Building wealth is a long-term journey that requires careful planning and strategic decision-making. One crucial aspect of this journey is tax planning. While it may seem like a technical and often overlooked element, tax planning plays a pivotal role in maximizing your financial growth and ensuring your hard-earned money works for you, not against you.

Effective tax planning goes beyond simply filling out your tax returns; it’s about strategically structuring your finances to minimize your tax burden throughout your life. By taking a proactive approach to tax planning, you can unlock significant savings, accelerate your wealth accumulation, and position yourself for a more secure financial future. This article will explore the essential elements of tax planning and how it can be a powerful tool in your wealth-building journey.

Understanding the Basics of Tax Planning

Tax planning is the process of arranging your financial affairs in a way that legally reduces your tax liability. It is a proactive approach to managing your finances, aiming to minimize your tax burden while maximizing your after-tax income and wealth. Effective tax planning involves understanding the tax laws and regulations that apply to your situation and implementing strategies to optimize your tax position.

Benefits of Tax Planning

Tax planning offers several benefits, including:

- Reduced tax liability: By strategically planning your financial decisions, you can lower your tax bill and keep more of your hard-earned money.

- Increased after-tax income: Lower taxes mean more money available for spending, saving, or investing.

- Financial security: Tax planning helps you manage your financial resources more effectively, contributing to long-term financial security.

- Compliance with tax laws: Proper tax planning ensures that you are complying with all applicable tax regulations, avoiding potential penalties and legal issues.

Key Tax Planning Strategies

Tax planning strategies can be tailored to your specific financial situation. Some common strategies include:

- Deductions and credits: Take advantage of eligible deductions and credits to reduce your taxable income.

- Tax-advantaged accounts: Utilize retirement accounts like IRAs and 401(k)s, as well as health savings accounts (HSAs), to enjoy tax benefits and grow your savings.

- Investment strategies: Choose investments that offer tax advantages, such as tax-free municipal bonds or investments held within tax-advantaged accounts.

- Estate planning: Plan for the transfer of your assets to beneficiaries while minimizing estate taxes.

Getting Started with Tax Planning

If you’re looking to start planning for your taxes, consider these steps:

- Gather relevant financial information: This includes income statements, tax returns, investment statements, and other pertinent documents.

- Consult a tax professional: A qualified accountant or financial advisor can provide personalized advice and help you implement strategies tailored to your needs.

- Review and update your plan regularly: Your financial situation and tax laws can change over time, so it’s essential to revisit your plan regularly to ensure it remains effective.

Tax planning is an ongoing process that can help you minimize your tax burden and achieve your financial goals. By understanding the fundamentals and implementing appropriate strategies, you can take control of your finances and enjoy the benefits of reduced taxes.

Strategies for Reducing Your Taxable Income

Paying taxes is an unavoidable part of life, but that doesn’t mean you have to pay more than you legally owe. There are several strategies you can implement to reduce your taxable income and keep more of your hard-earned money. Here are some effective methods:

1. Maximize Deductions and Credits

Deductions and credits are like discounts on your taxes. They directly reduce the amount of your income that is subject to taxation. Some common deductions include:

- Standard deduction or itemized deductions: Choose the option that benefits you most.

- Mortgage interest: If you own a home, you can deduct the interest you pay on your mortgage.

- State and local taxes: Depending on your state, you may be able to deduct certain state and local taxes.

- Charitable contributions: Donations to eligible charities can be deducted from your taxable income.

Credits, on the other hand, directly reduce your tax liability. Some popular tax credits include:

- Earned Income Tax Credit (EITC): This credit is available to low- and moderate-income working individuals and families.

- Child Tax Credit: You can claim this credit for each qualifying child under the age of 17.

- American Opportunity Tax Credit: This credit is available for qualified education expenses.

2. Take Advantage of Retirement Savings Plans

Retirement savings plans like 401(k)s and IRAs offer tax advantages. Contributions to these plans are typically made with pre-tax dollars, reducing your taxable income. Additionally, earnings in these accounts grow tax-deferred, meaning you won’t have to pay taxes on them until you withdraw the money in retirement.

3. Consider a Home Office Deduction

If you use part of your home for business purposes, you may be eligible for the home office deduction. This deduction can help reduce your taxable income by allowing you to deduct expenses related to your home office, such as rent, utilities, and insurance.

4. Explore Tax-Advantaged Investments

Certain investments offer tax advantages that can help reduce your taxable income. For example, municipal bonds are generally exempt from federal income taxes, making them attractive to investors seeking tax-free income.

5. Consult with a Tax Professional

The best way to ensure you’re taking advantage of all available tax-saving strategies is to consult with a qualified tax professional. A tax professional can help you understand your tax situation, identify eligible deductions and credits, and develop a personalized tax plan to minimize your tax liability.

Remember, tax laws are complex and can change frequently. Staying informed about tax strategies and seeking professional advice is crucial for maximizing your tax savings and minimizing your tax burden.

The Power of Tax-Advantaged Investments

Investing can be a powerful tool for building wealth over time. However, taxes can significantly eat away at your investment returns. That’s why it’s important to understand the benefits of tax-advantaged investments, which offer the potential to grow your money faster by reducing your tax liability.

What are Tax-Advantaged Investments?

Tax-advantaged investments are accounts or assets that receive special tax treatment from the government. This means that the income earned from these investments is taxed differently than other types of income, often at a lower rate or not at all.

Types of Tax-Advantaged Investments:

There are several different types of tax-advantaged investments available, including:

- Retirement Accounts:

- 401(k)s: Offered by employers, contributions are often tax-deferred, meaning you don’t pay taxes until you withdraw the money in retirement.

- IRAs: Individual Retirement Accounts, allow individuals to contribute pre-tax dollars or after-tax dollars with tax-free withdrawals in retirement.

- Health Savings Accounts (HSAs): Allow you to contribute pre-tax dollars to cover qualified medical expenses. These funds can grow tax-free and withdrawals for qualified medical expenses are tax-free.

- 529 College Savings Plans: Used to save for college expenses. Contributions may be tax-deductible, and earnings grow tax-deferred. Withdrawals for qualified education expenses are tax-free.

- Municipal Bonds: Issued by state and local governments, the interest earned is often exempt from federal income tax and sometimes state and local taxes.

Benefits of Tax-Advantaged Investments:

Investing in tax-advantaged accounts offers several key advantages:

- Tax Savings: Reduced taxes on investment income can lead to higher returns over time.

- Compounding: Tax-deferred growth allows your investments to compound faster, as you’re not paying taxes on the earnings each year.

- Long-Term Growth Potential: These accounts can help you build wealth steadily over the long term.

Considerations:

While tax-advantaged investments offer significant benefits, it’s important to keep a few things in mind:

- Withdrawal Rules: Most tax-advantaged accounts have specific rules for when and how you can withdraw funds. Early withdrawals may result in penalties.

- Investment Choices: The investment options available within each type of tax-advantaged account can vary.

Conclusion:

Tax-advantaged investments are a powerful tool for building wealth and achieving your financial goals. By understanding the different options available and carefully considering your financial situation, you can choose the right accounts to help you maximize your returns and minimize your tax liability.

Tax-Efficient Estate Planning: Preserving Your Legacy

Estate planning is an essential aspect of financial planning, ensuring your assets are distributed according to your wishes and minimizing tax liabilities. Tax-efficient estate planning involves strategic strategies to reduce the tax burden on your estate, allowing your loved ones to inherit a larger portion of your hard-earned wealth.

Understanding Estate Taxes

In the United States, estate taxes are levied on the value of your assets exceeding the federal exemption amount. This exemption amount changes periodically, and for 2023, it stands at $12.92 million per individual. If your estate value surpasses this threshold, your heirs may face substantial tax obligations.

Key Strategies for Tax-Efficient Estate Planning

Here are some proven strategies to minimize estate taxes and protect your legacy:

1. Gift Tax Exemption

The annual gift tax exclusion allows you to gift up to $17,000 per recipient per year without incurring any gift tax liability. This strategy can be effective for reducing your estate value and maximizing your heirs’ inheritance over time.

2. Charitable Giving

Donating assets to qualified charities can significantly reduce your estate taxes. You can make outright donations or establish a charitable remainder trust, which provides income to you during your lifetime and then distributes the remaining assets to the charity after your death.

3. Revocable Living Trusts

Creating a revocable living trust allows you to maintain control over your assets during your lifetime while specifying how they will be distributed after your passing. Trusts can help avoid probate, a lengthy and costly legal process, and reduce estate taxes.

4. Irrevocable Life Insurance Trusts (ILITs)

An ILIT is a powerful tool for minimizing estate taxes. Life insurance proceeds paid into the trust are typically not included in your taxable estate, allowing your beneficiaries to receive a tax-free inheritance.

5. Estate Tax Planning with Business Owners

Business owners have unique estate planning considerations. Strategies such as using a grantor retained annuity trust (GRAT) or a family limited partnership (FLP) can help reduce the tax burden on your business interests while ensuring a smooth transition to the next generation.

Conclusion

Tax-efficient estate planning is crucial for safeguarding your legacy and maximizing your heirs’ inheritance. By utilizing the strategies outlined above, you can effectively minimize estate taxes and ensure your assets are distributed according to your wishes. It’s essential to consult with a qualified estate planning attorney to develop a customized plan that meets your specific needs and goals.

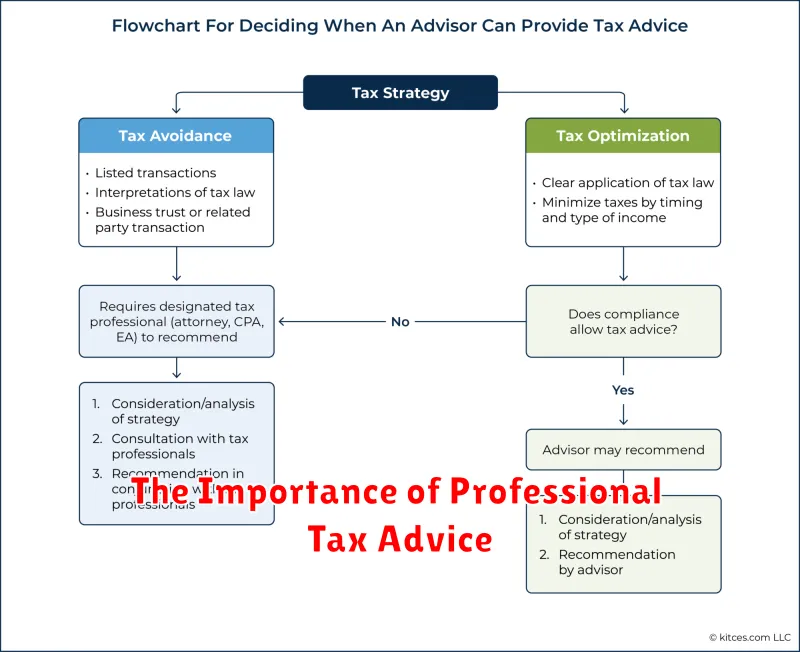

The Importance of Professional Tax Advice

Navigating the complex world of taxes can be a daunting task, especially for individuals and businesses alike. With ever-changing regulations and a myriad of deductions and credits, it’s easy to feel overwhelmed and unsure of how to optimize your tax situation. This is where seeking professional tax advice becomes crucial.

Professional tax advisors, such as certified public accountants (CPAs) or enrolled agents (EAs), possess specialized knowledge and expertise in tax laws and regulations. They can provide invaluable guidance and support throughout the tax year, helping you make informed decisions and ensure compliance.

Benefits of Professional Tax Advice

- Minimize Tax Liability: Tax advisors can help you identify all eligible deductions and credits, reducing your overall tax burden.

- Ensure Compliance: They stay updated on the latest tax laws and regulations, ensuring that you file accurate and timely returns.

- Avoid Penalties: Mistakes on your tax return can result in penalties. Professional advice can help you avoid these costly errors.

- Tax Planning: Tax advisors can help you develop a tax plan to minimize your future tax liability.

- Peace of Mind: Knowing that you have an expert handling your taxes provides peace of mind and reduces stress.

When to Seek Professional Tax Advice

It’s always a good idea to consult with a tax advisor if you’re facing any of the following situations:

- Starting a new business: Setting up your business structure and understanding your tax obligations are essential.

- Significant life changes: Marriage, divorce, the birth of a child, or a major career change can impact your tax situation.

- Complex financial situations: If you have investments, rental properties, or other complex financial arrangements, professional advice is crucial.

- Uncertainty about tax laws: If you’re unsure about how new laws affect you, a tax advisor can provide clarity.

Investing in professional tax advice can save you money and headaches in the long run. By leveraging the expertise of a qualified tax advisor, you can navigate the tax system with confidence and maximize your financial well-being.

Case Studies: How Tax Planning Built Wealth

Tax planning is often seen as a complex and overwhelming process, but it can be a powerful tool for building wealth. By strategically planning your finances, you can reduce your tax liability, save more money, and invest smarter. Here are a few case studies that illustrate the impact of effective tax planning:

Case Study 1: The Early Investor

Sarah, a young professional, started investing early in her career. She understood the importance of compounding and wanted to maximize her returns. By utilizing tax-advantaged accounts like a 401(k) and a Roth IRA, she was able to shelter her earnings from taxes and watch her investments grow significantly over time. Through strategic tax planning, Sarah accumulated a sizable retirement nest egg by the time she reached her 40s.

Case Study 2: The Business Owner

John, a small business owner, was struggling to keep up with his growing tax burden. He was unsure of how to optimize his deductions and minimize his tax liability. By consulting with a tax advisor, he discovered strategies like incorporating his business and utilizing tax credits for small businesses. This helped him significantly reduce his tax bill and reinvest the saved money back into his company, propelling its growth.

Case Study 3: The Real Estate Investor

Emily, a real estate investor, was keen on maximizing her rental income. She learned about the benefits of depreciation, a tax deduction that allows investors to write off the value of their rental properties over time. By utilizing this strategy, Emily was able to lower her taxable income and increase her cash flow, allowing her to reinvest in more properties and build her real estate portfolio.

The Takeaway

These case studies demonstrate how tax planning can be a vital component of building wealth. By understanding your tax obligations and utilizing available strategies, you can optimize your financial position and achieve your financial goals faster. It’s essential to seek professional guidance from a qualified tax advisor to develop a personalized tax plan that meets your specific needs and circumstances.

Common Tax Planning Mistakes to Avoid

Tax planning is an essential part of personal finance. It can help you save money and avoid penalties. However, many people make mistakes when planning their taxes. Here are some common tax planning mistakes to avoid:

Not Keeping Good Records

One of the most common tax planning mistakes is not keeping good records. The IRS requires you to keep accurate records of your income and expenses. This includes receipts, invoices, and bank statements. Without proper documentation, you may not be able to claim all of the deductions and credits you are entitled to.

Failing to Claim All Deductions and Credits

There are many different deductions and credits available to taxpayers. Some common deductions include the standard deduction, itemized deductions, and homeownership deductions. Credits include the Earned Income Tax Credit and the Child Tax Credit. If you don’t claim all of the deductions and credits you qualify for, you could be leaving money on the table.

Not Taking Advantage of Tax-Advantaged Accounts

Tax-advantaged accounts, such as 401(k)s, IRAs, and 529 plans, can help you save money on your taxes. These accounts allow you to grow your investments tax-deferred or tax-free. If you are not taking advantage of these accounts, you are missing out on a significant tax benefit.

Procrastination

Procrastination is another common tax planning mistake. Waiting until the last minute to file your taxes can lead to stress, errors, and penalties. Start gathering your tax documents early and give yourself plenty of time to complete your return. Many free or low-cost tax preparation services can help you file your taxes accurately and on time.

Not Seeking Professional Advice

If you are unsure about any aspect of tax planning, it is always best to seek professional advice from a tax advisor or CPA. They can help you understand your tax obligations, identify deductions and credits you may qualify for, and develop a tax plan that meets your specific needs. Working with a professional can help you save money and avoid penalties.

By avoiding these common tax planning mistakes, you can ensure that you are taking full advantage of the tax system and maximizing your tax savings.

Conclusion: Securing Your Financial Future Through Tax Planning

Tax planning is not just about minimizing your tax liability; it’s about maximizing your financial well-being. By strategically planning your financial moves, you can gain control of your financial future, ensuring that you keep more of what you earn and build a solid foundation for long-term financial security.

Remember, tax planning is an ongoing process, not a one-time event. As your financial situation evolves, so should your tax strategy. Stay informed about tax laws and regulations, seek professional guidance, and take advantage of the opportunities available to optimize your tax situation.

By proactively engaging in tax planning, you can unlock significant benefits, such as:

- Increased financial flexibility: You’ll have more money at your disposal for investments, savings, and other financial goals.

- Reduced tax burden: By minimizing your tax liability, you can save money and increase your overall wealth.

- Peace of mind: Knowing you have a solid tax strategy in place can provide significant peace of mind and reduce stress.

In conclusion, tax planning is an essential part of any sound financial strategy. By taking the time to understand your options and plan accordingly, you can ensure that you’re not just paying your fair share of taxes, but also maximizing your financial well-being for the future.