Are you tired of living paycheck to paycheck? Do you dream of financial freedom but feel overwhelmed by the thought of creating a budget? You’re not alone! Many people struggle with managing their finances, but the good news is that it doesn’t have to be complicated. A personal finance plan can help you take control of your money and achieve your financial goals, whether it’s paying off debt, saving for retirement, or simply having more peace of mind.

This article will guide you through simple steps to create a personal finance plan that works for you. We’ll cover everything from tracking your income and expenses to setting realistic goals and developing healthy spending habits. Get ready to empower yourself with financial knowledge and start building a brighter financial future!

Assess Your Current Financial Situation

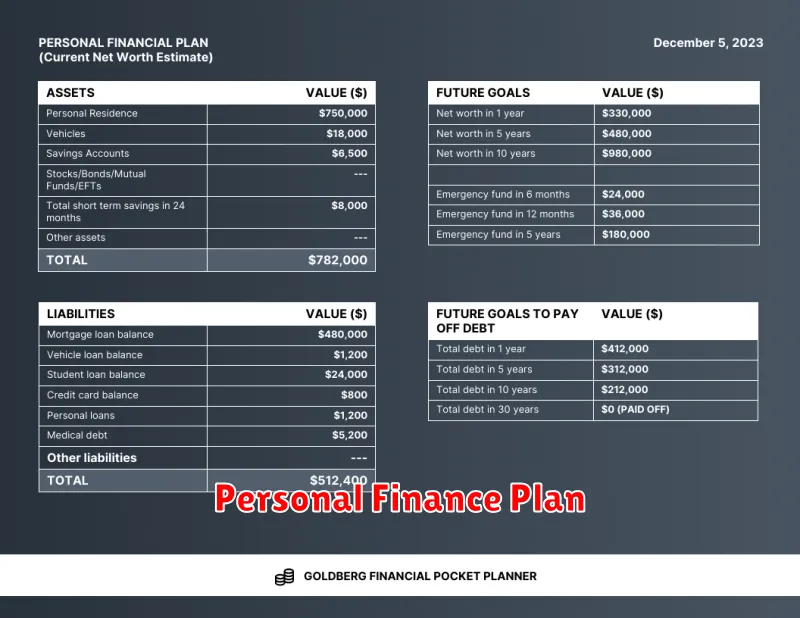

Before you can start planning for your financial future, you need to understand your current financial situation. This means taking a close look at your income, expenses, assets, and debts.

To get started, you can create a budget. This will help you track your income and expenses and see where your money is going. You can use a spreadsheet, budgeting app, or even just a notebook to keep track of your finances.

Once you have a good understanding of your income and expenses, you can start to assess your assets and debts. Your assets include things like your home, car, savings, and investments. Your debts include things like student loans, credit card debt, and mortgages.

Once you have a clear picture of your financial situation, you can start to develop a plan for the future. This plan should include goals for saving, investing, and paying down debt.

Here are some tips for assessing your current financial situation:

- Track your income and expenses for at least one month. This will give you a good idea of where your money is going.

- Create a budget and stick to it. This will help you control your spending and reach your financial goals.

- Review your credit report and credit score. This will help you understand your creditworthiness and identify any errors that need to be corrected.

- Assess your assets and debts. This will help you understand your net worth and identify any areas where you can improve.

Once you have a clear understanding of your current financial situation, you can start to plan for your future. This plan should include goals for saving, investing, and paying down debt. You can also consult with a financial advisor to get personalized advice.

Set Realistic Financial Goals

Setting realistic financial goals is crucial for achieving financial success. Without clear and attainable goals, it’s easy to get lost in the vast world of personal finance. Here’s a guide to help you set goals that will motivate you and lead to positive financial outcomes.

1. Define Your Financial Needs and Wants

Start by understanding your financial needs and wants. Needs are essential expenses like housing, food, and healthcare, while wants are things you desire but can live without, such as a new car or vacation.

2. Establish SMART Goals

Follow the SMART goal framework:

- Specific: Clearly define what you want to achieve.

- Measurable: Set a quantifiable target for your goal.

- Attainable: Ensure your goal is achievable within a realistic timeframe.

- Relevant: Make sure the goal aligns with your overall financial objectives.

- Time-bound: Set a deadline for reaching your goal.

3. Prioritize Your Goals

Once you have a list of goals, prioritize them based on importance and urgency. Focus on the most critical goals first and work your way down the list.

4. Break Down Large Goals into Smaller Steps

Large financial goals can seem overwhelming. Break them down into smaller, more manageable steps. This will make the process feel less daunting and keep you motivated.

5. Track Your Progress

Regularly track your progress towards your financial goals. This will help you stay on track and make adjustments as needed. Consider using a budget app or a spreadsheet to monitor your finances.

6. Seek Professional Advice

If you’re struggling to set realistic financial goals or need personalized guidance, consider consulting with a financial advisor. They can provide expert advice and support to help you achieve your objectives.

Conclusion

Setting realistic financial goals is essential for reaching your financial aspirations. By following these steps, you can create a clear roadmap for financial success. Remember to be patient, stay focused, and celebrate your milestones along the way.

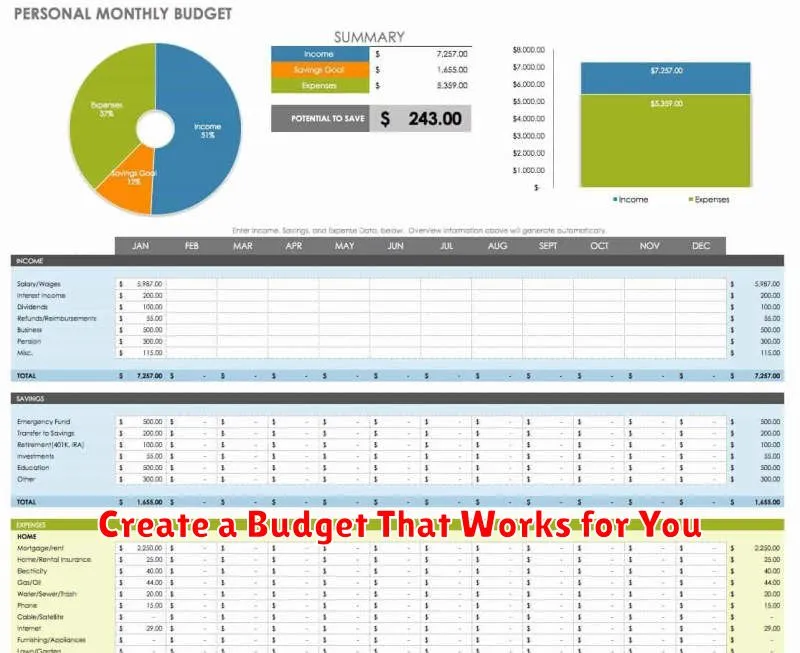

Create a Budget That Works for You

Creating a budget can feel overwhelming, but it’s an essential step towards financial stability and achieving your financial goals. A budget helps you track your income and expenses, identify areas where you can save money, and make informed decisions about your finances.

Here are some steps to create a budget that works for you:

- Track Your Income and Expenses: The first step is to understand where your money is coming from and where it’s going. Track your income from all sources, such as your salary, investments, or side hustles. Also, track your expenses for a month or two to get a clear picture of your spending habits. You can use a spreadsheet, budgeting app, or a notebook to keep track.

- Categorize Your Expenses: Once you have a list of your expenses, categorize them into different groups such as housing, food, transportation, entertainment, and savings. This will help you see where your money is going and identify areas where you can cut back.

- Set Realistic Goals: Before creating your budget, set realistic financial goals. Do you want to save for a down payment on a house, pay off debt, or invest for retirement? Having clear goals will help you stay motivated and prioritize your spending.

- Allocate Your Income: After tracking your income and expenses and setting your goals, allocate your income to different categories based on your priorities. For example, you might allocate a certain percentage of your income to housing, another percentage to food, and so on. Remember to include savings and debt payments in your budget.

- Review and Adjust Regularly: Your financial situation can change over time, so it’s important to review your budget regularly and make adjustments as needed. You may need to increase your savings contributions, adjust your spending habits, or re-evaluate your financial goals. A good rule of thumb is to review your budget at least once a month.

Creating a budget doesn’t have to be complicated. By following these steps, you can create a budget that works for you and helps you achieve your financial goals.

Establish an Emergency Fund

An emergency fund is a crucial component of a sound financial plan. It provides a safety net during unexpected financial hardships, helping you avoid debt and maintain financial stability. Here’s a guide to help you establish and maintain an emergency fund:

Determine Your Needs

Before starting, it’s essential to assess your financial situation. Consider your monthly expenses, potential unexpected costs like medical emergencies or car repairs, and your current savings. A good rule of thumb is to aim for 3-6 months of living expenses in your emergency fund. If you’re a freelancer or have a less stable income, you might want to aim for a larger cushion.

Set a Realistic Goal

Once you know your target amount, break it down into smaller, achievable goals. Setting smaller, more frequent milestones can make the process feel less daunting and keep you motivated. For example, you could aim to save $100 per week, or $500 per month.

Automate Your Savings

Make saving automatic by setting up recurring transfers from your checking account to your savings account. This ensures consistent contributions and helps you build your emergency fund without actively having to think about it.

Find Extra Money to Save

Look for opportunities to reduce expenses and free up money for your emergency fund. This could include:

- Cutting back on unnecessary subscriptions

- Cooking at home more often

- Negotiating lower bills

- Finding side hustles for extra income

Be Patient and Consistent

Building an emergency fund takes time and consistency. Avoid dipping into your emergency fund for non-emergencies. The key is to stay disciplined and continue contributing even when it seems like a slow process. The peace of mind it provides is well worth the effort.

Protect Your Savings

Keep your emergency fund in a high-yield savings account or money market account to earn interest and potentially beat inflation. Avoid keeping it in a checking account, where it may earn little to no interest.

By prioritizing an emergency fund, you’re taking a proactive step towards securing your financial future. It provides a buffer against life’s unexpected challenges and helps you maintain financial stability in the face of adversity.

Manage Debt Effectively

Managing debt effectively is crucial for achieving financial stability and peace of mind. It involves taking proactive steps to understand your debt, create a budget, and develop a repayment plan. This article will guide you through the essential steps to manage your debt effectively.

1. Understand Your Debt

The first step to managing your debt is to understand the nature and extent of your obligations. This involves gathering information about your outstanding loans, credit card balances, and other forms of debt.

Create a list of all your debts, including the following details for each:

- Creditor name

- Account number

- Balance owed

- Interest rate

- Minimum payment

This information will help you identify your highest-interest debts, which should be prioritized for repayment.

2. Create a Budget

A budget is essential for managing your debt effectively. It allows you to track your income and expenses, identify areas where you can cut back, and allocate funds towards debt repayment.

Start by listing all your sources of income and your regular monthly expenses. Categorize your expenses into essential needs, such as housing and food, and discretionary spending, such as entertainment and dining out.

Once you have a clear picture of your income and expenses, you can determine how much you can afford to allocate towards debt repayment each month. This amount should be realistic and sustainable to ensure you can stick to your budget.

3. Develop a Repayment Plan

With a budget in place, you can develop a repayment plan that outlines how you will prioritize your debts and make regular payments. There are several popular strategies for debt repayment, including:

- Snowball method: This approach involves paying the minimum payment on all debts except the smallest one. You then focus on paying down the smallest debt as quickly as possible, using the extra money you have saved by minimizing payments on other debts. Once the smallest debt is paid off, you roll the extra payment amount into the next smallest debt, and so on.

- Avalanche method: This strategy prioritizes the debts with the highest interest rates first. This method is more efficient in terms of saving on interest costs, but it can be challenging to stay motivated when dealing with large balances.

Choose the method that best suits your financial situation and personality. Remember to make regular payments as per your plan to keep your credit score healthy and avoid late payment fees.

4. Consider Debt Consolidation

Debt consolidation is an option to simplify your debt repayment by combining multiple loans into a single loan with a lower interest rate. This can make it easier to manage your payments and save money on interest. However, it’s crucial to ensure that the new loan’s terms are favorable and that you can afford the monthly payments.

5. Seek Professional Help

If you are struggling to manage your debt, don’t hesitate to seek professional help. A credit counselor or financial advisor can provide guidance on debt management strategies, budgeting techniques, and options for debt relief.

Conclusion

Managing debt effectively requires discipline, planning, and commitment. By following the steps outlined in this article, you can take control of your finances, reduce your debt burden, and achieve financial stability. Remember to be patient and consistent with your efforts, and you will eventually reach your debt-free goals.

Start Saving for Retirement

Retirement may seem far off, but it’s never too early to start planning. Saving for retirement early on can help you reach your financial goals and enjoy a comfortable lifestyle in your later years.

Here are some tips to help you get started:

- Start saving early: The sooner you start saving, the more time your money has to grow. Even small contributions can add up over time.

- Choose the right retirement account: There are several different types of retirement accounts available, such as 401(k)s, Roth IRAs, and traditional IRAs. It’s important to choose an account that meets your specific needs.

- Contribute regularly: Make saving for retirement a regular part of your budget. Set up automatic contributions to your retirement account.

- Take advantage of employer matches: If your employer offers a 401(k) match, be sure to contribute enough to take advantage of the full match. This is free money that can boost your retirement savings.

- Consider a Roth IRA: If you think your income will be higher in retirement, a Roth IRA might be a good option. Roth IRA contributions are made with after-tax dollars, but withdrawals in retirement are tax-free.

- Don’t be afraid to ask for help: If you need help planning for retirement, talk to a financial advisor. They can help you develop a personalized savings plan.

Saving for retirement may seem daunting, but it’s a crucial step towards a secure financial future. By taking action today, you can set yourself up for a comfortable and fulfilling retirement.

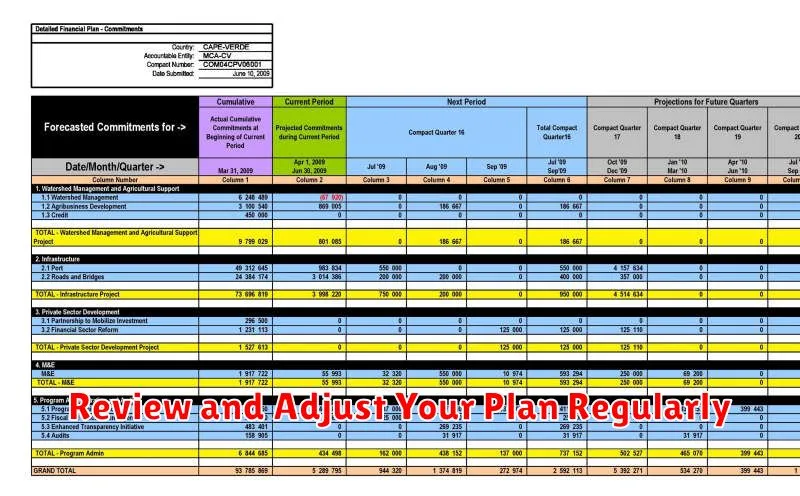

Review and Adjust Your Plan Regularly

A well-crafted plan is essential for achieving success, but it’s not a static document. The world is constantly changing, and so are your goals, resources, and priorities. To stay on track and maximize your chances of success, you need to review and adjust your plan regularly.

Here are some key reasons why regular plan review is crucial:

- Identify and address gaps: As you work towards your goals, you may realize that certain aspects of your plan are not working as expected. Perhaps you underestimated the time required for a particular task, or you encountered unforeseen obstacles. Regular review allows you to identify these gaps and adjust your plan accordingly.

- Stay aligned with your goals: Your goals may evolve over time. What was important to you a year ago may no longer be a priority. Reviewing your plan ensures that it remains aligned with your current goals and aspirations.

- Capitalize on opportunities: The market, your industry, and your personal circumstances are constantly changing. Regular review gives you the opportunity to identify new opportunities and adjust your plan to leverage them.

- Maintain motivation: When you see progress and make adjustments to your plan based on real-time feedback, it can help you stay motivated and engaged in the process.

How often should you review your plan? The frequency depends on the nature of your goals and the level of change in your environment. For short-term goals, a weekly review may be sufficient, while long-term plans may benefit from quarterly or even annual reviews.

The review process should be a structured activity that involves analyzing your progress, identifying areas for improvement, and making necessary adjustments. Here are some tips for conducting effective plan reviews:

- Set aside dedicated time: Don’t try to squeeze a review into a few spare minutes. Schedule a block of time where you can focus without distractions.

- Gather relevant data: Review your progress, performance metrics, and any other relevant information that will help you assess your plan’s effectiveness.

- Be objective: Avoid getting emotionally attached to your plan. Be honest about what is and isn’t working.

- Make specific changes: Don’t just make vague adjustments. Identify clear actions that will improve your plan.

- Communicate changes: If your plan affects other people, ensure that you communicate any changes to them.

Regularly reviewing and adjusting your plan is a vital component of success. It allows you to stay on track, capitalize on opportunities, and adapt to change. By making this a habit, you increase your chances of achieving your goals and living a more fulfilling life.