Planning for retirement is a crucial part of financial well-being, but it’s a complex process that can be significantly impacted by a factor many people overlook: healthcare costs. As you approach retirement, your healthcare expenses are likely to increase, posing a significant threat to your carefully crafted retirement plan. Rising healthcare costs are a growing concern for Americans, and for good reason. Medical bills, prescription drugs, and long-term care can quickly drain your savings, forcing you to make difficult choices about your lifestyle and quality of life in retirement.

This article delves into the impact of healthcare costs on retirement planning. We’ll explore the rising trends in healthcare spending, discuss the various costs you may encounter, and provide practical strategies for mitigating the financial burden. By understanding the challenges and opportunities, you can take proactive steps to ensure a financially secure and healthy retirement.

Understanding the Rising Costs of Healthcare

Healthcare costs have been steadily increasing for decades, becoming a significant burden for individuals, families, and the overall economy. Understanding the factors contributing to these rising costs is crucial for finding solutions and ensuring access to affordable healthcare for all.

Factors Contributing to Rising Healthcare Costs:

Several factors contribute to the escalating healthcare costs, including:

- Technological advancements: While innovative medical technologies offer significant benefits, they often come with high costs. New treatments, procedures, and medical devices can be expensive to develop and implement.

- Aging population: As the population ages, the demand for healthcare services increases, leading to higher utilization and costs. Older individuals tend to have more chronic conditions requiring ongoing care.

- Chronic diseases: The prevalence of chronic diseases like diabetes, heart disease, and cancer is on the rise, resulting in long-term care needs and increased healthcare expenditures.

- Administrative costs: The complex administrative processes associated with healthcare, including insurance claims processing and billing, contribute significantly to overall costs.

- Drug costs: Pharmaceutical prices have been steadily increasing, driven by factors like research and development costs, patent protections, and limited competition in the market.

- Defensive medicine: Healthcare providers may order unnecessary tests and procedures to avoid potential lawsuits, contributing to inflated costs.

Consequences of Rising Healthcare Costs:

The rising costs of healthcare have significant consequences for individuals, families, and the economy:

- Reduced access to care: Higher costs can make healthcare inaccessible for many individuals and families, leading to delayed care and potentially worse health outcomes.

- Financial strain: Healthcare costs can place a significant financial burden on individuals and families, leading to debt, reduced savings, and difficulty meeting other essential needs.

- Slower economic growth: High healthcare costs can stifle economic growth by diverting resources away from other sectors and impacting productivity.

Addressing Rising Healthcare Costs:

Addressing the rising costs of healthcare requires a multifaceted approach involving:

- Promoting preventive care: Focusing on preventive measures can reduce the incidence of chronic diseases and lower healthcare costs in the long run.

- Improving efficiency: Streamlining administrative processes, reducing unnecessary tests, and promoting cost-effective treatments can help lower healthcare costs.

- Negotiating drug prices: Finding ways to negotiate lower drug prices, such as allowing for importation from other countries or promoting generic alternatives, can significantly impact healthcare costs.

- Investing in research and innovation: Continued investment in research and development can lead to new technologies and treatments that improve healthcare outcomes and potentially lower costs over time.

Understanding the factors contributing to the rising costs of healthcare is essential for finding solutions that ensure affordable and accessible care for all.

Estimate Your Healthcare Needs in Retirement

Retirement is a significant life transition that requires meticulous planning, particularly when it comes to healthcare. As you age, your health needs are likely to change, and managing these costs can be a major concern. Accurately estimating your healthcare expenses in retirement is crucial to ensure financial security and peace of mind.

Factors to Consider:

To estimate your healthcare costs, consider these important factors:

- Age and Health Status: Older individuals generally experience higher healthcare costs due to an increased likelihood of chronic conditions and the need for more frequent medical care.

- Lifestyle Habits: Factors such as diet, exercise, and smoking habits can influence your health and potentially impact your healthcare expenses.

- Family History: Understanding your family’s medical history can help anticipate potential health issues you may face in retirement.

- Prescription Medications: The number and cost of prescription medications you need can significantly impact your healthcare budget.

- Long-Term Care: If you anticipate needing assisted living or nursing home care, these costs can be substantial and require separate planning.

Estimating Tools and Resources:

Several tools and resources can help you estimate your healthcare costs in retirement:

- Medicare.gov: Provides information about Medicare coverage, costs, and benefits.

- HealthCare.gov: Offers a tool to estimate healthcare costs based on your location and income.

- Financial Planners: Consulting a financial planner can provide personalized guidance on retirement planning, including healthcare expenses.

Tips for Saving for Healthcare Costs:

Here are some tips to help you save for your healthcare needs in retirement:

- Start Saving Early: The earlier you begin, the more time your investments have to grow.

- Contribute to Health Savings Accounts (HSAs): If eligible, HSAs offer tax advantages for healthcare expenses.

- Maintain a Healthy Lifestyle: By engaging in healthy habits, you can potentially reduce your healthcare costs.

Conclusion:

Estimating your healthcare costs in retirement is essential for comprehensive financial planning. By considering various factors, utilizing available resources, and implementing smart saving strategies, you can prepare for the healthcare needs of your golden years with confidence.

Factor in Healthcare Costs When Creating a Retirement Budget

Retirement is a time to relax and enjoy life after years of hard work. But, it’s also a time when your healthcare needs may increase. As you age, you’re more likely to experience health problems that require expensive medical care. This is why it’s essential to factor in healthcare costs when creating a retirement budget.

According to the Department of Health and Human Services, healthcare costs for retirees can vary significantly depending on their health status, age, and location. However, it’s safe to say that healthcare expenses will be a significant part of your retirement budget.

Here are a few tips for factoring in healthcare costs when creating a retirement budget:

- Estimate your healthcare expenses. Use online calculators or talk to a financial advisor to get a realistic estimate of how much you’ll need to spend on healthcare in retirement.

- Consider long-term care costs. Long-term care can be very expensive, so it’s important to factor in the possibility of needing this type of care in your budget.

- Explore your healthcare options. There are a number of different healthcare options available to retirees, such as Medicare, Medicaid, and private insurance. Research these options to find the best fit for your needs and budget.

- Save early and often. The earlier you start saving for retirement, the more time your money has to grow. This will make it easier to cover your healthcare expenses in retirement.

By factoring in healthcare costs when creating a retirement budget, you can ensure that you have enough money to cover your medical expenses and enjoy a comfortable retirement.

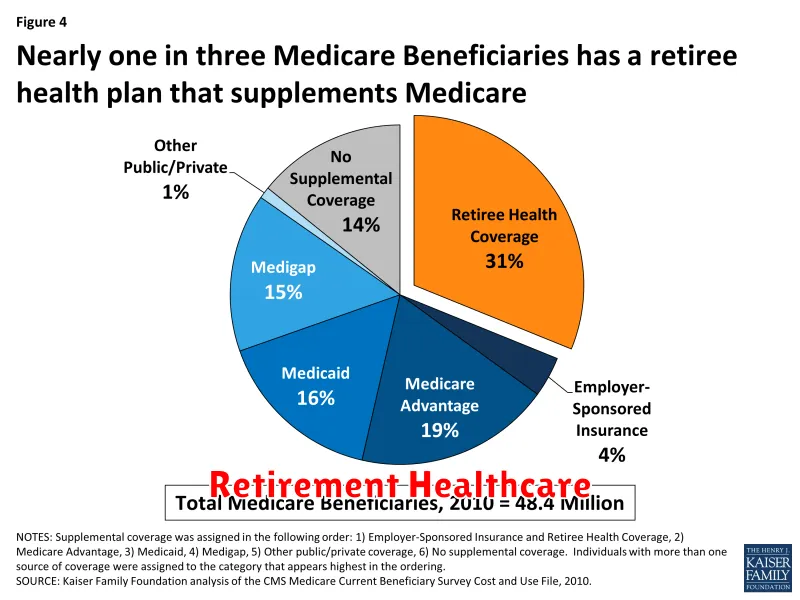

Explore Different Health Insurance Options for Retirees

Retirement is a time to relax and enjoy the fruits of your labor, but it’s also a time to consider your health insurance needs. Your needs may change in retirement, and you may need to switch to a different plan. There are several different health insurance options available for retirees, and it’s important to choose one that’s right for you.

Medicare is a government-funded health insurance program for people over 65. It’s a good option if you have limited income. There are four parts to Medicare:

- Part A (Hospital Insurance) covers inpatient hospital stays, skilled nursing facilities, hospice care, and some home health care.

- Part B (Medical Insurance) covers doctor’s visits, outpatient care, preventive services, and some medical equipment.

- Part C (Medicare Advantage) offers private health insurance plans that can provide coverage for Part A, Part B, and sometimes prescription drugs.

- Part D (Prescription Drug Coverage) covers prescription drugs.

If you’re eligible for Medicare, you’ll likely want to enroll in it. However, you can choose to get coverage from a private insurance company instead. This may be a good option if you want more flexibility or if you don’t qualify for Medicare.

Here are some other health insurance options for retirees:

- Employer-sponsored health insurance: Some employers offer health insurance to retirees. This is a good option if your former employer offers a generous plan.

- Individual health insurance: You can purchase individual health insurance from a private insurance company. This option gives you a lot of flexibility, but it can be expensive.

- Health savings accounts (HSAs): HSAs are tax-advantaged savings accounts that you can use to pay for healthcare expenses. This is a good option if you’re healthy and expect to have relatively low healthcare costs.

No matter what health insurance option you choose, it’s important to carefully compare plans and choose one that meets your needs and budget. You should also consider your health status and your expected healthcare costs.

Talking to a licensed insurance agent can help you find the right health insurance plan for you. An agent can help you understand your options and compare different plans. They can also help you enroll in a plan and make sure that you’re getting the coverage that you need.

Maximize Retirement Savings Vehicles Like 401(k)s and IRAs

Retirement may seem like a distant thought, but it’s never too early to start planning for your future. One of the most effective ways to secure a comfortable retirement is by maximizing your contributions to retirement savings vehicles like 401(k)s and IRAs. These accounts offer significant tax advantages and can help you accumulate a substantial nest egg over time.

401(k)s: Your Employer-Sponsored Savings Plan

A 401(k) is a retirement savings plan offered by your employer. With a 401(k), you contribute a portion of your pre-tax salary to an account that grows tax-deferred. This means that you don’t have to pay taxes on your earnings until you withdraw them in retirement. Many employers also offer matching contributions, which essentially provide free money towards your retirement savings.

IRAs: Individual Retirement Accounts

An IRA is a retirement savings plan that you set up and manage yourself. There are two main types of IRAs: traditional and Roth.

- Traditional IRAs offer tax-deductible contributions, meaning you can deduct your contributions from your taxable income. You’ll then pay taxes on the withdrawals in retirement.

- Roth IRAs require you to contribute after-tax dollars, but your withdrawals in retirement are tax-free.

Maximizing Your Contributions

The key to maximizing your retirement savings is to contribute the maximum amount allowed each year. For 2023, the annual contribution limit for 401(k)s is $22,500, and for IRAs it’s $6,500. If you’re 50 or older, you can contribute an additional $7,500 to your 401(k) and $1,000 to your IRA.

Investment Strategies

Once you’ve chosen your retirement savings vehicles, you need to decide how to invest your contributions. Consider your risk tolerance, time horizon, and financial goals. A diversified portfolio that includes stocks, bonds, and other asset classes can help mitigate risk and potentially achieve higher returns.

Start Early and Stay Consistent

The earlier you start saving for retirement, the more time your money has to grow. Even small, consistent contributions can add up significantly over time. Remember, compound interest is a powerful force that can work in your favor.

Seek Professional Advice

If you’re unsure about how to maximize your retirement savings, consider seeking professional advice from a financial advisor. A financial advisor can help you develop a personalized retirement plan tailored to your specific needs and goals.

By taking these steps, you can set yourself up for a comfortable and secure retirement. Don’t delay – start maximizing your retirement savings today!

Consider Long-Term Care Insurance Options

Long-term care is a significant expense that many people don’t plan for. It can include a wide range of services, such as assistance with daily living activities, skilled nursing care, and home health care. The cost of long-term care can quickly deplete savings and retirement funds, leaving families in a difficult financial situation.

Long-term care insurance can help protect you and your family from these financial burdens. It is a type of insurance that helps pay for the costs of long-term care services. While it can be an expensive premium, it’s a good idea to investigate the possibility of long-term care insurance.

Types of Long-Term Care Insurance

There are many different types of long-term care insurance policies available. Some common types include:

- Traditional long-term care insurance: This type of policy provides coverage for a wide range of long-term care services, including nursing home care, assisted living, and home health care.

- Hybrid long-term care insurance: These policies combine long-term care coverage with life insurance or an annuity. This can be a good option for people who want to protect their assets and ensure that their loved ones will have financial security.

- Partnership long-term care insurance: These policies are offered by state governments and provide additional benefits, such as asset protection, if you need to use Medicaid.

Benefits of Long-Term Care Insurance

There are many benefits to purchasing long-term care insurance, including:

- Financial protection: Long-term care insurance can help protect your savings and retirement funds from the high costs of long-term care.

- Peace of mind: Knowing that you have long-term care insurance can give you peace of mind that you will be able to afford the care you need.

- Choice of care: Long-term care insurance can give you more choices about where and how you receive care.

- Preservation of assets: Long-term care insurance can help you preserve your assets for your family and loved ones.

Things to Consider

Before purchasing long-term care insurance, it’s important to consider several factors, such as:

- Your age and health: The younger and healthier you are, the lower your premiums will be.

- Your financial situation: Make sure you can afford the premiums and other costs associated with long-term care insurance.

- Your family history: If you have a family history of long-term care needs, it may be especially important to consider long-term care insurance.

Conclusion

Long-term care insurance can be a valuable investment to protect your financial security and ensure you can afford the care you need. It’s important to carefully consider your individual needs and circumstances to make the right decision for you. Consulting with a financial advisor or insurance agent can be helpful to make informed decisions about long-term care insurance.

Create a Strategy to Manage Healthcare Expenses in Retirement

Healthcare expenses are a significant concern for many retirees. As you age, you’re more likely to experience health issues, and these can be costly. A well-planned strategy can help you manage these costs and ensure that you have access to the care you need.

Estimate Your Healthcare Costs

The first step in creating a healthcare strategy is to estimate your costs. This will help you understand how much you’ll need to save and how much you’ll be able to spend on other things. There are a number of resources available to help you with this, including online calculators and financial advisors. Be sure to include costs for:

- Health insurance premiums

- Prescription drugs

- Over-the-counter medications

- Doctor’s visits

- Hospital stays

- Long-term care

Explore Your Coverage Options

Once you’ve estimated your costs, it’s time to explore your coverage options. There are a number of different health insurance plans available to retirees, and it’s important to choose one that meets your needs and budget. Consider these options:

- Medicare: The federal government’s health insurance program for people 65 and older. It’s generally the most affordable option.

- Medicare Advantage: A private health insurance plan that contracts with Medicare. It may offer additional benefits, but premiums and co-pays can be higher.

- Medicare Supplement: A private insurance plan that helps pay for costs that Medicare doesn’t cover. It’s good for those who want the peace of mind that comes with having supplemental coverage.

- Employer-sponsored coverage: If you’re still working, you may be able to stay on your employer’s health insurance plan after you retire. This may be a good option if your employer offers a good plan.

You can also consider purchasing a long-term care insurance policy. This type of insurance helps pay for the costs of long-term care services, such as assisted living or nursing home care. It can help protect you and your family from the financial burden of these costs.

Reduce Your Costs

Once you’ve chosen your coverage, there are a number of things you can do to reduce your healthcare costs. Here are some tips:

- Shop around for prescription drugs

- Use generic medications whenever possible

- Take advantage of preventive care services

- Make healthy lifestyle choices

- Take advantage of discounts for seniors

Save for Healthcare

It’s important to save for healthcare costs, just as you would for other retirement expenses. You can save in a Health Savings Account (HSA) or use a traditional or Roth IRA to save for healthcare costs. HSA contributions are tax-deductible and withdrawals are tax-free when used for qualified medical expenses.

Prepare for the Unexpected

Even with careful planning, there’s always the possibility of an unexpected healthcare expense. It’s important to have a plan in place for these situations. This could involve having a line of credit or emergency savings account available. You can also consider setting up a trust to help pay for future healthcare costs.

Managing healthcare expenses in retirement is an important part of financial planning. By following the tips above, you can create a strategy that helps you access the care you need while staying within your budget.

Review and Adjust Your Retirement Plan Regularly

Retirement planning is an ongoing process that requires regular review and adjustment. Life is full of unexpected twists and turns, and your financial goals may change over time. It’s important to stay on top of your retirement plan and make necessary adjustments to ensure you’re on track to achieve your financial goals.

There are several reasons why it’s crucial to review and adjust your retirement plan regularly:

Reasons to Review Your Retirement Plan Regularly

- Changes in Income and Expenses: Your income and expenses can fluctuate over time. For example, you may experience a raise, job change, or unexpected medical expenses. These changes can impact your retirement savings goals, so it’s important to adjust your plan accordingly.

- Market Fluctuations: The stock market can be unpredictable, and your investments may experience gains or losses. It’s essential to monitor your portfolio and make adjustments as needed to ensure you’re comfortable with the level of risk.

- Changes in Life Circumstances: Your retirement goals may change as you get older. For example, you may decide to retire earlier than planned or you may need to take care of an elderly parent. It’s important to adjust your retirement plan to reflect these changes.

- Changes in Retirement Legislation: Retirement laws are constantly evolving. It’s important to stay informed about any changes that could affect your retirement savings.

Tips for Reviewing and Adjusting Your Retirement Plan

Here are some tips for reviewing and adjusting your retirement plan:

- Review Your Plan Annually: It’s a good idea to review your retirement plan at least once a year, or more often if you experience any significant life changes.

- Evaluate Your Financial Goals: Re-evaluate your retirement goals to ensure they are still realistic and achievable. Consider your desired lifestyle, expenses, and potential sources of income.

- Assess Your Investment Portfolio: Review your investment portfolio and make sure it’s still aligned with your risk tolerance and time horizon. You may need to adjust your asset allocation or rebalance your portfolio if necessary.

- Consider Your Retirement Income Sources: Think about your retirement income sources, such as Social Security, pensions, and savings. Ensure you have a plan to cover your living expenses in retirement.

- Seek Professional Advice: If you’re unsure about how to review and adjust your retirement plan, consider seeking professional advice from a financial advisor.

Conclusion

Regularly reviewing and adjusting your retirement plan is crucial for ensuring you are on track to reach your financial goals. By staying proactive and making necessary changes, you can increase your chances of achieving a comfortable and secure retirement.