Feeling overwhelmed by your finances? You’re not alone. Many people, especially those just starting out, feel lost when it comes to managing their money. But don’t worry, you don’t need a degree in finance to get started. This article will guide you through the essential steps of building a solid foundation for your personal finances, even if you have no prior experience. We’ll cover everything from budgeting and saving to investing and debt management, making it easy for you to take control of your money and reach your financial goals.

Whether you’re looking to pay off debt, save for a down payment on a house, or simply want to have more financial peace of mind, this comprehensive guide provides practical advice and actionable steps that anyone can implement. So, get ready to embrace the journey of becoming a savvy money manager and achieve financial freedom.

Assessing Your Current Financial Situation

Before you can start planning for your financial future, it’s crucial to understand your current financial situation. This involves taking a comprehensive look at your income, expenses, assets, and liabilities. This process can feel overwhelming, but it’s essential to gain clarity and make informed decisions about your money.

Income

Start by listing all your sources of income, including your salary, wages, investments, and any other regular income. Be sure to include both your gross and net income. Gross income is your income before taxes and deductions, while net income is what you actually take home after those deductions.

Expenses

Next, track your expenses over a period of time, ideally a month or two. This will help you identify where your money is going and if there are any areas where you can cut back. Categorize your expenses for easier analysis. Common categories include housing, transportation, food, entertainment, and debt payments.

Assets

Assets are anything you own that has value. This includes items such as:

- Checking and savings accounts

- Investments (stocks, bonds, mutual funds)

- Real estate

- Vehicles

- Personal property (jewelry, art, collectibles)

Liabilities

Liabilities are your debts. This includes:

- Credit card debt

- Student loans

- Mortgage

- Car loans

- Personal loans

Analyzing Your Financial Snapshot

Once you’ve compiled this information, you can start to analyze your financial snapshot. This involves comparing your income to your expenses, calculating your debt-to-income ratio, and reviewing your net worth. This will provide a clear picture of your financial health and highlight areas that require attention.

A debt-to-income ratio measures how much of your income goes toward debt payments. A high debt-to-income ratio can make it difficult to save money and achieve your financial goals.

Your net worth is the difference between your assets and liabilities. A positive net worth indicates that you have more assets than debts, while a negative net worth suggests you have more debts than assets.

Tools for Financial Assessment

There are various tools available to help you assess your current financial situation. These include:

- Budgeting apps (Mint, You Need a Budget)

- Spreadsheet software (Excel, Google Sheets)

- Financial planning software (Personal Capital, Quicken)

Conclusion

Assessing your current financial situation is the first step towards achieving financial stability and reaching your financial goals. By understanding your income, expenses, assets, and liabilities, you can make informed decisions about your money and create a plan for a brighter financial future.

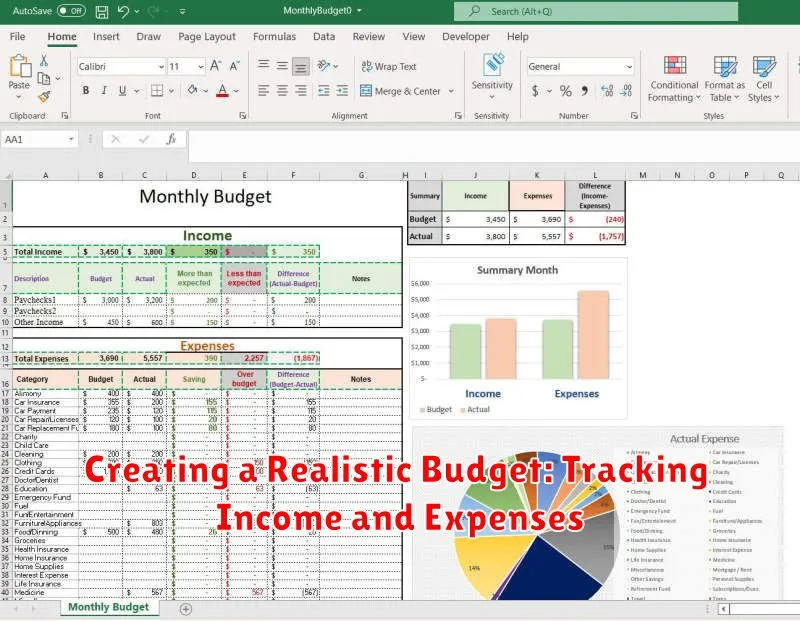

Creating a Realistic Budget: Tracking Income and Expenses

A budget is a financial plan that outlines how you will spend your money. It’s an essential tool for achieving your financial goals, whether that’s saving for retirement, paying off debt, or buying a house. But creating a realistic budget that you can stick to can be challenging. Here’s a guide to help you get started.

1. Track Your Income and Expenses

The first step is to track your income and expenses for a month or two. This will give you a clear picture of where your money is going. You can use a spreadsheet, a budgeting app, or a notebook. Be sure to track all of your income, including your salary, bonuses, and any other sources of income. Track all of your expenses, no matter how small. This includes things like rent or mortgage payments, utilities, groceries, transportation, entertainment, and dining out.

2. Categorize Your Expenses

Once you have tracked your income and expenses, categorize them. This will help you identify areas where you can cut back. Common categories include housing, transportation, food, utilities, healthcare, entertainment, and personal care. You can also create more specific categories, such as clothing, subscriptions, and gifts.

3. Set Financial Goals

Before you start creating your budget, it’s important to set financial goals. What do you want to achieve with your money? Do you want to save for a down payment on a house, pay off your student loans, or invest for retirement? Having clear goals will help you prioritize your spending and make sure you’re on track to achieve your financial objectives.

4. Create a Budget

Now that you have a clear picture of your income, expenses, and financial goals, you can start creating your budget. There are many different ways to budget, but the most common method is the 50/30/20 rule. This rule suggests allocating 50% of your income to needs (housing, utilities, groceries, transportation), 30% to wants (entertainment, dining out, travel), and 20% to savings and debt payments. However, you can adjust these percentages based on your individual needs and goals.

5. Monitor Your Progress

It’s important to monitor your progress regularly and make adjustments to your budget as needed. Review your budget at least once a month. This will help you stay on track and make sure you’re meeting your financial goals. You can also use a budgeting app to automatically track your progress and send you alerts when you’re close to exceeding your budget.

Tips for Creating a Realistic Budget

- Start small. Don’t try to change everything at once. Start with one or two areas where you can cut back and gradually make more changes.

- Be realistic. Don’t set unrealistic goals for yourself. It’s better to start with a budget that you can actually stick to and then make adjustments as needed.

- Be patient. It takes time to create a realistic budget that you can stick to. Don’t get discouraged if you don’t see results right away.

- Reward yourself. When you reach a financial goal, reward yourself for your hard work. This will help you stay motivated.

Creating a budget is an important step in achieving your financial goals. By tracking your income and expenses, setting financial goals, and creating a budget that works for you, you can take control of your finances and achieve financial stability.

Identifying and Reducing Unnecessary Spending

In today’s economy, it’s more important than ever to be mindful of your spending habits. Unnecessary expenses can quickly drain your bank account, leaving you with less money for the things that truly matter. By identifying and reducing these expenses, you can gain control of your finances and achieve your financial goals.

The first step to reducing unnecessary spending is to identify where your money is going. This can be done by keeping track of your expenses for a month or two. There are many tools available to help you with this, such as budgeting apps or spreadsheets. Once you have a clear picture of your spending patterns, you can start to look for areas where you can cut back.

One common area of unnecessary spending is on subscriptions. Many people sign up for subscriptions without realizing how much they are costing them. Take a look at your subscriptions and see if there are any that you can cancel or downgrade. You may also be able to negotiate a better rate with your service providers.

Another area to consider is your eating habits. Eating out frequently can be expensive. Consider cooking more meals at home and packing your lunch instead of buying it. You can also look for ways to save money on groceries, such as buying in bulk or taking advantage of sales.

Finally, take a look at your leisure activities. Do you spend a lot of money on entertainment? There are many free or low-cost activities that you can enjoy. Consider going for a walk in the park, reading a book at the library, or watching a movie at home instead of going to the theater.

By making a few simple changes to your spending habits, you can save a significant amount of money each month. This money can then be used to pay down debt, build your savings, or invest for your future.

Setting SMART Financial Goals: Short-Term and Long-Term

In the realm of personal finance, setting clear and achievable goals is paramount to achieving financial success. The acronym SMART provides a framework for crafting effective financial goals that are specific, measurable, attainable, relevant, and time-bound.

Short-Term Financial Goals

Short-term financial goals typically have a time horizon of less than a year. They serve as stepping stones towards larger financial aspirations. Here are some examples of short-term goals:

- Pay off credit card debt: Reducing or eliminating high-interest debt can significantly improve your financial well-being.

- Build an emergency fund: Having a readily available cash reserve can provide a safety net for unexpected expenses.

- Save for a vacation: Short-term savings goals can allow you to enjoy memorable experiences.

Long-Term Financial Goals

Long-term financial goals often encompass a time frame of several years or even decades. These goals require a strategic approach and consistent effort. Here are some examples of long-term goals:

- Purchase a home: Saving for a down payment and managing your finances responsibly can help you achieve homeownership.

- Fund retirement: Consistent contributions to retirement accounts can secure your financial future in your later years.

- Invest in your education or career: Investing in your personal and professional development can lead to long-term financial rewards.

Benefits of Setting SMART Financial Goals

Setting SMART financial goals offers numerous benefits, including:

- Increased motivation and focus: Clear goals provide direction and inspire you to take action.

- Improved financial discipline: Tracking progress towards your goals can foster responsible spending habits.

- Enhanced financial security: Achieving your goals can lead to greater peace of mind and financial stability.

Tips for Setting Effective SMART Financial Goals

To ensure your financial goals are effective, consider these tips:

- Be specific: Define your goals in detail, leaving no room for ambiguity.

- Make them measurable: Set quantifiable targets to track your progress.

- Ensure they are attainable: Set realistic goals that are within your reach.

- Make them relevant: Align your goals with your values and overall financial objectives.

- Set deadlines: Establish clear timeframes for achieving your goals.

By setting SMART financial goals, you can take control of your financial future and work towards achieving your aspirations. Remember to regularly review and adjust your goals as your circumstances evolve.

Building an Emergency Fund: Preparing for Unexpected Events

Life is full of unpredictable events, and sometimes these events can be financially devastating. A sudden job loss, a medical emergency, or a car repair can quickly drain your savings and leave you scrambling to make ends meet. That’s where an emergency fund comes in.

An emergency fund is a safety net, a pool of money set aside specifically for unexpected expenses. It provides a financial cushion that can help you weather the storms of life without jeopardizing your financial stability. Without an emergency fund, you may be forced to take drastic measures like borrowing money at high interest rates, selling valuable assets, or even falling behind on bills.

Why is an Emergency Fund Important?

Having an emergency fund offers numerous benefits, including:

- Financial Security: It provides peace of mind knowing you have a safety net to fall back on in case of unexpected events.

- Reduced Stress: Financial emergencies can cause significant stress. An emergency fund can help alleviate this stress by giving you a financial buffer.

- Avoidance of Debt: By having an emergency fund, you can avoid taking on high-interest debt to cover unexpected expenses.

- Opportunity for Savings: When you have an emergency fund, you are more likely to save money for other financial goals.

How to Build an Emergency Fund

Building an emergency fund may seem daunting, but it’s achievable with a little planning and discipline. Here are some steps to get started:

- Set a Goal: Determine how much you want to save in your emergency fund. A good rule of thumb is to aim for 3-6 months’ worth of living expenses.

- Track Your Spending: Monitor your spending habits to identify areas where you can cut back.

- Automate Savings: Set up automatic transfers from your checking account to your savings account each month.

- Look for Extra Income: Consider taking on a side hustle or selling unwanted items to boost your savings.

- Be Patient and Consistent: Building an emergency fund takes time and effort. Stay focused on your goal and keep saving consistently.

Conclusion

An emergency fund is an essential part of a healthy financial plan. It provides a crucial safety net to protect you from the unexpected events that life throws your way. By building an emergency fund, you can gain financial security, reduce stress, and avoid debt. Start saving today and create a brighter financial future for yourself.

Exploring Different Banking Options: Choosing the Right Accounts

In today’s digital age, banking has become increasingly convenient and accessible. With numerous options available, it can be overwhelming to navigate the different types of accounts and choose the ones that best suit your needs. This article will guide you through the various banking options, helping you make informed decisions.

Types of Bank Accounts

Checking Accounts: These accounts are designed for everyday transactions, such as paying bills, making purchases, and depositing paychecks. They typically offer debit cards, check-writing privileges, and online banking access.

Savings Accounts: Savings accounts are ideal for storing funds you want to keep safe and earn interest over time. They usually offer lower interest rates than other investment options, but they provide a secure and liquid way to save.

Money Market Accounts (MMAs): MMAs offer higher interest rates than traditional savings accounts but often come with restrictions on withdrawals. They typically require a minimum balance and may limit the number of transactions per month.

Certificates of Deposit (CDs): CDs are time deposits that lock in a fixed interest rate for a specific duration. This provides a predictable return on your investment but requires you to commit to the chosen term.

Factors to Consider When Choosing Bank Accounts

Here are some crucial factors to consider when selecting bank accounts:

- Fees: Banks may charge various fees for services like monthly maintenance, ATM withdrawals, overdrafts, and wire transfers. Compare fee structures across different banks.

- Interest Rates: Interest rates on savings and money market accounts can vary significantly. Choose accounts that offer competitive rates.

- Convenience: Consider factors like branch locations, ATM availability, and online banking features.

- Minimum Balance Requirements: Some accounts require a minimum balance to avoid fees. Make sure you can meet these requirements.

- Customer Service: Check the bank’s reputation for customer service and responsiveness to queries.

Tips for Choosing the Right Accounts

Here are some tips to guide you in choosing the right banking options:

- Assess Your Financial Needs: Determine your everyday spending habits, saving goals, and investment preferences.

- Research and Compare: Explore different banks and compare their offerings, fees, and interest rates.

- Consider Online Banks: Online banks often offer higher interest rates and lower fees than traditional banks.

- Don’t Be Afraid to Switch: If you find that your current accounts no longer meet your needs, don’t hesitate to switch banks.

Conclusion

Choosing the right banking accounts is an important step in managing your finances effectively. By carefully considering your needs, researching options, and comparing offers, you can find accounts that provide convenience, security, and financial benefits.

Understanding Basic Financial Concepts: Saving, Investing, and Debt

Managing your finances effectively is crucial for a secure and fulfilling future. Understanding basic financial concepts like saving, investing, and debt is essential for making informed decisions about your money. Let’s delve into each of these concepts and explore how they can impact your financial well-being.

Saving

Saving is the act of setting aside a portion of your income for future use. It’s a fundamental building block of financial stability, providing a safety net for unexpected expenses, emergencies, and achieving long-term goals. There are different types of savings accounts, each with its own features and benefits.

- Emergency Fund: A readily accessible fund for unexpected expenses, such as medical bills or car repairs.

- Short-Term Savings: Funds for near-term goals like a vacation or down payment on a car.

- Long-Term Savings: Funds for distant goals like retirement or a child’s education.

Investing

Investing involves using your savings to acquire assets with the potential to grow in value over time. Investing can help you reach financial goals faster than simply saving. Different investment options cater to different risk tolerances and financial goals. Some common investment types include:

- Stocks: Shares of ownership in a company.

- Bonds: Loans to governments or companies.

- Mutual Funds: Pooled investments in a variety of assets.

- Real Estate: Investing in properties for appreciation and rental income.

Debt

Debt is borrowed money that needs to be repaid with interest. While debt can be a useful tool for financing large purchases or emergencies, it’s crucial to manage it responsibly. Uncontrolled debt can have serious consequences, leading to financial stress and even bankruptcy.

- Good Debt: Debt used to invest in assets that generate income or appreciate in value, like a mortgage for a rental property.

- Bad Debt: Debt used for non-productive expenses, such as high-interest credit card debt or payday loans.

Seeking Free Resources and Educational Materials

In today’s digital age, access to information and educational resources has never been easier. With the rise of online platforms and open-source initiatives, a vast array of free materials is available to anyone with an internet connection. From online courses and textbooks to research papers and multimedia content, the possibilities for learning are endless.

For students, educators, and lifelong learners alike, seeking out free resources can be a valuable way to enhance their knowledge and skills. Whether you’re looking to supplement your formal education, explore new subjects, or simply stay up-to-date on current trends, there are numerous options to consider.

One of the most popular platforms for finding free educational materials is Khan Academy. This non-profit organization offers a wide range of courses and exercises covering subjects such as math, science, history, and computer programming. The platform is designed to be accessible to learners of all ages and backgrounds, and its content is constantly being updated with new resources.

Another valuable source of free educational materials is OpenStax, an initiative of Rice University. OpenStax provides free, peer-reviewed textbooks and other learning materials for a variety of subjects, including biology, chemistry, physics, and psychology. These resources are designed to be used in conjunction with traditional textbooks or as standalone materials.

Beyond online platforms, there are also numerous libraries and archives that offer free access to books, journals, and other resources. Many libraries also host events and workshops, providing opportunities for learning and engagement. Additionally, government agencies and research institutions often publish free reports, studies, and datasets that can be valuable resources for students and researchers.

In conclusion, seeking out free resources and educational materials can be a rewarding and enriching experience. By taking advantage of the vast array of resources available online and in our communities, we can enhance our learning, expand our horizons, and contribute to a more knowledgeable and informed society.

Gradually Implementing Financial Habits for Long-Term Success

In the realm of personal finance, achieving long-term success necessitates a strategic approach that prioritizes the gradual implementation of sound financial habits. Rather than overwhelming yourself with drastic changes, focus on incorporating small, manageable steps that build upon one another over time. This gradual approach fosters consistency, reduces the likelihood of burnout, and lays the foundation for a sustainable financial future.

1. Track Your Spending: The Foundation of Financial Awareness

Before embarking on any significant financial changes, it’s crucial to understand your current spending patterns. Start by tracking your expenses for a month or two. This practice, often referred to as “budgeting,” provides valuable insights into where your money is going. You can utilize budgeting apps, spreadsheets, or even a simple notebook to keep track of your income and expenditures.

2. Set Realistic Financial Goals: Guiding Your Journey

Having clear and attainable financial goals is essential for staying motivated and on track. Whether it’s saving for a down payment on a house, paying off debt, or building an emergency fund, define your goals and break them down into smaller, achievable milestones. This approach makes the journey feel less daunting and more manageable.

3. Automate Savings: Ensuring Consistent Progress

One of the most effective strategies for building wealth is to automate your savings. Set up automatic transfers from your checking account to your savings account on a regular basis. This approach eliminates the need for manual effort and ensures consistent progress toward your financial goals. Even small, regular contributions can accumulate significantly over time.

4. Minimize Unnecessary Expenses: Freeing Up Financial Resources

Identify areas where you can reduce unnecessary expenses. This could involve cutting back on dining out, subscription services you don’t use, or impulsive purchases. By streamlining your spending, you free up more resources to allocate towards your financial goals.

5. Seek Professional Advice: Navigating Complex Financial Decisions

For complex financial decisions, such as investing or retirement planning, consider consulting with a qualified financial advisor. Their expertise can provide valuable guidance and help you make informed choices that align with your unique financial circumstances.

6. Patience and Consistency: The Keys to Long-Term Success

Building healthy financial habits takes time and effort. Don’t get discouraged by setbacks or occasional slip-ups. Maintain a consistent approach, and remember that patience and perseverance are key to achieving long-term financial success.

By gradually implementing these financial habits, you can cultivate a strong foundation for financial security and achieve your long-term financial goals. Remember, every small step you take today contributes to a brighter financial future tomorrow.