Are you leaving money on the table when you file your taxes? It’s possible that you’re missing out on valuable tax deductions and credits that can significantly reduce your tax liability. Many taxpayers don’t realize the full extent of the deductions and credits they qualify for, potentially leading to a larger tax bill than necessary. Whether you’re self-employed, a homeowner, or have dependents, there are likely opportunities to save on your taxes.

This article will guide you through a comprehensive overview of common tax deductions and credits that you might be overlooking. From medical expenses and home improvements to child tax credits and education expenses, we’ll explore the various options available to help you maximize your tax savings. By understanding these potential deductions and credits, you can make informed decisions and ensure you’re claiming everything you deserve.

Understanding Tax Deductions and Credits

Taxes are a necessary part of life, but they can also be a source of confusion. One of the most common sources of confusion is the difference between tax deductions and tax credits. While both can save you money on your taxes, they work in very different ways.

Tax Deductions

A tax deduction is an expense that you can subtract from your gross income to reduce your taxable income. This means you’ll pay less tax overall. Some common examples of tax deductions include:

- Mortgage interest

- State and local taxes

- Charitable contributions

To understand how deductions work, imagine you have a gross income of $100,000 and a standard deduction of $12,000. If you take a deduction for mortgage interest of $5,000, your taxable income will be reduced to $83,000 ($100,000 – $12,000 – $5,000). The lower your taxable income, the less tax you’ll pay.

Tax Credits

A tax credit is a direct reduction in the amount of tax you owe. Unlike deductions, which reduce your taxable income, credits reduce your tax liability. This means that you’ll get a dollar-for-dollar reduction in your tax bill. Some common examples of tax credits include:

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Residential Renewable Energy Credit

Imagine you owe $10,000 in taxes and you qualify for a $2,000 tax credit. The $2,000 credit directly reduces your tax liability, leaving you with a tax bill of $8,000.

Key Differences

Here’s a table summarizing the key differences between deductions and credits:

| Feature | Deduction | Credit |

|---|---|---|

| Reduces | Taxable income | Tax liability |

| Benefit | Reduces tax owed by lowering your taxable income | Reduces tax owed directly |

| Impact | Reduces tax owed by a percentage, depending on your tax bracket | Reduces tax owed dollar-for-dollar |

Which is Better?

There’s no simple answer to the question of which is better, deductions or credits. The best option for you will depend on your individual circumstances and the specific deductions and credits available.

For example, if you’re in a high tax bracket, a deduction might be more valuable because it reduces your taxable income by a larger amount. On the other hand, if you’re in a low tax bracket, a credit might be more beneficial because it reduces your tax liability directly.

Getting Help

If you’re unsure which deductions and credits you qualify for, it’s best to consult with a tax professional. They can help you understand the available options and maximize your tax savings.

Commonly Overlooked Deductions for Homeowners

When it comes to filing your taxes, many homeowners overlook deductions that could save them a significant amount of money. Here are some commonly overlooked deductions that you may be eligible for:

Property Taxes

Property taxes are often the biggest expense for homeowners. Fortunately, they are also a deductible expense. You can deduct the property taxes you paid on your primary residence, as well as any other property you own.

Mortgage Interest

If you have a mortgage, you can deduct the interest you paid on the loan. This deduction can be quite substantial, especially in the early years of your mortgage when you are paying more interest than principal.

Home Improvements

You can deduct the cost of certain home improvements, such as those that make your home more energy-efficient or accessible. For example, you can deduct the cost of installing solar panels, energy-efficient windows, or a ramp for someone with a disability.

Medical Expenses

If you have a home office, you can deduct a portion of your medical expenses. This includes the cost of healthcare, insurance premiums, and prescription drugs. To claim this deduction, you must use your home office for medical purposes, such as storing medical supplies or meeting with a doctor.

Other Deductions

There are a number of other deductions that you may be eligible for, depending on your individual circumstances. These include:

- Homeowner’s insurance premiums: You can deduct the premiums you paid for homeowner’s insurance.

- Homeowner’s association fees: You can deduct the fees you paid to your homeowner’s association.

- Casualty losses: If your home was damaged by a natural disaster, you may be able to deduct the cost of repairs or replacements.

It is important to note that the deductibility of these expenses can vary depending on your individual tax situation. It is always best to consult with a tax professional to determine which deductions you are eligible for.

By taking advantage of all the deductions you are eligible for, you can significantly reduce your tax liability and save yourself money.

Deductions for Healthcare Expenses: What You Need to Know

Healthcare expenses can be a significant drain on your finances, but there are ways to offset these costs through tax deductions. Understanding the rules and eligibility requirements is crucial for maximizing your tax savings. This article will guide you through the essential aspects of healthcare expense deductions.

What Expenses Qualify?

The Internal Revenue Service (IRS) allows deductions for certain medical expenses that exceed a specific threshold. These expenses include:

- Doctor and dentist fees

- Hospital and nursing home costs

- Prescription drugs and over-the-counter medications

- Medical insurance premiums

- Long-term care services

- Out-of-pocket expenses for medical equipment and supplies

It’s important to note that expenses related to cosmetic surgery, weight-loss programs, and non-prescription vitamins are generally not deductible.

The Threshold for Deductibility

You can only deduct medical expenses that exceed a certain percentage of your adjusted gross income (AGI). This percentage varies annually, so it’s essential to consult the latest IRS guidelines. For instance, in 2023, you can deduct medical expenses exceeding 7.5% of your AGI.

How to Claim the Deduction

To claim the medical expense deduction, you need to complete Form 1040 and Schedule A (Itemized Deductions). Be sure to keep accurate records of all your eligible medical expenses, including receipts, invoices, and statements. You can choose to itemize your deductions or claim the standard deduction, whichever benefits you more.

Additional Considerations

Here are some points to remember:

- The deduction applies to expenses paid for yourself, your spouse, and your dependents.

- If you’re self-employed, you can deduct health insurance premiums as a business expense.

- You may be eligible for other tax credits, such as the Premium Tax Credit, which can further reduce your healthcare costs.

Seek Professional Advice

Tax laws can be complex, so it’s always advisable to consult a qualified tax professional for personalized guidance. They can help you navigate the intricacies of healthcare expense deductions and ensure you’re maximizing your tax benefits.

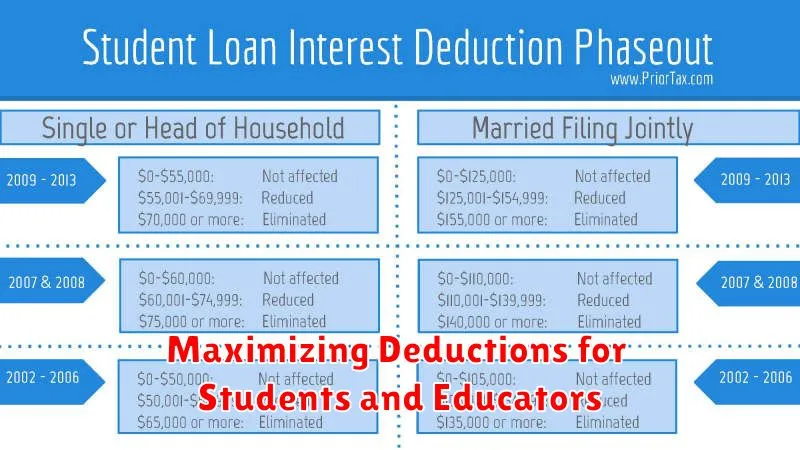

Maximizing Deductions for Students and Educators

Navigating the complex world of taxes can be daunting, especially for students and educators. However, understanding available deductions can significantly reduce your tax burden and put more money back in your pocket. This guide will delve into the various deductions you can claim, ensuring you maximize your savings.

Student Deductions

As a student, you have access to several tax deductions that can ease the financial strain of education. Here are some key deductions to consider:

Tuition and Fees Deduction

This deduction allows you to claim up to $4,000 in educational expenses, including tuition, fees, and course materials. The deduction is phased out for taxpayers with higher adjusted gross incomes (AGI).

Student Loan Interest Deduction

You can deduct up to $2,500 in interest paid on student loans. However, this deduction is subject to income limitations, and you must have paid the interest on qualified educational loans.

Educator Expenses Deduction

If you are a qualified educator, you can deduct up to $250 in expenses incurred for supplies used in the classroom. This deduction includes expenses for books, supplies, computer equipment, and other educational materials.

Other Relevant Deductions

Besides these specific deductions, you may also be eligible for other deductions that can benefit you, such as:

Home Office Deduction

If you use a portion of your home for teaching or studying, you can claim the home office deduction. This deduction allows you to deduct a portion of your home expenses, such as rent, utilities, and insurance.

Moving Expenses Deduction

If you relocate for a new job as an educator, you may be able to deduct certain moving expenses. This deduction is subject to specific requirements, such as distance and job-related reasons.

Tips for Maximizing Deductions

To ensure you claim all eligible deductions, consider these tips:

- Keep detailed records of all your educational and professional expenses.

- Consult a tax professional for personalized advice on deductions specific to your situation.

- Stay informed about changes in tax laws and deductions that may affect you.

By understanding and utilizing these available deductions, students and educators can significantly reduce their tax burden. Remember to review your eligibility and claim all applicable deductions to maximize your savings and make the most of your hard-earned income.

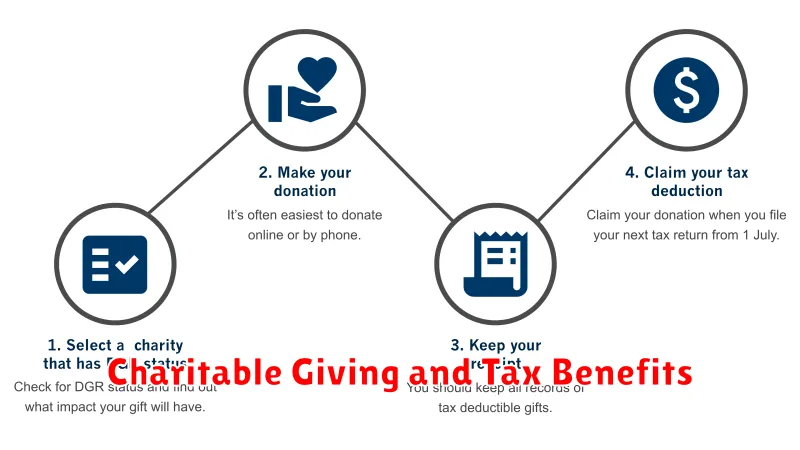

Charitable Giving and Tax Benefits

In the United States, charitable giving is a cornerstone of civic engagement and plays a vital role in supporting a wide range of causes. From supporting education and healthcare to advancing scientific research and alleviating poverty, charitable donations make a tangible difference in the lives of countless individuals and communities.

Beyond the inherent satisfaction of contributing to a worthy cause, charitable giving also offers a range of tax benefits for individuals and businesses. These benefits can significantly reduce one’s tax liability, providing an added incentive for generosity.

Tax Deductions for Charitable Donations

The most common tax benefit associated with charitable giving is the deduction for charitable contributions. Individuals can deduct cash donations, as well as the value of donated items such as clothing, furniture, and vehicles. The deduction is typically limited to a percentage of one’s adjusted gross income (AGI). For example, in 2023, individuals can deduct up to 60% of their AGI for cash donations and 30% for non-cash donations.

Other Tax Benefits

In addition to the standard deduction for charitable contributions, there are several other tax benefits available for specific types of donations:

- Qualified Charitable Distributions (QCDs): Individuals aged 70 1/2 or older can make direct contributions from their Individual Retirement Accounts (IRAs) to eligible charities without incurring any income tax.

- Donor-Advised Funds (DAFs): DAFs allow individuals to make a lump-sum donation and then distribute the funds to charities over time, receiving a tax deduction for the initial donation. DAFs offer flexibility and tax planning advantages.

- Charitable Remainder Trusts (CRTs): CRTs are complex estate planning tools that allow individuals to make a charitable donation while retaining income from the donated assets for a specified period. CRTs offer potential tax savings and reduce estate taxes.

Considerations for Charitable Giving

While charitable giving can offer significant tax benefits, it’s important to consider the following factors:

- Charity’s Eligibility: Only qualified charities are eligible for tax deductions. The Internal Revenue Service (IRS) maintains a list of eligible organizations.

- Documentation Requirements: Individuals should retain proper documentation for all charitable contributions, including receipts and donation agreements.

- Tax Implications: Understanding the tax implications of charitable giving is crucial, especially for large donations or complex donation arrangements.

Charitable giving is a rewarding act that can benefit both individuals and society. By understanding the available tax benefits, donors can maximize their impact and make a meaningful difference while potentially reducing their tax liability.

Deductions for Self-Employed Individuals and Freelancers

Being self-employed comes with many perks, like setting your own hours and being your own boss. But it also comes with some unique tax obligations. One of the biggest advantages of being self-employed is the ability to claim various deductions on your taxes. These deductions can significantly reduce your tax liability, allowing you to keep more of your hard-earned money.

Here are some common deductions that self-employed individuals and freelancers can take advantage of:

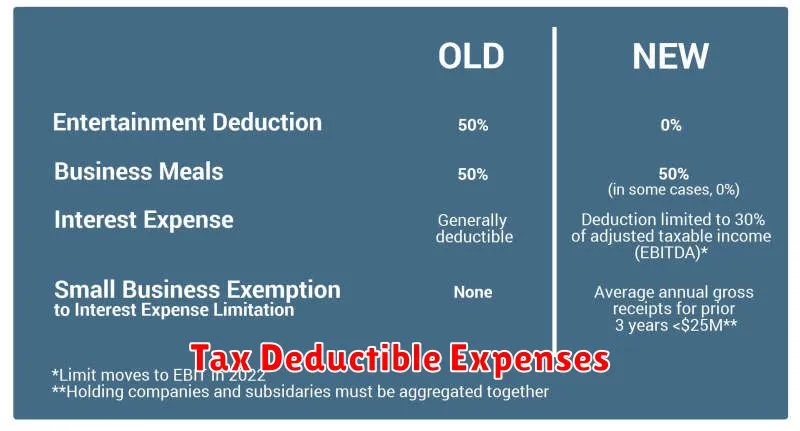

Business Expenses

Any expense incurred directly related to your business can be deducted. This includes:

- Office Supplies: Paper, ink, printer cartridges, etc.

- Equipment: Computers, software, phones, etc.

- Rent: Office space, home office space (if used exclusively for business).

- Utilities: Electricity, internet, phone, etc. (proportionate to business use).

- Travel: Mileage, airfare, lodging related to business trips.

- Marketing and Advertising: Website expenses, social media ads, business cards, etc.

- Professional Services: Accountants, lawyers, consultants, etc.

Home Office Deduction

If you use a portion of your home exclusively for business, you can deduct a portion of your home expenses, such as:

- Mortgage interest

- Property taxes

- Insurance

- Utilities

- Repairs and maintenance

The deduction is calculated based on the percentage of your home used for business.

Health Insurance Premiums

Self-employed individuals can deduct 100% of their health insurance premiums as a business expense.

Retirement Contributions

Self-employed individuals can contribute to a Solo 401(k) or a SEP IRA and deduct these contributions from their taxable income. This is a great way to save for retirement and reduce your tax burden simultaneously.

Other Deductions

There are other deductions that may apply, depending on your specific circumstances, such as:

- Continuing education

- Depreciation

- Bad debts

Important Considerations

It’s essential to keep meticulous records of all your business expenses. This documentation will be crucial when filing your taxes. Consider using a dedicated accounting software or app to track your income and expenses. Consult with a tax professional to determine which deductions you qualify for and how to maximize your tax savings.

Taking advantage of all available deductions can significantly impact your tax liability and help you keep more of your hard-earned money. Remember, it’s always best to consult with a qualified tax advisor to ensure you are claiming all applicable deductions correctly.

Tax Credits vs. Deductions: What’s the Difference?

When it comes to filing your taxes, you may have heard of the terms “tax credits” and “tax deductions.” While both can help you save money on your tax bill, they work in different ways. Understanding the difference between tax credits and tax deductions can help you maximize your savings.

Tax Credits

A tax credit is a direct reduction in the amount of taxes you owe. For example, if you’re eligible for a $1,000 tax credit, your tax liability will be reduced by $1,000, dollar for dollar.

Tax credits are generally more valuable than deductions because they directly reduce your tax liability. They can be either refundable or nonrefundable.

- Refundable tax credits can reduce your tax liability to zero and may even result in a refund, even if you didn’t owe any taxes.

- Nonrefundable tax credits can only reduce your tax liability to zero; they won’t result in a refund.

Tax Deductions

A tax deduction, on the other hand, reduces your taxable income. This means that you’ll pay less tax on your overall income. For example, if you have a $10,000 deduction, your taxable income will be reduced by $10,000. However, the amount you save on your taxes will depend on your tax bracket.

Tax deductions can be either above the line or below the line.

- Above-the-line deductions are deducted from your gross income before calculating your adjusted gross income (AGI).

- Below-the-line deductions are deducted from your AGI to determine your taxable income.

Which is Better: Tax Credits or Deductions?

Ultimately, whether a tax credit or deduction is better for you depends on your individual circumstances. Tax credits are generally more beneficial because they directly reduce your tax liability. However, tax deductions can still be advantageous if you’re in a higher tax bracket.

It’s essential to consult with a tax professional to determine which tax credits and deductions you qualify for and which will provide you with the most significant tax savings.

How to Claim Your Missed Deductions and Credits

It’s tax season, and you’ve probably already filed your return. But what if you missed out on some deductions and credits that could have saved you money? Don’t worry, it’s not too late to claim what’s rightfully yours!

Here’s a step-by-step guide on how to claim your missed deductions and credits:

Step 1: Identify Potential Missed Deductions and Credits

The first step is to determine if you missed any eligible deductions or credits. Here are some common ones:

- Medical Expenses: If you incurred significant medical expenses, you may be able to deduct a portion of them.

- State and Local Taxes: In some cases, you can deduct state and local taxes, depending on your location and tax bracket.

- Charitable Donations: Did you donate to charities? You can often deduct a portion of your donations.

- Child Tax Credit: If you have children, you may be eligible for the Child Tax Credit, which can significantly reduce your tax liability.

- Education Credits: If you paid for college tuition or other education expenses, you may be able to claim education credits.

This is not an exhaustive list, so it’s important to review your tax situation thoroughly.

Step 2: Gather Necessary Documents

Once you’ve identified potential deductions and credits, you’ll need to gather the required documentation to support your claims.

For example, for medical expenses, you’ll need receipts and invoices. For charitable donations, you’ll need donation receipts or statements. For education credits, you’ll need tuition bills and other relevant documents.

Step 3: File an Amended Tax Return

To claim your missed deductions and credits, you’ll need to file an amended tax return. This is done using Form 1040-X, which is available on the IRS website.

When filing an amended return, be sure to include:

- Your original tax return information

- The specific deductions or credits you’re claiming

- Supporting documentation

Step 4: File Your Amended Return Before the Deadline

You have three years from the date you filed your original return or two years from when you paid the tax, whichever is later, to file an amended return. Don’t wait until the last minute!

Important Considerations

Here are some important things to remember:

- Seek Professional Advice: If you’re unsure about your eligibility for deductions and credits, it’s always best to consult with a tax professional.

- Keep Records Organized: It’s crucial to keep all your tax records organized, including receipts and other documentation, for future reference.

- Be Patient: Processing amended returns can take time. It’s essential to be patient and allow the IRS sufficient time to process your request.

By following these steps, you can increase your chances of claiming your missed deductions and credits and getting the tax refund you deserve. Remember, every dollar counts, and it’s never too late to claim what’s rightfully yours!

Tips for Staying Organized and Maximizing Your Tax Savings

Tax season can be a stressful time, but it doesn’t have to be. By staying organized and taking advantage of available tax deductions and credits, you can maximize your tax savings and minimize your stress. Here are some tips to help you get started:

1. Gather All Your Tax Documents

The first step is to gather all of your tax documents, including your W-2, 1099s, and any other relevant forms. You can use a tax organizer to keep track of everything.

2. Keep Track of Your Expenses

Throughout the year, keep track of all your expenses that may be deductible, such as medical expenses, charitable donations, and business expenses. You can use a spreadsheet, a dedicated app, or a notebook to keep track.

3. Consider Using Tax Software

Tax software can help you file your taxes electronically and take advantage of all available deductions and credits. Many software programs offer free versions for simple returns or discounted versions for more complex returns.

4. Seek Professional Advice

If you have a complex financial situation or are unsure about which deductions and credits you qualify for, consider seeking advice from a tax professional. They can help you ensure that you are maximizing your tax savings.

5. File on Time

The deadline for filing your taxes is April 15th each year. Filing on time can help you avoid penalties.

Benefits of Staying Organized

Staying organized has many benefits, including:

- Reduced stress

- Increased efficiency

- Maximized tax savings

By taking the time to stay organized and plan ahead, you can make tax season a little less stressful and ensure that you are maximizing your tax savings.