Retirement is a time for relaxation and enjoying life’s simple pleasures, but it’s also a time when financial planning and management are crucial. After years of working and contributing to your retirement savings, it’s important to make sure that your hard-earned money lasts throughout your golden years. Managing your retirement income and expenses effectively is essential for ensuring a comfortable and secure retirement. This article will provide you with valuable tips on how to navigate the financial aspects of retirement, allowing you to enjoy this new chapter of your life with peace of mind.

Managing your retirement finances can seem daunting, but it doesn’t have to be. With a little planning and a proactive approach, you can create a sustainable budget that meets your needs and allows you to live a fulfilling retirement. From understanding your retirement income sources and developing a spending plan to exploring ways to reduce expenses and protect your assets, we’ll cover all the essential aspects of retirement income management. Whether you’re newly retired or approaching retirement, this guide will provide you with the tools and strategies you need to make the most of your hard-earned savings.

Creating a Realistic Retirement Budget

Retirement is a time to enjoy the fruits of your labor, but it’s also important to be financially prepared. A realistic retirement budget is crucial to ensure you can maintain your desired lifestyle and avoid financial hardship. Here’s a step-by-step guide to creating a budget that works for you:

1. Determine Your Income Sources

Start by identifying all your potential income sources in retirement. This may include:

- Social Security benefits

- Pensions

- Retirement savings (401(k), IRA, Roth IRA)

- Part-time work or side hustles

- Rental income

- Other investments

Estimate how much you can expect to receive from each source, considering factors like inflation and potential changes in tax laws.

2. Project Your Expenses

Next, create a detailed list of your anticipated expenses in retirement. This includes:

- Housing (mortgage payments, rent, property taxes, utilities)

- Food

- Healthcare (medical insurance, prescriptions, over-the-counter medications)

- Transportation (car payments, gas, insurance, public transportation)

- Entertainment and leisure activities

- Travel

- Personal care (haircuts, clothing, toiletries)

- Home maintenance and repairs

- Other miscellaneous expenses

Be thorough and consider both fixed and variable expenses. You may need to adjust your lifestyle to accommodate reduced income in retirement. For example, you might downsize your home, travel less frequently, or cut back on dining out.

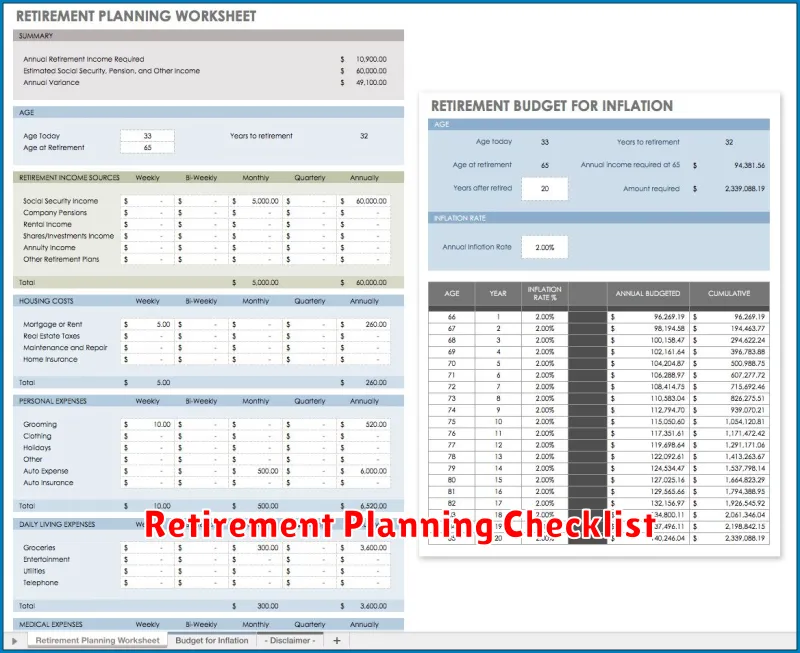

3. Use Online Tools and Calculators

There are numerous online tools and calculators available to help you create a retirement budget. These resources can provide estimates of your expenses based on your current lifestyle and income, and they can help you adjust your savings goals accordingly.

4. Factor in Inflation

It’s essential to account for inflation, as the cost of goods and services will likely increase over time. Use an inflation calculator to adjust your projected expenses for future years.

5. Account for Unexpected Expenses

Life is unpredictable, and unexpected expenses can arise in retirement. Set aside a contingency fund for unforeseen events, such as medical emergencies, home repairs, or car breakdowns.

6. Review and Adjust Regularly

Your retirement budget shouldn’t be a static document. Regularly review and adjust it to reflect changes in your income, expenses, and financial goals. You may need to make adjustments as you age, experience health issues, or simply change your lifestyle preferences.

7. Seek Professional Advice

If you’re struggling to create a realistic retirement budget, consider seeking professional financial advice from a certified financial planner. They can help you develop a personalized strategy tailored to your individual circumstances.

By following these steps, you can create a realistic retirement budget that helps you achieve financial security and peace of mind during your golden years.

Understanding Your Sources of Retirement Income

Retirement is a significant milestone in life, and it’s essential to have a solid plan to ensure financial security during this phase. One crucial aspect of retirement planning is understanding your sources of income. This article will delve into the various avenues you can tap into to fund your golden years, helping you make informed decisions about your financial future.

1. Social Security

Social Security is a government-funded program that provides retirement benefits to eligible individuals. It’s a vital source of income for many retirees. However, it’s important to understand that Social Security is intended to supplement, not fully replace, your other retirement savings. You can claim Social Security benefits at age 62, but your monthly payment will be reduced. You can wait until age 70 to claim, and your payment will be higher.

2. Employer-Sponsored Retirement Plans

Many employers offer retirement plans such as 401(k)s and 403(b)s. These plans allow you to contribute pre-tax dollars to an account that grows tax-deferred. Employer matching contributions can significantly boost your retirement savings. Make sure to take advantage of any matching contributions offered by your employer, as it’s essentially free money.

3. Personal Savings and Investments

Beyond employer-sponsored plans, individual savings and investments play a critical role in retirement planning. Consider opening a Traditional IRA or Roth IRA to build tax-advantaged savings. Explore various investment options, such as stocks, bonds, mutual funds, and real estate, to diversify your portfolio. You can also create a personal investment account to invest in a range of assets based on your risk tolerance and financial goals.

4. Pensions

While less common than in the past, some employers still offer defined benefit pensions, which guarantee a specific monthly payment upon retirement. If you have a pension, it’s essential to understand the terms and conditions of the plan, including the vesting schedule and any potential cost-of-living adjustments.

5. Annuities

Annuities are financial products that provide a guaranteed stream of income during retirement. You can purchase an annuity with a lump sum or through regular payments. Annuities can offer a sense of financial security and help protect you against outliving your savings. However, it’s crucial to carefully consider the pros and cons and consult with a financial advisor before making any decisions.

6. Part-Time Work or Consulting

Many retirees choose to continue working part-time or pursue consulting opportunities. This can provide a supplementary income stream and offer a sense of purpose and engagement during retirement. Explore your skills and experiences and consider how you can contribute to the workforce on a flexible schedule.

7. Reverse Mortgages

A reverse mortgage allows homeowners aged 62 and older to tap into the equity in their homes. It provides a lump sum or regular payments, but the loan must be repaid when you sell the house or move. Reverse mortgages can provide a financial lifeline for seniors with significant home equity, but they come with risks and should be carefully considered.

8. Rental Income

If you own rental property, you can generate a steady stream of income from rent. However, managing rental properties can be time-consuming and involves certain risks. Consider the potential benefits and drawbacks before investing in rental properties.

Conclusion

Retirement income planning is an ongoing process that requires careful consideration of various sources. Understanding your options and their implications will help you create a comprehensive strategy that aligns with your financial goals and lifestyle. Remember, it’s never too early to start planning for retirement, and seeking professional financial advice can provide valuable insights and guidance along the way.

Managing Social Security Benefits

Social Security benefits are a crucial part of retirement planning for many Americans. They provide a steady stream of income that can help cover essential expenses and maintain a comfortable lifestyle. However, managing these benefits effectively is essential to maximizing their value and ensuring financial security.

Here are some key strategies for managing Social Security benefits:

1. Understand Your Benefits

The first step is to understand how Social Security benefits work and how much you are eligible to receive. You can create a My Social Security account to access your personalized benefit information. This will show your estimated retirement benefits, how your earnings record is calculated, and other important details.

2. Plan Your Filing Strategy

The age at which you file for Social Security benefits significantly impacts the amount you receive. You can begin receiving benefits as early as age 62, but your monthly payments will be reduced. Waiting until your full retirement age (FRA), which is 66 or 67 depending on your birth year, will result in the full amount you are entitled to. Delaying benefits beyond your FRA will further increase your monthly payments.

3. Consider a Spousal or Survivor Benefit

If you are married, you may be eligible for spousal or survivor benefits. Spousal benefits can be claimed by a spouse who is not working or has lower earnings than their working spouse. Survivor benefits are payable to a surviving spouse or dependent children after the death of a worker who was receiving Social Security benefits.

4. Monitor Your Benefits

It’s crucial to stay informed about changes to Social Security benefits. The annual cost-of-living adjustment (COLA) is designed to protect against inflation, but benefits can still be affected by changes in law or economic conditions. You can receive updates on your benefits through your My Social Security account.

5. Plan for Taxes

Social Security benefits are taxable for some individuals, depending on their income level. It’s essential to factor in potential taxes when planning your retirement income. You can consult with a financial advisor to determine your tax liability.

By taking these steps, you can effectively manage your Social Security benefits and ensure they provide the financial security you need in retirement.

Making the Most of Your Retirement Savings

Retirement is a time to enjoy the fruits of your labor after years of working. To ensure that you have a comfortable and fulfilling retirement, it’s crucial to plan and save diligently throughout your working years. One of the most important aspects of retirement planning is maximizing your retirement savings. With careful planning and strategic decisions, you can set yourself up for a financially secure and enjoyable retirement.

Start early and be consistent with your savings. The power of compounding works wonders over time. Even small contributions made regularly can accumulate into significant sums. Consider contributing to employer-sponsored retirement plans like 401(k)s or 403(b)s, taking advantage of any employer match available. Employer matching is free money, so be sure to contribute enough to get the full match.

If you are self-employed, consider a Solo 401(k). This will allow you to contribute as an employee and an employer.

Understand the different types of retirement accounts available to you, such as traditional IRAs, Roth IRAs, and 401(k)s. Each has its advantages and disadvantages, and choosing the right one depends on your individual circumstances and financial goals. Consult a financial advisor to determine which options are best for you.

Diversify your retirement portfolio to manage risk. Don’t put all your eggs in one basket. Instead, invest in a mix of stocks, bonds, and other assets to spread your risk and potentially achieve higher returns. Consider working with a financial advisor to create a diversified portfolio that aligns with your risk tolerance and retirement goals.

Take advantage of tax-advantaged retirement accounts. Traditional IRA and 401(k) contributions are tax-deductible, while Roth IRA distributions are tax-free in retirement. These tax benefits can significantly reduce your tax liability and increase your overall savings. Review the tax implications of different retirement account options and choose the one that benefits you most.

Don’t be afraid to adjust your retirement plan as your life changes. Your circumstances, financial goals, and risk tolerance may evolve over time. Regularly review your retirement plan and make necessary adjustments to ensure it remains aligned with your current needs. Seek professional advice from a financial advisor to help you navigate these changes and make informed decisions.

Retirement savings are a crucial foundation for a secure and enjoyable retirement. By taking a proactive approach, understanding your options, and seeking professional advice, you can maximize your savings and achieve your financial goals for a comfortable and fulfilling retirement.

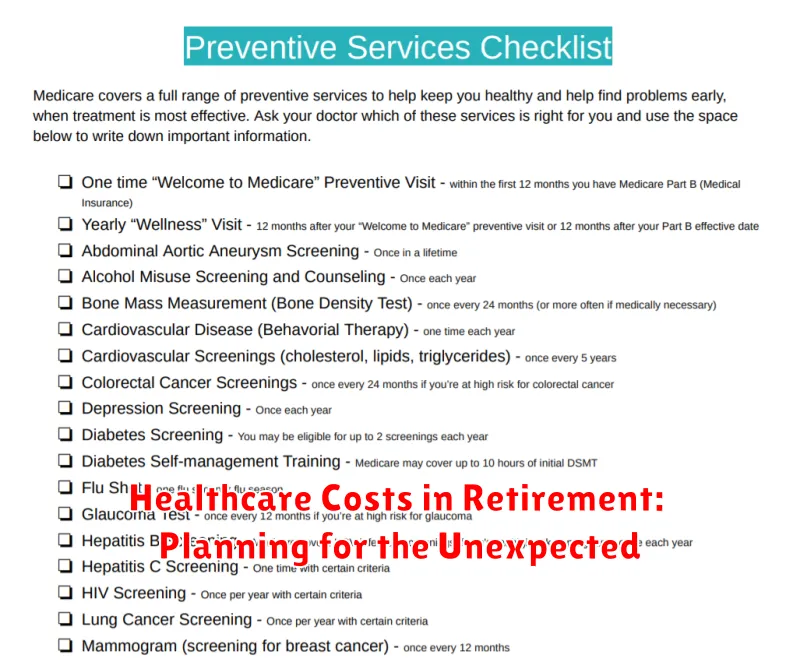

Healthcare Costs in Retirement: Planning for the Unexpected

Retirement is a time to enjoy the fruits of your labor, but it’s also a time when unexpected healthcare costs can quickly drain your savings. As you age, the likelihood of needing medical care increases, and the cost of that care can be significant. While you can’t predict the future, you can take steps to prepare for the financial realities of healthcare in retirement.

One of the first steps is to understand the potential costs. According to the 2023 Fidelity Retiree Health Care Cost Estimate, a 65-year-old couple retiring this year will need an estimated $315,000 to cover healthcare expenses throughout their retirement. This includes premiums for Medicare, out-of-pocket costs, and potential long-term care.

It’s also important to consider your individual health history and family history. If you have a history of chronic conditions or a family history of health issues, you may need to factor in higher healthcare costs. This includes chronic conditions like diabetes, heart disease, and cancer.

Here are some tips for planning for healthcare costs in retirement:

- Start saving early and often. The earlier you begin saving, the more time your money has to grow. Even small contributions can make a big difference over time.

- Consider a Health Savings Account (HSA). HSAs offer tax advantages for saving for healthcare expenses and can be a valuable tool for retirement planning. They are great for those who are enrolled in a high-deductible health plan (HDHP).

- Shop around for Medicare plans. Medicare offers a variety of plans with different coverage and costs. It’s important to compare options and choose a plan that meets your needs and budget.

- Explore long-term care options. Long-term care can be very expensive, and it’s important to plan for this possibility. You can consider purchasing long-term care insurance, which can help cover the costs of assisted living, nursing homes, or in-home care.

- Maintain a healthy lifestyle. Eating a healthy diet, exercising regularly, and managing stress can help reduce your risk of developing chronic conditions. It’s important to prioritize your health throughout your retirement years.

- Stay informed about healthcare trends. Keep up-to-date on changes in healthcare costs and policies. This will help you make informed decisions about your retirement planning.

Planning for healthcare costs in retirement can seem daunting, but it’s essential to protect your financial security. By taking steps to prepare, you can increase your chances of enjoying a comfortable and healthy retirement.

Strategies for Reducing Living Expenses in Retirement

Retirement is a time to enjoy the fruits of your labor, but it can also be a time of financial uncertainty. Many retirees find that their income is lower than they anticipated, and their expenses remain the same or even increase. If you’re worried about making ends meet in retirement, there are several strategies you can use to reduce your living expenses.

Downsize Your Home

One of the most effective ways to reduce your living expenses is to downsize your home. A smaller home means lower mortgage payments, lower property taxes, and lower utility bills. You can also save money on maintenance and upkeep. If you are comfortable with a smaller living space, downsizing can free up a significant amount of cash flow.

Reduce Your Debt

Debt payments can take a big chunk out of your retirement income. Before you retire, make a plan to pay down your debts as much as possible. Consider consolidating your debts into a lower-interest loan or using a debt snowball method to pay off your smallest balances first. The less debt you have, the more money you’ll have to spend on things you enjoy.

Cut Unnecessary Expenses

Take a close look at your monthly expenses and identify areas where you can cut back. Can you cancel any subscriptions or memberships you no longer use? Can you shop around for lower prices on your insurance, utilities, and other services? Small savings can add up over time.

Consider a Part-Time Job

If you’re looking for a way to supplement your retirement income, consider taking on a part-time job. Even a few hours per week can make a big difference in your budget. Choose a job that you enjoy and that fits into your lifestyle.

Live a More Minimalist Lifestyle

A minimalist lifestyle is about focusing on what truly matters and letting go of unnecessary possessions. By simplifying your life, you can reduce your expenses on things like housing, transportation, and consumer goods. This can free up more time and money for the things you love.

Take Advantage of Senior Discounts

Many businesses offer senior discounts, so be sure to take advantage of them. You can save money on everything from groceries and dining out to entertainment and travel.

Plan for Unexpected Expenses

Retirement is full of unknowns. Having a plan for unexpected expenses can help you avoid financial stress. Consider setting aside a portion of your savings for emergencies and unexpected costs. This can provide you with peace of mind knowing you’re prepared for whatever life throws your way.

By implementing these strategies, you can reduce your living expenses and ensure a more comfortable and secure retirement. Remember, it’s never too late to take control of your finances and make informed choices about your future.

Staying Active and Engaged in Retirement

Retirement can be a time of great joy and freedom, but it can also be a time of transition and adjustment. After a lifetime of working, it can be difficult to know how to fill your days and stay active and engaged. However, there are many ways to make the most of your retirement years. Here are some tips for staying active and engaged in retirement:

1. Find your passion: What have you always wanted to do but never had the time for? Now is the time to pursue your passions. Whether it’s traveling, volunteering, learning a new skill, or starting a hobby, make time for activities that bring you joy. Passion and purpose can help you stay motivated and engaged in retirement.

2. Stay social: Social interaction is crucial for maintaining both physical and mental health. Stay connected with friends and family, join clubs or groups, and volunteer in your community. Social connections can provide a sense of belonging and purpose.

3. Stay active: Exercise is essential for maintaining your physical health and mental well-being. Find activities you enjoy and make time for them regularly. Whether it’s walking, swimming, dancing, or playing a sport, physical activity can boost your energy levels, improve your mood, and reduce your risk of chronic diseases.

4. Keep learning: Retirement is a great opportunity to expand your knowledge and learn new skills. Take classes, read books, attend lectures, or learn a new language. Keeping your mind active can help you stay sharp and engaged.

5. Give back to your community: Volunteering is a great way to stay active, engaged, and make a difference in the lives of others. There are countless opportunities to volunteer in your community, from working with children or seniors to supporting local charities or environmental causes. Volunteering can provide a sense of purpose and satisfaction.

Retirement is a time for new beginnings. By embracing new experiences, staying active, and connecting with others, you can create a fulfilling and enriching retirement experience.

Estate Planning Essentials: Protecting Your Legacy

Estate planning is a crucial aspect of financial planning, ensuring that your assets are distributed according to your wishes and minimizing potential tax burdens. It involves creating a comprehensive plan that addresses various aspects of your estate, from managing your assets during your lifetime to distributing them upon your death.

A well-structured estate plan provides peace of mind, knowing that your loved ones are financially secure and your legacy is protected. Here are some essential components of a robust estate plan:

Will

A will is a legal document that outlines how your assets will be distributed after your death. It designates beneficiaries, appoints an executor to manage your estate, and specifies any charitable donations or other wishes you may have. It is essential to have a valid will that complies with your state’s laws to avoid probate issues.

Trusts

Trusts are legal entities that hold assets for the benefit of others. They can be used for various purposes, including asset protection, tax planning, and managing assets for minors or individuals with special needs. Types of trusts include:

- Revocable Living Trusts

- Irrevocable Trusts

- Special Needs Trusts

Power of Attorney

A power of attorney authorizes someone else to act on your behalf in financial and legal matters if you become incapacitated. It can be a general power of attorney, granting broad authority, or a durable power of attorney, which remains in effect even if you become incapacitated. It is crucial to choose a trustworthy individual who understands your financial affairs.

Health Care Directives

Health care directives, such as a living will and durable power of attorney for healthcare, allow you to express your wishes regarding medical treatment if you become unable to make decisions for yourself. A living will specifies your preferences for end-of-life care, while a durable power of attorney for healthcare designates someone to make medical decisions on your behalf.

Life Insurance

Life insurance can provide financial security for your beneficiaries upon your death. It can cover funeral expenses, outstanding debts, and provide a lump sum for ongoing living expenses. The amount of coverage should be tailored to your individual needs and the financial needs of your beneficiaries.

Regular Review and Updates

Your estate plan should not be a one-time event but rather an ongoing process. It is essential to review your plan regularly, at least every 3-5 years, or more often if you experience significant life events such as marriage, divorce, birth of a child, or major financial changes. You may need to update your will, beneficiary designations, trusts, or other documents to reflect your current situation.

Estate planning is a complex process that involves legal, financial, and tax considerations. It is advisable to consult with qualified professionals, including an estate planning attorney, a financial advisor, and a tax accountant, to develop a comprehensive and tailored plan that meets your unique needs and protects your legacy.

Seeking Professional Advice for Retirement Planning

Retirement planning is an essential part of financial security and well-being. As you approach retirement, it’s crucial to have a comprehensive plan in place to ensure a comfortable and fulfilling post-work life. While you may be tempted to handle retirement planning on your own, seeking professional advice from a qualified financial advisor can be incredibly beneficial.

Benefits of Professional Retirement Planning Advice

Here are some key benefits of working with a financial advisor for your retirement planning:

- Personalized Strategy: A financial advisor will take the time to understand your unique financial situation, goals, and risk tolerance. They can then develop a personalized retirement plan tailored to your specific needs.

- Expert Guidance: Financial advisors have extensive knowledge and experience in investment strategies, tax planning, and retirement regulations. They can provide valuable insights and guidance to help you make informed decisions.

- Objective Perspective: When making financial decisions, it’s easy to get caught up in emotions or biases. A financial advisor can provide an objective perspective and help you avoid costly mistakes.

- Regular Reviews: Your financial situation may change over time, so it’s essential to have regular reviews of your retirement plan. A financial advisor will monitor your progress and make adjustments as needed.

- Peace of Mind: Knowing that you have a qualified professional guiding your retirement planning can provide peace of mind and reduce stress.

Finding the Right Financial Advisor

When choosing a financial advisor, it’s important to consider the following factors:

- Experience and Qualifications: Look for an advisor with a proven track record and relevant credentials, such as a Certified Financial Planner (CFP) or a Chartered Financial Analyst (CFA).

- Fees and Services: Understand the advisor’s fees and the services they offer. Some advisors charge hourly rates, while others may charge a percentage of assets under management.

- Communication Style: It’s essential to feel comfortable communicating with your advisor. Choose someone who listens attentively and explains financial concepts in a clear and understandable way.

- References: Ask for references from previous clients to get an idea of the advisor’s experience and reputation.

Conclusion

Seeking professional advice for retirement planning can be a wise decision. A qualified financial advisor can provide personalized guidance, expert insights, and peace of mind as you navigate this important financial journey. By working with an advisor, you can increase your chances of achieving your retirement goals and securing a comfortable future.