Are you looking for a way to grow your wealth and secure your financial future? Investing in mutual funds can be a powerful tool to achieve your financial goals. Mutual funds offer a simple and convenient way to diversify your portfolio and gain exposure to a wide range of assets. Whether you’re a seasoned investor or just starting, understanding the basics of mutual fund investing is crucial. This article will guide you through the fundamental concepts, helping you make informed decisions and navigate the world of mutual fund investing with confidence.

Mutual funds are investment vehicles that pool money from multiple investors to buy a diversified portfolio of securities, such as stocks, bonds, or other assets. By investing in a mutual fund, you gain access to a professionally managed portfolio without the need for individual stock selection. Mutual funds provide significant advantages, including diversification, professional management, and affordability. This article will explore the different types of mutual funds available, the factors to consider when choosing a fund, and how to effectively manage your mutual fund investments.

What are Mutual Funds and How Do They Work?

Mutual funds are a type of investment vehicle that allows investors to pool their money together to purchase a diversified portfolio of securities, such as stocks, bonds, or other assets. These funds are managed by professional fund managers who use their expertise to select and trade securities on behalf of the fund’s investors.

When you invest in a mutual fund, you are essentially buying shares of that fund. The price of each share is determined by the total value of the fund’s underlying assets, divided by the number of outstanding shares. This means that the value of your investment will fluctuate based on the performance of the securities held by the fund.

Types of Mutual Funds

There are many different types of mutual funds, each with its own investment strategy and risk profile. Some common types include:

- Stock funds: Invest primarily in stocks, aiming for capital appreciation.

- Bond funds: Invest primarily in bonds, aiming for income and stability.

- Balanced funds: Invest in a mix of stocks and bonds, aiming for a balance between growth and income.

- Index funds: Track a specific market index, such as the S&P 500, providing broad market exposure.

- Target-date funds: Designed for retirement savings, with a mix of assets that become more conservative as the target retirement date approaches.

How Mutual Funds Work

Here’s a breakdown of the process:

- Investment: You purchase shares in a mutual fund, contributing to the fund’s overall assets.

- Management: Professional fund managers use your investment and others to buy and sell securities based on the fund’s investment strategy.

- Performance: The fund’s value fluctuates based on the performance of its underlying investments. Your investment shares appreciate or depreciate accordingly.

- Distribution: Funds may distribute dividends and capital gains to investors based on their share ownership.

- Redemption: You can sell your shares back to the fund at their current net asset value (NAV).

Advantages of Mutual Funds

Mutual funds offer several advantages for investors:

- Diversification: Investing in a mutual fund automatically diversifies your portfolio by spreading your investment across a wide range of securities. This reduces risk by minimizing the impact of any single investment’s poor performance.

- Professional Management: You benefit from the expertise of experienced fund managers who make investment decisions on your behalf.

- Accessibility: Mutual funds are readily available through brokerage accounts and various financial institutions, making them easy to purchase.

- Transparency: Mutual funds are required to disclose their holdings and performance regularly, providing investors with valuable information about their investments.

Disadvantages of Mutual Funds

While mutual funds offer benefits, there are also some potential drawbacks:

- Fees: Mutual funds typically charge annual fees, including management fees and expense ratios. These fees can impact your overall return.

- Tax Implications: Dividends and capital gains distributions from mutual funds are subject to taxation.

- Performance Variation: Fund performance can vary significantly, depending on the market conditions and the fund manager’s investment strategy.

Conclusion

Mutual funds can be a valuable part of a diversified investment portfolio, providing access to professional management, diversification, and potentially higher returns. However, it’s important to carefully research different funds, understand their investment strategies, and consider their fees and tax implications before making any investment decisions.

Types of Mutual Funds: Exploring Your Options

Mutual funds are a popular investment vehicle that allows individuals to pool their money together to invest in a diversified portfolio of securities. By investing in a mutual fund, you gain access to a wide range of assets, professional management, and potentially higher returns than you might achieve on your own. But with so many different types of mutual funds available, choosing the right one for your needs can be overwhelming. This guide will explore the various types of mutual funds to help you make an informed decision.

1. Equity Funds

Equity funds, also known as stock funds, invest primarily in stocks. These funds aim to generate capital appreciation by investing in companies with the potential for growth. There are various types of equity funds, including:

- Large-cap funds invest in companies with large market capitalizations, typically those with a market value of over $10 billion.

- Mid-cap funds focus on companies with mid-sized market capitalizations, usually between $2 billion and $10 billion.

- Small-cap funds invest in companies with smaller market capitalizations, typically under $2 billion.

- Growth funds seek out companies that are expected to experience rapid earnings growth.

- Value funds focus on undervalued companies with strong fundamentals.

- Sector funds concentrate their investments in specific industries, such as technology, healthcare, or energy.

2. Bond Funds

Bond funds invest in a portfolio of bonds, which are debt securities that represent loans to companies or governments. Bond funds typically provide a stream of income through interest payments and aim to preserve capital. Here are some common types of bond funds:

- Government bond funds invest in bonds issued by the U.S. government.

- Corporate bond funds invest in bonds issued by corporations.

- High-yield bond funds, also known as junk bond funds, invest in bonds with lower credit ratings but potentially higher returns.

- Municipal bond funds invest in bonds issued by state and local governments, which are often tax-exempt.

3. Balanced Funds

Balanced funds, also known as hybrid funds, aim to achieve a balance between growth and income by investing in a combination of stocks and bonds. They provide diversification across asset classes, reducing overall portfolio risk.

4. Money Market Funds

Money market funds invest in short-term debt securities, such as U.S. Treasury bills and commercial paper. They are designed to preserve capital while providing a small return. Money market funds are generally considered a safe and liquid investment option.

5. Index Funds

Index funds track a specific market index, such as the S&P 500 or the Nasdaq 100. They aim to match the performance of the underlying index, providing low-cost diversification across a broad range of securities.

Choosing the Right Mutual Fund

The best type of mutual fund for you depends on your individual investment goals, risk tolerance, and time horizon. Consider these factors when making your decision:

- Investment objective: What are you hoping to achieve with your investment? Growth, income, or preservation of capital?

- Risk tolerance: How comfortable are you with potential losses? A higher risk tolerance may lead you to invest in equity funds, while a lower risk tolerance may suggest bond funds or balanced funds.

- Time horizon: How long do you plan to invest? Longer time horizons allow for greater potential for growth.

- Fees: Mutual funds charge fees for management, administration, and other expenses. Compare the expense ratios of different funds before making a decision.

It’s essential to conduct thorough research and consult with a financial advisor before investing in any mutual fund. They can help you understand the various types of funds, assess your risk tolerance, and choose an investment strategy that aligns with your individual financial goals.

Understanding Mutual Fund Fees and Expense Ratios

Mutual funds are a popular investment vehicle for individuals seeking to diversify their portfolios. However, it’s crucial to understand the fees and expenses associated with these funds before investing. This article will delve into the key concepts of mutual fund fees and expense ratios, providing you with the knowledge to make informed investment decisions.

Types of Mutual Fund Fees

Mutual funds can charge various fees, including:

- Front-end load: A fee charged at the time of purchase, typically a percentage of the investment amount. This fee is used to compensate brokers and sales representatives.

- Back-end load: A fee charged when you sell your shares, usually decreasing over time. This fee discourages investors from redeeming their shares too early.

- 12b-1 fee: A fee used to cover marketing and distribution costs. This fee is charged annually and can be a percentage of the fund’s assets.

- Expense ratio: An annual fee that covers the fund’s operating expenses, such as management fees, administrative costs, and trading expenses.

Understanding Expense Ratios

The expense ratio is a crucial factor to consider when evaluating mutual funds. It represents the percentage of a fund’s assets that are used to cover its operational costs. A higher expense ratio means that more of your money is going towards fees and less towards actual investment returns.

For example, a fund with an expense ratio of 1% will deduct 1% of its assets annually to cover its operating expenses. This means that if the fund has $100,000 in assets, $1,000 will be deducted annually for expenses.

How Expense Ratios Impact Returns

Expense ratios can significantly impact your investment returns over time. Since fees are deducted from the fund’s assets, they reduce the potential for growth. A higher expense ratio can result in lower returns compared to funds with lower expense ratios.

Consider this example: Two funds with identical investment strategies, one with a 1% expense ratio and another with a 0.5% expense ratio. Over a 10-year period, the fund with the lower expense ratio could potentially generate higher returns due to the lower fees.

Comparing Expense Ratios

When comparing mutual funds, it’s essential to consider the expense ratios of similar funds. You should aim for funds with lower expense ratios, but keep in mind that the performance of a fund is also influenced by its investment strategy and the market conditions.

While a lower expense ratio is generally desirable, it’s important to remember that it’s just one factor to consider. The overall performance of the fund is more important than just its expense ratio. Look for funds with strong track records, experienced managers, and strategies that align with your investment goals.

Determining Your Investment Goals and Risk Tolerance

Investing can be a daunting task, but it’s essential for building a secure financial future. Before you start investing, it’s crucial to determine your investment goals and risk tolerance. These two factors will help you make informed investment decisions and choose the right investment strategies.

Investment Goals

Your investment goals are your financial aspirations, both short-term and long-term. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART).

- Short-term goals typically have a time horizon of less than five years. Examples include:

- Saving for a down payment on a house

- Funding a vacation

- Paying off debt

- Long-term goals have a time horizon of five years or more. Examples include:

- Retirement planning

- Saving for your child’s education

- Building wealth

Risk Tolerance

Risk tolerance is your ability and willingness to accept potential losses in pursuit of higher returns. It’s a crucial aspect of investing because it determines the types of investments you’re comfortable with.

- High-risk tolerance investors are comfortable with potentially losing money in exchange for the possibility of significant gains. They may choose investments like stocks, penny stocks, or speculative real estate.

- Low-risk tolerance investors prioritize preservation of capital and are averse to substantial losses. They may prefer low-risk investments like bonds, money market accounts, or certificates of deposit.

Determining Your Risk Tolerance

There are several ways to assess your risk tolerance:

- Consider your financial situation. Your income, expenses, debt levels, and overall financial stability play a role in your risk tolerance.

- Evaluate your investment time horizon. Longer time horizons allow for more risk-taking, as you have more time to recover from potential losses.

- Assess your emotional response to market fluctuations. How would you feel if your investment portfolio experienced a significant drop?

- Consider your investment goals. The more urgent your goals, the less risk you should take.

- Take an online risk tolerance questionnaire. Many financial institutions offer online quizzes to help you gauge your risk tolerance.

Matching Your Goals and Risk Tolerance

Once you’ve identified your investment goals and risk tolerance, you can start matching them with appropriate investment strategies. For example, if you have a high risk tolerance and a long-term investment horizon, you might consider investing a larger portion of your portfolio in stocks. Conversely, if you have a low risk tolerance and a short-term investment horizon, you might prefer to invest in low-risk assets like bonds.

Important Considerations

It’s important to note that your investment goals and risk tolerance can change over time. As your financial situation evolves, so should your investment strategies. It’s always a good idea to review your investments regularly and make adjustments as needed.

Investing is a journey, not a destination. By taking the time to define your goals and risk tolerance, you can make informed decisions that align with your financial aspirations and build a solid foundation for a secure future.

Choosing the Right Mutual Funds for Your Portfolio

Mutual funds are a great way to diversify your investment portfolio and gain exposure to a wide range of assets. But with so many different funds to choose from, it can be overwhelming to know where to start. Here are some tips to help you choose the right mutual funds for your portfolio:

1. Determine Your Investment Goals and Risk Tolerance

Before you start looking at specific funds, it’s important to understand your investment goals and risk tolerance. What are you hoping to achieve with your investments? Are you saving for retirement, a down payment on a house, or your child’s education? How much risk are you willing to take on to reach your goals?

2. Consider Different Fund Categories

There are many different types of mutual funds, each with its own investment strategy. Some common categories include:

- Stock Funds: Invest in stocks of companies of different sizes and industries.

- Bond Funds: Invest in bonds, which are debt securities issued by companies or governments.

- Index Funds: Track a specific market index, such as the S&P 500.

- Target-Date Funds: Designed for retirement savings and automatically adjust their asset allocation over time.

3. Research Fund Performance and Fees

Once you’ve identified some funds that align with your investment goals and risk tolerance, it’s time to research their performance and fees. Look at the fund’s historical returns, expense ratio, and turnover rate. You can use online tools like Morningstar or Fidelity to find this information.

4. Pay Attention to the Fund Manager

The fund manager is the individual responsible for making investment decisions for the fund. Research the fund manager’s experience, track record, and investment philosophy. A skilled fund manager can significantly impact the fund’s performance.

5. Diversify Your Portfolio

Don’t put all your eggs in one basket. Diversify your portfolio by investing in different types of funds across different asset classes. This will help to reduce your overall risk.

6. Monitor Your Investments Regularly

Once you’ve invested in a mutual fund, it’s important to monitor its performance regularly. You should rebalance your portfolio periodically to ensure that your asset allocation remains aligned with your investment goals. You should also review the fund’s performance and fees to make sure it’s still meeting your needs.

Developing a Diversified Investment Strategy with Mutual Funds

Mutual funds are a popular investment option for individuals of all experience levels. They offer a simple and convenient way to diversify your portfolio and gain exposure to a wide range of assets, from stocks and bonds to real estate and commodities. By investing in mutual funds, you can potentially achieve your financial goals while managing risk effectively.

A diversified investment strategy using mutual funds involves carefully selecting a mix of funds that align with your investment objectives, risk tolerance, and time horizon. It is crucial to consider the following factors:

1. Asset Allocation:

Asset allocation refers to the distribution of your investment portfolio across different asset classes, such as stocks, bonds, real estate, and cash. Determining the optimal asset allocation depends on your risk tolerance and time horizon.

For instance, if you are a young investor with a long time horizon, you may allocate a larger portion of your portfolio to stocks, which historically have provided higher returns than bonds over the long term. However, if you are nearing retirement, you may prefer a more conservative approach with a higher allocation to bonds, which tend to be less volatile than stocks.

2. Fund Selection:

Once you have determined your asset allocation, you need to select individual mutual funds within each asset class. It is essential to research funds carefully, considering factors such as:

- Investment Style: Does the fund focus on growth stocks, value stocks, or a blend of both? Does it invest in large-cap, mid-cap, or small-cap companies?

- Expense Ratio: The expense ratio is the annual fee charged by the fund manager. Lower expense ratios generally translate to higher returns for investors.

- Past Performance: While past performance is not necessarily indicative of future results, it can provide insights into the fund manager’s skills and investment strategy.

- Fund Size: Larger funds may offer greater diversification and liquidity, but smaller funds could potentially provide higher returns.

3. Rebalancing:

Rebalancing is the process of adjusting your portfolio’s asset allocation periodically to maintain your desired investment strategy. As market conditions change, the value of different asset classes can fluctuate, leading to deviations from your original allocation.

Regularly rebalancing your portfolio ensures that you remain aligned with your risk tolerance and investment objectives. A common rebalancing frequency is annually or semi-annually.

4. Monitoring and Adjusting:

It is important to monitor your portfolio’s performance and adjust your investment strategy as needed. Consider factors such as:

- Changes in your financial situation, such as a job change or an increase in income.

- Market trends and economic conditions.

- Performance of individual funds within your portfolio.

Making adjustments to your investment strategy based on these factors can help you stay on track to achieve your financial goals.

Benefits of a Diversified Mutual Fund Strategy:

A diversified mutual fund strategy offers several advantages, including:

- Reduced Risk: Diversification helps to mitigate risk by spreading your investments across different asset classes and sectors. This reduces the impact of any single investment’s performance on your overall portfolio.

- Professional Management: Mutual funds are managed by experienced professionals who have expertise in selecting and managing investments. This can save you time and effort.

- Convenience: Mutual funds offer a convenient way to invest in a wide range of assets through a single investment. You can easily buy and sell fund shares through your brokerage account.

- Liquidity: Mutual fund shares are generally highly liquid, meaning you can easily buy and sell them on the market.

- Transparency: Mutual funds are required to disclose information about their holdings, fees, and performance, providing investors with transparency.

Developing a diversified investment strategy using mutual funds can be an effective way to manage risk and potentially achieve your financial goals. By carefully considering your investment objectives, risk tolerance, and time horizon, you can create a portfolio that is tailored to your individual needs.

Investing in Mutual Funds: Long-Term vs. Short-Term

Mutual funds are a popular investment option for both seasoned investors and those just starting out. They offer diversification, professional management, and relative ease of access. But when it comes to mutual fund investing, there’s a crucial consideration: time horizon. This article will delve into the differences between investing in mutual funds for the long term versus the short term, helping you make informed decisions about your investment strategy.

Long-Term Investing (5+ Years)

Long-term investing in mutual funds is often associated with the concept of “buy and hold.” The idea is to invest in funds with a proven track record and hold them for an extended period, weathering market fluctuations along the way. Here’s why long-term investing is beneficial:

- Compounding Returns: Over time, your investments grow not only on the principal but also on the accumulated earnings, generating exponential returns.

- Market Volatility: Short-term market fluctuations are less impactful over the long term. Market downturns are seen as opportunities to buy more shares at lower prices, ultimately averaging out your cost over time.

- Tax Efficiency: Long-term capital gains are taxed at a lower rate than short-term gains, making long-term investments more tax-efficient.

Short-Term Investing (Less than 5 Years)

Short-term investing in mutual funds involves holding investments for a shorter period, typically less than five years. This approach may be suitable for specific goals, such as:

- Emergency Fund: Investing in a low-risk mutual fund for a short period can provide access to funds in case of an emergency.

- Short-Term Goals: If you have a goal that needs to be met within a few years, you might choose a short-term investment strategy.

However, short-term investing in mutual funds comes with certain risks:

- Market Fluctuation Risk: The market is constantly changing, and short-term investments are more vulnerable to market downturns.

- Loss of Principal: There’s a higher chance of losing money in the short term due to market volatility.

- Tax Inefficiency: Short-term capital gains are taxed at a higher rate, leading to potential tax liabilities.

Choosing the Right Time Horizon

Ultimately, the optimal time horizon for investing in mutual funds depends on your individual circumstances, risk tolerance, and investment goals. Here are some factors to consider:

- Investment Goals: Are you saving for retirement, a down payment on a house, or a child’s education? Your goals will determine the time horizon.

- Risk Tolerance: How comfortable are you with market volatility? If you’re risk-averse, a longer time horizon is generally recommended.

- Financial Situation: Your current income, expenses, and debt levels will influence your investment choices.

It’s advisable to consult with a financial advisor to determine the best time horizon for your investment strategy. They can help you assess your risk tolerance, understand the complexities of the market, and create a personalized plan that aligns with your financial goals.

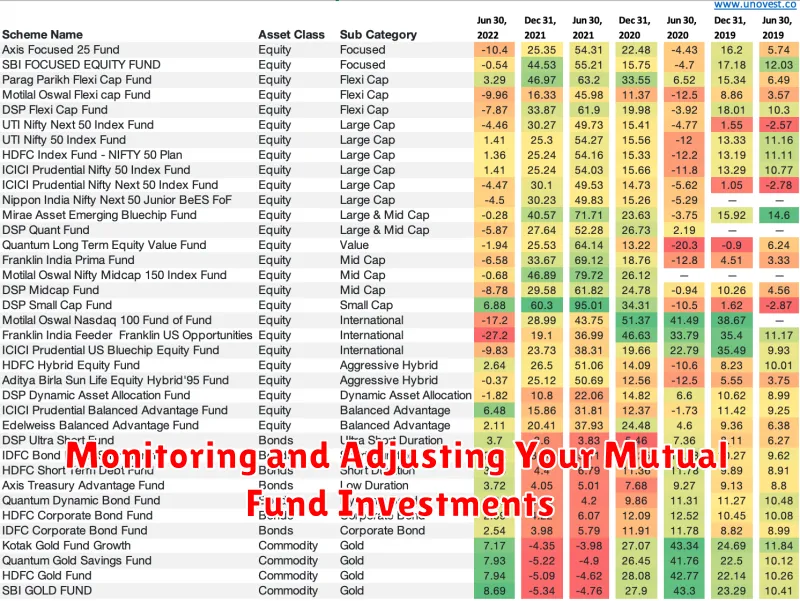

Monitoring and Adjusting Your Mutual Fund Investments

Mutual funds can be a great way to diversify your investment portfolio and achieve your financial goals. However, it’s important to remember that mutual funds are not a “set it and forget it” investment. You need to actively monitor your investments and make adjustments as needed. This means staying informed about market conditions, the performance of your funds, and your own financial goals.

How Often Should You Monitor Your Mutual Funds?

There is no one-size-fits-all answer to this question. However, a good rule of thumb is to review your mutual fund holdings at least once a year, and more frequently if there are significant changes in your financial situation or the market.

What to Look For When Monitoring Your Mutual Funds

When reviewing your mutual fund holdings, here are some key things to consider:

- Performance: How have your funds performed over the past year, three years, five years, and since inception? Are they meeting your expectations?

- Fees: Are the fees you are paying for your funds reasonable?

- Fund Manager: Has there been any change in fund management?

- Investment Strategy: Is the fund’s investment strategy still aligned with your goals?

- Market Conditions: How are market conditions affecting your investments?

Adjusting Your Mutual Fund Investments

If you are not satisfied with the performance of your mutual funds, or if your financial goals have changed, you may need to make adjustments to your portfolio. This could include:

- Switching Funds: If you are unhappy with the performance of a particular fund, you may want to switch to a different fund with a similar investment strategy.

- Adding Funds: If you are looking to increase your exposure to a particular asset class, you may want to add a new fund to your portfolio.

- Reducing Your Exposure: If you are concerned about market volatility, you may want to reduce your exposure to certain asset classes.

Tips for Monitoring Your Mutual Fund Investments

Here are a few tips for monitoring your mutual fund investments:

- Set Up Regular Reminders: Set up calendar reminders to review your investments on a regular basis.

- Use Online Tools: There are a number of online tools that can help you track your investments and compare fund performance.

- Talk to a Financial Advisor: If you are unsure about how to monitor your investments or make adjustments, consider talking to a financial advisor.