These strategies aim to preserve or even grow your wealth in the face of rising prices:

1. Real Estate

Real estate has historically been a good hedge against inflation. As prices rise, so does the value of your property, potentially outpacing inflation. Owning rental properties can also generate passive income that can keep up with inflation.

2. Commodities

Commodities like gold, oil, and agricultural products tend to rise in value during periods of high inflation. Investing in commodities through exchange-traded funds (ETFs) or futures contracts can provide diversification and inflation protection.

3. TIPS (Treasury Inflation-Protected Securities)

TIPS are U.S. Treasury bonds that adjust their principal value based on inflation. As inflation rises, the principal value of your TIPS increases, providing protection against inflation erosion.

4. Equities (Stocks)

While stocks can be volatile, companies with strong pricing power and a history of increasing dividends can offer some inflation protection. These companies can pass on rising costs to consumers, potentially maintaining their profitability in an inflationary environment.

Considerations for Diversification

It’s important to remember that no single investment strategy is foolproof. Diversifying your retirement portfolio across various asset classes, including inflation-hedging investments, is crucial. This approach helps reduce risk and potentially improve your overall returns.

Consulting with a financial advisor is recommended to create a personalized retirement investment plan tailored to your individual circumstances, risk tolerance, and time horizon.

Considering Inflation-Protected Securities (TIPS)

In an environment of rising inflation, investors are looking for ways to protect their portfolios. One option to consider is inflation-protected securities, also known as TIPS (Treasury Inflation-Protected Securities). These bonds adjust their principal value to keep pace with inflation, which helps investors preserve their purchasing power.

How TIPS Work

TIPS are issued by the U.S. Treasury and have a fixed interest rate, just like traditional bonds. However, the principal amount of the bond is adjusted every six months to reflect changes in the Consumer Price Index (CPI). This means that if inflation rises, the principal value of your TIPS bond will increase, which in turn will increase the interest payments you receive. Conversely, if inflation falls, the principal value of your TIPS bond will decrease, and your interest payments will be lower.

Advantages of TIPS

Here are some of the key advantages of investing in TIPS:

- Inflation Protection: As mentioned earlier, TIPS provide a hedge against inflation by adjusting their principal value to reflect changes in the CPI. This helps investors preserve their purchasing power in an inflationary environment.

- Guaranteed Interest Payments: While the principal amount of a TIPS bond can fluctuate, the interest payments are fixed. This provides a predictable stream of income for investors.

- Low Risk: TIPS are considered to be a relatively safe investment, as they are backed by the full faith and credit of the U.S. government.

Disadvantages of TIPS

While TIPS offer several advantages, they also have some drawbacks:

- Lower Yields: TIPS typically offer lower interest rates than traditional bonds, as they provide inflation protection. This can be a drawback for investors who are looking for higher yields.

- Potential for Principal Loss: Although TIPS are designed to protect against inflation, they can lose value if interest rates rise. This is because rising interest rates make existing bonds less attractive to investors, which can lead to a decrease in bond prices.

Who Should Consider TIPS?

TIPS can be a valuable investment for investors who are concerned about inflation. They are especially well-suited for:

- Retirement savers: TIPS can help retirees protect their nest egg from inflation and ensure that they have enough money to live on in retirement.

- Long-term investors: TIPS can be a good choice for investors who are planning to hold their investments for a long period of time, as they provide inflation protection over the long haul.

- Risk-averse investors: TIPS are considered to be a relatively safe investment, as they are backed by the U.S. government.

Conclusion

TIPS can be a valuable tool for investors who are looking to protect their portfolios from inflation. However, it is important to understand the risks and potential downsides of investing in TIPS before making a decision. Consult with a financial advisor to determine if TIPS are a good fit for your individual financial goals and risk tolerance.

Exploring Real Estate and Other Tangible Assets

In the realm of investments, the concept of tangible assets often takes center stage. These assets, unlike their intangible counterparts, possess a physical form and can be touched, felt, and seen. Among the most prominent tangible assets are real estate and other forms of physical property. This exploration delves into the intricacies of these assets, examining their characteristics, benefits, and potential pitfalls.

Real Estate: A Foundation of Wealth

Real estate, encompassing land and the structures built upon it, has long been regarded as a cornerstone of wealth creation and financial stability. Its inherent value stems from its scarcity and the fundamental need for shelter and space. Owning real estate offers a myriad of benefits, including:

- Appreciation Potential: Over time, real estate values tend to rise, providing investors with the opportunity for capital appreciation. This appreciation is often driven by factors such as population growth, economic development, and limited land availability.

- Rental Income: Investors can generate passive income by renting out their properties to tenants. This income stream can provide a steady flow of cash, offsetting expenses and potentially creating a positive return on investment.

- Tax Advantages: Various tax deductions and incentives are available to real estate owners, such as deductions for mortgage interest, property taxes, and depreciation. These benefits can significantly reduce tax liabilities and enhance overall returns.

- Hedge Against Inflation: Real estate values tend to keep pace with or even outpace inflation, offering a hedge against the erosion of purchasing power. As prices rise, the value of real estate often increases as well, preserving wealth.

However, it is crucial to acknowledge that real estate investments are not without their risks. These include:

- Market Fluctuations: Real estate markets are subject to cycles of booms and busts, and property values can decline in periods of economic downturn.

- Maintenance Expenses: Owning real estate entails significant ongoing expenses, such as property taxes, insurance, repairs, and utilities. These costs can erode profitability and require careful budgeting.

- Liquidity Concerns: Real estate can be relatively illiquid, meaning it may take time to sell a property and convert it into cash. This lack of liquidity can pose challenges in times of financial need.

- Tenancy Issues: Rental properties are subject to the risks associated with tenants, such as late rent payments, property damage, and legal disputes.

Other Tangible Assets: Diversifying the Portfolio

Beyond real estate, a diverse range of tangible assets can enhance an investment portfolio. These include:

- Precious Metals: Gold, silver, platinum, and other precious metals have historically served as safe haven assets during periods of economic uncertainty. Their value tends to rise when inflation or market volatility is high.

- Collectibles: Art, stamps, coins, and other collectible items can appreciate in value over time, particularly if they are rare or in high demand. However, the value of collectibles can be subjective and subject to market fluctuations.

- Commodities: Agricultural products, energy resources, and industrial materials are considered commodities. Their prices are influenced by supply and demand factors, and they can provide diversification benefits.

- Infrastructure: Investments in infrastructure, such as roads, bridges, and utilities, can offer stable returns and contribute to economic growth. However, these investments often require substantial capital and long-term commitments.

When considering tangible assets, it is essential to conduct thorough due diligence, understand the associated risks, and diversify investments to mitigate potential losses. Consulting with financial professionals can provide valuable insights and guidance in navigating the complexities of tangible asset investing.

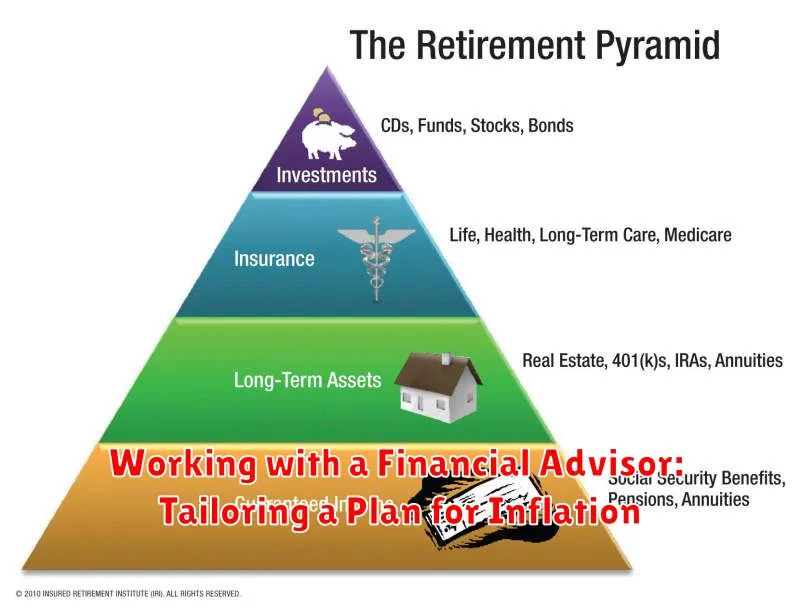

Working with a Financial Advisor: Tailoring a Plan for Inflation

In today’s economic climate, inflation is a significant concern for many individuals. With rising prices for everyday goods and services, it’s more crucial than ever to have a robust financial plan that can weather the storm. This is where working with a financial advisor can be invaluable.

A financial advisor can provide personalized guidance on how to navigate the challenges of inflation and protect your assets. Here are some key ways they can help:

1. Assessing Your Current Financial Situation

Before developing a plan, your advisor will carefully assess your current financial situation, including your income, expenses, assets, and debts. This comprehensive assessment helps them understand your individual needs and risk tolerance.

2. Developing a Customized Investment Strategy

With inflation eroding the purchasing power of your savings, it’s essential to have an investment strategy that can outpace inflation. Your advisor can help you create a portfolio that aligns with your financial goals and risk tolerance, considering factors such as:

- Asset Allocation: Diversifying your investments across different asset classes, such as stocks, bonds, and real estate, can help mitigate the impact of inflation on your portfolio.

- Inflation-Hedging Assets: Your advisor may recommend investing in assets that historically have a tendency to perform well during inflationary periods, such as commodities and real estate.

- Tax-Efficient Strategies: Proper tax planning can help you preserve more of your earnings and protect your wealth from erosion due to inflation.

3. Reviewing and Adjusting Your Budget

A financial advisor can assist you in reviewing and adjusting your budget to cope with rising prices. This may involve finding ways to reduce expenses, increase income, or prioritize spending on essential items.

4. Protecting Your Assets from Inflation

Your advisor can provide guidance on various strategies to protect your assets from inflation, such as:

- Debt Management: Paying down high-interest debt can free up more of your income to combat inflation.

- Insurance Review: Ensuring you have adequate insurance coverage can safeguard your assets in case of unexpected events.

- Estate Planning: Proper estate planning helps ensure your assets are distributed according to your wishes and protected from inflation.

5. Providing Ongoing Support and Advice

A financial advisor is a valuable resource for ongoing support and advice. They can help you stay informed about economic trends, market fluctuations, and the impact of inflation on your financial plan. They can also assist you with adjustments as your circumstances evolve.

Working with a financial advisor during periods of inflation can be a wise decision to protect your financial well-being. Their expertise and personalized guidance can help you navigate these challenging times and secure your future.

Regularly Monitoring and Adjusting Your Strategy

In the dynamic world of business, a static strategy is a recipe for stagnation. The key to success lies in constantly monitoring your progress, analyzing market trends, and adapting your approach to stay ahead of the curve. Regular strategy reviews are not just optional; they are essential for staying relevant and achieving long-term growth.

Here’s why regular monitoring and adjustment are crucial:

- Identifying opportunities and threats: The business landscape is constantly evolving. New competitors emerge, customer preferences shift, and technological advancements disrupt industries. Monitoring your progress and the wider market allows you to identify emerging opportunities and potential threats early on, giving you a head start in adapting.

- Measuring progress and identifying bottlenecks: Regular reviews help you assess the effectiveness of your current strategy. You can track key performance indicators (KPIs) and analyze data to understand what’s working, what’s not, and where improvements are needed. This allows you to pinpoint bottlenecks and take corrective action before they become major problems.

- Staying ahead of the competition: Businesses that are constantly adapting are more likely to outmaneuver their competitors. By staying informed about industry trends, competitor activities, and customer feedback, you can anticipate market shifts and adjust your strategy accordingly, ensuring you remain competitive.

- Ensuring alignment with goals: Your strategic direction should be aligned with your overall business goals. Regular monitoring ensures that your tactics are effectively contributing to your desired outcomes. If your strategy is not delivering the desired results, adjustments are needed to realign it with your goals.

- Promoting agility and innovation: A culture of continuous improvement and adaptation fosters a more agile and innovative organization. Regular strategy reviews encourage open communication, collaboration, and creative problem-solving, leading to new ideas and solutions.

Regularly reviewing and adjusting your strategy is not about throwing out your plan completely. It’s about making informed adjustments based on data, market insights, and customer feedback. By embracing this proactive approach, you can navigate the challenges of a dynamic business environment and achieve sustainable success.