Are you struggling to keep track of your finances? Feeling overwhelmed by the constant pressure of bills and expenses? You’re not alone. Many people find it difficult to manage their money effectively, leading to stress, debt, and financial instability. But it doesn’t have to be this way. The key to unlocking financial success is to adopt a sound budgeting method. By carefully tracking your income and expenses and creating a plan for your money, you can gain control of your finances and achieve your financial goals.

This article will explore the top 7 budgeting methods that can help you achieve financial success. From traditional methods like the 50/30/20 method to newer approaches like the zero-based budget, we’ll cover a range of options to suit different financial situations and personalities. Whether you’re looking to pay off debt, save for retirement, or simply gain more financial control, these budgeting methods can provide the framework you need to reach your goals. Ready to take charge of your finances? Let’s dive in!

Why Budgeting is Crucial for Financial Success

In the realm of personal finance, budgeting often takes center stage as a cornerstone of financial well-being. It’s not just about tracking your spending; it’s about taking control of your money and charting a course towards your financial goals. A well-crafted budget serves as a roadmap, guiding you towards a future of financial security and freedom.

Gaining Clarity and Control

One of the most significant benefits of budgeting is the clarity it provides. By meticulously tracking your income and expenses, you gain an accurate picture of where your money is going. This newfound understanding allows you to identify areas where you may be overspending or where potential savings exist. Armed with this knowledge, you can make informed decisions about your spending habits and prioritize your financial goals.

Achieving Financial Goals

Budgets are essential tools for achieving your financial goals, whether it’s buying a house, paying off debt, saving for retirement, or simply building an emergency fund. By allocating your income strategically, you can ensure that you’re consistently saving towards your objectives. A budget provides a tangible framework for visualizing your financial aspirations and staying motivated on the path to achieving them.

Avoiding Debt and Overspending

Living within your means is a fundamental principle of sound financial management, and budgeting plays a crucial role in this regard. By creating a budget, you set limits on your spending and prevent overspending, which can lead to debt accumulation. A budget helps you prioritize your expenses and make conscious decisions about how you allocate your limited resources.

Building a Strong Financial Foundation

A well-maintained budget fosters financial discipline and responsibility. It teaches you to make informed financial decisions, prioritize needs over wants, and create a sustainable financial plan. This discipline extends beyond your personal finances, influencing your overall financial well-being and contributing to a secure and prosperous future.

Conclusion

In conclusion, budgeting is not just a financial tool but a powerful catalyst for financial success. It empowers you to take control of your finances, achieve your goals, avoid debt, and build a solid foundation for a financially secure future. By embracing the principles of budgeting, you embark on a journey of financial freedom and personal fulfillment.

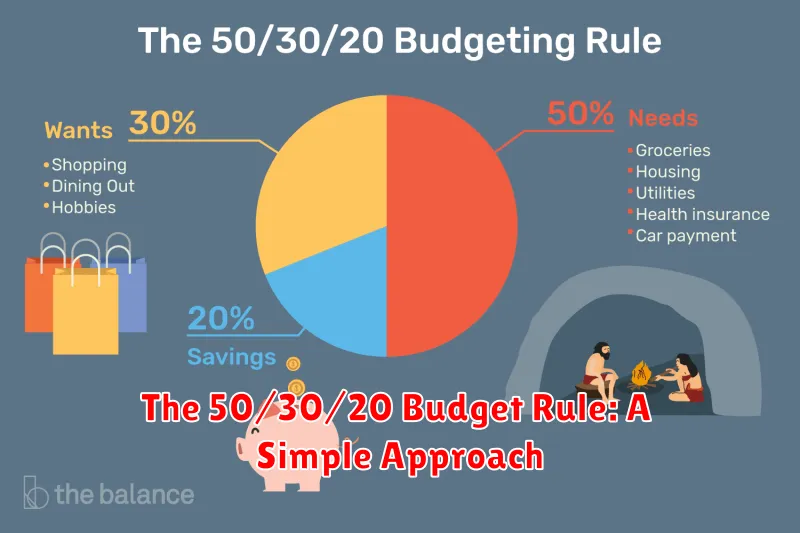

The 50/30/20 Budget Rule: A Simple Approach

Managing your finances can feel overwhelming, especially if you’re new to budgeting. There are many different methods out there, but one that’s consistently praised for its simplicity and effectiveness is the 50/30/20 budget rule. This rule offers a clear framework for allocating your income, ensuring you meet your needs, indulge in wants, and prioritize your financial future.

How it Works

The 50/30/20 rule suggests dividing your after-tax income into three categories:

- Needs (50%): This includes essential expenses like housing, utilities, groceries, transportation, and healthcare.

- Wants (30%): This category covers discretionary spending, such as entertainment, dining out, shopping, and hobbies.

- Savings and Debt Repayment (20%): This portion is dedicated to building your financial security through savings, paying down debt, and investing.

Benefits of the 50/30/20 Rule

The 50/30/20 rule provides numerous advantages:

- Simplicity: It’s straightforward to understand and implement, even for those with limited financial experience.

- Flexibility: The percentages are not rigid and can be adjusted based on your individual circumstances and priorities.

- Balance: It encourages a healthy balance between meeting your needs, enjoying your life, and planning for the future.

- Financial Discipline: By allocating a specific portion of your income to savings and debt repayment, it fosters a sense of financial responsibility.

Adapting the Rule

While the 50/30/20 rule provides a solid foundation, it’s essential to adapt it to your unique situation. For instance, if you have a high debt burden, you may want to increase the savings and debt repayment percentage. Alternatively, if you’re in a low-cost area, you might have more room in your budget for wants. The key is to find a balance that works for you.

Conclusion

The 50/30/20 budget rule offers a practical and approachable method for managing your finances. It promotes financial responsibility by ensuring you meet your essential needs, allocate funds for enjoyment, and prioritize savings and debt repayment. Remember that it’s a guideline, and you can adjust it based on your individual circumstances. By embracing a structured approach to budgeting, you can gain control over your finances and build a brighter future.

Zero-Based Budgeting: Allocating Every Dollar

Zero-based budgeting is a method of budgeting that starts from scratch each month. This means that you don’t simply carry over any leftover money from the previous month; instead, you allocate every dollar of your income to a specific category. This approach can be a powerful tool for saving money, controlling spending, and achieving your financial goals.

How Zero-Based Budgeting Works

The first step in zero-based budgeting is to track your income and expenses. This can be done using a spreadsheet, a budgeting app, or even a simple notebook. Once you have a clear picture of where your money is going, you can start to allocate it to different categories.

Here are some common budgeting categories:

- Housing

- Food

- Transportation

- Utilities

- Healthcare

- Entertainment

- Savings

- Debt repayment

Once you have allocated your income to different categories, you should aim to spend no more than the amount allocated to each category. This can be challenging, but it’s important to stick to your budget as closely as possible. If you find that you’re consistently overspending in a particular category, you may need to adjust your budget or find ways to cut back.

Benefits of Zero-Based Budgeting

There are several benefits to using zero-based budgeting, including:

- Increased financial awareness: By tracking your income and expenses, you’ll gain a better understanding of where your money is going.

- Improved financial control: Allocating every dollar of your income gives you more control over your spending.

- Reduced debt: By prioritizing debt repayment, you can pay off debt faster.

- Increased savings: Zero-based budgeting helps you prioritize saving money for your goals.

- Greater financial peace of mind: Knowing that you’re in control of your finances can give you greater financial peace of mind.

Tips for Implementing Zero-Based Budgeting

Here are some tips for successfully implementing zero-based budgeting:

- Start with a realistic budget: Don’t try to cut back too much too quickly. Start with a budget that you can realistically stick to and gradually make adjustments as needed.

- Use a budgeting tool: There are many budgeting tools available, both online and offline. Choose one that fits your needs and preferences.

- Review your budget regularly: Your financial situation may change over time, so it’s important to review your budget at least once a month.

- Be patient: Zero-based budgeting takes time and effort to implement successfully. Don’t get discouraged if you don’t see results immediately. Just keep at it and you’ll eventually see the benefits.

The Envelope System: Cash-Based Budgeting for Control

In the digital age, with online banking and mobile payments, it’s easy to lose track of where your money goes. But what if there was a way to regain control of your finances and stick to a budget with more ease? Enter the envelope system, a tried-and-true cash-based budgeting method that can help you take charge of your spending.

The concept is simple: you allocate a specific amount of cash for each spending category, such as groceries, entertainment, or gas, and place it in a separate envelope. Once the money in an envelope runs out, you’re done spending in that category for the month. This visual and tangible approach provides immediate feedback on your spending and encourages conscious decision-making.

Benefits of the Envelope System:

The envelope system offers numerous benefits, making it a popular choice for budget-conscious individuals:

- Increased awareness of spending: The physical act of taking money out of an envelope makes you more aware of your spending habits and forces you to think twice before making unnecessary purchases.

- Improved budgeting discipline: When you know you have a limited amount of cash for each category, you’re more likely to prioritize your needs and avoid overspending.

- Reduced impulsive purchases: The envelope system helps curb impulse buying because you’re physically limited to the amount of cash you’ve allocated for each category.

- Greater control over cash flow: By managing your cash flow manually, you gain a clearer understanding of your income and expenses.

- Reduced debt: The envelope system can help you avoid unnecessary debt by preventing overspending and promoting financial discipline.

Setting Up the Envelope System:

Setting up the envelope system is straightforward:

- Determine your spending categories: Identify the areas where you typically spend money, such as groceries, transportation, entertainment, dining out, and personal care.

- Allocate your budget: Based on your income and financial goals, allocate a specific amount of money to each category. You can use a budgeting app or spreadsheet to help with this step.

- Prepare envelopes: Label each envelope with a spending category and place the allocated cash inside.

- Track your spending: Keep track of your spending in each category by writing down the amount spent and the date on a notepad or using a budgeting app.

- Reassess and adjust: Regularly review your spending and adjust your budget as needed to ensure you’re meeting your financial goals.

Tips for Success:

Here are some tips to make the envelope system more effective:

- Start small: Choose a few categories to start with and gradually add more as you become more comfortable with the system.

- Use cash for all spending: To make the envelope system truly effective, try to use cash for all of your spending, even for recurring bills.

- Avoid “borrowing” from other envelopes: It’s tempting to use money from one envelope to cover expenses in another category, but this can disrupt your budget and lead to overspending.

- Be flexible: Life happens, and sometimes you may need to adjust your spending in a particular category. Don’t be afraid to make adjustments as needed, but try to stick to your overall budget as much as possible.

The envelope system is a simple yet powerful tool for managing your money effectively and taking control of your financial future. By embracing this method, you can gain a better understanding of your spending habits, stick to your budget, and achieve your financial goals.

Pay Yourself First: Prioritizing Savings

In the whirlwind of daily expenses, it’s easy to get caught in the cycle of spending everything we earn. But what if we shifted our mindset and prioritized saving? The “Pay Yourself First” philosophy encourages us to allocate a portion of our income to savings before paying any other bills or indulging in discretionary spending. This simple yet powerful approach can dramatically impact our financial well-being.

Imagine this: every time you get paid, you automatically transfer a predetermined amount to your savings account. This creates a sense of discipline and ensures that you’re consistently building a financial safety net. The beauty of this method lies in its ability to make saving a habit rather than an afterthought.

But how much should you “pay yourself”? The ideal amount depends on your individual circumstances, financial goals, and risk tolerance. However, a good starting point is to aim for 10-20% of your income. Don’t worry if it feels challenging at first – even small, consistent contributions can add up over time.

Here are some compelling reasons why prioritizing savings is essential:

- Financial Security: Savings provide a buffer against unexpected expenses, such as medical emergencies, car repairs, or job loss. They offer peace of mind and reduce the need to rely on debt.

- Reaching Your Goals: Whether it’s buying a house, traveling the world, or retiring comfortably, saving consistently brings your dreams closer to reality.

- Building Wealth: Compound interest works wonders when you’re consistently saving. The more you save, the more interest you earn, creating a snowball effect that grows your wealth over time.

- Taking Control: By prioritizing savings, you gain control over your finances and break free from the paycheck-to-paycheck cycle. It fosters a sense of empowerment and financial independence.

Incorporating “Pay Yourself First” into your financial routine takes a little effort but can lead to significant rewards. It’s about making a conscious choice to secure your financial future. Start small, stay consistent, and watch your savings grow!

The Reverse Budgeting Method: Automating Your Finances

In the realm of personal finance, the traditional budgeting approach often involves meticulously tracking expenses and then allocating remaining funds. However, an alternative method known as reverse budgeting flips this paradigm on its head, empowering individuals to prioritize their financial goals and automate savings.

How Reverse Budgeting Works

Reverse budgeting starts by determining your financial goals and desired lifestyle. It emphasizes allocating funds to specific categories first, such as saving, investing, debt repayment, and essential expenses, before allocating any remaining funds to discretionary spending.

The Key Steps

- Define your financial goals: What are you saving for? Do you want to retire early, buy a home, or fund your children’s education? Clearly define your goals and set specific timelines.

- Determine your essential expenses: This includes housing, utilities, groceries, transportation, and healthcare. Estimate these costs based on your current spending patterns.

- Allocate funds to your goals: Prioritize your financial goals and allocate a fixed amount of money to each. This could be a specific percentage of your income or a set dollar amount.

- Automate your savings and investments: Set up automatic transfers from your checking account to your savings and investment accounts. This ensures that your financial goals are funded consistently.

- Track your progress: Regularly review your progress toward your financial goals and make adjustments as needed.

Benefits of Reverse Budgeting

Reverse budgeting offers several advantages, including:

- Increased savings and financial security: By prioritizing savings and investments, you ensure that your financial goals are met consistently.

- Reduced stress and anxiety: Knowing that your financial future is secure can alleviate financial stress and anxiety.

- Greater control over your finances: You are actively shaping your financial future by allocating funds strategically.

- Improved financial discipline: By automating savings and tracking progress, you develop strong financial habits.

Conclusion

Reverse budgeting is a powerful tool for taking control of your finances, prioritizing your goals, and achieving financial freedom. By automating savings and allocating funds strategically, you can create a solid foundation for your financial future.

Budgeting Apps and Tools to Simplify the Process

Managing finances can be a daunting task, especially if you’re not organized. Fortunately, there are numerous budgeting apps and tools available to make the process easier and more efficient. These applications can help you track your spending, set financial goals, and stay on top of your budget.

Here are some of the most popular and effective budgeting apps and tools available today:

Mint

Mint is a comprehensive financial management platform that allows you to track your spending, set budgets, and monitor your credit score. It automatically connects to your bank accounts and credit cards, providing you with a real-time overview of your financial situation.

YNAB (You Need a Budget)

YNAB is a popular budgeting app that emphasizes the “zero-based budgeting” approach. This means that you allocate every dollar of your income to a specific purpose, leaving no room for overspending. YNAB also helps you track your spending, set goals, and prioritize your financial needs.

Personal Capital

Personal Capital is a free financial management tool that offers a variety of features, including budgeting, investment tracking, retirement planning, and net worth analysis. It provides insightful reports and visualizations to help you understand your financial health and make informed decisions.

EveryDollar

EveryDollar is a budgeting app based on the teachings of Dave Ramsey. It encourages you to create a written budget and allocate every dollar of your income. The app also offers a variety of features, such as debt tracking, goal setting, and expense reports.

PocketGuard

PocketGuard is a user-friendly budgeting app that simplifies your finances. It tracks your spending, sets budgets, and provides real-time insights into your cash flow. The app also features a “safe to spend” indicator that tells you how much money you have left after essential expenses.

Choosing the Right Budgeting App

The best budgeting app for you will depend on your individual needs and preferences. Consider factors such as ease of use, features, pricing, and integration with your existing financial accounts.

Whether you’re looking to track your spending, set financial goals, or gain a better understanding of your finances, budgeting apps and tools can provide valuable support. Try out a few options and find the one that best suits your needs and helps you achieve your financial goals.

Choosing the Right Budgeting Method for Your Lifestyle

Budgeting is an essential part of managing your finances and achieving your financial goals. However, with so many different budgeting methods available, it can be overwhelming to choose the right one for you. The key is to find a method that aligns with your lifestyle, financial goals, and personal preferences.

50/30/20 Method

The 50/30/20 method is a simple and popular budgeting method. It suggests allocating 50% of your after-tax income to needs (such as rent, utilities, and groceries), 30% to wants (such as entertainment, dining out, and hobbies), and 20% to savings and debt repayment. This method provides a clear framework for spending and saving, but it may not be suitable for everyone, especially if you have a large amount of debt or specific financial goals.

Zero-Based Budgeting

Zero-based budgeting involves planning how every dollar of your income will be spent. You allocate every dollar to a specific category, ensuring that your expenses equal your income. This method can help you gain complete control over your finances, identify areas where you can cut back, and reach your savings goals faster. However, it requires meticulous tracking and planning and may be time-consuming for some individuals.

Envelope System

The envelope system is a cash-based budgeting method where you allocate cash to different categories and store it in separate envelopes. You can only spend the money allocated to each category, preventing overspending. This method helps you visualize your spending and stay within your budget, but it may not be practical for everyone, especially if you prefer using credit cards or online banking.

50/30/20 Method

The 50/30/20 method is a simple and popular budgeting method. It suggests allocating 50% of your after-tax income to needs (such as rent, utilities, and groceries), 30% to wants (such as entertainment, dining out, and hobbies), and 20% to savings and debt repayment. This method provides a clear framework for spending and saving, but it may not be suitable for everyone, especially if you have a large amount of debt or specific financial goals.

Choosing the Right Method

Ultimately, the best budgeting method for you depends on your individual circumstances and preferences. Consider factors such as:

- Your income and expenses

- Your financial goals

- Your spending habits

- Your comfort level with technology and budgeting tools

Experiment with different methods to find one that works best for you. There are numerous budgeting apps and resources available to help you track your finances and stay on track.

Tips for Sticking to Your Budget and Achieving Your Goals

Budgeting can be a daunting task, but it is essential for achieving your financial goals. A budget helps you track your income and expenses, allowing you to make informed decisions about your money. Sticking to a budget can be challenging, but with a few simple tips, you can make it easier and more effective.

1. Set Realistic Goals

It is important to set realistic goals when creating a budget. If your goals are too ambitious, you may become discouraged and give up. Start with small, achievable goals, and gradually increase the difficulty as you become more comfortable. For example, you might start by saving $100 a month, then increase that to $200 or $300 once you have mastered that goal.

2. Track Your Expenses

Tracking your expenses is a crucial part of budgeting. You need to know where your money is going in order to make informed decisions about how to spend it. There are many ways to track your expenses, such as using a spreadsheet, budgeting app, or even a notebook. Choose a method that works best for you, and stick to it!

3. Create a Budget

Once you have a good understanding of your expenses, you can create a budget. There are many different budgeting methods, so find one that fits your needs and preferences. The 50/30/20 rule is a popular method that allocates 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. You can adjust these percentages to suit your own situation.

4. Stick to Your Budget

Sticking to your budget can be tough, especially when you are faced with temptations or unexpected expenses. However, it is important to remember why you created the budget in the first place. Think about your financial goals, and remind yourself that sticking to your budget is the best way to achieve them.

5. Review Your Budget Regularly

It is important to review your budget regularly to make sure it is still working for you. Your financial situation may change over time, so it is important to adjust your budget accordingly. You can also use this opportunity to identify areas where you can save more money.

6. Be Patient and Persistent

Sticking to a budget takes time and effort. You may not see results immediately, but it is important to be patient and persistent. If you are consistent with your budgeting, you will eventually achieve your financial goals.

Budgeting is not about deprivation, but about making informed choices about how you spend your money. By following these tips, you can create a budget that works for you and achieve your financial goals.