Are you looking for a hassle-free and efficient way to manage your finances and grow your wealth? If so, then you should consider using a robo-advisor. Robo-advisors are automated investment platforms that utilize algorithms and technology to provide personalized financial advice and manage your investments. They are a convenient and affordable alternative to traditional financial advisors, making them an attractive option for investors of all levels, from beginners to experienced traders.

With a robo-advisor, you can automate your investment process, save time and money, and access a wide range of investment options tailored to your financial goals and risk tolerance. This article will delve into the intricacies of robo-advisors, exploring their benefits, how they work, and what you need to know before choosing one. Whether you are a young professional starting your investment journey or a seasoned investor seeking to streamline your portfolio, this guide will provide valuable insights into the world of robo-advisors and how they can help you achieve your wealth management goals.

What are Robo-Advisors and How Do They Work?

In today’s digital age, technology has revolutionized many aspects of our lives, including the way we manage our finances. One such innovation is the emergence of robo-advisors, automated platforms that provide investment advice and portfolio management services.

Robo-advisors are essentially digital financial advisors that leverage algorithms and advanced technology to create and manage investment portfolios. Unlike traditional financial advisors who rely on human interaction, robo-advisors use automated processes to analyze your financial goals, risk tolerance, and investment preferences, then allocate your assets accordingly.

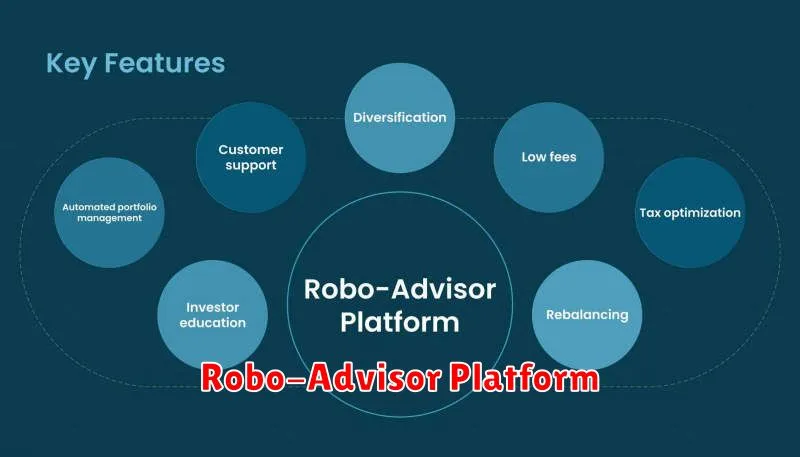

Key Features of Robo-Advisors:

- Automated Portfolio Management: Robo-advisors use algorithms to automatically rebalance your portfolio based on your investment goals and market conditions.

- Low Fees: Compared to traditional financial advisors, robo-advisors generally charge lower fees, often based on a percentage of your assets under management (AUM).

- Personalized Investment Strategies: Robo-advisors can tailor investment portfolios to meet individual needs and preferences through online questionnaires and risk assessments.

- Convenience and Accessibility: Robo-advisors are accessible 24/7, allowing investors to manage their portfolios from any location with an internet connection.

- Transparency: Robo-advisors provide clear and concise reporting on your investment performance, allowing you to track your progress and make informed decisions.

How Robo-Advisors Work:

The process of using a robo-advisor is typically straightforward and user-friendly. Here’s a general overview:

- Sign Up: You’ll need to create an account and provide basic personal and financial information.

- Risk Assessment: The robo-advisor will ask you questions about your investment goals, risk tolerance, and time horizon.

- Portfolio Allocation: Based on your responses, the robo-advisor will create a personalized investment portfolio consisting of various asset classes such as stocks, bonds, and ETFs.

- Automated Rebalancing: The platform will regularly monitor your portfolio and make adjustments to maintain your desired asset allocation.

- Performance Reporting: You’ll receive regular updates on your portfolio’s performance, including returns, fees, and asset allocation breakdowns.

Benefits of Using Robo-Advisors:

Robo-advisors offer several advantages for investors, especially those who are new to investing or seeking a more affordable and convenient way to manage their money. Here are some key benefits:

- Lower Costs: Robo-advisors typically charge lower fees than traditional financial advisors, making them more accessible to investors with smaller portfolios.

- Transparency: Robo-advisors provide detailed information about your portfolio and investment strategies, fostering transparency and trust.

- Diversification: Robo-advisors help you diversify your portfolio by allocating your assets across different asset classes, reducing risk and maximizing potential returns.

- Convenience and Accessibility: You can manage your investments anytime, anywhere, through a user-friendly online platform.

- Objectivity: Robo-advisors rely on data and algorithms, eliminating potential biases and emotional decision-making.

Considerations Before Using a Robo-Advisor:

While robo-advisors offer many benefits, it’s important to consider their limitations before making a decision. Here are some factors to think about:

- Limited Customization: Robo-advisors may not offer as much customization as traditional financial advisors, particularly for complex investment needs.

- Lack of Human Interaction: Robo-advisors provide automated services without personal interaction, which may not be suitable for investors who prefer personalized advice.

- Tax Implications: Robo-advisors may not provide tax advice, which could be important for investors with complex tax situations.

- Limited Investment Options: Some robo-advisors may offer a limited selection of investment options, especially for alternative investments such as real estate or private equity.

Conclusion:

Robo-advisors have emerged as a viable and accessible option for investors seeking automated portfolio management services. Their low fees, convenience, and transparent approach make them attractive for both novice and experienced investors. However, it’s essential to carefully consider their limitations and choose a robo-advisor that aligns with your individual investment needs and goals.

Benefits of Using Robo-Advisors for Investing

In today’s fast-paced world, managing investments can feel overwhelming, especially for those who are new to the market or lack the time and expertise. This is where robo-advisors come in, offering an accessible and automated way to invest your money. Robo-advisors are online platforms that use algorithms and automated processes to build and manage investment portfolios. While they are not a replacement for human financial advisors, they provide several benefits that make them a valuable tool for many investors.

One of the most significant benefits of robo-advisors is their affordability. Traditional financial advisors often charge high fees, making their services inaccessible to many. Robo-advisors, on the other hand, typically have low fees, often charging a small percentage of your assets under management. This makes them a more budget-friendly option for investors of all levels.

Another key benefit is accessibility. Robo-advisors are available 24/7, allowing you to access your portfolio and make changes whenever it’s convenient for you. You can also set up your account and start investing with a small initial investment, making it easier to get started with investing.

Furthermore, robo-advisors offer diversification, which is essential for managing risk. They typically use algorithms to spread your investments across a wide range of asset classes, such as stocks, bonds, and real estate. This helps reduce the impact of any single investment performing poorly.

Robo-advisors are also transparent in their operations. They provide clear and easy-to-understand information about their investment strategies and fees. You can also see how your portfolio is performing in real-time, giving you greater control over your investments.

While robo-advisors offer many advantages, it’s important to note that they are not suitable for everyone. If you have complex financial needs or require personalized advice, a human financial advisor may be a better option. However, for investors looking for a low-cost, automated, and accessible way to manage their investments, robo-advisors can be a valuable tool.

Choosing the Right Robo-Advisor for Your Needs

Robo-advisors have become increasingly popular in recent years, offering automated investment management services that are often more affordable than traditional wealth managers. These platforms use algorithms to create and manage investment portfolios based on your individual financial goals, risk tolerance, and time horizon. While robo-advisors can be a great option for many investors, it’s important to choose the right one for your specific needs.

Key Factors to Consider

Here are some key factors to consider when choosing a robo-advisor:

- Investment Options: Consider the types of investments offered, such as ETFs, mutual funds, and individual stocks. Some robo-advisors may specialize in certain asset classes, while others offer a wider range of options.

- Fees: Robo-advisors typically charge a management fee, which can vary significantly. Some platforms charge a flat fee, while others charge a percentage of your assets under management (AUM). Make sure to compare fees across different providers.

- Minimum Investment: Some robo-advisors have minimum investment requirements, which can be a barrier for smaller investors. Consider whether the minimum investment is affordable for you.

- Features and Services: Robo-advisors offer a variety of features, such as tax-loss harvesting, rebalancing, and personalized financial planning. Determine which features are most important to you.

- Customer Support: It’s important to choose a robo-advisor that provides adequate customer support. Consider whether the platform offers phone, email, or live chat support.

- Security: Ensure that the robo-advisor you choose has robust security measures in place to protect your personal and financial information.

Types of Robo-Advisors

Robo-advisors can be broadly categorized into two types:

- Full-service robo-advisors: These platforms provide a comprehensive suite of investment management services, including portfolio creation, rebalancing, and tax-loss harvesting.

- Hybrid robo-advisors: These platforms combine automated investing with human financial advisors. You can access human advice on a limited basis, typically through phone or email.

Choosing the Right Fit

Ultimately, the best robo-advisor for you will depend on your individual needs and circumstances. If you’re a hands-off investor with a long-term investment horizon, a full-service robo-advisor may be a good fit. If you prefer to have access to human advice, a hybrid robo-advisor may be a better option.

Before choosing a robo-advisor, be sure to thoroughly research different platforms and compare their features, fees, and customer support. Read reviews from other investors and consider speaking with a financial advisor for personalized advice.

Investment Strategies Employed by Robo-Advisors

Robo-advisors are automated investment platforms that use algorithms and technology to provide financial advice and manage investment portfolios. They have gained popularity in recent years as a cost-effective and convenient alternative to traditional financial advisors.

One of the key aspects of robo-advisors is their investment strategies, which are typically based on modern portfolio theory (MPT). MPT is a mathematical framework that aims to optimize portfolio returns for a given level of risk. Robo-advisors use algorithms to construct diversified portfolios that align with the client’s risk tolerance and investment goals.

Here are some common investment strategies employed by robo-advisors:

- Passive Investing: Robo-advisors often favor passive investing strategies, which involve investing in low-cost index funds or exchange-traded funds (ETFs). These funds track specific market indices, such as the S&P 500, providing broad market exposure with minimal management fees.

- Target-Date Funds: These funds automatically adjust their asset allocation over time based on the investor’s target retirement date. As the investor approaches retirement, the portfolio gradually shifts towards more conservative investments, reducing risk.

- Risk-Based Allocation: Robo-advisors use sophisticated algorithms to assess a client’s risk tolerance and allocate assets accordingly. Clients are typically asked to complete a risk questionnaire to determine their desired level of risk.

- Rebalancing: Robo-advisors automatically rebalance portfolios to maintain the desired asset allocation. This helps to ensure that portfolios remain aligned with the client’s investment goals and risk tolerance over time.

Robo-advisors often provide a range of investment options, including stocks, bonds, and other asset classes. They may also offer features such as tax-loss harvesting, which aims to minimize tax liabilities.

The specific investment strategies employed by robo-advisors may vary depending on the platform and its target audience. It’s essential to carefully research and compare different robo-advisors before making a decision.

Fees and Costs Associated with Robo-Advisors

Robo-advisors are online investment platforms that use algorithms to create and manage investment portfolios. They are often seen as a more affordable and convenient alternative to traditional financial advisors. However, it’s important to understand the fees and costs associated with robo-advisors before making a decision.

Asset Management Fees

Robo-advisors typically charge an annual asset management fee, which is usually expressed as a percentage of your total assets under management (AUM). This fee can range from 0.25% to 0.50% per year. Some robo-advisors also offer tiered pricing, where the fee decreases as your AUM increases.

Trading Fees

Many robo-advisors don’t charge trading fees for buying and selling securities in your portfolio. However, some may charge a small fee for certain trades, such as options or futures contracts. It’s important to check with the robo-advisor you’re considering to understand their trading fee structure.

Account Fees

Some robo-advisors charge account fees, which can include annual maintenance fees or minimum account balances. These fees can vary depending on the robo-advisor and the type of account you open.

Other Fees

In addition to the fees mentioned above, some robo-advisors may charge additional fees for services such as tax-loss harvesting or portfolio rebalancing. It’s crucial to review the terms and conditions of the robo-advisor you’re considering to fully understand all associated costs.

Comparing Fees

Before choosing a robo-advisor, it’s essential to compare the fees charged by different platforms. You can use online tools or contact the robo-advisors directly to obtain fee information. Consider the following factors when comparing fees:

- Asset management fee

- Trading fees

- Account fees

- Other fees

- Minimum investment amount

Conclusion

While robo-advisors can offer a cost-effective way to invest, it’s essential to understand the fees and costs associated with these platforms. By carefully comparing fees and understanding the fee structure, you can choose the most suitable robo-advisor for your needs.

Account Minimums and Investment Options

When you’re starting out with investing, one of the first things you’ll encounter is the concept of account minimums. These are the minimum amounts of money that you need to deposit into an investment account to open and maintain it.

Account minimums can vary widely depending on the type of account you’re opening and the financial institution you’re working with. For example, a traditional brokerage account might have a low minimum, while a robo-advisor or a high-yield savings account may have a higher minimum.

Here’s a quick breakdown of common account types and their typical minimums:

- Traditional Brokerage Accounts: Often have no minimums or very low minimums, like $0 or $100. These accounts give you the most flexibility and control over your investments.

- Robo-Advisors: Usually have minimums ranging from $500 to $5,000, depending on the platform. These automated investment services offer a hands-off approach, managing your portfolio based on your risk tolerance and investment goals.

- High-Yield Savings Accounts: These accounts offer higher interest rates than traditional savings accounts, but they typically have minimum deposit requirements, often around $1,000 or more.

- Certificates of Deposit (CDs): CDs offer fixed interest rates for a set period of time, but they often require a minimum deposit, usually $500 or more.

It’s crucial to consider the investment options available within each account type. Not all accounts offer the same range of investment choices. For instance, a traditional brokerage account allows you to buy individual stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Robo-advisors often limit you to a set selection of ETFs or mutual funds.

When choosing an investment account, carefully evaluate the account minimums, investment options, fees, and features. It’s essential to find an account that aligns with your investment goals, risk tolerance, and financial situation.

Tax-Loss Harvesting and Other Features

Tax-loss harvesting is a strategy that investors use to offset capital gains by selling losing investments. This can help to reduce your tax liability and potentially increase your overall returns. It is important to note that tax-loss harvesting is a strategy that should be used in conjunction with a well-diversified investment portfolio.

Other features that robo-advisors may offer include:

- Portfolio Rebalancing: Robo-advisors can automatically rebalance your portfolio to ensure that your asset allocation remains in line with your investment goals. This can help to reduce risk and improve returns over time.

- Goal-Based Investing: Robo-advisors can help you set and track your investment goals, such as saving for retirement or a down payment on a house. They can also provide personalized investment advice based on your goals.

- Fractional Shares: Some robo-advisors allow you to invest in fractional shares of stocks and ETFs. This can be a good option for investors who are looking to diversify their portfolio without having to invest large sums of money.

- Automatic Investing: Robo-advisors can automatically invest your money on a regular basis, such as monthly or quarterly. This can help to make investing easier and more consistent.

Robo-Advisors vs. Traditional Financial Advisors

In the world of personal finance, navigating the complex landscape of investments and financial planning can be daunting. Two prominent avenues for guidance are robo-advisors and traditional financial advisors. Both offer assistance in managing your money, but they differ significantly in their approach, cost, and suitability. Understanding these differences is crucial to making an informed decision about which path is right for you.

Robo-Advisors: Technology-Driven Financial Planning

Robo-advisors are automated platforms that use algorithms and technology to create and manage investment portfolios. They often employ a “set it and forget it” approach, requiring minimal human interaction. Here’s a closer look at their key features:

- Automated Investment Management: Robo-advisors use sophisticated algorithms to create and manage investment portfolios based on your risk tolerance, financial goals, and investment horizon. These algorithms consider market conditions and rebalance your portfolio automatically.

- Low Fees: Robo-advisors typically charge lower fees compared to traditional financial advisors, often expressed as an annual percentage of your assets under management (AUM). This makes them an attractive option for budget-conscious investors.

- Convenience: They offer 24/7 access to your account through their online platforms, providing transparency and control over your investments. The onboarding process is typically streamlined, making it easy to get started.

- Limited Personalization: While robo-advisors offer personalized recommendations based on your profile, their ability to provide tailored advice may be limited compared to human advisors.

Traditional Financial Advisors: Personalized Guidance

Traditional financial advisors are human professionals who offer personalized financial advice and services. They take a more holistic approach, considering your individual circumstances, goals, and risk appetite. Here’s a breakdown of their key characteristics:

- Personalized Advice: Traditional advisors provide customized guidance based on your unique financial situation, helping you navigate complex financial decisions like retirement planning, college savings, and estate planning.

- Human Interaction: The ability to discuss your financial needs and concerns directly with a qualified professional can be invaluable, especially for individuals who prefer a more hands-on approach.

- Higher Fees: Traditional advisors typically charge higher fees, often as a percentage of AUM or through hourly rates. They may also charge commissions for specific financial products.

- Limited Availability: Access to traditional advisors may be limited based on location and minimum investment requirements, potentially making them less accessible for some investors.

Choosing the Right Path: A Balancing Act

The choice between a robo-advisor and a traditional financial advisor depends on your individual needs and circumstances. Here’s a helpful guide:

- Robo-advisors are well-suited for investors who:

- Prefer a hands-off approach to investment management.

- Are comfortable with technology and online platforms.

- Have a relatively simple financial situation and clear investment goals.

- Are budget-conscious and prioritize low fees.

- Traditional financial advisors are a better fit for investors who:

- Require personalized financial planning and guidance.

- Prefer a more hands-on approach and direct human interaction.

- Have complex financial situations or specific needs.

- Are willing to pay for a higher level of personalized service.

Ultimately, the best approach is to carefully consider your financial goals, risk tolerance, and preferred level of service before making a decision. You can also explore hybrid options, such as robo-advisors that offer access to human advisors for more complex financial planning needs.

The Future of Robo-Advising in Wealth Management

The financial services industry is constantly evolving, and one of the most significant changes in recent years has been the rise of robo-advisors. These automated platforms use algorithms and technology to provide investment advice and manage portfolios, often at a lower cost than traditional financial advisors.

Robo-advisors have gained popularity for several reasons. They offer a convenient and affordable way to invest, with many platforms having low minimum investment requirements and transparent fee structures. They also use data-driven algorithms to create personalized investment portfolios, taking into account factors such as risk tolerance, investment goals, and time horizon. This personalized approach can help investors achieve their financial goals more effectively.

While robo-advisors have revolutionized the way many people invest, they are not a one-size-fits-all solution. For investors with complex financial situations, such as those with high net worth, significant tax implications, or specific estate planning needs, traditional financial advisors may still be the best option. However, robo-advisors can provide a valuable service to a wide range of investors, particularly those who are new to investing or who prefer a hands-off approach.

The Future of Robo-Advising

The future of robo-advising is bright. As technology continues to advance, robo-advisors are expected to become even more sophisticated and offer a wider range of services. This could include features such as:

- AI-powered financial planning: Robo-advisors could use artificial intelligence to provide more personalized financial planning advice, taking into account factors such as income, expenses, and debt.

- Enhanced portfolio management: Robo-advisors could use machine learning algorithms to optimize portfolio performance and manage risk more effectively.

- Integration with other financial services: Robo-advisors could integrate with other financial services, such as banking, insurance, and retirement planning, to provide a more comprehensive financial solution.

Robo-advisors are already having a significant impact on the wealth management industry, and their role is only likely to grow in the future. While traditional financial advisors will continue to play an important role, robo-advisors are making investing more accessible and affordable for everyone.