Are you constantly feeling like you’re living paycheck to paycheck, with little to no money left over at the end of the month? You’re not alone. Many people struggle to make ends meet, especially in today’s economy. But don’t despair! There are ways to save more money, even on a tight budget. With a little effort and planning, you can start building a financial safety net and achieving your financial goals.

This article will provide you with practical and actionable tips to help you save money on a tight budget. We’ll cover everything from creating a budget and tracking your spending to finding ways to cut costs on your everyday expenses and finding side hustles to supplement your income. So, if you’re ready to take control of your finances and start saving more, keep reading!

Assessing Your Current Financial Situation

Before you can start planning for your financial future, you need to understand where you are today. This means taking stock of your current financial situation. This can be a daunting task, but it is essential for making sound financial decisions.

Steps to Assess Your Financial Situation

Here are some steps you can take to assess your current financial situation:

- Gather Your Financial Documents: Start by gathering all of your financial documents, including bank statements, credit card statements, loan statements, investment statements, and tax returns. This will give you a complete picture of your income, expenses, and assets.

- Track Your Income and Expenses: Once you have gathered your documents, it’s time to track your income and expenses. You can do this manually using a spreadsheet or by using a budgeting app. This will help you see where your money is going and identify areas where you can save.

- Evaluate Your Assets and Liabilities: Next, you need to evaluate your assets and liabilities. Assets are things you own, such as a home, car, or investments. Liabilities are things you owe, such as loans, credit card debt, or mortgages. Understanding your assets and liabilities will help you determine your net worth.

- Analyze Your Credit Report: Your credit report provides a snapshot of your credit history. It shows your credit utilization, payment history, and any outstanding debts. Checking your credit report regularly can help you identify any errors or potential problems.

- Review Your Insurance Policies: Make sure you have adequate insurance coverage for your needs. Review your health, auto, and homeowner’s or renter’s insurance policies to ensure they are still appropriate.

Benefits of Assessing Your Financial Situation

There are many benefits to assessing your financial situation. This can help you:

- Set Financial Goals: Once you know where you stand financially, you can set realistic financial goals for the future. This could include saving for retirement, buying a home, or paying off debt.

- Make Informed Financial Decisions: Understanding your financial situation can help you make informed decisions about your money. You can better manage your expenses, invest wisely, and avoid debt.

- Reduce Financial Stress: Knowing your financial situation can reduce financial stress. You’ll have a better understanding of your finances and feel more in control of your money.

- Improve Your Financial Health: Regular assessment of your financial situation can help you improve your overall financial health. You can identify areas for improvement and make changes to reach your financial goals.

Conclusion

Assessing your financial situation is an essential step in managing your finances. By taking the time to gather information, analyze your spending, and evaluate your assets and liabilities, you can gain a clear picture of your current financial standing. This will enable you to make informed decisions about your money and achieve your financial goals.

Setting Realistic Budget Goals

Setting realistic budget goals is crucial for achieving financial stability and reaching your financial aspirations. It’s not about being restrictive but about creating a plan that allows you to enjoy life while managing your money wisely. Here’s a breakdown of how to set realistic budget goals:

1. Track Your Spending

Before you can set goals, you need to understand your current spending habits. Track your expenses for a month or two to see where your money is going. There are numerous budgeting apps and tools available to make this process easier. This will help you identify areas where you can cut back or adjust.

2. Identify Your Financial Goals

What are your financial aspirations? Do you want to buy a house, pay off debt, invest, or save for retirement? Having clear goals gives you direction and motivates you to stay on track.

3. Start Small and Be Specific

Avoid setting overly ambitious goals that are hard to sustain. Start with small, achievable goals. For example, instead of aiming to save $10,000 in a year, aim for $500 a month. Make your goals specific, measurable, attainable, relevant, and time-bound (SMART).

4. Prioritize Your Needs

Distinguish between your needs and wants. While it’s okay to indulge in some wants, prioritizing your needs ensures that your essential expenses are covered.

5. Leave Room for Flexibility

Life is unpredictable, so it’s essential to build flexibility into your budget. Include a cushion for unexpected expenses or emergencies.

6. Review and Adjust Regularly

Your financial situation can change over time, so it’s important to review and adjust your budget goals regularly. This ensures your goals remain realistic and aligned with your current needs.

7. Celebrate Your Progress

Recognizing your accomplishments is essential for motivation. Celebrate your progress toward your budget goals, no matter how small they may seem. This reinforces your commitment and keeps you motivated to stay on track.

8. Seek Professional Advice

If you find it difficult to create a realistic budget or manage your finances, consider seeking professional advice from a financial advisor. They can provide personalized guidance and support tailored to your unique circumstances.

Setting realistic budget goals requires a commitment to understanding your spending habits, prioritizing your needs, and making smart choices. By following these tips, you can create a budget that works for you and helps you achieve your financial aspirations.

Identifying Areas to Cut Expenses

In today’s economy, it’s more important than ever to be mindful of your spending. Whether you’re trying to save for a big purchase, pay off debt, or simply live a more comfortable life, identifying areas where you can cut expenses is crucial.

The first step is to take a close look at your current spending habits. This may seem daunting, but it’s essential to understand where your money is going. You can start by tracking your spending for a month or two, using a budgeting app or a simple spreadsheet. Once you have a clear picture of your spending, you can begin to identify areas where you can cut back.

Common Areas to Cut Expenses

Here are some common areas where people often find opportunities to reduce their spending:

- Dining Out: Eating out can be expensive, especially if you do it frequently. Try cooking more meals at home, or look for deals and discounts when you do eat out.

- Subscriptions: Many people have subscriptions they don’t use or need anymore. Review your subscriptions and cancel any that you don’t use regularly.

- Entertainment: Entertainment can be a major expense. Consider exploring free or low-cost options like going for walks in nature, attending free events, or borrowing books from the library.

- Shopping: Impulse purchases can add up quickly. Make a list before you go shopping and stick to it. Avoid shopping when you’re stressed or bored.

- Transportation: Transportation is another big expense. Consider carpooling, taking public transportation, or biking instead of driving.

- Utilities: You can often save money on your utilities by making small changes, such as turning off lights when you leave a room, using energy-efficient appliances, and lowering the thermostat in the winter.

Once you’ve identified areas where you can cut expenses, it’s time to start making changes. It’s helpful to set realistic goals and start small. Don’t try to change everything at once, or you’re likely to get overwhelmed and give up.

Remember, even small changes can add up to significant savings over time. By being mindful of your spending and making smart choices, you can take control of your finances and achieve your financial goals.

Finding Savings in Everyday Purchases

In today’s economy, it’s more important than ever to find ways to save money. While it’s easy to get caught up in the hustle and bustle of everyday life, taking a few minutes to look for ways to save can make a big difference in your bank account.

One of the easiest ways to save money is to be mindful of your everyday purchases. This means paying attention to the things you buy on a regular basis, such as groceries, gas, and household supplies.

Here are a few tips for finding savings on everyday purchases:

- Create a budget and stick to it. This will help you track your spending and identify areas where you can cut back.

- Shop around for the best deals. Don’t just settle for the first price you see. Compare prices at different stores, both online and in person.

- Take advantage of coupons and discounts. Many stores offer coupons and discounts on a variety of products. Sign up for email newsletters and loyalty programs to stay informed about these offers.

- Buy generic brands. Generic brands are often just as good as name brands, but they cost less. Consider trying them out if you’re looking for a way to save money.

- Buy in bulk. Buying in bulk can often save you money, especially on items that you use frequently.

- Make your own. If you’re willing to put in a little extra effort, you can often save money by making your own food, cleaning products, and other household items.

By following these tips, you can find savings in everyday purchases and keep more money in your pocket. Remember, even small savings can add up over time.

Negotiating Bills and Monthly Expenses

In today’s economy, it’s more important than ever to be mindful of your finances. Negotiating your bills and monthly expenses can be a great way to save money and improve your financial well-being. Here are some tips to get you started:

Know your rights

Before you start negotiating, it’s important to understand your rights as a consumer. For example, you may have the right to cancel certain contracts within a certain time frame. You should also be aware of any applicable laws and regulations in your area.

Be prepared

When you contact a company to negotiate, be prepared to provide them with information about your situation. For example, you might want to mention that you’re looking to lower your monthly payments, or that you’re considering switching to a different provider. You should also be prepared to explain why you believe you deserve a better deal.

Be polite and respectful

While it’s important to be assertive when negotiating, it’s also essential to remain polite and respectful. Avoid being confrontational or aggressive. Remember that the person on the other end of the line is just trying to do their job. By remaining professional and courteous, you’ll increase your chances of reaching a mutually agreeable solution.

Don’t be afraid to walk away

If you’re not happy with the offer you’re given, don’t be afraid to walk away. You don’t have to accept the first offer that’s presented to you. You can always try negotiating again later, or you can simply switch to a different provider. This is a crucial part of the negotiation process.

Consider your options

There are many different ways to negotiate your bills and expenses. You can call the company directly, email them, or even use a third-party service. It’s also helpful to research the company’s policies and procedures for negotiating bills. Some companies may have specific programs or offers that you can take advantage of.

Negotiating your bills and monthly expenses can seem daunting, but it’s well worth the effort. By taking the time to learn about your rights and preparing for the negotiation, you can save money and improve your financial well-being. Remember to be polite, respectful, and confident, and don’t be afraid to walk away if you’re not happy with the offer.

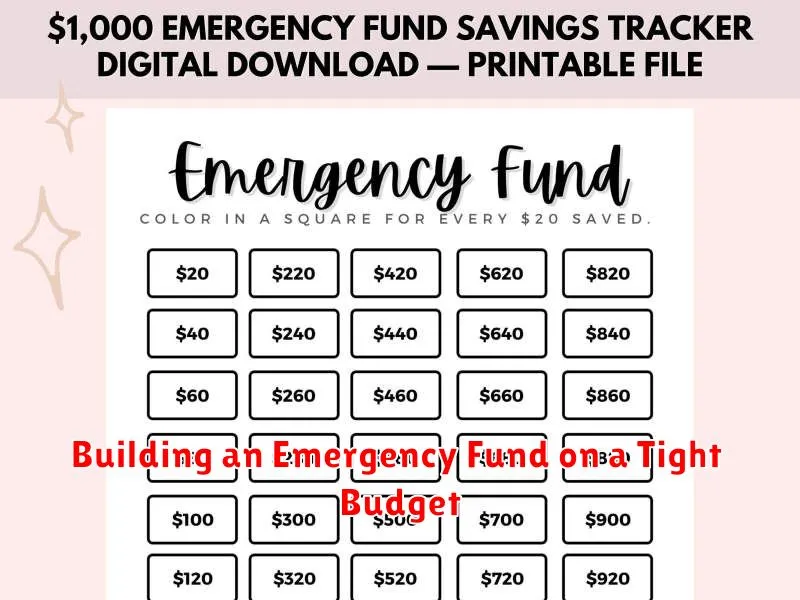

Building an Emergency Fund on a Tight Budget

Having an emergency fund is crucial for financial stability. It acts as a safety net to cover unexpected expenses such as medical bills, car repairs, or job loss. While building an emergency fund can seem daunting, especially on a tight budget, it’s achievable with discipline and smart strategies.

Start Small and Be Consistent

Don’t feel overwhelmed by the thought of accumulating a large sum. Start small and make consistent contributions. Even saving $20 or $50 a week can add up over time. Set up automatic transfers from your checking account to your savings account to ensure regular contributions.

Identify Areas to Cut Spending

Analyze your expenses and identify areas where you can cut back. Track your spending for a month and identify unnecessary expenditures. This could involve reducing dining out, canceling subscriptions you don’t use, or finding cheaper alternatives for everyday items.

Seek Out Additional Income

Consider taking on a side hustle or freelance work to supplement your income. There are numerous online platforms and opportunities available for earning extra money. Even a few hours of work each week can make a significant difference in your savings goals.

Take Advantage of Windfalls

Unexpected financial gains, such as tax refunds, bonuses, or gifts, can be used to boost your emergency fund. Allocate a portion of these windfalls directly to your savings account, instead of spending them on frivolous items.

Review Your Savings Goals Regularly

It’s important to review your savings goals and adjust them as needed. As your income and expenses change, you may need to adjust your savings targets. Monitor your progress and celebrate milestones along the way to stay motivated.

Consider a High-Yield Savings Account

Store your emergency fund in a high-yield savings account to earn interest on your savings. Online banks often offer higher interest rates than traditional brick-and-mortar banks. Make sure to choose a reputable bank with FDIC insurance to protect your deposits.

Building an emergency fund on a tight budget requires patience and discipline. Start small, be consistent, and explore opportunities to increase your income. Remember that every little bit counts and that your future self will thank you for taking proactive steps towards financial security.

Making Savings a Habit

Saving money can seem like a daunting task, especially if you’re just starting out. But it doesn’t have to be! With a few simple changes to your daily routine, you can make saving a habit and reach your financial goals. Here are some tips to help you get started:

1. Set Clear Financial Goals:

Before you start saving, it’s important to know what you’re saving for. Having specific goals in mind, like buying a house, paying off debt, or retiring early, will give you the motivation to stay on track.

2. Automate Your Savings:

Set up automatic transfers from your checking account to your savings account each month. This way, you’ll be saving consistently without having to think about it.

3. Track Your Expenses:

Keep track of where your money is going by using a budgeting app or a spreadsheet. This will help you identify areas where you can cut back.

4. Reduce Unnecessary Expenses:

Look for ways to save money on everyday expenses, such as groceries, transportation, and entertainment. Consider cutting back on subscriptions, eating out less, or finding cheaper alternatives to your usual spending habits.

5. Take Advantage of Employer Matching:

If your employer offers a 401(k) match, take advantage of it. This is free money that can help you grow your savings faster.

6. Make Saving a Part of Your Lifestyle:

Saving money should be a part of your everyday life, not just something you think about when you’re struggling financially. By making small changes and building positive habits, you can create a solid financial foundation for your future.

Utilizing Free or Low-Cost Entertainment Options

In today’s economy, it’s essential to find ways to save money without sacrificing the enjoyment of life’s simple pleasures. Entertainment is a crucial part of a well-rounded life, but it can also be expensive. Fortunately, there are numerous free and low-cost options available to keep you entertained without breaking the bank.

One of the most accessible and enjoyable options is exploring the great outdoors. Hiking, biking, and picnicking in parks and nature reserves provide a refreshing change of scenery and physical activity. Many cities offer free walking tours that allow you to discover hidden gems and local history. If you have access to a beach or lake, consider spending an afternoon swimming, sunbathing, or building sandcastles.

Libraries are another excellent resource for entertainment. They offer a wide range of books, movies, and music, all for free. Many libraries also host free events, such as author readings, book clubs, and movie screenings. For those with a love for the arts, museums often offer free admission on specific days or during special events. Art galleries and street fairs can also be a great source of visual inspiration and cultural experiences.

Take advantage of community events and festivals. Many cities and towns organize free concerts, farmers markets, and cultural celebrations throughout the year. These events provide a chance to socialize, experience local traditions, and enjoy live music or entertainment. You can often find free concerts and performances at local bars and restaurants, especially on weekends.

In the digital age, there are countless free or low-cost entertainment options at our fingertips. Streaming services like Netflix and Hulu offer free trials or affordable monthly subscriptions. Podcasts provide a wealth of information and entertainment on a variety of topics. YouTube is a treasure trove of music, videos, and educational content. If you’re a gamer, there are many free-to-play mobile games and online games available.

By embracing free or low-cost entertainment options, you can enjoy life’s pleasures without straining your budget. It’s a matter of being creative, exploring your surroundings, and taking advantage of the many resources available to you. So go ahead, get out there, and experience the joy of entertainment without spending a fortune.

Exploring Additional Income Streams

In today’s economy, it’s more important than ever to have multiple income streams. Whether you’re looking to pay off debt, save for retirement, or simply increase your financial security, having a side hustle can provide you with the extra income you need.

There are many different ways to generate additional income. Some popular options include:

- Freelancing: Offer your skills and expertise to businesses or individuals, such as writing, editing, web design, or social media management.

- E-commerce: Sell products online through platforms like Amazon, Etsy, or your own website.

- Blogging or vlogging: Share your knowledge and passion with the world and monetize your content through advertising, affiliate marketing, or selling products or services.

- Renting out property: If you own a spare room, apartment, or house, you can rent it out for short-term or long-term stays.

- Investing: Invest in stocks, bonds, real estate, or other assets to earn passive income.

When choosing an additional income stream, it’s important to consider your skills, interests, and available time. Some side hustles require a significant time commitment, while others can be done in your spare time. It’s also important to research the potential earnings and costs associated with each option.

No matter what you choose, having a side hustle can be a great way to improve your financial situation and achieve your financial goals.